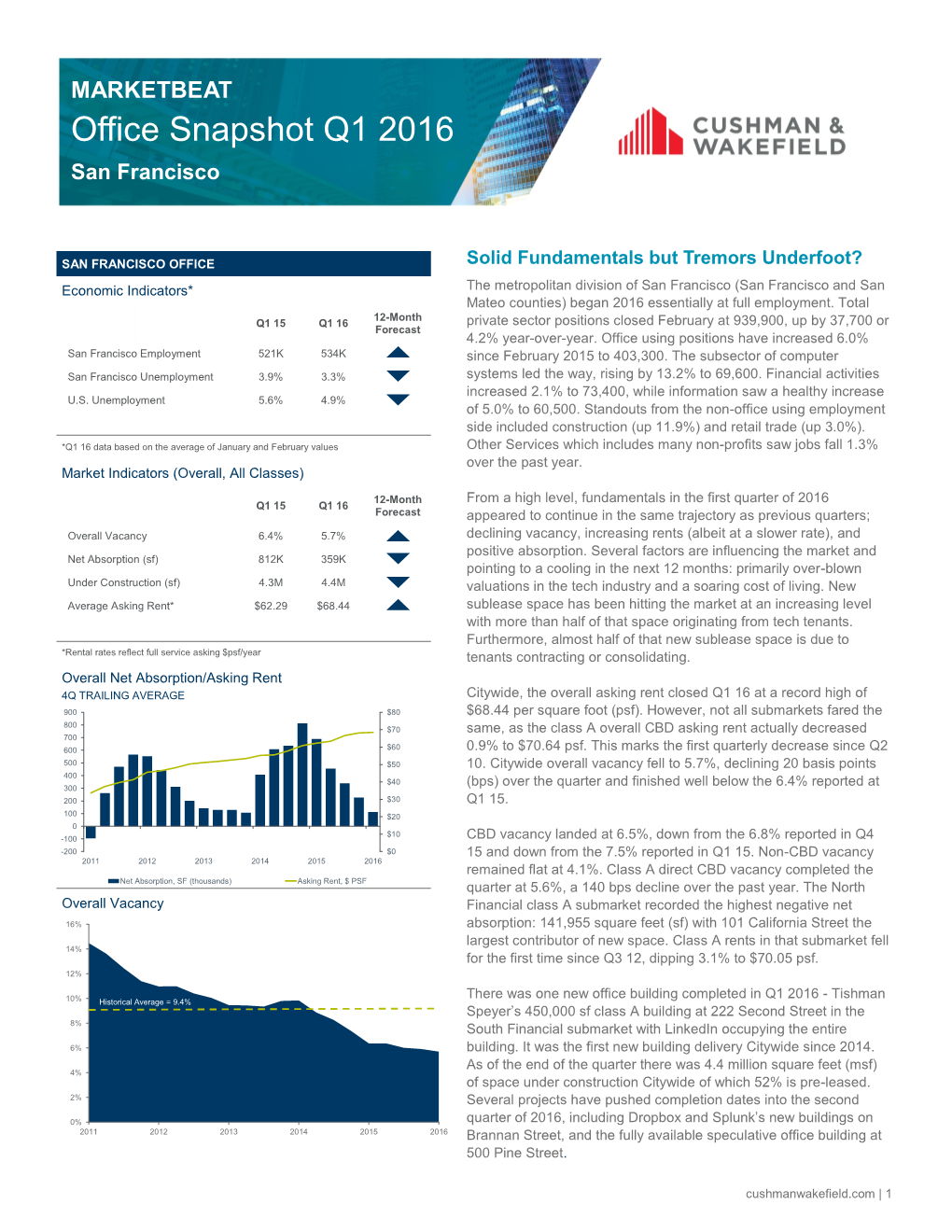

Office Snapshot Q1 2016 San Francisco

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SAN FRANCISCO 2Nd Quarter 2014 Office Market Report

SAN FRANCISCO 2nd Quarter 2014 Office Market Report Historical Asking Rental Rates (Direct, FSG) SF MARKET OVERVIEW $60.00 $57.00 $55.00 $53.50 $52.50 $53.00 $52.00 $50.50 $52.00 Prepared by Kathryn Driver, Market Researcher $49.00 $49.00 $50.00 $50.00 $47.50 $48.50 $48.50 $47.00 $46.00 $44.50 $43.00 Approaching the second half of 2014, the job market in San Francisco is $40.00 continuing to grow. With over 465,000 city residents employed, the San $30.00 Francisco unemployment rate dropped to 4.4%, the lowest the county has witnessed since 2008 and the third-lowest in California. The two counties with $20.00 lower unemployment rates are neighboring San Mateo and Marin counties, $10.00 a mark of the success of the region. The technology sector has been and continues to be a large contributor to this success, accounting for 30% of job $0.00 growth since 2010 and accounting for over 1.5 million sf of leased office space Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2012 2012 2012 2013 2013 2013 2013 2014 2014 this quarter. Class A Class B Pre-leasing large blocks of space remains a prime option for large tech Historical Vacancy Rates companies looking to grow within the city. Three of the top 5 deals involved 16.0% pre-leasing, including Salesforce who took over half of the Transbay Tower 14.0% (delivering Q1 2017) with a 713,727 sf lease. Other pre-leases included two 12.0% full buildings: LinkedIn signed a deal for all 450,000 sf at 222 2nd Street as well 10.0% as Splunk, who grabbed all 182,000 sf at 270 Brannan Street. -

(170085) ([email protected]) 2 John C

Case 4:13-md-02420-YGR Document 779 Filed 08/12/15 Page 1 of 5 1 COOLEY LLP Stephen C. Neal (170085) ([email protected]) 2 John C. Dwyer (136533) ([email protected]) 3175 Hanover Street 3 Palo Alto, CA 94304 Telephone: (650) 843-5000 4 Facsimile: (650) 857-0663 5 Beatriz Mejia (190948) ([email protected]) Matthew M. Brown (264817) ([email protected]) 6 101 California Street, 5th Floor San Francisco, CA 94111-5800 7 Telephone: (415) 693-2000 Facsimile: (415) 693-2222 8 Counsel for Defendants 9 SONY CORPORATION, SONY ELECTRONICS INC., and SONY ENERGY DEVICES CORPORATION 10 11 12 UNITED STATES DISTRICT COURT 13 NORTHERN DISTRICT OF CALIFORNIA 14 OAKLAND DIVISION 15 16 17 IN RE: LITHIUM ION BATTERY Master File No. 4:13-md-02420-YGR (DMR) ANTITRUST LITIGATION MDL No. 2420 18 19 This document is related to: Case No. 2:15-cv-1038 4:15-cv-3443-YGR 20 MICROSOFT MOBILE, INC., et al. STIPULATION AND [PROPOSED] 21 Plaintiffs, ORDER REGARDING SERVICE OF vs. SUMMONS AND COMPLAINT 22 LG CHEM AMERICA, INC., et al. 23 Defendants. 24 25 26 27 28 COOLEY LLP ATTORNEYS AT LAW 1. SAN FRANCISCO Case 4:13-md-02420-YGR Document 779 Filed 08/12/15 Page 2 of 5 1 Plaintiffs Microsoft Mobile Inc. and Microsoft Mobile Oy (collectively, “Microsoft 2 Mobile” or the “Microsoft Mobile Plaintiffs”) and defendants LG Chem America, Inc., LG Chem, 3 Ltd., Panasonic Corporation, Panasonic Corporation of North America, Samsung SDI America, 4 Inc., Samsung SDI Co., Ltd., Sanyo Electric Co. Ltd., Sanyo North America Corporation, Sony 5 Corporation, Sony Electronics Inc., and Sony Energy Devices Corporation (collectively, 6 “Defendants”), by and through their undersigned counsel, stipulate and agree, as follows: 7 1. -

San Francisco Ethics Commission Disclosure Report for Permit

DocuSign Envelope ID: 22F915A2-4A57-4DCD-ABD1-3562213B15D9 San Francisco Ethics Commission 25 Van Ness Avenue, Suite 220, San Francisco, CA 94102 Received on: Phone: 415.252.3100 . Fax: 415.252.3112 04-14-2020\DateSigned | 16:28:46\ PDT [email protected] . www.sfethics.org \DateSigned\ Disclosure Report for Permit Consultants SFEC Form 3410B (S.F. Campaign and Governmental Conduct Code § 3.400A et seq.) A Public Document 1. FILING INFORMATION TYPE OF FILING DATE OF ORIGINAL FILING (for amendment only) \OriginalFilingType\ \OriginalFilingDate\ PERIOD COVERED \PeriodMonths\ \PeriodYear\ January 1 to March 31 2020 2. PERMIT CONSULTANT AND EMPLOYER INFORMATION NAME OF PERMIT CONSULTANT NAME OF EMPLOYER Kyle Thompson \PermitConsultantName\ A.R.\PermitConsultantEmployer Sanchez-Corea & \Associates, Inc. BUSINESS ADDRESS 301 Junipero Serra Blvd., Suite 270, San Francisco, CA 94127 \PermitConsultantAddress\ BUSINESS TELEPHONE BUSINESS EMAIL ADDRESS 415-333-8080 [email protected] \PermitConsultantTelephone\ \PermitConsultantEmail\ 3. CLIENT INFORMATION Enter the name, business address, contact person (if applicable), e-mail address, and business telephone number of each client for whom you performed permit consulting services during the reporting period. Also enter the amount of compensation you or your employer received or expected to receive from each client for permit consulting services during the reporting period. # CLIENT INFORMATION NAME OF CLIENT One De Haro, LLC c/o SKS Investments \ClientName1\ BUSINESS ADDRESS OF CLIENT 601 -

Before the Public Utilities Commission of The

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA FILED 01/25/21 Order Instituting Rulemaking to Create a 04:59 PM Consistent Regulatory Framework for the Rulemaking 14-10-003 Guidance, Planning and Evaluation of Integrated (Filed October 2, 2014) Distributed Energy Resources. CERTIFICATE OF SERVICE I hereby certify that a copy of OPENING COMMENTS OF SAN DIEGO GAS & ELECTRIC COMPANY (U 902-E) ON THE PROPOSED DECISION ADOPTING TWO TARIFF PILOTS FOR PROCURING DISTRIBUTED ENERGY RESOURCES THAT AVOID OR DEFER UTILITY CAPITAL INVESTMENTS has been electronically mailed to each party of record of the service list in R.14-10-003. Due to the current Coronavirus (COVID-19) health crisis, our legal staff is working from home. Accordingly, the normal mailing of hard copies is not possible and hard copies will not be mailed to the Administrative Law Judge or to parties who are on the service list and have not provided an electronic mail address. Executed January 25, 2021 at San Diego, California. /s/ Tamara Grabowski Tamara Grabowski 1 / 15 CPUC - Service Lists - R1410003 CPUC Home CALIFORNIA PUBLIC UTILITIES COMMISSION Service Lists PROCEEDING: R1410003 - CPUC - OIR TO CREATE FILER: CPUC LIST NAME: LIST LAST CHANGED: JANUARY 5, 2021 Download the Comma-delimited File About Comma-delimited Files Back to Service Lists Index Parties CARMELITA L. MILLER DAMON FRANZ LEGAL COUNSEL DIR - POLICY & ELECTRICITY MARKETS THE GREENLINING INSTITUTE TESLA, INC. EMAIL ONLY EMAIL ONLY EMAIL ONLY, CA 00000 EMAIL ONLY, CA 00000 FOR: THE GREENLINING INSTITUTE FOR: TESLA, INC. (FORMERLY SOLARCITY CORPORATION) EVELYN KAHL MARC D JOSEPH GENERAL COUNSEL, CALCCA ATTORNEY CALIFORNIA COMMUNITY CHOICE ASSOCIATION ADAMS BROADWELL JOSEPH & CARDOZO, PC EMAIL ONLY EMAIL ONLY EMAIL ONLY, CA 00000 EMAIL ONLY, CA 00000 FOR: ENERGY PRODUCERS AND USERS FOR: COALITION OF CALIFORNIA UTILITY COALITION EMPLOYEES MERRIAN BORGESON DENISE GRAB SR. -

2020-008009Oth

MEMO TO THE PLANNING COMMISSION HEARING DATE: October 1, 2020 September 24, 2020 Record No.: 2020-008009OTH Subject: Planning Commission Policy: Implementing Proposition E Staff Contact: Corey Teague, Zoning Administrator – (628) 652-7328 [email protected] Recommendation: Adopt the Proposed Resolution Office Development Annual Limit Program San Francisco’s Office Development Annual Limit Program (“Program”) was initially created in 1985 as part of the Downtown Plan. It limited the amount of large office development (projects containing at least 50,000 square feet of office space) that could be permitted each year in the City (the “Large Cap”). The passage of Proposition M the following year amended the Program in various ways, including the addition of a new and separate annual limit for smaller office development (projects containing between 25,000 square feet to 49,999 square feet), which is commonly known as the “Small Cap.” Each October 17th the Program receives an allotment of 875,000 square feet for the Large Cap, and allotment of 75,000 square feet for the Small Cap. Under the original Program, the Planning Commission could not allocate office space to any development in excess of what was available in the relevant cap at that time. Additionally, unallocated office space in one year rolls over to the next year, and unused office space may be revoked and returned to the relevant cap. A net total of more than 12 Million square feet of office was allocated from the Large Cap in the last 10 years, with the most recent allocations for projects within Central SoMa. -

Certificate of Service

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIAFILED 07/07/20 Order Instituting Investigation on the 04:01 PM Commission’s Own Motion into the Maintenance, Operations and Practices of Pacific Gas and Electric Company (U39E) with Respect to its Electric Facilities; and Investigation 19-06-015 Order to Show Cause Why the Commission Should not Impose Penalties and/or Other Remedies for the Role PG&E’s Electrical Facilities had in Igniting Fires in its Service Territory in 2017. CERTIFICATE OF SERVICE I, Thomas R. Del Monte, certify under penalty of perjury under the laws of the State of California that on Tuesday, July 07, 2020, I served a copy of the following on all parties on the attached list 19-06-015: • INTERVENOR COMPENSATION CLAIM OF THOMAS R. DEL MONTE Executed this Tuesday, July 07, 2020, at Walnut Creek, California. /s/ Thomas R. Del Monte 1555 Botelho Drive, #172 Walnut Creek, CA 94956 [email protected] 858-412-0738 Certificate of Service 1 1 / 4 CPUC - Service Lists - I1906015 https://ia.cpuc.ca.gov/servicelists/I1906015_86896.htm WENDY AL-MUKDAD HAYLEY GOODSON CALIF PUBLIC UTILITIES COMMISSION STAFF ATTORNEY SAFETY POLICY DIVISION THE UTILITY REFORM NETWORK AREA 4-A 785 MARKET ST., STE. 1400 505 VAN NESS AVENUE SAN FRANCISCO, CA 94103 SAN FRANCISCO, CA 94102-3214 ASHLEY VINSON CRAWFORD GEORGE D.(CHIP) CANNON, JR. AKIN GUMP STRAUSS HAUER & FELD LLP AKIN GUMP STRAUSS HAUER & FELD LLP 580 CALIFORNIA ST, SUITE 1500 580 CALIFORNIA STREET, STE. 1500 SAN FRANCISCO, CA 94104 SAN FRANCISCO, CA 94104 FOR: AD HOC COMMITTEE OF SENIOR FOR: AD HOC COMMITTEE OF SENIOR UNSECURED NOTEHOLDERS OF PACIFIC GAS UNSECURED NOTEHOLDERS OF PACIFIC GAS AND ELECTRIC COMPANY AND ELECTRIC COMPANY ALYSSA T. -

3700 SF for Lease Prime San Francisco Restaurant

± 3,700 SF 424 Clay Street For Lease Prime San Francisco restaurant opportunity in highly trafficked Financial District Jones Lang LaSalle Brokerage, Inc. Real Estate License #: 01856260 Financial District • Highly trafficked area • Strong hotel and office driven demand: 2,500 hotel rooms and 15,534,764 SF of office space • Highly visible storefront CLUB QUARTERS HOTEL TRANSAMERICA PYRAMID • Existing liquor license • Kitchen equipment in place • Attached to a 346 room hotel • Strong partners: Blackstone owned and Club Quarters operated since 2003 • Robust neighborhood: Jackson Square, North Beach, Ferry Building • Co-tenancy: Popular restaurants such as Cotogna and Kokkari, famed galleries, and OMNI HOTEL EMBARCADERO CENTER emerging retailers such as Shinola Area Profile 0.5 miles 0.75 miles 1 mile Daytime Population 192,479 265,367 322,305 LE MERIDIEN HOTEL ONE MARITIME PLAZA DUNNE'S BROADWAY Offices NOTTINGHAM OSGOOD PL. DAVIS ST. DAVIS FRONT ST. BATTERY ST. BATTERY SANSOME ST. THE EMBARCADERO 1 444 Washington Street (415,805 SF) MONTGOMERY ST. MONTGOMERY PACIFIC AVE. 2 One Maritime Plaza (526,464 SF) ACSON 3 600 Montgomery Street (501,456 SF) SQUARE 4 655 Montgomery Street (445,500 SF) 5 1 Embarcadero Center (907,560 SF) JACKSON ST. COLUMBUS ST. 6 2 Embarcadero Center (708,300 SF) 424 Clay Street 7 3 Embarcadero Center (767,340 SF) 8 4 Embarcadero Center (973,575 SF) HOTALING PL. HOTALING 1 CUSTOM HOUSE PL. CUSTOM 9 50 California Street (703,000 SF) WASHINGTON ST. 10 100 California Street (273,988 SF) 4 2 11 505 Montgomery Street (348,000 SF) MARK TWAIN ST. MERCHANT ST. -

BART Market Street Canopies and Escalators Modernization Project

Draft Initial Study/Mitigated Negative Declaration BART Market Street Canopies and Escalators Modernization Project San Francisco Bay Area Rapid Transit District April 30, 2018 Draft Initial Study/Mitigated Negative Declaration BART Market Street Canopies and Escalators Modernization Project Prepared for San Francisco Bay Area Rapid Transit District 300 Lakeside Drive, 21st floor Oakland, CA 94612 Prepared by 300 Lakeside Drive, Suite 400 Oakland, CA 94612 April 30, 2018 DRAFT INITIAL STUDY/MITIGATED NEGATIVE DECLARATION Date of Publication of Draft Initial Study/Mitigated Negative Declaration: April 30, 2018 Project Title: BART Market Street Canopies and Escalators Modernization Project Sponsor and Lead Agency: San Francisco Bay Area Rapid Transit District Contact Person and Phone Number: Janie Layton, (510) 874-7423 Project Location: Downtown San Francisco BART Stations (Embarcadero, Montgomery Street, Powell Street, and Civic Center/UN Plaza). Project Description: The San Francisco Bay Area Rapid Transit District (BART), in cooperation with the City and County of San Francisco, is working to improve escalator durability and security at station entrances/exits along Market Street leading to the underground Embarcadero, Montgomery Street, Powell Street, and Civic Center/UN Plaza station concourses. The existing entrances/exits consist of variations of side-by-side stairs and escalators leading down to the underground concourse level, and are currently uncovered and exposed to inclement weather and discarded trash leading to frequent breakdowns of the existing escalators. The proposed improvements would include the installation of canopy covers over the entrances/exits, as well as replacement and refurbishment of existing street-level escalators. Each protective canopy would also be equipped with a motorized security grille that would lock at the sidewalk level of the station entrance/exit when the stations are closed. -

3700 SF for Lease Prime San Francisco Restaurant

± 3,700 SF 424 Clay Street For Lease Prime San Francisco restaurant opportunity in highly trafficked Financial District Jones Lang LaSalle Brokerage, Inc. Real Estate License #: 01856260 Financial District • Highly trafficked area • Strong hotel and office driven demand: 2,500 hotel rooms and 15,534,764 SF of office space • Highly visible storefront CLUB QUARTERS HOTEL TRANSAMERICA PYRAMID • Existing liquor license • Kitchen equipment in place • Attached to a 346 room hotel • Strong partners: Blackstone owned and Club Quarters operated since 2003 • Robust neighborhood: Jackson Square, North Beach, Ferry Building • Co-tenancy: Popular restaurants such as Cotogna and Kokkari, famed galleries, and OMNI HOTEL EMBARCADERO CENTER emerging retailers such as Shinola Area Profile 0.5 miles 0.75 miles 1 mile Daytime Population 192,479 265,367 322,305 LE MERIDIEN HOTEL ONE MARITIME PLAZA DUNNE'S BROADWAY Offices NOTTINGHAM OSGOOD PL. DAVIS ST. DAVIS FRONT ST. BATTERY ST. BATTERY SANSOME ST. THE EMBARCADERO 1 444 Washington Street (415,805 SF) MONTGOMERY ST. MONTGOMERY PACIFIC AVE. 2 One Maritime Plaza (526,464 SF) ACSON 3 600 Montgomery Street (501,456 SF) SQUARE 4 655 Montgomery Street (445,500 SF) 5 1 Embarcadero Center (907,560 SF) JACKSON ST. COLUMBUS ST. 6 2 Embarcadero Center (708,300 SF) 424 Clay Street 7 3 Embarcadero Center (767,340 SF) 8 4 Embarcadero Center (973,575 SF) HOTALING PL. HOTALING 1 CUSTOM HOUSE PL. CUSTOM 9 50 California Street (703,000 SF) WASHINGTON ST. 10 100 California Street (273,988 SF) 4 2 11 505 Montgomery Street (348,000 SF) MARK TWAIN ST. MERCHANT ST. -

Before the Public Utilities Commission of the State Of

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA FILED 04/26/21 04:59 PM Order Instituting Rulemaking to Review, Revise and Consider Alternatives to the Rulemaking 17-06-026 Power Charge Indifference Adjustment. CERTIFICATE OF SERVICE I hereby certify that I have on this date served a copy of the PUBLIC ADVOCATES OFFICE COMMENTS ON THE PROPOSED PHASE 2 DECISION ON POWER CHARGE INDIFFERENCE ADJUSTMENT CAP AND PORTFOLIO OPTIMIZATION to all known parties by either United States mail or electronic mail, to each party named on the official service list attached in R.17-06-026. An electronic copy was sent to the assigned Administrative Law Judge. Executed on April 26, 2021 at San Francisco, California. /s/ RACHEL GALLEGOS Rachel Gallegos 380195577 1 / 25 CALIFORNIA PUBLIC UTILITIES COMMISSION Service List PROCEEDING: R1706026 - CPUC - OIR TO REVIEW FILER: CPUC LIST NAME: LIST LAST CHANGED: APRIL 26, 2021 Parties BARBARA BOSWELL BETH VAUGHAN SAN JACINTO POWER OPERATIONS DIRECTOR EMAIL ONLY CALIFORNIA COMMUNITY CHOICE ASSOCIATION EMAIL ONLY, CA 00000 EMAIL ONLY FOR: SAN JACINTO POWER EMAIL ONLY, CA 00000 FOR: CALIFORNIA COMMUNITY CHOICE ASSOCIATION EVELYN KAHL KATHERINE HERNANDEZ GENERAL COUNSEL, CALCCA CITY OF PICO RIVERA CALIFORNIA COMMUNITY CHOICE ASSOCIATION EMAIL ONLY EMAIL ONLY EMAIL ONLY, CA 00000 EMAIL ONLY, CA 00000 FOR: PICO RIVERA COMMUNITY CHOICE FOR: ENERGY PRODUCERS AND USERS AGGREGATION COALITION KRISTY MORRIS MATT SKOLNIK CITY OF HERMOSA BEACH LOS ANGELES COUNTY EMAIL ONLY EMAIL ONLY EMAIL ONLY, CA 00000 EMAIL -

Calcca and DACC Comments on Draft Resolution E-5131

March 30, 2021 CPUC Energy Division Attn: Tariff Unit and Edward Randolph, Director 505 Van Ness Avenue San Francisco, CA 94102 By email: [email protected] Re: California Community Choice Association and Direct Access Customer Coalition Comments on Draft Resolution E-5131, Concerning Joint IOU Advice Letters in response to Decision 20-03-019 (PCIA Bill Presentation) Dear Tariff Unit and Mr. Randolph: Pursuant to General Order 96-B, and the Comment Letter dated March 10, 2021, California Community Choice Association1 (CalCCA) and the Direct Access Customer Coalition2 (DACC) (Joint Parties) submit these comments on draft resolution E-5131 (Draft Resolution). The Draft Resolution approves with modifications Pacific Gas and Electric Company’s Advice Letter 4302-G/5932-E, Southern California Edison Company’s Advice Letter 4280-E, and San Diego Gas & Electric Company’s Advice Letter 3600-E (Advice Letters). 1. Summary of CalCCA Position Joint Parties support implementing the proposed changes in the Advice Letters, as modified in the Draft Resolution, as soon as possible. Joint Parties disagree with Finding 5 that “Further changes to bundled customer bills are 1 California Community Choice Association was formed in 2016 as a trade organization to facilitate joint participation in certain regulatory and legislative matters in which members share common interests. CalCCA’s voting membership includes community choice aggregators (CCAs) serving load and others in the process of implementing new service, including: Apple Valley Choice Energy, -

East Bay Book of Lists December 11, 2020 3 4 San Francisco Business Times East Bay Book of Lists

EAST BAY PARTNER BOOK OF LISTS 2021 DECEMBER 11, 2020 2 SAN FRANCISCO BUSINESS TIMES EAST BAY BOOK OF LISTS DECEMBER 11, 2020 3 4 SAN FRANCISCO BUSINESS TIMES EAST BAY BOOK OF LISTS FROM THE PUBLISHER AND EDITOR ABOUT THE EAST BAY BOOK OF LISTS elcome to the East Bay Book of Book of Lists covering the wider Bay Area — by Lists, an informative resource visiting www.sanfranciscobusinesstimes.com. that complements our annual Bay As a subscriber to the Business Times, every Area Book of Lists, published each week you will receive an edition packed with WDecember. timely Bay Area business news, profi les and In addition to the East Bay business lists market data that will help you succeed and grow published in the Business Times in 2020, we have your business. And you will have access to all the included a business resource directory and an Business Times’ premium content online off erings economic overview of the East Bay. is content that are reserved exclusively for subscribers. was provided to us courtesy of the East Bay For daily news on Bay Area businesses, be sure Economic Development Alliance. Many thanks to subscribe to our free daily email news alerts: to the East Bay EDA executive director, Stephen e Lists in the Book were produced by the the Morning Edition and the Afternoon Edition. Baiter, for agreeing to provide that information San Francisco Business Times research team, To sign up for our daily email news alerts, visit — which is only a small portion of the valuable including Julia Cooper and Ahalya Srikant.