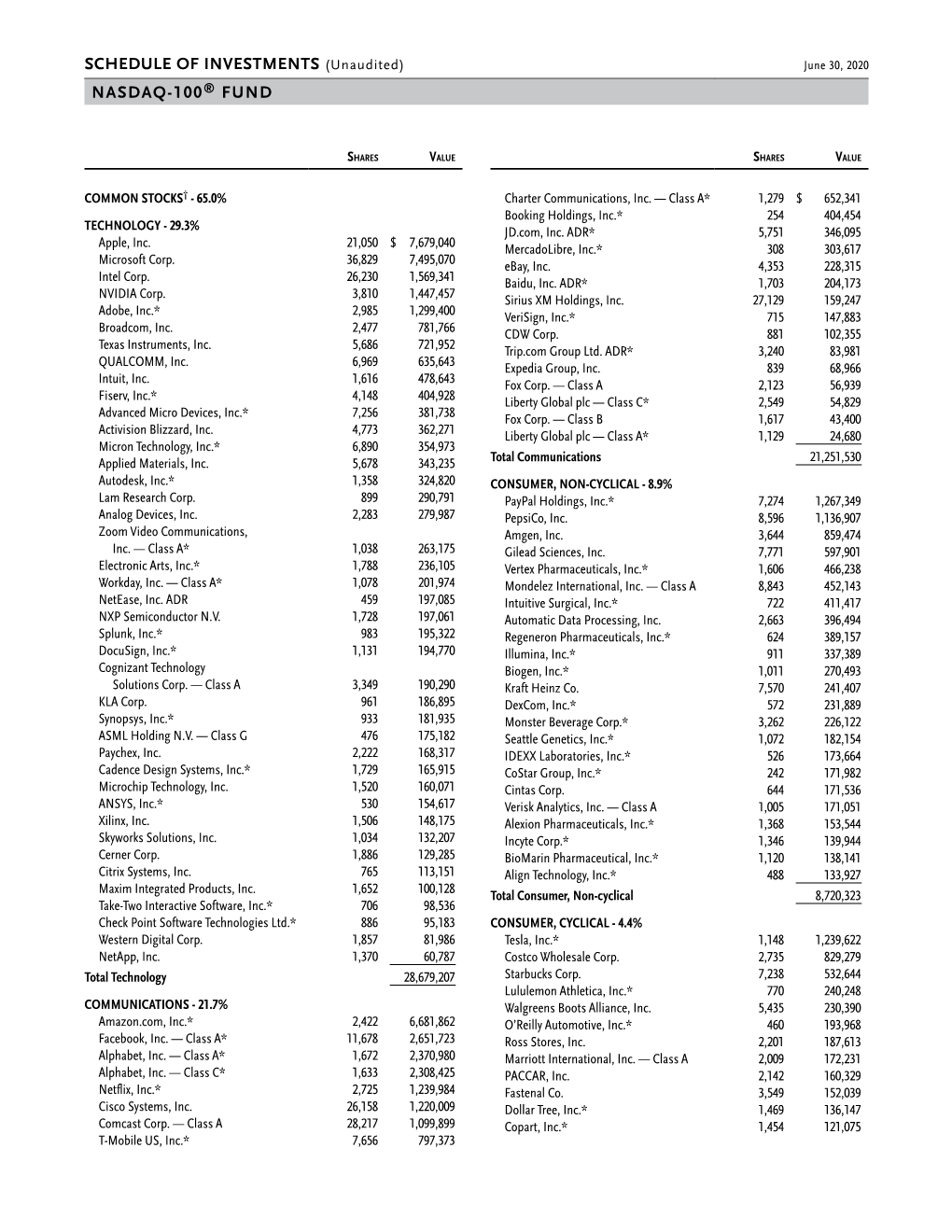

Nasdaq-100® Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(SB #097802) [email protected]

Electronically FILED by Superior Court of California, County of Los Angeles on 12/04/2020 09:16 AM Sherri R. Carter, Executive Officer/Clerk of Court, by M. Mariscal,Deputy Clerk 20SMCV01866 Assigned for all purposes to: Santa Monica Courthouse, Judicial Officer: H. Ford III 1 DANIEL M. PETROCELLI (S.B. #097802) [email protected] 2 MOLLY M. LENS (S.B. #283867) [email protected] 3 O’MELVENY & MYERS LLP 1999 Avenue of the Stars, 8th Floor 4 Los Angeles, CA 90067-6035 Telephone: (310) 553-6700 5 Facsimile: (310) 246-6779 6 ERIC AMDURSKY (S.B. #180288) [email protected] 7 O'MELVENY & MYERS LLP 2765 Sand Hill Road 8 Menlo Park, California 94025 Telephone: (650) 473-2600 9 Facsimile: (650) 473-2601 10 Attorneys for Plaintiff ACTIVISION BLIZZARD, INC. 11 12 SUPERIOR COURT OF THE STATE OF CALIFORNIA 13 COUNTY OF LOS ANGELES, WEST DISTRICT 14 ACTIVISION BLIZZARD, INC., a Delaware Case No. Corporation, 15 Plaintiff, COMPLAINT FOR: 16 vs. (1) Intentional Interference with 17 Contract; NETFLIX, INC., a Delaware Corporation, and 18 DOES 1 through 25, inclusive, (2) Unfair Competition – Cal. Bus. & Prof. Code §§ Code 17200 et seq.; and 19 Defendants. (3) Aiding and Abetting Breach of 20 Fiduciary Duty 21 DEMAND FOR JURY TRIAL 22 23 24 25 26 27 28 COMPLAINT 1 Plaintiff Activision Blizzard, Inc. (“Plaintiff” or “Activision”), for its complaint against 2 Netflix, Inc. (“Netflix” or “Defendant”), alleges on knowledge as to itself and its own acts, and on 3 information and belief as to all other matters, as follows: 4 NATURE OF ACTION 5 1. -

Activision Blizzard, Inc

Investment Club Presentation Activision Blizzard, Inc. (ATVI) Analyst: Niko Martinovic 5-Yr Stock Performance $90 $80 $70 $60 $50 $40 $30 Decline in stock primarily driven by analyst sentiment changes, missing expectations, CFO firings, $20 and most recently, Bungie games leaving ATVI $10 $0 1/15/20144/15/20147/15/201410/15/20141/15/20154/15/20157/15/201510/15/20151/15/20164/15/20167/15/201610/15/20161/15/20174/15/20177/15/201710/15/20171/15/20184/15/20187/15/201810/15/2018 Source: AIM/Martinovic 2018, Company Filings, S&P Capital IQ, and IBIS World 2 They’re Wrong Activision Blizzard has three meaningful and diverse revenue streams that can all grow in unique ways. E-Sports and Virtual Reality are the most exciting growth opportunities in this industry and ATVI is the best positioned to take advantage of it with the power of their brands, aggressive R&D spend, and patience. Source: 3 Note: Three Year Stock Performance ATVI has outperformed the S&P consistently since early 2017 while the Peer Set1 has reverted back. 160.00% 140.00% Stock Price $46.85 Shares Outstanding $762.41mm 120.00% Market Cap $36.08bn 52 Week Range $43.71-$84.68 100.00% Avg. Volume 7,550,000 EPS (TTM) $2.13 80.00% Past Month Performance -1.60% Past 1 Year -33.63% 60.00% Past 5 Year 170.36% 40.00% 20.00% 0.00% -20.00% -40.00% 1/15/2016 4/15/2016 7/15/2016 10/15/2016 1/15/2017 4/15/2017 7/15/2017 10/15/2017 1/15/2018 4/15/2018 7/15/2018 10/15/2018 S&P ATVI Peer Set Source: AIM/Martinovic 2018, Company Filings, S&P Capital IQ, and IBIS World 4 1Electronic Arts, Ubisoft, Take Two Interactive, Square Enix, and Zynga Company Overview & Monetization Activision Blizzard, Inc. -

AM General V. Activision Blizzard

Case 1:17-cv-08644-GBD-JLC Document 218 Filed 03/31/20 Page 1 of 29 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORI( -- -- ----- -- -- ------------------------- --x AM GENERAL LLC, Plaintiff, MEMORANDUM DECISION -against- AND ORDER ACTIVISION BLIZZARD, INC., ACTIVISION 17 Civ. 8644 (GBD) PUBLISHING, INC., and MAJOR LEAGUE GAMING CORP., Defendants. --------- -- --- -- --------- -- -- -- ---- -- - --x GEORGE B. DANIELS, United States District Judge: Plaintiff AM General LLC ("AMG") brings this action against Defendants Activision Blizzard, Inc. and Activision Publishing, Inc. (collectively, "Activision") and Major League Gaming Corp. ("MLG") for trademark infringement, trade dress infringement, unfair competition, false designation of origin, false advertising, and dilution under the Lanham Act, 15 U.S.C. §§ 1114, 1125, and 1125(c), respectively. (Compl., ECF No. 1, ~~ 82-147.) AMG also raises pendant New York state law claims for trademark infringement, unfair competition, false designation of origin, trade dress infringement, false advertising, and dilution. (Jd. ~~ 148-81.) On May 31, 2019, Defendants moved for summaty judgment on all of AMG's claims pursuant to Federal Rule of Civil Procedure 56. (Defs. Activision and MLG's Notice of Mot. for Summ. J., ECF No. 131.) On the same day, Plaintiff moved for partial summaty judgment on Defendants' laches claim pursuant to Federal Rule of Civil Procedure 56(a). (PI. AMG's Notice of Mot. for Partial Summ. J., ECF No. 138.) Subsequently, Defendants filed a motion to strike (1) certain portions of Plaintiffs Rule 56.1 statement of material facts and (2) the "experiment" contained in the rebuttal report of Plaintiff s expeli, Dr. Y oran Wind ("MTS I"). -

Victory Fund Holdings Victory Rs Mid Cap Growth

VICTORY FUND HOLDINGS As of June 30, 2021 VICTORY RS MID CAP GROWTH FUND MATURITY TRADED MARKET TRADED MARKET SECURITY DESCRIPTION DATE VALUE (BASE) VALUE (BASE) % ADVANCED DRAINAGE SYSTEMS INC 3,267,457.10 0.71% ALIGN TECHNOLOGY INC 6,788,210.00 1.48% AMERISOURCEBERGEN CORP. 4,443,356.90 0.97% APELLIS PHARMACEUTICALS INC 3,165,688.00 0.69% ARISTA NETWORKS INC 3,079,635.00 0.67% AVANTOR INC 4,718,923.90 1.03% AXON ENTERPRISE INC 6,244,576.00 1.37% BILL.COM HOLDINGS INC 4,132,540.80 0.90% BOSTON BEER COMPANY INC-CLASS A 3,521,760.00 0.77% BUILDERS FIRSTSOURCE INC 3,443,941.80 0.75% BURLINGTON STORES INC 5,383,672.80 1.18% CAESARS ENTERTAINMENT INC 4,181,125.00 0.91% CARMAX INC. 2,479,680.00 0.54% CARRIER GLOBAL CORP 5,655,096.00 1.24% CENTENE CORP. 3,567,079.23 0.78% CHARLES RIVER LABORATORIES INTERNATIONAL, INC. 8,030,963.20 1.76% CHART INDUSTRIES INC 3,985,756.80 0.87% CHEWY INC-CLASS A 5,215,106.46 1.14% CHIPOTLE MEXICAN GRILL, INC. 9,922,176.00 2.17% COSTAR GROUP INC 6,517,934.00 1.43% CROWDSTRIKE HOLDINGS INC-A 6,242,540.40 1.36% DARDEN RESTAURANTS, INC. 2,988,415.30 0.65% DEXCOM, INC. 5,435,710.00 1.19% DOCUSIGN INC 8,635,917.30 1.89% DOLBY LABORATORIES INC 4,895,824.90 1.07% DROPBOX INC 3,032,818.60 0.66% ENPHASE ENERGY INC 4,557,696.60 1.00% ENTEGRIS INC 7,171,610.40 1.57% FAIR ISAAC CORP. -

Starbucks to Grow in Yunnan Percent of the IPO Proceeds Chemchina Currently to Expand and Upgrade Its Has Four Overseas Subsidiar- European Plants and Another Ies

10 businesscompanies SATURDAY, NOVEMBER 13, 2010 CHINA DAILY Bluestar Adisseo seeks $1.56 billion in HK IPO BEIJING — Bluestar Adisseo Nutrition Group, the French animal-nutrition company backed by China National Chemical Corp (ChemChina), is seeking In all of our compa- HK$12.08 billion ($1.56 bil- nies we show respect lion) in a Hong for diff erent cultures, RETAIL Kong initial public ‘‘ offering, accord- which I believe is the ing to a term sheet sent to key to success.” investors. REN JIANXIN Bluestar Adisseo is off er- PRESIDENT, CHEMCHINA ing 2.3 billion shares, or 25 percent of the company, at HK$3.50 to HK$5.25. pany would take advantage Pricing the stock at the of its rich resources in the ARIANA LINDQUIST / BLOOMBERG top end of the range would country to help Bluestar Howard Schultz (center), chairman, president and chief executive offi cer of Starbucks Corp, speaks at a news conference after a signing ceremony for a Memorandum give the company a market Adisseo to achieve further of Understanding (MOU) between Starbucks Corp, the Yunnan Academy of Agricultural Science and the People’s Government of Pu’er city, in Kunming, Yunnan capitalization of about development. province, on Friday. Starbucks Corp, the world’s biggest coff ee chain, will set up a farm and processing facilities in China’s southern Yunnan province. $6.23 billion. Deutsche “In all of our companies Bank AG and Morgan we show respect for diff er- Stanley are managing the ent cultures, which I believe sale. is the key to success,” said The company will use 40 Ren. -

Esports – Who Are the Big Players and the Likely

Esports – Who are the big players and the likely winners Millennial driven esports continues to grow rapidly. The number of esports enthusiasts worldwide was estimated to be ~165 million in 2018, and for total global viewers, the forecast is ~453 million in 2019. Esports global revenue is forecast to pass US$1b in 2019 and by 2022 the global eSports market revenue is forecast to reach US$1.79 billion growing at a CAGR of 22.3%. The big players in esports Activision Blizzard Inc. (NASDAQ: ATVI) Activision Blizzard owns the popular Overwatch League as well as World of Warcraft, StarCraft, Diablo, and Hearthstone. In 2018 Activision Blizzard signed a multiyear deal with Walt Disney to broadcast the Overwatch League. As of March 2018, it was the largest game company in the Americas and Europe in terms of revenue and market capitalization. Activision Blizzard has several business units: Activision Publishing, Blizzard Entertainment, King, Major League Gaming,and Activision Blizzard Studios. Alphabet Inc. (NASDAQ: GOOGL) Alphabet (Google) has a new cloud gaming platform called Stadia. It operates games hosted on remote servers and then streams video content to connected devices, including smartphones, tablets, computers and TVs. Other competitors in the streaming space include Amazon (Twitch), Facebook, Twitter, Microsoft, Tencent, and Alibaba. Amazon (NASDAQ: AMZN) Amazon’s Twitch leads the online USA streaming market. Amazon acquired Twitch for nearly $1 billion in 2014. Twitch is only a very small percentage of Amazon’s massive revenue. Electronic Arts Inc. (NASDAQ: EA) Electronic Arts is an American video game company headquartered in California. It is the second-largest gaming company in the Americas and Europe by revenue and market capitalization. -

Net Neutrality and Game Development Back in 2007 … FCC Goal

Net Neutrality and Game Development Back in 2007 … FCC Goal “[W]e seek to preserve the open, safe, and secure Internet and to promote and protect the legitimate business needs of broadband Internet access service providers and broader public interests such as innovation, investment, research and development, competition, consumer protection, speech, and democratic engagement.” Open Internet NPRM (October 2009) The Core Distinction Telecommunications services The offering of telecommunications for a fee directly to the public. “Telecommunications” is the transmission of information of the user’s choosing, without change in the form or content of the information as sent and received. Information services The offering of a capability for generating, acquiring, storing, transforming, processing, retrieving, utilizing, or making available information via telecommunications. FCC Classification Decisions Conclusion: Broadband Internet Access Service is an information service. The transmission element is not a separate component that must be offered to others. “Telecommunications service” obligations do not apply. 2005 FCC Policy Statement Consumers are entitled to access the lawful Internet content of their choice; Consumers are entitled to run applications and use services of their choice, subject to the needs of law enforcement; Consumers are entitled to connect their choice of legal devices that do not harm the network; and Consumers are entitled to competition among network providers, application and service providers, and content -

Fiserv Cashless Payment Innovations for Merchants, Insurers Receive 2020 Payments Awards

Fiserv Cashless Payment Innovations for Merchants, Insurers Receive 2020 Payments Awards December 18, 2020 Solutions enable cashless payments at the point of sale and remotely Warsaw, Poland, 18 December 2020 – Fiserv, a leading global provider of payments and financial services technology, has won two 2020 Payments Awards thanks to the company’s innovative and pioneering approach to cashless payments. “First and foremost, these awards recognise the work of the entire team, as well as the innovative mindset and courage of our partners. Both awards are not only a source of great pride, but also serve as additional incentive for further growth. I am glad to be able to work with trendsetters shaping the world of cashless payments,” said Krzysztof Polończyk, President of First Data Polska, now Fiserv. The Payments Innovation of the Year Award was presented for the SoftPOS PIN on Mobile solution from Fiserv, a technology developed in conjunction with Visa, Samsung and PayCore. The solution enables cashless payment acceptance by merchants on their own devices, such as smartphones or tablets, for any payment amount and without the need for additional equipment. The solution, which is currently being piloted in Poland, opens up the possibility of increased use of mobile devices as payment terminals worldwide. “The popularity of non-cash payments in Poland continues to grow. We already have over a million terminals in Poland, and connecting smartphones and tablets to this huge network will not only increase the share of cashless transactions, but above all will have a positive impact on the cash flow of merchants, small businesses and service providers,” says Rafał Galiński, Products Development Director at First Data Polska, now Fiserv. -

August 5, 2021 Robert J. Morgado Lead Independent Director

August 5, 2021 Robert J. Morgado Lead Independent Director Activision Blizzard, Inc. 3100 Ocean Park Boulevard Santa Monica, CA 90405 Dear Mr. Morgado: While we appreciate the improved tone and increased detail in CEO Kotick’s recent letter to Activision Blizzard employees, customers, and shareholders,1 the changes Mr. Kotick has announced do not go nearly far enough to address the deep and widespread issues with equity, inclusion, and human capital management at the company. To wit: • No changes have been announced or proposed that would in any way alter the current process for filling vacancies either to the board of directors or to senior management. • No changes have been announced with respect to executive pay, either with respect to clawing back compensation from executives who are found to have engaged in or enabled abusive practices, or to align executives with the equity goals Mr. Kotick articulated. • The announced review by Wilmer Hale is deficient in a number of ways: this firm has a sterling reputation as a defender of the wealthy and connected, but it has no track record of uncovering wrongdoing, the lead investigator does not have in-depth experience investigating workplace harassment and abuse, and the scope of the investigation fails to address the full range of equity issues Mr. Kotick acknowledges. We believe that to ensure smooth operations and a strong reputation going forward, Activision Blizzard should commit to the following changes: • Increase board diversity and equity by adding a woman director – preferably one with a history of advocacy for marginalized people and communities - by the end of 2021, committing to gender-balance on the board by 2025, and reserving at least one board seat for a nominee selected by current employees as their representative. -

Nicholas Fund, Inc. Schedule of Investments (Unaudited) As of December 31, 2020

NICHOLAS FUND, INC. SCHEDULE OF INVESTMENTS (UNAUDITED) AS OF DECEMBER 31, 2020 SHARES OR PRINCIPAL AMOUNT VALUE ------------------------ ------------------------------ COMMON STOCKS - 98.86% Communication Services - Media & Entertainment - 6.04% 71,000 Alphabet Inc. - Class C * $ 124,383,480 650,000 Comcast Corporation - Class A 34,060,000 145,000 Facebook, Inc. - Class A * 39,608,200 ----------------- 198,051,680 ----------------- Consumer Discretionary - Retailing - 9.31% 21,000 Amazon.com, Inc. * 68,395,530 270,000 Home Depot, Inc. (The) 71,717,400 144,976 O'Reilly Automotive, Inc. * 65,611,788 850,000 TJX Companies, Inc. (The) 58,046,500 145,000 Ulta Beauty, Inc. * 41,638,200 ----------------- 305,409,418 ----------------- Consumer Discretionary - Services - 3.05% 180,000 McDonald's Corporation 38,624,400 575,000 Starbucks Corporation 61,513,500 ----------------- 100,137,900 ----------------- Consumer Staples - Food & Staples Retailing - 1.21% 105,000 Costco Wholesale Corporation 39,561,900 ----------------- Consumer Staples - Food, Beverage & Tobacco - 4.84% 660,000 Coca-Cola Company (The) 36,194,400 180,000 Constellation Brands, Inc. - Class A 39,429,000 700,000 Mondelez International, Inc. - Class A 40,929,000 285,000 PepsiCo, Inc. 42,265,500 ----------------- 158,817,900 ----------------- Energy - 1.02% 1,700,000 Enterprise Products Partners L.P. 33,303,000 ----------------- Financials - Banks - 2.79% 395,000 JPMorgan Chase & Co. 50,192,650 865,000 Truist Financial Corporation 41,459,450 ----------------- 91,652,100 ----------------- Financials - Diversified - 4.57% 1,000,000 Charles Schwab Corporation (The) 53,040,000 385,000 Intercontinental Exchange, Inc. 44,386,650 160,000 S&P Global Inc. 52,596,800 ----------------- 150,023,450 ----------------- Financials - Insurance - 3.99% 415,000 Aon plc 87,677,050 280,000 Chubb Limited 43,097,600 ----------------- 130,774,650 ----------------- Health Care - Equipment & Services - 9.36% 605,000 Alcon, Inc. -

Fintech & Bank

VOLUME 3 | 2018 THE CENTER OF COMMERCE Fintech & Bank FUsionThere Are Certain Things In Life That You Expect To Be Boring. Technology relevant to the consumer,” says Nigel So, banks have stepped up, have started There are Motyer, who heads up First Data’s Direct to “shake off” the old stodgy perceptions Acquiring Business in EMEA and sits and are beginning to innovate in on the Board of Directors at First Data response to consumer needs. Recently, certain things Europe. “Why did PayPal® become so major banks collaborated to create their all-pervasive? Because it was the only own fintech P2P platform called Zelle®, method of payment that you had on which allows account holders to transfer Fintech in life that eBay – and the consumer loved eBay.” cash instantly over apps or online. you expect to Consumers also love a new way to pay Meanwhile, the fintech world is actively their friends and family, via person-to- seizing ground once monopolized by person micropayments. Early versions banks. SoFi® is an online company that Bank Fusion be boring. allowed for easy payments via text provides personal loans, mortgages, messages. Now, person-to-person and student loan refinancing, mostly For example, rice cakes, micropayments live on a platform nearly targeting Millennials.5 GreenSky® offers waiting rooms, stories indistinguishable from social media, a instant loans for home improvements,6 about rocks – and certain no-go zone for banks.4 and Avant® offers loans to consumers things that you hope will with low credit scores.7 be boring like visits to the “Banks, traditionally, were very slow dentist and travel by plane. -

2020 Q1 Mid Cap Growth Factsheet

Mid Cap Growth Strategy | Fact Sheet as of 03/31/2020 Philosophy Chuck Lauber, CFA First National believes 15% Portfolio Manager that active portfolio 10% Chuck has 25 years of management grounded in 5% investment management strong fundamental 0% experience serving a research and adherence -5% majority of that time as a to risk management will -10% Small and Mid Cap Equity add value to our clients' -15% Analyst at Koesten portfolios over full market -20% Hirschmann & Crabtree cycles by limiting volatility -25% Quarter 1 Year 3 Years 5 Years 10 Years and Security Benefit and increasing their Group. He joined First First National Bank (Gross of Fees) returns. First National Bank (Net of Fees) National in August 2006. Russell Midcap Growth Chuck earned his Bachelors in Business Quarter 1 Year 3 Years 5 years 10 Years Strategy Administration from East Composite (Gross of Fees) -21.19% -11.41% 4.91% 4.63% 10.67% Texas State University in Seeks to maximize long- Composite (Net of Fees) -21.37% -12.32% 4.01% 3.78% 9.73% 1987 and his Masters of term total return, by Russell Midcap Growth -20.04% -9.45% 6.53% 5.61% 10.89% Business Administration in identifying mid-cap 1993 at the University of growth companies in a Portfolio Statistics Strategy Benchmark Texas. broad range of economic Weighted Avg. Market Cap $17.63B $17.26B sectors and industries in Median Market Cap $11.81B $7.24B a bottom-up process. We Kurt Spieler, CFA Price/Earnings (ex-neg) 26.0x 23.0x search for companies that Senior Managing Director Price/Book Ratio 4.1x 4.4x have established a & Portfolio Manager Standard Deviation 17.78% 17.43% sustainable competitive Kurt joined First National Beta 1.01 1.00 advantage.