Federal Communications Commission DA 99-803 KHTS(FM), El Cajon

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

4. Spanish News and Talk Show Bookings 5

since 1996 2012 Map of Idaho Media Outlet Pickup* *A full list of outlets that picked up NRNS can be found in section 8. “In the current news landscape, PNS plays a critical role in bringing public- interest stories into communities around the country. We appreciate working with this growing network.” - Roye Anastasio-Bourke, Senior Communications Manager, Annie E. Casey Foundation 1. About Us 2. Our Reach Market Share Graph Issue Graph 3. Why Solution-Focused Journalism Matters (More Than Ever) 4. Spanish News and Talk Show Bookings 5. Member Benefits 6. List of Issues 7. PR Needs (SBS) 8. Media Outlet List Northern Rockies News Service • northernrockiesnewsservice.org page 2 1. About Us What is the Northern Rockies News Service? Launched in 1996, the Northern Rockies News Service is part of a network of independent public interest state-based news services pioneered by Public News Service. Our mission is an informed and engaged citizenry making educated decisions in service to democracy; and our role is to inform, inspire, excite and sometimes reassure people in a constantly changing environment through reporting spans political, geographic and technical divides. Especially valuable in this turbulent climate for journalism, currently 115 news outlets in Idaho and neighboring markets regularly pick up and redistribute our stories. Last year, an average of 44 media outlets used each Northern Rockies News Service story. These include outlets like the Ag Weekly, Associated Press ID Bureau, CBS ID Affiliates, DCBureau.org/Public Education Center, KIDK-TV CBS Idaho Falls, Sirius Satellite Radio, KEZJ-FM Clear Channel News Talk Twin Falls KFXD-AM Clear Channel News talk Boise. -

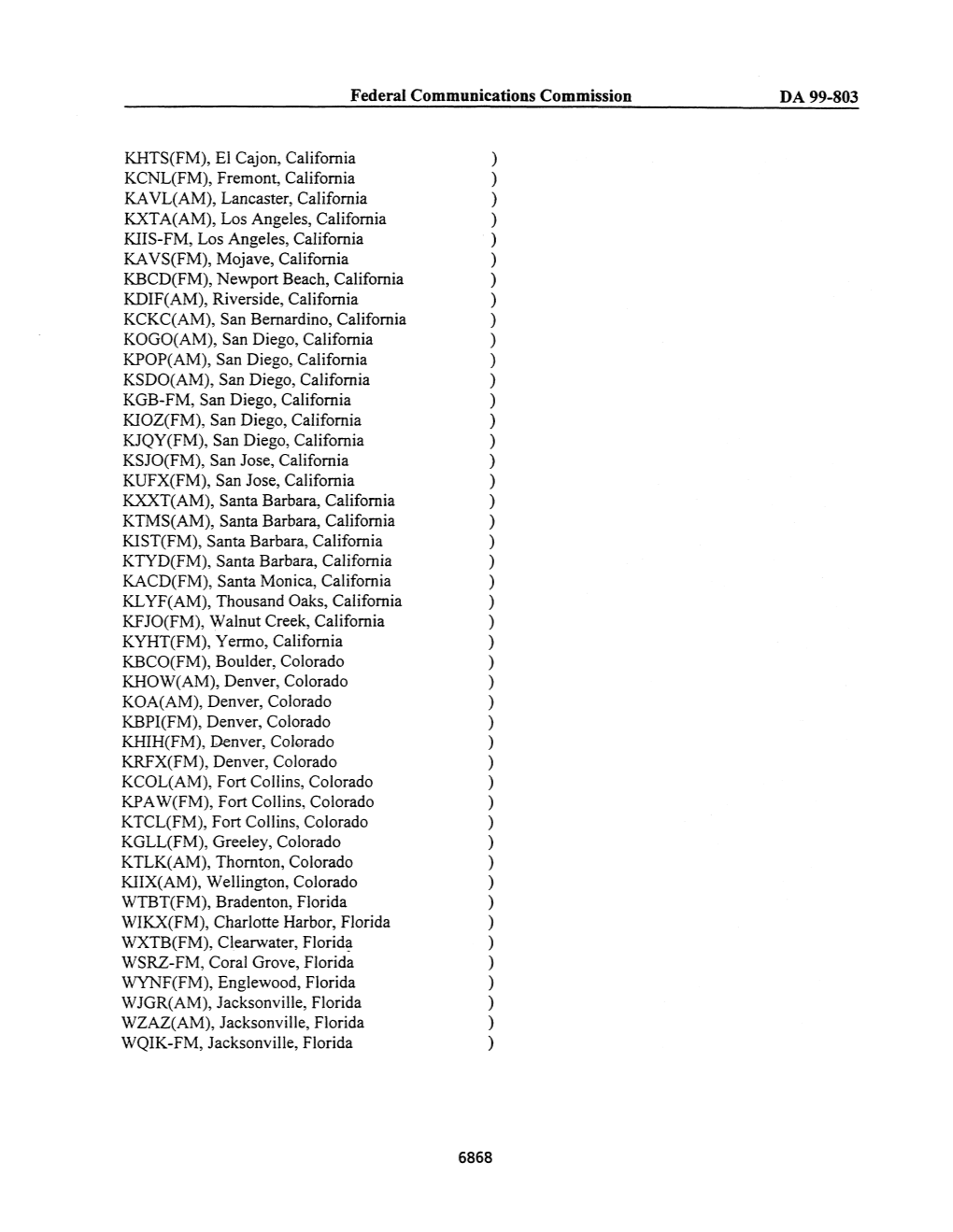

Federal Communications Commission Before the Federal

Federal Communications Commission Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) Existing Shareholders of Clear Channel ) BTCCT-20061212AVR Communications, Inc. ) BTCH-20061212CCF, et al. (Transferors) ) BTCH-20061212BYE, et al. and ) BTCH-20061212BZT, et al. Shareholders of Thomas H. Lee ) BTC-20061212BXW, et al. Equity Fund VI, L.P., ) BTCTVL-20061212CDD Bain Capital (CC) IX, L.P., ) BTCH-20061212AET, et al. and BT Triple Crown Capital ) BTC-20061212BNM, et al. Holdings III, Inc. ) BTCH-20061212CDE, et al. (Transferees) ) BTCCT-20061212CEI, et al. ) BTCCT-20061212CEO For Consent to Transfers of Control of ) BTCH-20061212AVS, et al. ) BTCCT-20061212BFW, et al. Ackerley Broadcasting – Fresno, LLC ) BTC-20061212CEP, et al. Ackerley Broadcasting Operations, LLC; ) BTCH-20061212CFF, et al. AMFM Broadcasting Licenses, LLC; ) BTCH-20070619AKF AMFM Radio Licenses, LLC; ) AMFM Texas Licenses Limited Partnership; ) Bel Meade Broadcasting Company, Inc. ) Capstar TX Limited Partnership; ) CC Licenses, LLC; CCB Texas Licenses, L.P.; ) Central NY News, Inc.; Citicasters Co.; ) Citicasters Licenses, L.P.; Clear Channel ) Broadcasting Licenses, Inc.; ) Jacor Broadcasting Corporation; and Jacor ) Broadcasting of Colorado, Inc. ) ) and ) ) Existing Shareholders of Clear Channel ) BAL-20070619ABU, et al. Communications, Inc. (Assignors) ) BALH-20070619AKA, et al. and ) BALH-20070619AEY, et al. Aloha Station Trust, LLC, as Trustee ) BAL-20070619AHH, et al. (Assignee) ) BALH-20070619ACB, et al. ) BALH-20070619AIT, et al. For Consent to Assignment of Licenses of ) BALH-20070627ACN ) BALH-20070627ACO, et al. Jacor Broadcasting Corporation; ) BAL-20070906ADP CC Licenses, LLC; AMFM Radio ) BALH-20070906ADQ Licenses, LLC; Citicasters Licenses, LP; ) Capstar TX Limited Partnership; and ) Clear Channel Broadcasting Licenses, Inc. ) Federal Communications Commission ERRATUM Released: January 30, 2008 By the Media Bureau: On January 24, 2008, the Commission released a Memorandum Opinion and Order(MO&O),FCC 08-3, in the above-captioned proceeding. -

Broadcast Applications 12/8/2009

Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 27127 Broadcast Applications 12/8/2009 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N AM STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING TX BAL-20091202ACL KHEY 67771 CCB TEXAS LICENSES, INC. Voluntary Assignment of License E 1380 KHZ TX , EL PASO From: CCB TEXAS LICENSES, INC. To: CC LICENSES, LLC Form 316 TX BAL-20091202ACR KPRC 9644 CCB TEXAS LICENSES, INC. Voluntary Assignment of License E 950 KHZ TX , HOUSTON From: CCB TEXAS LICENSES, INC. To: CC LICENSES, LLC Form 316 TX BAL-20091202ACV KTKR 11945 CCB TEXAS LICENSES, INC. Voluntary Assignment of License E 760 KHZ TX , SAN ANTONIO From: CCB TEXAS LICENSES, INC. To: CC LICENSES, LLC Form 316 TX BAL-20091202ACW KTSM 69561 CCB TEXAS LICENSES, INC. Voluntary Assignment of License E 690 KHZ TX , EL PASO From: CCB TEXAS LICENSES, INC. To: CC LICENSES, LLC Form 316 TX BAL-20091202ACZ WOAI 11952 CCB TEXAS LICENSES, INC. Voluntary Assignment of License E 1200 KHZ TX , SAN ANTONIO From: CCB TEXAS LICENSES, INC. To: CC LICENSES, LLC Form 316 Page 1 of 139 Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 27127 Broadcast Applications 12/8/2009 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N AM STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING WA BAL-20091202ADB KHHO 18523 ACKERLEY BROADCASTING Voluntary Assignment of License OPERATIONS, LLC E 850 KHZ From: ACKERLEY BROADCASTING OPERATIONS, LLC WA , TACOMA To: CITICASTERS LICENSES, INC. -

Community Involvement Plan Iowa Army Ammunition Plant Middletown, Iowa Contract No

FINAL Community Involvement Plan Iowa Army Ammunition Plant Middletown, Iowa Contract No. W912QR-12-D-0005 Delivery Order 0006 Prepared for U.S. Army Corps of Engineers Louisville District 600 Dr. Martin Luther King Jr. Place Louisville, Kentucky 40202-2232 May 2017 STATEMENT OF INDEPENDENT TECHNICAL REVIEW Environmental Services at Iowa Army Ammunition Plant Middletown, Iowa U.S. ARMY CORPS OF ENGINEERS LOUISVILLE DISTRICT CH2M HILL, Inc., has completed the Final submittal of the Community Involvement Plan, Iowa Army Ammunition Plant, Middletown, Iowa. Notice is hereby given that an independent technical review (ITR) has been conducted that is appropriate to the level of risk and complexity inherent in the project, as defined in the Project Management Plan and Contractor Quality Control Plan. During the ITR, compliance with established policy principles and procedures, utilizing justified and valid assumptions, was verified. This included review of assumptions; methods, procedures, and material used in analyses; the appropriateness of data used and level of data obtained; and reasonableness of the results, including whether the product meets the U.S. Army Corps of Engineers (USACE)’s needs consistent with the law and existing USACE policy. Project Manager ITR Team Leader 5/1/2017 5/1/2017 Signature Date Signature Date Mike DeRosa Kim-Lee Yarberry Contents Section Page Acronyms and Abbreviations ............................................................................................................ vii 1 Overview of the Community Involvement -

Public Notice >> Licensing and Management System Admin >>

REPORT NO. PN-2-210125-01 | PUBLISH DATE: 01/25/2021 Federal Communications Commission 45 L Street NE PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 ACTIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status 0000122670 Renewal of FM KLWL 176981 Main 88.1 CHILLICOTHE, MO CSN INTERNATIONAL 01/21/2021 Granted License From: To: 0000123755 Renewal of FM KCOU 28513 Main 88.1 COLUMBIA, MO The Curators of the 01/21/2021 Granted License University of Missouri From: To: 0000123699 Renewal of FL KSOZ-LP 192818 96.5 SALEM, MO Salem Christian 01/21/2021 Granted License Catholic Radio From: To: 0000123441 Renewal of FM KLOU 9626 Main 103.3 ST. LOUIS, MO CITICASTERS 01/21/2021 Granted License LICENSES, INC. From: To: 0000121465 Renewal of FX K244FQ 201060 96.7 ELKADER, IA DESIGN HOMES, INC. 01/21/2021 Granted License From: To: 0000122687 Renewal of FM KNLP 83446 Main 89.7 POTOSI, MO NEW LIFE 01/21/2021 Granted License EVANGELISTIC CENTER, INC From: To: Page 1 of 146 REPORT NO. PN-2-210125-01 | PUBLISH DATE: 01/25/2021 Federal Communications Commission 45 L Street NE PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 ACTIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status 0000122266 Renewal of FX K217GC 92311 Main 91.3 NEVADA, MO CSN INTERNATIONAL 01/21/2021 Granted License From: To: 0000122046 Renewal of FM KRXL 34973 Main 94.5 KIRKSVILLE, MO KIRX, INC. -

Broadcasting Telecasting

YEAR 101RN NOSI1)6 COLLEIih 26TH LIBRARY énoux CITY IOWA BROADCASTING TELECASTING THE BUSINESSWEEKLY OF RADIO AND TELEVISION APRIL 1, 1957 350 PER COPY c < .$'- Ki Ti3dddSIA3N Military zeros in on vhf channels 2 -6 Page 31 e&ol 9 A3I3 It's time to talk money with ASCAP again Page 42 'mars :.IE.iC! I ri Government sues Loew's for block booking Page 46 a2aTioO aFiE$r:i:;ao3 NARTB previews: What's on tap in Chicago Page 79 P N PO NT POW E R GETS BEST R E SULTS Radio Station W -I -T -H "pin point power" is tailor -made to blanket Baltimore's 15 -mile radius at low, low rates -with no waste coverage. W -I -T -H reaches 74% * of all Baltimore homes every week -delivers more listeners per dollar than any competitor. That's why we have twice as many advertisers as any competitor. That's why we're sure to hit the sales "bull's -eye" for you, too. 'Cumulative Pulse Audience Survey Buy Tom Tinsley President R. C. Embry Vice Pres. C O I N I F I I D E I N I C E National Representatives: Select Station Representatives in New York, Philadelphia, Baltimore, Washington. Forloe & Co. in Chicago, Seattle, San Francisco, Los Angeles, Dallas, Atlanta. RELAX and PLAY on a Remleee4#01%,/ You fly to Bermuda In less than 4 hours! FACELIFT FOR STATION WHTN-TV rebuilding to keep pace with the increasing importance of Central Ohio Valley . expanding to serve the needs of America's fastest growing industrial area better! Draw on this Powerhouse When OPERATION 'FACELIFT is completed this Spring, Station WNTN -TV's 316,000 watts will pour out of an antenna of Facts for your Slogan: 1000 feet above the average terrain! This means . -

Public Notice >> Licensing and Management System Admin >>

REPORT NO. PN-1-210601-01 | PUBLISH DATE: 06/01/2021 Federal Communications Commission 45 L Street NE PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 APPLICATIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status 0000147482 Renewal of AM KXEG 10975 Main 1280.0 PHOENIX, AZ STEPHAN C. SLOAN, 05/27/2021 Accepted License MEDIA SERVICES For Filing GROUP, RECEIVER From: To: 0000147360 Renewal of AM KRKK 5301 Main 1360.0 ROCK SPRINGS BIG THICKET 05/26/2021 Accepted License , WY BROADCASTING For Filing COMPANY OF WYOMING, INC. From: To: 0000147638 Modification FM KLBJ-FM 65792 Main 93.7 AUSTIN, TX WATERLOO MEDIA 05/27/2021 Accepted of License GROUP, L.P. For Filing From: To: 0000147483 Renewal of FX K241CS 156046 96.1 PHOENIX, AZ STEPHAN C. SLOAN, 05/27/2021 Accepted License MEDIA SERVICES For Filing GROUP, RECEIVER From: To: 0000147485 Renewal of FM KRNO 204 Main 106.9 INCLINE AMERICOM LIMITED 05/27/2021 Accepted License VILLAGE, NV PARTNERSHIP For Filing From: To: 0000147590 Renewal of FM KYBR 73118 Main 92.9 ESPANOLA, NM Richard L. Garcia 05/27/2021 Accepted License Broadcasting, Inc. For Filing Page 1 of 29 REPORT NO. PN-1-210601-01 | PUBLISH DATE: 06/01/2021 Federal Communications Commission 45 L Street NE PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 APPLICATIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status From: To: 0000147610 License To LPD K21OB-D 125172 Main 21 LAKE CHARLES WINDSONG 05/27/2021 Accepted Cover , LA COMMUNICATIONS, For Filing INC From: To: 0000147443 Renewal of AM KXEQ 57445 Main 1340.0 RENO, NV AZTECA 05/27/2021 Accepted License BROADCASTING For Filing CORPORATION From: To: 0000147536 Renewal of FM KLEA 2870 Main 95.7 HOBBS, NM NOALMARK 05/27/2021 Accepted License BROADCASTING For Filing CORPORATION From: To: 0000147386 Renewal of FX K239BR 157876 95.7 POCATELLO, ID RADIO BY GRACE, 05/26/2021 Accepted License INC. -

The Clear Picture on Clear Channel Communications, Inc.: a Corporate Profile

Cornell University ILR School DigitalCommons@ILR Articles and Chapters ILR Collection 1-28-2004 The Clear Picture on Clear Channel Communications, Inc.: A Corporate Profile Maria C. Figueroa Cornell University, [email protected] Damone Richardson Cornell University, [email protected] Pam Whitefield Cornell University, [email protected] Follow this and additional works at: https://digitalcommons.ilr.cornell.edu/articles Part of the Advertising and Promotion Management Commons, Arts Management Commons, and the Unions Commons Thank you for downloading an article from DigitalCommons@ILR. Support this valuable resource today! This Article is brought to you for free and open access by the ILR Collection at DigitalCommons@ILR. It has been accepted for inclusion in Articles and Chapters by an authorized administrator of DigitalCommons@ILR. For more information, please contact [email protected]. If you have a disability and are having trouble accessing information on this website or need materials in an alternate format, contact [email protected] for assistance. The Clear Picture on Clear Channel Communications, Inc.: A Corporate Profile Abstract [Excerpt] This research was commissioned by the American Federation of Labor-Congress of Industrial Organizations (AFL-CIO) with the expressed purpose of assisting the organization and its affiliate unions – which represent some 500,000 media and related workers – in understanding, more fully, the changes taking place in the arts and entertainment industry. Specifically, this report examines the impact that Clear Channel Communications, with its dominant positions in radio, live entertainment and outdoor advertising, has had on the industry in general, and workers in particular. Keywords AFL-CIO, media, worker, arts, entertainment industry, advertising, organization, union, marketplace, deregulation, federal regulators Disciplines Advertising and Promotion Management | Arts Management | Unions Comments Suggested Citation Figueroa, M. -

Wyoming's Highway Safety Office Annual Report

WYOMING’S HIGHWAY SAFETY OFFICE ANNUAL REPORT FEDERAL FISCAL YEAR 2013 Highway Safety Program Wyoming Department of Transportation 5300 Bishop Blvd. Cheyenne, Wyoming 82009-3340 MATTHEW H. MEAD MATTHEW D. CARLSON, P.E. Governor Governor’s Representative for Highway Safety FINAL ADMINISTRATIVE REPORT WYOMING FY2013 HIGHWAY SAFETY PLAN December 23, 2013 Matthew D. Carlson, P.E. State Highway Safety Engineer Governor’s Representative for Highway Safety Dalene Call, Manager Highway Safety Behavioral Program State Highway Safety Supervisor TABLE OF CONTENTS Office Structure ...........................................................................................................................1 Compliance to Certifications and Assurances ............................................................................. 2 Executive Summary .................................................................................................................... 3 Performance and Core Outcome Measures Statewide .................................................................................................................... 4-6 Alcohol Impaired Driving ...............................................................................................7-9 Occupant Protection ................................................................................................. 10-12 Speed Enforcement ................................................................................................. 13-14 Motorcycle Safety .....................................................................................................15 -

Ed Phelps Logs His 1,000 DTV Station Using Just Himself and His DTV Box. No Autologger Needed

The Magazine for TV and FM DXers October 2020 The Official Publication of the Worldwide TV-FM DX Association Being in the right place at just the right time… WKMJ RF 34 Ed Phelps logs his 1,000th DTV Station using just himself and his DTV Box. No autologger needed. THE VHF-UHF DIGEST The Worldwide TV-FM DX Association Serving the TV, FM, 30-50mhz Utility and Weather Radio DXer since 1968 THE VHF-UHF DIGEST IS THE OFFICIAL PUBLICATION OF THE WORLDWIDE TV-FM DX ASSOCIATION DEDICATED TO THE OBSERVATION AND STUDY OF THE PROPAGATION OF LONG DISTANCE TELEVISION AND FM BROADCASTING SIGNALS AT VHF AND UHF. WTFDA IS GOVERNED BY A BOARD OF DIRECTORS: DOUG SMITH, SAUL CHERNOS, KEITH MCGINNIS, JAMES THOMAS AND MIKE BUGAJ Treasurer: Keith McGinnis wtfda.org/info Webmaster: Tim McVey Forum Site Administrator: Chris Cervantez Creative Director: Saul Chernos Editorial Staff: Jeff Kruszka, Keith McGinnis, Fred Nordquist, Nick Langan, Doug Smith, John Zondlo and Mike Bugaj The WTFDA Board of Directors Doug Smith Saul Chernos James Thomas Keith McGinnis Mike Bugaj [email protected] [email protected] [email protected] [email protected] [email protected] Renewals by mail: Send to WTFDA, P.O. Box 501, Somersville, CT 06072. Check or MO for $10 payable to WTFDA. Renewals by Paypal: Send your dues ($10USD) from the Paypal website to [email protected] or go to https://www.paypal.me/WTFDA and type 10.00 or 20.00 for two years in the box. Our WTFDA.org website webmaster is Tim McVey, [email protected]. -

Media Outlets News Service

115 115 8 116 115 115 111 32 115 115 52 116 57 111 111 32 37 103 75 52 25 97 97 37 107 110 84 52 104 40 101 110 84 83 83 21 21 37 76 22 84 50 22 56 84 17 21 48 22 43 4370 63 93 62 122 112 66 70 7070 17 17 42 117 54 114 9393 122 109 88 117 15 54 54 117 70 70100 17 114 78 42 41 68 51 41 2009 annual report 34 67 15 15 54 70 100 65 73 11974 100 60 4 41 118 5 59 18 106 City Map # Outlets 80 12 59 81 9 18 86 96 29 94 3 58 18 80 26 3 3 5992 18 35 7 61 1 72 69 35 35 45 Des Moines 38 CityView, Des Moines 61 38 72 38 38 113 35 64 61 44 38 69 35 48 27 102 38 3535 Register, Iowa Radio 3838 113 90 85 120 38 38 90 105 35 iowa Network-KXNO AM, 91 6 38 28 95 38 38 90 KIOA-FM, KKDM-FM, 31 46 98 98 99 53 53 20 14 NEWS SERVICE KLYF-FM, KMXD-FM, 33 47 89 14 11 14 KPSZ-AM, KRNT-AM, 30 39 77 77 55 55 14 108 24 87 19 16 KSTZ-FM, WHO-AM, 77 71 71 36 82 10 10 WHO-TV 82 23 Diagonal 39 Diagonal Progress Dickeyville, WI 40 WVRE-FM City Map # Outlets MEDIA OUTLETS Dubuque 41 KATF-FM, KDTH-AM, KFXB-TV Mason City 83 Globe Gazette, Iowa Radio Network- City Map # Outlets Dyersville 42 Dyersville Commercial, KDST-FM Eagle Grove 43 Eagle Grove Eagle, KJYL-FM KGLO AM, KLSS-FM, KRIB-AM Adel 1 Grimes Today Earlham 44 Earlham Advocate Milford 84 KUQQ-FM Algona 2 KLGA-AM, KLGA-FM East Moline, IL 45 KUUL-FM Missouri Valley 85 Missouri Valley Times-News Ames 3 KASI-AM, KCCQ-FM, KLTI-FM Eddyville 46 KKSI-FM Monticello 86 Monticello Express Anamosa 4 Anamosa Journal Eureka Eldon 47 KRKN-FM Mount Ayr 87 Mount Ayr Record-News Ankeny 5 KDRB-FM Elk Horn 48 Danish Villages Voice Moville 88 Moville Record Atlantic 6 KJAN-AM Elkader 49 Clayton County Register Mt. -

The School Calendar Principal's Column

October 3, 2005 Boulder Valley’s First Charter School Volume 20, Number 3 The School Calendar October November th • Tuesday, 4 Vision/Hearing Screening - 8:30 a.m. • Friday, 11th NO SCHOOL - Veteran's Day th st th • Monday, 10 No lunch service – send sack lunch Monday, 21 - Friday, 25 NO SCHOOL - th • • Tuesday 18 Parent Teacher Conferences 1:30- Thanksgiving Holiday th 6:30 p.m. * Monday 28 School Resumes th • • Wednesday, 19 Picture Retakes 8:00-10:00 a.m. th • Wednesday, 19 Parent-Teacher Conferences 1:30-6:30 p.m. * st • Friday, 21 NO SCHOOL - Summit Charter Day nd • Saturday 22 – Parent Work Party 9:00am- 3:00pm • Wednesday, 26th End of 1st Quarter December January th • Wednesday, 21st - Tuesday 3rd Jan. NO SCHOOL • Wednesday, 4 School Resumes th - Winter Holiday Break • Friday 13 NO SCHOOL Professional Development Day th • Monday 16 NO SCHOOL Martin Luther King Jr. Holiday th • Thursday 19 End of First Semester rd • Monday 23 – No lunch service – send sack lunch * Conference Note: Summit students will be in class 8:10-12:20 p.m. on these days (no lunch service.) Principal’s Column David. Finell Summit Parents: I again encourage parents to use Tantra as the primary pick-up and drop-off area for the school. We expect this In order to improve the safety of our small parking lot, work to be done in October. As always, please follow all BVSD will be making some changes in the configuration safety rules so no one is injured during drop-off and pick- of parking, pick-up and drop-off areas.