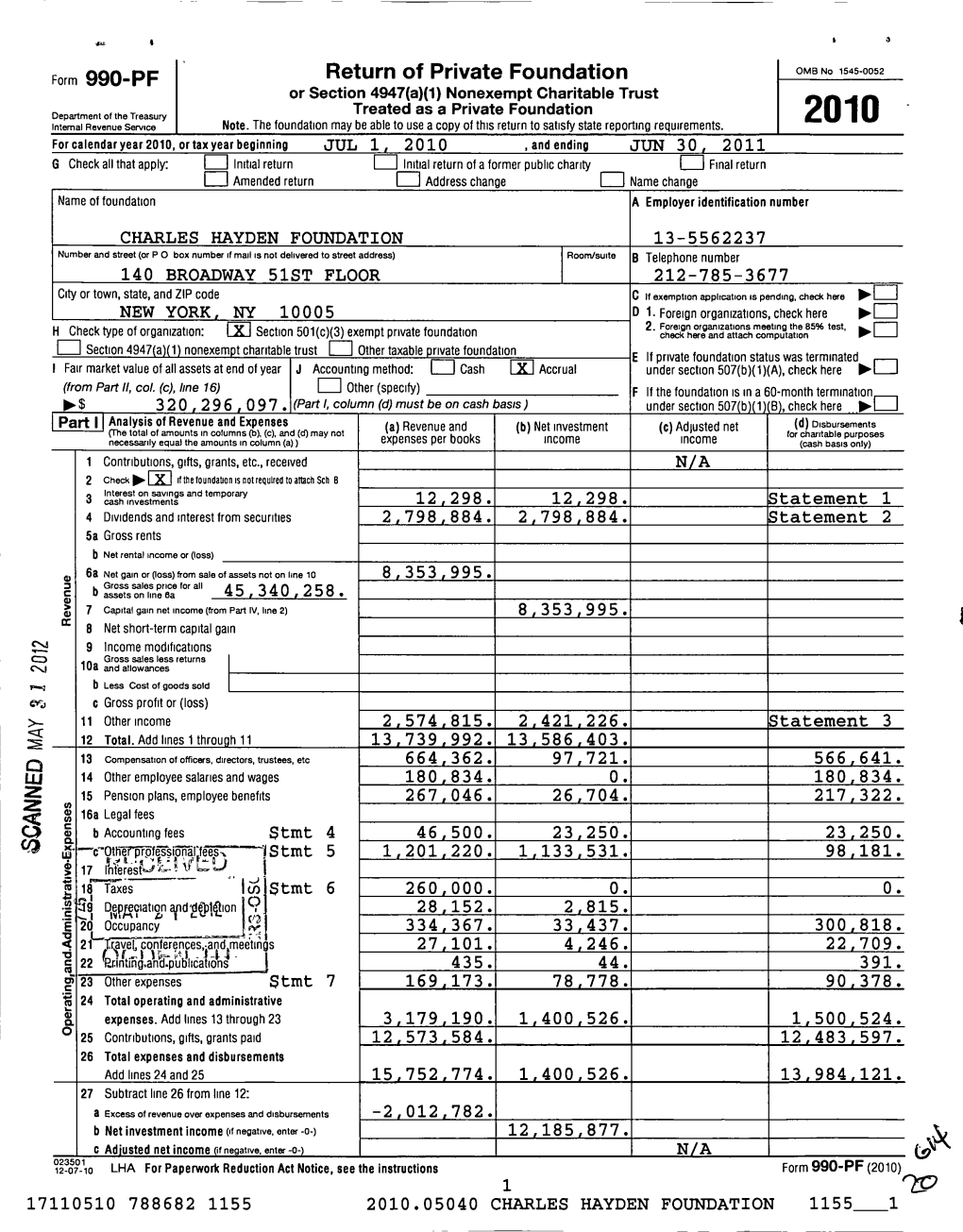

Form 990-PF Return of Private Foundation Or Section 4947(A)(1) Nonexempt Charitable Trust ^O O

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bachstitz, Inc. Records, 1923-1937

Bachstitz, Inc. records, 1923-1937 Finding aid prepared by Adrianna Slaughter, Karol Pick, and Aleksandr Gelfand This finding aid was generated using Archivists' Toolkit on September 18, 2013 The Metropolitan Museum of Art Archives 1000 Fifth Avenue New York, NY, 10028-0198 212-570-3937 [email protected] Bachstitz, Inc. records, 1923-1937 Table of Contents Summary Information .......................................................................................................3 Biographical Note................................................................................................................4 Scope and Contents note.....................................................................................................5 Arrangement note................................................................................................................ 6 Administrative Information .............................................................................................. 6 Controlled Access Headings............................................................................................... 7 Collection Inventory............................................................................................................8 Series I. Correspondence...............................................................................................8 Series II. General Administrative Records................................................................. 21 Series III. Inventory................................................................................................... -

New Traffic Regulations Wars on Hotel

BANK VOLUME XL. NO. 41, RED BANK, N. J., WEDNESDAY, APRIL .3, 1918. PAGES! TO 10. NEW BATTERY COMPANY. PRINCIPLES IN POLITICS. DR. STOKES BUYS A HOME. " Two Red Bank Young Men Open W. Ray Johnson's Residence on East Buiineis on Mechanic Street. NEW TRAFFIC REGULATIONS GEORGE L, RECORD OUTLINES Front Street Bought by Him. Donald Johnson und George Acker- WARS ON HOTEL Dr. Harold J. Stokes of Red Bank nan have formed a partnership and HIS PLATFORM. has bought W. Ray Johnson's con- AUTOISTS CANT PARK ON BOTH SIDES have opened a storage battery busi- A Parlor Meeting at Mort V. Pach's, crete house on East Front street. Mr. ness on Mcchunic street. Both mem- Home at Allenhurst .Last Friday Johnson's wife died recently and he COLT'S NECK DOMINIE OUT TO MAKE bers of the firm are experts on bat- Night at Which Mr. Record. Made moved to his mother's home at OF NARROW STREETS. tery repair work. They were former- an Address. Shrewsbury. He had built a fine'resi- ATLANTIC TOWNSHIP DRY. ly employed at Fred Boice's garage. dence on East Front street about two Their place of business has been made George L. Record, who is a Repub- years ago and this he offered for sale. This Will be the Rule En Red Bank if Ordinance the Red Bank service station for Ex- lican candidate for .United States It was bought by Dr. Stokes for Rev. Octave VanBeverhoudt Calls a Meeting In an ide batteries. They have named the senator and who has been endorsed $6,600. -

The United States Managers! Their Plans for Precious Metals?

The United States Managers! Their Plans for Precious Metals? Presented June 2019 By Charles Savoie www.silverstealers.net www.nosilvernationalization.org https://www.youtube.com/watch?v=hoy793X4TP0 https://www.facebook.com/charles.savoie.96387 https://www.silvermarketnewsonline.com/archives.htm PILL-GRAMS! The Pilgrims Society has been “keeping the world on the right track” (Congressional Record, August 19, 1940) and it is “the most powerful international society on earth” and is “so wrapped in silence that few Americans know of its existence since 1903” (“The Empire of The City- --World Superstate,” 1946). It holds the management reins of Bilderberg, Trilaterals, CFR and many more! As precious metals really threaten to break out to new sustained highs, what is their strategy? How could they attempt to steal silver from us, using as excuse we have no silver stockpile for the military, if Butler’s allegations about JPMC Bank holding so much silver, are correct? Are they finally running out of tricks? No, because they can still use the price gouging Medical Colossus to break the middle class down to Royal Crown poverty serfdom! The Pilgrims NYC 2014--- Notice Astor Place! From the May 1902 issue, page 556--- https://babel.hathitrust.org/cgi/pt?id=hvd.hn469y&view=1up&seq=568 “You might finish the war by union with America and universal peace, I mean after one hundred years, and a secret society supported by the accumulated wealth of those whose desire is to do something, and a hideous annoyance created by the difficult question placed daily before their minds as to which of their incompetent relations they should leave their wealth to. -

York a Tribute to the Waldorf-Astoria

THE UNOFFICIAL PALACE OF NEW YORK A TRIBUTE TO THE WALDORF-ASTORIA EDITED BY/'~, FRANK CROWNINSHIELD PUBLISHED IN NEW YORK· MCMXXXIX Copyright 1939, Hotel Waldorf-Astoria Corporation, New York DESIGN AND DECORATIONS BY WARREN CHAPPELL THIS BOOK IS PRESENTED TO THE FRIENDS OF THE WALDORF-ASTORIA, OLD AND NEW, HOPING IT MAY ADD SOMETHING TO THEIR APPRECIATION AND REGARD FOR A GREAT HOUSEHOLD PLEDGED TO THEIR SERVICE. LUCIUS BOO!vIER, President AUGUSTUS NULLE, Secretary-Treasurer FRANK A. READY, Manager fl The Unofficial, Pal,ace of New York t,,0•~' :r.1 i P·•·. (i•f;i r ;;r"":'· t' i( t,- 1; · r ·. .... ·-•tr r.r \ r : • f , i • r: •· i . • ' . ·''"S·. ,1 C t .. .•,·~-;~ :- l r'. ~~-. ·1 . - . :~--~ ~ j ~-.~.:. '.J.~- -~~*- ,_ . ,~.. "~- -,l?·-·~-- -, __ ,-r/1- ;~,,;_.. · r. ,.,.·z- ... --.:;r -·•·· '"'" r I rr . : <-;'f-_;';i;-;~~. :,,i.'t' t- . ,_-;,' ! '.;:...'·;?'::.~r- F~ r: ~ ,-v - . I. " tt_· lf.i;,~~-~---~~~~~lJ.r.. " . .' .i~ ~'.LJ.1..V~Jl ~f j:'ti.'-. "./"P• r'" . r· r [ ,~- ~f.~'r··\<-• . .-.• ~ ~=- reI"'"'..,. r ~ • ,. ► f r I' !I • 1,,;. l i !• . (f'• f1,.f·J - '"'ct..._ i . t, lt. · r .• f'i.Bf 1rr ~ tt ~ HH II H I! ~. ~ ~ i ~ Ill ' ~ r !, ~ n-~- fl!. r= ~.:: n~ tt et" _.,.. ,. ... --~- ~ Ill·•· o 4 ,._ The Wal.dorf-Astoria From an etching br Chester Price FOREWORD THE UNOFFICIAL PALACE OF NEW YORK BY FRANK CROWNINSHIELD JUST AS THE WORLD'S FAIR commemorates a landmark in American history, so this book is, with a proper degree of modesty, designed to mark an anniversary in the life of The Waldorf-_Astoria. For it v1as pre cisely ten years ago that ground was first broken for the new hotel, and forty-seven years ago that work was begun on its progenitor, the origi nal Waldo~ at 34th Street. -

Ld Ernmen . CI Loninnssion R Evv *41 T'lr *I

I CAMBRIDGE, MAB~SS. Basketball; . .. · . Page 3 TUESDAY, DEC. 12, 1950 THE PRICE FIVE CENTS Mui ............ a Page 2 VOL. LXX NO. 52 THE OFFICIAL NEWSPAPER lacement Information . a a . Page 4 OF THE M.I.T. UNDERGRADUATES - - '- ~ .......... .a aa pnslh x-. ~,.,l ~~,~·............................nw ........ - I ~ -- - ·-- i-I -.- r- illian Stresseos evv *41t'lr *I ' I an 'o I er Specialism Need By- Sigmza C~hi Student Must Be Able ,Swee~theart lD ernmen . CI loninnssion oo To Achieve Competence I "We must prepare men to be skilled and creative. For his own dignity of soul a man must be able duniors' en~iorsf, ,ra$. u mmd to do at least one thing extremely A special Air Force ROTC course leading to a commission well. He must be able to achieve Report On Educeational in the reserve air corps will be put into effect next semester. this." This point was one of the Any Junior, Senior, or Graduate student who has completed goals of education in a free society as seen by President James R. Survey To Be Discussed the two-year basic course in Military Science or who is a Killian, jr., in his address before the ny Faculty COver WAIT veteran with one year's service, is eligible to enroll. Lecture Services Committee on Applicants should have at least a 3.0 cum and be in good - J-- --- ---- - "Education for Freedom" held last Four faculty members and three physical condition. Men with a cum 'below 3.0, must have Istudents will discuss some aspects Thursday. their application approved by the Petitions Committee. -

Stolen Calves Are Found Mr

VOLUME XL. NO. 23. RED BANK, N. J., WEDNESDAY, NOVEMBER 28, 1917. PAGES 1 TO 8. MARRIED FIFTY YEARS. BIG MEETING OF WOMEN. HOLMDET HUNTER KILLED STOLEN CALVES ARE FOUND MR. AND MRS. CHARLES ALLEN DISTRICT CLUB MEETING AT OBSERVE GOLDEN WEDDING. RED BANK. LAST WEEK. DEAD BODIES OF BROOKDALE FARM Celebration at Fair Haven Saturday State Federation Officials and Dele- Night Attended by Eighty Relatives gates from Fifteen Clubs Were MICHAEL MAHER FATALLY WOUNDED and Friendi—The Affair an Elabor- Present—Speeches on Women's STOCK DISCOVERED IN SLOUGH. ate One. Work in the War. BY A FRIEND SATURDAY AFTERNOON. Mr. and Mrs. Charles N. Allen of Delegates from fifteen clubs and Fair Haven celebrated their golden the principal officials of the* state fed- They Had Been Hidden Under a Pile of Leaves wedding Saturday night. The affair eration of women's clubs attended a was an elaborate one and was at- district meeting of these clubs at the The Shot That Killed Him Was Fired From a Gun and Their Bodies Had Begun to Decompose— tended by about eighty relativesand ypt friends. Tho house was decorated day. Morning and afternoon meet- in the Hands of Harry Heale of Allenhurst —Mr. Finding]] of the Calves Destroys Part of the with gold tinsel, yellow chrysanthe- ings were held and at noon luncheon mums and running pine. A wedding was served to the visitors by the Maher was Rushed to a Doctor's Office at Mat- Evidence Against Joseph Miller and His Sons. cake covered with yellow icing and members of the Red Bank woman's bearing fifty candles was on the din- <-l»*r, The state officials and dele- awan, but He Died Before He Got There. -

WALL STREET PERSONALITIES Elli C01.Qxd 11/21/02 3:00 PM Page 2 Elli C01.Qxd 11/21/02 3:00 PM Page 3

elli_c01.qxd 11/21/02 3:00 PM Page 1 WALL STREET PERSONALITIES elli_c01.qxd 11/21/02 3:00 PM Page 2 elli_c01.qxd 11/21/02 3:00 PM Page 3 August S. Belmont GREGORY HUNTER August Schöenberg Belmont was a protégé of the Rothschilds, who trained him in his native Germany. On coming to America in 1837, he represented their U.S. interests, developed his own successful firm in Wall Street, and was a social leader in New York City. He was also the de facto head of the Democratic Party from 1860 to 1884, served as a U.S. diplomat abroad, and played a key role in blocking both Eu- ropean recognition and financing for the Confederacy during our Civil War. Racing’s Belmont Stakes are a memorial to his interest in breeding fast horses. Belmont was born on December 8, 1813, in the village of Alzey in the RhenishPalatinate region of Germany. His father, Simon Belmont, was a community leader who served as president of the local synagogue for many years. ... Tragedy came early to young Belmont’s life. His mother died when he was seven, followed one month later by the death of his brother. Less than a year later, Belmont went to Frankfurt, 40 miles to the north, to live with his grandmother, Gertrude, and her husband, Hajun Hanau, who had con- nections with the Rothschilds. In Frankfurt, Belmont attended a Jewish school. In 1828, his father had to remove him because the tuition payments had fallen so far in arrears. After he left school, Belmont’s relatives convinced their Frankfurt friends, the Rothschilds, to train the boy for a business career. -

Eggleston of the Anaconda Standard

University of Montana ScholarWorks at University of Montana Graduate Student Theses, Dissertations, & Professional Papers Graduate School 1978 Eggleston of the Anaconda Standard Ralph Henry Wanamaker The University of Montana Follow this and additional works at: https://scholarworks.umt.edu/etd Let us know how access to this document benefits ou.y Recommended Citation Wanamaker, Ralph Henry, "Eggleston of the Anaconda Standard" (1978). Graduate Student Theses, Dissertations, & Professional Papers. 5046. https://scholarworks.umt.edu/etd/5046 This Thesis is brought to you for free and open access by the Graduate School at ScholarWorks at University of Montana. It has been accepted for inclusion in Graduate Student Theses, Dissertations, & Professional Papers by an authorized administrator of ScholarWorks at University of Montana. For more information, please contact [email protected]. •EGGLESTON OF THE ANACONDA STANDARD By Ralph H. Wanamaker B. A., Elizabethtown College, 1965 Presented in partial fulfillment of the requirements for the degree of Master of Arts UNIVERSITY OF MONTANA 1978 Approved by: Chairman, Board oiNSxaminers Dean, Graduate School UMI Number: EP40510 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. UMI EP40510 Published by ProQuest LLC (2014). Copyright in the Dissertation held by the Author. Microform Edition © ProQuest LLC. All rights reserved. This work is protected against unauthorized copying under Title 17, United States Code ProQuest LLC.