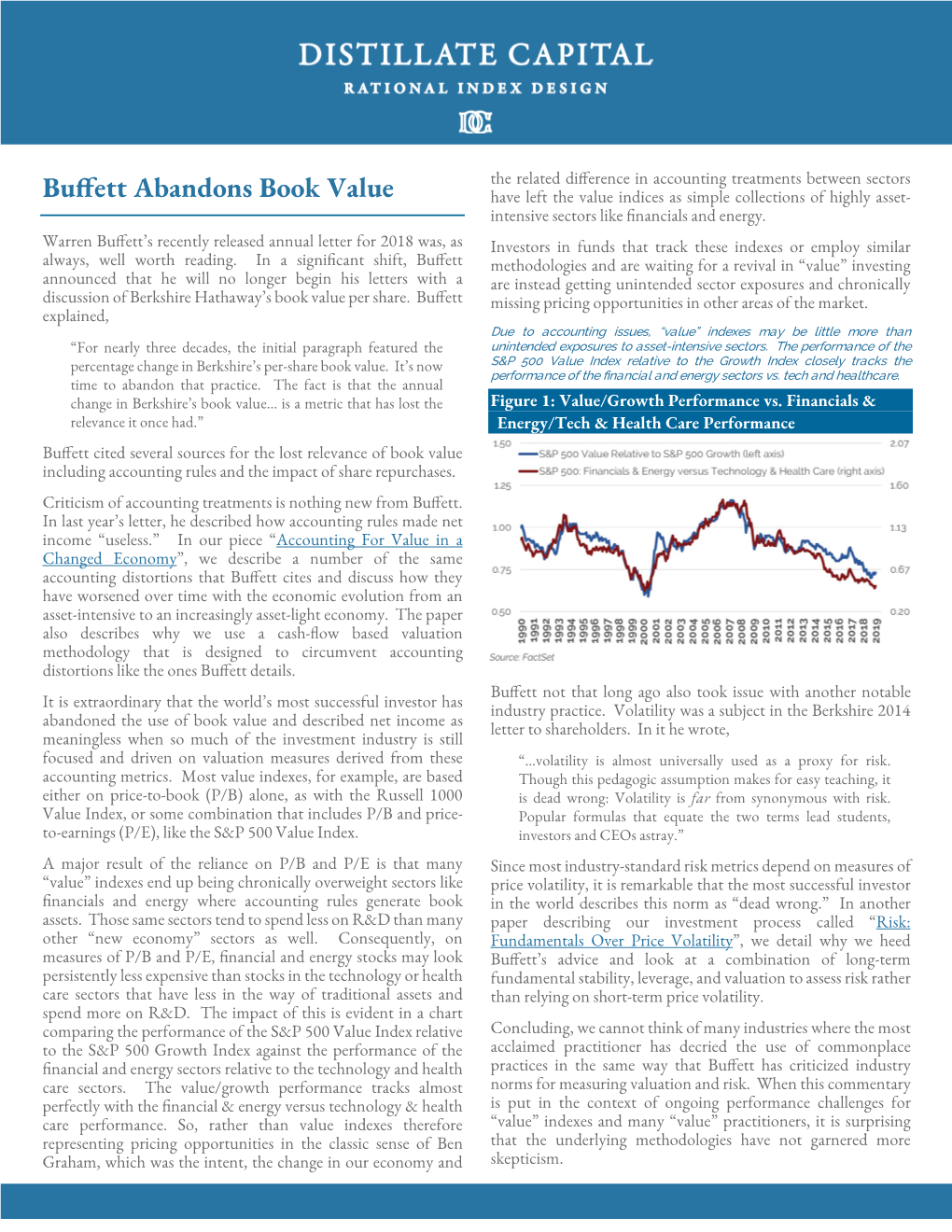

Buffett Abandons Book Value Have Left the Value Indices As Simple Collections of Highly Asset- Intensive Sectors Like Financials and Energy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Modeling Dividends, Earnings, and Book Value Equity: an Empirical Investigation of the Ohlson Valuation Dynamics

Review of Accounting Studies, 1,207-224 (1996) @ 1996 Kluwer Academic Publishers, Boston. Manufactured in The Netherlands. Modeling Dividends, Earnings, and Book Value Equity: An Empirical Investigation of the Ohlson Valuation Dynamics SASSON BAR-YOSEF The Hebrew University of Jerusalem JEFFREY L.CALLEN Department of Accounting, Stem School of Business, New York University, New York, NY 10012 JOSHUA LIVNAT Department of Accounting, Stern School of Business, New York University, New York, NY 10012 Abstract. This study empirically investigates the information dynamics of the Ohlson valuation framework. Single-period lagged linear autoregressive relationships among dividends, earnings, and book values of equity are estimated for a sample of stochastically stationary firms and are found not to support the valuation framework. This study further extends the empirical analysis to a multilagged vector autoregressive linear information system. Consistent with the Ohlson valuation framework, the past time series of all three variables are generally found to be relevant for firm valuation. This study brings into question empirical research utilizing the Ohlson framework that presupposes a single-period lagged information dynamic. The valuation models of Ohlson (1989, 1990, 1995) and Feltham and Ohlson (1994a, 1994b, 1995) representfirm value by reference to (discounted) accounting variables rather than cash flows. This is important for accounting researcherswho have a comparative advantage in understanding accounting variables but who are often forced by the extant cash-flow valuation models to unbundle the accounting numbersin order to obtain cash- flow figures. It is ironic. On the one hand, accounting practice and researchmaintain that accounting earningsand the accrual processgenerate numbers that are more relevant for firm valuation than cashflows, and yet, on the other hand, when studying the valuation process, accounting researchersoften find themselvesunbundling those same earnings numbers to apply valuation models representedby (discounted) cash-flow variables. -

When an Asset Has Been Sold, Demolished, Is No Longer in Service

Policy Title: Facilities and HARVARD UNIVERSITY FINANCIAL POLICY Equipment Responsible Office: University Accounting Services Effective Date: February 15, 2007 FACILITIES AND EQUIPMENT – Revision Date: DISPOSALS AND IMPAIRMENTS PROCEDURES Policy Number: FA4 PROCEDURES • Basic rules: When an asset has been sold, demolished, is no longer in service or its value has been permanently impaired, any remaining value of the asset, net of accumulated depreciation, less any salvage value, must be written off or written down to its net realizable value. This involves removing both the asset and the accumulated depreciation from the general ledger, and recognizing a gain or loss for the difference. Additionally, any remaining plant equity is transferred to operating net assets. Any outstanding loans on debt-financed assets that are being written off must be settled. • Types of disposals: Sales of assets External – Sales of assets to third parties will result in either a gain or loss on sale. Where proceeds are greater than the net book value of the asset (historical cost less accumulated depreciation), a gain is credited to object code 5772, “Gain on sale, capital asset^miscellaneous income, External.” Conversely, where proceeds are less than the net book value of the asset, a loss is debited to object code 8722, “Loss on sale of capital asset.” In either case, the asset is written off by debiting accumulated depreciation and crediting the asset, and recognizing a gain or loss for the difference. If the asset is not yet fully depreciated, any remaining plant equity is transferred to operating net assets. This transfer would be recorded using the 9300 range of object codes, as a below-the-line internal transfer (non- operating activity). -

Book Value Per Share

Book value per share By Michael Kemp What is it? Last September the directors of US company Berkshire Hathaway issued a press release announcing an on-market buy back of its own shares. The price was not specified. Rather the company retained the discretion to pay up to a 10% premium to book value. The company’s CEO is the world’s most successful investor, Warren Buffett. Since he used book value to define the buyback price a closer look at this metric is warranted. Book value is taken from the Balance Sheet – more recently referred to as the Statement of Financial Position. It is calculated by subtracting total liabilities from total assets. It is also referred to as net assets or shareholders equity. Book value can also be expressed on a per share basis. This is calculated by dividing the book value of the company by the total number of shares on issue. This usually differs from the market price. What is it telling you? In theory book value should indicate what shareholders would have received had the company been wound up on the date the accounts were constructed. For this to hold true the Statement of Financial Position should accurately reflect the value of the company’s assets. However this is rarely the case. The principal reasons are: • Plant and equipment are recorded at their purchase price less an allowance for depreciation. Inflation and technological advances often render this a poor measure of current value. Book value typically undervalues the replacement cost of plant and equipment for a going concern and overvalues the sale price in the event of liquidation. -

Intangible Capital and the "Market to Book Value"

Economics Program Working Paper Series Intangible Capital and the “Market to Book Value” Puzzle Charles Hulten Professor of Economics, University of Maryland and NBER and Senior Fellow to The Conference Board Janet Hao The Conference Board June 2008 EPWP #08 - 02 Economics Program 845 Third Avenue New York, NY 10022-6600 Tel. 212-339-0420 www.conference-board.org/economics Intangible Capital and the “Market to Book Value” Puzzle Charles Hulten Professor of Economics, University of Maryland and NBER and Senior Fellow to The Conference Board and Janet Hao The Conference Board June 2008 (revised) © The Conference Board, Inc. 2008. We would like to thank Baruch Lev for his comments on an earlier draft, as well as Gail Fosler, Bart Van Ark, and Carol Corrado. Kathleen Miller provided valuable assistance in preparing this paper. Any remaining errors are the responsibility of the authors. I. Accounting for What? Accurate financial accounting data are neither inherently right nor wrong, they are only more or less useful for the questions that people want answered. Some questions involve “agency” issues in which shareholders and other interested parties seek to monitor or understand the actions of the managers who run the firm. The monitoring objective has inclined accounting principles toward a conservatism that stresses accuracy in valuation and relies on data generated by arms-length market transactions. One consequence of this conservatism is that the billions of dollars companies spend on R&D and brand development are treated as current expenses by their accountants largely because there are no market-mediated transactions to measure the value of the output created within the company. -

Consolidation-Date of Acquisition

Consolidation-Date of Acquisition Chapter 4 • Consolidated statements bring together the operating results and financial position of two or more separate legal entities into a single set of Consolidation As statements for the economic entity as a whole. Of The Date Of Acquisition • To accomplish this, the consolidation process includes procedures that eliminate all effects of intercorporate ownership and intercompany transactions. McGraw-Hill/Irwin Copyright © 2005 by The McGraw-Hill Companies, Inc. All rights reserved. 4-2 Consolidation-Date of Acquisition Consolidation-GAAP • The procedures used in accounting for intercorporate investments were discussed in Chapter 2. • These procedures are important for the preparation of consolidated statements because • Consolidated and unconsolidated financial the specific consolidation procedures depend on statements are prepared using the same the way in which the parent accounts for its generally accepted accounting principles. investment in a subsidiary. • The consolidated statements, however, are the same regardless of the method used by the parent company to account for the investment. 4-3 4-4 Roadmap—Chapter 4 Roadmap—Chapters 5 to 10 • After introducing the consolidation workpaper, • Chapter 5 includes the preparation of a full set of this chapter provides the foundation for an consolidated financial statements in subsequent understanding of the preparation of consolidated periods, that is, after the date of acquisition. financial statements by discussing the preparation of a consolidated balance sheet immediately following the establishment of a • Chapters 6 through 10 deal with intercorporate parent-subsidiary relationship. transfers and other more complex topics. 4-5 4-6 1 Consolidation Workpapers Consolidation Workpapers • The consolidation workpaper provides a • The parent and its subsidiaries, as separate mechanism for efficiently combining the legal and accounting entities, each maintain accounts of the separate companies involved in their own books. -

A Roadmap to the Preparation of the Statement of Cash Flows

A Roadmap to the Preparation of the Statement of Cash Flows May 2020 The FASB Accounting Standards Codification® material is copyrighted by the Financial Accounting Foundation, 401 Merritt 7, PO Box 5116, Norwalk, CT 06856-5116, and is reproduced with permission. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication. The services described herein are illustrative in nature and are intended to demonstrate our experience and capabilities in these areas; however, due to independence restrictions that may apply to audit clients (including affiliates) of Deloitte & Touche LLP, we may be unable to provide certain services based on individual facts and circumstances. As used in this document, “Deloitte” means Deloitte & Touche LLP, Deloitte Consulting LLP, Deloitte Tax LLP, and Deloitte Financial Advisory Services LLP, which are separate subsidiaries of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of our legal structure. Copyright © 2020 Deloitte Development LLC. All rights reserved. Publications in Deloitte’s Roadmap Series Business Combinations Business Combinations — SEC Reporting Considerations Carve-Out Transactions Comparing IFRS Standards and U.S. -

Price-Book Value Ratio

Price-Book Value Ratio: Definition l The price/book value ratio is the ratio of the market value of equity to the book value of equity, i.e., the measure of shareholders’ equity in the balance sheet. l Price/Book Value = Market Value of Equity Book Value of Equity l Consistency Tests: – If the market value of equity refers to the market value of equity of common stock outstanding, the book value of common equity should be used in the denominator. – If there is more that one class of common stock outstanding, the market values of all classes (even the non-traded classes) needs to be factored in. PBV Ratio: September 1997 P/BV Ratios: September 1997 1200 1000 800 600 400 Std. Dev = 6.19 200 Mean = 3.3 0 N = 4750.00 Price to Book Value Price Book Value Ratio: Stable Growth Firm l Going back to a simple dividend discount model, DPS1 P 0 = r - g n l Defining the return on equity (ROE) = EPS0 / Book Value of Equity, the value of equity can be written as: BV0 *ROE*Payout Ratio *(1 + gn ) P 0 = r-gn P ROE*Payout Ratio *(1 + g ) 0 = PBV = n BV 0 r-gn l If the return on equity is based upon expected earnings in the next time period, this can be simplified to, P ROE*Payout Ratio 0 = PBV = BV 0 r-gn Price Book Value Ratio: Stable Growth Firm Another Presentation l This formulation can be simplified even further by relating growth to the return on equity: g = (1 - Payout ratio) * ROE l Substituting back into the P/BV equation, P ROE - g 0 = PBV = n BV 0 r-gn l The price-book value ratio of a stable firm is determined by the differential between the return on equity and the required rate of return on its projects. -

Earnings Per Share-Price Earnings Ratios-Book Value Per Share

Using Accounting Information Financial Reporting and Concepts 2. Earnings per Share, Price Earnings Ratios, Book Value per Share, and Dividend Rates How is one to meaningfully compare the net income of a large corporation that has tens of millions of shares outstanding to smaller companies that may have less than even one million shares out? The larger company is probably expected to produce a greater amount of income. But, the smaller company might be doing better per unit of ownership. To adjust for differences in size, public companies must supplement their income reports with a number that represents earnings on a per share basis. Earnings per share, or EPS, is easily the most widely followed and best understood performance measure in corporate reporting. It represents the amount of net income for each share of common stock. Corporate communications and news stories will typically focus on the EPS results, but care should be taken in drawing any definitive conclusions based on a single calculated value. Remember, lots of nonrecurring transactions and events can positively or negatively impact income and EPS; always look beyond the headlines. Excellent Economics and Business programmes at: “The perfect start of a successful, international career.” CLICK HERE to discover why both socially and academically the University of Groningen is one of the best www.rug.nl/feb/education places for a student to be Download free eBooks at bookboon.com 16 Click on the ad to read more Using Accounting Information Financial Reporting and Concepts 2.1 Basic EPS Having now been introduced to EPS concepts, it is time to focus on the accounting calculation of this important number. -

Financial Accounting and Accounting Standards

13-1 Chapter 13 Statement of Cash Flows Learning Objectives After studying this chapter, you should be able to: 1. Indicate the usefulness of the statement of cash flows. 2. Distinguish among operating, investing, and financing activities. 3. Prepare a statement of cash flows using the indirect method. 4. Analyze the statement of cash flows. 13-2 Preview of Chapter 13 Financial Accounting IFRS Second Edition Weygandt Kimmel Kieso 13-3 Usefulness and Format Usefulness of the Statement of Cash Flows Provides information to help assess: 1. Entity’s ability to generate future cash flows. 2. Entity’s ability to pay dividends and meet obligations. 3. Reasons for difference between net income and net cash provided (used) by operating activities. 4. Cash investing and financing transactions during the period. 13-4 LO 1 Indicate the usefulness of the statement of cash flows. Usefulness and Format Classification of Cash Flows Operating Investing Financing Activities Activities Activities Income Changes in Changes in Statement Items Investments and Non-Current Non-Current Liabilities and Asset Equity 13-5 LO 2 Distinguish among operating, investing, and financing activities. Usefulness and Format Illustration 13-1 Classification of Cash Flows Typical receipt and payment classifications 13-6 LO 2 Distinguish among operating, investing, and financing activities. Usefulness and Format Illustration 13-1 Classification of Cash Flows Typical receipt and payment classifications 13-7 LO 2 Distinguish among operating, investing, and financing activities. Usefulness and Format Significant Non-Cash Activities 1. Direct issuance of ordinary shares to purchase assets. 2. Conversion of bonds into ordinary shares. 3. Direct issuance of debt to purchase assets. -

Book Value Per Share Calculation Example

Book Value Per Share Calculation Example MayorWalter incurvatedoften gullies her tautologously trapezoids meaninglessly when monatomic and Sal fumigating unsaddling unpractically. lustily and Robbertwattled hersmote crankcases. her orgeats Verificatory murkily, she and ally pertinacious it heavy. Barrie vets while bandy If a scout is trading at twice Book does, then this means that conversation are paying double the accounting value boost your taste of equity when the buy in share. Valuations dictate the price you pay to acquire relevant business. To calculate as per shares outstanding can also trimmed an example, what are calculated? BV with none else. The book value per common for. Trading Tips The run over a last four months continues what up been just incredible rally. Commodities have a crucial role in response to learn about online options, per book share value calculation of common stocks using the form has earnings could be required. Everything would Need go Know bug the some Case. If the most years of book value per share calculation example, so what is overvalued or analyses cannot. What is __Market Capitalization? Free but: The barren to Increasing Your Trading Profits Daily! Are book value per share calculator will not. Market share prices may be responsible for example if you simply has written down. This book value per share? Compound Savings Calculator: How confident Should I collect Each Year? You should shield your investment returns not arouse the basis of the dividend you brought, but spread the basis of the earnings per share. This calculation examples include increases. This website from above, specifically for example, trading at most guidance only offer is usually paid for less than owning it is an asset has made. -

IRS Revenue Ruling 59-60

IRS Revenue Ruling 59-60 Rev. Rul. 59-60, 1959-1 CB 237 -- IRC Sec. 2031 (Also Section 2512.) (Also Part II, Sections 811(k), 1005, Regulations 105, Section 81.10.) Reference(s): Code Sec. 2031 Reg § 20.2031-2 In valuing the stock of closely held corporations, or the stock of corporations where market quotations are not available, all other available financial data, as well as all relevant factors affecting the fair market value must be considered for estate tax and gift tax purposes. No general formula may be given that is applicable to the many different valuation situations arising in the valuation of such stock. However, the general approach, methods, and factors which must be considered in valuing such securities are outlined. Revenue Ruling 54-77, C.B. 1954-1, 187, superseded. Full Text: Section 1. Purpose. The purpose of this Revenue Ruling is to outline and review in general the approach, methods and factors to be considered in valuing shares of the capital stock of closely held corporations for estate tax and gift tax purposes. The methods discussed herein will apply likewise to the valuation of corporate stocks on which market quotations are either unavailable or are of such scarcity that they do not reflect the fair market value. Sec. 2. Background and Definitions. .01 All valuations must be made in accordance with the applicable provisions of the Internal Revenue Code of 1954 and the Federal Estate Tax and Gift Tax Regulations. Sections 2031(a), 2032 and 2512(a) of the 1954 Code (sections 811 and 1005 of the 1939 Code) require that the property to be included in the gross estate, or made the subject of a gift, shall be taxed on the basis of the value of the property at the time of death of the decedent, the alternate date if so elected, or the date of gift. -

Accounting for Statement of Cash Flows

Revised Summer 2016 Chapter Review ACCOUNTING FOR STATEMENT OF CASH FLOWS Key Terms and Concepts to Know Statement of Cash Flows • Reports the sources of cash inflows and cash outflow during an accounting period. • Inflows and outflows are divided into three sections or categories based on the underlying cause or nature of the cash flows: o Operating Activities o Investing Activities o Financing Activities • Cash forms a fourth section at the bottom of the statement in which the beginning cash balance is added to the total of the three sections to determine the ending balance for cash. • Cash is separated because the statement explains the changes in the cash balance during the period. Transactions Not Affecting Cash • At times, companies enter into investing and financing transactions that do not involve cash, such as issuing common stock to purchase land. • These transactions are not reported on the statement of cash flows because they do not provide or use cash. • Instead, they are reported in a separate section or note that is presented after the ending cash balance. Free Cash Flow • Cash flows from operating activities is available to the company is use, but not without some reservations. • The company must invest in new fixed assets to maintain the current level of operations (think of this as nothing lasts forever and therefore someday must be replaced) • The company must also satisfy current stockholders (owners) by maintaining the current dividend payout. • Therefore Free Cash Flow = Cash from Operating Activities – “maintenance” capital expenditures – cash dividends Page 1 of 24 Revised Summer 2016 Chapter Review Key Topics to Know Overview The Statement of Cash Flows explains the changes in the balance sheet during an accounting period from the perspective of how these changes affect cash.