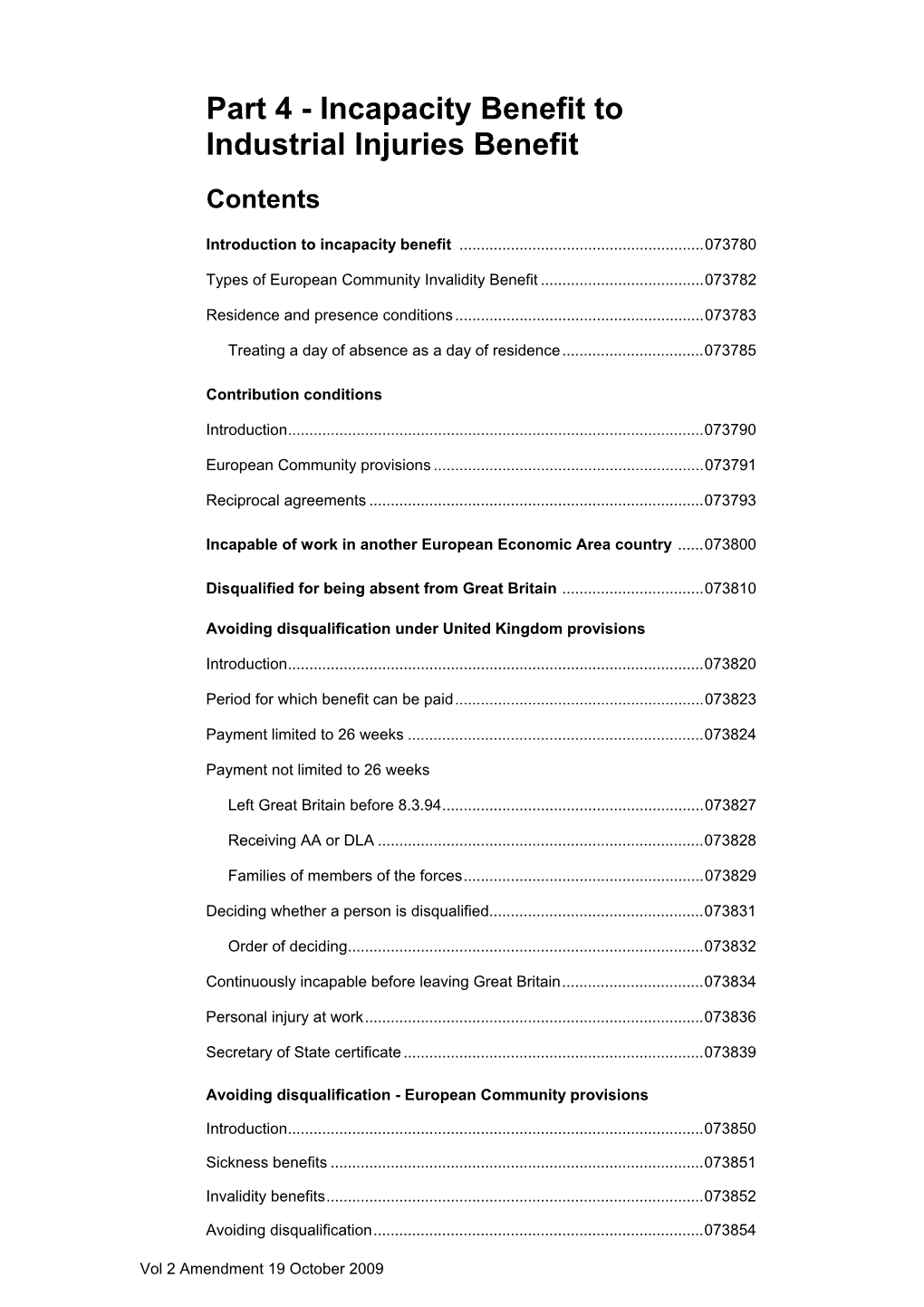

Incapacity Benefit to Industrial Injuries Benefit Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Comparing Historical and Modern Methods of Sea Surface Temperature

EGU Journal Logos (RGB) Open Access Open Access Open Access Advances in Annales Nonlinear Processes Geosciences Geophysicae in Geophysics Open Access Open Access Natural Hazards Natural Hazards and Earth System and Earth System Sciences Sciences Discussions Open Access Open Access Atmospheric Atmospheric Chemistry Chemistry and Physics and Physics Discussions Open Access Open Access Atmospheric Atmospheric Measurement Measurement Techniques Techniques Discussions Open Access Open Access Biogeosciences Biogeosciences Discussions Open Access Open Access Climate Climate of the Past of the Past Discussions Open Access Open Access Earth System Earth System Dynamics Dynamics Discussions Open Access Geoscientific Geoscientific Open Access Instrumentation Instrumentation Methods and Methods and Data Systems Data Systems Discussions Open Access Open Access Geoscientific Geoscientific Model Development Model Development Discussions Open Access Open Access Hydrology and Hydrology and Earth System Earth System Sciences Sciences Discussions Open Access Ocean Sci., 9, 683–694, 2013 Open Access www.ocean-sci.net/9/683/2013/ Ocean Science doi:10.5194/os-9-683-2013 Ocean Science Discussions © Author(s) 2013. CC Attribution 3.0 License. Open Access Open Access Solid Earth Solid Earth Discussions Comparing historical and modern methods of sea surface Open Access Open Access The Cryosphere The Cryosphere temperature measurement – Part 1: Review of methods, Discussions field comparisons and dataset adjustments J. B. R. Matthews School of Earth and Ocean Sciences, University of Victoria, Victoria, BC, Canada Correspondence to: J. B. R. Matthews ([email protected]) Received: 3 August 2012 – Published in Ocean Sci. Discuss.: 20 September 2012 Revised: 31 May 2013 – Accepted: 12 June 2013 – Published: 30 July 2013 Abstract. Sea surface temperature (SST) has been obtained 1 Introduction from a variety of different platforms, instruments and depths over the past 150 yr. -

Official U.S. Bulletin

: : WBLISUED DJIILY under order of THE PRESIDENT of THE UNITED STATES by COMMITTEE on PUBLIC INFORMATION GEORGE CREEL, Chairman ir "k ~k COMPLETE Record of U, S, GOVERNMENT Activities VoL. 3 WASHINGTON, SATURDAY, FEBRUARY 15, 1919. No. 539 STATEMENT BY SECRETARY BAKER OCEAN SHIPPING PREFERENCE COMMISSIONS FOR 15,419 RELATING TO THE MAINTENANCE TO SOUTH miCA CANCELED DISCHARGED MEN GIVEN IN OF AMERICAN TROOPS IN RUSSIA War Trade Board Rule Revoliing Procedure ou Shipments to OFFICERS’ RESERVE CORPS, RECEIVES A DETROIT DELEGATION the East Coast. GENERAL MARCH REPORTS Supreme Military Command in Paris The War Trade Board announces, in a Would Not Permit Allied Forces new ruling (W. T. B. R. 600), supple- 9,026 APPLICATIONS menting W. T. B. R. 573, issued Febru- to Remain Without Reinforcements ary 3, 1919, that the ocean shipping pref- FOR REGULAR ARMY erence procedure for the east coast of in Face Danger, He Says. of South America (see W. T. B. R. 363, is- Progress of Demobilization sued Dec. 8, 1918 ; W. T. B. R. 413, is- Press statement by the Secretary of sued Dec. 14, 1918 W. T. B. R. 425, is- ; of Overseas Forces De~ War, February 15, 1919 sued Dec. 16, 1918, and W. T. B. R. 501, “ A delegation of citizens from Detroit, issued Jan. 13, 1919) has been canceled, pendent Upon Shipping, Mich., called on the Secretary of War and the steamship companies have been to-day with reference to numerously- instructed to disregard any outstanding Says Weekly Press State- signed petitions which are to be presented preferences heretofore granted. -

1779 Soldiers, Sailors and Marines Kyllonen

1779 Soldiers, Sailors and Marines Kyllonen pation, farmer; inducted at Hillsboro on April 29, 1918; sent to Camp Dodge, Iowa; served in Company K, 350th Infantry, to May 16, 1918; Com- pany K, 358th Infantry, to discharge; overseas from June 20, 1918, to June 7, 1919. Engagements: Offensives: St. Mihiel; Meuse-Argonne. De- fensive Sectors: Puvenelle and Villers-en-Haye (Lorraine). Discharged at Camp Dodge, Idwa, on June 14, 1919, as a Private. KYLLONEN, CHARLEY. Army number 4,414,704; registrant, Nelson county; born, Brocket, N. Dak., July 5, 1894, of Finnish parents; occu- pation, farmer; inducted at La,kota on Sept. 3, 1918; sent to Camp Grant, Ill.; served in Machine Gun Training Center, Camp Hancock, Ga., to dis- charge. Discharged at Camp Hancock, Ga., on March 26, 1919, as a Private. KYLMALA, AUGUST. Army number 2,110,746; registrant, Dickey county; born, Oula, Finland, Aug. 9, 1887; naturalized citizen; occupation, laborer; inducted at Ellendale on Sept. 21, 1917; sent. to Camp Dodge, Iowa; served in Company I, 352nd Infantry, to Nov. 28, 1917; Company L, 348th Infantry, to May 18, 1918; 162nd Depot Brigade, to June 17, 1918; 21st Battalion, M. S. Gas Company, to Aug. 2, 1918; 165th Depot Brigade, to discharge. Discharged at Camp Travis, Texas, on Dec. 4, 1918, as a Private. KYNCL, JOHN. Army number 298,290; registrant, Cavalier county; born, Langdon, N. Dak., March 27, 1896, of Bohemian parents; occupation, farmer; inducted at Langdon on Dec. 30, 1917; sent to Fort Stevens, Ore.; served in Battery D, 65th Artillery, Coast Artillery Corps, to discharge; overseas from March 25, 1918, to Jan. -

Support Directory for Families, Authority Staff and Partner Agencies

1 From mountain to sea Aberdeenshirep Support Directory for Families, Authority Staff and Partner Agencies December 2017 2 | Contents 1 BENEFITS 3 2 CHILDCARE AND RESPITE 23 3 COMMUNITY ACTION 43 4 COMPLAINTS 50 5 EDUCATION AND LEARNING 63 6 Careers 81 7 FINANCIAL HELP 83 8 GENERAL SUPPORT 103 9 HEALTH 180 10 HOLIDAYS 194 11 HOUSING 202 12 LEGAL ASSISTANCE AND ADVICE 218 13 NATIONAL AND LOCAL SUPPORT GROUPS (SPECIFIC CONDITIONS) 223 14 SOCIAL AND LEISURE OPPORTUNITIES 405 15 SOCIAL WORK 453 16 TRANSPORT 458 SEARCH INSTRUCTIONS 1. Right click on the document and select the word ‘Find’ (using a left click) 2. A dialogue box will appear at the top right hand side of the page 3. Enter the search word to the dialogue box and press the return key 4. The first reference will be highlighted for you to select 5. If the first reference is not required, return to the dialogue box and click below it on ‘Next’ to move through the document, or ‘previous’ to return 1 BENEFITS 1.1 Advice for Scotland (Citizens Advice Bureau) Information on benefits and tax credits for different groups of people including: Unemployed, sick or disabled people; help with council tax and housing costs; national insurance; payment of benefits; problems with benefits. http://www.adviceguide.org.uk 1.2 Attendance Allowance Eligibility You can get Attendance Allowance if you’re 65 or over and the following apply: you have a physical disability (including sensory disability, e.g. blindness), a mental disability (including learning difficulties), or both your disability is severe enough for you to need help caring for yourself or someone to supervise you, for your own or someone else’s safety Use the benefits adviser online to check your eligibility. -

Notes About Claiming Carer's Allowance

Carer’s Allowance Notes Carer’s Allowance gives fnancial help to people who cannot take up full-time paid work as they provide regular care to a disabled person. The quickest and easiest way to claim Carer’s Allowance is online. Check if you can get Carer’s Allowance and make a claim at www.gov.uk/carers-allowance We have many different ways we can communicate with you If you would like us to communicate with you by braille, British Sign Language, a hearing loop, translations, large print, audio or something else please contact us. You can find our contact details by searching for the relevant benefit on GOV.UK About these notes • These notes tell you more about Carer’s Allowance • They tell you how Carer’s Allowance might affect other benefts that you or the person you provide care for are getting • You can check if you might get Carer’s Allowance by using an easy checklist on page 2 of this booklet. If you cannot get Carer’s Allowance, go to www.gov.uk to see what other help you might be able to get About the form • Use the form to claim Carer’s Allowance • You, the carer, should fll in the form, not the person you provide care for. • Please fll in the form with BLACK INK and in CAPITALS • Please answer all the questions and send us all the documents we ask for • Contact us if you cannot fll in the form or send us the documents we ask for, because this might delay your claim • The form and these notes are available in Welsh, large print or braille. -

A Man's Passion, Seen in the Cards by Jonathan Yardley

The Washington Post May 2, 2006 Tuesday Final Edition Style; C08 , BOOK WORLD A Man's Passion, Seen in the Cards By Jonathan Yardley VULNERABLE IN HEARTS A Memoir of Fathers, Sons, and Contract Bridge By Sandy Balfour Farrar, Straus and Giroux. 204 pp. $22 The game of contract bridge -- a variation dashing men in tuxedos played for high and improvement upon auction bridge, itself stakes while sipping vodka martinis and an offspring of whist -- was introduced by seducing women of impeccable breeding Harold Stirling Vanderbilt "while on a and pleasingly fluid morals." cruise ship called the SS Finland sailing As that passage suggests, "Vulnerable through the Panama Canal in the fall of in Hearts" is, as Balfour acknowledges, "a 1925," Sandy Balfour writes. It was an book about bridge that [isn't] really about immediate hit with the three men with bridge at all." It is, as its subtitle says, about whom he played, and before long it was a hit fathers and sons, and about how a game can just about everywhere. It featured, according become not merely a metaphor for certain to Vanderbilt, "a number of new and aspects of their lives but also something far exciting features," all of which increased the more than a mere game. The rules and game's complexity and added "enormously," conventions of bridge fascinated Tom Vanderbilt claimed, to its popularity. Balfour, and he saw their deeper One of those who fell under the implications. "Everyone gets dealt some game's spell was a Scotsman named Tom cards," he said. "It's what you make of them Balfour. -

Benefit and Pension Rates 2020 to 2021

Benefit and Pension Rates 2020/2021 RATES RATES (Weekly rates unless otherwise shown) 2019 2020 ATTENDANCE ALLOWANCE higher rate 87.65 89.15 low er rate 58.70 59.70 BEREAVEMENT BENEFIT (for deaths between 11 April 1998 & 5 April 2017) Widowed Parents Allowance 119.90 121.95 BEREAVEMENT SUPPORT PAYMENT (for deaths occurring on or after 6 April 2017) Standard rate (lump sum) 2500.00 2500.00 Standard rate monthly payments 100.00 100.00 Higher rate (lump sum) 3500.00 3500.00 Higher rate monthly payments 350.00 350.00 BENEFIT CAP - Rates introduced November 2016 Reduction in annual level of Benefit Cap (Greater London) Couples (with or without children) or single claimants with a child of qualifying age 23000.00 23000.00 Single adult households without children 15410.00 15410.00 Reduction in annual level of Benefit Cap (Rest of Great Britain) Couples (with or without children) or single claimants with a child of qualifying age 20000.00 20000.00 Single adult households without children 13400.00 13400.00 Monthly equivalent (Greater London) Couples (with or without children) or single claimants with a child of qualifying age 1916.67 1916.67 Single adult households without children 1284.17 1284.17 Monthly equivalent (Rest of Great Britain) Couples (with or without children) or single claimants with a child of qualifying age 1666.67 1666.67 Single adult households without children 1116.67 1116.67 Weekly equivalent (Greater London) Couples (with or without children) or single claimants with a child of qualifying age 442.31 442.31 Single adult households -

Pulling in Different Directions? the Impact of Economic Recovery and Continued Changes to Social Security on Health and Health Inequalities in Scotland

Pulling in different directions? The impact of economic recovery and continued changes to social security on health and health inequalities in Scotland Martin Taulbut, Wendy Hearty, Fiona Myers, Neil Craig and Gerry McCartney 2016 We are happy to consider requests for other languages or formats. Please contact 0131 314 5300 or email [email protected] Research undertaken June 2014–October 2015. This document should be cited as: Taulbut M, Hearty W, Myers F, Craig N, McCartney G. Pulling in different directions? The impact of economic recovery and continued changes to social security on health and health inequalities in Scotland. Edinburgh: NHS Health Scotland; 2016 Published by NHS Health Scotland 1 South Gyle Crescent Edinburgh EH12 9EB © NHS Health Scotland 2016 All rights reserved. Material contained in this publication may not be reproduced in whole or part without prior permission of NHS Health Scotland (or other copyright owners). While every effort is made to ensure that the information given here is accurate, no legal responsibility is accepted for any errors, omissions or misleading statements. NHS Health Scotland is a WHO Collaborating Centre for Health Promotion and Public Health Development. Contents Acknowledgements .................................................................................................... 2 Selected glossary of terms ......................................................................................... 3 Executive summary ................................................................................................... -

Changes to Pay Periods and Pay Week-Ending Days

Changes to pay periods and pay week-ending days Summary of the changes From 6 April 2009 Jobcentre Plus will introduce important changes for the majority of customers receiving working age benefits. Instead of receiving different benefits on different days people will have one pay week-ending day allocated to them that is determined by their National Insurance number. Also, payments will normally be made a minimum of fortnightly in arrears instead of the current situation where some benefits are paid weekly and others fortnightly. The aim of this is to simplify the benefits system as people will retain the same pay week- ending day whichever benefit they are awarded from Jobcentre Plus. The following sections give more details of the changes and how they may affect you. Please use the links below to navigate to the top of the relevant page…… Working age benefit customers included in the changes Notification of the changes Pay week-ending day and pay period explained Pay week-ending day changes If you are moving from payment in advance to payment in arrears Non-recoverable compensation payment Illustration of moving from payment in advance to payment in arrears If you are moving from receiving payments weekly in arrears to fortnightly in arrears Recoverable payment Illustration of moving from weekly in arrears to fortnightly in arrears If only your pay week-ending day is changing Weekly Payments Conversion Procedures Jobseeker's Allowance When will my benefit award for Jobseeker’s Allowance be converted? If only your pay week-ending -

Local Authority Breakdown: Incapacity Benefits and Disability Living Allowance Claimants with Main Condition of Alcohol Or Drug Abuse - Update

Local Authority Breakdown: Incapacity Benefits and Disability Living Allowance claimants with main condition of alcohol or drug abuse - Update July 2012 Background Incapacity benefits are weekly payments for people who become incapable of work while under State Pension age. They are: Employment and Support Allowance (ESA), which is for new claimants from October 2008, offers personalised support and financial help, so that claimants can do appropriate work, if they are able to, and provides increased financial support for those who have an illness or disability that severely affects their ability to work. Incapacity Benefit (IB) provides support for people who cannot work because of an illness or disability which started before October 2008. Similarly, Severe Disablement Allowance (SDA) could be claimed before April 2001 by those unable to work for at least 28 weeks in a row because of illness or disability. IB and SDA are being phased out, and work is underway to review claims of those under state pension age to see if they can claim ESA instead. Disability Living Allowance (DLA) is a non-means-tested benefit that provides a cash contribution towards the extra costs of needs arising from an impairment or health condition. From 2013 the Government is proposing to replace DLA with a new benefit called Personal Independence Payment to support disabled working age people with the greatest needs and help them live more independently. More information on incapacity benefits and DLA is available on the DirectGov website at http://www.direct.gov.uk/en/DisabledPeople/FinancialSupport/esa/DG_171894 and http://www.direct.gov.uk/en/MoneyTaxAndBenefits/BenefitsTaxCreditsAndOtherSupport/Di sabledpeople/DG_10018702 . -

Are You Claiming Free Prescriptions?

Are you claiming free prescriptions? Don’t assume you’re entitled. You could have to pay up to £100 – as well as your prescription charge. Check before you tick What entitles you to free NHS prescriptions? Your age You’re entitled to free prescriptions if you’re: • under 16 • 16, 17, or 18 and in full-time education • 60 or over Students aged 19 and over aren’t automatically entitled to free prescriptions, but can apply for help through the NHS Low Income Scheme (see page 6). Certain benefits Not all benefits entitle you to free prescriptions. Check which type of benefit you get before you tick the back of your prescription. You’re entitled to free prescriptions if you are named on a claim for: • Income Support • income-based Jobseeker’s Allowance • income-related Employment and Support Allowance • Pension Credit (Guarantee Credit) paid on its own, or Pension Credit (Guarantee Credit with Savings Credit) • certain Tax Credits - see page 4, under ‘NHS Tax Credit Exemption Certificate’ • Universal Credit - but only if your earnings in your last assessment period were £435 or less, or £935 or less if you get an element for a child or have limited capability for work 2 You’re not entitled to free prescriptions if you are named on a claim for: • contribution-based Jobseeker’s Allowance, paid on its own • contribution-based Employment and Support Allowance, paid on its own • Pension Credit (Savings Credit), paid on its own • any benefit paid on its own and not listed in the green box opposite (such as Disability Living Allowance, Personal Independence Payment or Incapacity Benefit) Certificates You’re entitled to free NHS prescriptions if you have one of these certificates and it is still valid. -

Attachment #3 Ship Manifest for Olympic (Radovs) and Finland (Mandibergs)

ATTACHMENT #3 SHIP MANIFEST FOR OLYMPIC (RADOVS) AND FINLAND (MANDIBERGS) Discussed in conversations of Bertha Blau, Jack Thompson and Alan Mandiberg. Radov Chronicles © Joel Levin SHIP MANIFEST FOR OLYMPIC (RADOVS & CAROLS) AND FINLAND (MANDIBERGS) The Radovs Radovs came to the United States in 1908, 1911 and 1922. It is unclear what passage was booked for the first two trips, with only limited family members making the initial voyages. In 1908, Joe Radov and Raful Carl, with his older children Morris and Minnie, came. In 1911, Joe Radov returned for his wife, Cirka (Sarah), and two children, Sam and Gus, as well as his sister, Ida, to help care for the children should one need to be left at Ellis Island for quarantine. In 1922, when most of the Radovs arrived, it was aboard the R.M.S. Olympic. The passage (described further in Attachment 17, A76‐79), which began in Russia and Bucharest, departed from Cherbourg, France on the coast of Normandy. Luba Radov gave birth on ship, mid‐Atlantic, to Anna. The vessel itself, the Olympic, was the sister ship to the Titanic on the White Star Line. The earlier trip in 1911 by the Mandibergs was made on the U.S.S. Finland, a ship that, at least after some re‐chartering, joined the White Star Line in 1909. Like the occasionally troubled Finland, the Olympic could be a dangerous carrier. It collided with the H.M.S. Hawke, but unlike the most famous ship of the White Star Line, the Titanic, it did not sink altogether. The Olympic in New York in 1911 on her maiden voyage.