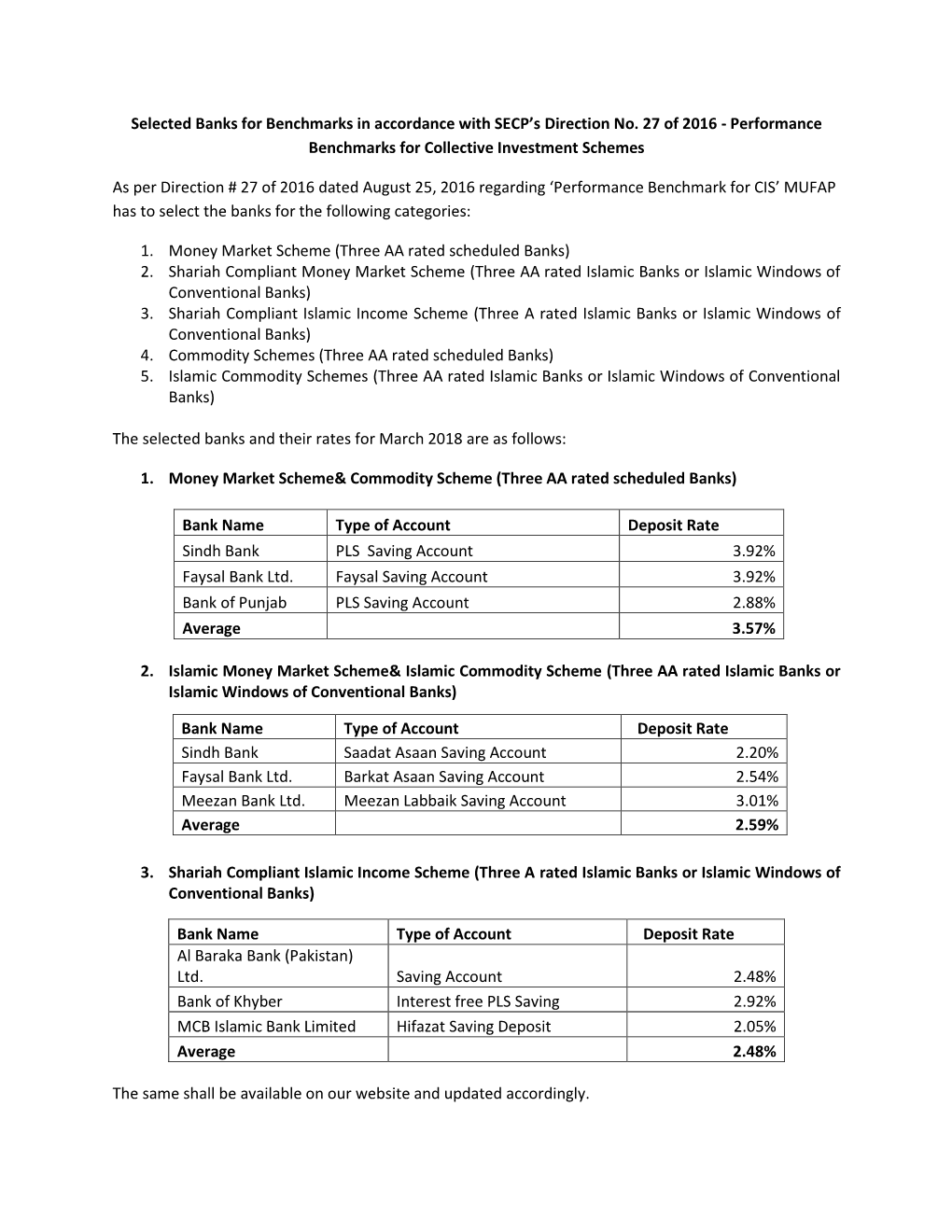

Selected Banks for Benchmarks in Accordance with SECP's Direction

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IBFT- Account Number Formats

IBFT- Account Number Formats Allied Bank Please enter Allied Bank Account Number by following the layout below: Total Digits of Account Number: 13 or 20 Digits Format Example: BBBBAAAAAAAAA or BBBBAAAAAAAAAAAAAAAA BBBB = 4 Digit Branch Code, AAAAAAAAA = 9 Digit Account Number, AAAAAAAAAAAAAAAA = 16 Digit Account Number Apna Microfinance Bank Please enter Apna Microfinance Bank Account Number by following the layout below: Total Digits of Account Number: 16 Digits Format Example: BBBBAAAAAAAAAAAA BBBB = 4 Digit Branch Code, AAAAAAAAA = 12 Digits Askari Bank Please enter Askari Bank Account Number by following the layout below: Total Digits of Bank Account Number: 14 Digits Format Example: BBBB = 4 Digit Branch Code, AAAAAAAAAA = 10 Digit Account Number Branchless Banking Account # Always consist of 11 digits Mobile Number. Al-Baraka Please enter Bank Al-Baraka total digits of account Number: Total Digits of Account Number: 13 Digits Bank Alfalah Please enter Bank Alfalah Account Number by following the layout below: Conventional A/C#: Total Digits of Account Number: 14 Format Example: BBBBAAAAAAAAAA BBBB = 4 Digit Branch Code, AAAAAAAAAA = 10 Digit Account Number Islamic A/C#: Total Digits of Account Number: 18 Digit Format Example: BBBBAAAAAAAAAAAAAA BBBB = 4 Digit Branch Code, AAAAAAAAAAAAAA = 14 Digit Account Number Branchless Banking Account # : Always consist of 11 digits Mobile Number. Bank Al-Habib Please enter Bank Al-Habib Account Number by following the layout below: Total Digits of Account Number: 17 Digit Format -

Pakistan Banking Perspective 2021

KPMG Taseer Hadi & Co. Chartered Accountants Pakistan Banking Perspective 2021 June 2021 — home.kpmg/pk COLOURS0 / 51 / 141 0 / 94 / 184 0 / 145 / 218 72 / 54 / 152 71 / 10 / 104 109 / 32 / 119 0 / 163 / 161 0 / 154 / 68 67 / 176 / 42 234 / 170 / 0 246 / 141 / 46 188 / 32 / 75 198 / 0 / 126 117 / 63 / 25 155 / 100 / 46 157 / 147 / 117 227 / 188 / 159 227 / 104 / 119 Pakistan Banking Perspective | 2021 Foreword Alhamdulillah, we are beginning to resilience to face the future see a gradual and phased return to developments in banking. During this normalcy with renewed confidence time of rapid developments, and optimism. embracing Environmental, Social and Governance (ESG) agenda is of We are delighted to introduce our immense importance to ensure annual Pakistan Banking perspectives investor confidence in the banking report for the year ended 31 sector in the long-run. December 2020 that analyses the financial results for leading listed Our source of information remain the commercial banks across Pakistan, published financial statements and comparing these with the previous views expressed do not constitute year. This report provides banking advice. industry leaders with brief analysis, We believe this report is insightful comparing banking sector key and a thought-provoking read. We performance indicators and furnishes would be delighted to discuss with forward-looking views and insights you the views outlined within it and from our professionals and industry explore how we could assist your leads. organization in capitalizing on For the first time in this publication potential opportunities. Thank you series, we are proud to include an for your support as we take yet interview with a sector leader about another step forward in our exciting the existing challenges and future client service journey. -

State Bank of Pakistan I.I. Chundrigarh Road Karachi KHI001 United Bank Ltd

State Bank of Pakistan I.I. Chundrigarh Road Karachi KHI001 United Bank Ltd. NEAR BALOCH COLONY BUS STOP Karachi KHI003 United Bank Ltd. RAFIH E AAM SOCIETY Karachi KHI004 BankIslami Ltd. DHA PHASE-2 Karachi KHI005 Allied Bank Ltd. SCHEME-36,GULISTAN-E-JOHAR, UNI ROAD Karachi KHI006 United Bank Ltd. STOCK EXCHANGE BLDG.I.I.CHUNDRIGAR Karachi KHI007 Allied Bank Ltd. SADDAR BAZAR QUARTER, ZAIB UN NISA St Karachi KHI008 Allied Bank Ltd. WEST WHARF DOCKYARD ROAD, Karachi KHI009 Askari Bank Ltd. ASKARI BANK LTD., MALIR CANTT BRANCH Karachi KHI010 Faysal Bank Ltd. Q-14, Sector 33-A, Korangi # 2 (209) Karachi KHI011 HBL LASBELA Karachi KHI012 HBL SHIREEN JINNAH Karachi KHI013 Habib Metropolitan North Western Zone Prt Qasim Karachi KHI014 Bank Ltd. Askari Bank Ltd. Guslah-e-Iqbal Branch Karachi KHI015 Meezan Bank Ltd. Opp Jungle Shah College, Kemari Town Karachi KHI016 Bank Al Habib Ltd. Malir Halt Railway Stn,Shahrah Faisal Karachi KHI017 Bank Al Habib Ltd. Near Siemens Chowrangi, S.I.T.E Karachi KHI018 Silk Bank Ltd. KCHS bahadurabad karachi Karachi KHI019 Bank Al Habib Ltd. Rashid Minhas,Block B Gulshan-e-Jamal Karachi KHI020 Bank Al Habib Ltd. Speedy Towers, Phase-I, DHA Karachi KHI021 Bank Al Habib Ltd. Block 17 KDA36,Shalimar Center,Jauhar Karachi KHI022 BankIslami Ltd. 13-C, GULSHAN E IQBAL UNIVERSIITY ROAD Karachi KHI023 BankIslami Ltd. I I CHUNDRIGAR ROAD, Karachi KHI024 Bank Al Habib Ltd. Block 13A, Uni Road Gulshan Iqbal Karachi KHI025 BankIslami Ltd. BLOCK-15 KDA SCHEME 36,GULISTAN-E-JOHER Karachi KHI026 Faysal Bank Ltd. ST - 02, Main Shahrah-e-Faisal (110) Karachi KHI027 MCB Bank Ltd MCB Shah Faisal Colony Branch No. -

Wide Screen Template

KPMG Taseer Hadi & Co. Chartered Accountants Snapshot of results ofBanks inPakistan Snapshot of results of banks in Pakistanfor the six months period ended 30 June2019 This snapshot has been prepared by KPMG Taseer Hadi & Co. and summarizes the performance of selected commercial banks in Pakistan for the six months period ended 30 June 2019. The information contained in this snapshot has been obtained from the published interim consolidated financial statements of the banks. Reference should be made to the published interim financial statements of the banks to enhance the understanding of ratios and analysis of performance of a particular bank. The interim financial statements of Summit Bank and First Woman Bank Limited were not published till the date of our publication, and accordingly their results are not included in this snapshot. We have tried to provide relevant financial analysis of the banks which we thought would be useful for benchmarking and comparison. However, we welcome any comments, which would facilitate in improving the contents of this document. The comments may be sent at [email protected] Dated: 25 September 2019 Karachi © 2019 KPMG Taseer Hadi & Co., a Partnership firm registered in Pakistan and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rightsreserved. 2 HBL NBP UBL MCB ABL BAH Meezan 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 Ranking By total assets 1 1 2 2 3 3 4 4 5 5 6 6 7 -

IBFT Guideline

MCB Bank Limited IBFT- Guidelines 1. Al Baraka Bank (Pakistan) Limited Please enter Bank Al-Baraka total digits of account Number: Total Digits of Account Number: 13 Digits Format Example: AAAAAAAAAAAAA Note: A = Account Number 2. Allied Bank Limited Please enter Allied Bank Account Number by following the layout below: Total Digits of Account Number: 13 or 20 Digits Format Example: BBBBAAAAAAAAA or BBBBAAAAAAAAAAAAAAAA Note: B = Branch Code, A = Account Number 3. APNA Microfinance Bank Please enter APNA Microfinance Bank Account Number by following the layout below: Total Digits of Account Number: 16 Digits Format Example: BBBBAAAAAAAAAAAA Note: B = Branch Code, A = Account Number 4. Askari Bank Limited Please enter Askari Bank Account Number by following the layout below: For Branch Banking: Total Digits of Bank Account Number: 14 Digits Format Example: BBBBAAAAAAAAAA Note: B = Branch Code, A = Account Number For Branchless Banking: Total Digits of Bank Account Number: 11 Digits Format Example: 03XXXXXXXXX 5. Bank Al-Habib Limited Please enter Bank Al-Habib Account Number by following the layout below: Total Digits of Account Number: 17 Digits Format Example: BBBBTTTTBBBBBBRRC Note: B = Branch Code, A = Account Number, T = Account Type, BBBB= Base Number, RR = Digit Running Number, C = Check Digit 111 000 622 mcb.com.pk /MCBBankPk Over 1350 Branches & ATMs 6. Bank Al-Falah Limited Please enter Bank Al-Falah Account Number by following the layout below: For Conventional Banking: Total Digits of Account Number: 14 Digits Format Example: BBBBAAAAAAAAAA Note: B = Branch Code, A = Account Number For Islamic Banking: Total Digits of Account Number: 18 Digits Format Example: BBBBAAAAAAAAAAAAAA Note: B = Branch Code, A = Account Number For Branchless Banking: Total Digits of Account Number: 11 Digits Format Example: 03XXXXXXXXX 7. -

FINANCIAL CHECKS – Agent Checklist

FINANCIAL CHECKS – Agent Checklist Student Name Date of Birth Agent (Agency) Name You should provide evidence of funds as outlined below. This checklist will assist you to calculate required funds. For information on the financial capacity requirement see http://www.border.gov.au/Trav/Stud/More/Student- Visa-Living-Costs-and-Evidence-of-Funds. Instructions: Please complete this checklist and return it together with bank/agent certified financial documents to [email protected] . All documents must be certified by the Financial Institution, Bank, a Notary Public or your Education Agent. If you are providing bank statements, they must be for the last 6 months ONLY and should be a summary. No more than 10 pages will be accepted. You can choose to provide evidence of funds in two ways. 1. 12 months of funds option 2. Annual income option Please write YES next to which option you choose to indicate evidence of funds in the box below and provide the documentation stated in the relevant section. Option 1 Option 2 Acceptable Financial Institutions N MCB (Muslim Commercial Faysal Bank Limited SME Bank Limited Bank Al Baraka Bank (Pakistan) Ltd First Women Bank Limited Samba Bank Limited Allied Bank Limited Habib Bank Limited Silk Bank Limited Askari Bank Limited Habib Metropolitan Bank Limited Sindh Bank Limited Bank Alfalah Limited Industrial & Commercial Bank of Soneri Bank Limited China Bank Al-Habib Limited Industrial Development Bank of Standard Chartered Bank Pakistan (Pakistan) Limited BankIslami Pakistan Limited JS Bank Limited Summit -

List of Scheduled Banks

Scheduled Banks S.No Banks Website Contact Info. Public Sector Commercial Banks 1 First Women Bank Ltd http://www.fwbl.com.pk/ 111-676-767 2 National Bank of Pakistan www.nbp.com.pk 111-627-627 3 Sindh Bank Limited https://sindhbank.com.pk/ 111-333-225 4 The Bank of Khyber https://www.bok.com.pk/ 111-95-95-95 5 The Bank of Punjab https://www.bop.com.pk/BoP 111-267-200 Specialized Banks 6 SME Bank Limited https://smebank.org/ 111-110-011 7 The Punjab Provincial Cooperative Bank Ltd. https://www.ppcbl.com.pk/ 111-772-250 8 Zarai Taraqiati Bank Limited https://www.ztbl.com.pk/ 111-30-30-30 Domestic Private Banks 9 Al-Barka Bank (Pakistan) Ltd. https://www.albaraka.com.pk/ 111-113-442 10 Allied Bank Limited https://www.abl.com/ 111-225-225 10 Askari Bank Limited https://askaribank.com/ 111-000-787 11 Bank Al-Falah Limited https://www.bankalfalah.com/ 111-225-111 12 Bank Al-Habib Limited https://www.bankalhabib.com/ 111-014-014 13 BankIslami Pakistan Limited https://www.bankislami.com.pk/ 111-475-264 14 Dubai Islamic Bank Pakistan Limited https://www.dibpak.com/ 111-786-342 15 Faysal Bank Limited https://www.faysalbank.com/ 111-06-06-06 16 Habib Bank Limited https://www.hbl.com/ 111-111-425 17 Habib Metropolitan Bank Limited https://www.habibmetro.com/ 111-1-42242 18 JS Bank Limited https://jsbl.com/ 111-654-321 19 MCB Bank Limited https://www.mcb.com.pk/ 111-000-622 20 MCB Islamic Bank Limited https://www.mcbislamicbank.com/ 042-34501000 21 Meezan Bank Limited https://www.meezanbank.com/ 111-331-331 22 Samba Bank Limited https://www.samba.com.pk/ -

Regional Focal Persons of Commercial Banks for Risk Sharing Facility Under Rozgar Refinance Schemes-COVID 19

Regional Focal Persons of Commercial Banks for Risk Sharing Facility under Rozgar Refinance Schemes-COVID 19 Designation Sr. No. SBP BSC Office Name of Bank Name Land Line No. Cell No. Email Address (SVP/ VP/ AVP etc) Albaraka Bank (Pakistan) 1 Bahawalpur Asif Muslim VP 062-2731303 0300-8688466 [email protected] Limited MG-8 2 Bahawalpur Allied Bank Limited Riaz Ahmad 062-2881324 0300-7347534 [email protected] Unit Head Assets 3 Bahawalpur Askari Bank Limited Noor Ul Islam VP 062-2882268 0331-4888662 [email protected] 4 Bahawalpur Bank Alhabib Limited Tahir Qureshi VP 062-2880516 0333-8423366 [email protected] 5 Bahawalpur Bank Alfalah Limited Muhammad Ehtisham SVP 062-2889987 0321-9678889 [email protected] Ghulam Abbas Malik 6 Bahawalpur BankIslami Pakistan Limited Area Manager +92 (062) 2281831-3 +92 333 0130210 [email protected] 7 Bahawalpur Dubai Islamic Bank Pakistan LimitedFahad Sial VP 062-2889951 0333-3323824 [email protected] 8 Bahawalpur Faysal Bank Limited Zeeshan Mustafa SVP 062-2730696 0321-6801270 [email protected] 9 Bahawalpur First Women Bank Limited Mubeena Tariq VP 061-4586535 0322-6124688 [email protected] 10 Bahawalpur Habib Bank Limited Khalid Mehmood SVP 062-2733014 0345-5466691 [email protected] Habib Metropolitan Bank 11 Bahawalpur Rana Nadeem Yonus SVP 062-2889901 0321-6801280 [email protected] Limited 12 Bahawalpur JS Bank Limited Syed Noman Ahmed VP 062-2889172 0321-6323239 [email protected] 13 Bahawalpur MCB Bank -

Amc Annual 2018.Fh10

TABLE OF CONTENTS 1 Vision, Mission and Core Values 02 2 Company Information 03 3 Notice of Annual General Meeting 04 4 Chairmans Review Report 12 5 Directors Report 14 6 Pattern of Shareholding 31 7 Statement of Compliance with the Code of Corporate Governance 33 8 Review Report to the Members on the Statement of Compliance 35 with the Code of Corporate Governance 9 Financial and Business Highlights 37 10 Auditors Report to the Members 38 11 Balance Sheet 44 12 Profit and Loss Account 45 13 Statement of Comprehensive Income 46 14 Cash Flow Statement 47 15 Statement of Changes in Equity 48 16 Notes to Financial Statements 49 17 Form of Proxy 90 MCB Arif Habib Savings and Investments Limited 01 Annual Report 2018 Vision To become synonymous with Savings. Mission To become a preferred Savings and Investment Manager in the domestic and regional markets, while maximizing stakeholders value. Core Values The Company takes pride in its orientation towards client service. It believes that its key success factors include continuous investment in staff, systems and capacity building and its insistence on universal best practices at all times. MCB Arif Habib Savings and Investments Limited 02 Annual Report 2018 COMPANY INFORMATION Board of Directors Audit Committee Human Resource & Remuneration Committee Risk Management Committee Mr. Mirza Qamar Beg Chairman Mr. Ahmed Jahangir Member Mr. Nasim Beg Member Chief Executive Officer Saleem Chief Operating Officer & Mr. Muhammad Asif Mehdi Rizvi Company Secretary Chief Financial Officer Bankers Bank Alfalah Limited Chartered Accountants 1st Floor, Shaikh Sultan Trust, Building No. 2, Beaumant Road, Karachi - 75530 MCB-Arif Habib Savings & Investments Limited 24th Floor, Centrepoint, Off Shaheed-e-Millat Expressway Near K.P.T. -

01 Mcb Dcf Income Fund.Fh10

Vision To become synonymous with Savings. Mission To become a preferred Savings and Investment Manager in the domestic and regional markets, while maximizing stakeholders value. Core Values The Company takes pride in its orientation towards client service. It believes that its key success factors include continuous investment in staff, systems and capacity building and its insistence on universal best practices at all times. CONTENTS 1 MCB DCF INCOME FUND 03 2 PAKISTAN INCOME FUND 38 3 MCB PAKISTAN SOVEREIGN FUND 68 4 PAKISTAN INCOME ENHANCMENT FUND 94 5 MCB CASH MANAGEMENT OPTIMIZER 123 6 PAKISTAN CASH MANAGEMENT FUND 151 7 MCB PAKISTAN STOCK MARKET FUND 176 8 ALHAMRA ISLAMIC STOCK FUND 207 9 MCB PAKISTAN ASSET ALLOCATION FUND 237 10 PAKISTAN CAPITAL MARKET FUND 272 11 ALHAMRA ISLAMIC ASSET ALLOCATION FUND 303 12 ALHAMRA ISLAMIC INCOME FUND 333 13 ALHAMRA ISLAMIC ACTIVE ALLOCATION FUND 361 14 MCB PAKISTAN FREQUENT PAYOUT FUND 398 15 PAKISTAN PENSION FUND 425 16 ALHAMRA ISLAMIC PENSION FUND 460 17 ALHAMRA DAILY DIVIDEND FUND 494 02 MCB DCF INCOME FUND MCB DCF INCOME FUND CONTENTS 1 Funds Information 05 2 Report of the Directors of the Management Company 06 3 Trustee Report to the Unit Holders 12 4 Auditors Report to the Unit Holders on Review of Condensed Interim Financial Statements 13 5 Condensed Interim Statement of Assets And Liabilities 14 6 Condensed Interim Income Statement (Un-audited) 15 7 Condensed Interim Statement of Other Comprehensive Income (Un-audited) 16 8 Condensed Interim Statement of Movement in Unit Holders Funds (Un-audited) 17 9 Condensed Interim Cash Flow Statement ( Un-audited) 18 10 Notes to and forming part of the Condensed Interim Financial Statements (Un-audited) 19 04 MCB DCF INCOME FUND FUNDS INFORMATION Management Company MCB-Arif Habib Savings & Investments Limited Adamjee House, 2nd Floor, I.I. -

Bank of Khyber First Women Bank Industrial & Commercial Bank of China MCB Islamic Bank National Bank of Pakistan

Bank of Khyber Please enter Bank of Khyber Account Number by following the layout below: Total Digits of Account Number: 12 or 16 Digit Format Example: BBBBAAAAAAAA or BBBBAAAAAAAAAAAA BBBB = 4 Digit Branch Code, AAAAAAAA = 8 Digit Account Number, AAAAAAAAAAAA = 12 Digit Account Number First Women Bank Please enter First Women Bank Account Number by following the layout below: Total Digits of Account Number: 20 Digit Format Example: BBBBAAAAAAAAAAAAAAAA BBBB = 4 Digit Branch Code, AAAAAAAAAAAAAAAA = 16 Digit Account Number Industrial & Commercial Bank of China Please enter ICBC total digits of Account Number: Total Digits of Account Number: 16 or 19 Digit MCB Islamic Bank Please enter MCB Islamic Bank Account Number by following the layout below: Total Digits of Account Number: 16 Digit Format Example: BBBAAAAAAAAAAAAA BBB = 3 Digit Branch Code, AAAAAAAAAAAAA = 13 Digit Account Number National Bank of Pakistan Please enter National Bank of Pakistan Account Number by following the layout below: Total Digits of Account Number: 10 Digit Format Example: AAAAAAAAAA AAAAAAAAAA = 10 Digit Account Number NRSP Microfinance Bank Limited Please enter NRSP Microfinance Bank Limited Account Number by following the layout below: Total Digits of Account Number: 13 Digit Format Example: BBBPPPAAAAAAA BBB = 3 Digit Branch Code, PPP = 3 Digit Product Code, AAAAAAA = 7 Digit Account Number Allied Bank Please enter Allied Bank Account Number by following the layout below: Total Digits of Account Number: 13 or 20 Digit Format Example: BBBBAAAAAAAAA -

K-Electric Limited Prospectus STRUCTURING AGENTS

ADVICE FOR INVESTORS INVESTORS ARE STRONGLY ADVISED IN THEIR OWN INTEREST TO CAREFULLY READ THE CONTENTS OF THIS PROSPECTUS ESPECIALLY THE RISK FACTORS AT PARA [•] OF THIS PROSPECTUS BEFORE MAKING ANY INVESTMENT DECISION SUBMISSION OF FALSE AND FICTITOUS APPLICATIONS IS PROHIBITED AND SUCH APPLICANT’S MONEY MAY BE FOREFEITED UNDER SECTION 87(8) OF THE SECURITIES ACT, 2015 K-Electric Limited Date of Incorporation: September 13, 1913, Incorporation Number: 0000002 , Registered and Corporate Office: KE House, 39-B, Sunset Boulevard, Phase II, Defence Housing Authority, Karachi, Contact Number: 92-21-3870 9132 , Website: www.ke.com.pk, Email: [email protected] Prospectus The Issue Size of Rated, Secured and Listed Diminishing Musharakah Sukuk of up to PKR 25,000 million, out of which Sukuk of PKR 23,708 million (94.8% of Issue Size) are issued to the Pre-IPO investors and PKR 1,292 million (5.2% of Issue Size) are being offered to the general public by way of an Initial Public Offering through this Prospectus Rate of Return: 7-year floating rate instrument @ 3-month KIBOR (Ask Side) plus 1.70% per annum Instrument Rating: AA+ (Double A Plus) by VIS Credit Rating Company Limited Long Term Entity Rating: AA (Double A) by VIS Credit Rating Company Limited & Pakistan Credit Rating Agency (PACRA) Short Term Entity Rating: A1+ (A One Plus) by VIS Credit Rating Company Limited & Pakistan Credit Rating Agency (PACRA) As per PSX’s Listing of Companies and Securities Regulations, the Draft Prospectus was placed on PSX’s website for seeking public comments starting from [•],2020 to [•], 2020.