Platform Policy and Its Effect on Diffusion: the Case Study of Android and Ios

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Netsuite for Mobile

NetSuite for Mobile September 9, 2020 2020.2 Copyright © 2005, 2020, Oracle and/or its affiliates. All rights reserved. This software and related documentation are provided under a license agreement containing restrictions on use and disclosure and are protected by intellectual property laws. Except as expressly permitted in your license agreement or allowed by law, you may not use, copy, reproduce, translate, broadcast, modify, license, transmit, distribute, exhibit, perform, publish, or display any part, in any form, or by any means. Reverse engineering, disassembly, or decompilation of this software, unless required by law for interoperability, is prohibited. The information contained herein is subject to change without notice and is not warranted to be error- free. If you find any errors, please report them to us in writing. If this is software or related documentation that is delivered to the U.S. Government or anyone licensing it on behalf of the U.S. Government, then the following notice is applicable: U.S. GOVERNMENT END USERS: Oracle programs, including any operating system, integrated software, any programs installed on the hardware, and/or documentation, delivered to U.S. Government end users are "commercial computer software" pursuant to the applicable Federal Acquisition Regulation and agency-specific supplemental regulations. As such, use, duplication, disclosure, modification, and adaptation of the programs, including any operating system, integrated software, any programs installed on the hardware, and/or documentation, shall be subject to license terms and license restrictions applicable to the programs. No other rights are granted to the U.S. Government. This software or hardware is developed for general use in a variety of information management applications. -

Zebra Scanner SDK for Ios Developer Guide (En)

ZEBRA SCANNER SDK for iOS DEVELOPER GUIDE ZEBRA SCANNER SDK for iOS DEVELOPER GUIDE MN001834A04 Revision A July 2019 ii Zebra Scanner SDK for iOS Developer Guide No part of this publication may be reproduced or used in any form, or by any electrical or mechanical means, without permission in writing from Zebra. This includes electronic or mechanical means, such as photocopying, recording, or information storage and retrieval systems. The material in this manual is subject to change without notice. The software is provided strictly on an “as is” basis. All software, including firmware, furnished to the user is on a licensed basis. Zebra grants to the user a non-transferable and non-exclusive license to use each software or firmware program delivered hereunder (licensed program). Except as noted below, such license may not be assigned, sublicensed, or otherwise transferred by the user without prior written consent of Zebra. No right to copy a licensed program in whole or in part is granted, except as permitted under copyright law. The user shall not modify, merge, or incorporate any form or portion of a licensed program with other program material, create a derivative work from a licensed program, or use a licensed program in a network without written permission from Zebra. The user agrees to maintain Zebra’s copyright notice on the licensed programs delivered hereunder, and to include the same on any authorized copies it makes, in whole or in part. The user agrees not to decompile, disassemble, decode, or reverse engineer any licensed program delivered to the user or any portion thereof. -

A Survey on Architectures of Mobile Operating Systems: Challenges and Issues

International Journal of Research Studies in Computer Science and Engineering (IJRSCSE) Volume 2, Issue 3, March 2015, PP 73-76 ISSN 2349-4840 (Print) & ISSN 2349-4859 (Online) www.arcjournals.org A Survey on Architectures of Mobile Operating Systems: Challenges and Issues Prof. Y. K. Sundara Krishna1 HOD, Dept. of Computer Science, Krishna University Mr. G K Mohan Devarakonda2 Research Scholar, Krishna University Abstract: In the early years of mobile evolution, Discontinued Platforms Current mobile devices are enabled only with voice services Platforms that allow the users to communicate with each other. Symbian OS Android But now a days, the mobile technology undergone Palm OS IOS various changes to a great extent so that the devices Maemo OS Windows Phone allows the users not only to communicate but also to Meego OS Firefox OS attain a variety of services such as video calls, faster Black Berry OS browsing services,2d and 3d games, Camera, 2.1 Symbian OS: This Operating system was Banking Services, GPS services, File sharing developed by NOKIA. services, Tracking Services, M-Commerce and so many. The changes in mobile technology may be due Architecture: to Operating System or Hardware or Network or Memory. This paper presents a survey on evolutions SYMBIAN OS GUI Library in mobile developments especially on mobile operating system Architectures, challenges and Issues in various mobile operating Systems. Application Engines JAVA VM 1. INTRODUCTION Servers (Operating System Services) A Mobile operating system is a System Software that is specifically designed to run on handheld devices Symbian OS Base (File Server, Kernel) such as Mobile Phones, PDA’s. -

How Ios 7 Stacks Up:Smartphone OS User Experience Shootout

How iOS 7 Stacks Up: Smartphone OS User Experience Shootout a Pfeiffer Report Benchmark Project www.pfeifferreport.com @pfeifferreport Introduction Why is it that the arrival of iOS 7 Whether we like it or not, We do not look at features, we do not smartphones have become a compare cutting-edge options and is necessarily a momentous software game. Take any recent gadgets, we only look at aspects event for the smartphone top-of-the-line smartphone, and you that have a direct impact on the are likely to get a well-designed, fast, day-to-day user experience of an market? Simple: Unlike any other pleasant to use bit of hardware: fluid average, non-technical user. operating system out there, it will operation, responsive interaction, fast The aspects we have surveyed and be in the hands of millions or tens graphics. The difference of user rated are the following: experience, therefore, stems of millions of users within a few cognitive load, efficiency, almost exclusively from the customization, as well as user days after its launch. operating system, the user interface experience friction. Based on And that will make it a force to be design, the application integration, the the results from these benchmarks overall coherence. we have then established an overall reckoned with. This report compares the five Mobile Operating System User major mobile operating systems Experience Index presented at the * The question is, of course: in use today: iOS 7, iOS 6, Android , end of this document. Windows Phone 8, and Blackberry 10, The benchmarks are based on the How good is it really? and rates them in terms of user Pfeiffer Consulting Methodology experience. -

Android (Operating System) 1 Android (Operating System)

Android (operating system) 1 Android (operating system) Android Home screen displayed by Samsung Nexus S with Google running Android 2.3 "Gingerbread" Company / developer Google Inc., Open Handset Alliance [1] Programmed in C (core), C++ (some third-party libraries), Java (UI) Working state Current [2] Source model Free and open source software (3.0 is currently in closed development) Initial release 21 October 2008 Latest stable release Tablets: [3] 3.0.1 (Honeycomb) Phones: [3] 2.3.3 (Gingerbread) / 24 February 2011 [4] Supported platforms ARM, MIPS, Power, x86 Kernel type Monolithic, modified Linux kernel Default user interface Graphical [5] License Apache 2.0, Linux kernel patches are under GPL v2 Official website [www.android.com www.android.com] Android is a software stack for mobile devices that includes an operating system, middleware and key applications.[6] [7] Google Inc. purchased the initial developer of the software, Android Inc., in 2005.[8] Android's mobile operating system is based on a modified version of the Linux kernel. Google and other members of the Open Handset Alliance collaborated on Android's development and release.[9] [10] The Android Open Source Project (AOSP) is tasked with the maintenance and further development of Android.[11] The Android operating system is the world's best-selling Smartphone platform.[12] [13] Android has a large community of developers writing applications ("apps") that extend the functionality of the devices. There are currently over 150,000 apps available for Android.[14] [15] Android Market is the online app store run by Google, though apps can also be downloaded from third-party sites. -

Android Operating System

Software Engineering ISSN: 2229-4007 & ISSN: 2229-4015, Volume 3, Issue 1, 2012, pp.-10-13. Available online at http://www.bioinfo.in/contents.php?id=76 ANDROID OPERATING SYSTEM NIMODIA C. AND DESHMUKH H.R. Babasaheb Naik College of Engineering, Pusad, MS, India. *Corresponding Author: Email- [email protected], [email protected] Received: February 21, 2012; Accepted: March 15, 2012 Abstract- Android is a software stack for mobile devices that includes an operating system, middleware and key applications. Android, an open source mobile device platform based on the Linux operating system. It has application Framework,enhanced graphics, integrated web browser, relational database, media support, LibWebCore web browser, wide variety of connectivity and much more applications. Android relies on Linux version 2.6 for core system services such as security, memory management, process management, network stack, and driver model. Architecture of Android consist of Applications. Linux kernel, libraries, application framework, Android Runtime. All applications are written using the Java programming language. Android mobile phone platform is going to be more secure than Apple’s iPhone or any other device in the long run. Keywords- 3G, Dalvik Virtual Machine, EGPRS, LiMo, Open Handset Alliance, SQLite, WCDMA/HSUPA Citation: Nimodia C. and Deshmukh H.R. (2012) Android Operating System. Software Engineering, ISSN: 2229-4007 & ISSN: 2229-4015, Volume 3, Issue 1, pp.-10-13. Copyright: Copyright©2012 Nimodia C. and Deshmukh H.R. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. -

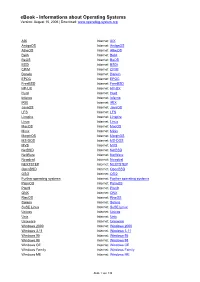

Ebook - Informations About Operating Systems Version: August 15, 2006 | Download

eBook - Informations about Operating Systems Version: August 15, 2006 | Download: www.operating-system.org AIX Internet: AIX AmigaOS Internet: AmigaOS AtheOS Internet: AtheOS BeIA Internet: BeIA BeOS Internet: BeOS BSDi Internet: BSDi CP/M Internet: CP/M Darwin Internet: Darwin EPOC Internet: EPOC FreeBSD Internet: FreeBSD HP-UX Internet: HP-UX Hurd Internet: Hurd Inferno Internet: Inferno IRIX Internet: IRIX JavaOS Internet: JavaOS LFS Internet: LFS Linspire Internet: Linspire Linux Internet: Linux MacOS Internet: MacOS Minix Internet: Minix MorphOS Internet: MorphOS MS-DOS Internet: MS-DOS MVS Internet: MVS NetBSD Internet: NetBSD NetWare Internet: NetWare Newdeal Internet: Newdeal NEXTSTEP Internet: NEXTSTEP OpenBSD Internet: OpenBSD OS/2 Internet: OS/2 Further operating systems Internet: Further operating systems PalmOS Internet: PalmOS Plan9 Internet: Plan9 QNX Internet: QNX RiscOS Internet: RiscOS Solaris Internet: Solaris SuSE Linux Internet: SuSE Linux Unicos Internet: Unicos Unix Internet: Unix Unixware Internet: Unixware Windows 2000 Internet: Windows 2000 Windows 3.11 Internet: Windows 3.11 Windows 95 Internet: Windows 95 Windows 98 Internet: Windows 98 Windows CE Internet: Windows CE Windows Family Internet: Windows Family Windows ME Internet: Windows ME Seite 1 von 138 eBook - Informations about Operating Systems Version: August 15, 2006 | Download: www.operating-system.org Windows NT 3.1 Internet: Windows NT 3.1 Windows NT 4.0 Internet: Windows NT 4.0 Windows Server 2003 Internet: Windows Server 2003 Windows Vista Internet: Windows Vista Windows XP Internet: Windows XP Apple - Company Internet: Apple - Company AT&T - Company Internet: AT&T - Company Be Inc. - Company Internet: Be Inc. - Company BSD Family Internet: BSD Family Cray Inc. -

Download Rom Motorola Defy Mini Xt320

Download rom motorola defy mini xt320 CLICK TO DOWNLOAD 09/04/ · ROM Motorola DEFY MINI XT – ROM Android ROM Official: TNBST_4_RPD_flex_LATAM_RTL_Brazil – renuzap.podarokideal.ru ROM For Brazil (for other countries ask me) Backup and Restore Defy Mini IMEI and NV Data. Preparations: •Install Motorola USB driver (Use forum serach button) •Install RSD Lite (Use forum serach /5(10). 09/06/ · Motorola Defy Mini XT Firmware Download In this post, you will find the direct link to download Motorola Defy Mini XT Stock ROM (firmware, flash file). The Firmware package contains Firmware, Driver, Flash Tool, and How-to Flash Manual. Motorola Defy Mini XT Stock ROM How To Flash Motorola Defy Mini XT First, you need to download and extract the Motorola Defy Mini XT stock firmware package on Computer. After extracting the zip package, you will get the Firmware File, Flash Tools, Drivers, and How-to Flash Guide. 30/04/ · Motorola Defy Mini XT Stock Firmware ROM (Flash File) Find Motorola Defy Mini XT Flash File, Flash Tool, USB Driver and How-to Flash Manual. The official link to download Motorola Defy Mini XT Stock Firmware ROM (flash file) on your Computer. Firmware comes in a zip package, which contains are below. 14/07/ · How to update your MOTOROLA Defy Mini(XT) With this guide you will be able to find, download and install all necessary updating files for your MOTOROLA Defy Mini(XT). Hope you can get satisfied with the new device update, enjoy the last Android version and don’t forget to look for new updates frequently. Firstly, you have what you came for: the updates. -

Complete Control Mobile App for Ios User's Guide

Complete Control Mobile App for use with a Complete Control system from URC iPhone/iPod touch iPad Complete Control Mobile App Overview As with iOS apps for the iPad, iPhone and iPod touch, finding your way around the Complete Control Mobile App is simple. Although, with the power of a Complete Control system, each and every page shown on the application could be slightly different ( depending upon the system programmer ), there are some consistencies. The button layout for the iOS devices consists of Volume, Channel, Colored, Numeric Keypad, Navigation/Information, Transport and Custom Keys. No matter which view your iOS device is in, portrait or landscape, the button layout is available for full control of your entertainment system. Features and Benefits ● House-Wide Control Control any IR, RS-232 or Relay controlled device anywhere in your home! By simply adding additional MRX-1s, expand control anywhere on your local network. ● iOS Gesture Navigation Use the familiar iOS gestures, like swipe, tap and rotate, to access and control your devices. Browse through the devices and their pages by swiping. Rotate the iPad, iPhone or iPod touch to display the remote in portrait or landscape view. ● Home Lighting Control With the addition of the optional RFTX-1 and URC Lighting by Lutron, easily control the environment within the home. Access lighting scenes, room scenes and specific control of each individual lighting load. 1 Complete Control Mobile App Button Overview The following common buttons are found in the Complete Control Mobile app, regardless of how the system was programmed: Volume/Channel Keys In this section you find VOLUME (Vol +, Vol -, Mute ) commands as well as CHANNEL (CH+, CH-, Jump ) commands for applicable devices. -

A Survey on Potential Privacy Leaks of GPS Information in Android Applications

UNLV Theses, Dissertations, Professional Papers, and Capstones May 2015 A Survey on Potential Privacy Leaks of GPS Information in Android Applications Srinivas Kalyan Yellanki University of Nevada, Las Vegas Follow this and additional works at: https://digitalscholarship.unlv.edu/thesesdissertations Part of the Library and Information Science Commons Repository Citation Yellanki, Srinivas Kalyan, "A Survey on Potential Privacy Leaks of GPS Information in Android Applications" (2015). UNLV Theses, Dissertations, Professional Papers, and Capstones. 2449. http://dx.doi.org/10.34917/7646102 This Thesis is protected by copyright and/or related rights. It has been brought to you by Digital Scholarship@UNLV with permission from the rights-holder(s). You are free to use this Thesis in any way that is permitted by the copyright and related rights legislation that applies to your use. For other uses you need to obtain permission from the rights-holder(s) directly, unless additional rights are indicated by a Creative Commons license in the record and/ or on the work itself. This Thesis has been accepted for inclusion in UNLV Theses, Dissertations, Professional Papers, and Capstones by an authorized administrator of Digital Scholarship@UNLV. For more information, please contact [email protected]. A SURVEY ON POTENTIAL PRIVACY LEAKS OF GPS INFORMATION IN ANDROID APPLICATIONS By Srinivas Kalyan Yellanki Bachelor of Technology, Information Technology Jawaharlal Nehru Technological University, India 2013 A thesis submitted in partial fulfillment -

Iphone Ios 5 Development Essentials

iPhone iOS 5 Development Essentials i iPhone iOS 5 Development Essentials – First Edition ISBN-13: 978-1466337275 © 2011 Neil Smyth. All Rights Reserved. This book is provided for personal use only. Unauthorized use, reproduction and/or distribution strictly prohibited. All rights reserved. The content of this book is provided for informational purposes only. Neither the publisher nor the author offers any warranties or representation, express or implied, with regard to the accuracy of information contained in this book, nor do they accept any liability for any loss or damage arising from any errors or omissions. This book contains trademarked terms that are used solely for editorial purposes and to the benefit of the respective trademark owner. The terms used within this book are not intended as infringement of any trademarks. Rev 2.3p ii Table of Contents Preface ............................................................................................................................................................... xix 1. About iPhone iOS 5 App Development Essentials .............................................................................................. 1 1.1 Example Source Code ................................................................................................................................... 2 1.2 Feedback ...................................................................................................................................................... 2 2. The Anatomy of an iPhone 4S ........................................................................................................................... -

Enterprise Best Practices for Ios Devices On

White Paper Enterprise Best Practices for iOS devices and Mac computers on Cisco Wireless LAN Updated: January 2018 © 2018 Cisco and/or its affiliates. All rights reserved. This document is Cisco Public. Page 1 of 51 Contents SCOPE .............................................................................................................................................. 4 BACKGROUND .................................................................................................................................. 4 WIRELESS LAN CONSIDERATIONS .................................................................................................... 5 RF Design Guidelines for iOS devices and Mac computers on Cisco WLAN ........................................................ 5 RF Design Recommendations for iOS devices and Mac computers on Cisco WLAN ........................................... 6 Wi-Fi Channel Coverage .................................................................................................................................. 7 ClientLink Beamforming ................................................................................................................................ 10 Wi-Fi Channel Bandwidth ............................................................................................................................. 10 Data Rates .................................................................................................................................................... 12 802.1X/EAP Authentication ..........................................................................................................................