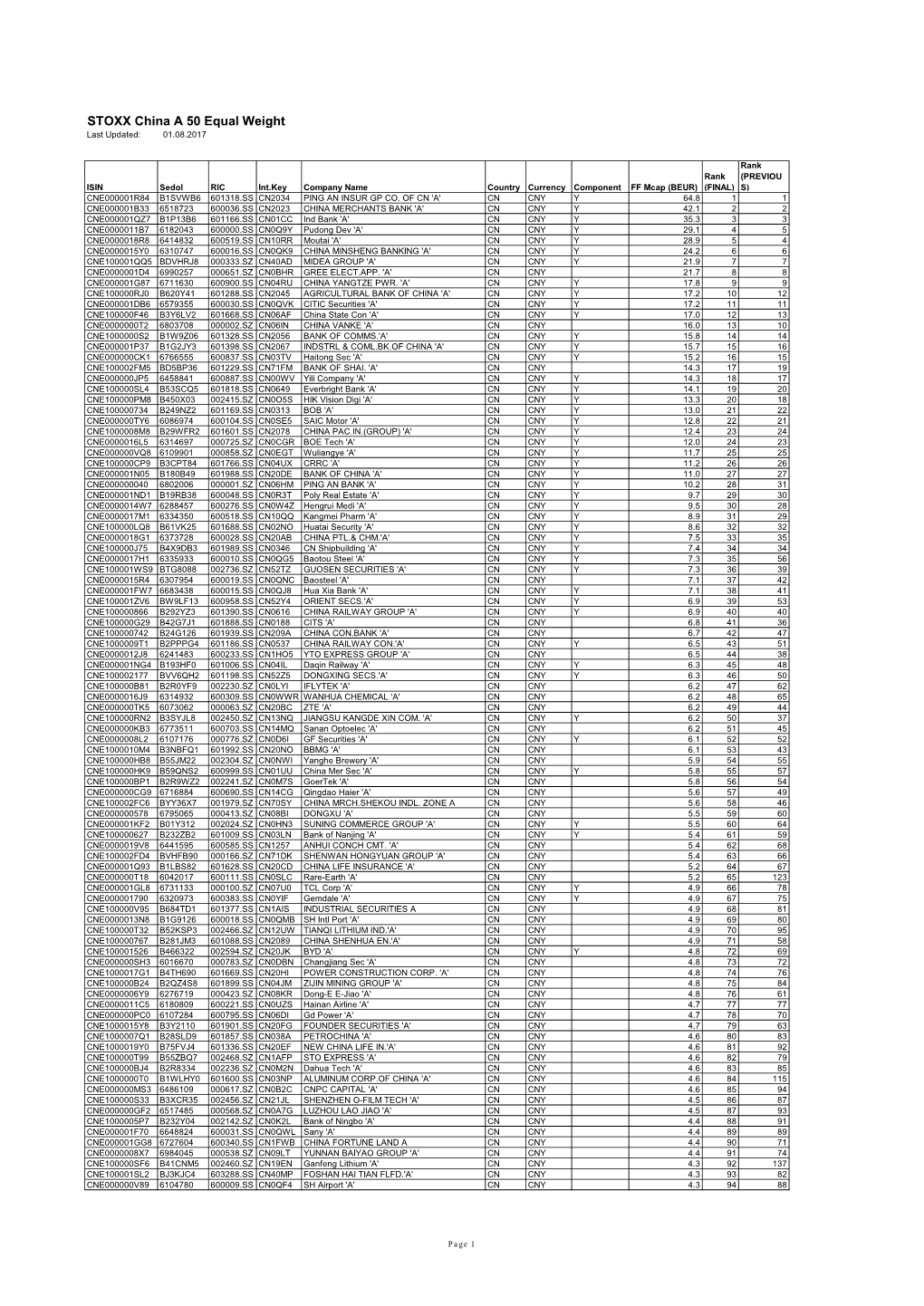

STOXX China a 50 Equal Weight Last Updated: 01.08.2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Evergrande Real Estate Group (Stock Code: 3333.HK)

Evergrande Real Estate Group (Stock code: 3333.HK) 1 Table of Contents • ExecuBve Summary Page 3 • SecBon 1: Fraudulent AccounBng Masks Insolvent Balance Sheet Page 13 • SecBon 2: Bribes, Illegally Procured Land Rights and Severe Idle Land LiabiliBes Page 27 • Secon 3: Crisis Page 39 • SecBon 4: Chairman Hui Page 47 • SecBon 5: Pet Projects Page 52 • Appendix: Recent development Page 57 2 ExecuBve Summary 3 Evergrande Valuaon Evergrande has a market capitalizaon of US$ 8.9bn and trades at 1.6x book value. By market capitalizaon, Evergrande ranks among the top 5 listed Chinese properBes companies. [1] [2] RMB, HKD and USD in billions, except as noted 6/15/2012 in RMB in HKD in USD Share Price 3.80 4.60 0.59 Total Shares Outstanding 14.9 Market Capitalization 56.7 68.7 8.9 + Current Borrowing 10.2 + Non-Current Borrowing 41.5 + Income Tax Liability 11.6 + Cash Advance from Customers 31.6 Subtotal: Debt 95.0 115.0 14.8 - Unrestricted cash (20.1) (24.3) (3.1) Net debt 74.9 90.7 11.7 Enterprise value 131.6 159.4 20.6 Book Value as of 12/31/2011 34.9 Ratio of Equity Market Capitalization to Book Value 1.6x Note: Assuming RMB /USD exchange rate of 6.4 and HKD/ USD exchange rate of 7.75 1] As of June 15, 2012, Evergrande ranked 5th in market capitalizaon behind China Overseas (668 HK), Vanke (000002 SZ), Poly Real Estate (6000048 SH) and China Resources Land (1109 HK) 2] Balance sheet data as of December 31, 2011 4 PercepBon • Evergrande, which primarily operates in 2nd and 3rd Ber ciBes, has grown its assets 23 fold since 2006, becoming the largest condo/ home developer in China. -

Offshore Wind Diffusion

energies Article The (R)evolution of China: Offshore Wind Diffusion Thomas Poulsen 1,* and Charlotte Bay Hasager 2 ID 1 Department of Materials and Production, Aalborg University, A.C. Meyers Vænge 15, 2450 Copenhagen SV, Denmark 2 Department of Wind Energy, Technical University of Denmark, Risø Campus, Frederiksborgvej 399, 4000 Roskilde, Denmark; [email protected] * Correspondence: [email protected] or [email protected]; Tel.: +45-2383-1621 or +45-212-661-88 Received: 30 October 2017; Accepted: 13 December 2017; Published: 16 December 2017 Abstract: This research presents an industry level gap analysis for Chinese offshore wind, which serves as a way to illuminate how China may fast track industry evolution. The research findings provide insight into how the Chinese government strongly and systematically decrees state-owned Chinese firms to expand into overseas markets to speed up learning efforts. Insights are offered regarding the nation-level strategic plans and institutional support policies mobilized by China in order to be able to conquer market shares internationally by building a strong home market and then facilitating an end-to-end and fully financed export solution. This is interesting in itself and in particular so because it now also includes complex billion-dollar megaprojects such as turnkey offshore wind farm assets with an expected lifespan of 30+ years. Research findings are provided on how European and Chinese firms may successfully forge long-term alliances also for future Chinese wind energy export projects. Examples of past efforts of collaboration not yielding desired results have been included as well. At policy level, recommendations are provided on how the evolution of the Chinese offshore wind power industry can be fast-tracked to mirror the revolutionary pace, volume, and velocity which the Chinese onshore wind power industry has mustered. -

Shanghai Municipal Commission of Commerce Belt and Road Countries Investment Index Report 2018 1 Foreword

Shanghai Municipal Commission of Commerce Belt and Road Countries Investment Index Report 2018 1 Foreword 2018 marked the fifth year since International Import Exposition Municipal Commission of Commerce, President Xi Jinping first put forward (CIIE), China has deepened its ties releasing the Belt and Road Country the Belt and Road Initiative (BRI). The with partners about the globe in Investment Index Report series Initiative has transformed from a trade and economic development. to provide a rigorous framework strategic vision into practical action President Xi Jinping has reiterated at for evaluating the attractiveness during these remarkable five years. these events that countries should of investing in each BRI country. enhance cooperation to jointly build Based on extensive data collection There have been an increasing a community of common destiny and in-depth analysis, we evaluated number of participating countries for all mankind , and the Belt and BRI countries' (including key and expanding global cooperation Road Initiative is critical to realizing African nations) macroeconomic under the BRI framework, along with this grand vision. It will take joint attractiveness and risks, and identified China's growing global influence. By efforts and mutual understanding to key industries with high growth the end of 2018, China had signed overcome the challenges ahead. potential, to help Chinese enterprises BRI cooperation agreements with better understand each jurisdiction's 122 countries and 29 international Chinese investors face risks in the investment environment. organizations. According to the Big BRI countries, most of which are Data Report of the Belt and Road developing nations with relatively The Belt and Road Country (2018) published by the National underdeveloped transportation and Investment Index Report 2017 Information Center, public opinion telecommunication infrastructures. -

Annual Report 2015

CSG HOLDING CO., LTD. ANNUAL REPORT 2015 Chairman of the Board: ZENG NAN March 2016 CSG Annual Report 2015 Section I Important Notice, Content and Paraphrase Board of Directors and the Supervisory Committee of CSG Holding Co., Ltd. (hereinafter referred to as the Company) and its directors, supervisors and senior executives hereby confirm that there are no any fictitious statements, misleading statements, or important omissions carried in this report, and shall take all responsibilities, individual and/or joint, for the facticity, accuracy and completeness of the whole contents. Mr. Zeng Nan, Chairman of the Board, CFO Mr. Luo Youming and principal of the financial department Mr. Ding Jiuru confirm that the Financial Report enclosed in this 2015 Annual Report is true, accurate and complete. All directors were present the meeting of the Board for deliberating the annual report of the Company in person. This report involves futures plans and some other forward-looking statements, which shall not be considered as virtual promises to investors. Investors are kindly reminded to pay attention to possible risks. The deliberated and approved profit distribution plan in the Board Meeting is: taking total shares of 31 December 2015 as the radix, sending cash dividends of RMB 3.0 (tax included) per 10 shares to all shareholders, neither bonus shares being sent, nor converting capital reserve into share capital. Existing industry risk, market risk and exchange rate risk have been well-described in this report, please found details of the risk factors and countermeasures of future development described in Section IV Discussion and Analysis of the Management. -

Lista Telefona Koji Podrzavaju Mbanking

Spisak mobilnih uređaja koje podržava mBanking Sparkasse Bank Proizvođać Model Proizvođać Model Acer Liquid MT Dell 101DL Acer E350 Dell Streak Acer S500 Dell Dell Venue Acer Z110 Enspert vanitysmart Acer E330 Enspert orion Acer AT390 Enspert CINK SLIM Acer E310 Enspert CINK KING Acer E350 Foxconn Boston Acer Liquid Foxconn International vizio VP800 Holdings Limited Acer S300 Foxconn International XOLO Acer Acer E320-orange Holdings Limited Anydata Philips W632 Foxconn International SHARP SH631W Anydata Philips W626 Holdings Limited Anydata Philips W832 Foxconn International ViewPhone3 Holdings Limited Anydata Philips W336 Foxconn International XOLO_X1000 Anydata Philips W536 Holdings Limited Archos Archos 97 Xenon Foxconn International Changhong H5018 Asus ASUS Transformer Pad Infinity Holdings Limited Asus PadFone Foxconn International MUSN COUPLE Holdings Limited Asus ME171 Foxconn International SH530U Asus PadFone Infinity Holdings Limited Asus PadFone 2 Foxconn International WellcoM-A99 Cellon HW-W820 Holdings Limited Coolpad Coolpad 5010 Foxconn International Axioo-VIGO410 Holdings Limited Coolpad MTS-SP150 Foxconn International SHARP SH630E Coolpad 801E Holdings Limited Coolpad Coolpad 7019 Foxconn International ViewSonic-V350 Coolpad 5860E Holdings Limited Coolpad PAP4000 Foxconn International Commtiva-HD710 Holdings Limited Coolpad 7266 Foxconn International WellcoM-A800 Coolpad 8180 Holdings Limited Coolpad 5860 Foxconn International SHARP SH837W Coolpad Coolpad 5210 Holdings Limited Coolpad 9120 Foxconn International CSL-MI410 -

The Annual Report on the Most Valuable and Strongest Real Estate Brands June 2020 Contents

Real Estate 25 2020The annual report on the most valuable and strongest real estate brands June 2020 Contents. About Brand Finance 4 Get in Touch 4 Brandirectory.com 6 Brand Finance Group 6 Foreword 8 Executive Summary 10 Brand Finance Real Estate 25 (USD m) 13 Sector Reputation Analysis 14 COVID-19 Global Impact Analysis 16 Definitions 20 Brand Valuation Methodology 22 Market Research Methodology 23 Stakeholder Equity Measures 23 Consulting Services 24 Brand Evaluation Services 25 Communications Services 26 Brand Finance Network 28 © 2020 All rights reserved. Brand Finance Plc, UK. Brand Finance Real Estate 25 June 2020 3 About Brand Finance. Brand Finance is the world's leading independent brand valuation consultancy. Request your own We bridge the gap between marketing and finance Brand Value Report Brand Finance was set up in 1996 with the aim of 'bridging the gap between marketing and finance'. For more than 20 A Brand Value Report provides a years, we have helped companies and organisations of all types to connect their brands to the bottom line. complete breakdown of the assumptions, data sources, and calculations used We quantify the financial value of brands We put 5,000 of the world’s biggest brands to the test to arrive at your brand’s value. every year. Ranking brands across all sectors and countries, we publish nearly 100 reports annually. Each report includes expert recommendations for growing brand We offer a unique combination of expertise Insight Our teams have experience across a wide range of value to drive business performance disciplines from marketing and market research, to and offers a cost-effective way to brand strategy and visual identity, to tax and accounting. -

Q3 2019 Holding Lijst

Aandelen Obligaties 360 Security Technology Inc 3SBio Inc 3i Group PLC Abbott Laboratories 3M Co AbbVie Inc 3SBio Inc Acadia Healthcare Co Inc 51job Inc adidas AG 58.com Inc ADLER Real Estate AG AAC Technologies Holdings Inc ADO Properties SA ABB Ltd Aermont Capital LLP Abbott Laboratories AES Corp/VA AbbVie Inc African Development Bank ABIOMED Inc Aggregate Holdings SA Aboitiz Equity Ventures Inc Air France-KLM Absa Group Ltd Air Transport Services Group I Accell Group NV Akamai Technologies Inc Accenture PLC Aker BP ASA Accor SA Albertsons Investor Holdings L Acer Inc Alcoa Corp ACS Actividades de Construccio Alfa SAB de CV Activision Blizzard Inc Alibaba Group Holding Ltd Acuity Brands Inc Allergan PLC Adecco Group AG Alliander NV adidas AG Allianz SE Adobe Inc Ally Financial Inc Advance Auto Parts Inc Almirall SA Advanced Info Service PCL Altice USA Inc Advanced Micro Devices Inc Amazon.com Inc Advantech Co Ltd America Movil SAB de CV Aegon NV American International Group I AES Corp/VA Amgen Inc Affiliated Managers Group Inc ams AG Agilent Technologies Inc ANA Holdings Inc AIA Group Ltd Anglian Water Group Ltd Aier Eye Hospital Group Co Ltd Anglo American PLC Air LiQuide SA Anheuser-Busch InBev SA/NV Air Products & Chemicals Inc Antero Resources Corp AirAsia Group Bhd APA Group Airbus SE APERAM SA Aisino Corp Aphria Inc Akamai Technologies Inc Apollo Global Management Inc Aker BP ASA Apple Inc Akzo Nobel NV Aptiv PLC Alcon Inc Arab Republic of Egypt Alexandria Real Estate Equitie Arconic Inc Alfa Laval AB ARD Holdings SA Alfa SAB de -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

China's Supply-Side Structural Reforms: Progress and Outlook

China’s supply-side structural reforms: Progress and outlook A report by The Economist Intelligence Unit www.eiu.com The world leader in global business intelligence The Economist Intelligence Unit (The EIU) is the research and analysis division of The Economist Group, the sister company to The Economist newspaper. Created in 1946, we have 70 years’ experience in helping businesses, financial firms and governments to understand how the world is changing and how that creates opportunities to be seized and risks to be managed. Given that many of the issues facing the world have an international (if not global) dimension, The EIU is ideally positioned to be commentator, interpreter and forecaster on the phenomenon of globalisation as it gathers pace and impact. EIU subscription services The world’s leading organisations rely on our subscription services for data, analysis and forecasts to keep them informed about what is happening around the world. We specialise in: • Country Analysis: Access to regular, detailed country-specific economic and political forecasts, as well as assessments of the business and regulatory environments in different markets. • Risk Analysis: Our risk services identify actual and potential threats around the world and help our clients understand the implications for their organisations. • Industry Analysis: Five year forecasts, analysis of key themes and news analysis for six key industries in 60 major economies. These forecasts are based on the latest data and in-depth analysis of industry trends. EIU Consulting EIU Consulting is a bespoke service designed to provide solutions specific to our customers’ needs. We specialise in these key sectors: • Consumer Markets: Providing data-driven solutions for consumer-facing industries, we and our management consulting firm, EIU Canback, help clients to enter new markets and be successful in current markets. -

INTERIM REPORT 中期報告 2017 深圳國際控股有限公司 Interim Report 2017 中期報告

Shenzhen International Holdings Limited INTERIM REPORT 中期報告 2017 深圳國際控股有限公司 Interim Report 2017 中期報告 (Incorporated in Bermuda with limited liability) (於百慕達註冊成立之有限公司) Stock Code 股份代號:00152 CONTENTS Corporate Profile 2 Independent Review Report 25 Corporate Information 4 Interim Consolidated Balance Sheet 26 Financial Highlights 5 Interim Consolidated Income Statement 28 Management Discussion and Analysis Interim Consolidated Statement Overall Review 6 of Comprehensive Income 29 Logistic Business 8 Interim Consolidated Statement of Changes in Equity 30 Toll Road Business 15 Interim Condensed Consolidated Other Investments 19 Statement of Cash Flows 32 Financial Position 20 Notes to the Unaudited Interim Financial Information 33 Outlook for the Second Half of 2017 23 Supplementary Information 62 Human Resources 24 CORPORATE PROFILE Shenzhen International Holdings Limited is a company incorporated in Bermuda with limited liability and is listed on the main board of the Stock Exchange of Hong Kong. The Group is principally engaged in the investment, construction and operation of logistic infrastructure facilities, as well as providing various value-added logistic services to customers leveraging its infrastructure facilities and information services platform. Shenzhen Investment Holdings Company Limited, the controlling shareholder of the Company, is a corporation wholly-owned by State-owned Assets Supervision and Administration Commission of the People’s Government of Shenzhen Municipal and, as at the date of this report, holds approximately -

STOXX Greater China 80 Last Updated: 01.08.2017

STOXX Greater China 80 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.9 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 80.6 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.5 3 3 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 51.5 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 50.8 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.3 6 6 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 32.0 7 9 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.8 8 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 31.1 9 8 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.0 10 10 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.6 11 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 20.0 12 11 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.0 13 13 TW0003008009 6451668 3008.TW TW05PJ LARGAN Precision TW TWD Y 19.7 14 15 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.4 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.4 17 19 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. -

China's Rise in Artificial Intelligence

EQUITY RESEARCH | August 31, 2017 Piyush Mubayi +852-2978-1677 [email protected] Goldman Sachs (Asia) L.L.C. Elsie Cheng +852-2978-0820 [email protected] China's Rise in Goldman Sachs (Asia) L.L.C. Heath P. Terry, CFA +1-212-357-1849 [email protected] Artificial Intelligence Goldman Sachs & Co. LLC The New New China Andrew Tilton For the exclusive use of [email protected] +852-2978-1802 China has emerged as a major global contender in the field of AI, the apex [email protected] technology of the information era. In this report, we set out China’s Goldman Sachs (Asia) L.L.C. ambitious top-down plans, the factors (talent, data and infrastructure) Tina Hou that make China unique and the companies (Baidu, Alibaba and Tencent) +86(21)2401-8694 that are making it happen. We believe the development of an ‘intelligent [email protected] economy’ and ‘intelligent society’ by 2030 in China has the potential to Beijing Gao Hua Securities drive productivity improvement and GDP growth in the next two decades. Company Limited Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html.