REALITY CHECK for LOCAL BUYERS Setting the Expectations Across the Northern Virginia Marketplace

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Moving the Region Forward

COG 2009 Annual Report 2010 Metropolitan Washington Regional Directory Transportation Public Safety Land Use Housing Health Environment Education Economy Climate Moving the Region Fo rward METROPOLITAN WASHINGTON COUNCIL OF GOVERNMENTS 2009 Annual Report Moving the Region Fo rward METROPOLITAN WASHINGTON 2010 Regional Directory METROPOLITAN WASHINGTON COUNCIL OF GOVERNMENTS COG Board of Directors 3-5 | Transportation Planning Board (TPB) 6-8 Metropolitan Washington Air Quality Committee (MWAQC) 9-11 COG Policy Committees 12 | COG Public/Private Partnerships 13-14 COG Administrative Staff 15 MEMBER JURISDICTIONS DISTRICT OF COLUMBIA 16-21 MARYLAND 22-45 Bladensburg 22 | Bowie 23 | College Park 24-25 | Frederick 26 Frederick County 27-29 | Gaithersburg 30-31 | Greenbelt 32-33 Montgomery County 34-37 | Prince George’s County 38-41 Rockville 42-43 | Takoma Park 44-45 VIRGINIA 46-69 Alexandria 46-48 | Arlington County 49-51 | Fairfax 52-53 Fairfax County 54-57 | Falls Church 58-60 | Loudoun County 61-63 Manassas 64-65 | Manassas Park 65-66 | Prince William County 67-69 STATE AND FEDERAL REGIONAL DELEGATIONS State of Maryland 70-72 | Commonwealth of Virginia 73-74 U.S. Congress 75 METROPOLITAN WASHINGTON COUNCIL OF GOVERNMENTS About COG FOR MORE THAN 50 YEARS , the Metropolitan Washington Council of Governments, known as COG, has helped develop regional solutions to such issues as the environment, affordable housing, growth and development, public health, child welfare, public safety, homeland security, and transportation. COG is an independent, nonprofit association comprised of elected officials from 21 local governments, members of the Maryland and Virginia state T legislatures, and members of the U.S. -

2020 Virginia Capitol Connections

Virginia Capitol Connections 2020 ai157531556721_2020 Lobbyist Directory Ad 12022019 V3.pdf 1 12/2/2019 2:39:32 PM The HamptonLiveUniver Yoursity Life.Proto n Therapy Institute Let UsEasing FightHuman YourMisery Cancer.and Saving Lives You’ve heard the phrases before: as comfortable as possible; • Treatment delivery takes about two minutes or less, with as normal as possible; as effective as possible. At Hampton each appointment being 20 to 30 minutes per day for one to University Proton The“OFrapy In ALLstitute THE(HUPTI), FORMSwe don’t wa OFnt INEQUALITY,nine weeks. you to live a good life considering you have cancer; we want you INJUSTICE IN HEALTH IS THEThe me MOSTn and wome n whose lives were saved by this lifesaving to live a good life, period, and be free of what others define as technology are as passionate about the treatment as those who possible. SHOCKING AND THE MOSTwo INHUMANrk at the facility ea ch and every day. Cancer is killing people at an alBECAUSEarming rate all acr osITs ouOFTENr country. RESULTSDr. William R. Harvey, a true humanitarian, led the efforts of It is now the leading cause of death in 22 states, behind heart HUPTI becoming the world’s largest, free-standing proton disease. Those states are Alaska, ArizoINna ,PHYSICALCalifornia, Colorado DEATH.”, therapy institute which has been treating patients since August Delaware, Idaho, Kansas, Kentucky, Maine, Massachusetts, 2010. Minnesota, Montana, Nebraska, NewREVERENDHampshir DR.e, Ne MARTINw Me LUTHERxico, KING, JR. North Carolina, Oregon, Vermont, Virginia, Washington, West “A s a patient treatment facility as well as a research and education Virginia, and Wisconsin. -

2021-Swanepoel-Trends-Report-Trend-01-Real-Estate-In-A-Post-Pandemic-'New-Normal'.Pdf

REAL ESTATE Swanepoel Trends Report, 16th Edition TRENDS OFFICIAL EXTRACT TREND 1: REAL ESTATE IN A POST-PANDEMIC ‘NEW NORMAL’ (PAGES 190-215) 2021 A Market Intelligence Report by T3 Sixty, LLC “Comprehensive research and strategic planning are indispensable for future real estate success. The Swanepoel Trends Report represents the gold standard for third party independent scholarship pertaining to this all-important process.” Gino Blefari, CEO, HSF Affiliates “The Swanepoel Trends Report is ‘the’ go-to book on what is happening within the industry, a great source of real information to help brokers and brands plan for what lies ahead. I have been a subscriber since inception. It gets better and better every year.” Sherry Chris, President & CEO, Realogy Expansion Brands “It’s the best consolidated market intel available and a great tool to use to ponder change, innovation and the industry.” Matthew Consalvo, CEO, Arizona Regional MLS “The Swanepoel Trends Report refines the way I view the industry It’s required reading for my entire board of directors.” Art Carter, CEO, CRMLS “The Swanepoel Trends Report is one of my ‘go to’ reference guides regarding future trends in the real estate vertical. Truly a phenom- enal resource and one that provides great insight and value.” Bob Goldberg, CEO, National Association of REALTORS® “Every month during our Executive Strategy Group Meeting, our executive team selects one trend from the Swanepoel Trends Report to talk through. We discuss this trend and identify a positive opportunity we want to pursue -

Annual Report, 2017, & Regional Directory, 2018

THE FUTURE OF THE REGION IS OUR BUSINESS 2017 ANNUAL REPORT 2018 REGIONAL DIRECTORY COVER (COG LEADERSHIP, BOARD) ROW 1 Matthew Letourneau, COG Board Chairman, Loudoun County Robert White, Jr., COG Board Vice Chairman, District of Columbia Derrick L. Davis, COG Board Vice Chairman, Prince George’s County Phil Mendelson, COG President, District of Columbia Karen Toles, COG Vice President, Prince George’s County Phyllis Randall, COG Vice President, Loudoun County Kate Stewart, COG Secretary-Treasurer, City of Takoma Park ROW 2 ABOUT COG Charles Allen, Transportation Planning The Metropolitan Washington Council of Governments (COG) is Board Chair, District of Columbia an independent, nonprofit association that brings area leaders Katie Cristol, Human Services Policy Committee Chair, Arlington County together to address major regional issues in the District of Libby Garvey, Chesapeake Bay and Water Columbia, suburban Maryland, and Northern Virginia. COG’s Resources Policy Committee Chair, membership is comprised of 300 elected officials from 24 local Arlington County governments, the Maryland and Virginia state legislatures, and Danielle Glaros, Region Forward Coalition Chair, Prince George’s County U.S. Congress. Mary Lehman, Climate, Energy, and Environment Policy Committee Chair, ACKNOWLEDGMENTS Prince George’s County Directory entries are updated by each local government and include Hans Riemer, Metropolitan Washington Air Quality Committee Chair, city and county departments and offices in areas related to Montgomery County committees -

SEP+OCT 2015 REAL ESTATE NOW.® > NVAR.COM FINANCING TIPS at YOUR FINGERTIPS from Courtship

SEP+OCT 2015 REAL ESTATE NOW.® > NVAR.COM FINANCING TIPS AT YOUR FINGERTIPS From Courtship Trends for to Consummation: Tomorrow Tools for Navigating Today DON’T MISS OUR the Lender 2015 ANNUAL CONVENTION & TRADE SHOW INSERT: Relationship CHECK INSIDE YOUR MAGAZINE FOR A FACT-FILLED PULL-OUT. CENTER SPREAD TAKES YOU FURTHER Section 8 BOD 2015 Housing Candidate Elections Myths Bios Update 11 21 17 LOOKING FORWARD, REFLECTING BACK: NVAR WELCOMES OUR NEW CEO SEP+OCT Volume 98, Issue 5 2015 Board of Directors Chair of the Board: Mary Bayat, GRI By Mary Bayat Chairman-Elect: Virgil Frizzell Immediate Past Chairman: Mario Rubio, CIPS, SRES, TRC September is a transition month: children head back to school; there’s a hint of Secretary/Treasurer: cool in the air; quarter three of this fast-track year ends. How quickly time flies! Suzanne Granoski, ABR, ASP, CLHMS, CRS and GRI For many Realtors®, it’s a time to recharge for a strong year-end finish. At NVAR, DIRECTORS-AT-LARGE changes are also coming. Bob Adamson, CRS, GRI Our CEO Christine Todd is retiring at the end of 2015, after 26 years of dedicated Lorraine Arora, ABR, GREEN, GRI, SRES Tom Bellanca, CCIM service to our association. During her tenure, NVAR has received accolades as one Brian Block, GRI, ABR, CRS, e-PRO, SRES of the most well respected local associations in the NAR organization. Christine’s Tracy Comstock, ABR, ASP, BPOR, CIPS, e-PRO, GREEN, accomplishments include helping to migrate an outdated MLS into a regional GRI, MRP, SFR, SRES one, upgrading our lock box system twice, and implementing strategic plan Reggie Copeland Nicholas Lagos goals that bring greater value to our members. -

Graduation Ceremonies December 2019

GRADUATION CEREMONIES DECEMBER 2019 CONTENTS Morning Ceremony – Thursday 12 December at 10h00............................................................……...3 Faculties of Health Sciences 1 and Law Afternoon Ceremony – Thursday 12 December at 15h00 ………..............….........…………………22 Faculties of Engineering & the Built Environment and Science Morning Ceremony – Friday 13 December at 09h00 …………................……................…………..48 Faculty of Humanities Afternoon Ceremony – Friday 13 December at 14h00 …….....…………..............................………66 Faculty of Commerce Evening Ceremony – Friday 13 December at 18h00 …………................……................…………..78 Faculty of Health Sciences 2 NATIONAL ANTHEM Nkosi sikelel’ iAfrika Maluphakanyisw’ uphondolwayo, Yizwa imithandazo yethu, Nkosi sikelela, thina lusapho lwayo. Morena boloka etjhaba sa heso, O fedise dintwa la matshwenyeho, O se boloke, O se boloke setjhaba sa heso, Setjhaba sa South Afrika – South Afrika. Uit die blou van onse hemel, Uit die diepte van ons see, Oor ons ewige gebergtes, Waar die kranse antwoord gee, Sounds the call to come together, And united we shall stand, Let us live and strive for freedom, In South Africa our land. 2 FACULTIES OF HEALTH SCIENCES (CEREMONY 1) AND LAW ORDER OF PROCEEDINGS Academic Procession. (The congregation is requested to stand as the procession enters the hall) The Presiding Officer will constitute the congregation. The National Anthem. The University Dedication will be read by a member of the SRC. Musical Item. Welcome by the Master of Ceremonies. The Master of Ceremonies will present Peter Zilla for the award of a Fellowship. The graduands and diplomates will be presented to the Presiding Officer by the Deans of the faculties. The Presiding Officer will congratulate the new graduates and diplomates. The Master of Ceremonies will make closing announcements and invite the congregation to stand. -

Norfolk Southern Corporation Contributions to Candidates and Political Committees January 1 ‐ December 31, 2017*

NORFOLK SOUTHERN CORPORATION CONTRIBUTIONS TO CANDIDATES AND POLITICAL COMMITTEES JANUARY 1 ‐ DECEMBER 31, 2017* STATE RECIPIENT OF CORPORATE POLITICAL FUNDS AMOUNT DATE ELECTION OFFICE OR COMMITTEE TYPE LA John Bel Edwards$ 4,000 2/6/2017 Primary 2019 Governor DE DE Dem Party (State Acct)$ 1,000 3/1/2017 Election Cycle 2018 State Party Cmte DE DE Rep Party (State Acct)$ 1,000 3/1/2017 Election Cycle 2018 State Party Cmte US Democratic Governors Association (DGA)$ 10,000 3/1/2017 N/A 2017 Association DE Earl Jaques$ 300 3/1/2017 General 2018 State House DE Edward Osienski$ 300 3/1/2017 General 2018 State House SC Henry McMaster$ 1,000 3/1/2017 Primary 2018 Governor DE James Johnson$ 300 3/1/2017 General 2018 State House DE John Kowalko$ 300 3/1/2017 General 2018 State House DE John Viola$ 300 3/1/2017 General 2018 State House DE Margaret Rose Henry$ 300 3/1/2017 Primary 2018 State Senate DE Mike Mulrooney$ 300 3/1/2017 General 2018 State House DE Nicole Poore$ 300 3/1/2017 Primary 2020 State Senate US Republican Governors Association (RGA)$ 10,000 3/1/2017 N/A 2017 Association SC SC Rep House Caucus/Cmte$ 3,500 3/1/2017 N/A 2017 State Party Cmte SC SC Rep Senate Caucus$ 3,500 3/1/2017 N/A 2017 State Party Cmte DE SENR PAC$ 300 3/1/2017 N/A 2017 State PAC DE Stephanie Hansen$ 300 3/1/2017 Primary 2018 State Senate DE Valerie Longhurst$ 300 3/1/2017 General 2018 State House AL AL Rep House Caucus$ 1,500 3/24/2017 N/A 2017 State Party Cmte MS Percy Bland$ 250 4/26/2017 General 2017 Mayor SC SC Dem House Caucus/Cmte$ 1,000 4/26/2017 N/A 2017 -

Supplemental Statement Washington, Dc 20530 Pursuant to the Foreign Agents Registration Act of 1938, As Amended

Received by NSD/FARA Registration Unit 06/21/2021 10:58:22 AM OMB No. 1124-0002; Expires July 31, 2023 U.S. Department of Justice Supplemental Statement Washington, dc 20530 Pursuant to the Foreign Agents Registration Act of 1938, as amended For 6 Month Penod Ending May 3i, 2021 (Insert date) I REGISTRANT 1. (a) Name of Registrant (b) Registration Number McGuireWoods Consulting LLC 6295 (c) Primary Business Address 800 E Canal Street Richmond, VA 23219 2. Has there been a change in the information previously furnished in connection with the following? (a) If an individual: (1) Residence address(es) Yes □ No □ (2) Citizenship Yes □ No □ (3) Occupation Yes □ No □ (b) If an organization: (1) Name Yes □ No [x] (2) Ownership or control Yes □ No [x] (3) Branch offices Yes □ No 0 (c) Explain fully all changes, if any, indicated in Items (a) and (b) above. IF THE REGISTRANT IS AN INDIVIDUAL, OMIT RESPONSES TO ITEMS 3, 4, 5, AND 6. 3. If the registrant previously filed an Exhibit C*1, state whether any changes therein have occurred during this 6 month reporting period. Yes □ No IE] If yes, has the registrant filed an updated Exhibit C? Yes □ No □ If no, please file the updated Exhibit C. 1 The Exhibit C, for which no printed form is provided, consists of a true copy of the charter, articles of incorporation, association, and by laws of a registrant that is an organization. (A waiver of the requirement to file an Exhibit C may be obtained for good cause upon written application to the Assistant Attorney General, National Security Division, U.S. -

Norfolk Southern Corporation Contributions

NORFOLK SOUTHERN CORPORATION CONTRIBUTIONS TO CANDIDATES AND POLITICAL COMMITTEES JANUARY 1 ‐ DECEMBER 31, 2018* STATE RECIPIENT OF CORPORATE POLITICAL FUNDS AMOUNT DATE ELECTION OFFICE OR COMMITTEE TYPE IN Eric Holcomb $1,000 01/18/2018 Primary 2018 Governor US National Governors Association $30,000 01/31/2018 N/A 2018 Association Conf. Acct. SC South Carolina House Republican Caucus $3,500 02/14/2018 N/A 2018 State Party Cmte SC South Carolina Republican Party (State Acct) $1,000 02/14/2018 N/A 2018 State Party Cmte SC Senate Republican Caucus Admin Fund $3,500 02/14/2018 N/A 2018 State Party Non‐Fed Admin Acct SC Alan Wilson $500 02/14/2018 Primary 2018 State Att. General SC Lawrence K. Grooms $1,000 03/19/2018 Primary 2020 State Senate US Democratic Governors Association (DGA) $10,000 03/19/2018 N/A 2018 Association US Republican Governors Association (RGA) $10,000 03/19/2018 N/A 2018 Association GA Kevin Tanner $1,000 04/16/2018 Primary 2018 State House GA David Ralston $1,000 04/16/2018 Primary 2018 State House IN Ryan Hatfield $750 04/16/2018 Primary 2018 State House IN Gregory Steuerwald $500 04/16/2018 Primary 2018 State House IN Karen Tallian $750 04/16/2018 Primary 2018 State Senate IN Blake Doriot $750 04/16/2018 Primary 2020 State Senate IN Dan Patrick Forestal $750 04/16/2018 Primary 2018 State House GA Bill Werkheiser $400 04/26/2018 Primary 2018 State House GA Deborah Silcox $400 04/26/2018 Primary 2018 State House GA Frank Ginn $500 04/26/2018 Primary 2018 State Senate GA John LaHood $500 04/26/2018 Primary 2018 State -

Certified Actuarial Analyst (CAA) – a Truly Global Qualification Jane Curtis Institute and Faculty of Actuaries (Ifoa)

Certified Actuarial Analyst (CAA) – a truly global qualification Jane Curtis Institute and Faculty of Actuaries (IFoA) 30 April 2015 Refresher: what is the CAA? • Two IFoA membership categories (CAA and Student Actuarial Analyst - SAA) • 1 entry test (Module 0) and 5 exam modules – technical calculations and bookwork. Module 0 taken by non-members • Modules 0-4 delivered by Computer Based Assessment. Module 5 is a practical exam on spreadsheet modelling • Work based skills and professionalism requirements; ongoing regulation • Generic, not practice-area specific • c2-3 years part time to qualify 2 30 April 2015 Strategy: why did the IFoA develop the CAA? • Market demand: increasingly business models are built around a small number of high level experts supported by a greater number of technically skilled professional analysts • Professionalism: professionalising those working alongside actuaries and in broader financial services • Actuarial capacity building: in markets where there is a desire for industry growth at pace and at manageable cost • Relevance and affordability: Fellowship isn’t always the right choice but is sometimes the only choice • Accessibility: diversification of the profession; non-traditional entry routes 30 April 2015 3 Benefits: why the CAA? For candidates • membership of a globally recognised prestigious body • globally recognised, portable qualification • opens up a wide range of financial career options For employers • professionalises technical and analytical roles, providing additional assurance to clients and -

2013 US Political Contributions & Related Activity Report

2013 U.S. Political Contributions & Related Activity Report Helping People Live Healthier Lives and Helping the Health Care System Work Better for Everyone Letter from the Chairman Our workforce of 165,000 people is dedicated to helping people live healthier lives and helping the health care system work better for everyone by collaborating across the public and private sectors and the entire health care marketplace to deliver transformative solutions. Each day, the men and women of UnitedHealth Group are working to modernize the nation’s health care system and leverage the latest technologies to enhance the consumer experience and improve health outcomes for the more than 85 million individuals we serve. As Federal and State policy-makers continue to look for solutions to modernize the health care system, UnitedHealth Group remains an active participant in the political process. The United for Health PAC continues to be an important component of our overall strategy to engage with elected officials and policy-makers to communicate our perspectives on various priority issues and to share with them our proven solutions and initiatives. The United for Health PAC is a bipartisan Political Action Committee supported by voluntary contributions from eligible employees. The PAC supports Federal and State candidates who champion policies that increase quality, access, and affordability in health care, in accordance with applicable election laws and as overseen by the UnitedHealth Group Board of Directors’ Public Policy Strategies and Responsibility Committee. As key issues of importance to the health care system continue to be debated, UnitedHealth Group remains committed to sharing the insights and solutions we have developed with policy-makers at the Federal and State levels to encourage innovation and sustainable solutions that modernize our nation’s health care system. -

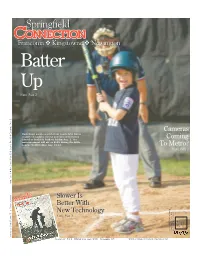

Springfieldspringfield

SpringfieldSpringfield FranconiaFranconia ❖❖ KingstowneKingstowne ❖❖ NewingtonNewington Batter Up News, Page 2 Cameras Classified, Page 15 Classified, Zach Keast awaits a pitch from coach John Burns ❖ as part of a public service announcement being Coming filmed at Trailside Park on Friday, Aug. 1. The announcement will air on ESPN during the Little League World Series, Aug. 15-24. To Metro? News, Page 2 Sports, Page 13 ❖ Real Estate, Page 12 Real Estate, ❖ Faith, Page 14 SlowerSlower IsIs insideinside BetterBetter WithWith Requested in home 8-8-08 Time sensitive material. NewNew TechnologyTechnology Attention Postmaster: /The Connection News,News, PagePage 33 U.S. Postage PRSRT STD PERMIT #322 Easton, MD PAID Sam Funt Photo by Photo Auguust 7-13, 2008 Volume XXII, Number 32 www.connectionnewspapers.com www.ConnectionNewspapers.com Springfield Connection ❖ August 9-13, 2008 ❖ 1 News Lights! Camera! Play Ball! TV spot will run during Little League World Series later this month. layers and coaches from the ball. Springfield Challenger Baseball Games are non-competitive, have two or P League had their Hollywood three innings and take place on Sunday af- moment on Friday, Aug. 1, as a ternoons. Challenger Baseball allows chil- crew filmed them at Trailside Park for a dren to socialize, develop skills, make public service announcement. friends and feel a sense of accomplishment. Little League Baseball and the Depart- Typically, each team has 10 or 11 players ment of Labor chose the Springfield Chal- and the league has 20 teams with over 200 lenger League to star in the television spot, players in the league. The league runs two which will air on ESPN Aug.