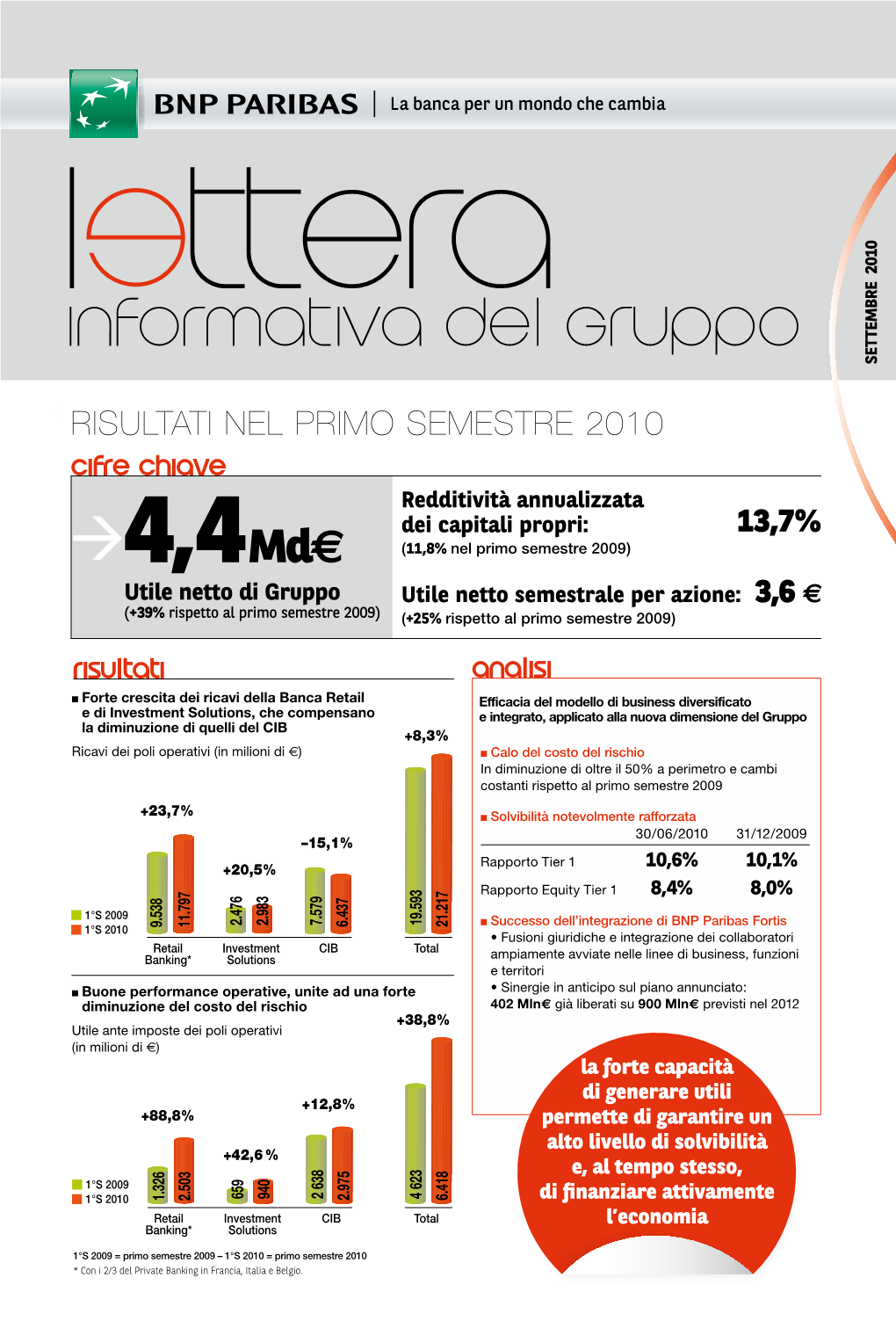

INFORMATIVA DEL GRUPPO Settembre 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COMMUNIQUE DE PRESSE Baudouin Prot a Fait Part Au Conseil

Paris, le 26 septembre 2014 COMMUNIQUE DE PRESSE Baudouin Prot a fait part au Conseil d’administration de sa décision de mettre fin à ses fonctions de Président et d’Administrateur le 1er décembre prochain. Jean Lemierre sera nommé à cette date Président de BNP Paribas. Le conseil d’Administration de BNP Paribas, qui s’est réuni ce jour, a pris acte de la décision de Baudouin Prot de mettre fin à ses fonctions de Président et d’Administrateur le 1er décembre prochain. Le Conseil a décidé de se réunir à cette même date afin de coopter, sur proposition du Comité élargi de gouvernement d'entreprise et des nominations, qui s'est réuni à deux reprises, Jean Lemierre en tant qu’Administrateur et de le nommer Président du Conseil d’Administration. Entré dans le groupe en 1983, Baudouin Prot est devenu Président de BNP Paribas il y a 3 ans, après avoir dirigé l’entreprise durant 8 ans, de 2003 à 2011. Au cours des 10 dernières années, dans un contexte de profonde transformation de l’industrie financière, BNP Paribas est devenu un leader européen de son industrie et l’une des banques les plus solides au monde. Sur cette période, BNP Paribas est parvenu à tripler la taille de ses fonds propres (de 25,7 à 77,1 milliards d’euros) et à doubler la taille de ses revenus (de 18 à 39 milliards d’euros) ainsi que celle de ses effectifs (de 89 000 à 185 000 collaborateurs, dont 70% se situent aujourd’hui à l’international, contre 35% il y a 10 ans). -

FINE-TUNED BNP PARIBAS EXCELS at the BUSINESS of BANKING BNP Paribas Is That Rarity: a Large Bank Actually Delivering on Its Promises to Stakeholders

Reprinted from July 2016 www.euromoney.com WORLD’S BEST BANK BNP PARIBAS EXCELS AT THE BUSINESS OF BANKING World’s best bank Reprinted from July 2016 Copyright© Euromoney magazine www.euromoney.com WORLD’S BEST BANK FINE-TUNED BNP PARIBAS EXCELS AT THE BUSINESS OF BANKING BNP Paribas is that rarity: a large bank actually delivering on its promises to stakeholders. It is producing better returns even than many of the US banks, despite being anchored in a low-growth home region, building capital and winning customers – all while proving the benefits of a diversified business model. Its cadre of loyal, long-serving senior executives look to have got the strategy right: staying the course in Asia and the US and running global customer franchises, but only in the select services it excels at By: Peter Lee Illustration: Jeff Wack eset by weak profitability, negative interest rates and Its third division, international financial services, includes banking low growth in their home markets, European banks in the US, Latin America and Asia, as well as specialist business such are losing out to US rivals that restructured and as consumer finance, asset and wealth management and insurance. recapitalized quickly after the global financial crisis At a time when peers are still shrinking, BNP Paribas is growing. and whose home economy has enjoyed a much more While new and uncertain management teams struggle to get back Brobust recovery since. to basics, the technicians at BNP Paribas embrace geographic and In April, the European Banking Authority published its latest update business diversity. Critics see a large bank running on six engines in on the vulnerabilities of the 154 biggest European banks and noted a the age of the monoplane. -

PUBLIC SECTION BNP Paribas 165(D)

PUBLIC SECTION OCTOBER 1, 2014 PUBLIC SECTION BNP Paribas 165(d) Resolution Plan Bank of the West IDI Resolution Plan This document contains forward-looking statements. BNPP may also make forward-looking statements in its audited annual financial statements, in its interim financial statements, in press releases and in other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about BNPP’s beliefs and expectations, are forward-looking statements. These statements are based on current plans, estimates and projections, and therefore undue reliance should not be placed on them. Forward-looking statements speak only as of the date they are made, and BNPP undertakes no obligation to update publicly any of them in light of new information or future events. CTOBER O 1, 2014 PUBLIC SECTION TABLE OF CONTENTS 1. Introduction ........................................................................................................................4 1.1 Overview of BNP Paribas ....................................................................................... 4 1.1.1 Retail Banking ....................................................................................... 5 1.1.2 Corporate and Investment Banking ....................................................... 5 1.1.3 Investment Solutions ............................................................................. 6 1.2 Overview of BNPP’s US Presence ........................................................................ -

Combined Annual Shareholder Meeting

(This document is a free translation of the original French version published on 27 June 2018 in the French legal newspapers “BALO” and “Petites Affiches”, which are available upon request) ALSTOM Société Anonyme with a share capital of € 1,556,077,180 Head Office: 48, rue Albert Dhalenne, 93400 Saint-Ouen Registration number: 389 058 447 RCS Bobigny NOTICE OF MEETING The shareholders of ALSTOM will be convened to participate in the Ordinary and Extraordinary Shareholder’s Meeting which will be held on first call on Tuesday 17 July 2018 at 2.00 p.m., at Maison de la Mutualité, 24 rue Saint-Victor, 75005 Paris, to deliberate on the following agenda: AGENDA Ordinary resolutions 1. Approval of the statutory financial statements and operations for the fiscal year ended on 31 March 2018. 2. Approval of the consolidated financial statements and operations for the fiscal year ended on 31 March 2018. 3. Proposal for the allocation of the result for the fiscal year ended on 31 March 2018 and distribution of a dividend. 4. Approval of a related-party agreement: letter agreement from Bouygues SA related to the strategic combination of Alstom and Siemens’ mobility business (the “Transaction”). 5. Approval of a related-party agreement: engagement letter with Rothschild & Cie as financial adviser in connection with the Transaction. 6. Renewal of Mr. Olivier Bouygues’ appointment as a Director. 7. Renewal of Bouygues SA’ appointment as a Director. 8. Renewal of Ms. Bi Yong Chungunco’s appointment as a Director. 9. Appointment of Mr. Baudouin Prot as a Director. 10. Appointment of Ms. -

La Banque D'un Monde Qui Change

2004 2004 SUSTAINABLE DEVELOPMENT REPORT DEVELOPMENT REPORT DEVELOPMENT SUSTAINABLE www.bnpparibas.com • HEAD OFFICE 16, boulevard des Italiens – 75009 Paris (France) Tel.: +33 1 40 14 45 46 Paris trade and companies register RCS Paris 662 042 449 Société Anonyme (Public Limited Company) with capital of: EUR 1 770 438 404 SHAREHOLDERS‘ RELATIONS Tel.: +33 1 42 98 21 61 / +33 1 40 14 63 58 AR05.01 La banque d’un monde qui change BNP PARIBAS La banqueLa banqueThe d’un bank d’unmonde for mondea changingqui changequi change world La banque d’un monde qui change La banque d’un monde qui change Creating a community of interests Sharing knowledge Partnering research initiatives Forging exchanges and alliances Cross-selling Pooling resources Setting up cross-fertilisation the bank for a changing world mechanisms Devising a systems approach over to the networks! Implementing knowledge management Building cross-functional structures Promoting teamwork As in 2003, to best illustrate our “Bank for a Changing World” signature, we have chosen to present some twelve BNP Paribas clients as a guiding thread throughout our 2004 Sustainable Development Report. The main factors driving change – global competition, the increasing pace of technological innovation and the growing consolidation of major players – pose new organizational challenges and encourage a network-based focus for operations to rival traditional ways of working. Through networks, we can act out a shared project. As unrivalled catalysers for developing network-oriented businesses, Internet and new information technologies are emblematic of these far-reaching changes. The best digital libraries within the reach of an ever-higher number of users (p.46) testify to the inescapable fact that we are all now connected, and the example of Senegalese fishermen using third generation mobile technology (p. -

VEOLIA ENVIRONNEMENT (Exact Name of Registrant As Specified in Its Charter)

Donald L. Correll As fded with the Securities and Exchange Commission on June 30,2005 DLC-8 DW 04-048 - 32 Pages SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F OREGISTRATION STATEMENT PURSUANT TO SECTION 12@) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR @ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the f~calyear ended December 31,2004 OR 0 TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the transition period from -to - Commission File Number: 001-15248 VEOLIA ENVIRONNEMENT (Exact name of Registrant as specified in its charter) N/A 36/38, avenue Klkber, Republic of France (Translation of Registrant's 75 116 Paris, (Jurisdiction of incorporation name into English) France or organization) (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12@) of the Act: Title of each class Name of eacb exchange on which registered Ordinary shares, nominal value €5 per share represented by The New York Stock Exchange American Depositary Shares (as evidenced by American Depositary Receipts), each American Depositary Share representing one ordinary share* Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: -

Legacy of Finance

Legacy of finance conference 23 June 2017 BNP Paribas – Paris - France eabh in cooperation with BNP Paribas and Banque Lombard Odier Keynote speech Kwasi Kwarteng (Cambridge University/member of the British parliament) Haute banque and real estate asset management: the case of Camondo; 1802-1919 Lorans Tanatur Baruh (SALT Istanbul) New Bank and the culture of the Haute Banque in France in the second half of the 19th century Nicolas Stoskopf (Centre de recherche sur les économies, les sociétés, les arts et les techniques, CRESAT Mulhouse) The haute banque, American Civil War debt, and the global integration of 19th century capital markets David K. Thomson (Sacred Heart University) The D´Eichthal Bank between St. Simonism and investment in Greece in the 19th century Korinna Schönhärl (Essen University) Neuflize OBC and predecessors, 19th and 20th centuries Ton de Graaf (ABN AMRO) Merchant banks in France 1970s to 1990s Hubert Bonin (Science Po Bordeaux) British public finance 1815 – 1844: Pillars of order Presented to Legacy of Finance Conference Paris, Friday 23rd June 2017 Keynote address Dr Kwasi Kwarteng MP Revolutionary wars from 1792 to 1815 A series of military conflicts in the aftermath of the French revolution which saw a coalition of European nations, such as Britain, Prussia, Austria and Russia succeed in restraining the ambitions of France. 1 Huge national debt: ratio of debt to GDP > 250% National debt as percentage of UK GDP from 1692 - 2012 2 Immediate aftermath: unrest, turbulence The poet Percy Bysshe Shelley (1792 – 1822) “Let the Ghost of Gold The Peterloo massacre, Manchester, 16th August 1819. -

Notice & Information Brochure

NOTICE & INFORMATION BROCHURE Combined General Meeting of Shareholders Wednesday, April 22, 2015 at 3.00 p.m. at the Maison de la Mutualité 24 rue Saint-Victor – 75005 Paris (France) SUMMARY Notice of the Combined Shareholders’ Meeting on Wednesday, April 22, 2015 Shareholders are invited to attend the Combined Shareholder’s General Meeting Wednesday, April 22, 2015 at 3.00 p.m. at the Maison de la Mutualité – 24 rue Saint-Victor, 75005 Paris MESSAGE FROM THE CHAIRMAN AND CEO 3 BRIEF REVIEW 4 PARENT COMPANY RESULTS FOR THE LAST FIVE YEARS 13 HOW TO PARTICIPATE AND VOTE AT THE GENERAL MEETING 14 If you attend the General Meeting in person 14 If you do not attend the General Meeting in person 14 How to fill in this form? 15 COMPOSITION OF THE BOARD OF DIRECTORS AND OF THE COMMITTEES OF THE BOARD AS OF MARCH 10, 2015 16 BIOGRAPHIES OF THE DIRECTORS PROPOSED FOR RENEWAL, APPOINTMENT AND RATIFICATION OF A COOPTATION 19 AGENDA OF THE SHAREHOLDERS’ GENERAL MEETING (COMBINED ANNUAL ORDINARY AND EXTRAORDINARY) OF APRIL 22, 2015 21 REPORT OF THE BOARD OF DIRECTORS ON THE RESOLUTIONS SUBMITTED TO THE GENERAL MEETING 22 DRAFT RESOLUTIONS SUBMITTED TO THE GENERAL MEETING 28 REQUEST FOR DOCUMENTS AND INFORMATION 33 Informations - shareholders : 0 805 800 000 - Toll-free number in France (no charge, except in Overseas Departements and Territories ) This is a free translation into English from the original version in French and is provided solely for the convenience of English speaking readers. 2 VEOLIA ENVIRONNEMENT • NOTICE & INFORMATION BROCHURE - COMBINED GENERAL MEETING OF SHAREHOLDERS WEDNESDAY, APRIL 22, 2015 MESSAGE FROM THE CHAIRMAN AND CEO Ladies and Gentlemen, Dear Shareholders, The Combined General Meeting of Veolia Environnement(1) Shareholders will take place on Wednesday, April 22, 2015 at 3:00 p.m., at the Maison de la Mutualité. -

Baudouin Prot Elected 2006 “Financier of the Year”, for the Prize Organised by ANDESE and INVESTIR in Partnership with Fininfo

EnIn partnershippartenariat with avec Paris, 29 November 2006 ANDESE PRIZE FOR THE 2006 FINANCIER OF THE YEAR Baudouin Prot elected 2006 “Financier of the year”, for the prize organised by ANDESE and INVESTIR in partnership with Fininfo. Baudouin Prot has been elected winner of the prize ‘Financier of the year’ 2006. Groupe Finance de l’ANDESE, Association Nationale des Docteurs Es-Sciences Economiques (national association for doctors of economic science) established the prize in 1984. INVESTIR has hosted the prize since 1990, together with FININFO since 2002. The prize is awarded to the person who has most contributed to the development of the finance industry in France during the year. The winner can be a public official, banker, insurer, pension fund manager, executive from a broking firm, journalist or company finance manager. The initial selection is made by a committee comprising Andese members and representatives from Investir and Fininfo. The committee chooses a shortlist of five, on which members of the French financial community then vote. This year, Investir, Andese and Fininfo have rewarded Baudouin Prot for the success of the acquisition of Italian-based BNL, which was conducted in a record time providing BNP Paribas a second retail market in Europe, and for the quality of the group results. BNP Paribas has enjoyed sharp growth in its international business and is now one of the world’s 10 leading banks. 55 year-old Baudouin Prot has been chief executive officer of BNP Paribas since 2003. Baudouin Prot succeeds Patrick Ricard (2005), Jean-François Dehecq (2004), Thierry Breton (2003) and Maurice Levy (2002). -

Financing the Transformation to a Sustainable Economy a Discussion

Financing the transformation to a sustainable economy A discussion with BNP Paribas August 2020 This interview is between Alice Spencer, Programme Director at the University of Cambridge Institute for Sustainability Leadership (CISL) and Antoine Sire, Head of Company Engagement, BNP Paribas. BNP Paribas is a French international banking group. It is the world’s 8th largest bank by total assets and currently operates with a presence in 72 countries and employing 192,000 staff. CISL and BNP Paribas have been working together for two years on the Positive Impact Business Training to support the bank’s ambition to lead its sector in driving impact through business model innovation and stakeholder engagement to be ‘the bank for a changing world.’ Alice Spencer: You chose to return to BNP Paribas in 2017 after dedicating your time to creative projects, and I am interested to hear your personal motivations in returning to lead such a significant, complex and long-term programme? Antoine Sire: I was head of communications of BNP between 1997-2013 and was part of the merger team that saw us become one of largest banks in the world; BNP Paribas. We became a European company with an international footprint, with strong growth in America and Asia; a really rewarding story to be part of. It is not often you can say you are part of the team that made a great company. Returning in 2013, after writing my second book, was at the request of Jean-Laurent Bonnafe, our CEO, who over lunch told me about the increasing concern about inequality, climate change and biodiversity challenges. -

BNP Paribas Fortis Industrial Plan

Program BNP Paribas Fortis Industrial Plan BNP Paribas Investor Day Brussels, December 1st, 2009 Agenda Brussels, December 1st, 2009 10.15 – 10.45 Welcome Coffee and registration 10.45 - 10.50 Introduction Herman Daems, Chairman of the Board BNP Paribas Fortis 10.50 - 11.10 Strategic Rationale and Synergies Jean-Laurent Bonnafé, Chief Executive Officer BNP Paribas Fortis 11.10 - 11.30 Retail and Private Banking Belgium Peter Vandekerckhove, Head of Retail and Private Banking 11.30 - 11.50 Corporate and Public Bank Belgium Max Jadot, Head of Corporate and Public Bank Belgium 11.50 - 12.10 BNP Paribas Retail Banking Jean-Laurent Bonnafé, Chief Executive Officer BNP Paribas Fortis 12.10 - 13.40 Buffet lunch 13.40 - 14.00 Corporate and Investment Banking Alain Papiasse, Head of Corporate and Investment Banking 14.00 - 14.20 Investment Solutions Jacques d’Estais, Head of Investment Solutions 14.20- 14.40 Risk Profile and Liquidity Georges Chodron de Courcel, Chief Operating Officer Financial Strength and Solvency Philippe Bordenave, Senior Executive Vice President and Chief Financial Officer 14.40 - 15.00 Keeping Ahead Baudouin Prot, Chief Executive Officer 15.00 - 16.00 Q&A session for Investors/Analysts in Auditorium A 16.00 - 17.00 Cocktail 19.00 - 23.30 Gala dinner at Magritte Museum (Investors/Analysts) Private visit of the exhibition Gala dinner hosted by Baudouin Prot and Jean-Laurent Bonnafé 3 Map Practical information Place of conference BNP Paribas Fortis Office e Place Sainte-Gudule ic r t Rue Royale 20 a r é p 1000 Brussels m I -

Your Hub in Euroland

Daniel Bouton « Pour une banque globale comme la Société Générale, la place « For a global banking group such as Société Générale, the Président Directeur Général financière de Paris constitue une plate-forme solide et efficace Paris financial market stands for a solid and efficient platform Chairman & CEO qui lui apporte non seulement une large capacité d’innovation which not only brings a major capacity for innovation and Société Générale et l’accès à l’un des plus importants gisements d’épargne access to one of the most significant pool of savings in en Europe mais qui lui procure également des avantages Europe, but also gives it significant advantages related to the significatifs liés à la proximité de grands émetteurs. » proximity to major issuers. » « Nous nous réjouissons de l’accueil fait à nos fonds « We are pleased by the reception the Vanguard funds have collectifs en Europe et plus particulièrement en received in Europe, and particularly so in France. French France. Les grands investisseurs privés et publics corporate and public investors are aware of the power of Jack Brennan français, ont pris conscience des avantages de la indexing, the benefits of low cost, and the importance of Président Directeur Général gestion indicielle, qu’elle soit intégrée ou non dans fund cost transparency. These are core Vanguard values, and Chairman & CEO une approche coeur-satellite, de ses faibles coûts et we are proud to hold them in common with the enlightened Vanguard Group de sa transparence. Il s’agit là de valeurs centrales investors in France. » pour le Groupe Vanguard, et nous sommes fiers de les partager avec ces investisseurs en France.