Otago – Southland Forestry Profile – 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

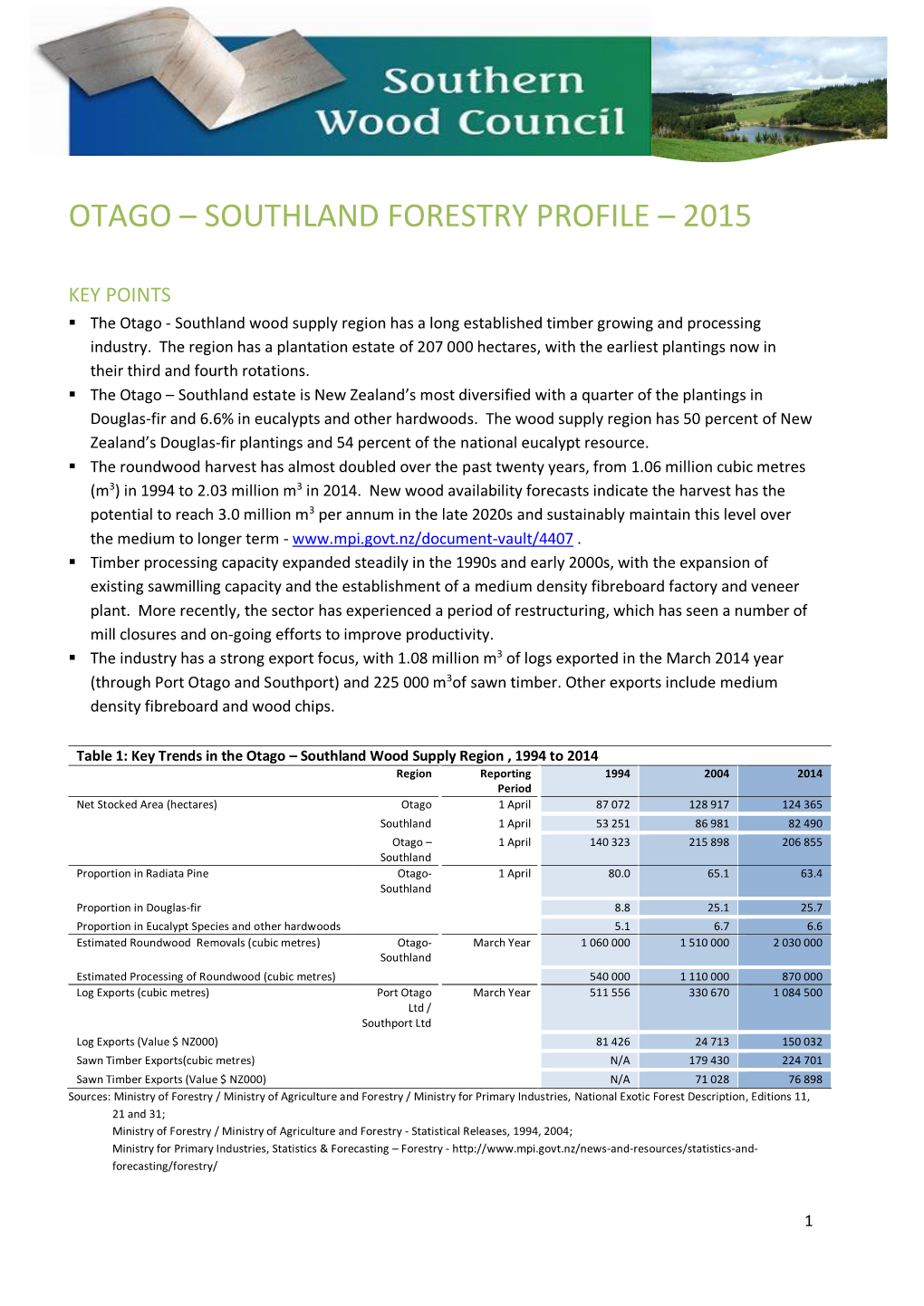

-

Otago Conservancy

A Directory of Wetlands in New Zealand OTAGO CONSERVANCY Sutton Salt Lake (67) Location: 45o34'S, 170o05'E. 2.7 km from Sutton and 8 km from Middlemarch, Straith-Tari area, Otago Region, South Island. Area: 3.7 ha. Altitude: 250 m. Overview: Sutton Salt Lake is a valuable example of an inland or athalassic saline lake, with a considerable variety of saline habitats around its margin and in adjacent slightly saline boggy depressions. The lake is situated in one of the few areas in New Zealand where conditions favour saline lakes (i.e. where precipitation is lower than evaporation). An endemic aquatic animal, Ephydrella novaezealandiae, is present, and there is an interesting pattern of vegetation zonation. Physical features: Sutton Salt Lake is a natural, inland or athalassic saline lake with an average depth of 30 cm and a salinity of 15%. The lake has no known inflow or outflow. The soils are saline and alkaline at the lake margin (sodium-saturated clays), and surrounded by yellow-grey earths and dry subdygrous Matarae. The parent material is loess. Shallow boggy depressions exist near the lake, and there is a narrow fringe of salt tolerant vegetation at the lake margin. Algal communities are present, and often submerged by lake water. The average annual rainfall is about 480 mm, while annual evaporation is about 710 mm. Ecological features: Sutton Salt Lake is one of only five examples of inland saline habitats of botanical value in Central Otago. This is the only area in New Zealand which is suitable for the existence of this habitat, since in general rainfall is high, evaporation is low, and endorheic drainage systems are absent. -

Economic Recovery Strategy

Manawatū-Whanganui Region (Post-COVID-19) Economic Recovery Strategy “WHAT” Survive Short-term Keep people in their jobs; keep businesses alive • Cash Support for businesses Survive 0-6 months 3 • Advice Wage subsidy 3 Keep people in work; provide work for businesses Revive Medium-term Shovel-ready, • Jobs Revive suffering from the COVID downturn 6-12 months job-rich infrastructure Phases Work • Businesses projects Create new, valuable jobs. Build vigorous, productive Plans Thrive Long-term Big Regional Thrive • Resilience businesses. Achieve ambitious regional goals. 12+ months Development Projects • Future-proof Priority Projects Box 2 – Project Detail High $ Estimated Central NZ Projects Impact Food O2NL Investment Jobs distribution Central NZ distribution – Regional Freight Ring Road and HQ Ruapehu c. $3-3.5 Freight efficiency and connectivity across Central North Island Freight Hub - significant development SkillsSkills & & Te Ahu a billion c. 350 for central New Zealand and ports, reduced freight Tourism project: new KiwiRail distribution hub, new regional freight Talent (public and construction costs, reduced carbon emissions, major wealth Talent Turanga ring road commercial) and job creation Shovel-ready Highway Lead: PNCC – Heather Shotter Skills & Talent Projects Critical north-south connection, freight SH1 – Otaki to North of Levin (O2NL) – major new alignment c. 300 over 5 Te Puwaha - c. $800 efficiency, safety and hazard resilience, major 1 2 for SH1 around Levin years for million wealth and job creation through processing, Whanganui Lead: Horowhenua District Council – David Clapperton construction Impact manufacturing and logistics growth Marton Port axis Manawatū Ruapehu Tourism - increasing Tourism revenue from $180m Facilities and tourism services development Rail Hub c. -

2021 Aon U19 Nationals Scorebench Draw

2021 AON U19 NATIONALS BASKETBALL DRAW MENS POOLS POOL A POOL B POOL C POOL D Waitakere West Harbour A Canterbury Wellington Hawkes Bay Auckland Otago Waikato Taranaki Nelson Southland Counties Manukau Northland Manawatu Harbour B Tauranga WOMENS POOLS POOL A POOL B Harbour Waikato Canterbury Taranaki Wellington Waitakere West Otago Manawatu Rotorua Northland Eventfinda Stadium 17 Silverfield, Wairau Valley, Auckland 1 2021 AON U19 NATIONALS BASKETBALL DRAW Saturday Court 1 Court 2 Court 3 Court 4 5th June Auckland V Manawatu V Rotorua V Northland V 9:00am Nelson Harbour A Harbour Waikato Mens Pool B Mens Pool B Womens Pool A Womens Pool B DUTY HARBOUR HARBOUR HARBOUR HARBOUR Otago V Manawatu V Northland V Hawkes Bay V 10:45am Canterbury Taranaki Waitakere West Taranaki Womens Pool A Womens Pool B Mens Pool A Mens Pool A DUTY Auckland Harbour A Harbour Waikato Harbour B V Waikato V Otago V Tauranga V 12:30pm Canterbury Counties Manukau Southland Wellington Mens Pool C Mens Pool D Mens Pool C Mens Pool D DUTY Canterbury Taranaki Northland Taranaki Wellington V Harbour A V Waitakere West V Auckland V 2:15pm Rotorua Nelson Northland Manawatu Womens Pool A Mens Pool B Womens Pool B Mens Pool B DUTY Harbour B Counties Manukau Otago Tauranga Hawkes Bay V Harbour V Waitakere West V Waikato V 4:00pm Northland Otago Taranaki Manawatu Mens Pool A Womens Pool A Mens Pool A Womens Pool B DUTY Wellington Nelson Waitakere West Manawatu Wellington V Otago V Waikato V Canterbury V 5:45pm Counties Manukau Harbour B Tauranga Southland Mens Pool D Mens -

Breastfeeding Support Across Otago and Southland

Breastfeeding Support ACROSS OTAGO AND SOUTHLAND Breastfeeding Support Otago and Southland (BFSOS). Trained peer supporters. Website: www.breastfeedingsos.co.nz Phone, text, email and/or home visit SOUTHLAND INVERCARGILL The Milk Room Drop-in Centre, Wed 10 – 11am, Plunket, 132 Kelvin St, Lisa 027 322 0869, Breastfeeding Support Southland and the Milk Room Invercargill La Leche League: Phone, text, email and/or home visit. Lisa 027 322 0869 La Leche League Invercargill Monthly meetings. https://lalecheleague.org.nz/get-help/ Lactation Consultants: Mary Grant, Southland Hospital Lactation Consultant – free service, Ph: 03 218 1949 ext: 48376 Email: [email protected] Gina Rutledge, Private Lactation Consultant providing home visits. Private message on Love Lactation or Love Lactation, email [email protected] LUMSDEN La Leche League: phone/text/email and/or home visits. Christine 021 157 6296 or 03 248 7205 La Leche League Invercargill COASTAL OTAGO BALCLUTHA Clutha Breastfeeding Drop-in Centre, 10am – 12pm, 2nd & 4th Thurs of month, South Otago Plunket, Clyde Street, Breastfeeding Support South Otago DUNEDIN The Breast Room® Drop-in Clinic, Thurs 10.30am-12.30, 1st Floor, South City Mall, South Dunedin Phone/text/email support 027 891 1270, [email protected], www.thebreastroom.org La Leche League: Message, phone, text, email and/or home visits. Brylin 03 467 5599; text Lydia 021 476 991, email [email protected], La Leche League Dunedin West Monthly meetings: La Leche League Dunedin West Facebook.com/llldunedin Lactation Consultants (private – there may be a charge for visits): Nourish: webpage: www.nourishbaby.nz Carrie van Rij, Ph: 021 021 81144, Email: [email protected], Donna Dalzell, Ph: 027 243 7350, Email: [email protected] Pauline Moore, Ph: 021 184 6858, Email: [email protected] Stefanie Kalmakoff, Ph: 027 3305 503, Email: [email protected] Dunedin Antenatal Breastfeeding Classes: Sessions held monthly. -

Otago Lakes' Trophic Status Lake Hayes Lake Johnson Lakes Onslow

Otago lakes’ trophic status Lake Hayes Lake Johnson Lakes Onslow Lake Wakatipu Lake Wanaka Otago Regional Council Private Bag 1954, 70 Stafford St, Dunedin 9054 Phone 03 474 0827 Fax 03 479 0015 Freephone 0800 474 082 www.orc.govt.nz © Copyright for this publication is held by the Otago Regional Council. This publication may be reproduced in whole or in part provided the source is fully and clearly acknowledged. ISBN 1-877265-85-3 Published November 2009 Otago lakes’ trophic status i Foreword The high quality of Otago’s lakes and waterways has come to be expected by all who live and visit the region. However, areas are coming under pressure from intensive agriculture, urbanisation and water discharge practices. To help protect water quality, the Otago Regional Council (ORC) carries out long-term water quality monitoring as part of its State of the Environment programme. Short-term monitoring programmes are also carried out in some catchments to provide more detailed information. These programmes assist regional planning and help everyone understand the need to protect water quality. This report provides the results from short-term studies, which monitored the health of five high country lakes (Lakes Hayes, Johnson, Onslow, Wakatipu and Wanaka). With this information the ORC and local community can work together to ensure the future wellbeing of these five important lakes. Otago lakes’ trophic status ii Otago lakes’ trophic status Executive summary Otago Regional Council monitored five high country lakes in the Clutha River/Mata-Au catchment between 2006 and 2009. The monitoring of Lakes Hayes, Johnson, Onslow, Wakatipu and Wanaka was undertaken in order to detect any small changes in the trophic status of the lakes. -

University of Otago, Christchurch

University of Otago, Christchurch Located within the Christchurch Public Hospital is a large division of the University Otago health campus. Their combined resources are further integrated with some of the top clinicians and scientists in the field of cancer research and treatment in New Zealand. This cooperative community is unique and unmatched in New Zealand and recognised globally. The University of Otago is one of New Zealand’s largest research organisations, internationally recognised for strengths in areas that enhance health, and social, environmental and economic well-being. The Christchurch campus is New Zealand’s most research-intensive campus for health sciences. This campus has about 250 academic and professional staff, plus about 500 Canterbury District Health Board senior medical officers who have affiliations as clinical lecturers and who play a vital role in undergraduate medical student teaching. University of Otago, Christchurch RESEARCH The University of Otago, Christchurch is New Zealand’s most research-intensive campus for medical and health sciences with a particular strength in clinical research. Studies often involve patients, and results feed into improving care at both general practice and specialist level. Cancer researchers are investigating many types of human cancer in order to develop new and better preventative and treatment options. • The Mackenzie Cancer Research Group researches the pathology of human tumours and seeks to identify the genetic changes that give rise to cancer. Research groups in the Departments of Surgery, Pathology, and Obstetrics and Gynaecology are focused on bowel, gynaecological and blood cancers. The Cancer Society Tissue Bank, a national resource that underpins cancer research, is hosted here. -

Precipitation Trends for the Otago Region Over the 21St Century June 2016

Report Prepared for Otago Regional Council Precipitation Trends for the Otago Region over the 21st century June 2016 Chris Cameron, Jared Lewis and Matt Hanson 1 Bodeker Scientific 42 Russell Street, Alexandra 9320 Ph: 03 448 8118 www.bodekerscientific.com Front Cover – Photo Acknowledgements Blossoms: David Wall Cyclists: Hedgehoghouse.com 2 Table of Contents Executive summary ................................................................................................................................. 4 Introduction ............................................................................................................................................ 5 1. Precipitation trends in New Zealand............................................................................................... 6 2. Historic data .................................................................................................................................... 8 2.1. Methodology ........................................................................................................................... 8 2.1.1. Station data ..................................................................................................................... 8 2.1.2. Precipitation indices ........................................................................................................ 8 2.1.3. Climate indices ................................................................................................................ 9 2.1.4. Trend analysis ................................................................................................................ -

The Book of New Zealand Wine NZWG

NEW ZEALAND WINE Resource Booklet nzwine.com 1 TABLE OF CONTENTS 100% COMMITTED TO EXCELLENCE Tucked away in a remote corner of the globe is a place of glorious unspoiled landscapes, exotic flora and fauna, and SECTION 1: OVERVIEW 1 a culture renowned for its spirit of youthful innovation. History of Winemaking 1 New Zealand is a world of pure discovery, and nothing History of Winemaking Timeline 2 distills its essence more perfectly than a glass of New Zealand wine. Wine Production & Exports 3 New Zealand’s wine producing history extends back to Sustainability Policy 4 the founding of the nation in the 1800’s. But it was the New Zealand Wine Labelling Laws introduction to Marlborough’s astonishing Sauvignon & Export Certification 5 Blanc in the 1980’s that saw New Zealand wine receive Wine Closures 5 high acclaim and international recognition. And while Marlborough retains its status as one of the SECTION 2: REGIONS 6 world’s foremost wine producing regions, the quality of Wine Regions of New Zealand Map 7 wines from elsewhere in the country has also achieved Auckland & Northland 8 international acclaim. Waikato/ Bay of Plenty 10 Our commitment to quality has won New Zealand its reputation for premium wine. Gisborne 12 Hawke’s Bay 14 Wairarapa 16 We hope you find the materials of value to your personal and professional development. Nelson 18 Marlborough 20 Canterbury & Waipara Valley 22 Central Otago 24 RESOURCES AVAILABLE SECTION 3: WINES 26 NEW ZEALAND WINE RESOURCES Sauvignon Blanc 28 New Zealand Wine DVD Riesling 30 New Zealand Wine -

Intro to Otago

1 TOP Ranked in the top 1% of universities in the world. 1% QS World University Rankings 85% of students from outside Dunedin. 95% of Otago graduates go 95% directly into work or further study. Graduate Opinion Survey 14 residential colleges. New Zealand’s #1 university for #1 educational performance. Tertiary Education Commission Educational Performance Indicators Awarded 5-stars plus – the highest- possible rating for teaching and research. QS Stars Rating 2 INTRO TO OTAGO SECTION 1 Otago life Tō noho ki Ōtākou 3 World-class teaching and a legendary student lifestyle – the two core elements that set us apart and the reason students from across the country choose Otago. 4 INTRO TO OTAGO Dunedin NZ Dunedin 5 Dunedin Our 21,000 students make up one fifth of Dunedin’s population, creating an energy and atmosphere that you will only find at Otago. The campus is right in the heart of the city and all of Dunedin’s best places for shopping, food and entertainment are just a Auckland short walk away. When it comes to sport, Otago takes on the best in the world. The University’s recreational facilities are state-of-the-art and Wellington Forsyth Barr Stadium, the world’s first fully enclosed grassed stadium, hosts top-level Christchurch sports matches and world-class concerts. But that’s just the beginning. Dunedin’s Dunedin beaches, mountains and bush surrounds offer an awesome range of activities. Ride the waves at one of the 30 nearby beaches, hit the mountain bike tracks, paddle-board, kayak or sail on the harbour, or head to Central Otago for a weekend at New Zealand’s top ski fields. -

New Zealand Touring Map

Manawatawhi / Three Kings Islands NEW ZEALAND TOURING MAP Cape Reinga Spirits North Cape (Otoa) (Te Rerengawairua) Bay Waitiki North Island Landing Great Exhibition Kilometres (km) Kilometres (km) N in e Bay Whangarei 819 624 626 285 376 450 404 698 539 593 155 297 675 170 265 360 658 294 105 413 849 921 630 211 324 600 863 561 t Westport y 1 M Wellington 195 452 584 548 380 462 145 355 334 983 533 550 660 790 363 276 277 456 148 242 352 212 649 762 71 231 Wanaka i l Karikari Peninsula e 95 Wanganui 370 434 391 222 305 74 160 252 779 327 468 454 North Island971 650 286 508 714 359 159 121 499 986 1000 186 Te Anau B e a Wairoa 380 308 252 222 296 529 118 781 329 98 456 800 479 299 348 567 187 189 299 271 917 829 Queenstown c Mangonui h Cavalli Is Themed Highways29 350 711 574 360 717 905 1121 672 113 71 10 Thames 115 205 158 454 349 347 440 107 413 115 Picton Kaitaia Kaeo 167 86 417 398 311 531 107 298 206 117 438 799 485 296 604 996 1107 737 42 Tauranga For more information visit Nelson Ahipara 1 Bay of Tauroa Point Kerikeri Islands Cape Brett Taupo 82 249 296 143 605 153 350 280 newzealand.com/int/themed-highways643 322 329 670 525 360 445 578 Mt Cook (Reef Point) 87 Russell Paihia Rotorua 331 312 225 561 107 287 234 1058 748 387 637 835 494 280 Milford Sound 11 17 Twin Coast Discovery Highway: This route begins Kaikohe Palmerston North 234 178 853 401 394 528 876 555 195 607 745 376 Invercargill Rawene 10 Whangaruru Harbour Aotearoa, 13 Kawakawa in Auckland and travels north, tracing both coasts to 12 Poor Knights New Plymouth 412 694 242 599 369 721 527 424 181 308 Haast Opononi 53 1 56 Cape Reinga and back. -

Quirky Facts

Dunedin - Quirky Facts • Dunedin is the world’s fifth largest city in geographical size, offering lots of leisure and recreational opportunities. • Dunedin is the celtic name for Edinburgh. • The only mainland breeding colony of the Northern Royal Albatross, large majestic seabirds with a wingspan of three metres, is at the Otago Peninsula. • Dunedin, and its surrounds, is home to some interesting locals, including the world’s rarest penguin - the yellow-eyed penguin, the world’s rarest sea lion - the New Zealand sea lion, New Zealand fur seals and little blue penguins. • Dunedin’s Baldwin Street is the steepest street in the world. • Larnach Castle located on the Otago Peninsula is New Zealand’s only castle. • Dunedin Railway Station is the most photographed building in New Zealand. • University of Otago, New Zealand’s oldest university, was the first in the country to admit women to all its classes. It is also the South Island’s largest employer. • Otago Girls’ High School was one of the first state run secondary schools for girls in the world. • New Zealand Sports Hall of Fame is, in effect, New Zealand’s national sports museum, the only one of its kind in the country. • New Zealand’s first authentic Chinese Garden - only the third outside of China and the first In the Southern Hemisphere - is found in Dunedin. • The Otago Daily Times is New Zealand’s first daily and oldest surviving newspaper. • The Dunedin Public Art Gallery is New Zealand’s first public art gallery. • The Dunedin (1876-82) was the first ship to successfully transport refrigerated meat, helping set the stage for New Zealand’s success as a major provider of agricultural exports, despite its extreme remoteness from most markets.. -

1/6/15 Otago Southland Regional Land Tranport Plans

Otago Southland Regional Land Transport Plans 2015-2021 Chairmen’s Foreword The Otago and Southland Regional Transport Committees are pleased to present these 2015–2021 Otago Southland Regional Land Transport Plans. These plans set our vision of transport in the future, and how we - the 10 local authorities in our two regions and the NZ Transport Agency - intend to achieve this by funding and providing transport services and infrastructure. The prosperity of both Otago and Southland - our quality of life - depends heavily on good land transport infrastructure and services. Our primary industries drive much of the area’s economic growth, so good access and freight services linking farms and forests, suppliers, processors and export gateways are critical. Tourism, another major economic driver in Otago and Southland, also depends on quality road links. Covering almost half of the South Island, the Otago and Southland regions face common transport challenges. These include a very large land area and road network but comparatively low rating population in many areas, natural hazards impacting on the roads, and infrastructure upgrades needed to give longer, heavier freight trucks access to key parts of the transport network. Our two regions also have many common road safety issues. It is these shared issues and opportunities that have led us to jointly develop our Regional Land Transport Plans. Our Regional Transport Committees have developed a common transport strategy for the two regions. This strategy focuses on maintaining our established transport networks, while making key improvements to transport services and infrastructure, focusing on: reducing the social cost of crashes; supporting economic productivity and growth by enabling freight journeys and visitor journeys; increasing network resilience; enabling all modes of transport appropriate access to the network; and ensuring value for money investments.