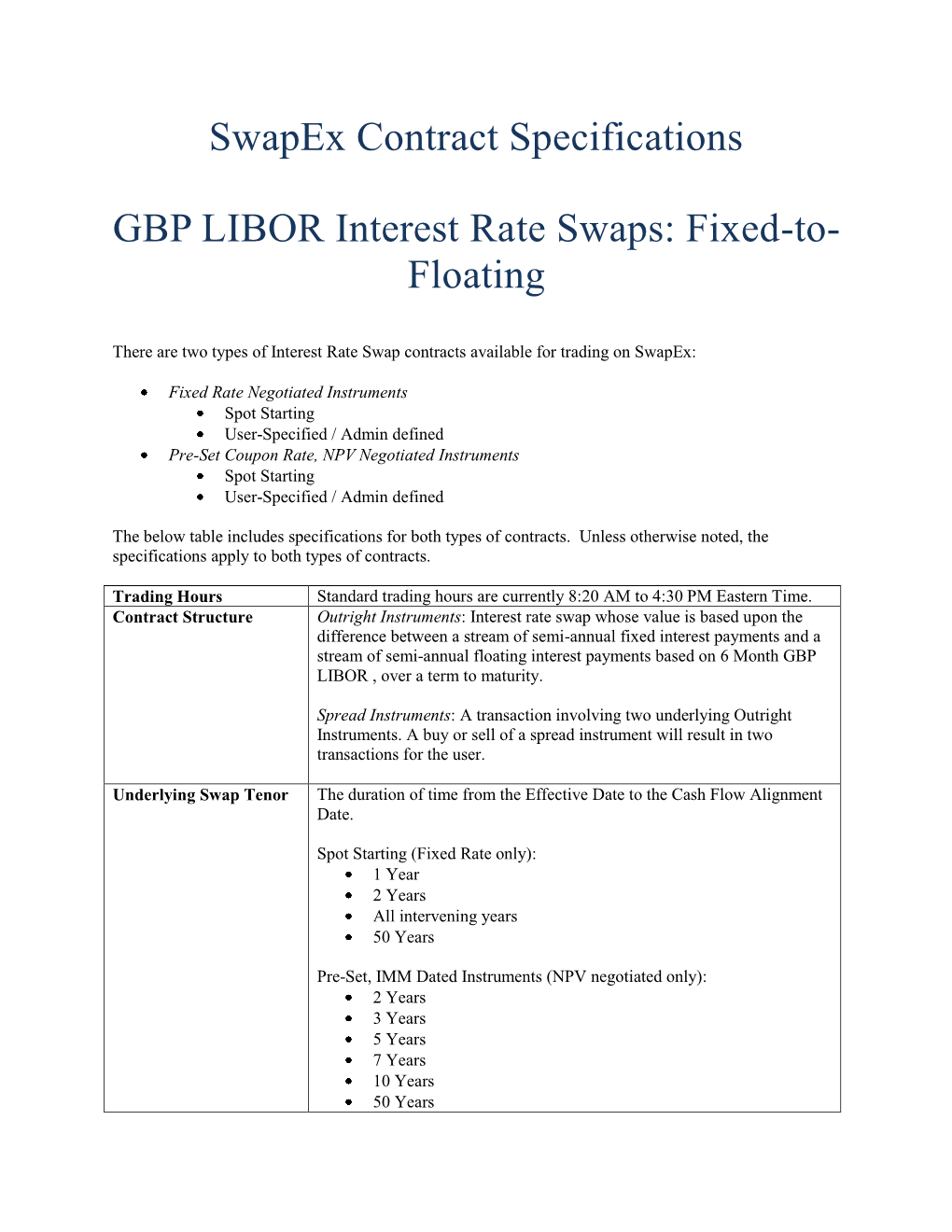

Swapex Contract Specifications GBP LIBOR Interest Rate Swaps: Fixed

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bond Arithmetic

Debt Instruments Set 2 Backus/Octob er 29, 1998 Bond Arithmetic 0. Overview Zeros and coup on b onds Sp ot rates and yields Day count conventions Replication and arbitrage Forward rates Yields and returns Debt Instruments 2-2 1. Why Are We Doing This? Explain nitty-gritty of b ond price/yield calculations Remark: \The devil is in the details" Intro duce principles of replication and arbitrage Debt Instruments 2-3 2. Zeros or STRIPS A zero is a claim to $100 in n p erio ds price = p n t + n t j j Pay p Get $100 n A spot rate is a yield on a zero: 100 p = n n 1 + y =2 n US treasury conventions: { price quoted for principal of 100 { time measured in half-years { semi-annual comp ounding Debt Instruments 2-4 2. Zeros continued A discount factor is a price of a claim to one dollar: p 1 n d = = n n 100 1 + y =2 n Examples US treasury STRIPS, May 1995 MaturityYrs Price $ DiscountFactor Sp ot Rate 0.5 97.09 0.9709 5.99 1.0 94.22 0.9422 6.05 1.5 91.39 0.9139 2.0 88.60 0.8860 6.15 Debt Instruments 2-5 3. Comp ounding Conventions A yield convention is an arbitrary set of rules for computing yields like sp ot rates from discount factors US Treasuries use semiannual comp ounding: 1 d = n n 1 + y =2 n with n measured in half-years Other conventions with n measured in years: 8 n > > 1 + y annual comp ounding > n > > > > > kn > > 1 + y =k \k" comp ounding n > > < ny n e continuous comp ounding k !1 d = n > > > > 1 > > 1 + ny \simple interest" > n > > > > > : 1 ny \discount basis" n All of these formulas de ne rules for computing the yield y from the discount factor d , but of course they're all n n di erent and the choice among them is arbitrary. -

Federal Home Loan Banks Consolidated Bonds and Consolidated Discount Notes (With Maturities of One Day Or Longer)

INFORMATION MEMORANDUM Federal Home Loan Banks Consolidated Bonds and Consolidated Discount Notes (with maturities of one day or longer) The terms “we,” “us” and “our” as used throughout this Information Memorandum mean the Federal Home Loan Banks (the “FHLBanks”), acting by and through the Office of Finance, a joint office of the FHLBanks (together with its successors and assigns, the “Office of Finance”). We may offer consolidated bonds (the “Bonds”) and consolidated discount notes (the “Discount Notes” and, together with the Bonds, the “Securities”) pursuant to this Information Memorandum (as defined herein) and, in the case of the Bonds, a Pricing Supplement or an Offering Notice (each, a “Supplement”) that will contain the specific terms of, and pricing details for, each particular issue (sometimes referred to as “series”) of Bonds. The Securities will constitute joint and several unsecured general obligations of the FHLBanks. No person other than the FHLBanks will have any obligations or liability with respect to the Securities. The Securities will be denominated in U.S. dollars or as may otherwise be specified by us at the time of issue in the applicable Supplement (the “Specified Currencies”). There is no specific limit on the aggregate principal amount of Securities that we may issue. The Securities will have maturities of one day or longer from the date of their original issuance. The Bonds will bear interest as set forth in the applicable Supplement. Principal payments on the Bonds may be made periodically or only at maturity. Any index or formula used to determine the principal or interest payable on the Bonds will be set forth in the applicable Supplement. -

Emu and Market Conventions: Recent Developments

ISDA International Swaps and Derivatives Association, Inc. EMU AND MARKET CONVENTIONS: RECENT DEVELOPMENTS 1. Introduction On 16th July, 1997, ISDA, along with a number of other trade associations, Cedel and Euroclear, published a joint statement on market conventions for the euro. That joint statement was subsequently supported by both the European Commission and the European Monetary Institute (now the European Central Bank). The joint statement was intended to focus attention on the need to establish a set of market conventions for the euro. Conventions of the type dealt with in the joint statement tend to differ between currencies, largely for historical rather than valid market reasons. It was inconceivable that the new single currency should itself suffer from the mixture of market conventions which apply to the various national currencies that it is due to replace. At the time of publication, the joint statement reflected a broad market consensus view on what standard market practice should be for new euro-denominated transactions entered into after 1st January, 1999. It also advocated that for "legacy" instruments or transactions (those entered into before 1999 in national currency units or the ECU, but maturing after 1st January, 1999) which incorporated the old national currency conventions, no change should be made to update the conventions. The purpose of this memorandum is to bring the issue of harmonised market conventions for the euro up to date in light of developments that have taken place since the publication of the joint statement over a year ago. A summary of the proposed market conventions for the euro financial markets is attached as Exhibit 1. -

Fabozzi Course.Pdf

Asset Valuation Debt Investments: Analysis and Valuation Joel M. Shulman, Ph.D, CFA Study Session # 15 – Level I CFA CANDIDATE READINGS: Fixed Income Analysis for the Chartered Financial Analyst Program: Level I and II Readings, Frank J. Fabozzi (Frank J. Fabozzi Associates, 2000) “Introduction to the Valuation of Fixed Income Securities,” Ch. 5 “Yield Measures, Spot Rates, and Forward Rates,” Ch. 6 “Introduction to Measurement of Interest Rate Risk,” Ch. 7 © 2002 Shulman Review/The Princeton Review Fixed Income Valuation 2 Learning Outcome Statements Introduction to the Valuation of Fixed Income Securities Chapter 5, Fabozzi The candidate should be able to a) Describe the fundamental principles of bond valuation; b) Explain the three steps in the valuation process; c) Explain what is meant by a bond’s cash flow; d) Discuss the difficulties of estimating the expected cash flows for some types of bonds and identify the bonds for which estimating the expected cash flows is difficult; e) Compute the value of a bond, given the expected cash flows and the appropriate discount rates; f) Explain how the value of a bond changes if the discount rate increases or decreases and compute the change in value that is attributable to the rate change; g) Explain how the price of a bond changes as the bond approaches its maturity date and compute the change in value that is attributable to the passage of time; h) Compute the value of a zero-coupon bond; i) Compute the dirty price of a bond, accrued interest, and clean price of a bond that is between coupon -

Isolating the Effect of Day-Count Conventions on the Market Value Of

Isolating the Effect of Day-Count Conventions on the Market Value of Interest Rate Swaps Geng Deng, PhD, FRM∗ Tim Dulaney, PhDy Tim Husson, PhDz Craig McCann, PhD, CFAx Securities Litigation and Consulting Group, Inc. 3998 Fair Ridge Drive, Suite 250, Fairfax, VA 22033 April 27, 2012 Abstract Day-count conventions are a ubiquitous but often overlooked aspect of interest-bearing investments. While many market traded securities have adopted fixed or standard conven- tions, over-the-counter agreements such as interest rate swaps can and do use a wide variety of conventions, and many investors may not be aware of the effects of this choice on their future cash flows. Here, we show that the choice of day-count convention can have a sur- prisingly large effect on the market value of swap agreements. We highlight the importance of matching day-count conventions on obligations and accompanying swap agreements, and demonstrate various factors which influence the magnitude of day-count convention effects. As interest rate swaps are very common amongst municipal and other institutional investors, we urge investors to thoroughly understand these and other ‘fine print' terms in any potential agreements. In particular, we highlight the ability of financial intermediaries to effectively increase their fees substantially through their choice of day-count conventions. 1 Introduction We have different day-count conventions today for the same reason we have different driving con- ventions in the US and the UK { history. Historically some securities have had their interest pay- ments calculated using a certain convention while others have used different conventions. Although ∗Director of Research, Office: (703) 539-6764, Email: [email protected]. -

International Securities Operational Market Practice Book

January 2012 International Securities Operational Market Practice Book New issues • New issuance draft and final documentation • Distribution processing Corporate actions • Corporate action event notifications • Corporate action processing Income • Income event notifications • Payment processing MARKET PRACTICE BOOK 2 MARKET PRACTICE BOOK Updates The MPB may be subject to a yearly review further to consultation with the International Securities Market Advisory Group. The main updates of this January 2012 version compared to February 2011 are: • Chapter 1 / section 1.2.: ISMAG Best Practices Summary #3. on Naming Convention - Updated • Chapter 3 / section 3.3.6.1.: Corporate Actions / Reg S - 144A transfers, flow “c” in table - Corrected • Annex 1: Letters of Representation June 2011 versions - Updated • Annex 6C: - General Meeting, Extraordinary Meeting, Repurchase/ Tender Offer, Exchange Offer, Consent checklists - Updated - Disclosure checklist - NEW 3 MARKET PRACTICE BOOK 4 MARKETMARKET PRACTICEPRACTICE BOOKBOOK Table of contents INTRODUCTION ........................................................................................................................................................9 LEGAL DISCLAIMER .................................................................................................................................................10 TIMING CONVENTION ..............................................................................................................................................10 GLOSSARY ......................................................................................................................................................11 -

NATIONAL STOCK EXCHANGE of INDIA LIMITED Capital Market Date : September 29, 2011 FAQ on Corporate Bond

NATIONAL STOCK EXCHANGE OF INDIA LIMITED Capital Market Date : September 29, 2011 FAQ on Corporate Bond 1. What are securities? Securities are financial instruments that represent a creditor relationship with a corporation or government. Generally, they represent agreement to receive a certain amount depending on the terms contained within the agreement. It represents a promise to pay bondholders a fixed sum of money (called the bond’s principal, or par or face value) at a future maturity date, along with periodic payments of interest (called coupons). 2. What are fixed income securities? Fixed income securities are investment where the cash flows are according to a pre- determined amount of interest, paid on a fixed schedule. Popularly known as Debt instrument. 3. What are the different types of fixed income securities? The different types of fixed income securities include government securities, corporate bonds, Treasury Bills, Commercial Paper, Strips etc. 4. What is the difference between debt and equity? Sr. No. PARAMETERS EQUITY DEBT 1. Ownership Owners of the Lenders of the Company Company 2. Risk High risk Low risk 3. Return Variable Fixed 4. Maturity Till the existence Pre - decided of the company Regd. Office : Exchange Plaza, BandraKurlaComplex, Bandra (E), Mumbai – 400 051 Page 1 of 11 5. Liquidation Hierarchy Last preference First preference 6. Voting Rights Eligible for Non-eligible for voting voting 5. What are Corporate Bonds? In broader terms Corporate bonds are fixed income securities issued by corporates i.e. entities -

1. BGC Derivative Markets, L.P. Contract Specifications

1. BGC Derivative Markets, L.P. Contract Specifications . 2 1.1 Product Descriptions . 2 1.1.1 Mandatorily Cleared CEA 2(h)(1) Products as of 2nd October 2013 . 2 1.1.2 Made Available to Trade CEA 2(h)(8) Products . 5 1.1.3 Interest Rate Swaps . 7 1.1.4 Commodities . 27 1.1.5 Credit Derivatives . 30 1.1.6 Equity Derivatives . 37 1.1.6.1 Equity Index Swaps . 37 1.1.6.2 Option on Variance Swaps . 38 1.1.6.3 Variance & Volatility Swaps . 40 1.1.7 Non Deliverable Forwards . 43 1.1.8 Currency Options . 46 1.2 Appendices . 52 1.2.1 Appendix A - Business Day (Date) Conventions) Conventions . 52 1.2.2 Appendix B - Currencies and Holiday Centers . 52 1.2.3 Appendix C - Conventions Used . 56 1.2.4 Appendix D - General Definitions . 57 1.2.5 Appendix E - Market Fixing Indices . 57 1.2.6 Appendix F - Interest Rate Swap & Option Tenors (Super-Major Currencies) . 60 BGC Derivative Markets, L.P. Contract Specifications Product Descriptions Mandatorily Cleared CEA 2(h)(1) Products as of 2nd October 2013 BGC Derivative Markets, L.P. Contract Specifications Product Descriptions Mandatorily Cleared Products The following list of Products required to be cleared under Commodity Futures Trading Commission rules is included here for the convenience of the reader. Mandatorily Cleared Spot starting, Forward Starting and IMM dated Interest Rate Swaps by Clearing Organization, including LCH.Clearnet Ltd., LCH.Clearnet LLC, and CME, Inc., having the following characteristics: Specification Fixed-to-Floating Swap Class 1. -

Market Conventions for Financial Products Referencing Nowa Working Group on Alternative Reference Rates for the Norwegian Krone June 2020

CONSULTATION: MARKET CONVENTIONS FOR FINANCIAL PRODUCTS REFERENCING NOWA WORKING GROUP ON ALTERNATIVE REFERENCE RATES FOR THE NORWEGIAN KRONE JUNE 2020 1 Content Introduction ..................................................................................................................................................................................................................................... 3 Background ...................................................................................................................................................................................................................................... 3 Day Count Convention .................................................................................................................................................................................................................... 4 Business Day Convention ................................................................................................................................................................................................................ 4 Forward-looking or Backward-looking Observations of NOWA Fixings during the Rate Period ................................................................................................. 5 Simple NOWA average or compounded NOWA average .............................................................................................................................................................. 7 Comparison between different methods for calculating -

Farm Credit System Bank Daily Estimated Funding Cost Indexes

Farm Credit System Bank Daily Estimated Funding Cost Indexes Federal Farm Credit Banks Funding Corporation Jersey City, NJ (201) 200-8000 Report Date: 08/30/21 Farm Credit Short Term Funding - Discount Note Rates Equiv. Bond Estimated DN Yield, all-in, Simple Int., all- Maturity (Days) Maturity Date Discount Rate ACT/365 in, ACT/360 O/N 8/31/2021 0.010% 0.041% 0.040% 30 9/29/2021 0.030% 0.061% 0.060% 90 11/26/2021 0.040% 0.071% 0.070% 180 2/25/2022 0.050% 0.081% 0.080% Farm Credit Term Funding - Non-Callable Bond Rates Farm Credit Spread to Underwriter Est. Funding Term Maturity Date Treasury Yield Treasury Fees Cost [1] 1 Year 8/30/2022 0.066% -6 7.50 0.081% 2 Year 8/30/2023 0.219% -5 6.27 0.237% 3 Year 8/30/2024 0.423% -3 5.04 0.443% 4 Year 8/30/2025 0.423% 18 4.44 0.647% 5 Year 8/30/2026 0.798% 0 4.09 0.839% 7 Year 8/30/2028 1.095% 6 3.73 1.192% 10 Year 8/30/2031 1.307% 16 3.24 1.499% 15 Year 8/30/2036 1.307% 61 2.31 1.940% 30 Year 8/30/2051 1.923% 67 1.69 2.610% Farm Credit Floating Rate Funding Index Spreads Term 1mLIBOR [2] 3mLIBOR [3] SOFR [4] 1 Year -2 -7 1 18 Month 4 0 2 2 Year 4 3 Year 7 Current Index 0.086% 0.120% 0.050% Farm Credit 1-Month SOFR Index 1 Year Farm Credit SOFR Spread - 12m average [5] 0.0272% 1m Pay Fixed SOFR Swap Rate [7] 0.0595% Est. -

OVER-THE-COUNTER INTEREST RATE DERIVATIVES Anatoli Kuprianov

Page 238 The information in this chapter was last updated in 1993. Since the money market evolves very rapidly, recent developments may have superseded some of the content of this chapter. Federal Reserve Bank of Richmond Richmond, Virginia 1998 Chapter 16 OVER-THE-COUNTER INTEREST RATE DERIVATIVES Anatoli Kuprianov INTRODUCTION Over-the-counter (OTC) interest rate derivatives include instruments such as forward rate agreements (FRAs), interest rate swaps, caps, floors, and collars. Broadly defined, a derivative instrument is a formal agreement between two parties specifying the exchange of cash payments based on changes in the price of a specified underlying item or differences in the returns to different securities. Like exchange-traded interest rate derivatives such as interest rate futures and futures options, OTC interest rate derivatives set terms for the exchange of cash payments based on changes in market interest rates. An FRA is a forward contract that sets terms for the exchange of cash payments based on changes in the London Interbank Offered Rate (LIBOR); interest rate swaps provide for the exchange of payments based on differences between two different interest rates; and interest rate caps, floors, and collars are option-like agreements that require one party to make payments to the other when a stipulated interest rate, most often a specified maturity of LIBOR, moves outside of some predetermined range. The over-the-counter market differs from futures markets in a number of important respects. Whereas futures and futures options are standardized agreements that trade on organized exchanges, the over-the- counter market is an informal market consisting of dealers, or market makers, who trade price information and negotiate transactions over electronic communications networks. -

ARRC, a User's Guide to SOFR: the Alternative Reference Rate

A User’s Guide to SOFR The Alternative Reference Rates Committee April 2019 Executive Summary This note is intended to help explain how market participants can use SOFR in cash products. In particular, those who are able to use SOFR should not wait for forward-looking term rates in order to transition, and the note lays out a number of considerations that market participants interested in using SOFR will need to consider: Financial products either explicitly or implicitly use some kind of average of SOFR, not a single day’s reading of the rate, in determining the floating-rate payments that are to be paid or received. An average of SOFR will accurately reflect movements in interest rates over a given period of time and smooth out any idiosyncratic, day-to-day fluctuations in market rates. Issuers and lenders will face a technical choice between using a simple or a compound average of SOFR as they seek to use SOFR in cash products. In the short-term, using simple interest conventions may be easier since many systems are already set up to accommodate it. However, compounded interest would more accurately reflect the time value of money, which becomes a more important consideration as interest rates rise, and it can allow for more accurate hedging and better market functioning. Users need to determine the period of time over which the daily SOFRs are observed and averaged. An in advance structure would reference an average of SOFR observed before the current interest period begins, while an in arrears structure would reference an average of SOFR over the current interest period.