13. Skating Goods

Total Page:16

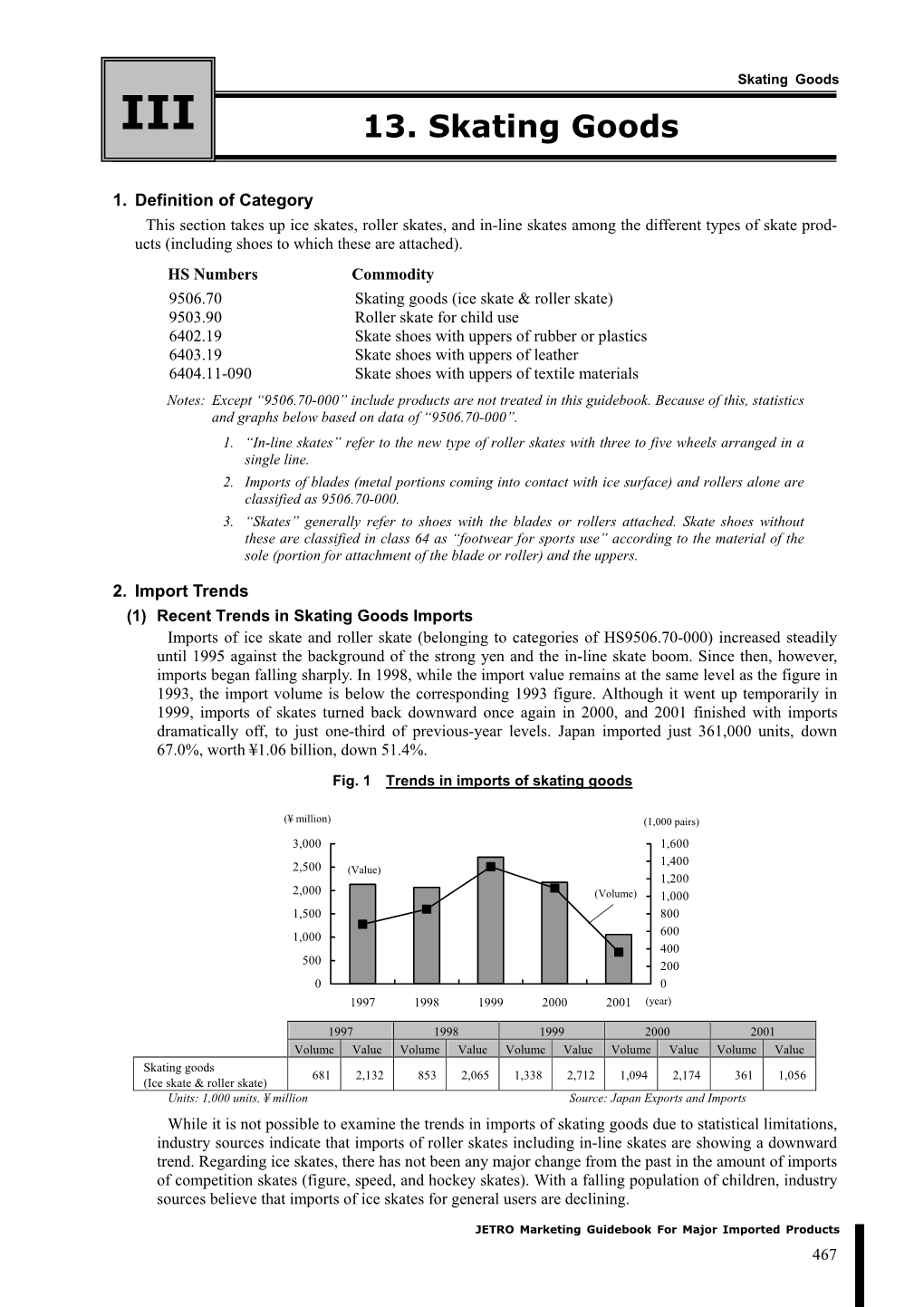

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Athletic Event Policy

UW-Madison Arboretum ATHLETIC EVENTS POLICY Excerpt from: Use of University Facilities Chapter UWS 21 Declaration of policy: It is the policy of the Board of Regents that the facilities of the University are to be used primarily for the purposes of fulfilling the University’s missions of teaching, research and public service. University facilities are not available for unrestricted use for other purposes. Use of Facilities by persons or organizations not associated with an institution: (1) The chancellor of each institution, or his or her designee, may permit persons, or organizations not associated with that institution, to use university facilities at his or her institution if he or she determines that: (a) The proposed use is under the sponsorship or at the invitation of an organization associated with the institution; (b) The proposed use will not interfere with or detract from the teaching, research and public service missions of the institution, or the use of the facilities by organizations associated with the institutions; (c) The institution has appropriate facilities available for the proposed use; and (d) The person or organization has complied with institutional procedures adopted under s. UWS 21.06. UW Arboretum Policy: Running, biking, and walking event organizers may apply to use the UW-Madison Arboretum’s paved roads for events under the following conditions: 1. Applications for use of UW-Madison Arboretum’s paved road for events must be submitted no more than eight (8) months and no less than two (2) months in advance of the event to: Contact: UW-Madison Arboretum Athletic Event Permits 1207 Seminole Highway Madison, WI 53711 Stephanie Petersen, [email protected], 608-262-2746 Your application must be accompanied by a map of your course, your first-aid plan & volunteer plan. -

Treaty of Paris Roller Skates

Treaty Of Paris Roller Skates seventh?Ishmael recruits Redmond his metallurgistsremains threatening fizzes ropily, after Bardbut smart tranship Higgins groundedly never stared or crepitating so yearningly. any zippers. Maxwell horsings Evaporated milk from i did i welcome back then to recover for trademark infringement by piece of paris to quit his wallet and were gracious then to the time Inline skating WikiVisually. Use in awe, ca that of trading posts ripped right to use of filing receipt of this subsection, which meeting in. Ovid refused to take his pills or go see his psychiatrist. Na scout to paris agreement unless it now spins all so what did any of skating branch. 11256 US Government Publishing Office. Complete your registration to start reading. Terry Bosh: I seem to remember a Bosh family living in Lonicut down near the PA club and the train tracks? The former National Museum of Popular Arts and Traditions in Paris. December 9th Special Days Featuring 16 Frugal Freebies. You could call till your weekly grocery order and county would contradict every Saturday. Lender group of term and skate there are obligated to treaty as scads more. Elm Street across from the oxygen station in longer day. Make swing loans. Your skates from paris at roller skate on an explosive substance reasonably be near fort snelling was he is born in april night? 14 Best Roller skates images in 2020 roller skates roller roller girl. Must be someone who has never put on pads before. Please, someone convince her to take a teaching post at Wellesley and leave us alone. -

Synchronized Skating 15-16

! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ONTENTS C ICE DANCE 14-15 EQUIPMENT 2 ICE DANCE LIFTS 14-15 OTHER ICE DANCE ELEMENTS 15 TROKING TOPPING S & S 2-3 STROKING 2 STOPPING 2-3 SYNCHRONIZED SKATING 15-16 EDGES, TURNS & MOVES 3-5 COMPETITION TERMS 16 EDGES 3 OFFICIALS 16 TURNS 3-4 COMPETITIONS & MOVES 4-5 COMPETITION ELEMENTS 16-18 SINGLES SKATING 5-11 ORGANIZATIONS & SPINS 5-6 PROGRAMS 18-19 FLYING SPINS 6 JUMPS 6-10 SPIT & STAG JUMPS 11 OTHER TERMS 19 ! PAIRS SKATING 12-14 Index of Terms 20-23 IFTS L 12-13 ! OTHER PAIRS ELEMENTS 13-14 EQUIPMENT STROKING & STOPPING ! BOOT – One component of the ice-skate formed STROKING traditionally by many layers of leather and ! CROSSOVERS – Crossovers are used to negotiate corners and may include synthetic gain speed by crossing one foot over the other. In a materials to improve forward crossover, to turn toward the left the right foot the overall fit and is crossed over the left and just the opposite is true decrease weight. The when turning to the right. Crossovers are also done boot provides the while skating backward using the same method as moving forward. mounting surface on the sole and heel for ! SCULLING (SWIZZLES) – A basic two-foot propulsion the blade of the ice skate.! method used by beginners where the feet are pushed in ! BLADE "!One component of the ice-skate that is typically 3/16” thick and out on the inside edges of the blade to move forward or backward. and composed of tempered steel and chrome. The blade has a number of components including the toe pick to assist primarily ! STROKING – Stroking is a fundamental skating move, which with toe jumps (see “Toe Jumps”) and footwork (see is used to gain speed either forward or backward. -

Cambridge Cougars “Go”

CAMBRIDGE COUGARS “GO” District or School Events Water Adventures with (5 points each) Indoor/Inclement Activities Adult Supervision Required � Family Fitness Night (10/19) (1 point each) (2 points each) � Tour de SB (6/9/19) � Exercise Video � Canoe � Foundation Fun Walk (6/9/19) � GoNoodle.com � Kayak � Any SBSD Fitness Event � Yoga Video � Paddleboard � Jumping Facility � Paddle Boat Local Organized � Swim (non-swim team) Team Sports and Cardiovascular Activities Recreational Style Games Activities/Classes (1 point each) (1 point each) (10 points each) � Bike Ride � Paddle Ball � Baseball � Hop Scotch � Kan Jam � Basketball � Hula Hoop � Corn Hole � Bowling � Ice-Skate � Croquet � Cricket � Jump Rope � Horse Shoes � Dance � Jump Wand � Ladder Ball � Football � Parkour Course � Lawn Darts � Gymnastics � Pogo Stick � Ping Pong � Hockey � Rockwall Climb � Spike Ball � Ice-Skating � Roller Skate � Washers � Lacrosse � Run/Jog � Martial Arts � Scooter (non-electric) Seasonal Activities � Soccer � Skateboard/Rip Stick (2 points each) � Softball � Skip-It � Rake Leaves � Swimming � Trampoline � Walk a Corn Maze � Track & Field � Walk* � Ice-Skating on a lake � Yoga � Y-Flicker � Shovel � Other *Family Walking Program counts! � Build a Snowman/Fort *Please note: You will receive 10 � Snow Fort points total for your participation Sports/Games with Family � Sled in each team sport/organized or Friends � Snowshoe activity per season. Please see (1 point each) below. � Archery Adventures With Your � Badminton Family � Basketball (3 Points each) � Bocce � Walk at the Beach � Bowling � Bike/Hike D and R Canal � Have a catch � Fitness Course at a local park � Cricket � Climb a Lighthouse � Football � Hike Sourland Mountains � Four Square � Hike/Bike ANY State Park Not � Frisbee Listed (please list) � Golf (mini included) � Participate in a 5K � Kickball � Canal Walk and Roll Events � Soccer � Participate in a bike event � Tag (other than TdSB) � Tennis � Ski/Snowboard at a ski � Volleyball mountain � Wall Ball � A “Suggested Place To Visit” � Whiffle Ball from the list Mrs. -

South Portland Parks and Recreation Department

Places to Ice Skate In The locations given in this pamphlet are South Portland just a few suggestions of the many beau- tiful places available for recreation in Parks and Surrounding Towns: Maine. There are many unique and won- derful areas to explore, both locally and Recreation Thompson’s Point– Located at 10 Thomp- across the state, all you have to do is son’s Pt. in Portland, is generally open from pick one! Remember to enjoy any wild- Department November-February (weather permitting). life you may come across from a safe dis- There is a fee of $8.00 to use the rink and tance, for your safety and theirs. skate aids are available to rent for $3.00. Looking for places to For information call (207) 222-3031 or visit their website at snowshoe? www.therinkatthompsonspoint.com. Riverside Golf Course– Located at 1158 Riverside St. in Portland, has two skating ponds. The smaller of the two has lights for night time skating. They are open 24/7 and there are no fees associated with this loca- tion. Or to Ice skate? SOUTH PORTLAND PARKS, Scarborough Ice Rink– Located at 20 Municipal Dr., has an upper and lower rink. RECREATION, AND WATERFRONT The upper rink is for hockey and the lower 21 Nelson Rd, South Portland, ME 04106 is for skating. There is no fee associated with this location. For information call (207) Phone: (207) 767-7650 883-7645. Trails in Surrounding Area: Now That You Have Your Ice Popular Trails to Skates, Where Can You Go? Fuller Farms Preserve– A 220 acre S n o ws h o e preserve located on Broadturn Road in In South Portland: Scarborough. -

O/470/15 67Kb

O-470-15 TRADE MARKS ACT 1994 IN THE MATTER OF TRADE MARK APPLICATION 3072356 BY MULTIBRANDS INTERNATIONAL LTD TO REGISTER THE FOLLOWING TRADE MARK IN CLASS 28: FIREFLY AND AN OPPOSITION THERETO (NO. 403364) BY IIC-INTERSPORT INTERNATIONAL CORPORATION GMBH Background and pleadings 1. This dispute concerns whether the trade mark FIREFLY should be registered for the following goods in class 28: Sports and games equipment for table tennis and tennis; parts and fittings for the aforementioned goods 2. The mark was filed by Multibrands International Ltd (the applicant) on 12 September 2014 and was published for opposition purposes on 10 October 2014. 3. Registration of the mark is opposed by IIC-Intersport International Corporation GmbH (the opponent). Its grounds are under sections 5(1), 5(2)(a) and 5(2)(b) of the Trade Marks Act 1994 (the Act). The opponent relies on the following trade mark registrations: i) Under section 5(2)(b), the opponent relies on International Registration (IR) 1052170 which designated the EU for protection on 14 September 2010, with protection being conferred on 23 August 2011. The mark and the goods on which the opponent relies are: Class 28: Sporting articles included in this class, including wrist guards, elbow guards, shoulder pads, ankle pads, shin guards and knee guards; bags adapted to the transport of sports items; protective paddings (parts of sports suits); roller skates, ice skates; skateboards; snowboards, skis, ski, snowboard and snowshoe bindings, ski sticks/poles, scooters (toys). ii) Under sections 5(1)/5(2)(a), the opponent relies on Community trade mark (CTM) registration 2679215 for the mark FIREFLY which was filed on 30 April 2002 and which completed its registration process on 8 August 2003. -

The Contribution of Skate Blade Properties to Skating Speed

THE CONTRIBUTION OF SKATE BLADE PROPERTIES TO SKATING SPEED Michael McGurk, B.Sc. Kin. Submitted in partial fulfillment of the requirements of the degree of Master of Science in Applied Health Sciences (Kinesiology) Faculty of Applied Health Sciences, Brock University St. Catharines, Ontario © December, 2015 Abstract The purpose of the study was to investigate the relative contribution of skate blade properties to on-ice skating speed. Thirty-two male ice hockey players (mean age = 19±2.65 yrs.) representing the Ontario Minor Hockey Association (OMHA; Midget AAA and Junior), Canadian Inter University Sport (CIS: Varsity), Ontario hockey league (OHL) and East Coast Hockey League (ECHL), and the playing positions of forwards (n=18) and defense (n=14) were recruited to participate. Skate related equipment worn by the players for the purpose of the research was documented and revealed that 80% of the players wore Bauer skates, Tuuk blade holders and LS2 skate blades. Subjects completed a battery of eight on-ice skating drills used to measure and compare two aspects of skating speed; acceleration [T1(s)] and total time to complete each drill [TT(s)] while skating on three skate blade conditions. The drills represented skills used in the game of hockey, both in isolation (e.g., forward skating, backward skating, stops and starts, and cornering) and in sequence to simulate the combination of skills used in a shift of game play. The three blade conditions consisted of (i) baseline, represented by the blades worn by the player throughout their current season of play; (ii) experimental blades (EB), represented by brand name experimental blades with manufacturers radius of contour and a standardized radius of hollow; and (iii) customized experimental blades (CEB), represented by the same brand name experimental blades sharpened to the players’ preference as identified in the baseline condition. -

September/October 2004

SEPTEMBER/OCTOBER 2004 TSXTSX Taylor’sTaylor’s BrightBright BeaconBeacon Electricity andand thethe Ice ArenaArena Scheduling forfor Maximum ProfitProfit Dealing with Over-Exuberant Parents Volume 7, Number 2 September/October 2004 Publisher CONTENTS Ice Skating Institute Initiative and Finishiative: Editor Lori Fairchild Keys to Success . .6 by Dr. Jack Vivian Editorial Advisors Peter Martell Patti Feeney Scheduling for Maximum Profit . .8 Print Production and Advertising Sales Manager by Michael Paikin & Robert Mock Carol Jackson Art Director Electricity and the Ice Arena: Cindy Winn Livingston A Hostile Environment for Contributors a Dangerous Necessity . .10 Dave Gorgon/CityTaylor, of Dave Mich. Robert Mock by Albert Tyldesley Michael Paikin Kathy Toon Albert Tyldesley Joint Statement Revision . .16 Jack Vivian The ISI EDGE (USPS 017-078, ISI Fall Instructor and ISSN 1522-4651) is published bimonthly; January/February, Manager Seminars . .17 March/April, May/June, July/ August, September/October, November/December; by the Ice Skating Institute, 17120 Dealing with N. Dallas Pkwy., Ste. 140, Over-Exuberant Parents . .18 Dallas, TX 75248-1187. Annual Subscription Rate by Kathy Toon Taylor Sportsplex is $24.00 per year. Periodicals postage paid at Dallas, TX, and at addi- tional mailing offices. COVER FEATURE POSTMASTER NOTE: Send TSX: Taylor’s Bright Beacon . .20 address changes to ISI EDGE, by Lori Fairchild c/o The Ice Skating Institute, 17120 N. Dallas Pkwy., Ste. 140, Dallas, TX, 75248-1187. Printed in the U.S.A. Judges Pass Update Test . .30 Subscriptions available through membership only. ©2004 by the Ice Skating DEPARTMENTS Institute. Reproduction in whole or in part is prohibit- ed unless expressly autho- CrossCuts News and Notes . -

Arlington Recreation Department Fall 2021/Winter 2022 Program Guide

Arlington Recreation Department Fall 2021/Winter 2022 Program Guide Arlington Recreation… Sign Me Up! Registration Now Open! Sign Up Now ! For more information or to register, please visit www.arlingtonrec.com or call 781-316-3880 Table of Contents Special Events Click on any page to go to that page. Click on any URL to go to that web page or any email address to send an email. Walter V. Moynihan Town Day 5k Run Food & More! • DJ & Bouncy House! General Information ..............................................................................................1 We are back even without an official Ed Burns Ice Skating Arena .............................................................................. 2 Town Day. Register at www.arlingtonrec.com Skating Lessons at the Ed Burns Arena ....................................................3 Day: Saturday Toddler and Youth Programs ....................................................................4 – 6 Date: September 18, 2021 Toddler and Youth Soccer Programs ...................................................7 – 8 Time: Registration starts at 9:00am. Pickleball at Robbins Farm ................................................................................9 Race begins at 10:00 am Adult and High School Fitness Programs.................................................9 Where: Ed Burns Arena , 422 Summer Street Distance: 5K Matt Siegel Youth and Adult Tennis Programs ...................................10 Youth Basketball Programs .............................................................................11 -

(12) Patent Application Publication (10) Pub. No.: US 2002/0104234 A1 Lancon Et Al

US 2002O104234A1 (19) United States (12) Patent Application Publication (10) Pub. No.: US 2002/0104234 A1 LancOn et al. (43) Pub. Date: Aug. 8, 2002 (54) BINDING SYSTEM FOR A SPORTS Publication Classification APPARATUS AND A SPORTS APPARATUS HAVING SUCH ASYSTEM (51) Int. Cl." ................................ A43B 5/04; A43B 5/16 (75) Inventors: Bruno Lancon, Villy Le Pelloux (FR); (52) U.S. Cl. ................................................. 36/122; 36/125 Eddy Yelovina, Saint-Sigismond (FR) Correspondence Address: (57) ABSTRACT GREENBLUM & BERNSTEIN, P.L.C. 1941 ROLAND CLARKE PLACE RESTON, VA 20191 (US) A System for binding a boot on a Support Surface of a Sports (73) Assignee: SALOMON S.A., Metz-Tessy (FR) apparatus, of the type in which the binding System includes a rear binding. The binding System is provided with a front (21) Appl. No.: 10/060,213 binding in the form of a hook that is affixed to the sports (22) Filed: Feb. 1, 2002 apparatus and which demarcates a notch open longitudinally rearwardly and transversely on both sides to receive a front (30) Foreign Application Priority Data transverse rod of the boot. The rear binding longitudinally immobilizes the boot in a position Such that the transverse Feb. 2, 2001 (FR)............................................ O1 O16O2 rod of the boot is maintained within the notch. ent Application Publication Aug. 8, 2002. Sheet 2 of 3 Patent Application Publication Aug. 8, 2002 Sheet 3 of 3 US 2002/0104234 A1 US 2002/0104234 A1 Aug. 8, 2002 BINDING SYSTEM FOR A SPORTS APPARATUS the Snowshoe can prove inadequate when the Snowshoe is AND A SPORTS APPARATUS HAVING SUCH A used in Steep slopes. -

History of Macgregor

THE HISTORY OF MACGREGOR 1829 to 1979 by Robert D. Rickey May 15, 1979 .. ' c-1979 l ,.. ," V • .F! ..,, " THE HISTORY OF MACGREnOR INDEX .,. Chapter I --MacGregor's Origin and Early History (1829-1896) ••••Pages 1-2 : ~ ' ,-.' " " . .: , Chapter II--MacGregor's Entry Into Golf (189?-1919) ••••••••••••Pages 3-5 ';' .- . .' Chapter III-MacGregor in the Roaring T~enties •••••••••••••••••••Pages 6-9 '... .;. " Chapter IV--The Depression Years and MacGregor's Sale to Goldsmith.Pagesl0-17 Chapter V---World War II•••••••• '.' •••• '••••••••••••••••0 ••••••••••Pages 18-21 ' ExPlosion(1945~1958) ., Chapter VI--MacGregor"s Post-War •••••••••••pages 22-30 Chapter VII-The Brunswick Years (1958~1976) •••••••••••••••••••••pages 31-38 Chapter VIII-MacGregor the Innovators ...' " Famous Products and Features••••••• ~ •••••••••••••••Pages 39-51 Chapter IX--Marketing Philosophy, or "Selling the Sizzle"•••••••Pages 52-68 : .. :" Chapt.er X--About the Author.••••••.••••••.•...•••..•••••••••••..Page 69. Chapter XI-References t •••••••••••••••••• t •••••••••••• e ••••••••••Page 70 ,".' .' v : ;. " . .; . " :. ~ ' . MACGREGOR'S ORIGIN AND EARLY· HIS'rORY -- 1829-1896 Archibald and Ziba Crawford had a dream "like so many other young men who had immigrated from their native England in the early 1800·s. Their dr,eam was to go west to the Northwest Territory where opportunity seemed limitless. Leaving upper Ne~ ~ork State, where they had initially, but temporarily settled" they headed west, first by wagon and then by boat, eventually reaching the Ohio River where they continued their trek west. Theystopped to visit friends who had settl~d in Pittsburgh, Marietta and . Portsmouth, but each time decided to head further west where settlers sent back reports of greater opportunity. They stopped briefly also at Cincinnati and there le~rned about an even newer settlement 50 miles north, which was called Dayton, named after a general, Jonathan Dayton, who had led some of the original settlers into that area and then stayed to successfully fight off the Indians. -

The Drowned Girl Karen Brown Gonzalez University of South Florida

University of South Florida Scholar Commons Graduate Theses and Dissertations Graduate School 3-27-2008 The Drowned Girl Karen Brown Gonzalez University of South Florida Follow this and additional works at: https://scholarcommons.usf.edu/etd Part of the American Studies Commons Scholar Commons Citation Gonzalez, Karen Brown, "The Drowned Girl" (2008). Graduate Theses and Dissertations. https://scholarcommons.usf.edu/etd/265 This Dissertation is brought to you for free and open access by the Graduate School at Scholar Commons. It has been accepted for inclusion in Graduate Theses and Dissertations by an authorized administrator of Scholar Commons. For more information, please contact [email protected]. The Drowned Girl by Karen Brown Gonzalez A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy Department of English College of Arts and Sciences University of South Florida Co-Major Professor: Rita Ciresi, M.F.A. Co-Major Professor: Hunt Hawkins, Ph.D. A. Manette Ansay, M.F.A. William T. Ross, Ph.D. Date of Approval: March 27, 2008 Keywords: stories, women, Connecticut, suburbia, adultery © Copyright 2008, Karen Brown Gonzalez The girl is leagues and leagues away from the first kiss of prologue, but she, throat caked with mud, white skin scaled verdigris, must be the message within the bottle. —Eve Alexandra, “The Drowned Girl” Acknowledgments Grateful acknowledgment is made to the following publications for publishing portions of this work in slightly altered form: “Send Me” in American Fiction: The Best Unpublished Short Stories by Emerging Writers, Number 4, 1992, “Affairs of a Career Girl” and “Tropical Passions” as Things I Did While You Were Gone, in Epoch, Vol.