Notes to the Financial Statements As at and for the Year Ended December 31, 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

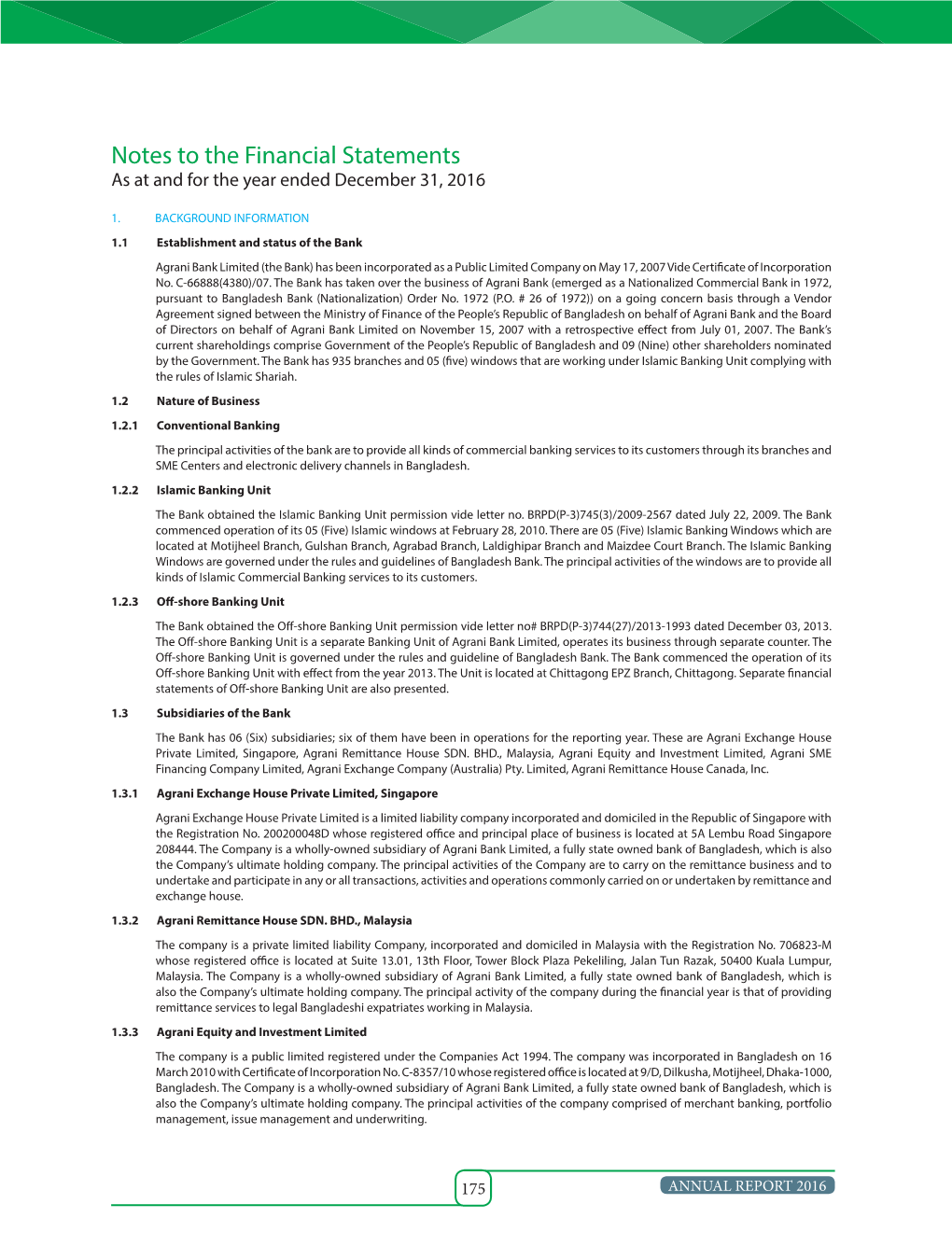

Agrani Bank Sl No. Name & Address of the Branch Ad Code

AGRANI BANK SL AD CODE NAME & ADDRESS OF THE BRANCH NO. NO. 1 HEAD OFFICE, MOTIJHEEL C/A, DHAKA 0000 2 PRINCIPAL BRANCH, 9/D DILKUSHA C/A, DHAKA 0001 3 BANGA BANDHU AVENUE BRANCH, 32 B.B. AVENUE, DHAKA 0002 4 MOULVI BAZAR BRANCH, 144 MITFORD ROAD, DHAKA. 0003 5 AMIN COURT, MOTIJHEEL, 62/63 MOTIJHEEL C/A, DHAKA 0004 6 RAMNA BRANCH, 18 BANGA BANDHU AVENUE, DHAKA 0005 7 FOREIGN EXCHANGE BRANCH, 1/B RAJUK AVENUE, DHAKA 0006 8 SADARGHAT BRANCH,3/7/1&2 JONSON RD,SADARGHAT, DHAKA. 0007 9 BANANI BRANCH, 26 KAMAL ATATURK AVENUE, BANANI, DHAKA. 0008 10 BANGA BANDHU ROAD BRANCH, 32/1 B.B. AVENUE, NARAYANGONJ 0009 11 COURT ROAD BRANCH, 52/1 B.B.ROAD, NARAYANGONJ 0010 12 FARIDPUR BRANCH, CHAWK BAZAR, FARIDPUR 0011 13 WASA BRANCH, KAWRAN BAZAR, DHAKA. 0012 14 TEJGAON INDUSTRIAL AREA BRANCH, 315/A TEJGAON I/A, DHAKA 0013 15 NAWABPUR ROAD BRANCH, 243-244 NAWABPUR ROAD, DHAKA 0014 16 COMMERCIAL AREA BRANCH, 28 AGRABAD C/A, CHITTAGONG 0015 17 ASADGONJ BRANCH, HAJI AMIR ALI CHOWDHURY ROAD, CHITTAGONG 0016 18 LALDIGHI EAST, 1012/1013 - LALDIGHI EAST, CHITTAGONG 0017 19 AGRABAD BRANCH, JAHAN BUILDING, 24 AGRABAD C/A, CTG 0018 20 COX'S BAZAR BRANCH, COX'S BAZAR 0019 21 RAJGANJ BRANCH, RAJGANJ, COMILLA 0020 22 LALDIGHIRPAR BRANCH, LALDIGHIRPAR, SYLHET 0021 23 CHAUMUHANI BRANCH,D.B.ROAD, BEGUMGONJ, CHAUMUHANI, NOAKHALI 0022 24 SIR IQBAL RAOD BRANCH, 25 SIR IQBAL RAOD, KHULNA 0023 25 JESSORE BRANCH, JESS TOWER, JESSORE 0024 26 CHAWK BAZAR BRANCH, 02/01 CHAWK BAZAR, BARISAL 0025 27 BARA BAZAR BRANCH, N.S. -

“E-Business and on Line Banking in Bangladesh: an Analysis”

“E-Business and on line banking in Bangladesh: an Analysis” AUTHORS Muhammad Mahboob Ali ARTICLE INFO Muhammad Mahboob Ali (2010). E-Business and on line banking in Bangladesh: an Analysis. Banks and Bank Systems, 5(2-1) RELEASED ON Wednesday, 07 July 2010 JOURNAL "Banks and Bank Systems" FOUNDER LLC “Consulting Publishing Company “Business Perspectives” NUMBER OF REFERENCES NUMBER OF FIGURES NUMBER OF TABLES 0 0 0 © The author(s) 2021. This publication is an open access article. businessperspectives.org Banks and Bank Systems, Volume 5, Issue 2, 2010 Muhammad Mahboob Ali (Bangladesh) E-business and on-line banking in Bangladesh: an analysis Abstract E-business has created tremendous opportunity all over the globe. On-line banking can act as a complementary factor of e-business. Bangladesh Bank has recently argued to introduce automated clearing house system. This pushed up- ward transition from the manual banking system to the on-line banking system. The study has been undertaken to ob- serve present status of the e-business and as its complementary factor on-line banking system in Bangladesh. The arti- cle analyzes the data collected from Bangladeshi banks up to February 2010 and also used snowball sampling tech- niques to gather answer from the five hundred respondents who have already been using on-line banking system on the basis of a questionnaire which was prepared for this study purpose. The study found that dealing officials of the banks are not well conversant about their desk work. The author observed that the country can benefit from successful utiliza- tion of e-business as this will help to enhance productivity. -

Sl. Correspondent / Bank Name SWIFT Code Country

International Division Relationship Management Application( RMA ) Total Correspondent: 156 No. of Country: 36 Sl. Correspondent / Bank Name SWIFT Code Country 1 ISLAMIC BANK OF AFGHANISTAN IBAFAFAKA AFGHANISTAN 2 MIZUHO BANK, LTD. SYDNEY BRANCH MHCBAU2S AUSTRALIA 3 STATE BANK OF INDIA AUSTRALIA SBINAU2S AUSTRALIA 4 KEB HANA BANK, BAHRAIN BRANCH KOEXBHBM BAHRAIN 5 MASHREQ BANK BOMLBHBM BAHRAIN 6 NATIONAL BANK OF PAKISTAN NBPABHBM BAHRAIN 7 AB BANK LIMITED ABBLBDDH BANGLADESH 8 AGRANI BANK LIMITED AGBKBDDH BANGLADESH 9 AL-ARAFAH ISLAMI BANK LTD. ALARBDDH BANGLADESH 10 BANGLADESH BANK BBHOBDDH BANGLADESH 11 BANGLADESH COMMERCE BANK LIMITED BCBLBDDH BANGLADESH BANGLADESH DEVELOPMENT BANK 12 BDDBBDDH BANGLADESH LIMITED (BDBL) 13 BANGLADESH KRISHI BANK BKBABDDH BANGLADESH 14 BANK ASIA LIMITED BALBBDDH BANGLADESH 15 BASIC BANK LIMITED BKSIBDDH BANGLADESH 16 BRAC BANK LIMITED BRAKBDDH BANGLADESH 17 COMMERCIAL BANK OF CEYLON LTD. CCEYBDDH BANGLADESH 18 DHAKA BANK LIMITED DHBLBDDH BANGLADESH 19 DUTCH BANGLA BANK LIMITED DBBLBDDH BANGLADESH 20 EASTERN BANK LIMITED EBLDBDDH BANGLADESH EXPORT IMPORT BANK OF BANGLADESH 21 EXBKBDDH BANGLADESH LTD 22 FIRST SECURITY ISLAMI BANK LIMITED FSEBBDDH BANGLADESH 23 HABIB BANK LTD HABBBDDH BANGLADESH 24 ICB ISLAMI BANK LIMITED BBSHBDDH BANGLADESH INTERNATIONAL FINANCE INVESTMENT 25 IFICBDDH BANGLADESH AND COMMERCE BANK LTD (IFIC BANK) 26 ISLAMI BANK LIMITED IBBLBDDH BANGLADESH 27 JAMUNA BANK LIMITED JAMUBDDH BANGLADESH 28 JANATA BANK LIMITED JANBBDDH BANGLADESH 29 MEGHNA BANK LIMITED MGBLBDDH BANGLADESH 30 MERCANTILE -

AGRANI BANK LIMITED Notes to the Financial Statements As at and for the Year Ended December 31, 2011

ACNABIN Howladar Yunus & Co. Chartered Accountants Chartered Accountants AGRANI BANK LIMITED Notes to the Financial Statements As at and for the year ended December 31, 2011 1. BACKGROUND INFORMATION 1.1 Establishment and status of the Bank Agrani Bank Limited (the Bank) has been incorporated as a Public Limited Company on May 17, 2007 Vide Certificate of Incorporation # C-66888(4380)/07. The Bank has taken over the business of Agrani Bank (emerged as a Nationalized Commercial Bank in 1972, pursuant to Bangladesh Bank (Nationalization) Order # 1972 (P.O. # 26 of 1972)) on a going concern basis through a Vendor Agreement signed between the Ministry of Finance of the People’s Republic of Bangladesh on behalf of Agrani Bank and the Board of Directors on behalf of Agrani Bank Limited on November 15, 2007 with a retrospective effect from July 01, 2007. The Bank’s current shareholdings comprise Government of the People’s Republic of Bangladesh and other 12 (Twelve) shareholders nominated by the Government. The Bank has 876 branches as on December 31, 2011. The Bank has four wholly-owned subsidiary Companies named (a) Agrani Exchange House (Pvt.) Ltd. in Singapore, (b) Agrani Remittance House SDN, BHD in Malaysia, (c) Agrani Equity and Investment Limited and (d) Agrani SME Financing Company Limited. 1.2 Nature of business The principal activities of the Bank are providing all kinds of commercial banking services to it’s customers and the principal activities of it’s subsidiaries are: a) To carry on the remittance business and to undertake and participate in any or all transactions, and operations commonly carried or undertaken by remittance and exchange houses established in Singapore and Malaysia. -

Procedure of Open Foreign Currency Account.Pdf

Embassy of Bangladesh Washington DC Wage Earner Development Bond Foreign Currency Foreign Currency Accounts Specimern Signature Specimern Signature FC Account Opening Form and Specimen Signature Extension [email protected] Diplomatic Bag /DHL/Fedex English Version The Government of the People’s Republic of Bangladesh have introduced special saving facilities for Non Resident Bangladeshis and also foreigner’s of Bangladeshi decent. Wage Earner Development Bond : Most profitable fixed deposit investment “Wage Earner Development Bond” for Non Resident Bangladeshi’s and Foreigners of Bangladeshi decent introduced by the Government of the People’s Republic of Bangladesh. Compound rate of profit is 12.00% per annum. Tk. 25,000 become Tk. 44,750 with profit after 5 years Tk. 50,000 become Tk. 89,500 with profit after 5 years Tk. 1,00,000 become Tk. 1,79,000 with profit after 5 years Tk. 5,00,000 become Tk. 8,95,000 with profit after 5 years Profits could be withdrawn at a rate of Tk. 1000.00 per month for every Tk. 100000.00. For withdrawal of profit simple rate is applicable. Nominee is entitled to 30% to 50% of invested amount as a death risk insurance at no extra charge in case of death of the bond owner. No income tax is levied on the initial investment or profits thereof. Initial investment amount could be transferred back in foreign currency. If encashed before maturity you will get interest at following rate : a. Before six month no interest b. After six month and before 1 year : 9% c. After 1 year and before 2 years : 10% d. -

Comparison and Analysis of Profitability of Top Three

Global Journal of Management and Business Research: C Finance Volume 19 Issue 3 Version 1.0 Year 2019 Type: Double Blind Peer Reviewed International Research Journal Publisher: Global Journals Online ISSN: 2249-4588 & Print ISSN: 0975-5853 Comparison and Analysis of Profitability of Top Three Nationalized Commercial Banks in Bangladesh By Saeed Sazzad Jeris Abstract- Banks are playing a vital role in the economic & financial development of Bangladesh. Profitability indicates the overall performance of the banks. In this study, it has been tried to compare the top three nationalized commercial banks by some financial parameters, and it relies on secondary sources of data. In this paper, I used statistical tool ANOVA for comparison. The result indicates the statistical difference among these banks and their performance is not stable. Keywords: bank, profitability, performance, ANOVA. GJMBR-C Classification: JEL Code: G21 ComparisonandAnalysisofProfitabilityofTopThreeNationalizedCommercialBanksinBangladesh Strictly as per the compliance and regulations of: © 2019. Saeed Sazzad Jeris. This is a research/review paper, distributed under the terms of the Creative Commons Attribution- Noncommercial 3.0 Unported License http://creativecommons.org/licenses/by-nc/3.0/), permitting all non-commercial use, distribution, and reproduction in any medium, provided the original work is properly cited. Comparison and Analysis of Profitability of Top Three Nationalized Commercial Banks in Bangladesh Saeed Sazzad Jeris Abstract- Banks are playing a vital role in the economic & III. Hypothesis financial development of Bangladesh. Profitability indicates the overall performance of the banks. In this study, it has been 1 2019 0 = There is an insignificant difference among Sonali tried to compare the top three nationalized commercial banks bank, Janata bank, and Agrani bank by on net worth. -

District Bank Branch Location Bank Bank Branch Address DLI Office

DLI Bank Branch DLI District Bank Bank Branch Address A/C Location Office No. Bagerhat Bagerhat Agrani Bank Ltd Bagerhat, Khulna Khulna 737 Bagerhat Bagerhat Pubali Bank Ltd Bagerhat-9300 Khulna 9 Bagerhat Chakshree Bazar Bangladesh Krishi Bank Chakshree Bz. Rampal, Bagerhat Khulna 110 Bagerhat Chital Mari Bazar Bangladesh Krishi Bank Chitalmari Bz.,Bagerhat-9360 Khulna 214 Bagerhat Fakirhat Bangladesh Krishi Bank Fakirhat, Bagerhat-9370 Khulna 293 Bagerhat Mongla Pubali Bank Ltd Mongla Bazar,MadrasaRd.,Bagerhat-9351 Khulna 5 Bagerhat Morelgonj Bangladesh Krishi Bank Morelgonj, Bagerhat-9320 Khulna 281 Bagerhat Raindabazar Bangladesh Krishi Bank Raindabazar,Sarankhola, Bagerhat-9330 Khulna 263 Bagerhat Rampal Bangladesh Krishi Bank Rampal, Bagerhat-9340 Khulna 211 Bagerhat Doiboghohati Bangladesh Krishi Bank Morelgonj, Bagerhat-9320 Khulna 44 Bagerhat Foltita Bangladesh Krishi Bank Kolkolia, Fakirhat, Bagerhat Khulna 30 Bagerhat Mollahat Bangladesh Krishi Bank Mollahat, Bagerhat-9380 Khulna 243 Bagerhat Sannayashibazar Bangladesh Krishi Bank Morelgonj, Bagerhat-9321 Khulna 1 Bagerhat Town Noapara Bangladesh Krishi Bank Town Noapara, Fakirhat, Bagerhat-9370 Khulna 45 Bandarban Baishari Bangladesh Krishi Bank Baishari, Naikhagchari, Bandarban-4660 Chittagong 81 Bandarban Bandarban Pubali Bank Ltd Bandarban-4600 Chittagong 16 Bandarban Lama Bangladesh Krishi Bank Lama, Bandarban Chittagong 453 Barguna Amtoli Bangladesh Krishi Bank Amtoli, Borguna-8710 Barisal 149 Barguna Barguna Pubali Bank Ltd Barguna-8700 Barisal 9 Barguna Betagi Bangladesh -

Premittances.Pdf

BANGLADESH BANK Statistics Department (BOP Division) Wage Earners’ Remittance during the month of September’2021 (Million USD) Sl. Bank Sep,2021 no State Owned Commercial Banks 01-02,Sep 05-09,Sep 12-16,Sep 19-23,Sep 01-23,Sep 1 Agrani Bank 8.88 46.99 40.12 25.57 121.56 2 Janata Bank 5.30 18.30 14.79 10.40 48.79 3 Rupali Bank 3.72 11.14 8.91 10.13 33.90 4 Sonali Bank 11.93 18.33 29.07 17.47 76.80 5 BASIC Bank 0.01 0.05 0.03 0.02 0.11 6 BDBL 0.00 0.00 0.00 0.00 0.00 Sub Total 29.84 94.81 92.92 63.59 281.16 Specialized Banks 7 Bangladesh Krishi Bank 2.67 11.59 10.17 5.99 30.42 8 RAKUB. 0.00 0.00 0.00 0.00 0.00 Sub Total 2.67 11.59 10.17 5.99 30.42 Private Commercial Banks 9 AB Bank Ltd. 1.70 4.04 2.81 2.52 11.07 10 Al-Arafah Islami Bank Ltd. 3.41 10.83 11.82 10.58 36.64 11 Bangladesh Commerce Bank Ltd. 0.14 0.35 0.27 0.20 0.96 12 Bank Asia Ltd. 9.42 24.57 19.44 15.83 69.26 13 BRAC Bank Ltd. 2.14 9.40 6.76 5.03 23.33 14 Community Bank Bangladesh Ltd. 0.00 0.00 0.00 0.00 0.00 15 Dhaka Bank Ltd. -

Information Memorandum

Strictly Private & Confidential INFORMATION MEMORANDUM 2nd Subordinated Floating Rate Bond of BDT 5,000 Million for International Finance Investment and Commerce Bank Limited Issuer: International Finance Investment and Commerce Bank Limited (IFIC Bank Limited) Head Office: IFIC Tower 61 Purana Paltan Dhaka - 1000, Bangladesh Trustee: Sena Kalyan Insurance Company Limited Type of Security: Subordinated Unsecured Floating Rate Bond Total Face Value: Up to BDT 5,000 Million Face Value of Each Bond is: BDT 10,000,000 Issue Price of Each Bond is: BDT 10,000,000 Number of Securities: 500 Total Issue Amount: BDT 5,000,000,000 Coupon Rate/discount rate and YTM: Floating Issue Date of IM: 05 July 2021 Credit Rating status of the Issue: Long Term Rating: AA3 (Hyb), Outlook: Stable “If you have any query about this document, you may consult the issuer and the trustee.” Mandated Lead Arranger Standard Chartered Bank ARRANGER’S DISCLAIMER IFIC Bank Limited (the “Issuer”) has authorized Standard Chartered Bank (“Standard Chartered” or the “Arranger”) to distribute this Information Memorandum in connection with the proposed transaction outlined in it (the “Transaction”) and the bond proposed to be issued in the Transaction (the “Bond”). “Standard Chartered Bank” means Standard Chartered and any group, subsidiary, associate or affiliate of Standard Chartered and their respective directors, representatives or employees and/or any persons connected with them. Nothing in this Information Memorandum constitutes an offer of securities for sale in the United States or any other jurisdiction where such offer or placement would be in violation of any law, rule or regulation. The Issuer has prepared this Information Memorandum and the Issuer is solely responsible for its contents. -

List of Nostro Accounts

Agrani Bank Limited International Trade & Foreign Currency Management Division, H.O, Dhaka List of Nostro Accounts Sl.No. Name of the Bank & Swift No. Currency Account No. Country 1. Citi Bank NA, New York USD 10961809 USA SWIFT NO: CITI US 33 2. Standard Chartered Bank, NY USD 3582-020117-001 USA SWIFT NO: SCBL US33 3. Mashreq Bank PSC, New York. USD 70120534 USA SWIFT NO.MSHQ US 33 4. Public Bank Berhad, Kualalumpur USD 3-9971556-19 Malaysia SWIFT NO.PBBE MY KL 5. Kookmin Bank, Seoul, USD 752-8-USD-01-9 South Korea Swift No: CZNB KR SE 6. Sonali Bank (UK)Ltd, London USD 2323 UK Swift: BSONGB2L 7. ICICI Bank Ltd, Hongkong. USD 852005406 Hongkong SWIFT NO:ICICHKHH 8. Habib Metropolitan Bank Ltd. Karachi. ACUD 6-1-52-20110-931-31601 Pakistan SWIFT NO: MPBL PK KA 9. AB Bank Limited, Mumbai ACUD 5001-000004-155 India SWIFT No: ABBLIN BB 10. Sonali Bank Ltd, Kolkata ACUD C102ACU01 India Swift No: BSON IN CC 11. Standard Chartered Bank, Mumbai ACUD 5220-5077427 India Swift No: SCBL IN BB 12. ICICI Bank Ltd, Mumbai ACUD 000406000315 India Swift No: ICIC IN BB 13. United Bank of India, Kolkata Swift: ACUD 0084050098102 India UTBIINBBCAL (New) 14. Bank of Ceylon , Colombo ACUD 1977940 Srilanka Swift No: BCEY LK LX 15. Standard Chartered Bank Nepal Ltd, Kathmandu ACUD 15-1390147-51 Nepal Swift No: SCBL NP KA 16. Bank of Ceylon, Male, Maldives ACUD 6320117369 Maldives Swift No:BCEYMVMVXXX 17 HDFC Bank Limited, India. ACUD 5020 0048 8482 83 India. -

IFIC Rights Share Offer Document

RIGHTS SHARE OFFER DOCUMENT IFIC Bank Limited RIGHTS SHARE OFFER DOCUMENT 22 March 2017 Rights Offer of 563,821,907 Ordinary Shares of BDT 10.00 each at an issue price of BDT 10.00 each at par totaling BDT 5,638,219,070.00 offered on the basis of 1(R): 1 (i.e. one Rights Share for every existing one share held) on the record date for the entitlement of rights shares. RECORD DATE FOR ENTITLEMENT OF RIGHTS OFFER 12 April 2017 Opens on: 31 May 2017 Subscription Closes on: 29 June 2017 Within Banking Hours (Both Days Inclusive) CREDIT RATING STATUS Rating Year Long Term Short Term Entity Rating 2015 AA2 ST-2 Date of Rating 23 June 2016 Validity 30 June 2017 Rating Assigned By: Credit Rating Agency of Bangladesh Limited (CRAB) MANAGER TO THE ISSUE ICB CAPITAL MANAGEMENT LIMITED Green City Edge (5th & 6th Floor),89, Kakrail, Dhaka-1000, Bangladesh Ph: 8300555 ,8300367, 8300387, 8300395, 8300421. Fax: 8802-8300396 E-Mail: [email protected], Website: www.icml.com.bd FULLY UNDERWRITTEN BY AFC Capital Ltd. IIDFC Capital Limited Saiham Sky View Towerv(11th floor), 45 Bijoy Nagar, Eunoos Trade Centre ( Level 7), 52-53, Dilkusha C/A, Dhaka-1000. Dhaka. Agrani Equity & Investment Ltd. Jamuna Bank Capital Management Limited Swantex Bhaban (4th floor), 9/I, Motijheel, Dhaka-1000 Hadi Mansion (3rd Floor), 2, Dilkusha C/A, Dhaka- 1000. Bengal Investments Limited Janata Capital and Investment Limited Eastern Nibash (3rd Floor), 138, Gulshan Avenue, Gulshan- 48, Motijheel (3rd floor), Dhaka1000 2, Dhaka-1212. Beta One Investments Limited Lanka Bangla Investments Limited Green Delta AIMS Tower (Level – 4), 51-52, Mohakhali City Center | Level - 24 | 90/1 Motijheel C/A, C/A, Dhaka-1212. -

Performance Evaluation and Competitive Analysis of State Owned Commercial Banks in Bangladesh

Research Journal of Finance and Accounting www.iiste.org ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) Vol 2, No 3, 2011 Performance Evaluation and Competitive Analysis of State Owned Commercial Banks in Bangladesh Shah Johir Rayhan (Corresponding author) Department of Management & Finance Sher-e-Bangla Agricultural University Sher-e-Bangla Nagar, Dhaka-1207, Bangladesh. Cell: +8801712700906 E-mail: [email protected] Alternative E-mail: [email protected] S.M. Sohel Ahmed Department of Marketing Northern College Bangladesh (Sister Concern of Northern University Bangladesh) Dhaka-1207, Bangladesh. Cell: +88 01711053120 E-mail: [email protected] Alternative E-mail: [email protected] Ripon Kumar Mondal Department of Agricultural Economics Sher-e-Bangla Agricultural University Sher-e-Bangla Nagar, Dhaka-1207, Bangladesh. Cell: +8801712953758 E-mail: [email protected] Abstract The broad objective of this study is Performance Evaluation and Competitive Analysis of state owned commercial banks in Bangladesh. This paper finds the development and growth of state owned commercial banks in Bangladesh. Secondary data was used for the research. The study reveals all the state owned commercial banks in Bangladesh are not able to achieve a stable growth, net profit, earning per Share, return on equity, return on assets, net asset value per share but they are capable to achieve a stable growth of deposit, loan and advances, equity. It is also observed that all the of state owned commercial banks have high non performing loan/classified loan and % of classified loan to total loan is very high. Employees of all state owned commercial banks are negative growth. Trend equations have been tested for different activities of the state owned commercial Banks.