Form 990-PF Return of Private Foundation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Jewish Observer L DR

CHESHVAN, 5738 I OCTOBER 1977 VOLUME XII, NUMBER 8 fHE EWISH SEVENTY FIVE CENTS "Holocaust" - a leading Rosh Yeshiva examines the term and the tragic epoch it is meant to denote, offering the penetrating insights of a Daas Torah perspective on an era usually clouded with emo tion and misconception. "Holocaust Literature" - a noted Torah educator cuts a path through ever-mounting stacks of popular and scholarly works on "Churban Europe," highlighting the lessons to be learned and the pitfalls to be avoided. THE JEWISH BSERVER in this issue "Holocaust" - A Study of the Term, and the Epoch it is Meant to Describe, from a discourse by Rabbi Yitzchok Hutner K"t:l•7w. translated by Chaim Feuerman and Yaakov Feitman ......... .3 Dealing With "Ch urban Europa", THE JEWISH OB.SERVER is publi$ed a review article by Joseph Elias .................................................... 10 monthly, excePt July and August, by the Agudath Israel of America, 5 Beekman St., New York, N.Y. Thumb Prints, Simcha Bunem Unsdorfer r, .. , ................................ 19 10038. Second class postage paid at New York, N.Y. Subscription: Torah Ambassadors at large $7.50 per year; Two years, $13.00; Three years, $18.00; outside of the I. Bringing Torah to the Valley, Moshe Turk ....................... 22 United States $8.50 per year. II. The Mexico City Junket, Single copy seventy~five cents. Printed in the U.S.A. Suri Rosenberg and Rochel Zucker ........................ 25 Letters to the Editor ............................................................................ 30 RABBI N1ssoN WotrJN Editor Subscribe ------Clip.andsave------- Editorial Board The Jewish Observer l DR. ERNST L. BODENHEIMER Chairman Renew 5 Beekman Street/ New York, N.Y. -

When Unity Reigned: Yom Ha-Azma’Ut 1954

51 When Unity Reigned: Yom ha-Azma’ut 1954 By: ELAZAR MUSKIN A number of years ago while I rummaged through a box of old pa- pers and memorabilia that belonged to my late father, Rabbi Jacob Muskin z”l, of Cleveland, Ohio, a stained yellow mimeographed paper fell on my lap. As I picked it up, I began to realize that I was holding an historic document. The paper was folded in half and on the front cover it read, “Sixth Anniversary Celebration Israel Independence Day, Sunday May 9, 1954, Iyar 6, 5714.” The front cover also indicated the loca- tion of the celebration, The Taylor Road Synagogue Auditorium in Cleveland Heights, Ohio and noted that the event was sponsored by an organization called “The Orthodox Jewish Association of Cleveland.”1 1 In my letter to Rabbi Shubert Spero dated 2 July, 1997 I asked him a number of questions including: What was this sponsoring organization “The Orthodox Jewish Association”? How long did it exist? Who was Dr. David Magid, its President? In his letter dated 19 August, 1997 Rabbi Spero responded: “Shortly after my arrival in Cleveland I was called to a meeting with Rabbis E.M. Bloch and C.M. Katz z”l (who were very close to my late uncles, H.I. and B.E. Spero z”l, who were instrumental in bringing the Yeshiva to Cleveland) who told me that the Roshei Yeshiva did not wish to isolate themselves from the ‘city’ but rather saw themselves as a part of the general commu- nity and, given the sad state of Orthodoxy, felt a religious obligation to work for the ideals of Torah. -

Roster of Religious Personnel Page 1 Compiled by Earl Pruce

4/25/2019 Roster of Religious Personnel Page 1 Compiled by Earl Pruce Name Title Position Congregation / Organization Location Date Death Date Abelow, Peter (Dr.) Principal Beth Tfiloh Congregation High School --1989 Abramowitz, Abraham Rabbi Anshe Neisen Congregation Nov. 15, 1926 Abramowitz, Abraham Rabbi Tifereth Israel Congregation of Forest Park Forest Park Nov. 15, 1926 Abrams, Mendel L., Dr. Rabbi Beth Torah Congregation Hyattsville 1989, 1996, 1997 Abramson, Barry Ephraim Rabbi Shochet 1999- Abramson, Mordechai Rabbi Shochet 1989 Ackerman, Everett S. Rabbi Moses Montefiore Emunath Israel Woodmoor Hebrew Congregation 1978-1998? Ackerson, Mitchell S. Rabbi Chaplain Sinai Hospital 1993-- Adashek, Steven Mohel M.D. Mohel, 2004 Adler, Abraham Rabbi Anshe Sphard Congregation Feb. 17, 1920 Adler, Elan Rabbi Associate Rabbi Beth Tfiloh Congregation July 1993--Jan 2001 Adler, Elan Rabbi "Rabbi Designate" Moses Montefiore Anshe Emunah, Liberty Jewish Center Jan 2001 Adler, Joseph Cantor Har Zion Congregation 1928?-1933 Adler, L. Rabbi Beth Hamedrosh Hagodol Congregation Adler, Leon Rabbi Temple Emanuel Kensington 1953-1988 1988 Aftel, Jeffrey Rabbi Hebrew Day School Montgomery County 2001 Agus, Jacob B. Rabbi Beth El Congregation 1950-1980 Sept. 26, 1986 Albrecht, Avraham (Avi) Cantor Beth Tfiloh Congregation 1996- Alpern, Ian Cantor Beth Israel Congregation 1969-- Alter,Joel Rabbi Shoshana S Cardin Community H S Baltimore 2002 Altman, Solomon B. Cantor Har Zion Congregation 1934-5, 1941 Altmeyer, ? Cantor Temple Oheb Shalom 1853? Altshul, William Rabbi Hebrew Academy of Greater Washington Silver Spring 1996, 1997,2004 Amerling, Suzanne (Dr.) Baltimore Hebrew Congregation Religious School 1989, 1990 Anemer, Gedaliah Rabbi Yeshiva Boys School Silver Spring 1989 Anemer, Gedaliah Rabbi Young Israel Shomrai Emunah Congregation Silver Spring 1989-92, 1996, 1997 Ansell (Anshel), Rev. -

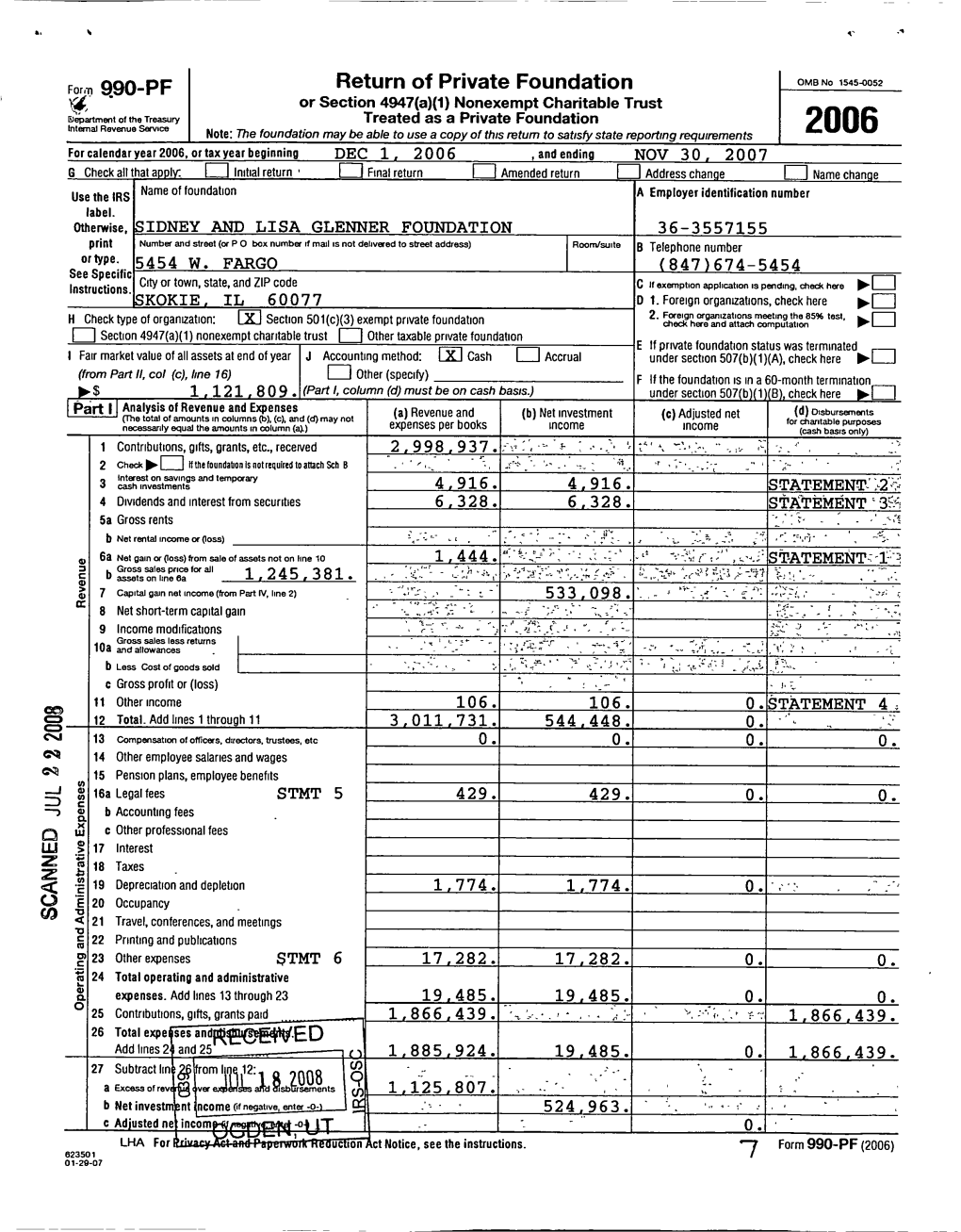

T S Form, 990-PF Return of Private Foundation

t s Form, 990-PF Return of Private Foundation OMB No 1545-0052 or Section 4947(a)(1) Nonexempt Charitable Trust Department of the Treasury Treated as a Private Foundation Internal Revenue service Note. The foundation may be able to use a copy of this return to satisfy state report! 2006 For calendar year 2006, or tax year beginning , and ending G Check all that a Initial return 0 Final return Amended return Name of identification Use the IRS foundation Employer number label. Otherwise , HE DENNIS BERMAN FAMILY FOUNDATION INC 31-1684732 print Number and street (or P O box number if mail is not delivered to street address) Room/suite Telephone number or type . 5410 EDSON LANE 220 301-816-1555 See Specific City or town, and ZIP code C If exemption application is pending , check here l_l Instructions . state, ► OCKVILLE , MD 20852-3195 D 1. Foreign organizations, check here Foreign organizations meeting 2. the 85% test, ► H Check type of organization MX Section 501(c)(3) exempt private foundation check here and attach computation = Section 4947(a)(1) nonexempt chartable trust 0 Other taxable private foundation E If private foundation status was terminated I Fair market value of all assets at end of year J Accounting method 0 Cash Accrual under section 507(b)(1)(A), check here (from Part ll, col (c), line 16) 0 Other (specify) F If the foundation is in a 60-month termination $ 5 010 7 3 9 . (Part 1, column (d) must be on cash basis) under section 507 (b)( 1 ► )( B ) , check here ► ad 1 Analysis of Revenue and Expenses ( a) Revenue and ( b) Net investment (c) Adjusted net ( d) Disbursements (The total of amounts in columns (b), (c), and (d) may not for chartable purposes necessary equal the amounts in column (a)) expenses per books income income (cash basis only) 1 Contributions , gifts, grants , etc , received 850,000 . -

The Lithuanian Jewish Community of Telšiai

The Lithuanian Jewish Community of Telšiai By Philip S. Shapiro1 Introduction This work had its genesis in an initiative of the “Alka” Samogitian Museum, which has undertaken projects to recover for Lithuanians the true history of the Jews who lived side-by-side with their ancestors. Several years ago, the Museum received a copy of the 500-plus-page “yizkor” (memorial) book for the Jewish community of Telšiai,2 which was printed in 1984.3 The yizkor book is a collection of facts and personal memories of those who had lived in Telšiai before or at the beginning of the Second World War. Most of the articles are written in Hebrew or Yiddish, but the Museum was determined to unlock the information that the book contained. Without any external prompting, the Museum embarked upon an ambitious project to create a Lithuanian version of The Telshe Book. As part of that project, the Museum organized this conference to discuss The Telshe Book and the Jewish community of Telšiai. This project is of great importance to Lithuania. Since Jews constituted about half of the population of most towns in provincial Lithuania in the 19th Century, a Lithuanian translation of the book will not only give Lithuanian readers a view of Jewish life in Telšiai but also a better knowledge of the town’s history, which is our common heritage. The first part of this article discusses my grandfather, Dov Ber Shapiro, who was born in 1883 in Kamajai, in the Rokiškis region, and attended the Telshe Yeshiva before emigrating in 1903 to the United States, where he was known as “Benjamin” Shapiro. -

Israeli Nonprofits: an Exploration of Challenges and Opportunities , Master’S Thesis, Regis University: 2005)

Israeli NGOs and American Jewish Donors: The Structures and Dynamics of Power Sharing in a New Philanthropic Era Volume I of II A Dissertation Presented to The Faculty of the Graduate School of Arts and Sciences Brandeis University Department of Near Eastern and Judaic Studies S. Ilan Troen, Advisor In Partial Fulfillment of the Requirements for the Degree Doctor of Philosophy by Eric J. Fleisch May 2014 The signed version of this form is on file in the Graduate School of Arts and Sciences. This dissertation, directed and approved by Eric J. Fleisch’s Committee, has been accepted and approved by the Faculty of Brandeis University in partial fulfillment of the requirements for the degree of: DOCTOR OF PHILOSOPHY Malcolm Watson, Dean Graduate School of Arts and Sciences Dissertation Committee: S. Ilan Troen, Department of Near Eastern and Judaic Studies Jonathan D. Sarna, Department of Near Eastern and Judaic Studies Theodore Sasson, Department of International Studies, Middlebury College Copyright by Eric J. Fleisch 2014 Acknowledgements There are so many people I would like to thank for the valuable help and support they provided me during the process of writing my dissertation. I must first start with my incomparable wife, Rebecca, to whom I dedicate my dissertation. Rebecca, you have my deepest appreciation for your unending self-sacrifice and support at every turn in the process, your belief in me, your readiness to challenge me intellectually and otherwise, your flair for bringing unique perspectives to the table, and of course for your friendship and love. I would never have been able to do this without you. -

Vertientes Del Judaismo #3

CLASES DE JUDAISMO VERTIENTES DEL JUDAISMO #3 Por: Eliyahu BaYonah Director Shalom Haverim Org New York Vertientes del Judaismo • LA ORTODOXIA MODERNA • La Ortodoxia moderna comprende un espectro bastante amplio de movimientos, cada extracción toma varias filosofías aunque relacionados distintamente, que en alguna combinación han proporcionado la base para todas las variaciones del movimiento de hoy en día. • En general, la ortodoxia moderna sostiene que la ley judía es normativa y vinculante, y concede al mismo tiempo un valor positivo para la interacción con la sociedad contemporánea. Vertientes del Judaismo • LA ORTODOXIA MODERNA • En este punto de vista, el judaísmo ortodoxo puede "ser enriquecido" por su intersección con la modernidad. • Además, "la sociedad moderna crea oportunidades para ser ciudadanos productivos que participan en la obra divina de la transformación del mundo en beneficio de la humanidad". • Al mismo tiempo, con el fin de preservar la integridad de la Halajá, cualquier área de “fuerte inconsistencia y conflicto" entre la Torá y la cultura moderna debe ser evitada. La ortodoxia moderna, además, asigna un papel central al "Pueblo de Israel " Vertientes del Judaismo • LA ORTODOXIA MODERNA • La ortodoxia moderna, como una corriente del judaísmo ortodoxo representado por instituciones como el Consejo Nacional para la Juventud Israel, en Estados Unidos, es pro-sionista y por lo tanto da un estatus nacional, así como religioso, de mucha importancia en el Estado de Israel, y sus afiliados que son, por lo general, sionistas en la orientación. • También practica la implicación con Judíos no ortodoxos que se extiende más allá de "extensión (kiruv)" a las relaciones institucionales y la cooperación continua, visto como Torá Umaddá. -

The Israeli Occupation of Jerusalem

77 The Suffering of Jerusalem Am I not a Human? and the Holy Sites (7) under the Israeli Occupation Book series discussing the sufferance of the Palestinian people under the Israeli By occupation Dr. Mohsen Moh’d Saleh Research Assistant Fatima ‘Itani English Version Translated by Edited by Salma al-Houry Dr. Mohsen Moh’d Saleh Rana Sa‘adah Al-Zaytouna Centre Al-Quds International Institution (QII) For Studies & Consultations www.alquds-online.org �سل�سلة “�أول�ست �إن�ساناً؟” (7) معاناة �لقد�س و�ملقد�سات حتت �لحتالل �لإ�رس�ئيلي Prepared by: Dr. Mohsen Moh’d Saleh English Version: Edited by: Dr. Mohsen Moh’d Saleh & Rana Sa‘adah Translated by: Salma al-Houry First published 2012 Al-Zaytouna Centre for Al-Quds International Institution (QII) Studies & Consultations P.O.Box: 14-5034, Beirut, Lebanon Beirut, Lebanon Tel: + 961 1 803 644 Tel: + 961 1 751 725 Tel-fax: + 961 1 803 643 Fax: + 961 1 751 726 Email: [email protected] Website: www.alzaytouna.net Website: www.alquds-online.org ISBN 978-9953-500-55-3 © All rights reserved to al-Zaytouna Centre for Studies & Consultations. No part of this publication may be reproduced, stored in retrieval system or transmitted in any form or by any means without the prior written permission of the publisher. For further information regarding permission(s), please write to: [email protected] The views expressed in this book are those of the authors alone. They do not necessarily reflect views of al-Zaytouna Centre for Studies and Consultations and al-Quds International Institution (QII). -

The Corona Ushpizin

אושפיזי קורונה THE CORONA USHPIZIN Rabbi Jonathan Schwartz PsyD Congregation Adath Israel of the JEC Elizabeth/Hillside, NJ סוכות תשפא Corona Ushpizin Rabbi Dr Jonathan Schwartz 12 Tishrei 5781 September 30, 2020 משה תקן להם לישראל שיהו שואלים ודורשים בענינו של יום הלכות פסח בפסח הלכות עצרת בעצרת הלכות חג בחג Dear Friends: The Talmud (Megillah 32b) notes that Moshe Rabbeinu established a learning schedule that included both Halachic and Aggadic lessons for each holiday on the holiday itself. Indeed, it is not only the experience of the ceremonies of the Chag that make them exciting. Rather, when we analyze, consider and discuss why we do what we do when we do it, we become more aware of the purposes of the Mitzvos and the holiday and become closer to Hashem in the process. In the days of old, the public shiurim of Yom Tov were a major part of the celebration. The give and take the part of the day for Hashem, it set a tone – חצי לה' enhanced not only the part of the day identified as the half of the day set aside for celebration in eating and enjoyment of a חצי לכם for the other half, the different nature. Meals could be enjoyed where conversation would surround “what the Rabbi spoke about” and expansion on those ideas would be shared and discussed with everyone present, each at his or her own level. Unfortunately, with the difficulties presented by the current COVID-19 pandemic, many might not be able to make it to Shul, many Rabbis might not be able to present the same Derashos and Shiurim to all the different minyanim under their auspices. -

Bring Back Our Boys – Jared Feldshreiber

WEEKLY BRING BACK Candle-lighting/Shabbos ends Friday, June 27: 8:12/9:21 OUR BOYS Vol. III No. 18 (#67) June 26, 2014 • 28 Sivan 5774 Free Lakewood Rabbanim Visit Community Unites New York City Offi cials Queens On Behalf Of At Prayer Gathering For Stand In Solidarity With Beth Medrash Govoha Kidnapped Boys In Israel Israel After Kidnapping Of Three Jewish Teenagers SEE STORY ON P. 55 SEE PHOTOS ON 36/37; ARTICLE ON P. 52 SEE STORY ON P. 39 Shabbos Inbox Blue And White Op-Ed Politics And Ethics Hooked On Healing (D)Anger Tragedy Helplessness Situational To Give Management Brings Unity By Betsalel Steinhart Awareness Or Not To Give Is Derech Eretz By Eytan Kobre By Shmuel Sackett hat can we do in the By Caroline Schumsky face of helplessness? By Abe Fuchs o goes the well-known hy do we do this to W This question is ooo… You want to give joke: ourselves? Why do being asked so many times, somehow, some way. S Husband to Wife: Wwe fi ght like dogs and over the last few days, as our and another person were SYou want to dedicate When I get mad at you, you cats until tragedy strikes? Why darkest fears take shape, as waiting on line at a bank the or allocate, but not so sure never fi ght back. How do you does it take the kidnapping of three boys sit who-knows- Iother day when there was how or where or how often? control your anger? three precious boys to bring us where, as three families lie only one teller available. -

General Assembly Distr.: General 23 June 2021

United Nations A/HRC/47/NGO/211 General Assembly Distr.: General 23 June 2021 English only Human Rights Council Forty-seventh session 21 June–9 July 2021 Agenda item 7 Human rights situation in Palestine and other occupied Arab territories Written statement* submitted by Palestinian Initiative for the Promotion of Global Dialogue and Democracy (MIFTAH), a non-governmental organization in special consultative status The Secretary-General has received the following written statement which is circulated in accordance with Economic and Social Council resolution 1996/31. [31 May 2021] * Issued as received, in the language(s) of submission only. GE.21-08499(E) A/HRC/47/NGO/211 Forcible Displacement of Palestinians in Sheikh Jarrah and Silwan Palestinians commemorated the 73rd anniversary of the Nakba amid similar circumstances of forced displacement and dispossession in Jerusalem. In 1948, 75 percent of the Palestinian indigenous population was expelled from their towns and villages. Today, Israel is still trying to displace a number of Palestinian families in Sheikh Jarrah neighborhood of occupied East Jerusalem and Palestinians continue to stand up against Israel’s policies and the ever present threat of forced transfer despite the continuous attacks by the Israeli Occupying Forces (IOF). Forcible Displacement The latest crackdown on Palestinians in ‘48, the West Bank including East Jerusalem, and Gaza clearly demonstrates the institutionalized policy aimed at maintaining settler colonial and apartheid system over the Palestinian people as a whole. Palestinians have been resisting forced displacement, dispossession, and ethnic cleansing in various cities and neighborhoods since 1948. Today, families in the Jerusalem neighborhood of Sheikh Jarrah and in Silwan are fighting to save their homes in Sheikh Jarrah and Silwan, more than 1,0001 Palestinians remain under threat of forced displacement from their homes and land. -

Shabbos Shacharis Zmanim-Minyan by the Minute

Shabbos Shacharis Zmanim‐Minyan By The Minute Vasikin Yeshivas Brisk 9:00 Adas Bnei Israel 7:00 Anshe Motele Adas Yeshurun 7:15 Kehilath Jacob Beth Samuel BAY Shul 7:25 Adas Yeshurun Beth Sholom Ahavas Achim Ezras Israel Mechitzah Minyon Heritage Russian Jewish Cong. 7:30 Kehilat Chovevei Tzion Kehilat Chovevei Tzion (Ashkenaz) K.I.N.S. of West Rogers Park Kehilath Jacob Beth Samuel Sha'arei Tzedek Mishkan Yair K.I.N.S. of West Rogers Park 8:00 Chicago Community Kollel Lubavitch Chabad of Skokie Kollel Ateres Ami (Russian) Or Torah Kollel Zichron Eliyahu Park Plaza Synagogue Or Torah Poalei Tzedek Telshe Yeshiva Yehuda Moshe 8:15 Bais Medrash Torah Utfillah Young Israel of Chicago Hebrew Theological College Young Israel of Northbrook Ohel Shalom Torah Center Young Israel of Skokie 8:20 Adas Yeshurun Young Israel of WRP 8:30 Agudath Israel Bikur Cholim 9:10 Khal Ohr Yisocher Chodorov Agudath Israel of West Rogers Park Shevet Achim/Buckingham Pavilion Bais Chaim Dovid 9:15 Ezras Israel Mechitzah Minyon Bais Yitzchok Darchei Noam of Glenbrook CCTC‐Chesed L'Avrohom Or Menorah Or Torah Yavneh‐ Newberger Hillel Center Sephardic Congregation Yisraelink Skokie Community Kollel 9:30 Anshei Lubavitch Yeshivas Brisk Bais Menachem Nusach Ari 8:40 Persian (Iran) Hebrew Bnei Reuven 8:45 Adas Yeshurun Chabad of Bucktown Anshe Motele Chabad of Wilmette‐ Kesser Maariv Lubavitch Chabad of Northbrook Bais Hamedrash Mikor Hachaim Lubavitch Chabad of the Gold Coast Bnei Reuven Mishna Ugemora Sha'arei Tzedek Mishkan Yair Or Simcha Nusach Ashkenaz Shearith