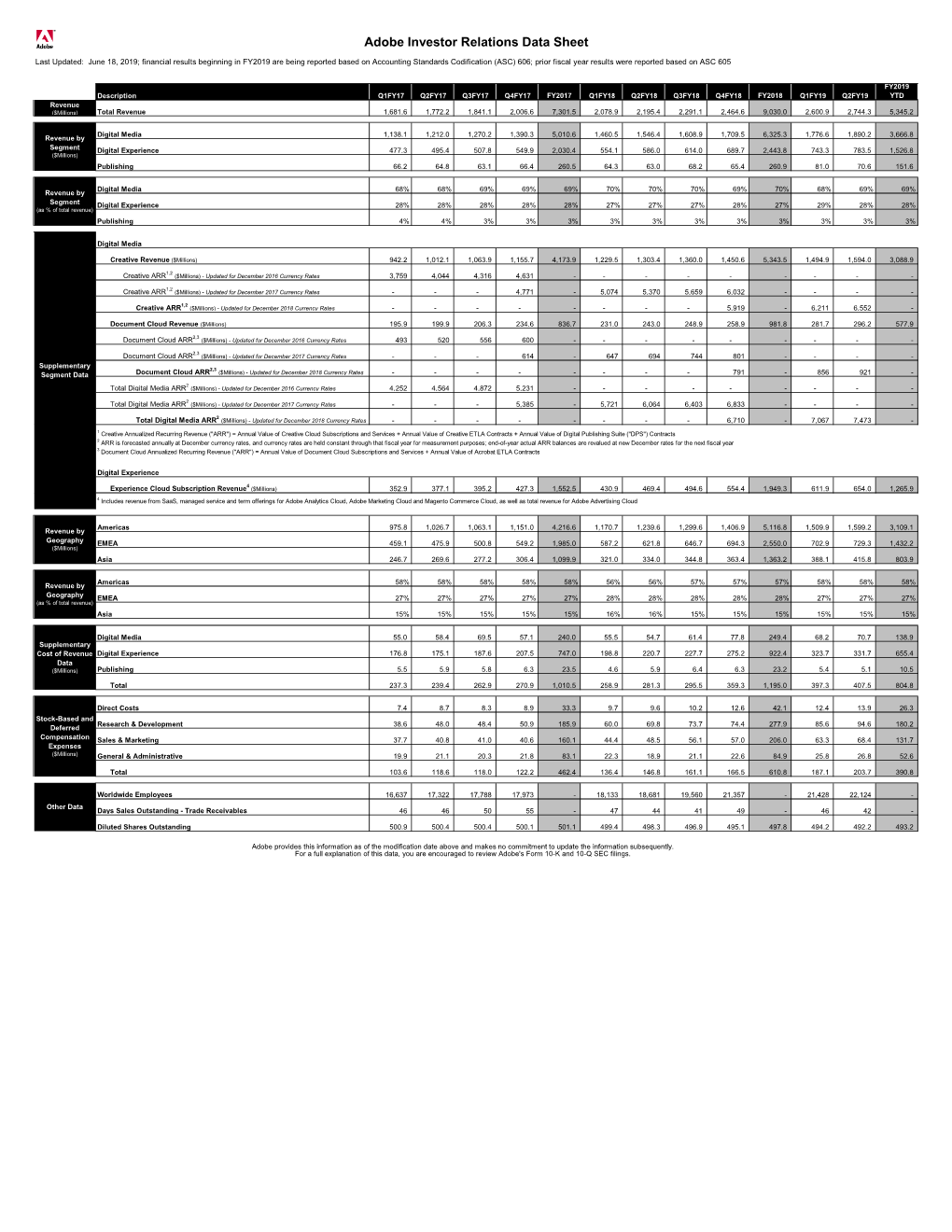

Adobe Q2 FY2019 Investor Datasheet (June 18, 2019)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Adobe Q4 and FY2019 Investor Datasheet

Adobe Investor Relations Data Sheet Last Updated: December 12, 2019; financial results beginning in FY2019 are being reported based on Accounting Standards Codification (ASC) 606; prior fiscal year results were reported based on ASC 605 Description Q1FY17 Q2FY17 Q3FY17 Q4FY17 FY2017 Q1FY18 Q2FY18 Q3FY18 Q4FY18 FY2018 Q1FY19 Q2FY19 Q3FY19 Q4FY19 FY2019 Revenue ($Millions) Total Revenue 1,681.6 1,772.2 1,841.1 2,006.6 7,301.5 2,078.9 2,195.4 2,291.1 2,464.6 9,030.0 2,600.9 2,744.3 2,834.1 2,992.0 11,171.3 Digital Media 1,138.1 1,212.0 1,270.2 1,390.3 5,010.6 1,460.5 1,546.4 1,608.9 1,709.5 6,325.3 1,776.6 1,890.2 1,962.2 2,078.0 7,707.0 Revenue by Segment Digital Experience 477.3 495.4 507.8 549.9 2,030.4 554.1 586.0 614.0 689.7 2,443.8 743.3 783.5 820.9 858.5 3,206.2 ($Millions) Publishing 66.2 64.8 63.1 66.4 260.5 64.3 63.0 68.2 65.4 260.9 81.0 70.6 51.0 55.5 258.1 Digital Media 68% 68% 69% 69% 69% 70% 70% 70% 69% 70% 68% 69% 69% 69% 69% Revenue by Segment Digital Experience 28% 28% 28% 28% 28% 27% 27% 27% 28% 27% 29% 28% 29% 29% 29% (as % of total revenue) Publishing 4% 4% 3% 3% 3% 3% 3% 3% 3% 3% 3% 3% 2% 2% 2% Digital Media Creative Revenue ($Millions) 942.2 1,012.1 1,063.9 1,155.7 4,173.9 1,229.5 1,303.4 1,360.0 1,450.6 5,343.5 1,494.9 1,594.0 1,654.7 1,738.7 6,482.3 1,2 Creative ARR ($Millions) - Updated for December 2016 Currency Rates 3,759 4,044 4,316 4,631 - - - - - - - - - - - 1,2 Creative ARR ($Millions) - Updated for December 2017 Currency Rates - - - 4,771 - 5,074 5,370 5,659 6,032 - - - - - - 1,2 Creative ARR ($Millions) -

Release Notes - January 2018

11/6/2020 Release Notes - January 2018 Documentation Release Notes Guide Release Notes - January 2018 Release Notes - January 2018 New features and Óxes in the Adobe Experience Cloud. NOTE To be notiÓed about the early release notes, subscribe to the Adobe Priority Product Update. Ïe Priority Product Update is sent three to Óve business days prior to the release. Please check back at release time for updates. New information published a×er the release will be marked with the publication date. Experience Cloud Recipes Use Case Date Published Description First-time Setup October 18, 2017 Ïe Órst-time setup recipe walks you through the steps to get started using Experience Cloud solutions. Email Optimization August 15, 2017 Ïe email marketing use case shows you how to implement an integrated email strategy with analytics, optimization, and campaign management. Mobile App Engagement June 1, 2017 Ïe mobile app engagement use case shows you how to integrate your mobile apps with the Adobe Experience Cloud to measure user engagement and deliver personalized experiences to your audiences. https://experienceleague.adobe.com/docs/release-notes/experience-cloud/previous/legacy-rns/2018/01182018.html?lang=en#previous 1/27 11/6/2020 Release Notes - January 2018 Use Case Date Published Description Digital Foundation May 2017 Ïe Digital Foundation use case helps you implement a digital marketing platform with Analytics, optimization, and campaign management. Customer Intelligence April 2017 Ïe Customer Intelligence use case shows you how to create a uniÓed customer proÓle using multiple data sources, and how to use this proÓle to build actionable audiences. Experience Cloud and Core Services Release notes for the core services interface, including Assets, Feed, NotiÓcations, People core service, Mobile Services, Launch, and Dynamic Tag Management. -

Adobe Trademark Database for General Distribution

Adobe Trademark List for General Distribution As of May 17, 2021 Please refer to the Permissions and trademark guidelines on our company web site and to the publication Adobe Trademark Guidelines for third parties who license, use or refer to Adobe trademarks for specific information on proper trademark usage. Along with this database (and future updates), they are available from our company web site at: https://www.adobe.com/legal/permissions/trademarks.html Unless you are licensed by Adobe under a specific licensing program agreement or equivalent authorization, use of Adobe logos, such as the Adobe corporate logo or an Adobe product logo, is not allowed. You may qualify for use of certain logos under the programs offered through Partnering with Adobe. Please contact your Adobe representative for applicable guidelines, or learn more about logo usage on our website: https://www.adobe.com/legal/permissions.html Referring to Adobe products Use the full name of the product at its first and most prominent mention (for example, “Adobe Photoshop” in first reference, not “Photoshop”). See the “Preferred use” column below to see how each product should be referenced. Unless specifically noted, abbreviations and acronyms should not be used to refer to Adobe products or trademarks. Attribution statements Marking trademarks with ® or TM symbols is not required, but please include an attribution statement, which may appear in small, but still legible, print, when using any Adobe trademarks in any published materials—typically with other legal lines such as a copyright notice at the end of a document, on the copyright page of a book or manual, or on the legal information page of a website. -

Web Vulnerabilities (Level 1 Scan)

Web Vulnerabilities (Level 1 Scan) Vulnerability Name CVE CWE Severity .htaccess file readable CWE-16 ASP code injection CWE-95 High ASP.NET MVC version disclosure CWE-200 Low ASP.NET application trace enabled CWE-16 Medium ASP.NET debugging enabled CWE-16 Low ASP.NET diagnostic page CWE-200 Medium ASP.NET error message CWE-200 Medium ASP.NET padding oracle vulnerability CVE-2010-3332 CWE-310 High ASP.NET path disclosure CWE-200 Low ASP.NET version disclosure CWE-200 Low AWStats script CWE-538 Medium Access database found CWE-538 Medium Adobe ColdFusion 9 administrative login bypass CVE-2013-0625 CVE-2013-0629CVE-2013-0631 CVE-2013-0 CWE-287 High 632 Adobe ColdFusion directory traversal CVE-2013-3336 CWE-22 High Adobe Coldfusion 8 multiple linked XSS CVE-2009-1872 CWE-79 High vulnerabilies Adobe Flex 3 DOM-based XSS vulnerability CVE-2008-2640 CWE-79 High AjaxControlToolkit directory traversal CVE-2015-4670 CWE-434 High Akeeba backup access control bypass CWE-287 High AmCharts SWF XSS vulnerability CVE-2012-1303 CWE-79 High Amazon S3 public bucket CWE-264 Medium AngularJS client-side template injection CWE-79 High Apache 2.0.39 Win32 directory traversal CVE-2002-0661 CWE-22 High Apache 2.0.43 Win32 file reading vulnerability CVE-2003-0017 CWE-20 High Apache 2.2.14 mod_isapi Dangling Pointer CVE-2010-0425 CWE-20 High Apache 2.x version equal to 2.0.51 CVE-2004-0811 CWE-264 Medium Apache 2.x version older than 2.0.43 CVE-2002-0840 CVE-2002-1156 CWE-538 Medium Apache 2.x version older than 2.0.45 CVE-2003-0132 CWE-400 Medium Apache 2.x version -

Adobe Systems Inc. Strategic Analysis and Recommendation David Cao University of Nebraska-Lincoln

University of Nebraska - Lincoln DigitalCommons@University of Nebraska - Lincoln Honors Theses, University of Nebraska-Lincoln Honors Program 2018 Adobe Systems Inc. Strategic Analysis and Recommendation David Cao University of Nebraska-Lincoln Follow this and additional works at: https://digitalcommons.unl.edu/honorstheses Part of the Business Analytics Commons, and the Strategic Management Policy Commons Cao, David, "Adobe Systems Inc. Strategic Analysis and Recommendation" (2018). Honors Theses, University of Nebraska-Lincoln. 7. https://digitalcommons.unl.edu/honorstheses/7 This Article is brought to you for free and open access by the Honors Program at DigitalCommons@University of Nebraska - Lincoln. It has been accepted for inclusion in Honors Theses, University of Nebraska-Lincoln by an authorized administrator of DigitalCommons@University of Nebraska - Lincoln. ADOBE SYSTEMS INC. STRATEGIC ANALYSIS AND RECOMMENDATION An Undergraduate Honors Thesis Submitted in Partial fulfillment of University Honors Program Requirements University of Nebraska-Lincoln By David Cao, BS Software Engineering College of Engineering 04/26/17 Faculty Mentor: Dr. Samuel Nelson, College of Business University of Nebraska-Lincoln 1 Abstract Adobe Systems Inc. is a dominant company in the software and creative industry. To provide a strategic recommendation for continued growth in the number of Creative Cloud subscribers, a strategic analysis was performed. This analysis comprised of looking at Adobe’s current market segments and market offerings, performing a SWOT analysis, performing a PEST analysis, examining Porter’s Five Forces regarding Adobe, and clarifying Adobe’s core competencies and competitive advantages. After this analysis, the strategic recommendation was made for Adobe to expand is Creative Cloud subscription options and increase its efforts in the education market. -

Adobe Q2 FY2018 Earnings Call Script and Slides (June 14, 2018)

Adobe Q2 FY2018 Earnings Call Script and Slides June 14, 2018 MIKE SAVIAGE Good afternoon and thank you for joining us today. Joining me on the call are Adobe’s President and CEO, Shantanu Narayen; and John Murphy, Executive Vice President and CFO. In our call today, we will discuss Adobe’s second quarter fiscal year 2018 financial results. By now, you should have a copy of our earnings press release which crossed the wire approximately one hour ago. We’ve also posted PDFs of our earnings call prepared remarks and slides, financial targets and an updated investor datasheet on Adobe.com. If you would like a copy of these documents, you can go to Adobe’s Investor Relations page and find them listed under Quick Links. Page 1 of 16 Adobe Q2 FY2018 Earnings Call Script and Slides June 14, 2018 Before we get started, we want to emphasize that some of the information discussed in this call, particularly our revenue and operating model targets, and our forward-looking product plans, is based on information as of today, June 14th, 2018, and contains forward-looking statements that involve risk and uncertainty. Actual results may differ materially from those set forth in such statements. For a discussion of these risks and uncertainties, you should review the Forward-Looking Statements Disclosure in the earnings press release we issued today, as well as Adobe’s SEC filings. During this call, we will discuss GAAP and non-GAAP financial measures. A reconciliation between the two is available in our earnings release and in our updated investor datasheet on Adobe’s Investor Relations website. -

Insight MFR By

Manufacturers, Publishers and Suppliers by Product Category 11/6/2017 10/100 Hubs & Switches ASCEND COMMUNICATIONS CIS SECURE COMPUTING INC DIGIUM GEAR HEAD 1 TRIPPLITE ASUS Cisco Press D‐LINK SYSTEMS GEFEN 1VISION SOFTWARE ATEN TECHNOLOGY CISCO SYSTEMS DUALCOMM TECHNOLOGY, INC. GEIST 3COM ATLAS SOUND CLEAR CUBE DYCONN GEOVISION INC. 4XEM CORP. ATLONA CLEARSOUNDS DYNEX PRODUCTS GIGAFAST 8E6 TECHNOLOGIES ATTO TECHNOLOGY CNET TECHNOLOGY EATON GIGAMON SYSTEMS LLC AAXEON TECHNOLOGIES LLC. AUDIOCODES, INC. CODE GREEN NETWORKS E‐CORPORATEGIFTS.COM, INC. GLOBAL MARKETING ACCELL AUDIOVOX CODI INC EDGECORE GOLDENRAM ACCELLION AVAYA COMMAND COMMUNICATIONS EDITSHARE LLC GREAT BAY SOFTWARE INC. ACER AMERICA AVENVIEW CORP COMMUNICATION DEVICES INC. EMC GRIFFIN TECHNOLOGY ACTI CORPORATION AVOCENT COMNET ENDACE USA H3C Technology ADAPTEC AVOCENT‐EMERSON COMPELLENT ENGENIUS HALL RESEARCH ADC KENTROX AVTECH CORPORATION COMPREHENSIVE CABLE ENTERASYS NETWORKS HAVIS SHIELD ADC TELECOMMUNICATIONS AXIOM MEMORY COMPU‐CALL, INC EPIPHAN SYSTEMS HAWKING TECHNOLOGY ADDERTECHNOLOGY AXIS COMMUNICATIONS COMPUTER LAB EQUINOX SYSTEMS HERITAGE TRAVELWARE ADD‐ON COMPUTER PERIPHERALS AZIO CORPORATION COMPUTERLINKS ETHERNET DIRECT HEWLETT PACKARD ENTERPRISE ADDON STORE B & B ELECTRONICS COMTROL ETHERWAN HIKVISION DIGITAL TECHNOLOGY CO. LT ADESSO BELDEN CONNECTGEAR EVANS CONSOLES HITACHI ADTRAN BELKIN COMPONENTS CONNECTPRO EVGA.COM HITACHI DATA SYSTEMS ADVANTECH AUTOMATION CORP. BIDUL & CO CONSTANT TECHNOLOGIES INC Exablaze HOO TOO INC AEROHIVE NETWORKS BLACK BOX COOL GEAR EXACQ TECHNOLOGIES INC HP AJA VIDEO SYSTEMS BLACKMAGIC DESIGN USA CP TECHNOLOGIES EXFO INC HP INC ALCATEL BLADE NETWORK TECHNOLOGIES CPS EXTREME NETWORKS HUAWEI ALCATEL LUCENT BLONDER TONGUE LABORATORIES CREATIVE LABS EXTRON HUAWEI SYMANTEC TECHNOLOGIES ALLIED TELESIS BLUE COAT SYSTEMS CRESTRON ELECTRONICS F5 NETWORKS IBM ALLOY COMPUTER PRODUCTS LLC BOSCH SECURITY CTC UNION TECHNOLOGIES CO FELLOWES ICOMTECH INC ALTINEX, INC. -

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27

Case 3:16-cv-04144-JST Document 49 Filed 11/15/16 Page 1 of 38 1 2 3 4 5 6 7 8 UNITED STATES DISTRICT COURT 9 NORTHERN DISTRICT OF CALIFORNIA 10 SAN FRANCISCO COURTHOUSE 11 12 ADOBE SYSTEMS INCORPORATED, a Case No.: 3:16-cv-04144-JST 13 Delaware Corporation, [PROPOSED] 14 Plaintiff, PERMANENT INJUNCTION AGAINST DEFENDANT ITR 15 v. CONSULING GROUP, LLC, AND DISMISSAL OF DEFENDANT ITR 16 A & S ELECTRONICS, INC., a California CONSULTING GROUP, LLC Corporation d/b/a TRUSTPRICE; SPOT.ME 17 PRODUCTS LLC, a Nevada Limited Liability Honorable Jon S. Tigar Company; ALAN Z. LIN, an Individual; 18 BUDGET COMPUTER, a business entity of unknown status; COMPUTECHSALE, LLC, a 19 New Jersey Limited Liability Company; EXPRESSCOMM INTERNATIONAL INC., a 20 California Corporation; FAIRTRADE CORPORATION, a business entity of unknown 21 status, FCO ELECTRONICS, a business entity of unknown status; ITR CONSULTING 22 GROUP, LLC, a Texas Limited Liability Company; RELIABLE BUSINESS PARTNER, 23 INC., a New York Corporation; LESTER WIEGERS, an individual doing business as 24 ULTRAELECTRONICS; and DOES 1-10, Inclusive, 25 Defendants. 26 27 28 - 1 - [PROPOSED] PERMANENT INJUNCTION & DISMISSAL – Case No.: 3:16-cv-04144-JST Case 3:16-cv-04144-JST Document 49 Filed 11/15/16 Page 2 of 38 1 The Court, pursuant to the Stipulation for Entry of Permanent Injunction & Dismissal 2 (“Stipulation”), between Plaintiff Adobe Systems Incorporated (“Plaintiff”), on the one hand, and 3 Defendant ITR Consulting Group, LLC (“ITR”), on the other hand, hereby ORDERS, 4 ADJUDICATES and DECREES that a permanent injunction shall be and hereby is entered against 5 ITR as follows: 6 1. -

Adobe Q4 and FY2018 Investor Datasheet

Adobe Investor Relations Data Sheet Last Updated: December 13, 2018 Description Q1FY16 Q2FY16 Q3FY16 Q4FY16 FY2016 Q1FY17 Q2FY17 Q3FY17 Q4FY17 FY2017 Q1FY18 Q2FY18 Q3FY18 Q4FY18 FY2018 Revenue ($Millions) Total Revenue 1,383.3 1,398.7 1,464.0 1,608.4 5,854.4 1,681.6 1,772.2 1,841.1 2,006.6 7,301.5 2,078.9 2,195.4 2,291.1 2,464.6 9,030.0 Digital Media 931.7 943.1 990.0 1,076.2 3,941.0 1,138.1 1,212.0 1,270.2 1,390.3 5,010.6 1,460.5 1,546.4 1,608.9 1,709.5 6,325.3 Revenue by Segment Digital Experience 377.3 385.4 404.0 464.7 1,631.4 477.3 495.4 507.8 549.9 2,030.4 554.1 586.0 614.0 689.7 2,443.8 ($Millions) Publishing 74.3 70.2 70.0 67.5 282.0 66.2 64.8 63.1 66.4 260.5 64.3 63.0 68.2 65.4 260.9 Digital Media 68% 67% 68% 67% 67% 68% 68% 69% 69% 69% 70% 70% 70% 69% 70% Revenue by Segment Digital Experience 27% 28% 27% 29% 28% 28% 28% 28% 28% 28% 27% 27% 27% 28% 27% (as % of total revenue) Publishing 5% 5% 5% 4% 5% 4% 4% 3% 3% 3% 3% 3% 3% 3% 3% Digital Media Creative Revenue ($Millions) 732.9 754.9 802.7 885.6 3,176.1 942.2 1,012.1 1,063.9 1,155.7 4,173.9 1,229.5 1,303.4 1,360.0 1,450.6 5,343.5 1,2 Creative ARR ($Millions) - Updated for December 2015 Currency Rates 2,735 2,998 3,256 3,539 - - - - - - - - - - - 1,2 Creative ARR ($Millions) - Updated for December 2016 Currency Rates - - - 3,515 - 3,759 4,044 4,316 4,631 - - - - - - 1,2 Creative ARR ($Millions) - Updated for December 2017 Currency Rates - - - - - - - - 4,771 - 5,074 5,370 5,659 6,032 - 1,2 Creative ARR ($Millions) - Updated for December 2018 Currency Rates - - - - - - - - - - -

Adobe & Marketo Fast Facts

Adobe & Marketo Fast Facts Company Adobe is one of the largest software companies in Marketo, Inc., offers the leading Engagement Overview the world and is the global leader in creative, Platform that empowers marketers to create lasting digital document and digital experience solutions. relationships and grow revenue. Consistently Its diverse product line—which includes Adobe recognized as the industry's innovation pioneer, Creative Cloud, Adobe Document Cloud and Adobe Marketo is the trusted platform for thousands of Experience Cloud—enables customers to create CMOs thanks to its scalability, reliability, and groundbreaking digital content, deploy it across openness. Marketo is headquartered in San Mateo, media and devices, measure and optimize it over CA, with offices around the world, and serves as a time, and achieve greater business success. Only strategic partner to large enterprises and fast- Adobe gives everyone—from emerging artists to growing organizations across a wide variety of global brands—everything they need to design and industries. deliver exceptional digital experiences. Ticker Symbol NASDAQ: ADBE Privately held company Website www.adobe.com www.marketo.com Headquarters San Jose, CA San Mateo, CA CEO Shantanu Narayen Steve Lucas Employees 19,000+ worldwide 1,300+ worldwide Revenue Reported revenue of $7.3 billion in FY2017 Not disclosed History Founded in 1982; Went public in 1986 Founded in 2006; Acquired by Vista Equity Partners in 2016 Founders Chuck Geschke, John Warnock Phil Fernandez, Jon Miller, David Morandi Industry Position Adobe Experience Cloud gives companies Marketo is the leading provider of marketing everything they need to deliver well-designed, engagement, analytics and attribution software. -

Web Crawling, Analysis and Archiving

Web Crawling, Analysis and Archiving Vangelis Banos Aristotle University of Thessaloniki Faculty of Sciences School of Informatics Doctoral dissertation under the supervision of Professor Yannis Manolopoulos October 2015 Ανάκτηση, Ανάλυση και Αρχειοθέτηση του Παγκόσμιου Ιστού Ευάγγελος Μπάνος Αριστοτέλειο Πανεπιστήμιο Θεσσαλονίκης Σχολή Θετικών Επιστημών Τμήμα Πληροφορικής Διδακτορική Διατριβή υπό την επίβλεψη του Καθηγητή Ιωάννη Μανωλόπουλου Οκτώβριος 2015 i Web Crawling, Analysis and Archiving PhD Dissertation ©Copyright by Vangelis Banos, 2015. All rights reserved. The Doctoral Dissertation was submitted to the the School of Informatics, Faculty of Sci- ences, Aristotle University of Thessaloniki. Defence Date: 30/10/2015. Examination Committee Yannis Manolopoulos, Professor, Department of Informatics, Aristotle University of Thes- saloniki, Greece. Supervisor Apostolos Papadopoulos, Assistant Professor, Department of Informatics, Aristotle Univer- sity of Thessaloniki, Greece. Advisory Committee Member Dimitrios Katsaros, Assistant Professor, Department of Electrical & Computer Engineering, University of Thessaly, Volos, Greece. Advisory Committee Member Athena Vakali, Professor, Department of Informatics, Aristotle University of Thessaloniki, Greece. Anastasios Gounaris, Assistant Professor, Department of Informatics, Aristotle University of Thessaloniki, Greece. Georgios Evangelidis, Professor, Department of Applied Informatics, University of Mace- donia, Greece. Sarantos Kapidakis, Professor, Department of Archives, Library Science and Museology, Ionian University, Greece. Abstract The Web is increasingly important for all aspects of our society, culture and economy. Web archiving is the process of gathering digital materials from the Web, ingesting it, ensuring that these materials are preserved in an archive, and making the collected materials available for future use and research. Web archiving is a difficult problem due to organizational and technical reasons. We focus on the technical aspects of Web archiving. -

Adbe 10K Fy11- Final

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 _____________________________ FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 2, 2011 or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 0-15175 ADOBE SYSTEMS INCORPORATED (Exact name of registrant as specified in its charter) _____________________________ Delaware 77-0019522 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 345 Park Avenue, San Jose, California 95110-2704 (Address of principal executive offices and zip code) (408) 536-6000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, $0.0001 par value per share The NASDAQ Stock Market LLC (NASDAQ Global Select Market) Securities registered pursuant to Section 12(g) of the Act: None _____________________________ Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.