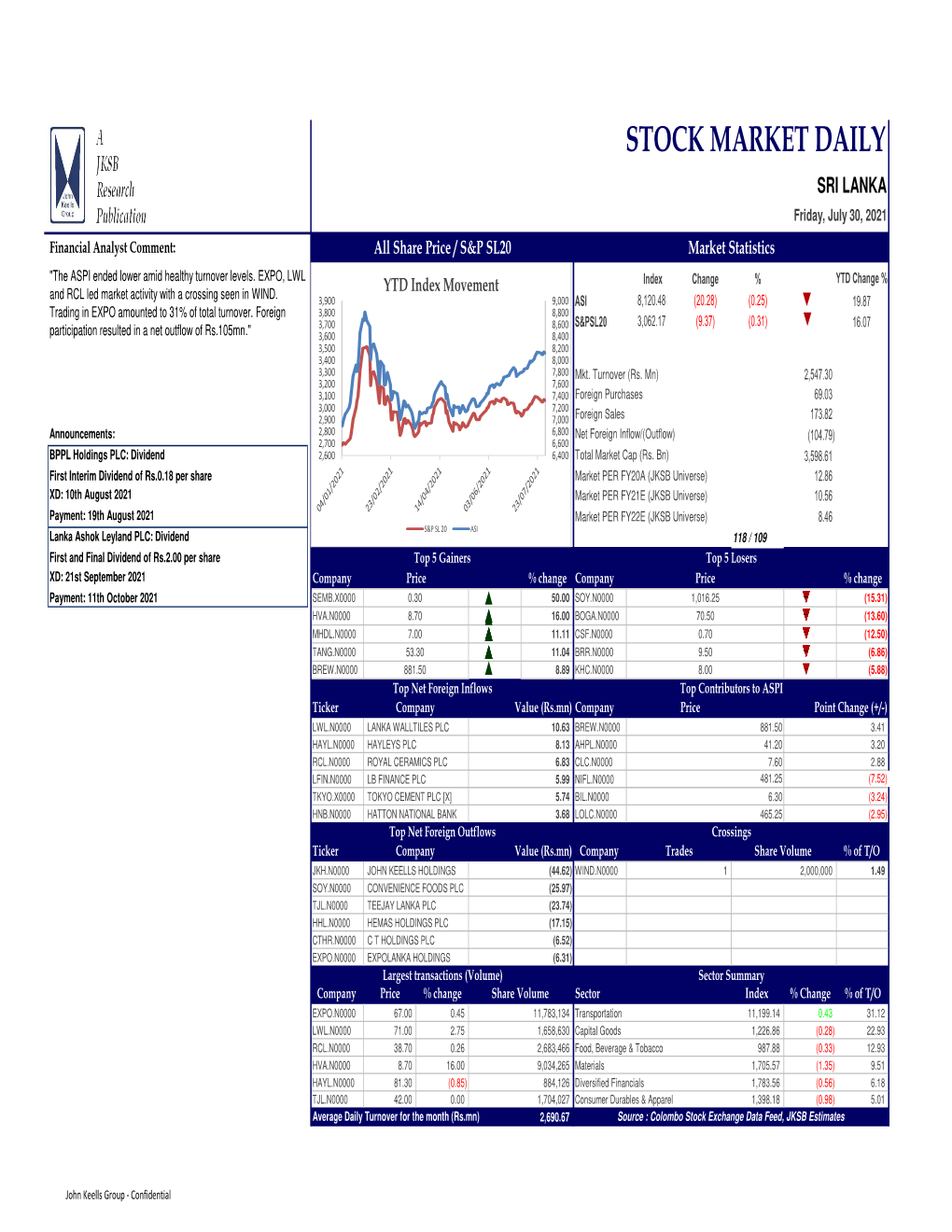

Jksb Daily Report 30-07-2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Guardian Acuity Equity Fund Open Ended Growth Fund June 2021 Tel: +94 112039377 E-Mail: [email protected]

Guardian Acuity Equity Fund Open Ended Growth Fund June 2021 Tel: +94 112039377 E-mail: [email protected] HIGHLIGHT Crishani Perera The fund recorded a 1.29% return for the month and 2.52% return for 3 Months. The Fund Manager Accelerated vaccine rollouts and generally strong economic data in developed YTD return of the fund was 2.19% vs.benchmark ASPI return of 15.70%. economies led to strong gains in equities with S&P 500 leading with an 8.5% RETURNS* gain during 2Q whilst European stocks followed closely with a 7.1% return. The vaccination programs in rest of the Europe is now catching up with the BENCHMARK PERIOD* FUND S&P SL 20 ASTRI ASPI UK & US. The reopening of economies and a fast rebound in activity has fueled 2021 June 1.29% 5.87% -0.35% 5.88% inflation in some of the developed economies which is expected to contribute 3 Months 2.52% 10.06% 4.15% 10.12% to market jitters in the 2H. The emerging equities lagged with a 5.1% gain Year To Date (YTD 2021) 2.19% 15.70% 12.52% 15.84% during 2Q amidst slow vaccination rollout in most economies, policy Since Inception Cum. 85.21% 43.11% 0.43% 58.15% tightening and regulatory concerns in China. 3.91% 0.05% 5.03% Since Inception CAGR 6.82% Note : All Share Price Index (ASPI) ,All Share Total Return Index(ASTRI) & S&P Srilanka 20 Index (S&P SL 20) are based on CSE data as of 30th June 2021 Retail activity continued to dominate the local equities as notable price gains * Performances are based on month end prices as of 30th June 2021. -

Sri Lanka Equities Aspi ^ 4.46% | S&P Sl20 ^ 7.04%

ACUITY STOCKBROKERS RESEARCH | SRI LANKA EQUITIES Weekly Market Review 02 Nov 2018 th nd ASPI Hits 2-Month High Amid Higher Volatility… LKR Indices vs. Turnover (29 Oct – 02 Nov) Falls as Foreign Sell-Off of Assets Increases… 6,300 3,500 ASPI Increases 6,200 S&P SL20 3,400 S&P SL20 S&P ASPI ^ 4.46% | S&P SL20 ^ 7.04% 6,100 3,300 ASPI 6,000 3,200 The Bourse ended the week… Cont. P2 5,900 3,100 5,800 3,000 29-Oct 30-Oct 31-Oct 01-Nov02-Nov Foreign investors closed the week... Cont. P3 5.00 4.00 3.00 Equity market volatility ….… Cont. P4 2.00 LKR Bn) LKR (Turnover 1.00 0.00 Economic Snapshot………… P5 29-Oct 30-Oct 31-Oct 01-Nov 02-Nov KEY STATISTICS Week ending 02-Nov 26-Oct +/- ASPI 6,092.21 5,831.96 4.46% S&P SL20 3,208.43 2,997.33 7.04% Banking & Finance 16,242.78 15,368.05 5.69% Food & Beverage 24,368.96 24,096.79 1.13% Diversified 1,591.90 1,482.33 7.39% Hotel & Travel 2,677.50 2,642.53 1.32% Plantations 749.11 725.44 3.26% Manufacturing 2,963.05 2,742.56 8.04% Turnover (LKR Bn) 9.92 3.15 215.37% Foreign Buying (LKR Mn) 2,656.24 1,959.06 35.59% Foreign Selling (LKR Mn) 6,519.96 2,403.48 171.27% Daily Average Turnover (LKR Bn) 1.98 0.79 152.29% Daily Average Foreign Buying (LKR Mn) 531.25 489.76 8.47% Daily Average Foreign Selling (LKR Mn) 1,303.99 600.87 117.02% TOP 10 GAINERS TOP 10 LOSERS Opening Closing WoW % Opening Closing WoW % Company Code Company Code Price Price Change Price Price Change MTD WALKERS KAPIN 8.0 12.9 61.3% KELSEY KDL N 35.0 29.5 -15.7% BLUE DIAMONDS[NV] BLUEX 0.2 0.3 50.0% UDAPUSSELLAWA UDPL 35.0 29.6 -15.4% AMANA LIFE ATLLN 9.0 12.9 43.3% MERC. -

DFCC Bank PLC Annual Report 2016.Pdf

Going beyond conventional reporting, we have implemented a About this Report more current format for reporting and have upgraded our corporate website with a focus on investor relations, supplemented by an investor relations app for smart phones and other devices. This is an integrated annual report and is a compact Reporting Period disclosure on how our strategy, governance, performance and prospects have resulted in the The DFCC Bank Annual Report for 2016 covers the 12 month period from 01 January 2016 to 31 December 2016 and is reflective of the creation of sustainable value within our operating change in the financial year-end implemented in 2015. The previous environment. annual report covered the nine month period from 01 April 2015 to 31 December 2015 and is available on the company website Value Creation and Capital Formation (www.dfcc.lk). Some of the Group entities have a 31 March financial year-end and they are consolidated with DFCC Bank’s reporting The ability of an organisation to create sustainable value for itself period with a three month time lag. A summary of the accounting depends on the value it creates for its stakeholders, making value periods covered by the Statement of Profit and Loss and Other creation essentially a two-way process. In fact, the more value an Comprehensive Income in the Bank and the Group columns is given organisation creates, the more value it is able to create for itself. in the Financial Report (page 136). Therefore firms spend substantial resources on creating and maintaining relationships with their stakeholders. Value creation leads to capital formation. -

Most Admired Companies of Sri Lanka 2019

Most Admired Companies of Sri Lanka 2019 Most Admired Companies of Sri Lanka 2019 Contents Making Sri Lanka Irresistible 02 About Deloitte 03 Message from ICC 04 Message from CIMA 05 Message from Daily Financial Times 06 Message from AIA 07 What is a Simply Irresistible Organization? 08 Most Admired Companies 10 Honourable mentions 20 01 Most Admired Companies of Sri Lanka 2019 Making Sri Lanka Irresistible Marco Polo wasn’t wrong when he With the overall business climate being called Sri Lanka the finest island of its conducive to rapid growth, business size in the world. One can visit the sun- and HR leaders must continually keep kissed beaches of the Indian Ocean, focusing on their talent priorities. Our enjoy the tropical grasslands, climb the belief is that only by unlocking the power lofty mountain peaks, and be a part of human capital, can organisations of their spiritual journeys. This lovely continue to deliver hyper-growth and island country not only boasts as one phenomenal business results. They of the most bio-diverse places on the will need to build organisations that planet, but also has a thriving business provide meaningful work and empower environment. During our multiple employees to deliver their best, create an engagements with the organisations environment that supports learning and in Sri Lanka, we found that the growth application of new skills, and constantly journey was absolutely inspirational. inspire and communicate a strong sense The country has access to quality of purpose. education backed with deep-rooted values of perseverance, integrity, and Sri Lanka is a great case study of how diligence, which has created a generation collaboration between the government of employees who are capable doing and the private sector can create incredibly different things. -

John Keells Holdings Plc | Annual Report 2018/19

GOING FORW RD JOHN KEELLS HOLDINGS PLC | ANNUAL REPORT 2018/19 GOING FORW RD For over 149 years, John Keells has built and managed a diverse industry portfolio including several industry sectors strategically selected to represent key growth areas of the economy. We are known as an entrepreneurial company constantly seeking new business opportunities to explore, innovate and make our own. That is how we have maintained an even trajectory of expansion and growth throughout every decade of our long history. Over the past few years, we have been investing in several enterprises that we identified as potentially value enhancing, such as the "Cinnamon Life" project, which will be an iconic landmark transforming the city of Colombo. Today, the Group moves into the next phase as our major investments begin to yield results. Yet the road has not always been an easy one and there were times when we had to dig deep, leveraging on our financial strength, operational expertise, business leadership and corporate resilience to withstand the challenges we have had to face. The Easter Sunday attacks of April 2019 will be long remembered for the tragedy and turmoil we all experienced. Yet, we have every confidence in our nation’s proven resilience and capacity to move ahead and prosper, united as one. Going forward, we will continue to harness the value created by our investment strategies; evolving our standards of governance while ensuring that our digital capabilities and innovative approach will drive your Company’s progress to the next level. JOHN -

John Keells Holdings PLC Equity Research Initiation Coverage

John Keells Holdings PLC Equity Research Initiation Coverage Strategic Player Leveraging on Sri Lanka's Growth Story BUY Sri Lanka is poised for robust economic expansion from the revival of the economy after the LOLC SEC Valuation LKR 262.24 end of civil conflict in 2009 and ensued progression made by the country with more stable Share Price LKR 195.10 macro economic fundamentals. Country's GDP has grown by 7.5% in real terms since 2009 Upside/(Downside) 34.41% and is expected to continue similar growth momentum. JKH has been able to establish strong Risk Level Medium presence in key growth segments of the economy with market leadership in most of its (refer page 29 for recommendation) businesses. Warrants Valuation W0022 JKH historically has been able to make strategic entries into growth sectors. The latest entry LOLC SEC Valuation LKR 16.70 is into mixed development projects via its flagship investment “Waterfront Integrated Resort Warrant Price LKR 20.00 Development Project (IR)” which is expected to drive the next growth phase of the group. We W0023 estimate the project to account for 26% of the valuation of the group and coupled with LOLC SEC Valuation LKR 22.20 existing portfolio of businesses JKH presents a unique opportunity for an investor to get Warrant Price LKR 37.10 exposure to Sri Lankan economy. Share Details Investment Considerations Bloomberg Ticker JKH SL CSE Sector Diversified Well established portfolio of businesses to drive the financials in medium term: JKH GICS Sector Industrials Market Cap (LKR Mn) 194,610 current operation includes well diversified portfolio of businesses with strong foothold on Issued Quantity (Mn) 997 their respective sectors. -

Correction: Fitch Affirms Melstacorp and Distilleries at 'AAA(Lka)'; Outlook Stable

04 Nov 2019 Affirmation Correction: Fitch Affirms Melstacorp and Distilleries at 'AAA(lka)'; Outlook Stable Fitch Ratings-Colombo-04 November 2019: This is a correction of a release published on 22 October 2019. It corrects the leverage level above which negative rating action may be taken. Fitch Ratings has affirmed the National Long-Term Ratings of Sri Lanka-based conglomerate, Melstacorp PLC, and its subsidiary, Distilleries Company of Sri Lanka PLC (DIST), at 'AAA(lka)'. The Outlook is Stable. Fitch rates DIST based on the consolidated profile of Melstacorp due to strong legal and operational linkages between the two entities, as defined in our Parent and Subsidiary Rating Linkage criteria. DIST contributes around 70% to Melstacorp's consolidated EBITDAR, shares the same board of directors and has previously provided financial support to weaker group entities in the form of corporate guarantees. The affirmations reflect Melstacorp's ability to maintain leverage below 2.0x over the medium-term, despite large investments in core and non-core operations. Leverage is defined as net adjusted debt/operating EBITDAR, including Melstacorp's 51%-share of Aitken Spence PLC's net debt and EBITDA, but excluding its insurance subsidiary. Melstacorp saw net leverage weaken to 1.8x in the financial year ending March 2019 (FY19), from 1.3x in FY18, following significant debt-funded investments. The group's investment drive is supported by the strong operating cash flow of its core subsidiary, DIST, which is Sri Lanka's market leader in spirits, enjoying a strong brand presence and high entry barriers. We expect DIST to account for around 70% of Melstacorp's group EBITDA, including its 51% share of Aitken Spence, over the medium-term. -

John Keells Hotels Plc Annual Report 2019/20

DistinctivJOHN KEELLS HOTELS PLC ANNUAL REPORT 2019/20 Distinctive DistinctiveEvery passing minute, across all our hotels, thousands of guests are living an adventure that will be cherished for a lifetime. As a pioneer in the industry, our distinct blend of style, service standards and passion have given us the ability to remain young in the hearts and minds of travellers worldwide, with our refreshing brand promise of ‘inspired living’. This report details our distinctive approach towards navigating a challenging year in the hospitality industry. It discusses how we strived forward with determination to create sustainable value for our stakeholders while focusing on our future strategic investments, repositioning ourselves for growth in the years to come. Join us, as we craft a distinctive path towards the future. CONTENTS About our Report 05 01 GROUP HIGHLIGHTS Group Structure 08 Performance Scorecard 10 About the Group 12 Our Journey 14 Year at a Glance 16 Group Financial and Operational Highlights 17 Chairman's Review 19 02 GOVERNANCE Board of Directors 25 Corporate Governance 28 Audit Committee Report 40 Report of the Human Resources and Compensation Committee 42 Report of the Nomination Committee 43 Report of the Related Party Transaction Review Committee 44 03 MANAGEMENT DISCUSSION AND ANALYSIS All about Strategy 48 Operating Environment 56 Cluster Review 57 Risk Management Report 63 Investor Information 68 04 FINANCIAL INFORMATION Financial Calendar 72 Index to the Financial Information 73 Annual Report of the Board of Directors -

Asha Phillip Securities Ltd

ASHA PHILLIP SECURITIES LTD DAILY STOCK MARKET HIGHLIGHTS Level 4, MillenniumJ House, 46/58, Navam Mw, Colombo 02 Tel 94 11 2429100 Fax 94 11 2429199 www.ashaphillip.net st [email protected] 21 November 2011 PRICE INDICES INDEX 21-Nov 18-Nov CHANGE % CHANGE ASPI 6,119.86 6,140.52 -20.66 -0.34% MPI 5,357.45 5,349.54 7.91 0.15% Market Statistics 21-Nov 18-Nov Value of Turnover(Rs.) 870,788,943 1,798,847,593 Domestic Purchases 855,525,483 1,741,205,723 Domestic Sales 803,808,550 1,558,305,873 Foreign Purchases 15,263,460 57,641,870 Foreign Sales 66,980,394 240,541,720 Volume of Turnover (No.) 29,299,057 86,352,969 PER 15.73 15.78 PBV 1.99 2.00 PRICE INDEX TURNOVER SECTOR SECTOR SECTOR TODAY PREVIOUS VALUE (Rs) VOLUME TRADES P/E PBV BANK FINANCE AND INSURANCE 14,355.76 14,361.11 88,314,552.00 1,585,962 824 13.00 2.00 BEVERAGE FOOD AND TOBACCO 11,630.54 11,734.60 53,890,648.00 892,766 544 14.90 4.00 CHEMICALS & PHARMACEUTICALS 10,143.15 10,122.46 7,124,607.00 282,231 78 9.20 1.20 CONSTRUCTION AND ENGINEERING 3,364.42 3,323.11 1,771,615.00 36,173 46 10.00 2.20 DIVERSIFIED HOLDINGS 1,955.54 1,965.68 535,936,064.00 5,167,508 568 17.80 1.80 FOOTWEAR AND TEXTILE 1,087.48 1,085.23 8,272,808.00 115,569 101 29.40 1.30 HEALTH CARE 553.71 558.72 4,136,120.00 822,900 108 17.50 1.90 HOTELS AND TRAVELS 3,882.64 3,869.64 10,905,322.00 293,390 345 27.40 1.90 INFORMATION TECHNOLOGY 219.63 225.44 8,541,240.00 954,900 332 21.00 2.60 INVESTMENT TRUSTS 33,479.05 33,026.27 8,949,957.00 106,805 135 17.80 2.20 LAND AND PROPERTY 630.75 631.61 10,098,423.00 -

Winning Ways... When You've Got Them You Can Change Challenges Into Success the Speed You Lose on the Bends You Can Make up on the Straights

WINNING WAYS... WHEN YOU'VE GOT THEM YOU CAN CHANGE CHALLENGES INTO SUCCESS THE SPEED YOU LOSE ON THE BENDS YOU CAN MAKE UP ON THE STRAIGHTS Annual Report 2008/09 | DFCC Bank VISION To be Sri Lanka’s premier financial services group. MISSION To provide superior financial solutions and nurture business enterprises, adding value to our customers, shareholders, employees and the nation. VALUES • Accountability • Be Ethical • Passion for Innovation and Excellence • Respect for the Individual • Social Responsibility • Teamwork “GREAT MOMENTUM...” IT HELPS WHEN YOU’RE ‘STRONG OUT OF THE BLOCK...’ WHEN YOU’VE MADE A STRONG START, WITH THE RIGHT FUNDAMENTALS IN PLACE... IT MAKES US GREAT CONTENDERS FOR SUCCESSFUL TOMORROWS Contents 1. Performance Highlights 03 2. Management Information Chairman’s Message 04 Chief Executive’s Report 08 Profiles of Directors 14 Management Team 17 Subsidiary, Joint Venture and Associate Companies 20 3. Reports of Directors Annual Report of the Directors 22 Corporate Governance 28 Committee Reports Audit Committee Report 36 Human Resources and Remuneration Committee Report 39 Nomination Committee Report 40 Board Integrated Risk Management Committee Report 41 4. Management Discussion and Analysis Operations Review 42 Financial Review 47 Risk Management 50 5. Sustainability Report Chief Executive’s Message 56 Reports Environment 58 Nurturing Small and Medium Enterprises 62 Transforming Education 64 Employee Empowerment 66 6. Financial Information 69 Director’s Responsibilities in relation to Financial Statements 70 CEO’s and CFO’s Responsibilities Statement 71 Independent Auditor’s Report 72 Income Statement 73 Balance Sheet 74 Statement of Changes in Equity 75 Cash Flow Statement 76 Notes on Financial Statements 79 7. -

Corporate Governance Commentary

CORPORATE GOVERNANCE COMMENTARY John Keells Holdings PLC Annual Report 2020/21 CORPORATE GOVERNANCE COMMENTARY The Group's robust and comprehensive corporate governance framework, endeavours to create an enabling environment for growth in a structured, predictable and sustainable manner. The Group's corporate governance philosophy is institutionalised across all its business units, and it is this philosophy that has continuously created value for all its stakeholders, notwithstanding the external environment and macro conditions. 1 EXECUTIVE SUMMARY 1.1 Compliance Summary The Group's framework has its own set of Regulatory Benchmarks internal policies, processes and structures aimed at meeting accepted best practice, Standard / Principle / Code Adherence in addition to the 'triggers' which ensure The Companies Act No.7 of 2007 and regulations Mandatory provisions - fully compliant compliance with mandatory regulatory Listing Rules of the Colombo Stock Exchange (CSE) requirements. This framework is regularly reviewed and updated to reflect global best Securities and Exchange Commission of Sri Lanka Act practice, evolving regulations, and dynamic No. 36 of 1987, including directives and circulars stakeholder needs, while maintaining its Code of Best Practices on Related Party Transactions foundational principles of accountability, (2013) advocated by the Securities and Exchange participation, integrity and transparency. Commission of Sri Lanka (SEC) Code of Best Practice on Corporate Governance Voluntary provisions - fully compliant The -

Nations Trust Bank

Nations Trust Bank PLC Annual Report 2017 Scan to view this report online https://www.nationstrust.com/about/ investor-relations/annual-reports At 18 years, Nations Trust Bank is one of the youngest full service commercial banks around. Yet in that short time, we have built a reputation for innovation, service and value that makes us truly proud. Our team is passionate, youthful and energetic, making us a bank that is perfectly positioned to deliver the best experience of SMART banking to our many customers; the service ethic, technological capability and product models that now define us. Strategic thinking and planning are key elements of our success. It is how we ensure that the design and implementation of our systems and processes, governance policies and sustainable business model are all ahead of their time. The performance reported in this financial review is another example of how we have realized value through business plans we put in place last year. We also report significant growth in many business areas, most especially in the SME sector; while our emphasis on evolving digital innovation saw the launch of Sri Lanka’s first digital bank, FriMi - a next-generation bank account, payment system and e-wallet that will offer convenience, speed and added value to the diverse customers we serve. This is how we remain a bank trusted and relied upon by the thousands of stakeholders who partner us today. Because they know that whatever their financial requirement might be, they can always count on us. Contents 6-9 pg 104-167 pg About