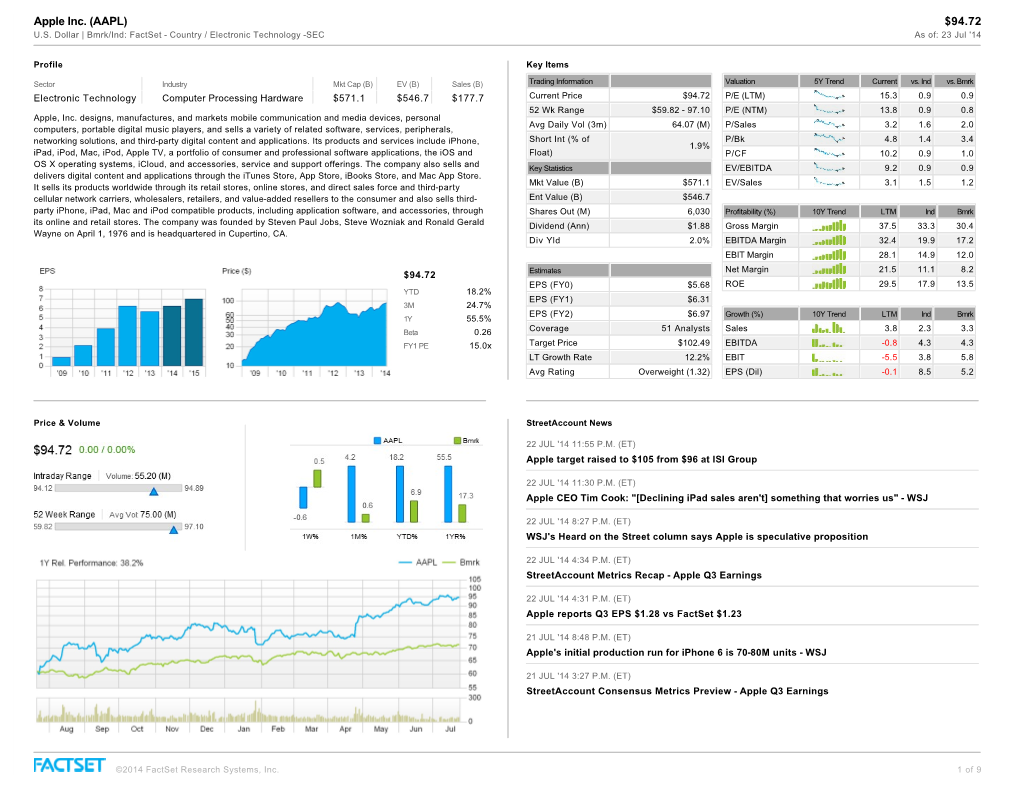

Apple Inc. (AAPL) $94.72 U.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Apple Inc AAPL (NAS) | QQQ

Morningstar Equity Research Apple Inc AAPL (NAS) | QQQ Last Price Fair Value Consider Buy Consider Sell Uncertainty Economic Moat™ Moat Trend™ Stewardship Morningstar Credit Rating Industry Group 541.65 USD 570.00 USD 342.00 USD 883.50 USD High Narrow Positive Standard AA- Computer Hardware Apple will have to fend off increased competition from Vital Statistics Android-based competitors in the years ahead. Market Cap (USD Mil) 483,146 52-Week High (USD) 575.13 52-Week Low (USD) 385.10 Brian Colello, CPA Investment Thesis 28 Jan 2014 52-Week Total Return % 29.1 Senior Analyst [email protected] We believe Apple's strength lies in its experience and expertise in YTD Total Return % -2.9 +1 (312) 384-3742 Last Fiscal Year End 30 Sep 2013 integrating hardware, software, services, and third-party 5-Yr Forward Revenue CAGR % 3.2 applications into differentiated devices that allow Apple to capture 5-Yr Forward EPS CAGR % 1.2 a premium on hardware sales. Although Apple has a sterling brand, Price/Fair Value 0.95 robust product pipeline, and ample opportunity to gain share in its Valuation Summary and Forecasts The primary analyst covering this company various end markets, short product life cycles and intense does not own its stock. Fiscal Year: 2012 2013 2014(E) 2015(E) competition will prevent the firm from resting on its laurels or Price/Earnings 15.1 12.0 12.6 12.2 Research as of 10 Mar 2014 carving out a wide economic moat, in our opinion. EV/EBITDA 10.2 7.3 7.5 7.5 Estimates as of 31 Jan 2014 EV/EBIT 10.8 8.3 8.7 9.2 Pricing data through 01 Apr 2014 Rating updated as of 01 Apr 2014 We believe Apple has developed a narrow economic moat, thanks Free Cash Flow Yield % 6.8 10.6 9.3 8.9 Dividend Yield % 0.4 2.5 2.4 2.4 to switching costs related to a variety of attributes around the iOS Currency amounts expressed with "$" are in U.S. -

Current Contract Price List

Apple 534480 Addn 19 Product Name Manufacturer Vendor Part No Description Unit of Measure State Price Apple Inc Apple Inc MMQA2LL/A iMac 21.5"/2.3GHz dual-core Intel Core i5/8GB/1TB hard drive/Intel Iris Plus Graphics 640 w/Apple Magic Keyboard and Apple Magic1 Mouse 2 1049.00 Apple Inc Apple Inc MNDY2LL/A iMac 21.5" 4K/3.0GHz quad-core Intel Core i5/8GB/1TB hard drive/Radeon Pro 555 w/Apple Magic Keyboard and Apple Magic Mouse1 2 1249.00 Apple Inc Apple Inc MNE02LL/A iMac 21.5" 4K/3.4GHz quad-core Intel Core i5/8GB/1TB Fusion drive/Radeon Pro 560 w/Apple Magic Keyboard and Apple Magic1 Mouse 2 1399.00 Apple Inc Apple Inc MNE92LL/A iMac 27" 5K/3.4GHz quad-core Intel Core i5/8GB/1TB Fusion drive/Radeon Pro 570 w/Apple Magic Keyboard and Apple Magic Mouse1 2 1699.00 Apple Inc Apple Inc MNEA2LL/A iMac 27" 5K/3.5GHz quad-core Intel Core i5/8GB/1TB Fusion drive/Radeon Pro 575 w/Apple Magic Keyboard & Apple Magic Mouse1 2 1899.00 Apple Inc Apple Inc MNED2LL/A iMac 27" 5K/3.8GHz quad-core Intel Core i5/8GB/2TB Fusion drive/Radeon Pro 580 w/Apple Magic Keyboard & Apple Magic Mouse1 2 2099.00 Apple Inc Apple Inc BMPP2LL/A BNDL iMac 21.5"/2.3GHz dual-core Intel Core i5/8GB/1TB hard drive/Intel IPG 640 with AppleCare+ for Mac 1 1168.00 Apple Inc Apple Inc BMPQ2LL/A BNDL iMac 21.5" 4K/3.0GHz quad-core Intel Core i5/8GB/1TB hard drive/RP 555 with AppleCare+ for Mac 1 1368.00 Apple Inc Apple Inc BMPR2LL/A BNDL iMac 21.5" 4K/3.4GHz quad-core Intel Core i5/8GB/1TB Fusion drive/RP 560 with AppleCare+ for Mac 1 1518.00 Apple Inc Apple Inc BMPS2LL/A BNDL -

HMS1-1011QPL BOEING MATERIAL SPECIFICATION Revision - QUALIFIED PRODUCT LIST 31 October 2008 the BOEING COMPANY Page 1 of 1

HMS1-1011QPL BOEING MATERIAL SPECIFICATION Revision - QUALIFIED PRODUCT LIST 31 October 2008 THE BOEING COMPANY Page 1 of 1 BARE AL ALY SH FOR HELICOPTER ROTOR BLADE SKINS THE FOLLOWING SOURCES ARE APPROVED FOR THE PROCUREMENT OF BARE ALUMINUM ALLOY SHEET FOR HELICOPTER ROTOR BLADE SKINS IN ACCORDANCE WITH THE REQUIREMENTS OF MCDONNELL DOUGLAS HELICOPTER COMPANY MATERIAL SPECIFICATION 1-1011. Supplier Info Supplier Comments BE10034516 APPROVED TO HMS1-1011 IN ACCORDANCE WITH ATTACHED EXCEPTIONS. PARAGRAPH ALUMINUM CO OF AMERICA 4.2.1 (SCRATCHES) PARAGRAPH 4.2.2 (MIL DEFECTS) PARAGRAPH 4.3 (CORROSION 4879 STATE ST SUSCEPTABILITY) BETTENDORF, IA 52722 USA UNCONTROLLED WHEN PRINTED CAGE CODE 02731 HMS11-1109QPL BOEING MATERIAL SPECIFICATION Revision - QUALIFIED PRODUCT LIST 31 October 2008 THE BOEING COMPANY Page 1 of 2 TITANIUM FORGINGS BETA PROCESSED 6AL-4V THE FOLLOWING SOURCES ARE APPROVED FOR THE PROCUREMENT OF TITANIUM FORGINGS IN ACCORDANCE WITH THE REQUIREMENTS OF MCDONNELL DOUGLAS HELICOPTER COMPANY MATERIAL SPECIFICATION 11-1109. Supplier Info Supplier Comments BE10038732 PACIFIC FORGE INC 10641 ETIWANDA AVE FONTANA, CA 92337-6909 USA Supplier Info Supplier Comments BE10029768 RMI TITANIUM COMPANY 1000 WARREN AVE NILES, OH 44446-1168 USA Supplier Info Supplier Comments BE10037611 CONSOLIDATED INDUSTRIES, INC. 677 MIXVILLE RD CHESHIRE, CT 06410-3836 USA Supplier Info Supplier Comments BE10029096 MCWILLIAMS FORGE COMPANY INC 387 FRANKLIN AVE ROCKAWAY, NJ UNCONTROLLED WHEN PRINTED CAGE CODE 02731 Supplier Info Supplier Comments 07866-4000 USA HMS11-1109QPL Revision - Page 2 of 2 UNCONTROLLED WHEN PRINTED CAGE CODE 02731 HMS11-1110QPL BOEING MATERIAL SPECIFICATION Revision - QUALIFIED PRODUCT LIST 31 October 2008 THE BOEING COMPANY Page 1 of 1 TITANIUM ALLOY 6A1-4V PLATE; HIGH FRACTURE TOUGHNESS THE FOLLOWING SOURCES ARE APPROVED FOR THE PROCUREMENT OF TITANIUM ALLOY PLATE IN ACCORDANCE WITH THE REQUIREMENTS OF MDHC MATERIAL SPECIFICATION 11-1110. -

Thiel Adopts New Core Curriculum

Culture Active SI & WL Shock Resident Beloit College Schedules Page 6 Directors Mindset List Page 5 Page 4 Page 4 THE THIELENSIAN the student-run newspaper of Thiel College in Greenville, PA Volume 133 Issue 1 Friday, September 19, 2014 Conference Thiel Adopts New Core Curriculum for SGA by Kristina Cotton, [email protected] by Bri Tiedeman, At Thiel this semester, would have gotten in the be more beneficial for stu- forth to find worth in it. formation out there…with [email protected] a new core curriculum is history of western humani- dents, than the old one, When asked to explain presentation intensive cours- being exercised. There is ties” Professor Brenda DelMaramo said “it’s hard and comment on the new es, you will be picking up a shift from classes that DelMaramo, of the English to predict.” She mentioned core curriculum, Allen Mor- skills along the way,” Mor- study the western humani- department, said. that there are many variables rill, director of the Langen- rill observed. ties to seminar-style classes She pointed out that in the that involve the student’s at- heim Library, emphasized He is very excited for the with varying class subjects, old core classes that re- titude and level of motiva- that the courses in this new research and preparation from Stephen King to Myths volved around the history of tion. curriculum will help stu- that these new courses will Exposed. western humanities, there But DelMaramo conclud- dents develop necessary entail. For the library itself, “The [Seminar] structure was a unifying factor: the ed that education, in any communication skills for the Morrill predicts that there gives more freedom to syllabus and textbooks used case, can have tremendous workforce. -

Walmart Faces Class Action Over Inhaling of Dust Spray

CASE 0:20-cv-01473-NEB-TNL Document 1 Filed 06/26/20 Page 1 of 75 UNITED STATES DISTRICT COURT DISTRICT OF MINNESOTA Natalie A. Chairez and Samantha G. Chairez, Case No. ______________ Plaintiffs, COMPLAINT AND DEMAND vs. FOR JURY TRIAL AW Distributing, Inc., Walmart Inc., Wal-Mart Stores, Inc., Wal-Mart Stores East, LP, Wal- Mart Stores East, LLC, and John Doe Company Defendants #1–10, Defendants. COME NOW, Plaintiffs, who for their causes of action against Defendants, state and allege: INTRODUCTION 1. Inhalant abuse has been known and prevalent in the United States for decades. Many common household products are used to get high because they are cheap and easily accessible, such as aerosols, glue, cleaning fluids, and gasoline, as examples. 2. One type of inhalant that people commonly abuse to get high is computer dust remover sprays. These products are compressed gas in a can that are used to spray off dust and debris from whatever surface is being cleaned. However, they contain a gas—difluoroethane—that, if inhaled, causes the person to lose consciousness and control of the bodily movements nearly immediately. CASE 0:20-cv-01473-NEB-TNL Document 1 Filed 06/26/20 Page 2 of 75 3. These dust removers are cheap and available at retail locations throughout the United States, meaning anyone with a few dollars can purchase the product to get high. Dust removers are popular among inhalant abusers, so much so that the companies who design, manufacture, distribute, and sell these products profit greatly as a result. Manufacturers, distributors, and sellers of dust removers— such as AW Distributing, Inc., Walmart Inc., Wal-Mart Stores, Inc., Wal-Mart Stores East, LP, and Wal-Mart Stores East, LLC (collectively “Defendants”)—know that people inhale their dust removers to get high. -

Formula 409 Clorox Co. Cleaning Bleach Walmart Cleaning Yes Great

BRAND NAME MANUFACTURER WHAT IS IT USED FOR (ALL SDS ON FILE USES) Formula 409 Clorox Co. cleaning bleach Walmart cleaning yes Great Value Vi-Jon cleaner yes 3M 3M Building and commerical multi purpose cleaner yes services division 3M 3M cleaner yes 3M 3M Building and commerical glass cleaner yes services division Acid Wayne Pharmacy wart remover yes Airwick air freshener air freshener no Ajax Ajax dish soap yes Ajax Ajax laundry soap yes Ajax Cleaner Colgate Palmolive cleaner/disinfectant no Alkyd high gloss Benjamin Moore painting All Sun Corporation laundry soap unknown Ammonia Walmart floor cleaner Ammonia Family Dollar cleaner Anti static fluid Xerox copier no Anti static monitor wipes Falcon Safety Products monitor wipes yes Antibacterial Hand Soap Dolgencorp LLC hand soap Appl. Solution Gila window film Arm & Hammer Laundry soap laundry soap no Assured Greenbrier International, Inc. hand sanitizer no Barkeepers Friend Serraas Labs cleaning Ben Exterior Benjamin Moore painting Ben Premium Benjamin Moore painting Best Look Benjamin Moore painting Bissell Bissell carpet cleaner yes Bissell Deep Clean Pro Bissell carpet cleaner yes Bissell Spring Breeze 2x Bissell carpet cleaner yes Bleach Clorox disinfectant no Bleach KK disinfectant yes bleach KIK International disinfectant/cleaning Bleach Walmart disinfectant Bleach Fabricado laundry Bleach Family Dollar disinfectant Bleach Champion Packaging disinfectant Bleach Spray Price Chopper disinfectant no Borax Henkel Co. classroom materials Bounce laundry sheets Proctor & Gamble dryer sheets -

Johnson Draft Notice of Removal (Fed. Ct.) (2349975.V3)

Case 4:20-cv-00008-AT Document 1 Filed 01/10/20 Page 1 of 17 IN THE UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF GEORGIA ROME DIVISION JARROD JOHNSON individually, and on ) Behalf of a Class of persons similarly ) Situated, ) ) Plaintiff, ) ) v. ) ) 3M COMPANY; ALADDIN ) MANUFACTURING CORPORATION; ) APRICOT INTERNATIONAL, INC.; ) ARROWSTAR, LLC; DALTONIAN ) FLOORING, INC.; DEPENDABLE RUG ) MILLS, INC.; DORSETT INDUSTRIES, ) INC.; DYSTAR, L.P.; ECMH, LLC d/b/a/ ) CLAYTON MILLER HOSPITALITY ) NOTICE OF REMOVAL CARPETS; E.I. DUPONT DE NEMOURS ) AND COMPANY; EMERALD CARPETS, ) INC.; ENGINEERED FLOORS, LLC; ) Civil Action No. ________4:20-cv-8-AT FORTUNE CONTRACT, INC.; HARCROS ) CHEMICALS, INC.; INDIAN SUMMER ) CARPET MILLS, INC.; INDUSTRIAL ) JURY TRIAL DEMANDED CHEMICALS, INC.; LEXMARK CARPET ) MILLS, INC.; LYLE INDUSTRIES, INC.; ) MFG CHEMICAL, INC.; MILLIKEN & ) COMPANY; MOHAWK CARPET, LLC; ) MOHAWK INDUSTRIES, INC.; NPC ) SOUTH, INC.; ORIENTAL WEAVERS ) USA, INC.; S & S MILLS, INC.; SHAW ) INDUSTRIES, INC.; SHAW INDUSTRIES ) GROUP, INC.; TANDUS CENTIVA, INC.; ) TANDUS CENTIVA US, LLC; TARKETT, ) INC.; TARKETT USA, INC.; THE ) CHEMOURS COMPANY; THE DIXIE ) GROUP, INC.; THE SAVANNAH MILLS ) GROUP, LLC; VICTOR CARPET MILLS, ) 1 Case 4:20-cv-00008-AT Document 1 Filed 01/10/20 Page 2 of 17 INC.; Q.E.P. CO., INC.; and FICTITIOUS ) DEFENDANTS A-J, those persons, ) corporations, partnerships or entities who ) acted either as principal or agent, for or in ) concert with the other named Defendants ) and/or whose acts caused or contributed to ) the damages sustained by the Plaintiff, ) whose identities are unknown to the Plaintiff, ) but which will be substituted by amendment ) when ascertained, ) ) Defendants. -

Target Corporation

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. __) Filed by the Registrant Filed by a Party other than the Registrant Check the appropriate box: Preliminary Proxy Statement CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) Definitive Proxy Statement Definitive Additional Materials Soliciting Material under §240.14a-12 TARGET CORPORATION (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): No fee required. Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: Fee paid previously with preliminary materials. Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: Notice of 2018 annual meeting of shareholders Wednesday, June 13, 2018 9:00 a.m. -

Wearable Technology: Protecting IP Rights and Minimizing Infringement Risks Leveraging Utility Patents, Design Patents, Trademarks and Trade Dress to Safeguard IP

Presenting a live 90-minute webinar with interactive Q&A Wearable Technology: Protecting IP Rights and Minimizing Infringement Risks Leveraging Utility Patents, Design Patents, Trademarks and Trade Dress to Safeguard IP TUESDAY, AUGUST 23, 2016 1pm Eastern | 12pm Central | 11am Mountain | 10am Pacific Today’s faculty features: John M. Augustyn, Shareholder, Leydig Voit & Mayer, Chicago Rod S. Berman, Partner, Jeffer Mangels Butler & Mitchell, Los Angeles The audio portion of the conference may be accessed via the telephone or by using your computer's speakers. Please refer to the instructions emailed to registrants for additional information. If you have any questions, please contact Customer Service at 1-800-926-7926 ext. 10. Tips for Optimal Quality FOR LIVE EVENT ONLY Sound Quality If you are listening via your computer speakers, please note that the quality of your sound will vary depending on the speed and quality of your internet connection. If the sound quality is not satisfactory, you may listen via the phone: dial 1-866-570-7602 and enter your PIN when prompted. Otherwise, please send us a chat or e-mail [email protected] immediately so we can address the problem. If you dialed in and have any difficulties during the call, press *0 for assistance. Viewing Quality To maximize your screen, press the F11 key on your keyboard. To exit full screen, press the F11 key again. Continuing Education Credits FOR LIVE EVENT ONLY In order for us to process your continuing education credit, you must confirm your participation in this webinar by completing and submitting the Attendance Affirmation/Evaluation after the webinar. -

Walmart Sued Over Girl Scouts Killed by Driver On

Case 4:20-cv-06942-DMR Document 1 Filed 10/05/20 Page 1 of 67 1 David Martinez, State Bar No. 193183 [email protected] 2 ROBINS KAPLAN LLP 2049 Century Park East, Suite 3400 3 Los Angeles, CA 90067-3208 Telephone: 310-552-0130 4 Facsimile: 310-229-5800 5 Tara Sutton (pro hac vice to be submitted) [email protected] 6 Gary Wilson, State Bar No. 139358 [email protected] 7 Philip Sieff (pro hac vice to be submitted) [email protected] 8 Jason DePauw (pro hac vice to be submitted) [email protected] 9 Rashanda Bruce (pro hac vice to be submitted) [email protected] 10 ROBINS KAPLAN LLP 800 LaSalle Avenue, Suite 2800 11 Minneapolis, MN 55402 LLP Telephone: 612-349-8500 AW L 12 Facsimile: 612-339-4181 T A NGELES 13 Attorneys for Plaintiffs APLAN A K OS L 14 UNITED STATES DISTRICT COURT TTORNEYS A 15 NORTHERN DISTRICT OF CALIFORNIA OBINS R 16 BRIAN KELLEY and ROBIN KELLEY, Case No. 3:20-cv-06942 Individually, and as Personal Representatives and 17 General Co-Administrators of THE ESTATE OF COMPLAINT FOR DAMAGES: J.K., their minor child, deceased; 1. WRONGFUL DEATH 18 J.O., a minor, Individually, and as Successor-in- 2. STRICT PRODUCTS LIABILITY 19 Interest to THE ESTATE OF H.H., deceased, and – DEFECTIVE DESIGN as Successor-in-Interest to THE ESTATE OF 3. STRICT PRODUCTS LIABILITY 20 SARA SCHNEIDER, deceased, by and through –MANUFACTURING DEFECT his Guardian ad Litem, JUDY SCHNEIDER, 4. STRICT PRODUCTS LIABILITY 21 – FAILURE TO WARN Plaintiffs, 22 v. -

3M Solutions Foraerospace

e c a p s o r e A r fo 3 ns 3M Solutio cia pe lity s v e h i ac c p e l s e p s o r e a e n i r a m Introduction Whether you are involved in manufacturing, maintenance or repair in the aerospace industry, we can help. 3M has more than 30 major technology platforms that form the basis for our 50,000 different products. This guide provides an overview of some of the most commonly used 3M products within the Aerospace industry. With over 50,000 products in our total portfolio, this guide only gives a snapshot of the total product offering. To find out if we have a product to meet your specific application, please contact our Aerospace Sales office on 0161 237 6174 fax us on 0161 237 3371 or email [email protected] Many of our products have been vigorously tested to comply with Aerospace regulations including Boeing, Airbus, Rolls Royce, BAE and military specifications. To check if a product meets a specific specification please contact our Aerospace Customer Service Desk in Manchester on the above contact number. opspa spec r c i e e a l e a it y n i r v e a h m i c l e s Tapes & Adhesives Tapes & Adhesives 3M is a leading supplier of tapes, adhesives, coatings and sealers to the aerospace industry. Our technologies include contact, instant, hot melt and structural adhesives. Structural Bonding Since 3M introduced one-part structural adhesives in the 1950s and the first tough two-part formulations in the 1960s, 3M™ Scotch-Weld™ Structural adhesives have been at work in many aerospace applications. -

«Company» «Lastname», «Firstname»

2017 Conference Attendees (By Company) 3M Company ....................................................................................................... Anderson, Kristie 3M Company ................................................................................................................ Earp, Sheila 3M Company ................................................................................................ Hilmanowske, Stacey 3M Company ...............................................................................................................Smith, Linda 3M Company ........................................................................................................ Stokes, Destane' 3M Company ............................................................................................................. Wold, Jessica Abbott ...................................................................................................................... Bridell, Sherry ABILITY Network Inc. ...................................................................................................Farra, Peggy ABILITY Network Inc. ................................................................................................. Folstad, Noel Advantus Capital Management ............................................................................ Hamm, Brianne Advantus Capital Management .................................................................................. Wyatt, Jane AgriBank FCB .....................................................................................................