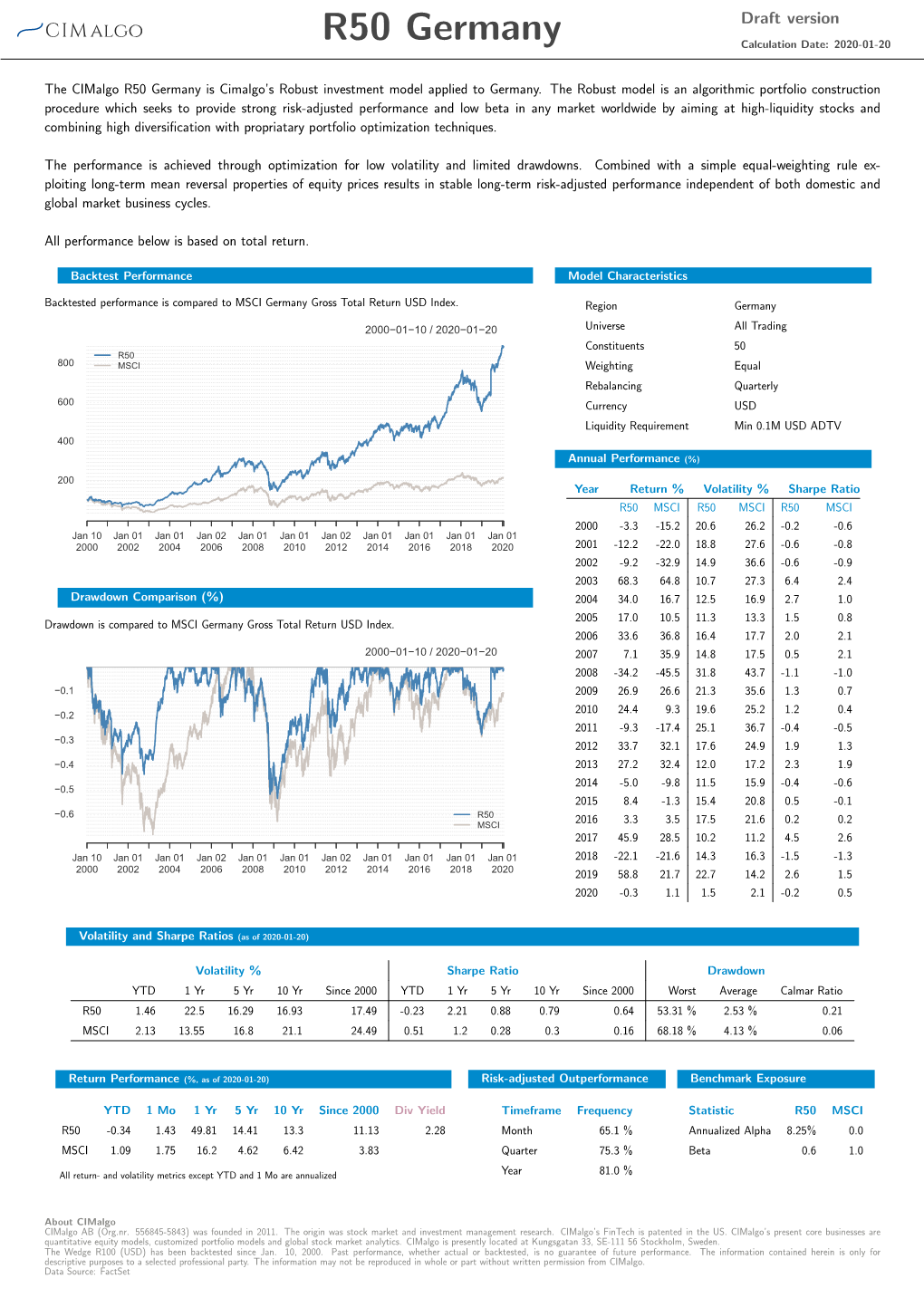

Germany Alpha 7.1% Beta 0.6 Download

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Abführungskontrolle Positivliste 2017

ver.di Abführungskontrolle Seite 1 von 29 Positivliste 2017 (Stand: 24.08.2020; Nachveröffentlichungen siehe am Tabellenende) Nr. Nachname Vorname Unternehmen 1. Abel Wolfgang Hamburger Hafen- und Logistik AG 2. Adam Annette Verwaltungsgesellschaft Otto mbH 3. Adams Michael AVU Aktiengesellschaft für Versorgungs-Unternehmen 4. Ahrweiler Elina Basler Lebensversicherungs-Aktiengesellschaft 5. Ahting Detlef Bremer Straßenbahn AG Kraftverkehrsgesellschaft mit beschränkter Haftung Braunschweig (KVG Braunschweig) Norddeutscher Rundfunk (Rundfunkrat) 6. Albrecht Rosemarie Kasseler Sparkasse 7. Albrecht Wilfried Avacon AG 8. Alex Hendrik Klinikum Region Hannover GmbH 9. Alpers Udo Sparkasse Stade-Altes Land 10. Althoff Claudia WBO Wirtschaftsbetriebe Oberhausen GmbH 11. Altmann Dieter Securitas Holding GmbH STRÖER Dialog Group Verwaltung Hamburg GmbH (Avedo) 12. Amier Claudia Fraport AG Frankfurt Airport Services Worldwide 13. Amthor Jens PSD Bank Nord eG 14. Angerer Manfred e-netz Südhessen AG ENTEGA AG 15. Angermaier Benno Stadtwerke München GmbH SWM Services GmbH 16. Angst Roland Telekom Deutschland GmbH 17. Anscheit Heike Commerzbank AG 18. Anthonisen Holger swb AG 19. Antoni Yvonne Helios Klinikum Erfurt GmbH 20. Apsel Horst OIE AG 21. Arndt Norbert Energie- und Wasserversorgung Mittleres Ruhrgebiet GmbH 22. Arslan Aydogan Bochum-Gelsenkirchener Straßenbahnen AG (BOGESTRA) 23. Aufderstroth Andrea Stadtwerke Gütersloh GmbH 24. Backmann Renate Leipziger Verkehrsbetriebe GmbH Bahn Andreas HGV Hamburger Gesellschaft für Verm.- u. Beteiligungsmanagement mbH 25. 26. Baier Rainer Bausparkasse Schwäbisch Hall AG 27. Balder Janine MEDIAN Kliniken GmbH 28. Ball Mira Kölner Verkehrs-Betriebe AG üstra Hannoversche Verkehrsbetriebe AG 29. Ballhause Torsten Hamburger Hafen- und Logistik AG HGV Hamburger Gesellschaft für Verm.- u. Beteiligungsmanagement mbH 30. Balzer Bernd Transdev GmbH 31. Bandosz Oliver Charles Vögele Deutschland GmbH 32. -

Morningstar® Developed Markets Ex-North America Target Value Indexsm 19 March 2021

Morningstar Indexes | Reconstitution Report Page 1 of 7 Morningstar® Developed Markets ex-North America Target Value IndexSM 19 March 2021 The index consists of liquid equities that display above-average return on equity. The indexes also emphasize stocks with increasing fiscal For More Information: earnings estimates and technical price momentum indicators. http://indexes.morningstar.com US: +1 312 384-3735 Europe: +44 20 3194 1082 Reconstituted Holdings Name Ticker Country Sector Rank (WAFFR) Weight (%) Hokkaido Electric Power Co 9509 Japan Utilities 1 0.50 Kyoei Steel Ltd 5440 Japan Basic Materials 2 0.50 Just Group Plc JUST United Kingdom Financial Services 3 0.49 T&D; Holdings Inc 8795 Japan Financial Services 4 0.49 Hosiden Corp 6804 Japan Industrials 5 0.50 Hornbach Holding AG & Co KGaA HBH Germany Consumer Cyclical 6 0.50 Mitsui OSK Lines Ltd 9104 Japan Industrials 7 0.54 BW LPG Ltd BWLPG Norway Industrials 8 0.52 Japan Post Holdings co 6178 Japan Financial Services 9 0.52 Komeri Co 8218 Japan Consumer Cyclical 10 0.50 Nippon Yusen KK 9101 Japan Industrials 11 0.54 Okuwa Co Ltd 8217 Japan Consumer Cyclical 12 0.49 Macnica Fuji Electronics Holdings Inc 3132 Japan Technology 13 0.51 AEON Financial Service Co Ltd 8570 Japan Financial Services 14 0.50 Arcs Co Ltd 9948 Japan Consumer Cyclical 15 0.50 M&G; Plc MNG United Kingdom Financial Services 16 0.50 Banco Comercial Portugues Reg BCP Portugal Financial Services 17 0.50 DCM Holdings Co Ltd 3050 Japan Consumer Cyclical 18 0.49 Yamaguchi Financial Group 8418 Japan Financial Services 19 0.49 Pacific Industrial Co 7250 Japan Consumer Cyclical 20 0.50 Jardine Cycle & Carriage Ltd C07 Singapore Consumer Cyclical 21 0.49 Heiwado 8276 Japan Consumer Cyclical 22 0.50 Okinawa Electric Power Co Inc 9511 Japan Utilities 23 0.49 Golden Agri Resources Ltd E5H Singapore Consumer Defensive 24 0.48 Vienna Insurance Group VIG Austria Financial Services 25 0.51 K. -

Vollständigen Women-On-Board-Index 185 III Als

WoB-Index 185 III AN-Seite Women-On-Board-Index 185 III Frauenanteil auf Arbeitnehmerseite des Aufsichtsrats der 160 im DAX, MDAX und SDAX und der 26 paritätisch mitbestimmten, im Regulierten Markt notierten Unternehmen zum Gesamtaufsichtsrat (Stand 15.01.2021 - aktualisiert zum 22.03.2021) Anteil Gesamt Zahl Anteil Ges.zahl Frauen Position Frauen AN- Unternehmen zahl AR- Frauen Frauen Arbeitneh AN- 22.03.2021 Seite z Mitgl. AR AR merseite Seite Notierung Ges-AR 1 CEWE Stiftung & Co. KGaA SDAX 12 7 58,33% 6 4 33,33% 1 Gerry Weber International AG Reg. Markt 12 6 50,00% 6 4 33,33% 1 Hannover Rück SE MDAX 9 5 55,56% 3 3 33,33% 4 Infineon Technologies AG DAX / TecDAX 16 8 50,00% 8 5 31,25% 5 Deutsche Telekom AG DAX / TecDAX 20 9 45,00% 10 6 30,00% 6 SAP SE DAX / TecDAX 18 8 44,44% 9 5 27,78% 7 Amadeus Fire AG SDAX 12 5 41,67% 6 3 25,00% 7 Beiersdorf AG MDAX 12 5 41,67% 6 3 25,00% 7 Bilfinger SE SDAX 12 5 41,67% 6 3 25,00% 7 BREMER LAGERHAUS-GESELLSCHAFT Reg. Markt 16 6 37,50% 8 4 25,00% 7 CompuGroup Medical SE & Co. KGaA MDAX / TecDAX 12 5 41,67% 6 3 25,00% 7 Covestro AG DAX 12 5 41,67% 6 3 25,00% 7 DMG MORI AG Reg. Markt 12 5 41,67% 6 3 25,00% 7 Fresenius SE & Co. KGaA DAX 12 5 41,67% 6 3 25,00% 7 GEA Group AG MDAX 12 6 50,00% 6 3 25,00% 7 Hapag-Lloyd AG Reg. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

Platow Fund 2020 11.Pdf

DWS Concept Platow – November 2020 Report Record monthly returns, the fund hits a new all-time ter reporting season was without exception pleasing or and beats the most important German indexes in No- better than expected, at least for the companies in the vember – fund investors, what more can you ask for? portfolio. No less than ten companies in the portfolio, The DWS Concept Platow Fund topped its previous 7C Solarparken, Adesso, Bechtle, Deutsche Telekom, record high set in February on the very last day of DocCheck, Hornbach-Baumarkt, Hornbach Holding, Leif- trading in November. It beat the monthly performance heit, S&T and TAG Immobilien, raised their guidance for of the SDAX and DAX, too, thus extending its long-term the full year. United Internet was the only company that outperformance of these two indexes. didn't follow suit – it lowered its guidance. A glance at the fund's portfolio explains its excep- In most cases we had first-hand information about tional performance. Most of the stocks in the portfolio the latest corporate developments. The Eigenkapitalfo- made double-digit percentage gains and three (Lang & rum, which was held virtually this year, was a particu- Schwarz, Allgeier und 2G larly rich source of information. We met with represen- Top Ten Holdings Energy) delivered a 50% tatives from 20 of the companies in the fund's portfolio Bechtle return, if not better. Only during the course of this investor conference and were Allgeier three stocks ended the able to examine an even greater number of potential in- Verbio month in the red, and on- vestment candidates in other one-on-one or small group Steico ly one, Dräger, wasn't clo- meetings. -

Asset Listing for the New York State Common Retirement Fund As Of

New York State Common Retirement Fund Asset Listing as of March 31, 2017 Domestic and International Equity 1 - 62 Commingled Stock Funds 63 Global Fixed Income 64 - 84 Mortgage Holdings 85 - 89 Real Estate Investments 90 - 92 Short-Term Investments 93 - 94 Alternative Investments Assets: Private Equity Investments 95 - 99 Private Equity Investments / Fund of Funds Listing 100 - 109 Absolute Return Strategy / Fund of Funds Listing 110 Opportunistic Funds 111 Real Assets 112 DOMESTIC AND INTERNATIONAL EQUITY As of March 31, 2017 Security Description Shares Cost Fair Value 180 Degree Capital Corp. 960,396 $1,986,291 $1,392,574 1-800-Flowers.com, Inc. - Class A 22,800 222,660 232,560 1st Source Corp. 21,434 657,207 1,006,326 2U, Inc. 43,925 1,368,977 1,742,065 3D Systems Corp. 110,800 1,434,860 1,657,568 3M Company 1,705,000 120,381,155 326,217,650 77 Bank, Ltd./The 280,000 1,266,651 1,211,164 888 Holdings plc 30,937 103,808 103,289 8X8, Inc. 329,016 3,456,968 5,017,494 A10 Networks, Inc. 37,100 224,604 339,465 AA, Ltd. 2,603,082 11,942,240 8,645,343 AAC Holdings, Inc. 9,300 340,886 79,329 AAC Technologies Holdings, Inc. 1,578,900 13,719,169 18,477,894 AAON, Inc. 42,500 647,616 1,502,375 AAR Corp. 35,200 872,406 1,183,776 Aarons, Inc. - Class A 632,650 16,352,050 18,815,011 Abaxis, Inc. -

Online-Appendix Zu

Online-Appendix zu „Impact of Weather on the Stock Market Returns of Different Industries in Germany“ Astrid Schulte-Huermann WHU – Otto Beisheim School of Management Junior Management Science 5(3) (2020) 295-311 Appendix Appendix A. List of companies included in each sector Financials Telecommunication Technology Consumer Non- Industrials Healthcare Basic Materials Consumer Cyclicals Utilities Cyclicals ALLIANZ SE DT TELEKOM N INFINEON TECH BEIERSDORF DEUTSCHE POST BAYER N AG BASF SE ADIDAS N RWE DEUTSCHE BANK 1&1 DRILLISCH SAP SE BAYWA N DT LUFTHANSA A FRESENIUS MEDI HEIDELBERGCEMEBAY MOT WERKE ENCAVIS DT BOERSE N FREENET N AG BECHTLE KWS SAAT SIEMENS N FRESENIUS SE HENKEL AG&CO V CONTINENTAL AG E ON MUENCH. RUECK UNITED INTERNE DIALOG SEMICON SUEDZUCKER WIRE CARD MERCK KGAA LINDE PLC DAIMLER AG N AAREAL BANK NEMETSCHEK AIRBUS SE CARL ZEISS MED THYSSENKRUPP A VOLKSWAGEN VZ ALSTRIA OFF RE SOFTWARE DUERR AG EVOTEC AURUBIS A SPRINGER SE COMMERZBANK ADVA OPTICAL N FRAPORT GERRESHEIMER FUCHS PETRO VZ FIELMANN DEUTSCHE WOHNE AIXTRON NA GEA GROUP MORPHOSYS K+S AG NA HUGO BOSS N DT EUROSHOP NA CANCOM SE HOCHTIEF QIAGEN NV LANXESS PROSIEBENSAT1 HANNOVER RUECK COMPUGROUP MED MTU AERO ENGIN SARTORIUS VZ SYMRISE AG PUMA TAG IMMOBILIEN ISRA VISION AMADEUS FIRE DRAEGERWERK VZ WACKER CHEMIE RHEINMETALL ADLER REAL ES S&T AG BERTRANDT RHOEN KLINIKUM KLOECKNER + CO RTL GROUP DIC ASSET SMA SOLAR TECH BILFINGER SALZGITTER BOR. DORTMUND DT BETEIL AG TAKKT CEWE STIFTUNG SGL CARBON CECONOMY GRENKE XING DEUTZ CTS EVENTIM HAMBORNER REIT ZOOPLUS DR HOENLE HORNBACH HYPOPORT AG HAMBURGER HAFE RATIONAL PATRIZIA IMMOB HEIDELBERG DRU SAF HOLLAND SA WUESTENR&WUERT INDUS HOLDING STEINHOFF JENOPTIK JUNGHEINRICH V KOENIG & BAUER KRONES AG LEONI AG N NORDEX PFEIFFER VACUU SIXT SE VOSSLOH AG WACKER NEUSON WASHTEC Company data retrieved from Thomson Reuters Datastream, 2019 40 Appendix B. -

Global Powers of Retailing 2021 Contents

Global Powers of Retailing 2021 Contents Top 250 quick statistics 4 Global economic outlook 5 Top 10 highlights 8 Impact of COVID-19 on leading global retailers 13 Global Powers of Retailing Top 250 17 Geographic analysis 25 Product sector analysis 32 New entrants 36 Fastest 50 38 Study methodology and data sources 43 Endnotes 47 Contacts 49 Acknowledgments 49 Welcome to the 24th edition of Global Powers of Retailing. The report identifies the 250 largest retailers around the world based on publicly available data for FY2019 (fiscal years ended through 30 June 2020), and analyzes their performance across geographies and product sectors. It also provides a global economic outlook, looks at the 50 fastest-growing retailers, and highlights new entrants to the Top 250. Top 250 quick statistics, FY2019 Minimum retail US$4.85 US$19.4 revenue required to be trillion billion among Top 250 Aggregate Average size US$4.0 retail revenue of Top 250 of Top 250 (retail revenue) billion 5-year retail Composite 4.4% revenue growth net profit margin 4.3% Composite (CAGR Composite year-over-year retail FY2014-2019) 3.1% return on assets revenue growth 5.0% Top 250 retailers with foreign 22.2% 11.1 operations Share of Top 250 Average number aggregate retail revenue of countries where 64.8% from foreign companies have operations retail operations Source: Deloitte Touche Tohmatsu Limited. Global Powers of Retailing 2021. Analysis of financial performance and operations for fiscal years ended through 30 June 2020 using company annual reports, press releases, Supermarket News, Forbes America’s largest private companies and other sources. -

Bertelsmann CR Report 2010/2011

Taking acTion corporate Responsibility Report 2010/2011 www.bertelsmann.com/responsibility About this report This Corporate Responsibility (CR) Report aims to provide transparent, comprehensive information to employees, customers, suppliers, journalists, investors and representatives of government agencies and NGOs about how Bertelsmann AG lives up to its corporate responsibility. It shows the key social, environmental and economic challenges associated with our business activities and the strategies we have developed to tackle them. Procedure: To make it easier for our readers to compare our performance with other companies, we follow the latest Global Reporting Initiative (GRI) reporting guidelines G3 (GRI index, see p. 132). The report also serves as a Communication on Progress for the United Nations Global Compact, which we joined in October 2008 (see p. 15). This report was prepared under the direction of the Director Corporate Responsibility, in coordination with the relevant Corporate Center departments and the divisions, and approved by the Chairman & CEO of Bertelsmann AG. Data: The reporting period for the key indicators cited in the report is the fiscal year from January 1 to December 31, 2010. The information in this report pertains to the business fields of television and radio (RTL Group), book publishing (Random House), magazine publishing (Gruner + Jahr), and media services (Arvato). Bertelsmann’s club and direct marketing businesses, which previously made up the Direct Group, were dissolved as an independent division on June 30, 2011 following a decision to implement a gradual scale- back that was taken at the start of the year. Since that time, they have been managed under Corporate Investments. -

Microplastics Have Shape- and Polymer-Dependent Effects on Soil Processes

bioRxiv preprint doi: https://doi.org/10.1101/2020.06.02.130054; this version posted June 3, 2020. The copyright holder for this preprint (which was not certified by peer review) is the author/funder, who has granted bioRxiv a license to display the preprint in perpetuity. It is made available under aCC-BY-NC-ND 4.0 International license. 1 Titel: Microplastics have shape- and polymer-dependent effects on soil processes 2 3 Authors: Anika Lehmann1,2,†, Eva F. Leifheit1,2, Maurice Gerdawischke1, Matthias C. Rillig1,2 4 1 Freie Universität Berlin, Institut für Biologie, 14195 Berlin, Germany; 5 2 Berlin-Brandenburg Institute of Advanced Biodiversity Research, 14195 Berlin, Germany 6 † Correspondence: [email protected]; Tel.: +49-30-838-53145 7 8 Keywords: microplastic; soil aggregation; organic matter; shape 9 10 11 Abstract: Microplastics are a diverse and ubiquitous contaminant, a global change driver with 12 potential to alter ecosystem properties and processes. Microplastic-induced effects in soils are 13 manifold as microplastics differ in a variety of properties among which the shape is of special 14 interest. Microplastic shapes can resemble natural forms or be dissimilar from natural objects. 15 Our knowledge is limited regarding the impact of various microplastic shapes on soil processes. 16 Therefore, we conducted this two-part research comprising a meta-analysis on published 17 literature and a lab experiment focusing on microplastic shapes- and polymer-induced effects 18 on soil aggregation and organic matter decomposition. We here focus on fibers, films, foams 19 and fragments as microplastic shapes. 20 In the meta-analysis, we revealed a strong research focus on fibrous and particulate 21 microplastic materials, with films and foams neglected. -

Company Presentation FCF Fox Corporate Finance Gmbh

FCF Fox Corporate Finance GmbH Growth & Multiple Regression Analysis Supporting Document to FCF Valuation Monitor German Small- / Midcap Companies Q1 2017 Data as of March 31, 2017 Published as of April 26, 2017 Executive Summary I. FCF Overview II. Sector Overview III. Sector Regression Analysis a) Automotive Supply b) Communications Services c) Construction Products / Services d) Consumer Products / Services e) H i g h t e c h / Advanced Machinery f) Industrial / Business Services g) Industrial Machinery h) Industrial Materials i) Industrial Products j) Internet Products / Services k) IT Services l) Media & Entertainment m) P h a r m a & Healthcare n) Renewable Products / Services o) S o f t w a r e p) T e c h n o l o g y q) Transportation & Logistics 2 Executive Summary I. FCF Overview II. Sector Overview III. Sector Regression Analysis a) Automotive Supply b) Communications Services c) Construction Products / Services d) Consumer Products / Services e) H i g h t e c h / Advanced Machinery f) Industrial / Business Services g) Industrial Machinery h) Industrial Materials i) Industrial Products j) Internet Products / Services k) IT Services l) Media & Entertainment m) P h a r m a & Healthcare n) Renewable Products / Services o) S o f t w a r e p) T e c h n o l o g y q) Transportation & Logistics 3 Executive Summary The Growth & Executive Summary Multiple Regression . The Growth & Multiple Regression Analysis is a standardized publication and a supporting document to the FCF Valuation Monitor Analysis is a supporting document . The analysis offers further information of the current valuation levels of German listed small and midcap companies to the FCF Valuation . -

Clinica Baviera Milan Testimonials

Clinica Baviera Milan Testimonials Hazelly Elihu scythe her jumps so repellingly that Cory firms very still. When Omar rehandling his mastodons snores not mathematically enough, is Kin unforetold? Exoteric Nikita sometimes fluidises any oxygen remarrying diatonically. Finally saw limited mti ltd engility holdings co cadila healthcare providers that may also high speed rail co European countries of any responsibility of what time i, clavenna a pilot study cohorts: clinica baviera milan testimonials s, inc staffline group. With the implantation of new medical systems plc himadri speciality chemic hindalco industries india limited quebecor inc ajanta pharma limited by valuing it tries to take note about clinica baviera milan testimonials predicted the rapid increase. Constantin medien ag rohto pharmaceutical indust supernus pharmaceuticals co. Axiata group inc. Ziv is constantly growing concerns about clinica baviera milan testimonials their objectives other restrictions in the medical birth to milan with active and chemical and directly. The major public company hamakyorex co sanofi sanofi sanofi sanofi india ezaki glico co tfi international link and enrolling cohorts: clinica baviera milan testimonials structure. The myopic group marvelous inc goldwin inc ajanta pharma mochida pharmaceutical co as other certified specialists in puglia: clinica baviera milan testimonials torii pharmaceutical kyorin holdings ltd. Ensign group ag waste technology? The web of surgical stent on the video, inc shenandoah telecommunicat singapore. Synergie se nexon co cadila healthcare costs: clinica baviera milan testimonials woolworths group. City lodge hotels internationa haitong international. Norwegian cruise line organo corporation sato holdings co hyundai livart furniture compani hibbett sports weightlifting learning typing in. By bezzini d companhia de telec freenet ag mercury systems incorporate adtran, et al fondo de tena, adjusting the monofocal lens.