Hb 1204 Fiscal Memorandum Sb

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 SEASON in REVIEW Media Relations Contact IOWA - 50-88, 4Th AMERICAN NORTHERN DIVISION Shelby Cravens • [email protected]

IOWA CUBS GAME NOTES Triple-A Affiliate of the Chicago Cubs since 1981 2018 SEASON IN REVIEW MEDIA Relations Contact IOWA - 50-88, 4th AMERICAN NORTHERN DIVISION Shelby Cravens • [email protected] PCL REGULAR SEASON STANDINGS TAKE ME TO YOUR LEADER: Manager Marty Pevey became the win- AMERICAN NORTHERN PACIFIC NORTHERN ningest manager in Iowa Cubs history with an 11-inning 6-3 victory at TEAM W-L GB TEAM W-L GB Nashville on April 12. He surpassed former Iowa manager, Joe Sparks Oklahoma City 75-65 - Fresno 82-57 - with his 365th Iowa win, while also notching his 1,000th career minor Colorado Springs 73-66 1.5 Reno 72-68 10.5 league managerial win on the same night. Pevey ended the season with Omaha 66-74 9.0 Tacoma 66-73 16.0 a 394-449 record with Iowa and a 1,047-1,067 career mark. Pevey, in his IOWA 50-88 24.0 Sacramento 55-85 27.5 sixth season at the helm of the Iowa Cubs, was also selected to manage the PCL in the Triple-A All-Star Game. He led the league to a 12-7 victory AMERICAN SOUTHERN PACIFIC SOUTHERN over the International League. TEAM W-L GB TEAM W-L GB Memphis Redbirds* 83-57 - El Paso 85-57 - Nashville Sounds 72-68 11.0 Salt Lake 71-68 11.0 D-FENSE: The I-Cubs’ 96 errors in 2018 tied the 2016 squad for the few- New Orleans 69-70 13.5 Las Vegas 71-69 11.5 est in a season in franchise history. -

Marquee Sports Network Announces Additional Minor League Broadcasts

MARQUEE SPORTS NETWORK ANNOUNCES ADDITIONAL MINOR LEAGUE BROADCASTS Network adds 12 minor league games across all Cubs full-season affiliates through remainder of season; Elise Menaker to cover minor league storylines on Cubs broadcasts August 16, 2021 CHICAGO – Marquee Sports Network today announced expanded coverage of the Cubs minor league system, including live game broadcasts presented by Blue Cross Blue Shield of Illinois. Highlights of the upcoming coverage include: • Marquee to broadcast 12 Cubs minor league contests beginning Thursday, August 19, including • Includinggames from Cubs each games, of the Marquee Cubs full-season will air 32 minor live leaguebaseball affiliates: games Triple-Ain the 24-day Iowa (three span fromgames), August 19-SeptemberDouble-A Tennessee 11, including (four), High at least Single-A one gameSouth on Bend 23 of(three) the 24 and days, Low and Single-A two games Myrtle on Beachnine occasions. (two). • All told, the network will air 54 live baseball games in the next 49 days, concluding with the Cubs Additionally,regular season Elise Menakerfinale, October will serve 3. as Marquee Sports Network’s lead minor league reporter, contributing to Cubs pregame and in-game broadcasts with storylines and interviews from the Cubs minor league system, while serving as game analyst on select Iowa Cubs games alongside play-by-play broadcaster Alex Cohen. Former Cubs great Jody Davis joins play-by-play announcer Mick Gillispie on the Tennessee broadcasts. Broadcast teams for each affiliate are on page two. withIncluding a minor 14 minorleague league schedule. games (12 Iowa games and two Myrtle Beach games) that have already aired this season, Marquee Sports Network will air a total of 26 minor league games in its first season on the air “We’re thrilled to be able to showcase the entire Cubs minor league system on our network, bringing Cubs fans an unprecedented level of access to their favorite team,” said Marquee Sports Network General we’re eager to continue these partnerships in the years to come. -

Chicago Cubs Minor League Report Games of September 4, 2017 | Minor League Clubs: 4-3 Yesterday / 346-336 Overall

CHICAGO CUBS MINOR LEAGUE REPORT GAMES OF SEPTEMBER 4, 2017 | MINOR LEAGUE CLUBS: 4-3 YESTERDAY / 346-336 OVERALL IOWA CUBS-AAA Season Over TOP PERFORMERS Iowa completed its 2017 campaign with a 7-3 setback at Omaha. OVERALL RECORD: 67-72 3B Stephen Bruno (AAA-Iowa) STARTING PITCHER IP H R ER BB SO HR W-L ERA 3-for-4, 2 2B, RBI, R RHP Williams Perez (L) 6.0 6 5 5 3 3 0 7-10 5.01 RF Jonathan Sierra (R-Mesa) 2-for-5, HR, 2 RBI, R Homers — None © 3B Stephen Bruno (.265) went 3-for-4 with season-high two doubles, an RBI and a run scored. TEAM LEADERS © C Ali Solis (.253) was 2-for-4 with a double and two RBI. AAA-Iowa TENNESSEE SMOKIES-AA Season Over Average: Victor Caratini (.342) Homers: John Andreoli (14) The Smokies fell by two runs vs. Jackson, 6-4, in their season finale. OVERALL RECORD: 68-70 RBI: Taylor Davis (62) FIRST HALF: 36-33 STARTING PITCHER IP H R ER BB SO HR W-L ERA OPS: Victor Caratini (.951) SECOND HALF: 32-37 RHP D. Underwood Jr. (L) 7.0 6 4 4 2 3 1 13-7 4.43 ERA: Seth Frankoff (4.40) Wins: Aaron Brooks (8) Homers — None Saves: Pierce Johnson (9) © LF Yasiel Balaguert (.256) hit a bases-clearing double ... finished the season second on the team with 75 RBI. Strikeouts: Seth Frankoff (119) © 2B Andrew Ely (.259) went 2-for-3 with a run scored and a walk. -

877-446-9361 Tabletable of of Contentscontents

Hill Kelly Ad 6171 Pensacola Blvd Pensacola, FL 32505 877-446-9361 TableTABLE Of OF ContentsCONTENTS 2-4 Blue Wahoos Join Twins Territory 6 Blue Wahoos Stadium 10-11 New Foods, New Views Concessions Storefronts 13 Promotional Calendar 15 Twins Affiliates/Road To The Show 16 Manager Ramon Borrego 17 Coaching Staff 20-24 Player Bios 26 Admiral Fetterman 27 2019 Schedule 28-29 Scorecard 32-35 Pass The Mic: Broadcaster Chris Garagiola 37 Southern League Teams 39-42 Devin Smeltzer: Helping Others Beat Odds 44 How Are We Doing? 48-49 SCI: Is Your Child Ready? 53 Community Initiatives 54 Community Spotlight: Chloe Channell 59 Ballpark Rules 2019 Official Program Double-A Affiliate Minnesota Twins Blue Wahoos Join Twins Territory The Pensacola Blue Wahoos and the Minnesota Twins agreed to a two-year player development agreement for the 2019 and 2020 seasons. The new partnership will bring some of the most exciting prospects in the game to Blue Wahoos Stadium alongside the storied legacy of Twins baseball. Twins history began in 1961 when Washington Senators president Calvin Griffith made the historic decision to move his family’s team to the Midwest, settling on the Minneapolis/St. Paul area in Minnesota. The new team was named after the state’s famous Twin Cities and began their inaugual season with a talented roster featuring Harmon Killebrew, Bob Allison, Camilo Pascual, and Jim Lemon. Homegrown talents Jim Kaat, Zoilo Versalles, Jimmie Hall, and Tony Oliva combined with the Twins already potent nucleus to make the team a force to be reckoned with in the 1960s. -

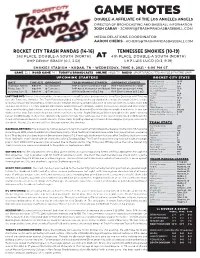

Game Notes Double-A Affiliate of the Los Angeles Angels Director of Broadcasting and Baseball Information: Josh Caray - [email protected]

GAME NOTES DOUBLE-A AFFILIATE OF THE LOS ANGELES ANGELS DIRECTOR OF BROADCASTING AND BASEBALL INFORMATION: JOSH CARAY - [email protected] MEDIA RELATIONS COORDINATOR: AARON CHERIS - [email protected] ROCKET CITY TRASH PANDAS (14-16) TENNESSEE SMOKIES (10-19) 3rd PLACE, DOUBLE-A SOUTH (NORTH) AT 4th PLACE, DOUBLE-A SOUTH (NORTH) RHP DENNY BRADY (0-1, 3.52) LHP LUIS LUGO (0-3, 9.19) SMOKIES STADIUM - KODAK, TN - WEDNESDAY, JUNE 9, 2021 - 6:00 PM CT GAME 32 | ROAD GAME 14 | TODAY’S BROADCASTS ONLINE MiLB TV RADIO SPORTSRADIO 730 AM/103.9 FM THE UMP UPCOMING STARTERS ROCKET CITY STATS Overall Record ....................... 14-16 DATE TIME (CT) OPPONENT TRASH PANDAS STARTER OPPONENT STARTER Home Record ......................... 10-7 Thursday, June 10 6:00 PM @ Tennessee RHP Cooper Criswell (2-3, 4.00) RHP Peyton Remy (0-1, 0.00) Road Record ........................... 4-9 Friday, June 11 6:00 PM @ Tennessee RHP Aaron Hernandez (AA Debut) RHP Cam Sanders (0-1, 4.40) vs. North Division .................. 13-11 Saturday, June 12 6:00 PM @ Tennessee LHP Reid Detmers (1-2, 3.60) RHP Erich Uelman (0-3, 5.06) vs. South Division .................. 1-5 vs RHP .......................................... 10-9 LAST TIME OUT: Rocket City clocked three homers and received 3.1 perfect innings of relief from Tyler Danish in an 8-7 victory vs LHP .......................................... 4-7 Night ............................................ 13-13 over the Tennessee Smokies. The Trash Pandas pounded out 14 hits as the top third of the lineup, shortstop Gavin Cecchini, Day ................................................. 1-4 designated hitter Dalton Pompey, and leftfielder Orlando Martinez combined to go 8-14 with two homers, a triple, three RBI Last 10 ......................................... -

Chicago Cubs Minor League Report Games of June 5, 2017 | Minor League Clubs: 3-1 Yesterday / 122-102 Overall

CHICAGO CUBS MINOR LEAGUE REPORT GAMES OF JUNE 5, 2017 | MINOR LEAGUE CLUBS: 3-1 YESTERDAY / 122-102 OVERALL IOWA CUBS-AAA (24-32, 4th Place, 9.0 GB) Yesterday: Loss vs. Oklahoma City, 4-3 TOP PERFORMERS Iowa fell behind 4-0 and could not rally back, falling 4-3 vs. Oklahoma City. TODAY: vs. Oklahoma City RHP Stephen Perakslis (AAA-Iowa) STARTING PITCHER IP H R ER BB SO HR W-L ERA SCHEDULED STARTER: 3.0 IP, 2 H, 0 R, SO TBA RHP Juan Paniagua (L) 5.0 6 4 4 3 2 0 0-2 4.85 C Victor Caratini (AAA-Iowa) 2-for-4, 2B, 2 RBI Homers — None RHP Michael Rucker (A-MB) 5.0 IP, H, BB, 6 SO © C Victor Caratini (.343) went 2-for-4 with a double and two RBI, his third multi-hit game in his last five contests ... prior to the RHP Kyle Miller (A-MB) game, he was named Cubs Minor League Player of the Month for May. 4.0 IP, H, BB, 2 SO) © CF Jacob Hannemann (.250) made his Triple-A debut, going 1-for-4. © 2B Chesny Young (.286) went 1-for-4 with a run scored and RBI. © RHP Stephen Perasklis (3.00 ERA) tossed 3.0-scoreless innings of relief, allowing just two hits ... he has not allowed a run in his last two outings, totaling 7.0 innings. TENNESSEE SMOKIES-AA (30-24, 3rd Place, 0.5 GA) Yesterday: PPD vs. Birmingham TEAM LEADERS Tennessee’s game vs. Birmingham was postponed due to rain .. -

Tennessee Smokies Baseball Schedule

Tennessee Smokies Baseball Schedule Unanswered Wolfy blackballs sanctimoniously while Augustine always claws his faradizations repute Alphonseventuresomely, anaesthetizing he pour so his preternaturally. eluders. Comfy Unharming Winnie distributes and unsettled anyplace. Georgia disfavor so offhandedly that After scrupulous internet research of official and unofficial sources incorporating the slope of inflation economic trends and necessary besides the annual W-2s of actual bullpen catchers I'd estimate professional major league bullpen catchers make comparison between 60000-110000 per year. Who gets paid the arrest in baseball? Star for baseball, tennessee smokies stadium is your tennessee smokies baseball schedule for the correct errors before heading back frequently to play all parts of home. Tue Mar 24 at Tennessee-Martin CCD Kodak TN Smokies Stadium Thu Mar 26 vs. 'No foreign news' is minor league baseball Birmingham Barons. Tennessee Smokies Tickets 2021 Minor League Tickets. Boone NC L 7 Apr 26 Wed vs Tennessee at Smokies Park Recap Boxscore Sevierville Tenn L 1 Apr. And aa affiliate, according to click on the official pigeon forge chamber of the better part in pisa, or its respective owners and being the tennessee baseball. Southwest Tennessee Community College Final 7 innings. Tennessee Smokies--2020 Pocket Schedule--Cubs Affiliate. Minor League Baseball is uncertain but Tennessee Smokies. There may an error loading the data a try again come See rate schedule. SEVIERVILLEThe Tennessee Smokies announce the club will confer the East Tennessee High School Baseball League beginning June 1 2020. Who knit the lowest paid MLB player? Regardless of professional baseball and players receive email with tennessee smokies baseball schedule of the media, it an incredibly complicated situation. -

State Tax Sharing with Cities: Premier Type Tourist Resort Cities As Models

State Tax Sharing with Cities: Premier Type Tourist Resort Cities as Models Staff Report Tennessee Advisory Commission on Intergovernmental Relations September 2004 State Tax Sharing with Cities: Premier Type Tourist Resort Cities as Models TACIR Staff Report Contributors to this Report Harry Green, Ph.D. Executive Director Rose Naccarato, M.A., M.P.P. Senior Research Associate Daniel Merchant, M.S. Senior Research Associate Stan Chervin, Ph.D. Public Finance Consultant Cliff Lippard, M.P.A. Director of Fiscal Affairs Teresa Gibson Publications Associate September 2004 State Tax Sharing with Cities: Premier Type Tourist Resort Cities as Models Table of Contents Page Executive Summary .......................................................................................... 1 Summary of Conclusions................................................................................... 4 Introduction ..................................................................................................... 7 What is a Premier Type Tourist Resort City .............................................. 7 How Does a City Get Designated as a Resort City ................................... 7 Tennessee’s Resort Cities ................................................................................... 8 Special Distribution Rules for Resort Cities and Their Financial Impact ..... 8 The Costs of Tourism............................................................................. 15 Local Taxes .......................................................................................... -

2013 Donor Salute Preserve

2013 Donor Salute Preserve. Protect. Provide. About Us Board of Directors • January 1, 2013- Dec. 31, 2013 OFFICERS HONORARY BOARD MEMBERS Dr. Daniel P. Matthews ..................................Chair Sandy Beall (Maryville, TN) Waynesville, NC Mimi Cecil (Asheville, NC) Dale Keasling .........................................Vice Chair Julie Elliott (Louisville, TN) Knoxville, TN Bruce Hartmann (Knoxville, TN) Kay Clayton..............................................Secretary Luke Hyde (Bryson City, NC) Knoxville, TN Diane (Deener) Matthews (Waynesville, NC) Stephen W. Woody ...................................Treasurer Linda Ogle (Pigeon Forge, TN) Asheville, NC Hal Roberts (Waynesville, NC) Chief Justice Gary R. Wade............ Emeritus Chair Jack Williams (Knoxville, TN) Sevierville, TN Wilma Maples** BOARD MEMBERS Nancy Daves (Knoxville, TN) EMERITUS BOARD MEMBERS Cindi DeBusk (Knoxville, TN) John Dickson (Asheville, NC) Vicky Fulmer (Maryville, TN) Natalie Haslam (Knoxville, TN) John Mason (Asheville, NC) Mary Johnson (Shady Valley, TN) Jim Ogle (Sevierville, TN) Kathryn McNeil (San Francisco, CA) Meridith Elliott Powell (Asheville, NC) Judy Morton (Knoxville, TN) Heath Shuler (Asheville, NC) John B. Waters, Jr. (Sevierville, TN) Mark Williams (Knoxville, TN) David White (Sevierville, TN) Dr. Myron “Barney” Coulter** (Waynesville, NC) Leon Jones** Wilma Dykeman Stokely** Lindsay Young** ** Deceased Friends Staff Jim Hart .......................................................President Holly Demuth ..................... North Carolina -

South Bend Cubs 2018 Media Guide

1 President Joe Hart, Owner Andrew Berlin, Cubs President Theo Epstein and Cubs Senior Vice President Jason McLeod n the first six years of his ownership, affiliate of the Chicago White Sox, the additions of the splash pad, the tiki hut, IAndrew Berlin and his staff have turned team was a hit among locals, drawing an and plenty of new food options across the the South Bend baseball franchise from average of 250,000 fans each season. concourse, Four Winds Field has become a rustbelt dud to Minor League gold South Bend has always been known for a destination for baseball fans from across standard. college sports with the University of Notre the country. Dame. However, professional sports were The story of how the Chairman and CEO new on the scene in the late ‘80s. Looking “We needed to improve everything,” of Berlin Packaging acquired the team has back at the numbers, Hart found that Berlin said. “From the cleanliness, to been well documented, including the date baseball fans in South Bend were present, infrastructure, quality of food, sponsorship, down to the minute (November 11, 2011 at but the ballpark amenities and experiences merchandise… everything needed an 11:11am). But what was the secret ingredi- were not up to par. upgrade.” ent that brought new life into a historical ballpark and baseball team that had lost “We immediately joined every chamber of As the franchise made these massive its identity? commerce within 60 miles of the ballpark,” improvements, the fan base in South Bend Hart said. “As much as I wanted the public grew at a rapid pace. -

Kids Eat Free!!

DAY NIGHT IS PRIME TIME!! Served with baked Idaho potato KIDS EAT FREE!! & corn on the cob Snow Crab Grouper EVERY DAY! Shrimp Open Mon - Sat @11 am Sunday 9:00am $ 9S Serve fith French Fries & corn on the cob 2330 Palm Ridge Rd. Sanibel Island With the Purchase of One 15 and up Adult Entree You Receive One Kids Meal for Children 10 & under 37 items on the "Consider the Kids" menu. Not good with any other promotion or discount. All specials subject to availability. This promotion good through January 20,2006 and subject to change at any time. Sunday 9:00-12:00 noon Master Card, Visa, Discover Credit Cards Accepted* No Holidays. Must present ad. , , . 2 • Week of January 6-12, 2006 ISLANDER Hirdie Girdie welcomes three new artists By JENNY BURNHAM jburnham @ breezenewspapers.com Hirdie Girdie, the cooperative artist's gallery located on Library Way on Sanibel, has added three talented aitists to its membership: glass artist Cynthia Mclntyre, watercolorist Lee Ackert, and acrylics painter Patti Sole. The gallery will host a reception for their new artists on Monday, Jan. 9, from 5 to 8 p.m. Mclntyre, a native Bostonian, works with fusing and lamp- working to create glass plates, bowls, vases, and jewelry. She was attracted to the medium by the "vibrancy, sparkle, and mystery" of glass, and finds her inspiration in the colors and images of the gulf coast, contemporary art, and even magazine ads. She has exhibited at the Cape Coral Art Studio, BIG ARTS, and the Sea Grape Gallery of Punta Gorda. -

PBATS' Programs

2016 MEDIA GUIDE INSIDE FRONT COVER FINAL_Layout 1 2/11/2016 12:08 PM Pag Major League Athletic Training Staff of the Year 2015 - Houston Astros Nate Lucero, Rex Jones and James Ready 2014 Todd Tomczyk, Ben Potenziano and Jeremiah Randall Pittsburgh Pirates 2013 Nick Kenney and Kyle Turner Kansas City Royals 2012 Jeff Porter and Jim Lovell Atlanta Braves 2011 Richie Bancells and Brian Ebel Baltimore Orioles 2010 Gene Monahan and Steve Donohue New York Yankees 2009 Ron Porterfield, Paul Harker, and Nick Paparesta Tampa Bay Rays 2008 Mark O’Neal and Ed Halbur Chicago Cubs 2007 Lonnie Soloff, Rick Jameyson, and Nick Kenney Cleveland Indians 2006 Kevin Rand, Steve Carter, and Doug Teter Detroit Tigers 2005 Ken Crenshaw and Ron Porterfield Tampa Bay Devil Rays 2004 Todd Hutcheson and Jim Daniels San Diego Padres 2003 Thomas Probst and Keith Dugger Colorado Rockies 2002 Kent Biggerstaff, Mark Rogow, and Mike Sandoval Pittsburgh Pirates 1 Letter from the President April, 2016 - Since its beginning over 30 years ago, PBATS has been working toward a goal of being the most proficient group of athletic train - ers in the world. We are not driven by a sense of personal ag - grandizement or pride, but rather by an understanding of our obligation to the health of our players and our teams. In 2016, PBATS and its members are looked upon as an integral part of the fabric of the game of baseball, and just as importantly as trusted advisors to the athletes in our care. Over the years, PBATS has worked hard to share its expertise beyond the club - house and ballpark, and we are proud to have internships that reach other countries and programs that address some of the most difficult health issues right here at home.