Annual Report 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Statement of Investment Holdings Dec. 31, 2016

1 DEUTSCHE TELEKOM AG STATEMENT OF INVESTMENT HOLDINGS IN ACCORDANCE WITH § 285 HGB AS OF DECEMBER 31, 2016 1. Subsidiaries Shareholders’ equity Indirectly Directly Total thousands of Net income/net loss Reporting No. Name and registered office Via % % nominal value Currency reporting currency thousands of € currency Note 1. 3.T-Venture Beteiligungsgesellschaft mbH (3. TVB), Bonn 1.93. 100.00 25,000 EUR 6,382 764 EUR e) 2. Antel Germany GmbH, Karben 1.105. 100.00 25,000 EUR (119) (48) EUR i) 3. Arbeitgeberverband comunity, Arbeitgeberverband für EUR - - EUR Telekommunikation und IT e.V., Bonn 4. Assessment Point (Proprietary) Limited, Johannesburg 1.125. 100.00 100 ZAR (3,192) (6) ZAR e) 5. Atrada GmbH, Nuremberg 100.00 150,000 EUR 3,220 (2,210) EUR e) 6. Atrada Trading Network Limited, Manchester 1.5. 100.00 1 GBP 0 0 GBP e) 7. BENOCS GmbH, Bonn 1.327. 100.00 25,000 EUR 94 (765) EUR e) 8. Benocs, Inc., Wilmington, DE 1.7. 100.00 100 USD - - USD 9. CA INTERNET d.o.o., Zagreb 1.129. 100.00 20,000 HRK 228 11 HRK e) 10. CBS GmbH, Cologne 1.19. 100.00 838,710 EUR 18,055 0 EUR a) e) 11. CE Colo Czech, s.r.o., Prague 1.232. 100.00 711,991,857 CZK 854,466 88,237 CZK e) 12. COMBIS - IT Usluge d.o.o., Belgrade 1.14. 100.00 49,136 RSD (112,300) (9,378) EUR e) 13. COMBIS d.o.o. Sarajevo, Sarajevo 1.14. 100.00 2,000 BAM 5,297 969 BAM e) 14. -

2020 Content

Annual report 2020 CONTENT FINANCIAL HIGHLIGHTS OPERATIONAL STATISTICS INTRODUCTION LETTER TO SHAREHOLDERS CORPORATE PROFILE INVESTOR INFORMATION MANAGEMENT BOARD SUPERVISORY BOARD CORPORATE GOVERNANCE CODE COMPLIANCE STATEMENT SUPERVISORY BOARD REPORT ECONOMIC ENVIRONMENT ECONOMIC BACKGROUND CROATIAN MARKET OVERVIEW REGULATORY OVERVIEW CHANGES IN REPORTING BUSINESS REVIEW SUMMARY OF KEY FINANCIAL INDICATORS – HT GROUP (INCLUDING CRNOGORSKI TELEKOM) SUMMARY OF KEY FINANCIAL INDICATORS – HT GROUP IN CROATIA SUMMARY OF KEY FINANCIAL INDICATORS – CRNOGORSKI TELEKOM STANDALONE OVERVIEW OF SEGMENT PROFITABILITY HT INC. FINANCIAL HIGHLIGHTS CORPORATE SOCIAL RESPONSIBILITY HT GROUP FINANCIAL STATEMENTS CONSOLIDATED INCOME STATEMENT CONSOLIDATED BALANCE SHEET CONSOLIDATED CASH FLOW STATEMENT CONSOLIDATED FINANCIAL STATEMENTS INDEPENDENT AUDITOR’S REPORT RESPONSIBILITY FOR THE CONSOLIDATED FINANCIAL STATEMENTS CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME CONSOLIDATED STATEMENT OF FINANCIAL POSITION CONSOLIDATED STATEMENT OF CASH FLOWS CONSOLIDATED STATEMENT OF CHANGES IN EQUITY NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 3 FINANCIAL HIGHLIGHTS Income statement in HRK million 2019 2020 % of change Q4 2019 Q4 2020 % of change BALANCE SHEET At 31 Dec At 31 Dec % of change At 31 Dec At 31 Dec % of change A20/A19 A20/A19 2019 2020 A20/A19 2019 2020 A20/A19 Total non current assets 10.447 10.415 -0,3% 10.447 10.415 -0,3% Revenue 7.704 7.458 -3,2% 1.992 1.966 -1,3% Assets classified as held for sale 68 2 -97,1% 68 2 -97,1% Mobile 3.464 3.325 -4,0% -

Deutsche Telekom Services Europe Czech Republic Company Presentation OVERVIEW

Deutsche telekom services Europe Czech republic Company presentation OVERVIEW 01 Deutsche Telekom Group 02 Deutsche Telekom Services Europe 03 Deutsche Telekom Services Europe Czech Republic: overview 04 Deutsche Telekom Services Europe Czech Republic: our Teams 2 DEUTSCHE TELEKOM PROFILE German telecommunication company Headquarters in Bonn By revenue the largest telecommunications provider in Europe – 73 bn. € (2016) Formed in 1996 - the former state-owned monopoly Deutsche Bundespost was privatized Active in 36 countries worldwide More than 218.000 employees DEUTSCHE TELEKOM figures Customers & Markets Facts & Figures Customers Markets Telekom in figures, 2018 Employees & responsibility Employeesworldwide: 215,675 178.4 mnmobile customers Presentin > 50 countries Revenue € 75.7 bn 5,713 trainees and cooperative 27.9 mnfixed-network lines/ Germany, Europe and the USA: Adjusted EBITDA € 23.3 bn degree students in Germany 20.2 mnbroadband lines with own infrastructure Free Cash-Flow € 6.2 bn Pioneer of social issues Approx. 8.2 m TV customers T-Systems: global presence& (climate protection, data privacy, alliances via partners diversity, etc.) Source: DT 2018 annual report 4 Company presentation OVERVIEW 01 Deutsche Telekom Group 02 Deutsche Telekom Services Europe 03 Deutsche Telekom Services Europe Czech Republic: overview 04 Deutsche Telekom Services Europe Czech Republic: our Teams 5 Where does dtse stand in the deutsche telekom group? operating model Future target operating Headquarters give an explicit Group model -

Hrvatski Telekom

HRVATSKI TELEKOM INVESTOR PRESENTATION OCTOBER 2020 HT GROUP DISCLAIMER These materials and the oral presentation do not constitute or form part of any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for, any securities of the Company nor should they or any part of them or the fact of their distribution form the basis of, or be relied on in connection with, any contract or investment decision in relation thereto. In particular, these materials and the oral presentation are not an offer of securities for sale in the United States. The Company's securities have not been, and will not be, registered under the US Securities Act of 1933, as amended The third party information contained herein has been obtained from sources believed by the Company to be reliable. Whilst all reasonable care has been taken to ensure that the facts stated herein are complete and accurate and that opinions and expectations contained herein are fair and reasonable, no representation or warranty, expressed or implied, is made by the Group or its advisors, with respect to the completeness or accuracy of any information and opinions contained herein These materials and the oral presentation contain certain forward-looking statements with respect to the financial condition, results of operations and business of the Group. These forward-looking statements represent the Company's expectations or beliefs concerning future events and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. -

Prepared for Upload GCD Wls Networks

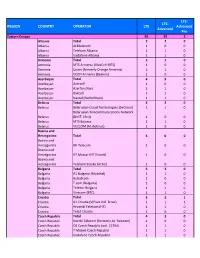

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Eastern Europe 92 57 4 3 Albania Total 32 0 0 Albania ALBtelecom 10 0 0 Albania Telekom Albania 11 0 0 Albania Vodafone Albania 11 0 0 Armenia Total 31 0 0 Armenia MTS Armenia (VivaCell‐MTS) 10 0 0 Armenia Ucom (formerly Orange Armenia) 11 0 0 Armenia VEON Armenia (Beeline) 10 0 0 Azerbaijan Total 43 0 0 Azerbaijan Azercell 10 0 0 Azerbaijan Azerfon (Nar) 11 0 0 Azerbaijan Bakcell 11 0 0 Azerbaijan Naxtel (Nakhchivan) 11 0 0 Belarus Total 42 0 0 Belarus A1 Belarus (formerly VELCOM) 10 0 0 Belarus Belarusian Cloud Technologies (beCloud) 11 0 0 Belarus Belarusian Telecommunications Network (BeST, life:)) 10 0 0 Belarus MTS Belarus 11 0 0 Bosnia and Total Herzegovina 31 0 0 Bosnia and Herzegovina BH Telecom 11 0 0 Bosnia and Herzegovina HT Mostar (HT Eronet) 10 0 0 Bosnia and Herzegovina Telekom Srpske (m:tel) 10 0 0 Bulgaria Total 53 0 0 Bulgaria A1 Bulgaria (Mobiltel) 11 0 0 Bulgaria Bulsatcom 10 0 0 Bulgaria T.com (Bulgaria) 10 0 0 Bulgaria Telenor Bulgaria 11 0 0 Bulgaria Vivacom (BTC) 11 0 0 Croatia Total 33 1 0 Croatia A1 Hrvatska (formerly VIPnet/B.net) 11 1 0 Croatia Hrvatski Telekom (HT) 11 0 0 Croatia Tele2 Croatia 11 0 0 Czechia Total 43 0 0 Czechia Nordic Telecom (formerly Air Telecom) 10 0 0 Czechia O2 Czech Republic (incl. CETIN) 11 0 0 Czechia T‐Mobile Czech Republic 11 0 0 Czechia Vodafone Czech Republic 11 0 0 Estonia Total 33 2 0 Estonia Elisa Eesti (incl. -

Ready for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced Advanced Pro Eastern Europe 92 55 2 Albania Total 320 Albania ALBtelecom 100 Albania Telekom Albania 110 Albania Vodafone Albania 110 Armenia Total 310 Armenia MTS Armenia (VivaCell‐MTS) 100 Armenia Ucom (formerly Orange Armenia) 110 Armenia VEON Armenia (Beeline) 100 Azerbaijan Total 430 Azerbaijan Azercell 100 Azerbaijan Azerfon (Nar) 110 Azerbaijan Bakcell 110 Azerbaijan Naxtel (Nakhchivan) 110 Belarus Total 420 Belarus Belarusian Cloud Technologies (beCloud) 110 Belarusian Telecommunications Network Belarus (BeST, life:)) 100 Belarus MTS Belarus 110 Belarus VELCOM (A1 Belarus) 100 Bosnia and Herzegovina Total 300 Bosnia and Herzegovina BH Telecom 100 Bosnia and Herzegovina HT Mostar (HT Eronet) 100 Bosnia and Herzegovina Telekom Srpske (m:tel) 100 Bulgaria Total 530 Bulgaria A1 Bulgaria (Mobiltel) 110 Bulgaria Bulsatcom 100 Bulgaria T.com (Bulgaria) 100 Bulgaria Telenor Bulgaria 110 Bulgaria Vivacom (BTC) 110 Croatia Total 321 Croatia A1 Croatia (VIPnet incl. B.net) 111 Croatia Hrvatski Telekom (HT) 110 Croatia Tele2 Croatia 100 Czech Republic Total 430 Czech Republic Nordic Telecom (formerly Air Telecom) 100 Czech Republic O2 Czech Republic (incl. CETIN) 110 Czech Republic T‐Mobile Czech Republic 110 Czech Republic Vodafone Czech Republic 110 Estonia Total 330 Estonia Elisa Eesti (incl. Starman) 110 Estonia Tele2 Eesti 110 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 110 Georgia Total 630 Georgia A‐Mobile (Abkhazia) 100 Georgia Aquafon GSM (Abkhazia) 110 Georgia MagtiCom -

SUMMARY ANNUAL REPORT Contents T-Mobile C Zech Republic A.S

2019 republic a.s. czech T-mobile summary annual reporT T-mobile czech republic a.s. conTenT s CONTENTS 2 SUMMARY ANNUAL reporT conTenTs T-mobile c zech republic a.s. Foreword 2 report of the board of Directors on business activities and assets 6 report on relationships 22 Financial statements according to the international Financial reporting standards 52 consolidated Financial statements according to the international Financial reporting standards 92 independent auditor’s report 132 SUMMARY ANNUAL reporT 1 T-mobile czech republic a.s. inTRODucTion INTRO- DUCTION builiDinG FULLY DiGiTal CZECHIA Digitisation is one of the main challenges that the czech republic is facing. i am very honoured that T-mobile czech republic has played a very important role in this transformation process and that we can take part in the transformation into a truly digital society. With its expertise, technologies, services and investments, T-mobile has contributed and can continue to contribute to the building of a fully digital czech republic. i am aware of the great responsibility that comes with this, but we are prepared to further increase our participation in the digital transformation of the entire czech republic in the coming years. 2 SUMMARY ANNUAL reporT inTRODucTion T-mobile c zech republic a.s. 3 SUMMARY ANNUAL reporT 3 T-mobile czech republic a.s. inTRODucTion The task that lies before us could not be achieved without massive investments in the development of the existing technologies, rollout of the fibre-optic network, introduction of new services and making modern communication tools available to the entire population. -

Deutsche Telekom AG

As filed with the Securities and Exchange Commission on March 1, 2007 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Form 20-F È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2006 Commission file number 001-14540 Deutsche Telekom AG (Exact Name of Registrant as Specified in its Charter) Federal Republic of Germany (Jurisdiction of Incorporation or Organization) Friedrich-Ebert-Allee 140, 53113 Bonn, Germany (Address of Registrant’s Principal Executive Offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered American Depositary Shares, each representing New York Stock Exchange one Ordinary Share Ordinary Shares, no par value New York Stock Exchange* Securities registered or to be registered pursuant to Section 12(g) of the Act: NONE (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: NONE (Title of Class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: Ordinary Shares, no par value: 4,361,119,250 (as of December 31, 2006) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes È No ‘ If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. -

Measures to Make the Internet a Better Place for Kids

Deutsche Telekom Group Measures to Make the Internet a Better Place for Kids Bonn, 21st January 2013 Inspired by the discussions within the 'CEO Coalition to make the internet a better place for kids' and the 'Principles for the Safer Use of Connected Devices and Online Services by Children and Young People in the EU' (ICT Coalition) on EU level, Deutsche Telekom Group commits to a set of measures that further improve child online safety in its European Union markets. These measures strive to provide effective solutions to identified problems in the area of child online safety based on Deutsche Telekom Group's businesses. By taking these steps, Deutsche Telekom builds on its engagement of the recent years and continuously takes on responsibility for own services and products within the ICT sector. Deutsche Telekom’s earlier international commitments to improve child safety are: . European Framework for Safer Mobile Use by Younger Teenagers and Children1, . Mobile Alliance against Child Sexual Abuse Content2, . Teach Today3. Various additional commitments have been undertaken by Deutsche Telekom Group’s subsidiaries on national level too. Each of the measures of this new commitment will be implemented in the services and products of each of Deutsche Telekom's subsidiaries in the EU within the next 12 months. The implementation will be undertaken in good faith to meet specific cultural preferences, different technologies and considering the companies' varying service and product portfolios as well as already established safeguards. The -

Voices of Deutsche Telekom Workers: a Report on Operations Outside Germany

Voices of Deutsche Telekom Workers: A Report on Operations outside Germany A Report by UNI Global Union December 2013 Voices of Deutsche Telekom Workers: A Report on Operations Outside Germany Table of Contents TABLE OF CONTENTS…………………………………………………………………………………………………………………. EXECUTIVE SUMMARY……………………………………………………………………………………………………………….. INTRODUCTION…………………………………………………………………………………………………………………………… DEUTSCHE TELEKOM, THE COMPANY…………………………………………………………………………………………. THE SOCIAL STANDARDS OF DEUTSCHE TELEKOM……………………………………………………………………… SURVEY METHODOLOGY…………………………………………………………………………………………………………….. “MY JOB MAKES ME SICK”…………………………………………………………………………………………………………… UNSAFE WORK…………………………………………………………………………………………………………………………... DT RESPONSE TO ILLNESS OR INJURY AT WORK…………………………………………………………………………. DISCRIMINATION AND BULLYING AT WORK……………………………………………………………………………….. ARBITRARY MANAGEMENT EXACERBATES HIGH-STRESS JOB…………………………………………………….. DT THWARTS WORKERS’ EFFORTS TO EXERCISE FREEDOM OF ASSOCIATION…………………………….. CHALLENGES FOR WORKERS IN THE DT GROUP OPERATIONS...……………………………………………….... REMEDIES TO ADDRESS CHALLENGES IDENTIFIED BY WORKERS IN THE DT GROUP…………………… CONCLUSION………………………………………………………………………………………………………………………………. Voices of Deutsche Telekom Workers Page 1 Executive Summary How do workers at Deutsche Telekom (DT) companies outside Germany experience their working conditions? Unions representing DT employees developed and administered a detailed survey about workers’ experiences on the job at companies in Bosnia and Herzegovina, Croatia, the Czech Republic, Greece, -

08.05.08 DT Backup Q1-2008 Final

Backup Q1 2008. Deutsche Telekom. Check out our IR website www.telekom.com/investor-relations for: This backup in .pdf and excel-format The IR calender Detailed information for debt investors Shareholder structure Corporate governance For further information on the business units please refer to: www.telekom.com www.t-home.de www.t-mobile.net www.t-systems.com Investor Relations, Bonn office Investor Relations, New York office Phone +49 228 181 - 8 88 80 Phone +1 212 424 2959 Fax +49 228 181 - 8 88 99 Phone +1 877 DT SHARE (toll-free) E-Mail [email protected] Fax +1 212 424 2977 E-Mail [email protected] ===!"§ Page 1 Notes. ===!"§ Page 2 Content. At a glance 4 Austria 51 Excellent market position 6 Czech Republic 52 Netherlands 53 Group Hungary 54 Adjusted income statement 8 Croatia 55 EBITDA reconciliation 9 Slovakia 56 Unadjusted income statement 10 Macedonia 57 Special factors in the income statement 11 Details on special factors 12 Broadband/Fixed Network Change in the composition of the group 14 Key figures adjusted for special factors 61 Balance sheet 15 EBITDA reconciliation 62 Maturity profile 17 Key figures (unadjusted) 63 Liquidity reserves 18 Special factors 64 Debt to net debt reconciliation 19 Additional information 65 Cash capex 20 Free cash flow 21 Business Customers Personnel 22 Key figures adjusted for special factors 81 Exchange rates 23 EBITDA reconciliation 82 Sustainability Achievements Key figures (unadjusted) 83 Supply chain management 24 Special factors 84 External ratings 25 Computing & Desktop Services 85 CO2 emission 26 Systems Integration 86 Telecommunications 87 Mobile Communications Key figures adjusted for special factors 29 GHS EBITDA reconciliation 30 Key figures adjusted for special factors 92 Key figures (unadjusted) 31 EBITDA reconciliation 93 Special factors 32 Key figures (unadjusted) 94 Customer data 33 Special factors 95 Germany 35 Vivento 96 USA 43 UK 46 Glossary 97 Poland 50 ===!"§ Page 3 At a Glance I. -

2017 ICT Principle Implementation Report

Principles for the Safer Use of Connected Devices and Online Services by Children and Young People in the EU Implementation Questionnaire July 2017 1 Principles for the Safer Use of Connected Devices and Online Services by Children and Young People in the EU Introduction Notes/instructions on completing this template • Please complete all sections and all questions as far as possible • Where a question or section is not applicable, please mark as N/A • Where is overlap – or no change – to information previously submitted in company statement of commitments, please simply enter “refer to self-statement” • URLs or screenshots (with links) are particularly useful in illustrating individual points • Please add any additional information/data relevant to the submission at the end of the appropriate Principle • In case you have different solutions in EU markets, please provide examples in the relevant sections 1. Name of the company on whose behalf this submission is made: Deutsche Telekom AG Friedrich-Ebert-Allee 140 53113 Bonn Germany 2. Country or primary markets where products/services are offered (in EU) to which this submission applies. Please indicate all EU-markets in which your company operates In January 2013, Deutsche Telekom has committed to a set of 25 measures to further increase child online safety.1 These apply to every subsidiary company of Deutsche Telekom Group: § T-Mobile Austria GmbH, Austria § Hrvatski Telekom d.d., Croatia § T-Mobile Czech Republic, a.s., Czech Republic § Telekom Deutschland GmbH, Germany § COSMOTE, Greece § Magyar Telekom Nyrt., Hungary § T-Mobile Netherlands B.V., Netherlands § T-Mobile Polska S.A., Poland § Telekom Romania, Romania § Slovak Telekom, a.s., Slovakia In the past four years, great progress has been made in each subsidiary company.