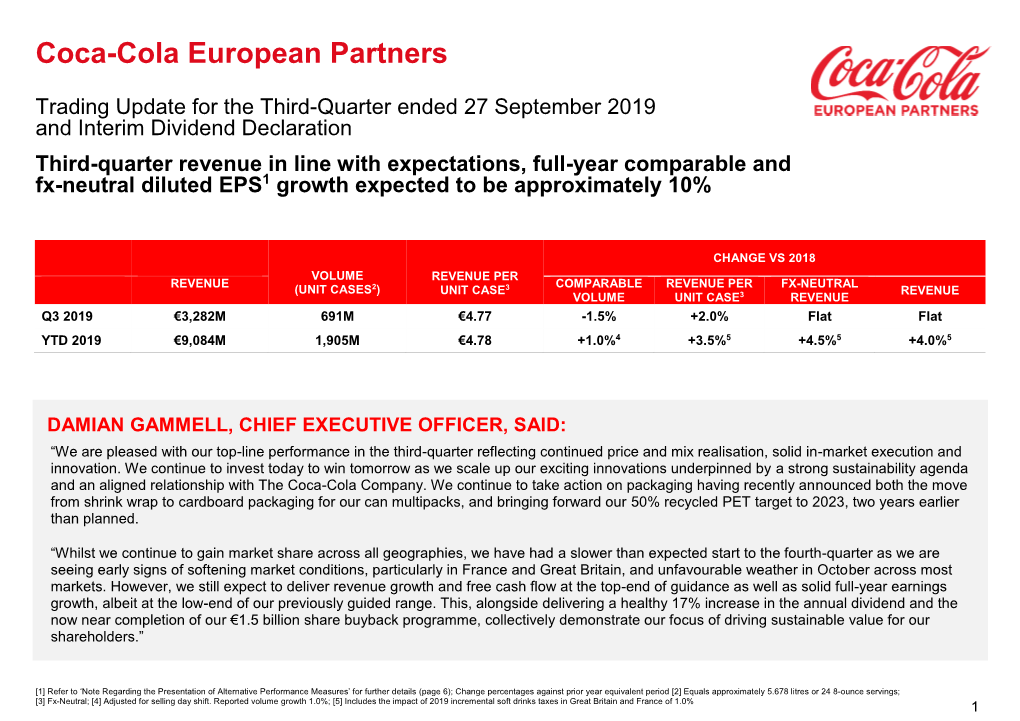

Revenue Performance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In Healthy Beverages Y

And, We Have Been Winning with Integrity 20 Net, Net, We Have Made Great Progress Over the Past Five Years Performance Net Assessment Assessment Workplace + Marketplace + + Community + Integrity + 21 At a High Level, Our Strategies Going Forward Are Clear 22 We Believe in the "Winning" Power of a Focused Food Company Focus Areas Categories Geographies Key Countries Simple Meals North America U.S./Canada Baked Snacks Europe Germany/France/Belgium Healthy Beverages Asia-Pacific Australia Emerging Markets Russia/China Divestitures • Godiva • Snack Foods • U.K. / Ireland • Other 23 As We Have Increased Our Focus, We Have Improved Performance Simple Baked Healthy Meals Snacks Beverages Perfd*formance Trend* Net Sales Growth Consumer Takeaway and Share Trend EBIT Growth * FY'02-'04 to FY'05-'09 24 To Win in the Marketplace With A Focused Food Company There Are Six Important Criteria 1. Large Growing Categories 2. Leading Brands 3. Regional Scale 4. World Class Product Technologies 5. Financial Strength 6. Organization Excellence 25 We Believe We Can Win Over Time in Our Three Areas of Focus Criteria Simple Baked Healthy Meals Snacks Beverages 1. Large Growing Categories 2. Leading Brands + + + 3. Regional Scale + + + 4. WldClPdWorld Class Product Technologies + + + 5. Financial Strength + + + 6. Organization Excellence + + + 26 Within Simple Meals, There are Two Segments Where We Want to Win Meal-Makers Meals Characteristics Less Complete Meals, More More Complete Meals, Less Preparation Required Preparation Required Campbell’s Portfolio • Campbell’s Condensed • Campbell’s Condensed Cooking Soups Eating Soups • Swanson Broth • Ready-To-Serve Soups • Prego Pasta Sauce – Chunky • Pace Mexican Sauces – Select Harvest • Kimball Sauces – V8 • D&L Sauces – Erasco • Domashnya Klassica – Leibig • Touch of Taste • Instant Dry Soups • More . -

Wie Viel Zucker Enthalten Die Getränke?

Wie viel Zucker enthalten die Getränke? Aufgabe: Berechne den Zuckergehalt der Getränke. Verwende dazu die Sipcan- Getränkeliste! 4g Zucker= 1 Würfelzucker Zuckergehalt gesamter Anzahl der Getränk in g/100 ml Zuckergehalt Würfelzucker in Gramm Coca Cola (500ml) Pepsi Cola (500ml) Fanta Orange (500ml) Rauch Eistee Zitrone (500ml) Rauch Happy Day Orange (330ml) Cappy Apfel gespritzt (500ml) Pago Erdbeere (330ml) Römerquelle Emotion Birne Melisse (500ml) Dreh & Trink Kirsche (200ml) Capri Sun Multivitamin (200ml) Almdudler Original (500ml) Mezzo Mix (500ml) Red Bull Organics Bitterlemon (250ml) Köse Mualla Als Faustregel gilt: Getränke sollten maximal 6,7 g Zucker pro 100 ml enthalten ! Zutatenliste: Hier gilt: Je weiter vorne eine Zutat in der Zutatenliste angeführt ist, desto größer ist ihr Anteil im Produkt. Als Faustregel gilt: Je niedriger der Fruchtanteil, desto mehr Zucker wird bei süßen Getränken zugesetzt. ! Hinweis: Mehr Fruchtanteil bedeutet auch mehr Gehalt an Vitaminen und Mineralstoffen. Nicht umsonst zählt 1 Glas 100%-iger Fruchtsaft auch als Obstportion und eigentlich nicht als Getränk. Getränke nach Alphabet sortiert Aufgrund des großen Angebots an verschiedenen Produkten, in denen unterschiedliche Mengen an Zucker enthalten sind, soll die Getränkeliste eine einfache Orientierungshilfe zur Produktauswahl bieten. Bei der Getränkeliste, die vom unabhängigen vorsorgemedizinischen Institut SIPCAN – Initiative für ein gesundes Leben erstellt wurde, handelt es sich um einen Praxisleitfaden. Neben dem Zuckergehalt bietet die Liste auch Informationen, ob ein Produkt Süßstoffe oder Koffein enthält. Weitere Informationen, wie über den Fruchtanteil, oder ob ein Produkt biologisch ist, finden Sie, sofern auf der jeweiligen Produktverpackung erwähnt, in der Online-Checkliste auf www.sipcan.at oder in unserer kostenlosen App (Suchbegriff „SIPCAN“). -

Coca-Cola Enterprises, Inc

A Progressive Digital Media business COMPANY PROFILE Coca-Cola Enterprises, Inc. REFERENCE CODE: 0117F870-5021-4FB1-837B-245E6CC5A3A9 PUBLICATION DATE: 11 Dec 2015 www.marketline.com COPYRIGHT MARKETLINE. THIS CONTENT IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED OR DISTRIBUTED Coca-Cola Enterprises, Inc. TABLE OF CONTENTS TABLE OF CONTENTS Company Overview ........................................................................................................3 Key Facts.........................................................................................................................3 Business Description .....................................................................................................4 History .............................................................................................................................5 Key Employees ...............................................................................................................8 Key Employee Biographies .........................................................................................10 Major Products & Services ..........................................................................................18 Revenue Analysis .........................................................................................................20 SWOT Analysis .............................................................................................................21 Top Competitors ...........................................................................................................25 -

National Kidney Foundation of Michigan

National Kidney Foundation of Michigan PEACH Evaluation Report Year 4 United Way Social Innovation Fund Grant NKFM Evaluation Team: Sarah Wesolek-Greenson, Nicole Waller, Ken Resnicow, Art Franke, Crystal D’Agostino, Robert Schwarzhaupt, Adrienne Cocci, and Nanhua Zhang 01/31/2017 Table of Contents Executive Summary 1 Section I: Introduction 3 o Problem Definition o Prior Research o Program Background o Program Development o Contribution of the Study . Overview of the Study . Previous and Target Level of Evidence . Level of Evidence Achieved . Strengths and Limitations to the Study o Research Questions . Impact Questions . Implementation Questions . Findings to Date Year 1 Year 2 Year 3 . Program Changes . Use of Previous Findings to Evolve Evaluation Section II: Study Approach and Methods 18 o Implementation Evaluation Design o Impact Evaluation Design o Sampling . Selection . Baseline Equivalence Analysis o Measures and Instruments . Regie’s Rainbow Adventure Parent Surveys . Regie’s Rainbow Adventure Teacher Surveys . The NAP SACC . Healthy Families Start with You Chats . Media Toolkit Analytics . Data Collection Regie’s Rainbow Adventure NAP SACC and HFSY . RRA Data Collection Timing . HFSY and NAP SACC Data Collection Timing . Secondary Data Sources . Data Protocol RRA Data NAP SACC and HFSY Data o Sample Retention and Attrition . Addressing Attrition and Treatment of Missing Data Section III: Statistical Analysis of Impacts 35 o Analysis Approach o Unit of Assignment and Analysis o Formation of Matched Groups o Analysis Model . Coding of Variables . Assumptions . Power Analyses Section IV: Findings, Lessons Learned, and Next Steps 40 o Fidelity o Satisfaction with Program Delivery o Media Toolkit . Monthly Trends . General Page Analysis o RRA Effect Sizes o Previous Program Analysis Approaches . -

Coca-Cola's Swoop for Costa Coffee Will Cut Its

COCA-COLA’S SWOOP FOR COSTA COFFEE WILL CUT ITS EXPOSURE TO SUGAR AND PLASTIC BOTTLES THE GROWING LOATHING FOR THE WHITE STUFF MUST KEEP SOFT DRINKS EXECS AWAKE AT NIGHT By IMD Professor John W. Walsh IMD Chemin de Bellerive 23 PO Box 915, CH-1001 Lausanne Switzerland Tel: +41 21 618 01 11 Fax: +41 21 618 07 07 [email protected] www.imd.org Copyright © 2006-2018 IMD - International Institute for Management Development. All rights, including copyright, pertaining to the content of this website/publication/document are owned or controlled for these purposes by IMD, except when expressly stated otherwise. None of the materials provided on/in this website/publication/document may be used, reproduced or transmitted, in whole or in part, in any form or by any means, electronic or mechanical, including photocopying, recording or the use of any information storage and retrieval system, without permission in writing from IMD. To request such permission and for further inquiries, please contact IMD at [email protected]. Where it is stated that copyright to any part of the IMD website/publication/document is held by a third party, requests for permission to copy, modify, translate, publish or otherwise make available such part must be addressed directly to the third party concerned. COCA-COLA’S SWOOP FOR COSTA COFFEE WILL CUT ITS EXPOSURE TO SUGAR AND PLASTIC BOTTLES Coca-Cola’s £3.9 billion acquisition of Costa Coffee has made quite a ripple. Atlanta-based Coca-Cola is obviously best known for its soft drinks portfolio, found in supermarkets, kiosks, hotels, bars and restaurants around the world. -

Coca-Cola HBC Strengthens Its Coffee Portfolio with Minority Stake in Casa Del Caffè Vergnano and Exclusive, Long-Term Distribution Agreement

Coca-Cola HBC strengthens its coffee portfolio with minority stake in Casa del Caffè Vergnano and exclusive, long-term distribution agreement Zug, Switzerland, 28 June 2021. Coca-Cola HBC AG (“Coca-Cola HBC”) is pleased to announce that on 25 June 2021, its wholly-owned subsidiary CC Beverages Holdings II B.V. (“CCH Holdings”), reached an agreement to acquire a 30% equity shareholding in Casa Del Caffè Vergnano S.p.A. (“Caffè Vergnano”), a premium Italian coffee company. Completion of the acquisition is expected in the second half of 2021 and is subject to customary closing conditions and regulatory approvals. Furthermore, Coca-Cola HBC and Caffè Vergnano will enter into an exclusive distribution agreement for Caffè Vergnano’s products in Coca-Cola HBC’s territories outside of Italy (together, the “Proposed Transaction”). CCH Holdings will be represented on the Board of Directors of Caffè Vergnano and have customary minority decision-making and governance rights. The parties have agreed not to disclose financial details of the Proposed Transaction. Caffè Vergnano is a family-owned Italian coffee company headquartered in Santena, Italy. It is one of the oldest coffee roasters in Italy with roots dating back to 1882. Its product offering consists of truly premium, high-quality coffee that represents Italian heritage and authenticity at its best. Caffè Vergnano’s portfolio includes traditional espresso in various blends, packages and formats such as beans, roast and ground coffee and single portioned pods. In 2020, the company sold approx. 7,000 tons of coffee in more than 90 countries worldwide. The Proposed Transaction represents an important milestone in Coca-Cola HBC’s vision of being the leading 24/7 beverage partner across its markets. -

Mexico Is the Number One Consumer of Coca-Cola in the World, with an Average of 225 Litres Per Person

Arca. Mexico is the number one Company. consumer of Coca-Cola in the On the whole, the CSD industry in world, with an average of 225 litres Mexico has recently become aware per person; a disproportionate of a consolidation process destined number which has surpassed the not to end, characterised by inventors. The consumption in the mergers and acquisitions amongst USA is “only” 200 litres per person. the main bottlers. The producers WATER & CSD This fizzy drink is considered an have widened their product Embotelladoras Arca essential part of the Mexican portfolio by also offering isotonic Coca-Cola Group people’s diet and can be found even drinks, mineral water, juice-based Monterrey, Mexico where there is no drinking water. drinks and products deriving from >> 4 shrinkwrappers Such trend on the Mexican market milk. Coca Cola Femsa, one of the SMI LSK 35 F is also evident in economical terms main subsidiaries of The Coca-Cola >> conveyor belts as it represents about 11% of Company in the world, operates in the global sales of The Coca Cola this context, as well as important 4 installation. local bottlers such as ARCA, CIMSA, BEPENSA and TIJUANA. The Coca-Cola Company These businesses, in addition to distributes 4 out of the the products from Atlanta, also 5 top beverage brands in produce their own label beverages. the world: Coca-Cola, Diet SMI has, to date, supplied the Coke, Sprite and Fanta. Coca Cola Group with about 300 During 2007, the company secondary packaging machines, a worked with over 400 brands and over 2,600 different third of which is installed in the beverages. -

Proposed Acquisition of Costa Limited

PROPOSED ACQUISITION OF COSTA LIMITED AUGUST 31, 2018 FORWARD-LOOKING STATEMENTS This presentation may contain statements, estimates or projections that constitute “forward-looking statements” as defined under U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will,” “plan,” “seek” and similar expressions identify forward-looking statements, which generally are not historical in nature. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from The Coca-Cola Company’s historical experience and our present expectations or projections. These risks include, but are not limited to, obesity and other health-related concerns; water scarcity and poor quality; evolving consumer preferences; increased competition; product safety and quality concerns; perceived negative health consequences of certain ingredients, such as non- nutritive sweeteners and biotechnology-derived substances, and of other substances present in our beverage products or packaging materials; an inability to be successful in our innovation activities; increased demand for food products and decreased agricultural productivity; an inability to protect our information systems against service interruption, misappropriation of data or breaches of security; changes in the retail landscape or the loss of key retail or foodservice -

Cultural Innovation: Triumph of a Better Ideology’ Look to Anthropology for Inspiration

QUARTER 1 JANUARY 2012 NEW THINKING, DIFFERENT PERSPECTIVES Cultural innovation: triumph of a better ideology Douglas Holt and Douglas Cameron NEVER WASTE A GOOD CRISIS Sir Terry Leahy QUARTER 1 QUARTER 2012 JANUARY ACCOUNTABILITY IS NOT ENOUGH Rory Sutherland THROUGH THE GLASS CEILING Janet Hull 1 cover.indd 1 28/11/2011 19:34:31 Market Leader_Experienica.HR.pdf 1 11/11/2011 13:05 Editorial Keeping brands healthy i rEcEntly attended a lecture on the applications of neuroscience to marketing. All the data marketers will ever need, it was claimed, can now be obtained from ‘neurometrics’ – via MRI scanning, EEG measurement and eye-tracking devices. I listened to the lengthening list of uses with mounting disquiet and an article formed in my mind entitled ‘Caution: neuroscience may be dangerous to the health of your brand’. The lead article in this issue provides the explanation of why the skills required for brand building live in a parallel universe. Douglas Holt and Douglas Cameron in ‘Cultural innovation: triumph of a better ideology’ look to anthropology for inspiration. It is commonplace to say that brands live in the mind (as opposed to the factory). But where they really live is in culture, in society’s norms, values, codes and practices. And while yes, neuroscience and anthropology can exist together, the danger is in what we qualitative researchers call ‘physics envy’ (the need to elevate market research to the level of the pure sciences). Put access to the brain – the human version of the Rosetta Stone – together with lots of gadgetry that measures things and before you know it, the new and intriguing drives out the old but essential. -

Lean Six Sigma Brings Outstanding Customer Service to Coca-Cola Enterprises

BSI Case Study Coca-Cola Enterprises Ltd Lean Six Sigma Lean Six Sigma brings outstanding Customer Service to Coca-Cola Enterprises “Our recent experience Customer objectives Customer benefits of working closely with • Boost consumer and customer • Climbed 39 places in “UK top BSI to deliver bespoke, in- satisfaction 50 Call Centres”, from 47th to company training has been 8th place 2010-2011 excellent. The commitment • To improve employee skills and enthusiasm shown by • Achieved 3rd place for most • To maintain the highest level of the BSI team to understand improved UK Call Centre standards and processes our business and then design • Improved end to end customer the training package was • Ensure the consistent quality experience commendable. The trainers of products were knowledgeable, friendly • A clearer understanding of and they adapted their style process bottlenecks thanks to according to the group. The Lean tools post training support to embed the learning has also been outstanding.” Vikas Joshi, Continuous Improvement Manager, Coca-Cola Enterprises BSI Case Study Coca-Cola Enterprises Ltd Lean Six Sigma Company background Coca-Cola Enterprises, Inc. is the world’s third-largest independent Coca-Cola bottler. Coca-Cola Enterprises is the sole licensed bottler for products of The Coca-Cola Company (TCCC) in Belgium, continental France, Great Britain, Luxembourg, Monaco, the Netherlands, Norway, and Sweden. Coca-Cola Enterprises makes, sells and © BSI Group BSI/UK/321/TR/1113/en/BLD delivers the following products in GB for The Coca-Cola Company (TCCC): Coca-Cola, diet Coke, Coke Zero, Fanta, Dr Pepper, Sprite, Schweppes, Schweppes Abbey Well, glacéau, Relentless, Powerade, Oasis BSI’s role and 5 Alive. -

Coca-Cola HBC 2020 Integrated Annual Report

Integrated Annual Report 2020 Coca‑Cola HBC Integrated Annual Report 2020 ADAPT TO WIN OUR PEOPLE p.38 OUR SUPPLIERS p.34 THANK YOU In a year of being apart, we have been more together. OUR PEOPLE p.38 OUR CUSTOMERS p.30 OUR SUPPLIERS p.34 OUR COMMUNITIES p.42 THANK YOU OUR CONSUMERS p.26 In a year of being apart, we have been more together. 2020 highlights Volume (m unit cases) Net sales revenue (€m) 2,135.6 6,131.8 2019: 2,264.5 2019: 7,026.0 Comparable EBIT1 (€m) Comparable EBIT1 margin (%) 672.3 11.0% 2019:758.7 2019: 10.8% Profit before tax (€m) Net profit2 (€m) 593.9 414.9 2019: 661.2 2019: 487.5 Comparable EPS1 (€) Basic EPS (€) 1.185 1.140 2019: 1.436 2019: 1.340 Primary packaging collected In 2020, we started reporting against for recycling (equivalent) the SASB framework. 44% 2019: 48% 1. For details on APMs, refer to ‘Alternative performance measures’ section. 2. Net profit and comparable net profit refer to net You can read more on page 132. profit and comparable net profit respectively after tax attributable to owners of the parent. Contents Strategic Report Corporate Governance Supplementary Information 10 Chairman’s letter 76 Chairman’s introduction 230 Alternative performance measures 12 Chief Executive Officer’s letter to corporate governance 233 Other supplementary information 14 Our business at a glance 80 Board of Directors 234 Assurance statement 16 Our business model 84 Corporate Governance Report 238 Glossary 18 Our socio-economic impact 110 Directors’ Remuneration Report 20 Stakeholder engagement 131 Statement -

Allergen Information | All Soft Drinks & Minerals

ALLERGEN INFORMATION | ALL SOFT DRINKS & MINERALS **THIS INFORMATION HAS BEEN RECORDED AND LISTED ON SUPPLIER ADVICE** DAYLA WILL ACCEPT NO RESPONSIBILITY FOR INACCURATE INFORMATION RECEIVED Cereals containing GLUTEN Nuts Product Description Type Pack ABV % Size Wheat Rye Barley Oats Spelt Kamut Almonds Hazelnut Walnut Cashews Pecan Brazil Pistaccio Macadamia Egg Crustacean Lupin Sulphites >10ppm Celery Peanuts Milk Fish Soya Beans Mollusc Mustard Sesame Seeds Appletiser 24x275ml Case Minerals Case 0 275ml BG Cox's Apple Sprkl 12x275ml Minerals Case 0 275ml BG Cranberry&Orange Sprkl 12x275ml Minerals Case 0 275ml BG E'flower CorDial 6x500ml Minerals Case 0 500ml BG E'flower Sprkl 12x275ml Minerals Case 0 275ml BG Ginger&Lemongrass Sprkl 12x275ml Minerals Case 0 275ml BG Ginger&Lemongrass Sprkl SW 12X275ml Minerals Case 0 275ml BG Pomegranate&E'flower Sprkl 12X275ml Minerals Case 0 275ml BG Strawberry CorDial 6x500ml Minerals Case 0 500ml Big Tom Rich & Spicy Minerals Case 0 250ml √ Bottlegreen Cox's Apple Presse 275ml NRB Minerals Case 0 275ml Bottlegreen ElDerflower Presse 275ml NRB Minerals Case 0 275ml Britvic 100 Apple 24x250ml Case Minerals Case 0 250ml Britvic 100 Orange 24x250ml Case Minerals Case 0 250ml Britvic 55 Apple 24x275ml Case Minerals Case 0 275ml Britvic 55 Orange 24x275ml Case Minerals Case 0 275ml Britvic Bitter Lemon 24x125ml Case Minerals Case 0 125ml Britvic Blackcurrant CorDial 12x1l Case Minerals Case 0 1l Britvic Cranberry Juice 24x160ml Case Minerals Case 0 160ml Britvic Ginger Ale 24x125ml Case Minerals Case