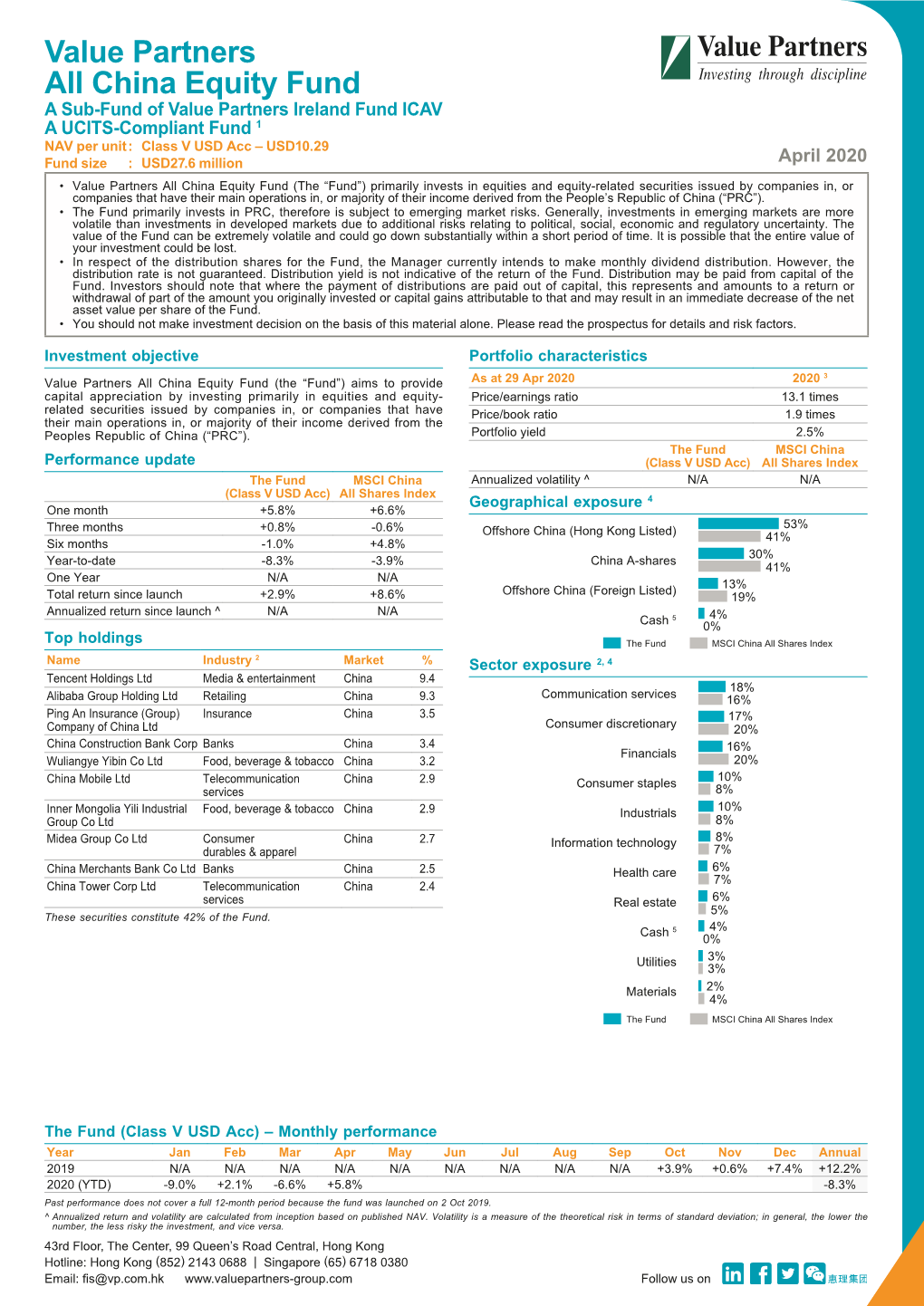

Value Partners All China Equity Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Reform in Deep Water Zone: How Could China Reform Its State- Dominated Sectors at Commanding Heights

Reform in Deep Water Zone: How Could China Reform Its State- Dominated Sectors at Commanding Heights Yingqi Tan July 2020 M-RCBG Associate Working Paper Series | No. 153 The views expressed in the M-RCBG Associate Working Paper Series are those of the author(s) and do not necessarily reflect those of the Mossavar-Rahmani Center for Business & Government or of Harvard University. The papers in this series have not undergone formal review and approval; they are presented to elicit feedback and to encourage debate on important public policy challenges. Copyright belongs to the author(s). Papers may be downloaded for personal use only. Mossavar-Rahmani Center for Business & Government Weil Hall | Harvard Kennedy School | www.hks.harvard.edu/mrcbg 1 REFORM IN DEEP WATER ZONE: HOW COULD CHINA REFORM ITS STATE-DOMINATED SECTORS AT COMMANDING HEIGHTS MAY 2020 Yingqi Tan MPP Class of 2020 | Harvard Kennedy School MBA Class of 2020 | Harvard Business School J.D. Candidate Class of 2023 | Harvard Law School RERORM IN DEEP WATER ZONE: HOW COULD CHINA REFORM ITS STATE-DOMINATED SECTORS AT COMMANDING HEIGHTS 2 Contents Table of Contents Contents .................................................................................................. 2 Acknowledgements ................................................................................ 7 Abbreviations ......................................................................................... 8 Introduction ......................................................................................... -

Pacer CSOP FTSE China A50 ETF Schedule of Investments July 31, 2020 (Unaudited) Shares Value COMMON STOCKS - 98.0% Agriculture - 1.6% Muyuan Foodstuff Co Ltd

Page 1 of 4 Pacer CSOP FTSE China A50 ETF Schedule of Investments July 31, 2020 (Unaudited) Shares Value COMMON STOCKS - 98.0% Agriculture - 1.6% Muyuan Foodstuff Co Ltd. - Class A 9,230 $ 120,977 Wens Foodstuffs Group Co Ltd. - Class A 4,660 15,857 136,834 Auto Manufacturers - 0.7% SAIC Motor Corp Ltd. - Class A 24,600 64,077 Banks - 23.7% Agricultural Bank of China Ltd. - Class H 352,300 163,039 Bank of China Ltd. - Class H 193,900 92,512 Bank of Communications Co Ltd. - Class A 184,100 125,556 China CITIC Bank Corp Ltd. - Class H 24,700 18,261 China Construction Bank Corp. - Class H 81,500 71,464 China Everbright Bank Co Ltd. - Class H 126,400 68,456 China Merchants Bank Co Ltd. - Class A 108,200 539,489 China Minsheng Banking Corp Ltd. - Class A 254,300 201,851 Industrial & Commercial Bank of China Ltd. - Class A 198,400 140,993 Industrial Bank Co Ltd. - Class A 127,400 285,849 Ping An Bank Co Ltd. - Class A 75,000 143,348 Shanghai Pudong Development Bank Co Ltd. - Class A 132,300 196,379 2,047,197 Beverages - 17.9% Jiangsu Yanghe Brewery Joint-Stock Co Ltd. - Class A 4,000 77,398 Kweichow Moutai Co Ltd. - Class A 4,000 961,777 Wuliangye Yibin Co Ltd. - Class A 16,200 504,835 1,544,010 Building Materials - 1.6% Anhui Conch Cement Co Ltd. - Class H 15,900 139,921 Coal - 0.5% China Shenhua Energy Co Ltd. -

Kweichow Moutai Growth Declines on Slow Deliveries

CHINA DAILY Tuesday, October 30, 2018 BUSINESS 17 Kweichow Moutai growth Execs optimistic on import expo By WANG YING in Shanghai products, their know-how, “Shanghai has become a [email protected] and how interesting they are vital center for advanced as a company,” said Brian technology leadership — for Top multinational corpora- Duperreault, president, CEO ABB and the world ... We will tions’ executives have and director of finance cor- make full use of the city’s declines on slow deliveries expressed their enthusiasm poration American Interna- existing advantages and for the first China Internation- tional Group Inc. make clear the main challen- al Import Expo set to launch According to Severin ges facing Shanghai, focus Share price of on Nov 5, as part of the nation’s Schwan, CEO of Roche Group, support policies on measures efforts to expand opening-up. the pharmaceuticals giant that can address the challen- liquor maker slips While attending the 30th will showcase its cutting-edge ges, and develop specific but consumption International Business Lead- technology at the import plans and solutions,” Spies- ers’ Advisory Council, held expo, covering early research shofer said, explaining the upgrades to buoy annually in Shanghai, busi- and development, integrated company’s rationale. ness leaders said they are diagnosis and treatment solu- “We are not only seeing future prospects optimistic about China’s tions, and personalised progress in Shanghai’s reform opening-up policy and new healthcare offerings. and opening-up, but we at By ZHU WENQIAN in Beijing opportunities. Roche are taking an active role and YANG JUN in Guiyang “The import expo is in the development of China’s unprecedented in China for biomedical industry. -

Jpmorgan Funds - China A-Share Opportunities Fund

Fund House of the Year Fund Selector Asia Awards - Singapore3) Singapore 2021 - Greater China/China Equity - Platinum4) FOR SINGAPORE INVESTORS ONLY SINGAPORE RECOGNISED SCHEME FACT SHEET | July 31, 2021 JPMorgan Funds - China A-Share Opportunities Fund INVESTMENT OBJECTIVE PERFORMANCE To provide long-term capital growth by investing primarily inCUMULATIVE PERFORMANCE (%) companies of the People's Republic of China (PRC). JPM China A-Share Opportunities A (acc) - USD CSI 300 (Net)1) EXPERTISE 300 200 Fund Manager Howard Wang, Rebecca Jiang 250 150 % CHANGE FUND INFORMATION (JPMorgan Funds - China A-Share Opportunities Fund) 200 100 Fund base currency Launch Date REBASED 150 50 CNH 11/09/15 Total fund size (m) Inception NAV 100 0 USD 8,051.8 USD 15.61 50 -50 ISIN code 08/15 08/16 08/17 08/18 08/19 08/20 08/21 LU1255011170 Since 11/09/15 Current charge Since 1 month 3months 1 year 3 years 5 years Initial : Up to 5.0% of NAV launch Redemption : Currently 0% (Up to 0.5% of NAV) A (acc) - USD (NAV to NAV) -7.9 -4.4 20.8 98.6 143.2 149.4 Management fee : 1.5% p.a. A (acc) - USD (Charges applied)* -12.3 -9.0 15.0 89.2 131.5 137.4 Subscription Channel Benchmark (in USD)1) -6.7 -4.9 12.3 52.4 69.1 59.2 Cash A (acc) - RMB (NAV to NAV) -8.0 -4.5 11.8 88.4 136.4 151.7 SRS(for platforms only) A (acc) - RMB (Charges applied)* -12.4 -9.0 6.4 79.4 125.1 139.7 RATINGS A (acc) - SGD (NAV to NAV) -7.3 -2.6 19.0 97.4 - 105.5 A (acc) - SGD (Charges applied)* -11.8 -7.2 13.3 88.0 - 95.7 Morningstar Analyst Rating Silver Morningstar Rating™ ★★★★★ ANNUALISED -

Annual Report 2019 001 2019 MILESTONES

CORPORATE CULTURE About China Telecom China Telecom Corporation Limited (“China Telecom” or the “Company”, a joint stock Corporate Mission limited company incorporated in the People’s Republic of China with limited liability, together with its subsidiaries, collectively the “Group”) is a large-scale and leading Let the customers fully enjoy a new information life integrated intelligent information services operator in the world, providing wireline & mobile telecommunications services, Internet access services, information services and other value-added telecommunications services primarily in the PRC. As at the end of 2019, the Strategic Goal Company had mobile subscribers of about 336 million, wireline broadband subscribers of about 153 million and access lines in service of about 111 million. The Company’s H shares Be a leading integrated intelligent information services operator and American Depositary Shares (“ADSs”) are listed on The Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange” or ”HKSE”) and the New York Stock Exchange respectively. Core Value Comprehensive innovation, pursuing truth and pragmatism, respecting people and creating value all together Operation Philosophy Pursue mutual growth of corporate value and customer value Service Philosophy Customer First Service Foremost Code of Corporate Practice Keep promise and provide excellent service for customers Cooperate honestly and seek win-win result in joint innovation Operate prudently and enhance corporate value continuously Manage precisely and allocate resources scientifically Care the staff and tap their potential to the full Reward the society and be a responsible corporate citizen Corporate Slogan Connecting the World Forward-Looking Statements Certain statements contained in this report may be viewed as “forward-looking statements” within the meaning of Section 27A of the U.S. -

2020 Annual Report 9668

渤海銀行股份有限公司 CHINA BOHAI BANK CO., LTD. (A joint stock company incorporated in the People’s Republic of China with limited liability) Stock Code : 9668 CHINA BOHAI BANK CO., LTD. CO., CHINA BOHAI BANK 2020 ANNUAL REPORT 2020 ANNUAL REPORT Annual Report 2020 Contents 1 Contents Definitions 2 Important Notice 4 Chairman’s Statement 5 President’s Statement 6 Statement of the Chairman of the Board of Supervisors 7 Corporate Profile 8 Awards and Ranking 10 Summary of Accounting Data and Business Data 11 Management Discussion and Analysis 15 Changes in Share Capital and Information on Shareholders 65 Directors, Supervisors, Members of Senior Management, Employees and Branches 71 Corporate Governance 86 Report of the Board of Directors 108 Report of the Board of Supervisors 117 Important Events 124 Audit Report and Financial Report 129 Organizational Structure Chart 280 CHINA BOHAI BANK CO., LTD. Annual Report 2020 2 Denitions Definitions Articles of Association the Articles of Association of CHINA BOHAI BANK CO., LTD. Bank, our Bank, Company, CHINA BOHAI BANK CO., LTD. (渤海銀行股份有限公司), a joint stock company our Company established on December 30, 2005 in the PRC with limited liability pursuant to the relevant PRC laws and regulations, and its H Shares were listed on the Hong Kong Stock Exchange (Stock Code: 9668) CBIRC China Banking and Insurance Regulatory Commission (中國銀行保險監督管理委員會) CBRC the former China Banking Regulatory Commission (中國銀行業監督管理委員會) Central Bank, PBoC the People’s Bank of China China Accounting Standards Accounting Standards for -

Premium China Funds Management

Premium China Fund Top 10 Portfolio Holdings as at 31 July 2020 Tencent (Media & Entertainment) Market Cap: USD 660.2 Billion • Tencent, a world leader in the internet-related services space, provides services across instant messaging, social media, email, web-portals, e-commerce, advertising, online payment as well as multiplayer games. • With offerings including QQ Instant Messenger and WeChat, Tencent is providing similar services to the likes of Facebook, Twitter and WhatsApp. By the end of Q2 2018, QQ had 803 million monthly active user accounts, whilst WeChat, since its launch in 2011, accommodates for over 1 Billion monthly active users. • In November 2017, Tencent's market value reached US$528 billion, surpassing Facebook’s market value at the time, which resulted in it being recognised as one of the world's top 5 most valuable public companies. Alibaba Group (Retailing) Market Cap: USD 681.2 Billion • Alibaba, an e-commerce giant, provides services ranging from web portals connecting businesses and consumers, electronic payment services and internet infrastructure. • Its flagship site Alibaba.com is the world’s largest online business-to-business trading platform for small businesses, handling sales between importers and exporters from over 240 countries. whilst its consumer-to-consumer portal—Taobao functions similar to eBay featuring nearly a billion products. Currently, it is amongst one of the 20 most visited websites globally on a consistent basis. • Global brands such as Nike, Uniqlo and Burberry, use Alibaba’s Tmall platform to market to an estimated 300 million shoppers. The companies online payment platform—Alipay is larger than PayPal and accounts for roughly half of all online payment transactions within China. -

2020 Annual Report

AUGUST 31, 2020 2020 Annual Report iShares, Inc. • iShares ESG Aware MSCI EM ETF | ESGE | NASDAQ • iShares MSCI Emerging Markets ex China ETF | EMXC | NASDAQ • iShares MSCI Emerging Markets Min Vol Factor ETF | EEMV | Cboe BZX • iShares MSCI Emerging Markets Multifactor ETF | EMGF | Cboe BZX • iShares MSCI Global Min Vol Factor ETF | ACWV | Cboe BZX Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. You may elect to receive all future reports in paper free of charge. Ifyou hold accounts throughafinancial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies ofyour shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds held with your financial intermediary. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by contactingyour financial intermediary. Please note that not all financial intermediaries may offer this service. -

CHINA VANKE CO., LTD.* 萬科企業股份有限公司 (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 2202)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. CHINA VANKE CO., LTD.* 萬科企業股份有限公司 (A joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2202) 2019 ANNUAL RESULTS ANNOUNCEMENT The board of directors (the “Board”) of China Vanke Co., Ltd.* (the “Company”) is pleased to announce the audited results of the Company and its subsidiaries for the year ended 31 December 2019. This announcement, containing the full text of the 2019 Annual Report of the Company, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to information to accompany preliminary announcement of annual results. Printed version of the Company’s 2019 Annual Report will be delivered to the H-Share Holders of the Company and available for viewing on the websites of The Stock Exchange of Hong Kong Limited (www.hkexnews.hk) and of the Company (www.vanke.com) in April 2020. Both the Chinese and English versions of this results announcement are available on the websites of the Company (www.vanke.com) and The Stock Exchange of Hong Kong Limited (www.hkexnews.hk). In the event of any discrepancies in interpretations between the English version and Chinese version, the Chinese version shall prevail, except for the financial report prepared in accordance with International Financial Reporting Standards, of which the English version shall prevail. -

Investment Daily

Investment Daily 12 August 2020 Major Market Indicators Market Overview 11 Aug 10 Aug 7 Aug Mkt. Turn.(mn) 141,400 135,300 177,800 HK stock will retreat today, resistance at 25,000; Eye on Tencent Stock Advances 1,015 741 577 Result Stock Declines 857 1,054 1,242 Overnight US equities performed well. Hang Seng Index significantly rebounded 513 points to 24,890 HSI 24,891 24,377 24,532 after dropping two days in a row. H-share Index rose 162 points to 10,153. Market turnover was Change +531 -154 -399 HK$141.4 billion. Heavyweight blue chips boosted market. Tencent(700) rose 2.3% before result announcement. AIA(1299) also rose 2.5%. Macau will resume issuing tourist visas. Gaming stocks HSI Turn.($bn) 41.50 44.96 56.02 HSCEI 10,153 9,991 10,063 rose. Sands(1928)surged 9.8% while Galaxy Entertainment(27) advanced 5.5%. Change +163 -73 -139 President Trump said he was considered a capital gain tax cut, together with newly daily confirmed HSCEI Turn.($bn) 34.63 41.20 54.31 COVID 19 cases decline in US, support the US stock market to rise on early Tuesday, the Dow once rose 360 points on Tuesday. However, Senate Majority Leader Mitch McConnell confirmed that talks between the Democrats and the White House were at a stalemate, triggered late selling pressure. US HSI Technical Indicators stock finished lower. 10-days MA 24,743 The three major US stock index fell 0.4-1.7% respectively on Tuesday, of which, the Nasdaq index fell 50-days MA 24,885 the most and closed below the 10 Day SMA. -

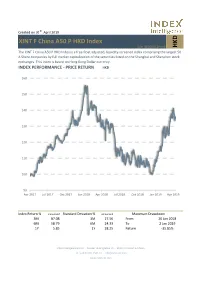

HKD XINT F China A50 P HKD Index

Created on 30th April 2019 XINT F China A50 P HKD Index ISIN: DE000A13PXH3 HKD The XINT F China A50 P HKD Index is a free-float adjusted, liquidity-screened index comprising the largest 50 A Share companies by full market capitalization of the securities listed on the Shanghai and Shenzhen stock exchanges. This index is based on Hong Kong Dollar currency. INDEX PERFORMANCE - PRICE RETURN HKD 160 150 140 130 120 110 100 90 Apr 2017 Jul 2017 Oct 2017 Jan 2018 Apr 2018 Jul 2018 Oct 2018 Jan 2019 Apr 2019 Index Return % annualised Standard Deviation % annualised Maximum Drawdown 3M 87.08 3M 27.56 From 26 Jan 2018 6M 58.79 6M 24.33 To 2 Jan 2019 1Y 5.85 1Y 28.25 Return -35.85% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com TOP 10 Largest Constituents FFMV million Weight Industry Sector Ping An Insurance Group Co of China Ltd 14.01% 923,482 14.01% Insurance Kweichow Moutai Co Ltd 7.61% 501,542 7.61% Food & Beverage China Merchants Bank Co Ltd 7.16% 471,859 7.16% Banks Industrial Bank Co Ltd 4.88% 321,481 4.88% Banks Gree Electric Appliances Inc of Zhuhai 4.18% 275,446 4.18% Personal & Household Goods China Vanke Co Ltd 3.30% 217,531 3.30% Real Estate Wuliangye Yibin Co Ltd 3.18% 209,889 3.18% Food & Beverage Midea Group Co Ltd 3.18% 209,780 3.18% Personal & Household Goods CITIC Securities Co Ltd 3.16% 208,599 3.16% Financial Services China Minsheng Banking Corp Ltd 3.13% 206,157 3.13% Banks Total 3,545,766 53.79% This information has been prepared by Index Intelligence GmbH (“IIG”). -

Ishares Core CSI 300 ETF 82846/ As of 31/08/2021 9846

2846/ iShares Core CSI 300 ETF 82846/ As of 31/08/2021 9846 INVESTMENT OBJECTIVE FUND DETAILS The iShares Core CSI 300 Index ETF seeks to track the performance of an index Asset Class Equity composed of 300 large and mid-capitalization stocks traded on the Shanghai and Inception Date 12/11/2009 Shenzhen stock exchanges. Benchmark CSI 300 Index Number of Holdings 301 WHY 2846? Net Assets 244,617,181 CNY Management Fee (in 0.38 1 Exposure to the 300 largest stocks listed on Shanghai and Shenzhen stock %) exchanges Units Outstanding 7,750,000 2 Liquid trading vehicle for the China A-share market Domicile Hong Kong Base Currency RMB GROWTH OF 10,000 CNY SINCE INCEPTION Bloomberg CSIN0300 Benchmark Ticker TOP 10 HOLDINGS (%) KWEICHOW MOUTAI LTD A 4.97 CHINA MERCHANTS BANK LTD A 3.08 PING AN INSURANCE (GROUP) OF CHINA 2.74 WULIANGYE YIBIN LTD A 1.98 LONGI GREEN ENERGY Fund Benchmark TECHNOLOGY LTD 1.97 The chart shows change of investment amount based on a hypothetical investment in MIDEA GROUP LTD A 1.65 the Fund. INDUSTRIAL BANK LTD A 1.36 ANNUALIZED PERFORMANCE (%CNY) EAST MONEY INFORMATION LTD A 1.30 Cumulative Annualized BYD LTD A 1.28 1 Month 3 Month YTD 1 Year 3 Year 5 Year Since HANGZHOU HIKVISION DIGITAL Inception TECHNOL 1.22 Fund 0.09% -8.78% -6.68% 0.97% 14.46% 8.88% 2.83% Total 21.55 Benchmark 0.11% -8.69% -6.41% 1.40% 15.06% 9.64% 4.59% Holdings are subject to change.