Terminal Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

What Happens to Microfinance Clients Who Default?

What Happens to Microfinance Clients who Default? An Exploratory Study of Microfinance Practices January 2015 LEAD AUTHOR Jami Solli Keeping clients first in microfinance CONTRIBUTORS Laura Galindo, Alex Rizzi, Elisabeth Rhyne, and Nadia van de Walle Preface 4 Introduction 6 What are the responsibilities of providers? 6 1. Research Methods 8 2. Questions Examined and Structure of Country Case Studies 10 Country Selection and Comparisons 11 Peru 12 India 18 Uganda 25 3. Cross-Country Findings & Recommendations 31 The Influence of Market Infrastructure on Provider Behavior 31 Findings: Issues for Discussion 32 Problems with Loan Contracts 32 Flexibility towards Distressed Clients 32 Inappropriate Seizure of Collateral 33 Use of Third Parties in Collections 34 Lack of Rehabilitation 35 4. Recommendations for Collective Action 36 ANNEX 1. Summary of Responses from Online Survey on Default Management 38 ANNEX 2. Questions Used in Interviews with MFIs 39 ANNEX 3. Default Mediation Examples to Draw From 42 2 THE SMART CAMPAIGN Acknowledgments Acronyms We sincerely thank the 44 microfinance institutions across Peru, AMFIU Association of Microfinance India, and Uganda that spoke with us but which we cannot name Institutions of Uganda specifically. Below are the non-MFIs who participated in the study ASPEC Asociacion Peruana de as well as those country experts who shared their knowledge Consumidores y Usuarios and expertise in the review of early drafts of the paper. BOU Bank of Uganda Accion India Team High Mark India MFIN Microfinance Institutions -

Final-Actis Inreview Lores Single.Pdf

Actis in review 2013 The positive power of capital Contents 03 Where we are now 08 Portfolio at work Banque Commerciale du Rwanda 10 Portfolio at work Garden City 13 Actis at a glance 14 Portfolio at work Bellagio 17 Portfolio at work Globeleq Mesoamerica Energy 20 Portfolio at work Asiri Group 23 Portfolio at work AGS 26 Regions and sectors 28 Investments 29 Investors 30 Portfolio companies 34 The team São Paulo, Brazil Welcome This report summarises the events and achievements of Actis in the last twelve months. Whether we are sharing the story of the Rwandan bank in which we invested nearly a decade ago, or the ATM chain rolling out across India, the tale we tell is of strong businesses, in attractive sectors, in some of the most populous and dynamic parts of the world. Our goal is to give you a sense of the breadth of our work, and the depth of our expertise. Providing insight into the energy and promise of those high growth markets which have already begun to define this century. I hope you enjoy reading this year’s annual review. Paul Fletcher Senior Partner Accra, Ghana Where we are now If the financial meltdown corporate governance, health and safety, labour law, and environmental and social practices. of August 2008 taught They must also be highly profitable. us anything it is that Our investment professionals have this in mind everything connects. The from the first dollar and day of the investment. Everything they do is focused on creating value. fortunes of a Manhattan Their work is supplemented by a dedicated team of in-house consultants who do nothing but headquartered bank, a implement best practices, and share what they know works from their past experiences in the string of late night phone same sectors. -

Review of Research Impact Factor : 5.7631(Uif) Ugc Approved Journal No

Review Of ReseaRch impact factOR : 5.7631(Uif) UGc appROved JOURnal nO. 48514 issn: 2249-894X vOlUme - 8 | issUe - 5 | feBRUaRY - 2019 __________________________________________________________________________________________________________________________ A STUDY ON “PAYMENT BANKING IN DIGITAL AND FINANCIAL INCLUSION THROUGH LEADING –SOCIAL ADVANCEMENT INITIATIVES” Prof. K. M. Mahesh1 and Dr. K .Manjunath2 1Research Scholar at Dravidian University, Kuppam,AP & Principal, Sri Bhagawan Mahaveer Jain Evening College, V.V.PURAM,Bangalore. 2Research Supervisor , Associate Professor Department of Commerce and Management Seshadripuram college Bangalore. ABSTRACT : The Payment Banks (PBS), which offerselectronic remittances, financial advisory, online banking and more,offerimmediate value to unbanked consumers.They are designed to improve social Culture,through Digital and Financial Inclusion. Payment Bank(PBS) will lead the Social advancement in terms of living standardwhen society uses the skill fullest,that society will prosper,it makes society upward movement.The Demonetizationand Digitation are given scope for innovating techniques of banking payment system. The concept of payments banks was first proposed by a Reserve Bank of India (RBI) committee onComprehensive Financial Services for Small Businesses and Low- Income Households. led by board member Nachiket Mor. Payment Banks (PBS) will help in promoting financial inclusion, or the process of spreading banking services is critical in India, where more than half of the adult population still do not have access to banking services. Through the Payment Banks (PBS)promoting 5 A’s of FinancialInclusion in cashless payment: Availability,Accessibility,Acceptability, Affordability, and Awareness. The Jan Dhan Aadhaar Mobile (JAM),Swiping ePoS and MicroATMswill help people to get digital transaction Awareness. KEYWORDS : Payment Banks, Financial inclusion, Reserve Bank of India (RBI), Social advancement and Digitation. -

Absa Bank 22

Uganda Bankers’ Association Annual Report 2020 Promoting Partnerships Transforming Banking Uganda Bankers’ Association Annual Report 3 Content About Uganda 6 Bankers' Association UBA Structure and 9 Governance UBA Member 10 Bank CEOs 15 UBA Executive Committee 2020 16 UBA Secretariat Management Team UBA Committee 17 Representatives 2020 Content Message from the 20 UBA Chairman Message from the 40 Executive Director UBA Activities 42 2020 CSR & UBA Member 62 Bank Activities Financial Statements for the Year Ended 31 70 December 2020 5 About Uganda Bankers' Association Commercial 25 banks Development 02 Banks Tier 2 & 3 Financial 09 Institutions ganda Bankers’ Association (UBA) is a membership based organization for financial institutions licensed and supervised by Bank of Uganda. Established in 1981, UBA is currently made up of 25 commercial banks, 2 development Banks (Uganda Development Bank and East African Development Bank) and 9 Tier 2 & Tier 3 Financial Institutions (FINCA, Pride Microfinance Limited, Post Bank, Top Finance , Yako Microfinance, UGAFODE, UEFC, Brac Uganda Bank and Mercantile Credit Bank). 6 • Promote and represent the interests of the The UBA’s member banks, • Develop and maintain a code of ethics and best banking practices among its mandate membership. • Encourage & undertake high quality policy is to; development initiatives and research on the banking sector, including trends, key issues & drivers impacting on or influencing the industry and national development processes therein through partnerships in banking & finance, in collaboration with other agencies (local, regional, international including academia) and research networks to generate new and original policy insights. • Develop and deliver advocacy strategies to influence relevant stakeholders and achieve policy changes at industry and national level. -

List of Certain Foreign Institutions Classified As Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms

NOT FOR PUBLICATION DEPARTMENT OF THE TREASURY JANUARY 2001 Revised Aug. 2002, May 2004, May 2005, May/July 2006, June 2007 List of Certain Foreign Institutions classified as Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms The attached list of foreign institutions, which conform to the definition of foreign official institutions on the Treasury International Capital (TIC) Forms, supersedes all previous lists. The definition of foreign official institutions is: "FOREIGN OFFICIAL INSTITUTIONS (FOI) include the following: 1. Treasuries, including ministries of finance, or corresponding departments of national governments; central banks, including all departments thereof; stabilization funds, including official exchange control offices or other government exchange authorities; and diplomatic and consular establishments and other departments and agencies of national governments. 2. International and regional organizations. 3. Banks, corporations, or other agencies (including development banks and other institutions that are majority-owned by central governments) that are fiscal agents of national governments and perform activities similar to those of a treasury, central bank, stabilization fund, or exchange control authority." Although the attached list includes the major foreign official institutions which have come to the attention of the Federal Reserve Banks and the Department of the Treasury, it does not purport to be exhaustive. Whenever a question arises whether or not an institution should, in accordance with the instructions on the TIC forms, be classified as official, the Federal Reserve Bank with which you file reports should be consulted. It should be noted that the list does not in every case include all alternative names applying to the same institution. -

Bank Supervision Annual Report 2019 1 Table of Contents

CENTRAL BANK OF KENYA BANK SUPERVISION ANNUAL REPORT 2019 1 TABLE OF CONTENTS VISION STATEMENT VII THE BANK’S MISSION VII MISSION OF BANK SUPERVISION DEPARTMENT VII THE BANK’S CORE VALUES VII GOVERNOR’S MESSAGE IX FOREWORD BY DIRECTOR, BANK SUPERVISION X EXECUTIVE SUMMARY XII CHAPTER ONE STRUCTURE OF THE BANKING SECTOR 1.1 The Banking Sector 2 1.2 Ownership and Asset Base of Commercial Banks 4 1.3 Distribution of Commercial Banks Branches 5 1.4 Commercial Banks Market Share Analysis 5 1.5 Automated Teller Machines (ATMs) 7 1.6 Asset Base of Microfinance Banks 7 1.7 Microfinance Banks Market Share Analysis 9 1.8 Distribution of Foreign Exchange Bureaus 11 CHAPTER TWO DEVELOPMENTS IN THE BANKING SECTOR 2.1 Introduction 13 2.2 Banking Sector Charter 13 2.3 Demonetization 13 2.4 Legal and Regulatory Framework 13 2.5 Consolidations, Mergers and Acquisitions, New Entrants 13 2.6 Medium, Small and Micro-Enterprises (MSME) Support 14 2.7 Developments in Information and Communication Technology 14 2.8 Mobile Phone Financial Services 22 2.9 New Products 23 2.10 Operations of Representative Offices of Authorized Foreign Financial Institutions 23 2.11 Surveys 2019 24 2.12 Innovative MSME Products by Banks 27 2.13 Employment Trend in the Banking Sector 27 2.14 Future Outlook 28 CENTRAL BANK OF KENYA 2 BANK SUPERVISION ANNUAL REPORT 2019 TABLE OF CONTENTS CHAPTER THREE MACROECONOMIC CONDITIONS AND BANKING SECTOR PERFORMANCE 3.1 Global Economic Conditions 30 3.2 Regional Economy 31 3.3 Domestic Economy 31 3.4 Inflation 33 3.5 Exchange Rates 33 3.6 Interest -

Bank of India (Uganda) Ltd Application for Opening an Account

Bank of India (Uganda) Ltd Application for opening an account Date: / / Customer ID No. Account No. (UGX): Account No. (USD): I / We hereby request Bank of India (Uganda) Limited to open following accounts with the following details. Type of A/c’s (Tick whichever is appropriate); Saving A/c Current A/c Fixed Deposit A/c Recurring Deposit A/c Currency Type (Tick whichever is appropriate); Ugandan Shillings USD GBP EUR Other (specify) For this purpose I / We supply the following information: Name of the Account: Mr /Mrs /Ms /Dr /M/s; ____________________________________ _______________________________________________________________________________________ CONSTITUTION INDIVIDUAL SINGLE JOINT COMPANY PUBLIC (LISTED/UNLISTED) PRIVATE (LISTED/UNLISTED) FIRM SOLE PROPRIETORSHIP PARTNERSHIP TRUST/SOCIETY PERSONAL DETAILS No First Name Middle Name Last Name 1 2 3 4 1 Date of Birth: 2 Date of Birth: 3 Date of Birth: 4 Date of Birth: ------/-------/----------- -------/-------/---------- ------/------/---------- -----/------/------------- Marital Status: Single Married Other (Specify) ________________ 1 Nationality: 2 Nationality: 3 Nationality: 4 Nationality: ----------------------- ------------------------ ---------------------- ------------------------ WORK DETAILS/OCCUPATION OCCUPATION/NATURE OF BUSINESS: EMPLOYER’S NAME: EMPLOYER’S ADDRESS: CONTACT DETAILS/ADDRESS NO CORRESPONDENCE ADDRESS PERMANT ADDRESS OFFICE ADDRESS 1 2 3 4 TELEPHONE NUMBERS/EMAIL ADDRESS NO MOBILE RESIDENTIAL OFFICE/FAX EMAIL 1 2 3 4 IDENTIFICATION PARTICULARS NO PASSPORT NO. DRIVING PERMIT NO. VOTER’S CARD NO. NSSF NO. 1 2 3 4 ISSUED BY: ISSUE DATE:____/____/______ EXPIRY DATE:____/____/_______ TIN NUMBER/ REGISTRATION NO: Do you have any other Bank Account(s) with Bank of India (U) Limited? Yes No NO ACCOUNT NUMBER BRANCH DETAILS OF CREDIT FACILITIES(IF ANY) 1 2 3 4 ACCOUNT FACILITIES REQUIRED 1) Cheque Book; Yes No {No. -

Licensed Commercial Banks As at July 01, 2020

LICENSED COMMERCIAL BANKS AS AT JULY 01, 2020 S/N NAME ADDRESS OF PHONE FAX SWIFT CODE E-MAIL AND WEBSITE HEADQUARTERS 1. ABC Capital Bank Plot 4 Pilkington Road, +256-414-345- +256-414-258- ABCFUGKA [email protected] Uganda Limited Colline House – Kampala 200 310 P.O. BOX 21091 Kampala [email protected] +256-200-516- 600 https://www.abccapitalbank.co.ug/ 2. Absa Bank Uganda Plot 16 Kampala Road, +256-312-218- +256-312-218- BARCUGKX [email protected] Limited P.O. Box 2971, Kampala, 348 393 Uganda +256-312-218- https://www.absa.co.ug/ 300/317 +256-417-122- 408 3. Afriland First Bank - - - - https://www.afrilandfirstgroup.com/ Uganda Limited 4. Bank of Africa Plot 45, Jinja Road. +256-414-302- +256-414-230- AFRIUGKA [email protected] Uganda Limited P.O. Box 2750, Kampala. 001 902 [email protected] +256-414-302- 111 https://boauganda.com/ 5. Bank of Baroda 18, Kampala Road, +256-414-233- +256-414-230- BARBUGKA Uganda Limited Kampala, Uganda. 680 781 [email protected] P.O. Box 7197, Kampala +256-414-345- https://www.bankofbaroda.ug/ 196 6. Bank of India Picfare House, Plot +256 200 422 +256 414 341 BKIDUGKA Uganda Limited No.37,(Next to NWSC 223 880 [email protected] Head Offices) Jinja Road, Kampala + 256 200 422 https://www.boiuganda.co.ug P.O. Box 7332, Kampala, 224 Uganda + 256 313 400 S/N NAME ADDRESS OF PHONE FAX SWIFT CODE E-MAIL AND WEBSITE HEADQUARTERS 437 7. Cairo International Greenland Towers, Plot +256 (0) 414 +256 (0) 414 CAIEUGKA Bank Limited 30 Kampala Road, 230 132/6/7 230 130 [email protected] Kampala P.O.Box 7052 Kampala, +256 (0) 417 Uganda 230 105 https://www.cib.co.ug/ +256 (0) 414 230 141 8. -

UGANDA © Shutterstock.Com COTTON, TEXTILE and APPAREL SECTOR INVESTMENT PROFILE UGANDA

COTTON, TEXTILE AND APPAREL SECTOR INVESTMENT PROFILE UGANDA © shutterstock.com COTTON, TEXTILE AND APPAREL SECTOR INVESTMENT PROFILE UGANDA 2016 ACKNOWLEDGEMENTS This profile has been produced under the framework of Supporting Indian radeT and Investment for Africa (SITA) project, funded by the Department for International Development, Government of the United Kingdom and implemented by the International Trade Centre. SITA is a South-South Trade and Investment project aimed at improving competitiveness of select value chains; and increasing investment in five Eastern African countries through partnerships with institutions and businesses from India. Special contributions to writing this report have been provided by: Cotton Development Organization Uganda Textile Manufacturers Association Uganda Revenue Authority African Cotton and Textile Industries Federation Quality Assurance: International Trade Centre (ITC), Trade Facilitation and Policy for Business Section (TFPB) TCA Ranganathan, External consultant, Rajesh Aggarwal, Chief (TFPB), Andrew Huelin, Associate Programme Advisor (TFPB) Author: Joseph Nyagari Design: Iva Stastny Brosig, Design plus Editor: Vanessa Finaughty The views expressed in this report are those of the authors and do not represent the official position of the International Trade Centre, Uganda Investment Authority and the Government of the United Kingdom. The images used in this profile may not always reflect accurately the country context. © International Trade Centre 2016 UGANDA CTA SECTOR INVESTMENT PROFILE: CTA -

1997 EXIM Bank Annual Report

E XPORT -IMPORT B ANK OF THE U NITED S T A TES Supporting Exports... Sustaining Jobs... S trengthening Communities... 1997 ANNUAL R EPORT CHAIRMAN’S LETTER AS THE 18TH PRESIDENT and Chairman of the Export-Import Bank of the United States (Ex-Im Bank), I am pleased to pre- sent the 1997 Annual Report to our “stockhold ers” — the taxpayers of the United States. The Ex-Im Bank is in a sound financial condition, with ample reserves and an excellent record of financial results. Furthermore, Congress has granted Ex-Im Bank a four-year reauthorization through the end of Fiscal Year 2001 to continue our work in support of U.S. exports and jobs. Our dedicated and talented staff has achieved James A. Harmon President & Chairman notable success in the past year, especially in implementing new ways to bring the Bank’s pro- grams closer to our customers — U.S. compa nies, small and large, that seek to export their products and services to developing markets around the globe. “Jobs through Exports” is not just a slogan: it is a mission that we carry out every day. We help businesses across the country to enter new and rapidly growing markets, where private sources of financing are very limited or nonexistent. For many people, Ex-Im Bank’s daily work of leveling the playing field for U.S. companies may seem as remote as the countries to which U.S. goods and services are being shipped. However, American workers — whether they are building commercial aircraft, telecommunications equipment, power generation facilities, or water purification systems to provide safe drinking water in developing nations — have higher quality, better paying jobs, thanks to Ex-Im Bank’s financing. -

UGANDA CLEARING HOUSE RULES and PROCEDURES March 2018

UGANDA CLEARING HOUSE RULES AND PROCEDURES March 2018 _____________________________________________________________________________________________________ UGANDA CLEARING HOUSE RULES AND PROCEDURES March 2018 BANK OF UGANDA UGANDA BANKERS’ASSOCIATION P.O.BOX 7120 P.O.BOX 8002 KAMPALA KAMPALA 1 | P a g e UGANDA CLEARING HOUSE RULES AND PROCEDURES March 2018 _____________________________________________________________________________________________________ Amendment History Version Author Date Summary of Key Changes 0.1 Clearing House 2009 Initial clearing house rules Committee 0.2 Clearing House 2011 Amendments included: Committee Inclusion of the 2nd clearing session. Inclusion of the pigeon hole’s clearing Inclusion of fine of Ugx.10,000 for each EFT unapplied after stipulated period. 0.3 Clearing House 2014 Amendments include: Committee Revision of the Direct Debit rules and regulations to make them more robust. Revision of the fine for late unapplied EFTs from Ugx.10,000 to Ugx.20,000 per week per transaction. Included the new file encryption tool GPG that replaced File Authentication System (FAS). Included a schedule for the upcountry clearing process. Discontinued the use of floppy disks as acceptable medium for transmitting back-up electronic files. The acceptable media is Flash disks and Compact Disks only. Revised the cut-off time for 2nd session files submission from 2.00p.m to 3.00p.m Updated the circumstances under which membership can be terminated. Revised committee quorum. 0.4 Clearing House 2018 Updated the rules to reflect the Committee requirements for the new automated clearing house with cheque truncation capability. Provided an inward EFT credits exceptions management process. REVIEW MECHANISM This procedure manual should be updated every two years or as and when new processes or systems are introduced or when there are major changes to the current process. -

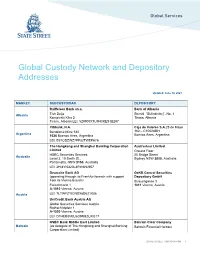

Global Custody Network and Depository Addresses

Global Custody Network and Depository Addresses Updated: June 30, 2021 MARKET SUBCUSTODIAN DEPOSITORY Raiffeisen Bank sh.a. Bank of Albania Albania Tish Daija Sheshi “Skënderbej”, No. 1 Kompleski Kika 2 Tirana, Albania Tirana, Albania LEI: 529900XTU9H3KES1B287 Citibank, N.A. Caja de Valores S.A.25 de Mayo Bartolome Mitre 530 362 – C1002ABH Argentina 1036 Buenos Aires, Argentina Buenos Aires, Argentina LEI: E57ODZWZ7FF32TWEFA76 The Hongkong and Shanghai Banking Corporation Austraclear Limited Limited Ground Floor HSBC Securities Services 20 Bridge Street Australia Level 3, 10 Smith St., Sydney NSW 2000, Australia Parramatta, NSW 2150, Australia LEI: 2HI3YI5320L3RW6NJ957 Deutsche Bank AG OeKB Central Securities (operating through its Frankfurt branch with support Depository GmbH from its Vienna branch) Strauchgasse 3 Fleischmarkt 1 1011 Vienna, Austria A-1010 Vienna, Austria Austria LEI: 7LTWFZYICNSX8D621K86 UniCredit Bank Austria AG Global Securities Services Austria Rothschildplatz 1 A-1020 Vienna, Austria LEI: D1HEB8VEU6D9M8ZUXG17 HSBC Bank Middle East Limited Bahrain Clear Company Bahrain (as delegate of The Hongkong and Shanghai Banking Bahrain Financial Harbour Corporation Limited) STATE STREET CORPORATION 1 GLOBAL CUSTODY NETWORK AND DEPOSITORY ADDRESSES MARKET SUBCUSTODIAN DEPOSITORY 1st Floor, Bldg. #2505 Harbour Gate (4th Floor) Road # 2832, Al Seef 428 Kingdom of Bahrain Manama, Kingdom of Bahrain LEI: 549300F99IL9YJDWH369 Standard Chartered Bank Bangladesh Bank Silver Tower, Level 7 Motijheel, Dhaka-1000 52 South Gulshan Commercial