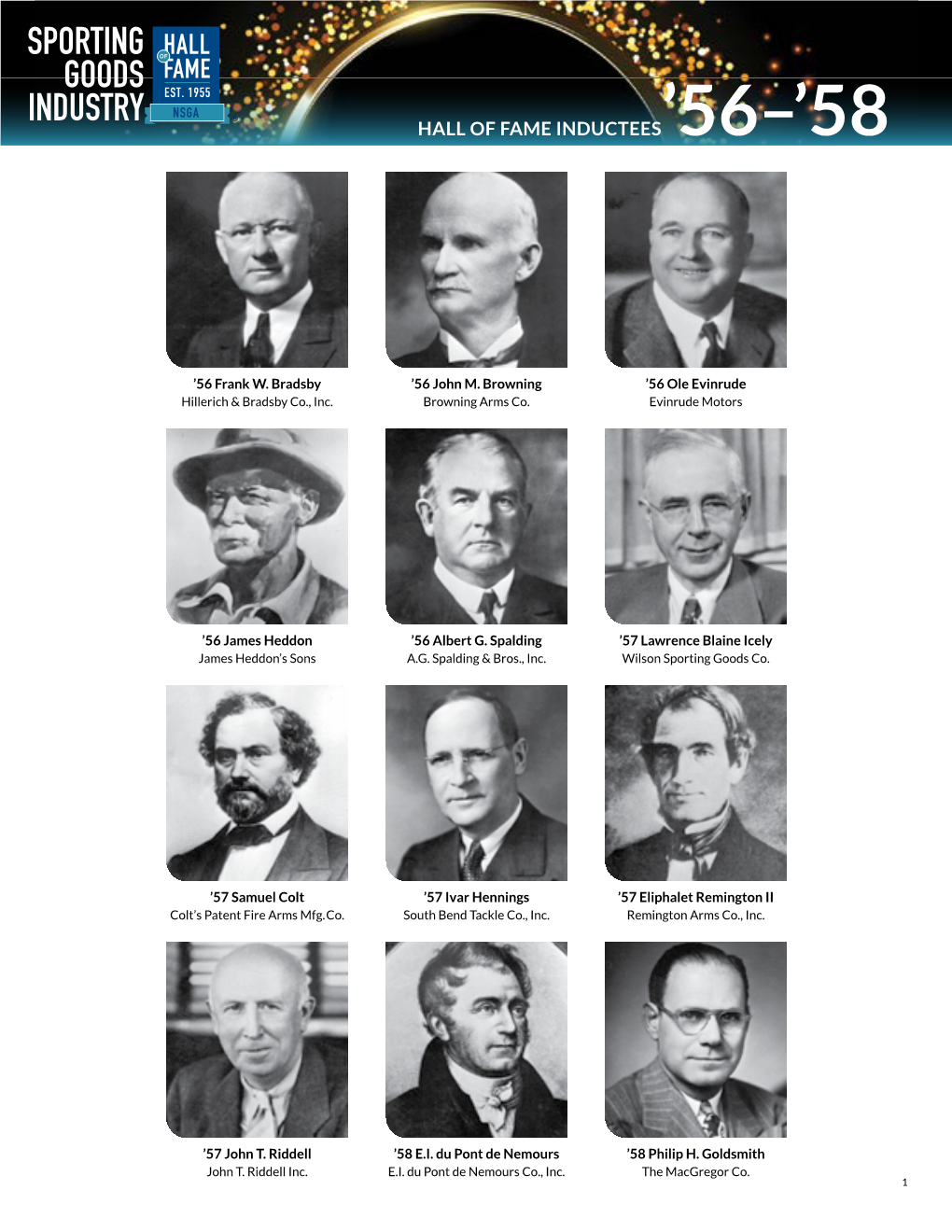

Hall of Fame Inductees'56–'58

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Baseball/Softball Batter's Helmets Legacy Product List

SEI Participant Brand Name Model Model Information Program Ampac Enterprises Inc Under Armour UABH-150 Sizes: OSFM (6 1/2 - 7 1/2) NOCSAE: Baseball/Softball Batter Helmets (ND022-10) Champro Sports CHAMPRO H4A, H4Y, H4T (RevB) Sizes: Adult, Youth and T-Ball NOCSAE: Baseball/Softball Batter Helmets (ND022-18) Champro Sports CHAMPRO H4GY, H4GA (RevB) Sizes: Adult and Youth, Gem gloss finish NOCSAE: Baseball/Softball Batter Helmets (ND022-18) Champro Sports CHAMPRO H4MY, H4MA, H4MT (RevB) Sizes: Adult, Youth and T-Ball; Matt finish NOCSAE: Baseball/Softball Batter Helmets (ND022-18) Dick's Sporting Goods Adidas - Destiny BTE00300 Size: OSFM (6 3/8 - 7 5/8) NOCSAE: Baseball/Softball Batter Helmets (ND022-10) Easton Diamond Sports Easton Z7 - A168 150, A168 152, A168 151, A168 153 Sizes: Junior (6 5/8 - 7 1/4), Senior (7 - 7 5/8) NOCSAE: Baseball/Softball Batter Helmets (ND022-10) Easton Diamond Sports Easton Z6 Sizes: Junior (6 1/2 - 7 3/8), Senior (7 1/8 - 7 5/8) NOCSAE: Baseball/Softball Batter Helmets (ND022-10) Easton Diamond Sports Easton Z6 2.0 Sizes: Junior (6 1/2 - 7 1/8), Senior (7 1/8 - 7 1/2) NOCSAE: Baseball/Softball Batter Helmets (ND022-10) Easton Diamond Sports Easton Easton Batter's Helmet - 1008495, 1006687, 1006690, 1006691 Size: OSFM (6 3/4 - 7-3/8) NOCSAE: Baseball/Softball Batter Helmets (ND022-10) Easton Diamond Sports Easton Natural OSFM 2.0 - BNA-02OS Size: OSFM (6 3/4 - 7 1/2) NOCSAE: Baseball/Softball Batter Helmets (ND022-10) Easton Diamond Sports Easton Natural Tee Ball - BNA-02TB Size: Tee Ball 6 - 6 1/2 NOCSAE: -

Under Armour and Three-Time Super Bowl Champion Tom Brady Form Multi-Year Partnership

Under Armour and Three-Time Super Bowl Champion Tom Brady Form Multi-Year Partnership Signing of Future Hall of Fame Quarterback Elevates Under Armour's NFL Roster, Re-asserts Brand's Dominance in Football Baltimore, MD (November 8, 2010) - Under Armour (NYSE:UA), the Baltimore, MD-based leader in sports performance apparel, footwear and accessories, announced today a multi-year partnership with three-time Super Bowl champion and NFL Most Valuable Player, Tom Brady. The owner of multiple NFL records and one of the winningest quarterbacks of all time, Brady is the highest profile team sport athlete to join the Under Armour family. As the newest member of the Under Armour team, Brady will appear in various in-store and advertising promotional campaigns. Brady bolsters a formidable offensive line-up for Under Armour, who also reached agreements earlier this season with Pro-Bowl wide receivers Miles Austin and Anquan Boldin. Brady will be wearing Under Armour apparel and footwear for training and will also be debuting a new customized Under Armour Fierce cleat in games in the near future. "Tom Brady represents a lot of what Under Armour is all about," said Kevin Plank, Founder and CEO, Under Armour. "He's humble and hungry and continues to be focused on winning and getting better every single day. We're proud to have him in our brand as he continues to re-write the NFL record books." A two-year starter at the University of Michigan, Brady was overlooked by most NFL teams before the New England Patriots claimed him with the 199th selection of the 2000 NFL Draft. -

Real Marketing 9.2 Converse: an Old Brand Story with a New Beginning

Real Marketing 9.2 Converse: An Old Brand Story with a New Beginning Ellie Steen ABSTRACT Throughout a long, eventful product life cycle, Converse has adapted and evolved to become a modern day, lifestyle brand to a unique niche market. How has a company, founded in 1908, been able to make it to the 21st Century? The Converse story shows how a company’s product life cycle evolves and how to adapt a product and brand image to survive over 100 years. Marquis Mills Converse founded the Converse Rubber Shoe Company in 1908 in Malden, MA. In 1917 the Converse All Star sneaker became the first performance basketball shoe. In the 1920’s, well-known basketball player—Chuck Taylor—became an endorser for the sneaker and even offered ideas for the improvement of the design. Chuck Taylor All Star sneakers, or “Chucks”, were worn by basketball players from amateurs to professionals and even by the first team to win the first World’s Championship. During the 1940’s, Converse shifted to producing boots for the U.S. Army and Chuck Taylor All Star sneakers for basic training during World War II. Converse remained popular throughout the 1950’s with the great social changes and a rebelling generation. The sneaker market exploded in the 1980’s and with new competitors such as Nike and Addidas, Converse’s market share dropped to 1% leading them to declare bankruptcy in 2001. Nike stepped in and bought Converse on the cheap, assigned them new management, provided some fresh cash and gave Converse the opportunity to come back to life. -

Spalding Woods Irons

WE /V£W /917 SPALDING WOODS IRONS Golfers love to argue about golf. .. but they usually wind up with "Let's ask the man who knows—our Pro!" This year, when they ask you what's new in golf clubs, you'll have plenty to tell them —about the new Registered Top-Flite Spalding Woods and stainless steel Registered Top-Flite Spalding Irons. Get the full story and let them know about all the advantages of these newly-designed Spaldings! A. G. SPALDING & BROS. • Div. of Spalding Sales Corp. Know Pro Shop Merchandise By JOEL BENNETT Asst. to Frank Walsh, pro, Red Run GC, Royal Oak, Mich. What makes selling of pro-grade clubs dence in all popular lines of golf clubs, a job that requires well-informed men in whether or not all the lines are stocked the pro shop is the superficial resemblance in his shop. of clubs that vary widely in price. Usually the retail buyer of golf clubs can't tell the This year, more than ever before, there difference between a $4 club and a club have been refinements introduced into de- that retails for $9 and far too often the signs with the purpose of helping the high- assistant in the shop or the pro himself isn't handicap player as well as the expert get too clear about the reasons that legitimate- greater certainty of results. Do you know ly account for the difference. all these features and the reasoning behind them? You should to qualify yourself as The pro doesn't see the factory cost an authority on golf playing equipment. -

JAY CHIAT AWARDS 2015 SUMMARY This Is the Story of How Under Armour Turned Their Uber-Masculine Sportswear Brand Into a Symbol of Female Athletic Aspiration

JAY CHIAT AWARDS 2015 SUMMARY This is the story of how Under Armour turned their uber-masculine sportswear brand into a symbol of female athletic aspiration. We set out to solve a critical business problem—how does Under Armour win over a massive new target that outright rejects the brand? It started with a truth about how their new target approaches fitness, then evolved into a big cultural insight about what it means to be a woman in the twenty-first century. This translated into a creative idea that connected Under Armour’s strong performance values to the true stories of women today achieving success on their own terms. The campaign put the brand at the heart of a cultural conversation, achieving a complete turnaround in connecting with their new target and an astonishing 28-percent sales increase. Even more, the campaign became a rallying cry that women everywhere could truly call their own. JAY CHIAT AWARDS 2015 2 BACKGROUND CORE ATHLETE Under Armour was born out of football in 1996 with the mission to make all athletes better. Their performance products were game-changing, putting the brand second to Nike in US sportswear. $2.8 Their meteoric rise to the top was propelled by overwhelming popularity among male athletes. But at the cost of this, Under Armour had forgotten about half the population. BILLION In 2013, the women’s business was seriously lacking, contributing only 17% of Under Armour’s total revenue of $2.3 billion. In the past 24 months, however, women’s sportswear brands like Lululemon, Champion, and Victoria’s Secret added $975 $11.4 million in revenues to their businesses—making women’s the fastest growing segment BILLION within the sportswear category. -

THE INSTITUTE of PUBLIC and ENVIRONMENTAL AFFAIRS Rapid Industrializa�On

Texles and Green Choice MATTHEW COLLINS – THE INSTITUTE OF PUBLIC AND ENVIRONMENTAL AFFAIRS Rapid Industrializaon Photo - Wikipedia Water Pollu$on Photo - IBTimes Soil Polluon Photo - SCMP Public Protests Obstacles to Polluon Control ? ? ! Public Parcipaon Needed • 《环境影响评价法》(2003) • Environmental Impact Assessment Law (2003) • Cleaner Production Promotion Law (2003) • 《清洁生产促进法》(2003) • Outline for Promoting Law-Based Administration • 全面推进依法行政实施纲要 (2004) (2004) • Interim Measures on Clean Production Checks (2004) • 《清洁生产审核暂行办法》 (2004) • State Council on Implementing the ScientiLic Concept of • 国务院关于落实科学发展观加强环境保护的决定 (2005) Development and Strengthening Environmental Protection (2005) 《关于加快推进企业环境行为评价工作意见》 • (2005) • “On Accelerating the Evaluation of Corporate Environmental Behavior Views” (2005) • 《环境影响评价公众参与暂行办法》(2006) • Interim Procedure on Public Participation in • 《政府信息公开条例》(2008) Environmental Impact Assessments (2006) • Regulation on Government Information Disclosure • 《环境信息公开办法 (试行)》(2008) (2008) • Environmental Information Disclosure Measures (2008) IPE Established in 2006 Green Choice Alliance Formed • Green Choice Alliance made up of 49 NGOs across China • Call on brands to make a pledge not to purchase from polluting suppliers Texle Industry Invesgaon Dyeing and Finishing Sector 90% 85% 80% 80% • Water Consumption: 85% 70% 65% • Energy 60% Consumption: 80% • Chemical 50% Consumption: 65% 40% Spinning 30% 22% Material Production 20% 12% 10% 8% 8% Dyeing and Finishing 10% 5% 2% 2% 1% 0% Garment Production Water Energy Chemicals -

Printmgr File

EXHIBIT 21 SUBSIDIARIES OF THE REGISTRANT Entity Name Jurisdiction of Formation American NIKE S.L. Spain Bragano Trading S.r.l. Italy BRS NIKE Taiwan, Inc. Taiwan Cole Haan Maine Cole Haan Company Store Maine Cole Haan Hong Kong Limited Hong Kong Cole Haan Japan Japan Converse (Asia Pacific) Limited Hong Kong Converse Canada Corp. Canada Converse Canada Holding B.V. Netherlands Converse Footwear Technical Service (Zhongshan) Co., Ltd. People’s Republic of China Converse Hong Kong Holding Company Limited Hong Kong Converse Hong Kong Limited Hong Kong Converse Inc. Delaware Converse Netherlands B.V. Netherlands Converse Sporting Goods (China) Co., Ltd. People’s Republic of China Converse Trading Company B.V. Netherlands Exeter Brands Group LLC Oregon Exeter Hong Kong Limited Hong Kong Futbol Club Barcelona, S.L. Spain Hurley 999, S.L. Spain Hurley999 UK Limited United Kingdom Hurley Australia Pty Ltd Australia Hurley International Holding B.V. Netherlands Hurley International LLC Oregon Juventus Merchandising S.r.l. Italy Manchester United Merchandising Limited United Kingdom NIKE 360 Holding B.V. Netherlands NIKE Africa Ltd. Bermuda NIKE Argentina Srl Argentina NIKE Asia Holding B.V. Netherlands NIKE Australia Holding B.V. Netherlands NIKE Australia Pty. Ltd. Australia NIKE BH B.V. Netherlands NIKE CA LLC Delaware NIKE Canada Corp. Canada NIKE Canada Holding B.V. Netherlands NIKE Chile B.V. Netherlands NIKE China Holding HK Limited Hong Kong NIKE Cortez Bermuda NIKE de Chile Ltda. Chile NIKE de Mexico S de R.L. de C.V. Mexico NIKE Denmark ApS Denmark NIKE Deutschland GmbH Germany NIKE do Brasil Comercio e Participacoes Ltda. -

Case No. 11MCV ^4

Case 1:09-cv-01024-LO-TCB Document 1 Filed 09/10/09 Page 1 of 34 PageID# 1 FILED IN THE UNITED STATES DISCTRICT COURT EASTERN DISTRICT OF VIRGINIA II? 10 \- CLl".'. Erik B. Cherdak 149 Thurgood Street Gaithersburg, Maryland 20878 Plaintiff', Pro Se, Case No. 11MCV ^4- v. COMPLAINT FOR PATENT INFRINGEMENT SKECHERS USA, INC. JURY TRIAL DEMANDED 228 Manhattan Beach Blvd. Manhattan Beach, California 90266 Defendant. SERVE ON: CORPORATION SERVICE COMPANY 11 South 12th Street P.O. Box 1463 Richmond, VA 23218-0000 COMPLAINT Plaintiff Erik B. Cherdak1 (hereinafter "Plaintiff or "Cherdak"), Pro Se, and in and for his Complaint against SKECHERS USA, INC. (hereinafter "SKECHERS"), and states as follows: JURISDICTION AND VENUE 1. This is an action for Patent Infringement under the Laws of the United States of America and, in particular, under Title 35 United States Code (Patents - 35 1 While Plaintiff Cherdak is not licensed to practice law in Virginia, he is a registered patent attorney before the U.S. Patent and Trademark Office. Case 1:09-cv-01024-LO-TCB Document 1 Filed 09/10/09 Page 2 of 34 PageID# 2 USC § 1, et seq.). Accordingly, Jurisdiction and Venue are properly based under Sections 1338(a), 1391(b) and (c), and/or 1400(b) of Title 28 of the United States Code. 2. Plaintiff is an individual who resides in Gaithersburg, Maryland at the address listed in the caption of this Complaint. At all times relevant herein, Plaintiff has been and is the named inventor of U.S. Patent Nos. 5,343,445 (the '445 patent) and 5,452,269 (the '269 patent) (hereinafter collectively referred to the "Cherdak patents," which were duly and legally issued by the U.S. -

Shoes Approved by World Athletics - As at 01 October 2021

Shoes Approved by World Athletics - as at 01 October 2021 1. This list is primarily a list concerns shoes that which have been assessed by World Athletics to date. 2. The assessment and whether a shoe is approved or not is determined by several different factors as set out in Technical Rule 5. 3. The list is not a complete list of every shoe that has ever been worn by an athlete. If a shoe is not on the list, it can be because a manufacturer has failed to submit the shoe, it has not been approved or is an old model / shoe. Any shoe from before 1 January 2016 is deemed to meet the technical requirements of Technical Rule 5 and does not need to be approved unless requested This deemed approval does not prejudice the rights of World Athletics or Referees set out in the Rules and Regulations. 4. Any shoe in the list highlighted in blue is a development shoe to be worn only by specific athletes at specific competitions within the period stated. NON-SPIKE SHOES Shoe Company Model Track up to 800m* Track from 800m HJ, PV, LJ, SP, DT, HT, JT TJ Road* Cross-C Development Shoe *not including 800m *incl. track RW start date end date ≤ 20mm ≤ 25mm ≤ 20mm ≤ 25mm ≤ 40mm ≤ 25mm 361 Degrees Flame NO NO NO NOYES NO Adidas Adizero Adios 3 NO YES NO YES YES YES Adidas Adizero Adios 4 NO YES NO YES YES YES Adidas Adizero Adios 5 NO YES NO YES YES YES Adidas Adizero Adios 6 NO YES NO YES YES YES Adidas Adizero Adios Pro NO NO NO NOYES NO Adidas Adizero Adios Pro 2 NO NO NO NOYES NO Adidas Adizero Boston 8 NO NO NO NOYES NO Adidas Adizero Boston 9 NO NO NO -

Dise Show May Not Be Bigger Than 1968, but It Will Be Better, from the Industry's Point of View

The 1969 edition of the Professional Golfers' Association Merchan- dise Show may not be bigger than 1968, but it will be better, from the industry's point of view. For the first time ever, the show will be closed to the public! This will undoubtedly cut down on traffic jams despite the fact that it will be held in the 45,000 square foot "big tent" again (150 feet by 300 feet). Also, although the number of booths will remain just about the same, 228 in '68, 226 this year, the number of companies and exhibitors are expected to increase. The Palm Beach Gardens show had 150 companies representing 875 exhibitors last year and at press time approximately 120 companies were already in the fold. Since this is a buying and ordering show only, the absence of the public and the expected increase of manufacturers displaying product lines (along with the current leisure time industry boom), should combine to make this one of the biggest dollar volume business meetings in recent times. A major part of last year's success reportedly was due to the stampede of alumi- num shaft orders. A PGA spokesman said a report also showed that some apparel sales were up 200 to 400 per cent and that a shoe manufacturer revealed a 30 per cent increase. The PGA is hoping that the closing of the show to the public will also enable it to take a count of the number of new products being shown—something that has never been tabulated. GOLFDOM, on the other hand, has been able to obtain an advance list of many of the expected show products and they follow. -

Sportswear Industry Data and Company Profiles Background Information for the Play Fair at the Olympics Campaign

Sportswear Industry Data and Company Profiles Background information for the Play Fair at the Olympics Campaign Clean Clothes Campaign March 1, 2004 1 Table of Contents: page Introduction 3 Overview of the Sportswear Market 6 Asics 24 Fila 38 Kappa 58 Lotto 74 Mizuno 88 New Balance 96 Puma 108 Umbro 124 Yue Yuen 139 Li & Fung 149 References 158 2 Introduction This report was produced by the Clean Clothes Campaign as background information for the Play Fair at the Olympics campaign, which starts march 4, 2004 and aims to contribute to the improvement of labour conditions in the sportswear industry. More information on this campaign and the “Play Fair at Olympics Campaign report itself can be found at www.fairolympics.org The report includes information on Puma Fila, Umbro, Asics, Mizuno, Lotto, Kappa, and New Balance. They have been labeled “B” brands because, in terms of their market share, they form a second rung of manufacturers in the sportswear industries, just below the market leaders or the so-called “A” brands: Nike, Reebok and Adidas. The report purposefully provides descriptions of cases of labour rights violations dating back to the middle of the nineties, so that campaigners and others have a full record of the performance and responses of the target companies to date. Also for the sake of completeness, data gathered and published in the Play Fair at the Olympics campaign report are copied in for each of the companies concerned, coupled with the build-in weblinks this provides an easy search of this web-based document. Obviously, no company profile is ever complete. -

History of Washington County

History of Washington County. Ella Mitchell Atlanta, GA 1924 DEDICATION TO THE BOYS AND GIRLS'FROM 1882 TO 1924 WHO HAVE BEEN TAUGHT BY ME THE FACTS RECORDED HERE THIS LITTLE VOLUME IS DEDICATED That the history of the men and women who made Washington County may be kept for future. generations, the Washington County Federation of Women's Clubs have had this book written and published.. The officers of the Federation at this time are as follows:· President . ..... MR.s. ARTHUR A. RAWLINGS, Sandersville, Ga. First Vice Pres .. ..... MRS. MACON WARTHEN, Warthen, Ga. Second Vice Pres .. ... MRS. JOHN F. TANNER, Sandersville, Ga. Secretary . ........ MRS. WILLIAM BRANTLEY, Tennille, Ga. Corres. Se:retary . MRS. FRED B. RAWLINGS, Sandersville, Ga. Treasurer ... ............ MISS LOUISE BROWN, Tennille, Ga. Parliamentarian . ....... MRS. C. D. HARDWICK, Tennille, Ga. Editor . ............. MRS. H. M. FRANKLIN, Tennille, Ga. f .MRS. DAN C. HARRIS, Sandersville, Ga. Advisory Committee~ MRS. THOS. A. WICKER, Sandersvill~. Ga. ( ...... MISS ALICE SMITH, Tennille. Ga. Membership in the Federation whose labor of love made possible the printing of this book are the SANDERSVILLE WOMAN'S CLUB SANDERSVILLE TRANSYLVANIA CLUB SANDERSVILLE ROUND TABLE CLUB SANDERSVILLE SOROSIS CLUB SANDERSVILLE MUSIC CLUB TENNILLE FINE .ARTS CLUB TENNILLE WoMAN' S CLUB SISTERS COMMUNITY CLUB WARTHEN WOMAN'S CLUB The Federation acknowledges with gratitude the assistance of the Kiwanis Club of Sandersville, in this work. PREFACE In November of 1922, at a conference of the High School Superintendents and the School Superintendents of the Coun ties of the Tenth District, Mrs. E. R. Hines, President of the Federation of Women's Clubs of this District, brought before the conference the matter of having a history of each- County written to be taught in the schools.