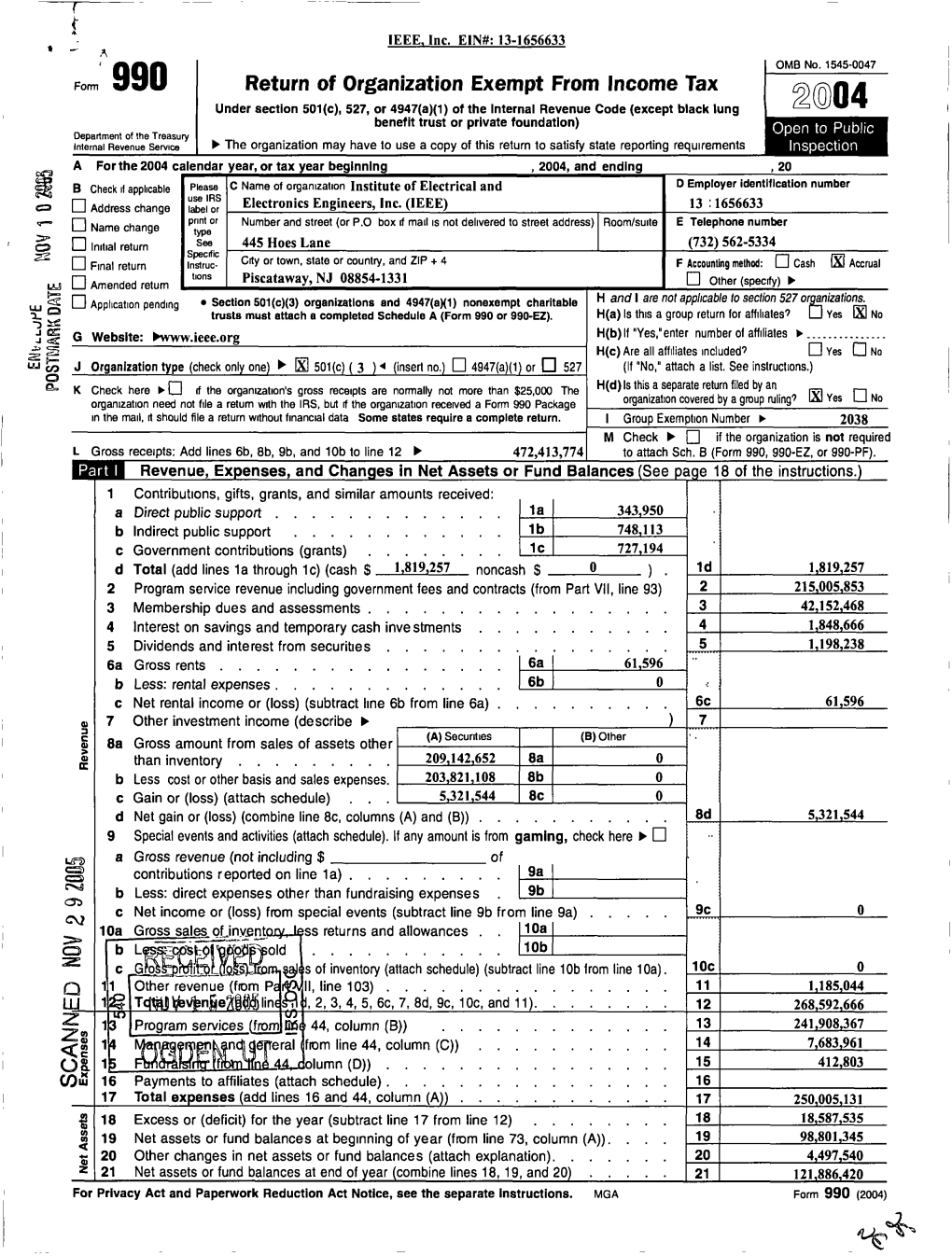

Return of Organization Exempt from Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download The

LEADING THE FUTURE OF TECHNOLOGY 2016 ANNUAL REPORT TABLE OF CONTENTS 1 MESSAGE FROM THE IEEE PRESIDENT AND THE EXECUTIVE DIRECTOR 3 LEADING THE FUTURE OF TECHNOLOGY 5 GROWING GLOBAL AND INDUSTRY PARTNERSHIPS 11 ADVANCING TECHNOLOGY 17 INCREASING AWARENESS 23 AWARDING EXCELLENCE 29 EXPANSION AND OUTREACH 33 ELEVATING ENGAGEMENT 37 MESSAGE FROM THE TREASURER AND REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS 39 CONSOLIDATED FINANCIAL STATEMENTS Barry L. Shoop 2016 IEEE President and CEO IEEE Xplore® Digital Library to enable personalized importantly, we must be willing to rise again, learn experiences based on second-generation analytics. from our experiences, and advance. As our members drive ever-faster technological revolutions, each of us MESSAGE FROM As IEEE’s membership continues to grow must play a role in guaranteeing that our professional internationally, we have expanded our global presence society remains relevant, that it is as innovative as our THE IEEE PRESIDENT AND and engagement by opening offices in key geographic members are, and that it continues to evolve to meet locations around the world. In 2016, IEEE opened a the challenges of the ever-changing world around us. second office in China, due to growth in the country THE EXECUTIVE DIRECTOR and to better support engineers in Shenzhen, China’s From Big Data and Cloud Computing to Smart Grid, Silicon Valley. We expanded our office in Bangalore, Cybersecurity and our Brain Initiative, IEEE members India, and are preparing for the opening of a new IEEE are working across varied disciplines, pursuing Technology continues to be a transformative power We continue to make great strides in our efforts to office in Vienna, Austria. -

IEEE Xplore文献资源介绍 IEEE Xplore科研检索演示 IEEE国际期刊会议投稿流程 IEEE相关资源推介 1

深度解密IEEE数据库: 科研检索与学术投稿 陈伟 iGroup公司IEEE产品培训主管 2016 培训重点 IEEE Xplore文献资源介绍 IEEE Xplore科研检索演示 IEEE国际期刊会议投稿流程 IEEE相关资源推介 1. 关于IEEE The Institute of Electrical & Electronics Engineers, 全球 最大的行业技术学会,成员遍布全球160多个国家和地区 ,会员超过40万人 IEEE带来的不仅仅只是技术文献 Our Global Reach 45 431,000+ Technical Societies and 160+ Members Councils Countries Our Technical Breadth 1,400+ 3,700,000+ 170 Annual Conferences Technical Documents Top-cited Periodicals 4 IEEE Societies IEEE Instrumentation and Measurement Society IEEE Aerospace and Electronic Systems Society IEEE Intelligent Transportation Systems Society IEEE Antennas and Propagation Society IEEE Magnetics Society IEEE Broadcast Technology Society IEEE Microwave Theory and Techniques Society IEEE Circuits and Systems Society IEEE Nuclear and Plasma Sciences Society IEEE Communications Society IEEE Oceanic Engineering Society IEEE Components, Packaging, and Manufacturing IEEE Photonics Society Technology Society IEEE Power Electronics Society IEEE Computational Intelligence Society IEEE Power and Energy Society IEEE Computer Society IEEE Product Safety Engineering Society IEEE Consumer Electronics Society IEEE Professional Communications Society IEEE Control Systems Society IEEE Reliability Society IEEE Dielectrics and Electrical Insulation Society IEEE Robotics and Automation Society IEEE Education Society IEEE Signal Processing Society IEEE Electron Devices Society IEEE Society on Social Implications of Technology IEEE Electromagnetic Compatibility Society IEEE Solid-State Circuits Society IEEE Engineering in Medicine -

IEEE Annual Report- 2017

THE 2017 IEEE TABLE OF PRESIDENT’S COIN CONTENTS Initiated by 2016 President Barry Shoop, the IEEE President’s Coin 1 MESSAGE FROM THE IEEE PRESIDENT is given to individuals in recognition of their dedication to IEEE. For me, one of the most interesting aspects is the embodiment of the President’s unique design and story. 3 INSPIRING CHANGE. EMPOWERING PEOPLE. “Find Your Reason, Purpose and Passion” 5 GROWING GLOBAL AND INDUSTRY PARTNERSHIPS The front of my coin features a personal motto, inspired by my daughter - “Find Your Reason, Purpose and Passion,” along with the mission of IEEE. 9 GROWING AWARENESS OF IEEE The back highlights five areas of IEEE activities in the outer ring and different facets of IEEE in the center. 15 EXPANDING IEEE’S PRESENCE AROUND THE WORLD The Wi-Fi symbol denotes IEEE’s leadership in standards. 21 ADVANCING TECHNOLOGY FOR THE FUTURE The image next to that represents engineering in medicine and biology. The skyline signifies Smart Cities and IEEE’s global nature. 27 REWARDING EXCELLENCE The circuit diagram symbolizes our computer and electronic engineering disciplines. The plant is for 31 ENCOURAGING OUTREACH AND DRIVING RESEARCH IEEE’s power and energy fields and sustainability initiatives. The sine wave stands for our many communications domains. 35 ELEVATING ENGAGEMENT My favorite icon is the group of people with one individual who is a little different, showing IEEE 39 IEEE BOARD OF DIRECTORS AND MANAGEMENT COUNCIL members welcoming me as a female engineer. With each coin I presented, came the feeling of pride 41 MESSAGE FROM THE TREASURER AND REPORT and humbleness to serve our great institution. -

THE IEEE REGION TEN NEWSLETTER History

THE IEEE REGION TEN NEWSLETTER September 2008 Editor: Dr Zia Ahmed IEEE REGION 10 HISTORY SUPPLEMENT COUNCILS & MESSAGES OF PAST REGION 10 REGION 10 DIRECTORS SECTIONS ACTIVITIES MESSAGES OF PAST REGION 10 DIRECTORS F C. Kohli, Region 10 Director 1973 - 1974 Tata Consultancy Services I was Director of Region 10 in the year 1973-74. All my Predecessors at Region 10 were from Japan for two reasons, one was Region 10 Director was selected by the Board and not elected, and second, most of the technology development was taking place in Japan. I had the opportunity to build IEEE Sections, Councils and Student Chapters all over India. I also helped set up the first IEEE Section in South Korea and Singapore. The most significant contribution from my end was to get my colleagues on the Board to understand that most of the Indians and some from other countries would not find it possible to pay full dues of IEEE. During meeting of the Board in December 1974, the Board passed a Resolution to tie for those to provide discount in dues for those with income below a certain level. This helped the professional in developing countries to become member of IEEE. Naturally as their income level improved they started paying the regular dues. This gave tremendous response to IEEE Membership not only in India but also in Africa and some parts of South America. IEEE is a living organisation. It helps to build professional careers and is a source of knowledge on a continuos basis for members even at my age. -

Challenge Today. Change Tomorrow

Challenge Today. Change Tomorrow. 2019 Annual Report Table of Contents 1 IEEE Overview: Challenge Today. Change Tomorrow. A Message to Our Community 3 Message from the IEEE President and the Executive Director IEEE and its volunteers and members have a long history of passionately embracing the 5 IEEE by the Numbers most pressing challenges of the day and finding ways to change tomorrow for the better. This spirit has never been more urgent as we face the global threat posed by COVID-19. 7 IEEE Shapes the Future We would like to express our heartfelt thanks to all IEEE volunteers and members supporting 9 Our Volunteers Drive Us Forward efforts to contain this crisis—connecting the world, powering communities and seeking vital treatments and cures. 15 Evolution of the Member Experience As an organization, IEEE actively responded to this global threat with speed, agility and 19 Diverse Membership with a Common Mission resourcefulness. To protect our volunteers, members and staff, IEEE shifted its operations, activities and global engagement to digital and virtual forums. 23 New Options for Researchers and Authors in Support of Open Science IEEE remains true to our mission of advancing technology for humanity, and we will sustain this mission and our engagement across our organization as together we overcome this 27 Honoring Technology Trailblazers crisis and move confidently into the future. 33 Advancing Technology for Humanity 37 Elevating Engagement 43 IEEE Board of Directors and Management Council 45 Message from the Treasurer and Report of Independent Certified Public Accountants 47 Consolidated Financial Statements Challenge Today. Change Tomorrow. -

Long Island Section 2013 Annual Awards Ceremony MESSAGE from the CHAIRMAN IEEE Members and Guests

Long Island Section 2013 Annual Awards Ceremony MESSAGE FROM THE CHAIRMAN IEEE Members and Guests, As Chair of the IEEE Long Island Section, I’m both privileged and honored to welcome each of you to the 2013 IEEE Long Island Section Awards Banquet. We’ve gathered to recognize and honor outstanding engineering achievements of our members and colleagues, and to commemorate the 60th anniversary of the IEEE Long Island Section. For our guests, the Long Island Section of the IEEE, or Institute of Electrical and Elec- tronics Engineers, is the largest engineering society on Long Island, with about 2500 engi- neering, science and other technical professionals. We are a key part of IEEE Region 1, with more than 30,000 members in the Northeastern US. And our ten regions comprise nearly a half million mem- bers globally. The IEEE is the world's largest professional association dedicated to advancing technological innovation and excellence for the benefit of humanity. Our Awards Banquet recognizes outstanding Long Islanders who have made significant engineering contributions. We’ll recognize those Executive Committee volunteers who have made contributions to our Section, including past section officers, as well as officers of technical society chapters, affinity groups and other func- tions and activities, including technical conferences. We’ll also present various Section awards, which are named in honor of key members from our past 60 years, and vetted by our Awards Nomination Committee Chair, Jesse Taub and his committee members. We’ll then present awards at the Regional level. And we are also proud to honor tonight a new IEEE Fellow, a distinction reserved for select IEEE members whose extraordinary accomplishments in an IEEE field of interest are deemed fitting of this prestigious grade. -

IEEE Reliability Society

IEEE Reliability Society http://www.ieee.org/society/rs Vol. 48, No. 3, July 2002 (ISSN 1059-8642) President’s Message CONTENTS Your Society Thanks to all of our members that participated in our Society’s Survey. Your AdCom wanted to obtain your viewpoint and to learn where we President’s Message are doing the right things, where we need to make improvements, and 1 where we need to make course corrections. From early data, a large majority responded that they were mem- Editor’s Column bers of the Reliability Society “To obtain current tech- 3 nical reliability information and resources to do my job” which is exactly what your Society is trying to Chapter Activities 3 provide. The final survey results will be briefed and provided to the AdCom in July, but just too late for this AdCom Meeting Minutes Newsletter issue. The results will be covered in the 5 next Newsletter, so watch for it. Again, many thanks to those members that participated. Educational Activites Your Society has a solid financial base, but the con- 8 tinuing corporate tax from Headquarters does strain the annual budget. Headquarters has updated many of their computer Standards News 10 systems and has provided members many new services, all of which re- quires money. As I have stated in past Newsletters, Headquarters com- Call for Papers: 2003 International Reliability mitted to these changes under good stock market conditions, but is Physics Symposium having to pay in this tough market period. The Societies are a major 14 revenue source for the IEEE, so that is where Headquarters looks in times of need. -

2011 IEEE Annual Report | 2011 Highlights | 3

Excellence Collaboration Innovation Global Influence Humanity IEEE ANNUAL REPORT 2 011 Innovative Solutions Through Global Collaboration Sustainability Communication Solutions Leadership Advancement Interdisciplinary Technology Research Development One Voice While the world benefits from what is new, IEEE is focused on what is next. TABLE of CONTENTS IEEE Annual Report Features 12 Life Sciences Pursuing Tomorrow’s Solutions IEEE portal launches as the premier global resource for life science technologies, information, and activities. Who We Are 07 A global overview of who we are. Serving Society IEEE fulfilled its mission of advancing technology for 20 09 humanity throughout 2011. Education Young Women Introduced to Engineering Mothers, daughters, and their teachers Serving Members were inspired to consider careers IEEE surpasses 415,000 members and continues to in technology through robotics and 25 expand globally. engineering workshops. Products & Services IEEE expands its role as leading source of high-quality 37 technical publications and conferences. Awards & Honors IEEE pays tribute to technologists whose achievements 32 45 have made a lasting impact on humanity. Student Showcase Students Provide Remote Healthcare Solution Brazil team named IEEE Student Financials Humanitarian Supreme with real-time 61 An overview of IEEE 2011 financials. e-health solution. 2011 Highlights January > EngineeringforChange.org debuted with the launch of an online platform designed to enable technical professionals to collaborate on solutions for humanitarian and developmental challenges. February > Interactive IEEE exhibit opened at B.M. Birla Science Centre in Hyderabad, India. > Three IEEE Milestones in Electrical Engineering and Computing dedicated–First Mercury Spacecraft, SPICE Circuit Simulation Program, Eel River High Voltage Direct Current Converter Station. -

Awards Program

Award Selection Committee Chairs Frontiers in Education Conference Benjamin J. Dasher Best Paper Award ........................................................... Diane Rover Helen Plants Award ........................................................................................ Elizabeth Eschenbach Ronald J. Schmitz Award ............................................................................... Robert Hofinger ASEE Electrical and Computer Engineering Division Hewlett-Packard Frederick Emmons Terman Award ..................................... Jeffrey Andrews IEEE Education Society IEEE William E. Sayle Award for Achievement in Education ....................... Susan Conry IEEE Transactions on Education Theodore Bachman Award ........................ Susan Lord Chapter Achievement Award ......................................................................... Kai Pan Mark Distinguished Chapter Leadership Award ...................................................... Trond Clausen and Emmanuel Gonzalez Distinguished Member Award ........................................................................ Victor Nelson Edwin C. Jones, Jr. Meritorious Service Award .............................................. Susan Lord Hewlett-Packard/Harriett B. Rigas Award ..................................................... Joanne Bechta Dugan Mac Van Valkenburg Early Career Teaching Award... ................................... S. Hossein Mousavinezhad Student Leadership Award ............................................................................. -

Contents | Zoom in | Zoom Outfor Navigation Instructions Please Click Here Search Issue | Next Page

Contents | Zoom in | Zoom outFor navigation instructions please click here Search Issue | Next Page Annual Report 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Contents | Zoom in | Zoom out For navigation instructions please click here Search Issue | Next Page qM qMqM Previous Page | Contents | Zoom in | Zoom out | Front Cover | Search Issue | Next Page qMqM Qmags THE WORLD’S NEWSSTAND® Table of Contents iWho We Are ii 2010 Highlights 1 Message from the President and the Executive Director 2Serving Society 7 IEEE Milestones 8 Serving Members 12 Products and Services 16 Awards, Fellows and Honors 20 2010 Board of Directors This Year’s Cover… 20 Management Council The January 2011 issue of IEEE Spectrum, our association’s award-winning magazine, inspired this year’s cover. Spectrum’s cover story — the most conse- 21 Message from the Treasurer quential innovations to come of age in the first decade of the 21st century — mirrors the contributions of IEEE members over the years to global society. 21 Report of Independent Auditors The drone aircraft, the planetary rover and the LED light bulb are each a 22 Financial Statements technological tour de force that our members and others in the world’s technical community had critical roles in developing and refining. Nicola Tesla first demonstrated his “telautomaton” — a small boat operated The 2010 IEEE Annual Report is available online at: remotely by radio — in 1898. His invention was rejected as too fanciful, but www.ieee.org/about/corporate/annual_report.html the value of unmanned, fully controllable and reusable combat vehicles came of age during the past decade. -

Bkj Diss Final.Pdf (2.562Mb)

Between Discipline and Profession A History of Persistent Instability in the Field of Computer Engineering, circa 1951-2006 by Brent K. Jesiek Dissertation submitted to the Faculty of the Virginia Polytechnic Institute and State University in partial fulfillment of the requirements for the degree of Doctor of Philosophy in Science and Technology Studies Gary L. Downey (Chair) Janet Abbate Daniel Breslau Timothy W. Luke Michael S. Mahoney (Princeton University) December 13, 2006 Blacksburg, VA Keywords: history, computer, computing, design, technology, engineers, engineering, engineering studies, discipline, profession, instability Copyright 2006, Brent K. Jesiek Between Discipline and Profession A History of Persistent Instability in the Field of Computer Engineering, circa 1951-2006 by Brent K. Jesiek Abstract This dissertation uses a historical approach to study the origins and trajectory of computer engineering as a domain of disciplinary and professional activity in the United States context. Expanding on the general question of “what is computer engineering?,” this project investigates what counts as computer engineering knowledge and practice, what it means to be a computer engineer, and how these things have varied by time, location, actor, and group. This account also pays close attention to the creation and maintenance of the “sociotechnical” boundaries that have historically separated computer engineering from adjacent fields such as electrical engineering and computer science. In addition to the academic sphere, I look at industry and professional societies as key sites where this field originated and developed. The evidence for my analysis is largely drawn from journal articles, conference proceedings, trade magazines, and curriculum reports, supplemented by other primary and secondary sources. -

IEEE for DUMMIES IEEE UNIFACS Student Branch Seção Bahia - Região 9 – IEEE Salvador, Bahia, Brasil

1 IEEE FOR DUMMIES IEEE UNIFACS Student Branch Seção Bahia - Região 9 – IEEE Salvador, Bahia, Brasil 2 O que é o IEEE? INSTITUTO DE ENGENHEIROS ELETRICISTAS E ELETRÔNICOS ▸Fundado em 1963 nos Estados Unidos; ▸Atualmente é a maior organização profissional do mundo; ▸Membros Famosos: Thomas A. Edison, Nikola Tesla. 3 O que é o IEEE? INSTITUTO DE ENGENHEIROS ELETRICISTAS E ELETRÔNICOS ▸ IEEE é uma organização profissional sem fins lucrativos fundada nos Estados Unidos que promove criação, desenvolvimento, integração, compartilhamento e o conhecimento aplicado no que se refere à ciência e tecnologia em benefício da humanidade e da profissão de engenheiro. 4 IEEE – Divisão Organizacional Ramo Estudantil ▸O Ramo Estudantil é um setor dentro da organização do IEEE que não tem fins lucrativos, sendo subordinado a uma Seção Estudantil. 5 IEEE – Divisão Organizacional Ramo Estudantil ▸O Ramo Estudantil do IEEE deve ser criado e gerenciado por estudantes de graduação, bem como de pós-graduação, que formam uma diretoria, sob a orientação de um professor da Universidade e um profissional ligado à Indústria, ambos associados ao IEEE. 6 IEEE – Divisão Organizacional Capítulo Estudantil ▸É uma subunidade técnica de um Ramo Estudantil IEEE, e consiste de membros de uma ou mais sociedades que compartilham interesses técnicos e proximidade geográfica. ▸Os capítulos fornecem aos membros da sociedade a oportunidade de conhecer e aprender com outros membros IEEE. 7 IEEE – Divisão Organizacional Capítulo Estudantil ▸Um capítulo ativo pode ser um dos elementos mais positivos de ser um membro IEEE, oferecendo programas, atividades, networking profissional, eventos especiais, conferências, etc. ▸Fornece oportunidades valiosas de networking a nível local, permitindo tanto um crescimento pessoal como profissional.