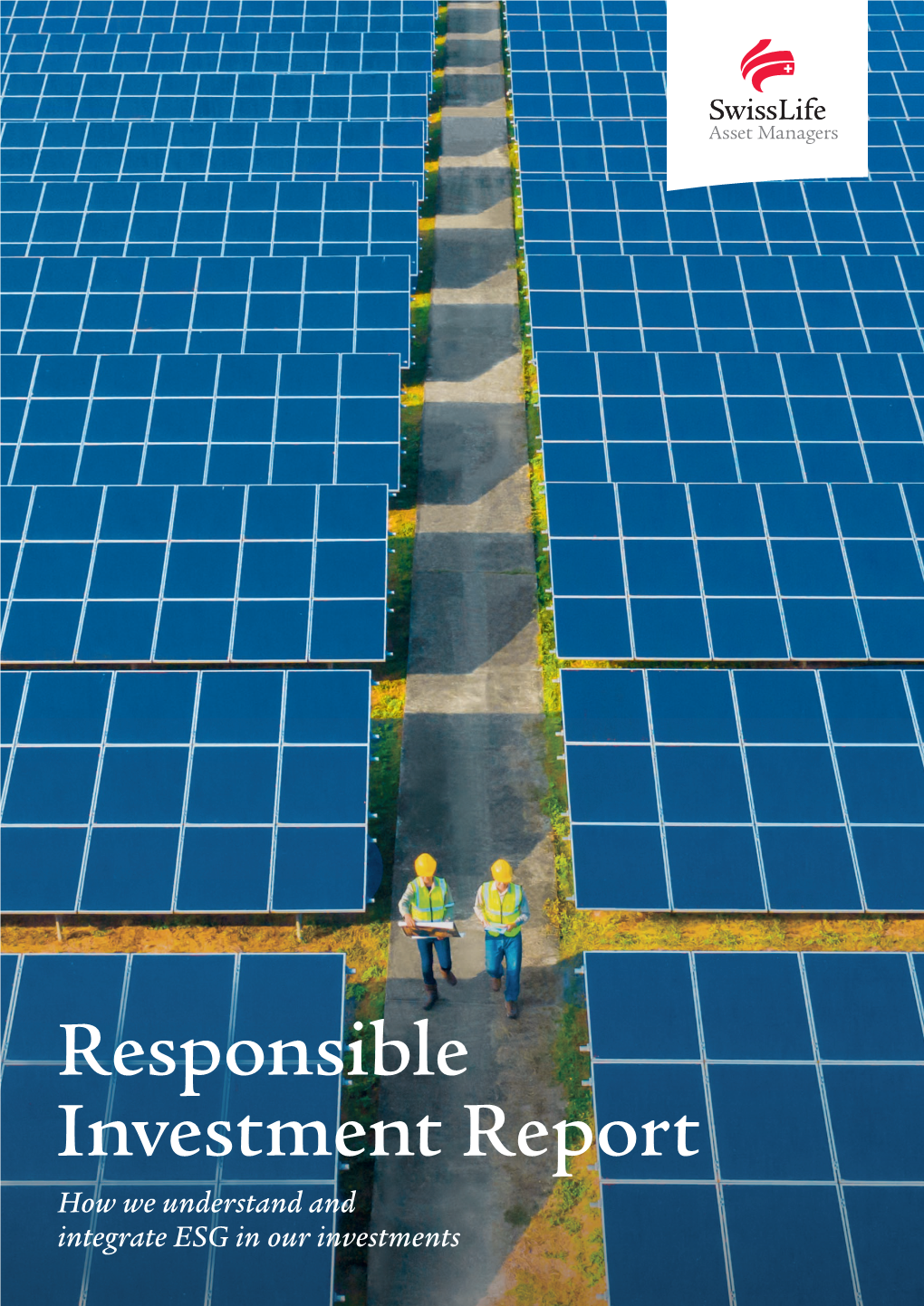

Swiss Life Asset Managers Responsible Investment Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Part VII Transfers Pursuant to the UK Financial Services and Markets Act 2000

PART VII TRANSFERS EFFECTED PURSUANT TO THE UK FINANCIAL SERVICES AND MARKETS ACT 2000 www.sidley.com/partvii Sidley Austin LLP, London is able to provide legal advice in relation to insurance business transfer schemes under Part VII of the UK Financial Services and Markets Act 2000 (“FSMA”). This service extends to advising upon the applicability of FSMA to particular transfers (including transfers involving insurance business domiciled outside the UK), advising parties to transfers as well as those affected by them including reinsurers, liaising with the FSA and policyholders, and obtaining sanction of the transfer in the English High Court. For more information on Part VII transfers, please contact: Martin Membery at [email protected] or telephone + 44 (0) 20 7360 3614. If you would like details of a Part VII transfer added to this website, please email Martin Membery at the address above. Disclaimer for Part VII Transfers Web Page The information contained in the following tables contained in this webpage (the “Information”) has been collated by Sidley Austin LLP, London (together with Sidley Austin LLP, the “Firm”) using publicly-available sources. The Information is not intended to be, and does not constitute, legal advice. The posting of the Information onto the Firm's website is not intended by the Firm as an offer to provide legal advice or any other services to any person accessing the Firm's website; nor does it constitute an offer by the Firm to enter into any contractual relationship. The accessing of the Information by any person will not give rise to any lawyer-client relationship, or any contractual relationship, between that person and the Firm. -

Insurance Market Report 2019 Foreword

Insurance market report 2019 Foreword 2 This report provides an overview of the Swiss sets as well as amounts due from derivative financial insurance market in 2019. The first part contains instruments no longer form part of the investments, information about the market as a whole. Parts 2, 3 some of the key figures published in the insurance Foreword Foreword and 4 provide detailed information on the life, non- market report 2018 such as the total assets, the in- life and reinsurance sectors. vestments, the underwriting liabilities, the gains on investments, the return on investments and the in- The figures presented in the report have been pre- formation on asset allocation differ from the previous pared on a statutory basis; any changes in the values year’s figures provided in this report. of assets and liabilities generally do not correspond FINMA | Insurance market report 2019 FINMA | Insurance market report to market value adjustments. For example, bonds are As announced in last year’s report, since the 2019 shown at amortised cost, which means the carrying annual survey, this report includes information on the values are not sensitive to interest rates. On the li- group life reporting for occupational pension schemes abilities side, technical provisions for life insurers are of life insurance companies for the first time and discounted with technical interest rates and not with replaces the transparency report on occupational the prevailing market yield curve. Technical provisions pensions. The information on the group life reporting for non-life insurers are generally undiscounted, while for occupational pension schemes of life insurance accident insurance benefits (UVG) have been companies can be found in ”Life insurance com- specifically excluded. -

Swiss Life Investment Foundation

Swiss Life Investment Foundation Benefit from the experience and up-to-date investment principles of large pension funds. • Top 5 investment foundation with assets of 14 billion • More than one in three Swiss employee benefits institutions as investors Cornerstones of Swiss Life Investment Foundation Tax-exempt foundation for the collective investment of Employee benefits foundations for Swiss Life personnel pension assets (established in 2001) as important key investors Gross assets of with around CHF 14 billion, and thus Majority of Board of Trustees members are investor among the top 5 of the 35 Swiss investment foundations representatives Strongest growing investment foundation in the past Supervisory authority: OAK BV (Federal Occupational ten years Pensions Regulatory Commission) Over 680 pension funds and collective foundations Member of KGAST (Conference of Managers of Swiss and thus every third Swiss employee benefits institution Investment Foundations), complying with its quality as an investor guidelines Comprehensive modular product range BVG-Mix 15 BVG-Mix 25 BVG-Mix 35 BVG-Mix 45 BVG-Mix 75 5% 2% 5% 2% 2% 2% 3% 2% 2% 5% 2%5% 5% 2% 13% 12% 5% 13% 16% 14% 9% 13% 11% 15% 5% 7% 13% 9% 7% 12% 17% 22% 20% 37% 6% 8% 24% 38% 13% 28% 18% 28% 23% Liquid Assets Bonds CHF Domestic Equities Switzerland Real Estate Alternative investments Mortgages Switzerland Bonds CHF Foreign Equities Foreign Switzerland (CHF hedged) Bonds Foreign Currencies Real Estate Foreign (CHF hedged) (CHF hedged) State-of-the-art investment philosophy Objective selection of asset managers The best qualified asset managers are selected on the basis of objective criteria and taking into account the specific requirements of the various investment groups. -

General Policy Conditions for Group Life Insurance

Swiss Life Ltd, General-Guisan-Quai 40, P.O. Box, 8022 Zurich Swiss Life Ltd, Zurich (Swiss Life) General Policy Conditions for Group Life Insurance Effective date: 1 January 2020 web0136 | 01.2020 Contents Art. 1 General 3 1 - Basis of the contract 2 - Specially agreed terms 3 - Entitlement to benefits 4 - Legal basis Art. 2 Insurance protection 3 1 - Insurance year 2 - Application 3 - Assumption of liability 4 - Underwriting 5 - Breach of the duty of disclosure 6 - Change in benefits Art. 3 Premiums 3 1 - Definition 2 - Due date 3 - Calculation 4 - Experience rating 5 - Settlement 6 - Consequences of default 7 - Refund of premiums Art. 4 Costs 3 Art. 5 Duty to inform; establishment of entitlement 3 1 - Duty to inform 2 - Certificate of life 3 - Disability 4 - Death 5 - Children in continuing education Art. 6 Subrogation 4 Art. 7 Bonus 4 1 - Bonus distribution 2 - Calculation of the bonus 3 - Bonus reserve 4 - Bonus allocation 5 - Entitlement to participation in surplus 6 - Information Art. 8 Premature withdrawal from the portfolio of insured persons 4 1 - Termination of the insurance 2 - Surrender value 3 - Extension Art. 9 Termination of insurance contract 5 1 - Termination of the insurance 2 - Partial termination 3 - Surrender value 4 - Deduction due to the interest rate situation Art. 10 Premium rate 5 1 - Guarantee of insurance tariffs 2 - Modification of the insurance tariffs 3 - Collective and individual insurance tariffs Art. 11 Further provisions 5 1 - Gross negligence 2 - Suicide 3 - Communications to Swiss Life 4 - Change of address 5 - Place of performance and jurisdiction Art. -

Important Notice This Offering Is

IMPORTANT NOTICE THIS OFFERING IS AVAILABLE ONLY TO INVESTORS WHO ARE NON-US PERSONS AND ADDRESSEES OUTSIDE OF THE US IMPORTANT: You must read the following before continuing. The following disclaimer applies to the attached Prospectus accessed via internet or otherwise received as a result of such access and you are therefore advised to read this disclaimer page carefully before reading, accessing or making any other use of the attached Prospectus. In accessing the attached Prospectus, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. THE SECURITIES HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE US SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT''), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES OR OTHER JURISDICTION, AND, SUBJECT TO CERTAIN EXCEPTIONS, THE SECURITIES MAY NOT BE OFFERED OR SOLD WITHIN THE UNITED STATES OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, US PERSONS (AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT). THE FOLLOWING PROSPECTUS MAY NOT BE FORWARDED OR DISTRIBUTED TO ANY OTHER PERSON AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER. ANY FORWARDING, DISTRIBUTION OR REPRODUCTION OF THIS DOCUMENT IN WHOLE OR IN PART IS UNAUTHORISED. FAILURE TO COMPLY WITH THIS DIRECTIVE MAY RESULT IN A VIOLATION OF THE SECURITIES ACT OR THE APPLICABLE LAWS OF OTHER JURISDICTIONS. -

Aegon N.V. Executive Board Remuneration Policy 2020

Aegon N.V. Executive Board Remuneration Policy 2020 The Hague, March 2020 Executive Board Remuneration Policy 2020 Version History Last Version March 24, 2011 Revised and updated March 11, 2020 Endorsed by the Supervisory Board of Aegon N.V. March 17, 2020 Adopted by Shareholders at the Annual General Meeting of Shareholders May 15, 2020 2 Executive Board Remuneration Policy 2020 1. Policy 1.1 Remuneration Policy This Executive Board Remuneration Policy (the 'Policy') outlines the terms and conditions for the board agreement with and remuneration of the members of the Executive Board of Aegon N.V. (the 'Executives'), to be submitted for approval by the shareholders of Aegon N.V. (the 'Shareholders') at the Annual General Meeting of Shareholders on May 15, 2020. This Policy replaces the Aegon N.V. Executive Board Remuneration Policy of 2011. Remuneration of all employees of Aegon N.V. and its direct and indirect subsidiaries ('Aegon') and the Executives is governed by the Aegon Group Global Remuneration Framework (the 'Remuneration Framework'). This Policy is aligned with the current version of this Remuneration Framework, which was adopted by the Supervisory Board of Aegon N.V. (the 'Supervisory Board') on December 18, 2019. The Remuneration Committee of the Supervisory Board of Aegon N.V. (the 'Remuneration Committee' ) prepared the changes to this Policy, which were endorsed by the Supervisory Board on March 17, 2020. At the date of approval, the Policy complies with the applicable rules and regulations such as the Dutch Financial Supervision Act, the Dutch Civil Code, the Dutch Corporate Governance Code and the Solvency II Legal Framework. -

Swiss Life Business Direct Full Insurance – the Uncomplicated Online Solution

Occupational benefits Swiss Life Business Direct full insurance – the uncomplicated online solution The employee benefits solution for startups who want to cover all risks. The product ɬ Different employee benefit plans: You can choose Swiss Life Business Direct is the first web-based em- between different benefit plans: from the minimum ployee benefits solution which is uncomplicated and BVG level to a comfortable benefit solution. Straight- straightforward to subscribe to. It just takes a few forward charts included in the offer help you to minutes. Swiss Life offers cover for all risks including determine the level of contributions and benefits. It’s longevity, disability and death. And Swiss Life offers a childishly simple process. With the information you a 100 % capital and interest rate guarantee. Swiss Life we provide you will be able to find the right solution bears 100 % of the insurance and investment risk. in a matter of minutes. ɬ Bonuses: You benefit from bonus distribution. Recommendation ɬ Payment method: monthly in arrears Swiss Life Business Direct is the right choice for a newly ɬ Contract documents: You can access the contract established company or a company in the process of documents online at any time. being established and which has yet to organise its em- ɬ Changes in salary and headcount can be easily ployee benefits. If you would like your employee benefits processed online at your convenience. You always to cover all risks and to have direct access to all relevant maintain an overview of the situation. information, Swiss Life Business Direct is ideal for you. -

Übersicht Der Dienstleister Von Swiss Life in Bezug Auf Vertriebspartner Stand: 24

Übersicht der Dienstleister von Swiss Life in Bezug auf Vertriebspartner Stand: 24. September 2021 Konzerngesellschaften, die an einer gemeinsamen Verarbeitung von Daten innerhalb der Unternehmensgruppe teilnehmen: Swiss Life AG, Niederlassung für Deutschland Swiss Life Invest GmbH SLP Swiss Life Partner Vertriebs GmbH & Co. KG Swiss Life Partner Service- und Finanzvermittlungs GmbH SLPM Schweizer Leben PensionsManagement GmbH Swiss Life Pensionsfonds Aktiengesellschaft Swiss Life AG, CH Swiss Life Pensionskasse Aktiengesellschaft Swiss Life Asset Management GmbH Swiss Life Products (Luxembourg) S.A., Niederlassung für Swiss Life Deutschland Holding GmbH Deutschland Swiss Life Deutschland Operations GmbH Swiss Life Service GmbH Swiss Life Deutschland Vertriebsservice GmbH Swiss Life Vermittlungs GmbH Swiss Life Holding AG, CH Verwaltung SLP Swiss Life Partner Vertriebs GmbH Dienstleister, die Datenverarbeitung für Swiss Life erbringen: Dienstleister Übertragene Aufgaben ABIS GmbH Aktualisierung und Anreicherung von Adressdaten Amazon Web Services, Inc. Hosten von Servern / Web-Diensten Amazon Web Services EMEA Sarl Auskunftsstelle über Versicherungs- - Bonitätsauskünfte /Bausparkassenaussendienst - Prüfung von Beteiligungsverhältnissen, und Versicherungsmakler - Adressauskünfte in Deutschland e.V. (AVAD) Breitsamer Entsorgung und Recycling GmbH Entsorgung und Recycling Computershare Communication Services GmbH Erbringung Backup-Leistungen Druckstraße, BCM, Notfall Creditreform München Ganzmüller, Groher & - Bonitätsauskünfte Kollegen -

Aegon Annual Report 2018 1

Integrated Integrated Aegon Annual Report 2018 Annual Report Aegon Annual Report 2018 1 Welcome to Aegon’s 2018 Annual Report To prosper, we believe companies must create long-term value a responsible approach to business. This report also contains for the societies in which they operate. Aegon creates value the 2018 consolidated financial statements and Company in several ways: as a provider of financial services, as well financial statements for Aegon N.V. (from page 101). as a responsible employer and business partner. We also make significant social and economic contributions through returns We have prepared this report in accordance with the International to shareholders, tax and support for local communities, as well Financial Reporting Standards, as adopted by the European Union as through investments both for our own account and on behalf (IFRS-EU), as well as the International Integrated Reporting of our customers. Our aim is to be a responsible corporate citizen, Council (IIRC) framework and reporting standards issued fully aware of the impact we have on our stakeholders and by the Global Reporting Initiative (GRI). This report also conforms on society as a whole. to relevant reporting requirements under the Dutch Corporate Governance Code and Dutch Civil Code (Part 9, Book 2). This is Aegon’s Annual Report for the year ending December 31, 2018. It is the Company’s first fully integrated report. This Annual Report is also used as the basis for our Form 20-F Aegon’s aim in producing this report is to provide a clear, (in compliance with our listing on the New York Stock Exchange). -

Life Insurance Results 2017 Strategic Focus in a Challenging Market Contents

Life insurance results 2017 Strategic focus in a challenging market Contents Foreword 01 Year in review 02 Solvency II Results – improved capital resilience 05 Economic Value Reporting 08 Challenges and opportunities ahead 10 Appendix A – Sensitivities 11 Contact details 12 Download a digital copy of this report at: Deloitte.co.uk/LifeInsuranceResults Life insurance results 2017 | Strategic focus in a challenging market Foreword 2017 was a strong year for the major European life insurers, with generally robust capital positions allowing the return of excess capital to shareholders. Insurers now seem confident in their Solvency II balance sheets, with a shift of focus from capital to profitability and higher levels of strategic activity, such as M&A. This report discusses the key themes emerging from the 2017 Uncertainties remain on the regulatory front with the continued annual results announcements for a range of UK and Continental evolution of Solvency II and questions around the likely Brexit European insurers, with a particular focus on the voluntary outcome. As an example, in the UK, the PRA has reviewed certain disclosures of Solvency II and Embedded Value (“EV”) results. As aspects of the application of Solvency II and will now allow internal well as looking back at the 2017 results, we consider the challenges model insurers to apply a Dynamic Volatility Adjustment and and opportunities for the sector and how we expect insurers’ may also take steps to address some of the concerns with the disclosures to evolve in the future. calibration of the Risk Margin. 2017 saw insurers focus on strategy. Recent life insurance M&A Looking ahead, 2018 will bring a number of challenges activity in both the UK and rest of Europe has been notable, as to insurers: firms look to refine their strategies and increasingly target dividend growth. -

2020 Global Benefits Financing Matrix and Poolable Coverages

2020 Global benefits financing matrix and poolable coverages Complete listing of the nine global benefits networks and their affiliated insurers across 212 countries and territories 2020 Global benefits financing matrix and poolable coverages Zurich Global AIG Global Allianz Global Swiss Life Country AIA Generali GEB IGP Insurope Maxis GBN Employee Benefits Network Benefits Global Solutions Solutions Number of countries and territory 19 120 86 125 68 105 116 77 135 members Afghanistan None None None None None None None None None SIGAL Life UNIQA Partner not Albania None None None None None Group Austria Life, None None disclosed Albania (L,A,D) AXA Assurances Salama, Globus Algeria None None None Macir Vie (L,A,D) None None Algérie Vie SPA None Networks (L,A,M) (L,A,D,M) Andorra None None None None None None None None Zurich Spain Sanlam Pan-Africa, Saham Angola Saham Angola Fidelidades, Globus Angola None Saham Angola None None None None Seguros (L,A,D) Seguros Network (L,A,D,M) Seguros (L,A,D,M) Pan-American Life Pan American Life Pan American Life Antigua and Sagicor Life Insurance Company None Insurance Group None None None None Insurance Group Barbuda (L,A,D,M) of the Eastern (L,A,D,M) (L,A,D,M) Caribbean (L,A,D,M) HSBC Seguros Allianz Argentina Galicia Vida Prudential Seguros La Caja De Seguros de Vida Argentina Argentina None Compañía de SMG LIFE (L,A,D) MetLife Argentina Compañía de Zurich (L,A,D) S.A. (L,A,D) (L,A,D) (L,A,D)/Prudential Seguros S.A. -

The Swiss Life Group's 2017 Financial

4 Facts & Figures The Swiss Life Group’s 2017 financial year at a glance: Business overview — The Swiss Life made further operational progress in 2017: Adjusted profit from operations increased by 5% to CHF 1475 million and net profit rose by 9% to CHF 1013 million. All units developed positively and increased their contribution to the result. The fee business was a significant factor in the good results: fee income rose by 8% in local currency to CHF 1480 million, driving the fee result to CHF 442 million or 11% over the previous year. Swiss Life posted a 6% rise in premiums in local currency to CHF 18.6 billion in 2017. Insurance reserves to the benefit of the company’s policyholders rose by 4% in local currency. In proprietary asset management Swiss Life earned direct investment income of CHF 4.3 billion. The direct investment yield was 2.8%; the net investment yield stood at 2.5%. In its third-party business, Swiss Life Asset Managers posted net new assets of CHF 7.1 billion. It had CHF 61.4 billion in third-party assets under management at the end of 2017, an increase of 24%. Markets — In Switzerland, France and Germany, Swiss Life offers individuals and corporations comprehensive and individual advice plus a broad range of own and partner products through its sales force and distribution partners such as brokers and banks. The Swiss Life Select, Tecis, Horbach, Proventus and Chase de Vere advisors choose suitable products for customers from the market according to the Best Select approach.