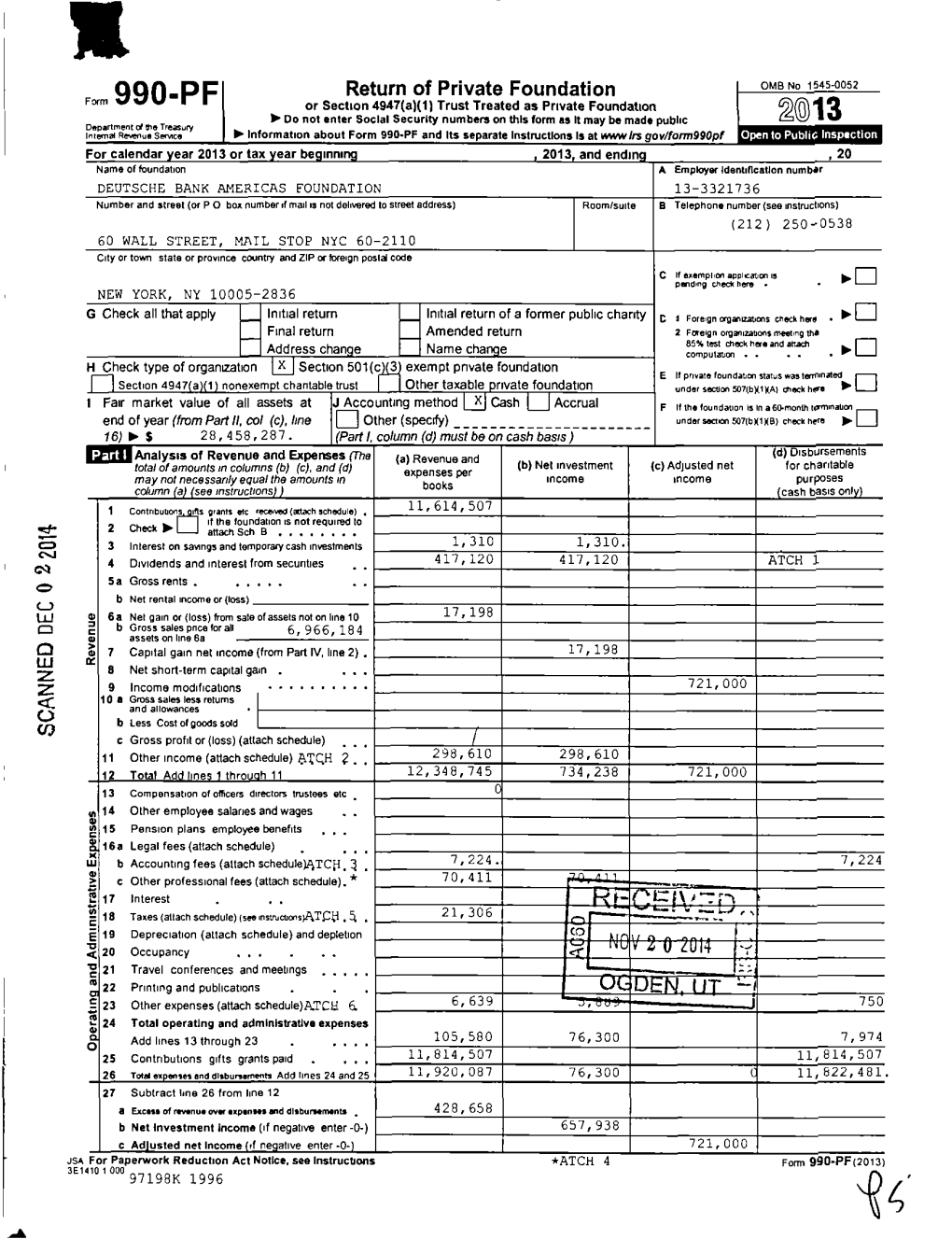

Return of Private Foundation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Montclair Film Festival Announces 2016 Emerging Filmmaker Competition Winners

For Immediate Release The Montclair Film Festival Announces 2016 Emerging Filmmaker Competition Winners Student Film Competition winners to be featured at MFF screening on May 7, 2016 March 30, 2016, Montclair, NJ— The Montclair Film Festival (MFF) today announced the winners of the 2016 Emerging Filmmaker Competition (EFC). This year’s competition, the festival’s 5th annual, features 20 winning films from 17 different area schools. The winning films will be screened at MFF’s the annual Emerging Filmmaker Competition ceremony on Saturday, May 7, 2016 at 11:00 AM the Wellmont Theater. A complimentary after party for all attendees follows the screening. The MFF assembled a jury of local film and television professionals to adjudicate a record number of film submissions. All films were placed in groups based upon the age of the filmmaker; Cinemaniacs (Grades 4-6), Storytellers (Grades 7-9), and Visionaries (Grades 10-12). Awards were given to films in each group in the Narrative, Comedy, Documentary, Experimental film categories, as well as a special award for films that seek to make a social impact. 2016 EFC Jurors included Evan Baily, Margaret Bodde, Evan Cutler, Amy Friedman, Mark Fitzmartin, JoAnn McCullough, Raphaela Neihausen, and Nina Sloan. MFF Education Director Sue Hollenberg and Emerging Filmmaker Competition Coordinator Michelle Anderson oversaw the submissions process on behalf of MFF. “We are incredibly proud of the work of every young filmmaker who had the courage and creative vision to make and submit a film for our Emerging Filmmakers Competition,” said MFF Education Director Sue Hollenberg. “We hope the entire community will join us on May 7 at the Wellmont to celebrate all of the wonderful stories these filmmakers have shared with us.” Tickets for MFF Members go on sale Tuesday, April 5, at 11:00 AM and will be on sale to the public on Friday, April 8, at 11:00 AM by visiting the MFF Box Office, located at 544 Bloomfield Avenue in Montclair, NJ or by visiting www.montclairfilmfest.org. -

New Jersey Hills Media Group $695 Ourour Towntown Informational Directory 2018-20192020-2021

New Jersey Hills Media Group $695 OurOur TownTown Informational Directory 2018-20192020-2021 Boonton Boonton Twp. Denville • Montville Mountain Lakes Dover • Rockaway Rockaway Twp. The Citizen PAGE 2 Our Town denvillecitizen.com HAVEN Eagle Scout Sean Tucker and Troop 17 of Boonton worked to create a shady haven to read at the Boonton Holmes Library. From left are: Tucker and his father, John; Michael Baresh, Matthew Baresh, Nathan Gupta and Patrick Anderson. Several others helped with the project, but are not pictured. They include: Elizabeth Tucker, Devin Gaglione, Ian Tucker and Jack Tucker. INSIDE Boonton ................................... 6-7 Boonton Township ................... 8-9 Community Groups ............... 29-32 Our Town Dover ................................... 10-11 Denville Township ................. 12-13 is published annually as a supplement to its newspapers Education .............................. 26-28 by New Jersey Hills Media Group, Golf Courses .............................. 33 Suite 104, 100 S. Jefferson Road, Whippany, N.J. 07981 Healthcare ............................ 39-40 Montville Township ............. 14-15 PUBLISHERS Morris County ............................. 5 Elizabeth K. Parker and Stephen W. Parker Mountain Lakes ................... 16-17 New Jersey Hills Media Group ..... 4 OUR TOWN COORDINATOR Places of Worship ................. 34-38 Jacob Yaniak, [email protected] Public Libraries ......................... 22 Public Safety ............................. 23 Executive Editor Elizabeth K. Parker Vice President of Sales and Marketing Public Schools ....................... 24-25 Business Manager Stephen W. Parker Jerry O’Donnell Recreation & Parks .................... 22 General Offices Manager Diane Howard Advertising Designer Assistant Executive Editor Philip Nardone Toni Codd Rockaway Borough .............. 18-19 Rockaway Township ............. 20-21 New Jersey Hills Media Group denvillecitizen.com Our Town PAGE 3 ABOUT THIS GUIDE Latest figures show the Essex-Hunterdon-Morris-Som- the longtime resident. -

Parenting Smart Sports Summer@ Delbarton

March 9, 2017 New Jersey Hills Media Group PARENTING www.newjerseyhills.com SMART SPORTS SUMMER@ DELBARTON 10 Sports Camps Co-ed Courses for Boys Grades 3-9 for Grades 3-12 June 26 – July 28 June 21 – July 28 Register Online • Early Bird Rates • Red Cross Swim Lessons 973/538-3231 ext. 3019 • 230 Mendham Road • Morristown, NJ 07960 delbarton.org/summer The Bernardsville News • Observer-Tribune • Echoes-Sentinel • Hunterdon Review • Randolph Reporter • Roxbury Register • Mt. Olive Chronicle • Madison Eagle Chatham Courier • Florham Park Eagle • Hanover Eagle • Morris NewsBee • The Citizen PAGE 2 Thursday, March 9, 2017 Parenting newjerseyhills.com • INDEX OF ADVERTISERS • TAKE CAMP SKILLS Apple Montessori School ................................. 8 Basking Ridge Country Club .............................. 9 Calderone School of Music .............................. 13 TO SCHOOL Camp Riverbend ....................................... 8 Chatham Day School .................................... 4 Delbarton School ....................................cover AND BEYOND Engineering Explorations ................................ 3 Far Hills Country Day School ............................. 19 The following article was reprinted by der to sustain some of the changes camp- permission of the American Camp Associ- ers have made. Bob Ditter, a clinical social FDU Camp Discovery ................................... 10 ation. ©2017, American Camping Associa- worker and psychotherapist, suggests: Greater Morristown YMCA .............................. 18 tion, Inc. -

SSS School Codes

To Apply For Financial Aid in Academic Year Parents’Parents’ Financial Financial Statement Statement WorkbookInstruction and Booklet Instruction Booklet T is instruction booklet walks you through completing your Parents’ Financial Statement (PFS) as part of your application for f nancial aid for the 2014-15 academic year. Apply online at sss.nais.org/parents. Step 1: Prepare to Apply Find out from each school its application deadlines and requirements. T en gather any materials you will need to reference as you answer the questions in the PFS. Step 2: Complete Your Online PFS From your PFS Online Dashboard, choose to begin a new PFS for the academic year for which you are applying. As you work, you can stop and save your work at any time then log in again using your email address and PFS Online password. Step 3: Pay For and Submit Your PFS Once you have completed all the f elds of the PFS, on the Pay and Submit screen you will choose your method of secure payment ($41.00). Once you submit your PFS, your information is sent immediately to schools. It cannot be withdrawn from the PFS system and your money cannot be refunded. Step 4: “Manage” Any Additional Documents You Must Submit On the Manage Documents screen, you can see what additional documents you should submit to SSS as part of your application, track the receipt of documents you submitted, and upload documents from your computer. Step 5: View your Family Report After you have paid for and submitted your PFS, SSS processes your information immediately and sends your PFS and Estimated Family Contribution to all of the schools you selected. -

BOARD of EDUCATION Montville Township Municipal Building: 195 Changebridge Road Montville, New Jersey

TOWNSHIP OF MONTVILLE BOARD OF EDUCATION Montville Township Municipal Building: 195 Changebridge Road Montville, New Jersey Agenda Regular Meeting of the Board of Education Tuesday, June 18, 2019 No members of the public were present. President Grau called the meeting to order at 6:30 p.m. with a roll call. Roll Call Present: Dr. K. Cortellino, Mr. J. Daughtry, Dr. D. Modrak, Mr. J. Morella, Mr. M. O’Brien, Mr. M. Rappaport, Ms. M. Zuckerman (6:38 p.m.), Mr. M. Palma and Mr. C. Grau. Absent: None. Also, Present: Superintendent of Schools, Dr. Rene Rovtar School Business Administrator, Ms. Katine Slunt Assistant Superintendent, Dr. Casey Shorter Assistant Superintendent for Curriculum & Instruction, Andrea Woodring Board Attorney, Mr. Steven Edelstein Closed Session A motion was made by Mr. O’Brien and seconded by Mr. Morella to enter into Closed Session through the following resolution. All present members voted yes. WHEREAS, the Open Public Meetings Act, N.J.S.A.10:4-11, permits the a public body to meet in closed session to discuss certain matters; WHEREAS, the said law requires the Board to adopt a resolution at a public meeting before it can meet in such an executive or private session; BE IT THEREFORE RESOLVED, that the Montville Township Board of Education has determined that it is necessary to meet in Closed Session on June 18, 2019 at 6:30 p.m. to discuss: 1) Superintendent’s Harassment, Intimidation and Bullying (“HIB”) update/recent matters and investigations, if any; and 2) JCP&L Lazar Power Lines Improvement Project. BE IT FURTHER RESOLVED, that the Montville Township Board of Education reserves the right to discuss such other matters BE IT FURTHER RESOLVED, that the minutes of this closed session be made public when the need for confidentiality no longer exists. -

New Jersey Hills Media Group $695 Our Town Ourinformational Directory Town 2019-2020

New Jersey Hills Media Group $695 Our Town OurInformational Directory Town 2019-2020 Mine Hill Mount Arlington Mount Olive Twp. Randolph Twp. Roxbury Twp. Randolph Reporter • Roxbury Register • Mt. Olive Chronicle Jessica Scharrer, Substation Electrician Jessica is making the frutue of energy brighter. Jessica excels in protecting her customers’ way of life while blazing a path for more women who wish to follow in her impressive footsteps. We’re reducing inpatient stays for VNA provides comprehensive home care, Our Private Care program offers carefully clients of all ages and making it from skilled nursing and rehabilitation screened, specially trained and closely possible for the elderly to age in place to volunteers who assist homebound supervised aides and homemakers in the comfort of their own homes. seniors with grocery shopping. part-time, full-time or on a live-in basis. A trusted resource The Visiting Nurse Association of Northern NJ (VNA) Comprehensive has been pioneering and leading the way in home Home Care Solutions care in this region since 1898. If you’re a senior in need of a t Skilled Nursing t Health helping hand or you’re caring t Hospice Aides & Homemakers for a parent, spouse or another t Physical Therapy t Private Care Services t Occupational Therapy t Friendship House that can improve your quality t Speech Therapy Adult Day Care Center of life. In fact, you may be eligible to receive free or low-cost t Caregiver Training t Registered Dieticians & Support t Social Workers assistance.* Please call us for a free, no obligation consultation. ACCR TH ED Telehealth L I t A TA E T I H O Y N T I P A House Calls for N t R U T M N M E Groceries O R C S E A N L IO O T F TA ACCREDI * Varied eligibility requirements apply. -

2013-2014 NAIS Booklet.Indd

To Apply For Financial Aid in Academic Year Parents’ Financial Statement Instruction Booklet 2013-2014 Th is instruction booklet walks you through completing your Parents’ Financial Statement (PFS) as part of your application for fi nancial aid for the 2013-14 academic year. Th e PFS form is stapled in the center of this instruction booklet. Step 1: Prepare to Apply For faster processing Find Frequently Asked Questions on page 2. of your PFS, apply online at Step 2: Complete the PFS sss.nais.org/parents. Find line-by-line help starting on page 3. Find a list of SSS Codes for participating schools on page 13. Step 3: Sign Your PFS and Provide Nonrefundable Payment Find important tips on page 7. Read the legal Terms and Conditions that you agree to when you submit your PFS on page 19. Step 4: Mail Your PFS to School and Student Services (SSS) Find important tips and SSS addresses on page 7. Step 5: Submit Additional Documents You’ve Been Told to Send to SSS Find important tips on page 7. Find a Required Documents Cover Sheet on page 8. WHAT HAPPENS NEXT? If you include your email address on your PFS, you’ll receive an email conÀ rmation letting you know your PFS has been received and providing you your PFS IdentiÀ cation number. You can use that PFS ID number to go to the PFS Online at sss.nais.org/parents where you can check on the status of documents you have submitted and view your Family Report. Call (800) 344-8328 or email [email protected] with questions. -

Harriet Tubman Play Brings Cheers and Tears to Prep School

PREMIER ISSUE 2010 OUR VOICES sTudenT ColumnisTs: summer life/ baCK To sCHool Harriet Tubman Play Brings Cheers and Tears to Prep School HoraCe manns, ConvenT of THe saCred HearTs, monTClair Kimberley aCademys HeadmasTers sHare diversiTy insigHTs Teen ColumnisTs: Health, Money, Dating, Movies and more PRESENTS The The Resurrection of Meeting Harriet Tubman "The Meeting," an engaging and intelligent play that depicts a fictitious secret meeting between Malcolm X and Dr. Martin Luther King Jr., follow - "The Resurrection of Harriet Tubman," stage ing the bombing of Malcolm X’s home shortly before he was assassinated. actress Melissa Waddy-Thibodeaux’s riveting Malcolm and Martin meet in a room inside the historic Theresa Hotel portrayal of the legendary freedom fighter and where they challenge each other’s strategies to end war, poverty, racism founder of the Underground Railroad who infil - and how to establish Black power. They were men with different ideologies, trated the slave-holding South repeatedly to but a common understanding of the plight of Black Americans. free her people. The emotional heft Waddy-Thi - bodeaux brings to the role frequently leaves “I wasn’t born when the audience in tears. Just recently, Texas Gov. Rick Perry honored the actress as a final - Malcolm and Martin were ist for the Humanities Texas Award, which rec - ognizes imaginative leadership in the here, so all I knew was performing arts. what I had read and what my parents had told me. But this play, fictional it might be, was as informa - tive and helpful to my un - derstanding of these great “The children welcomed Harriet Tubman leaders as anything else with excitement and awe. -

Bulletin 6-25-20

PARSIPPANY-TROY HILLS TOWNSHIP SCHOOLS SUPERINTENDENT'S BOARD OF EDUCATION BULLETIN Number 21 June 25, 2020 MISSION STATEMENT The mission of the Parsippany-Troy Hills Township School District, in partnership with families and the greater community, is to challenge and nurture all students academically and to develop confident learners who are compassionate, generous, appreciative, and invested in their diverse world. This will be accomplished through innovative opportunities that inspire life-long learning, critical thinking and problem solving, creative exploration, and the democratic collaboration among students and staff. Date Adopted: 12/15/16 Public Comments In an effort to align our meeting practices with those of the Township and to insure an orderly meeting, effective this evening the following guidelines must be adhered to for all of those who wish to speak during the public comment section of tonight’s meeting and all future meetings: 1. Each person must sign in and will have three minutes to speak to the Board. 2. Each person must address the presiding officer. 3. Each person must recognize the authority of the presiding officer and end his or her comments at the end of three minutes. 4. After everyone who wishes to speak has had that opportunity to do so, a person may speak one more time to the Board for one minute. 5. Please note that we have included copies of Board of Education Bylaw 0167 – Public Participation in Board Meeting which detail the Board’s expectations and guidelines for addressing the Board of Education. PARSIPPANY-TROY HILLS TOWNSHIP SCHOOLS SUPERINTENDENT’S BOARD OF EDUCATION BULLETIN Number 21 June 25, 2020 The following motions are non-controversial, a matter of routine business and will be voted on by one motion: ITEMS FOR DISCUSSION I.