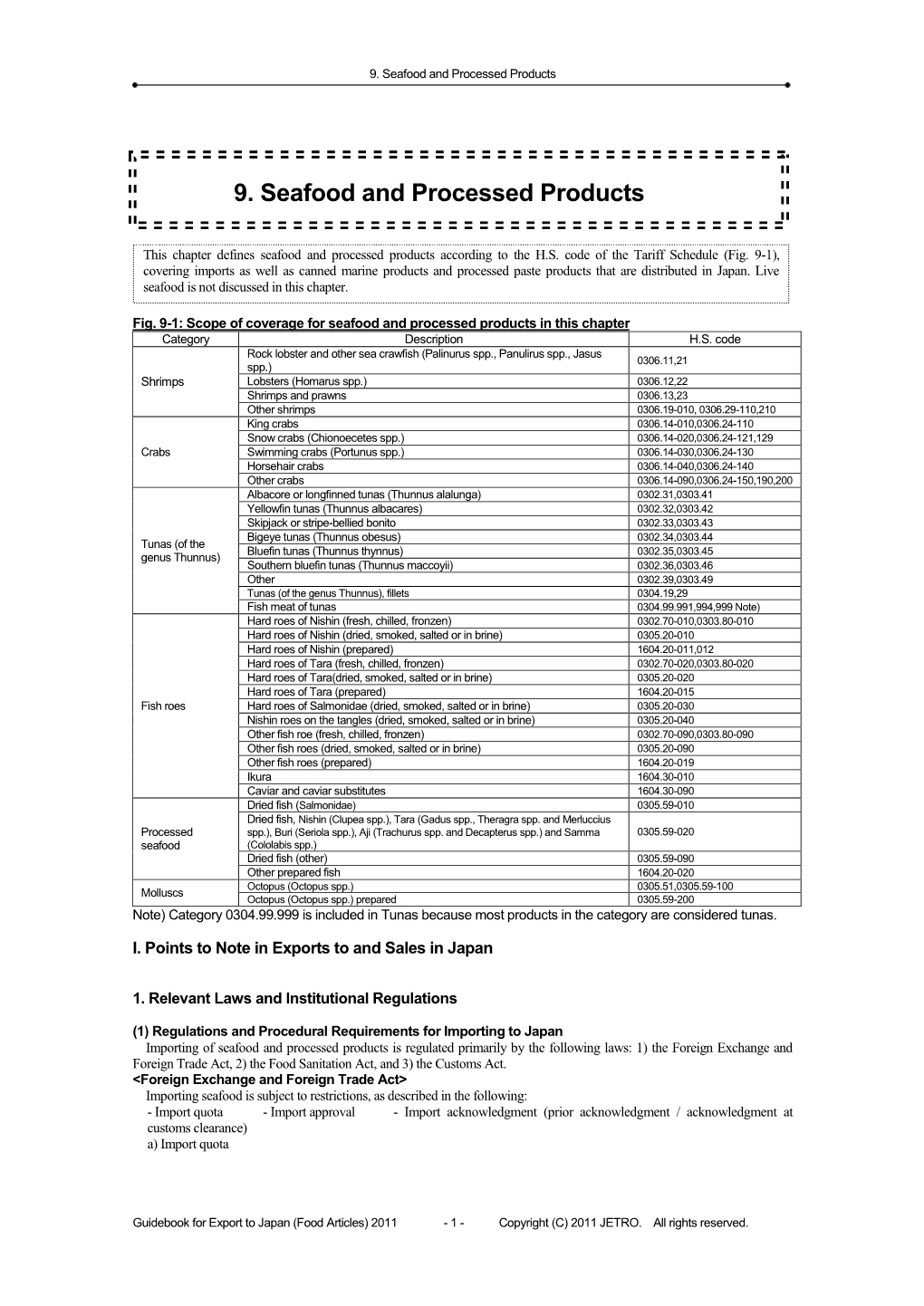

9. Seafood and Processed Products

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mycological Evaluation of Smoked-Dried Fish Sold at Maiduguri Metropolis, Nigeria: Preliminary Findings and Potential Health Implications

Original Article / Orijinal Makale doi: 10.5505/eurjhs.2016.69885 Eur J Health Sci 2016;2(1):5-10 Mycological Evaluation of Smoked-Dried Fish Sold at Maiduguri Metropolis, Nigeria: Preliminary Findings and Potential Health Implications Nijerya’da Maiduguri Metropolis’te satılan tütsülenmiş balıkların mikolojik değerlendirilmesi: Ön bulgular ve sağlığa potansiyel etkileri 1 2 3 Fatima Muhammad Sani , Idris Abdullahi Nasir , Gloria Torhile 1Department of Medical Laboratory Science, College of Medical Sciences University of Maiduguri, Borno State, Nigeria 2Department of Medical Microbiology, University of Abuja Teaching Hospital, Gwagwalada, FCT Abuja, Nigeria 3Department of Medical Microbiology, Federal Teaching Hospital Gombe, Gombe, Nigeria ABSTRACT Background: Smoked-dried fish are largely consumed as source of nutrient by man. It has been established that fish food can act as vehicle for transmission of some mycological pathogens especially in immunocompromised individuals. Methods: Between 7th October 2011 and 5th January 2012, a total of 100 different species of smoke-dried fish comprising 20 each of Cat fish (Arius hendeloti), Tilapia (Oreochromis niloticus), Stock fish (Gadus morhua), Mud fish (Neoxhanna galaxiidae) and Bonga fish (Enthalmosa fimbriota) were processed and investigated for possible fungal contamination based on culture isolation using Sabouraud dextrose agar (SDA) and microscopy. Results: Organisms isolated and identified in pure culture were Mucor spp. (36%), Aspergillus niger (35%), Aspergillus fumigatus (6%), Candida tropicalis (3%), Candida stellatoidea (2%), Microsporum audunii (2%), Penicillium spp. (2%), and Trichophyton rubrum (1%) while Mucor spp. and Aspergillus niger (4%); Mucor spp. and Candida tropicalis (3%); Aspergillus fumigatus and Mucor spp. (1%); Aspergillus niger, Candida spp. and Mucor spp. (1%) were isolated in mixed culture. -

A Report on the Sodium Levels of Salted Dry Fish in Chennai And

The Pharma Innovation Journal 2018; 7(11): 01-04 ISSN (E): 2277- 7695 ISSN (P): 2349-8242 NAAS Rating: 5.03 A report on the sodium levels of salted dry fish in TPI 2018; 7(11): 01-04 © 2018 TPI Chennai and recommendations to comply regulation www.thepharmajournal.com Received: 01-09-2018 Accepted: 02-10-2018 A Devi Dharshini, M Latha Mala Priyadharshini, D Baskaran and A Devi Dharshini G Dhinakar Raj College of Food and Dairy Technology, TANUVAS, Abstract Koduveli, Chennai, Tamil Nadu, Regulating the intake of sodium is in need of the hour pertaining to the established health effects of high India sodium consumption. Labeled food products from organized food sectors provide information on sodium M Latha Mala Priyadharshini levels, while in unorganized sector the sodium content of some of the heavily salted food products such Assistant Professor, Vaccine as dry fish goes unnoticed. This report is presented based on the studies from 12 commercial dry fish Research Centre – Bacterial samples collected form Chennai, one of the major sea food export coastal region of India. The samples Vaccine, Centre for Animal were tested for NaCl, sodium and moisture content. The NaCl content was found to be well above 15% in Health Studies, Madhavaram 7 samples, between 10-15% in 2 samples and below 10% in 3 samples. Consequently 9 samples had Milk Colony, Madhavaram, sodium content above 2000 mG/100G and it was evident that NaCl content of more than half the samples Chennai, Tamil Nadu, India was not in compliance with the FSSAI regulations of 10-15% NaCl content by weight of salted dry fish. -

Sakana Sushi & Asian Bistro

SAKANA ENTREES Served w. white rice Substitute Brown Rice $1 / Fried Rice $5 TEL: 952.476.7000 683 Lake Street E. Black Pepper Garlic Curry (GF) Sauteed broccoli, onion, bell pepper in butter pepper garlic soy Sauteed w. onion, bell pepper, broccoli, carrot, and snow peas. SAKANA Wayzata, MN 55391 Chicken 18/ Shrimp 21/ Beef 21 Tofu 17/ Chicken 18/ Shrimp 21/ Tenderloin 22 SUSHI & ASIAN BISTRO www.sakanamn.com Broccoli with Thai Peanut (GF) Chicken 18/ Shrimp 21/ Beef 22 Sauteed choice vegetable of meat w. onion, zucchini, pepper, asparagus. Cashew With Chicken 18/ Shrimp 21/ Beef 22 Sauteed choice of meat w. mixed vegetable and roasted cashews stir SAKANA SUSHI BAR LUNCH SPECIAL fried in chef’s special sweet chili sauce. Teriyaki (GF) 11am - 2:30pm Chicken 18/ Shrimp 21/ Beef 22 served with a side of homemade teriyaki sauce and steamed vegeta- All sushi lunches served with choice of miso soup or house salad bles. Extra Charge for Substitutions Spicy Kung Pao Chicken 18/ Shrimp 21/ Salmon 22 Sauteed choice of meat tossed w. asparagus, bell pepper, onion and peanuts in a house spicy kung pao sauce. Triple Green (GF) Broccoli, asparagus and snow pea w. all white meat chicken in Chinese Sushi Lunch 18 Sushi & Sashimi Combo Lunch 20 Chicken 18/ Shrimp 21/ Beef 22 Chef choice of 6 pcs assorted nigiri sushi Chef choice of 4 nigiri & 6 pcs sashimi ginger brown sauce. with spicy tuna roll and spicy salmon roll Kobe Style Chicken 18/ Shrimp 21/ Beef 22 Stir-fried choice of meat tossed w. -

Downloadable Sushi Guide

Courtesy of www.alighaemi.com THE SUSHI GUIDE – A LIST OF TYPES OF SUSHI 寿司 At over 200 terms I have attempted to compile as comprehensive a list of sushi fish and a guide to sushi terms and sushi terminology as possible. Sushi and its related fish can become confusing and many diners and restaurants, and lesser chefs, casually mistake and confuse the terms and the fish. The guide goes beyond sushi staples like shrimp, salmon and tuna. Many of the items may not be available locally or only have Japanese te rms. Where possible I have tried to indicate seasonality and availability to the alphabetical list of sushi terms and added my own subjective experience tasting the item. Incidentally, in Japan sushi has its own unit of measurement called Kan カン, which acted as a unit of measurement in the Edo Period equal to 3.75 Kg for fish or the equivalent to either 1 or 2 nigirizushi. Some believe it is 1 sushi, while others believe it is for 2 given how they typically come in a set comprised of pairs. Where possible purchase or order male fish. Female fish give part of their nutrients, and associated taste, to their eggs or roe. Additionally, it has been said that if one can pick a specific cut or part of a fish the rear side nearer to the tail is likely better. It has been moving more and is hence less rough. I recommend treating sushi with respect and focusing on quality as opposed to surrendering to the temptation of low-grade or cheap fish at the hands of uninformed restaurant owners and their chefs. -

If You Have Any Food Allergies Or Special Dietary Requirements, Please Inform Your Server Before Ordering

DINNER If you have any food allergies or special dietary requirements, please inform your server before ordering SMALL PLATES *Edamame (boiled green soybeans) 5.50 *Gyoza (Japanese pan fried dumplings) 6.50 *Shrimp Shumai (Pan-fried dumplings served with ponzu sauce) 6.99 Tempura appetizer *Japanese Crab Rangoon (spicy crab & cream cheese, deep fried with eel sauce) 8.99 *Shrimp Tempura (5pc.) (Shrimp lightly battered & deep fried with tempura sauce) 7.50 *O Calamari Tempura (Calamari lightly battered & deep fried with special sauce) 6.50 *Crab Stick Tempura 5pc (crab stick battered & deep fried served with special sauce) 6.50 *Vegetable Tempura (Vegetable lightly battered & deep fried served with tempura sauce) 6.50 *Lemon Chicken Tempura (Chicken lightly battered & deep fried served with lemon sauce) 8.95 *Monkey Brain 9.50 (Lightly fried mushroom stuffed with spicy tuna & crab meat served with spicy sauce) *Heart Attack 9.50 (Battered deep fried jalapeno shells stuffed with spicy tuna and cream cheese) *Boneless Hot Wings (lightly breaded chicken cooked to a golden crisp in buffalo sauce) 8.95 Salads House Salad 2.50 Cucumber Salad 3.00 Seaweed Salad (assorted seaweed with vegetables & special sauce) 5.50 *Consuming raw or uncooked meats, poultry, seafood, shellfish, or eggs may increase your risk of foodborne illness, especially if you have certain medical conditions. Fried Rice Include soup & salad- Hibachi fried rice with steamed carrot and broccoli Combo Fried Rice: *Shrimp & Chicken Fried Rice 14.99 *Chicken Fried Rice 10.99 *Steak -

Amazing Complete Wedding Packages

DINING GUIDE Anthony’s Italian Kitchen, offers home- made Italian cooking using the freshest ingredients, featuring favorites such as pizza, pasta,and sandwiches. Voted “Best in Port- land” for three years. Dine-in and catering services on offer. Beer and wine available. Open 11-8 Mon. through Sat. 151 Middle St #5, Portland; and new location Cumberland County Courthouse, 205 Newbury St. antho- nysitaliankitchen.com, 774-8668. Barnacle Billy’s, known for luxury lobster, steamed clams, large lusty drinks, barbecued chicken, homemade clam chowder & of course, the lobster roll & lobster stew. Features extensive indoor & sundeck seating where guests can enjoy both the beauty of the harbor & the ocean beyond. Perkins Cove, Ogunquit, 646-5575, barnbilly.com Bruno’s Voted Portland’s Best Italian Restaurant by Market Surveys of America, Bruno’s offers a delicious variety of classic Italian, American, and seafood dishes–and they make all of their pasta in-house. Great sandwiches, pizza, calzones, soups, chowders, and salads. Enjoy lunch or dinner ItalIan HerItage Center in the dining room or the Tavern. Casual dining at its best. 33 Allen Ave., 878-9511. EST. 1953 Bull Feeney’s Authentic Irish pub & restaurant, serving delicious from-scratch sandwiches, steaks, seafood & hearty Irish fare, pouring local craft & premium We Specialize in ... imported brews, as well as Maine’s most extensive selection of single malt Scotch Amazing Complete & Irish whiskeys. Live music five nights. Open 7 days, 11:30 a.m.-1 a.m. Kitchen closes at 10 p.m. 375 Fore St., Old Port, Wedding Packages 773-7210, bullfeeneys.com. DiMillo’s Now through December, relax Rooms Accomodate and enjoy Head Chef Melissa Bouchard’s masterful creations. -

Comparison of Surimi and Solubilized Surimi for Kamaboko Production from Farmed Chinook Salmon

COMPARISON OF SURIMI AND SOLUBILIZED SURIMI FOR KAMABOKO PRODUCTION FROM FARMED CHINOOK SALMON By JILL MARIE RICHARDSON B.Sc, The University of Alberta, 1993 A THESIS SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF SCIENCE In THE FACULTY OF GRADUATE STUDIES (Department of Food Science) We accept this thesis as conforming to the required standard THE UNIVERSITY OF BRITISH COLUMBIA April 1999 ©Jill Marie Richardson, 1999 In presenting this thesis in partial fulfilment of the requirements for an advanced degree at the University of British Columbia, I agree that the Library shall make it freely available for reference and study. I further agree that permission for extensive copying of this thesis for scholarly purposes may be granted by the head of my department or by his or her representatives. It is understood that copying or publication of this thesis for financial gain shall not be allowed without my written permission. Department of Food Science. The University of British Columbia Vancouver, Canada Date vTun^ /b. /Qtytf^B) -; Abstract The thesis hypothesis of this research was that farmed chinook salmon could be made into better quality functional kamaboko when made from solubilized frozen surimi than when made from conventional frozen surimi. An 84 day storage study compared kamaboko gel quality made from solubilized and traditional surimi. Fresh farmed chinook salmon (Oncorhynchus tshawytscha) was used to make both solubilized surimi and surimi (control). Solubilized treatments contained varying concentrations of calcium chloride, sodium chloride and water. The Random Centroid Optimization (RCO) program randomly generated concentration values of additives. All surimi treatments (solubilized and control) contained 8.3% cryoprotectants. -

A Survey in Bacteriological Quality of Traditional Dried Seafood Products Distributed in Chon Buri, Thailand

P-ISSN 2586-9000 E-ISSN 2586-9027 Homepage : https://tci-thaijo.org/index.php/SciTechAsia Science & Technology Asia Vol. 24 No. 4 October - December 2019 Page: [102-114] Original research article A Survey in Bacteriological Quality of Traditional Dried Seafood Products Distributed in Chon Buri, Thailand Subuntith Nimrat1,2,*, Namphueng Butkhot2, Sireeporn Samutsan2, Kittikoon Chotmongcol2, Traimat Boonthai3 and Veerapong Vuthiphandchai4 1Department of Microbiology, Faculty of Science, Burapha University, Chon Buri 20131, Thailand 2Environmental Science Program, Faculty of Science, Burapha University, Chon Buri 20131, Thailand 3Biological Science Program, Faculty of Science, Burapha University, Chon Buri 20131, Thailand 4Department of Aquatic Science, Faculty of Science, Burapha University, Chon Buri 20131, Thailand Received 11 April 2019; Received in revised form 15 July 2019 Accepted 24 July 2019; Available online 31 October 2019 ABSTRACT This study aimed to assess physicochemical and bacteriological qualities of dried seafood products distributed in Chon Buri province, Thailand. Forty-four dried seafood samples were collected from local markets and examined for pH, water activity (aw), salt content, numbers of viable bacteria and halophilic and halotolerant bacteria, numbers of Escherichia coli and Staphylococcus aureus and the presence of Salmonella, Vibrio parahaemolyticus and Vibrio cholerae using a standard protocol. Values of pH, aw and salt content in dried seafood products were 5.16 ± 0.04 – 8.63 ± 0.03, 0.221 ± 0.01 – 0.822 ± 0.02 and 0.28 ± 0.03 – 18.92 ± 0.10%, respectively. Numbers of viable bacteria, and halophilic and halotolerant bacteria were 102 – 109 and 102 – 109 CFU g-1, respectively. Main compositions of total viable bacteria, and halophilic and halotolerant bacteria in dried seafood products were Staphylococcus, Bacillus and Pantoae. -

Recipe Books in North America

Greetings How have Japanese foods changed between generations of Nikkei since they first arrived in their adopted countries from Japan? On behalf of the Kikkoman Institute for International Food Culture (KIIFC), Mr. Shigeru Kojima of the Advanced Research Center for Human Sciences, Waseda University, set out to answer this question. From 2015 to 2018, Mr. Kojima investigated recipe books and conducted interviews in areas populated by Japanese immigrants, particularly in Brazil and North American, including Hawaii. His research results on Brazil were published in 2017 in Food Culture No. 27. In this continuation of the series, he focuses on North America. With the long history of Japanese immigration to North America, as well as Nikkei internments during WWII, the researcher had some concerns as to how many recipe books could be collected. Thanks to Mr. Kojima’s two intensive research trips, the results were better than expected. At a time of increasing digitization in publishing, we believe this research is both timely and a great aid in preserving historical materials. We expect these accumulated historical materials will be utilized for other research in the future. The KIIFC will continue to promote activities that help the public gain a deeper understanding of diverse cultures through the exploration of food culture. CONTENTS Feature Recipe Books in North America 3 Introduction Recipe Books Published by Buddhist Associations and Other Religious Groups 10 Recipe Books Published by Nikkei Associations (Excluding Religious Associations) 13 Mobile Kitchen Recipe Books 15 Recipe Books Published by Public Markets and Others 17 Books of Japanese Recipes as Ethnic Cuisine 20 Recipe Books as Handbooks for Living in Different Cultures 21 Hand-written Recipe Books 22 Summary Shigeru Kojima A research fellow at the Advanced Research Center for Human Sciences, Waseda University, Shigeru Kojima was born in Sanjo City, Niigata Prefecture. -

Fishery Publications

76 COMMERCIAL FISHERIES REVIEW Vol. 18, No.5 RECENT FISHERY PUBLICATIONS Sep . No. 434 - Condition of the Middle Atlantic FISH AND WILDLIFE SERVICE Pound- Net Fishery. PUBLICATIONS Sep. No. 435 - School Lunch Fish-Cookery Dem THESE PROCESS EO PUBLICATIONS ARE AVAILAB LE fREE fROM onstrations in Oklahoma. THE OIVISION Of INfORMATION, U. S . fi SH AND WILDLifE SER V ICE, WASHINGTON 25, D. C. TYPES Of PU BLICAT IONS ARE DES IG NATED AS fOLLOWS: Sport Fishery Abstracts, vol. I, no. 3, Abstracts 315-446, 52 pp. processed, January 1956. CfS - CURRENT fiSHERY STATISTICS Of THE UNIT ED ST ATES AND ALASKA. THE f OLLOWING SERVI CE PUBLI CATION IS fOR SALE AND fL - fiSHERY LEAfLETS. SL - STATISTICAL SECTION LISTS Of DEALERS IN AND PRO- IS AVAI L ~B L E ~ ~ THE SUPERINTENDENT Of DOCUMENTS, DUCERS Of fiSHERY PRODUCTS AND BY PRODUCT S. WAS HINGTON 25, D.C. SSR. - fiSH - SPECIAL SCtENT l flC REPORTS --fISHER IES LIMITED DISTRIBUTjON). Fishery Publication Index, 1920-54, Circular 36, SEP. - SEPARATES (REPRINTS fROM COMMERCIAL f iSHERIES 264 pp., proc essed,$T. 50, 1955. This index REVIEW. desc ribes the publications of the United States Bur e au of Fisheries from 1920 to 1940 and fish Number Title e ry publications of the Fish and Wildlife Serv CFS-1267 - Alabama Landings, Novemboer 1955, ice from 1940 to 1954. The index is in three 2 pp. parts: (1) A serial list of the numbers issued CFS-1270 - New Jersey Landings, December 1955, in each publication series; (2) an alphabetical 2 pp. index of authors; and (3) an alphabetical index CFS-1272 - Frozen Fish Report, January 1956, of subjects . -

Fukusuke Japanese Ramen

OPEN HOUR LUNCH MON - THU 11:30 AM - 2:00 PM DINNER MON - THU 5:00 PM - 9:00 PM FRI 11:30 AM - 9:30 PM fukusuke SAT & SUN 11:30 AM - 9:00 PM Japanese Ramen Dining Substitution to Kale Noodle / Udon $1 Extra, Cha-Shu can be substituted with Gyoza or RAMEN Steamed Vegetable SHOYU Shoyu ... SOY SAUCE FLAVOR SHOYU RAMEN 9.79 2 pcs Chashu Pork, Naruto, Bamboo Shoots, Black Mushroom, Seaweed & Green Onion MISO Spicy Miso CHASHUMEN 11.29 5 pcs Chashu Pork, Naruto, Bamboo Shoots, Black Mushroom, Seaweed & Green Onion MISO RAMEN 11.29 2 pcs Chashu Pork, Naruto, Bamboo Shoots, SUPER CHASHUMEN RAMEN 13.79 Black Mushroom, Corn & Green Onion 8pcs Chashu Pork, Naruto, Soft/Hard Boiled Egg, Green Onion & Roasted Garlic Oil SPICY MISO 11.79 2 pcs Chashu Pork, Naruto, Bamboo Shoots, MOYASHI SHOYU RAMEN 11.99 Black Mushroom, Corn, Green Onion, Caramelized Chopped Chashu Pork, Bean Sprout, Jalapeno & Spicy Red Miso Green Onion, Red Onion, Roasted Seaweed MOYASHI MISO RAMEN 12.99 SHOYU RAMEN W/ CHICKEN KARAAGE 11.79 Caramelized Chopped Chashu Pork, Bean Sprout, Deep Fried Chicken Breast, Naruto, Roasted Seaweed, Green Onion, Red Onion & Corn Soft/Hard Boiled Egg & Green Onion SPICY “GARLIC BUTTER CORN” 11.79 3 pcs Chashu Pork, Garlic Butter Corn, Green Onion, Jalapeno & Spicy Red Miso TENNO SEAFOOD RAMEN 14.29 2 pcs Jumbo Shrimps, 2 pcs Mussels, Langostinos, Red Onion, Jalapeno, Cilantro, Green Onion, Bean Sprout, Yuzu Lemon & Spicy Red Miso Super Chashumen SHIO ... SEA SALT FLAVOR SHIO RAMEN 9.79 2 pcs Chashu Pork, Naruto, Bamboo Shoots, Black Mushroom -

NYE Menu 2015-TENKAI

NEW YEARS EVE 2015 Thursday 31st December 2015 TENKAI JAPANESE RESTAURANT BUFFET MENU JAPANESE SOUP KAMA JIRU (salmon head miso soup) COLD DISHES YASAI NIBITASHI (marinated boiled spinach with soya sauce ) TOMATO SALAD (sliced tomato with onion dressing) HIYASHI SOBA (cold Japanese soba noodles) NASU MISO (deep fried egg plant mixed with vegetables & miso sauce) POTATO SALAD ( potato mixed with vegetables & Japanese mayonnaise) TUNA SALAD (poached tuna mixed with vegetables & Japanese mayonnaise) NOODLES SALAD (cold Japanese udon salad) KAISEN SUNOMONO (marinated seafoods & seaweed with sweet sour sauce) SPICY TUNA SALAD (fresh tuna mixed with seaweed, vegetables & chili mayonnaise sauce) NIGIRISUSHI TUNA, SALMON, SNAPPER, PRAWN, TAMAGO, SQUID SUSHI ROLL TUNA, SALMON, CRAB CAKE, TAMAGO, CUCUMBER, AVOCADO, TUNA SALAD, SALMON SALAD, FUTOMAKI, CHICKEN TERIYAKI SASHIMI TUNA, SALMON, SNAPPER TEPPANYAKI BEEF RIB EYE, LAMB LEG, OX TOUNGE, US PORK RIB, CHICKEN, PRAWN, COD(GINDARA), SLIPPER LOBSTER , LOBSTER MEDALLION,ONION, ZUCCHINI TEMPURA PRAWN, COD(GINDARA), SOFT SHELL CRAB, WHITE BAIT FISH, ONION, CARROT, GREEN BEAN KUSHI YAKI CHICKEN , CHICKEN DUMPLING,(Japanese grilled skewers) PRAWN, BABY OCTPUS, SQUID *Items are subject to change without prior notice due to market conditions NEW YEARS EVE 2015 Thursday 31st December 2015 TENKAI JAPANESE RESTAURANT BUFFET MENU CHAFING DISHES CHICKEN KATSU (crumbed chicken cutlet with plum sauce) NIKUJAGA (sliced beef sirloin with sweet soya sauce) PORK SPARE RIBS (pork ribs with Japanese Rib sauce) YAKI