Citi Worldlink Payment Services

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Full Year 2020 Results Presentation to Investors and Analysts

FULL YEAR 2020 RESULTS PRESENTATION TO INVESTORS AND ANALYSTS Disclaimer The information presented herein is based on sources which Access Bank The information should not be interpreted as advice to customers on the Plc. (the “Bank”) regards dependable. This presentation may contain purchase or sale of specific financial instruments. Access Bank Plc. bears no forward looking statements. These statements concern or may affect future responsibility in any instance for loss which may result from reliance on the matters, such as the Bank’s economic results, business plans and information. strategies, and are based upon the current expectations of the directors. Access Bank Plc. holds copyright to the information, unless expressly They are subject to a number of risks and uncertainties that might cause indicated otherwise or this is self-evident from its nature. Written permission actual results and events to differ materially from the expectations from Access Bank Plc. is required to republish the information on Access expressed in or implied by such forward looking statements. Factors that Bank or to distribute or copy such information. This shall apply regardless of could cause or contribute to differences in current expectations include, but the purpose for which it is to be republished, copied or distributed. Access are not limited to, regulatory developments, competitive conditions, Bank Plc.'s customers may, however, retain the information for their private technological developments and general economic conditions. The Bank use. assumes no responsibility to update any of the forward looking statements contained in this presentation. Transactions with financial instruments by their very nature involve high risk. -

Tuition Fall 2018 Prepared By: Stephanie Bertolo, Vice President

POLICY PAPER Tuition Fall 2018 Prepared by: Stephanie Bertolo, Vice President Education McMaster Students Union, McMaster University Danny Chang, Vice President University Students’ Council, Western University Catherine Dunne, Associate Vice President University Students’ Council, Western University Matthew Gerrits, Vice President Education Federation of Students, University of Waterloo Urszula Sitarz, Associate Vice President Provincial & Federal Affairs McMaster Students Union, McMaster University With files from: Colin Aitchison, Former Research & Policy Analyst Ontario Undergraduate Student Alliance Mackenzie Claggett, Former Research Intern Ontario Undergraduate Student Alliance Martyna Siekanowicz Research & Policy Analyst Ontario Undergraduate Student Alliance Alexander “AJ” Wray, former Chair of the Board Federation of Students, University of Waterloo 2 ABOUT OUSA OUSA represents the interests of 150,000 professional and undergraduate, full-time and part-time university students at eight student associations across Ontario. Our vision is for an accessible, affordable, accountable, and high quality post-secondary education in Ontario. To achieve this vision we’ve come together to develop solutions to challenges facing higher education, build broad consensus for our policy options, and lobby government to implement them. OUSA’s Home Office is located on the traditional Indigenous territory of the Huron- Wendat, Haudenosaunee, and most recently, the territory of the Mississaugas of the Credit River. This territory is part of the Dish with One Spoon Treaty, an agreement between the Anishinaabe, Haudenosaunee, and allied nations to peaceably share and care for the resources around the Great Lakes. This territory is also covered by Treaty 13 of the Upper Canada Treaties. This Tuition Policy Paper by the Ontario Undergraduate Student Alliance is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License. -

China's 2020 Vision for Global Fund Managers

Markets and Securities Services | China’s 2020 vision for global fund managers 1 CHINA’S 2020 VISION FOR GLOBAL FUND MANAGERS Around 25 years ago, the authorities in China began to develop their capital markets ambitions. Stock exchanges were opened in Shanghai and Shenzhen. Members of the general public were allowed to buy stocks and shares on the market, albeit their choices at the time were limited to mainly (former) State-Owned Enterprises (SOEs). Talks also began for allowing the creation of mutual funds and the setting-up of fund management companies. Few would have believed, at the time, that by In July 2019, it was announced that the date for 2019 China’s stock markets in aggregate would 100% foreign ownership of fund management become one of the top-three largest in the companies would be brought forward to world by size and the largest by trading volume. sometime in 2020, and in October 2019 it was The aggregate scale of the assets managed in confirmed this would apply from April 2020. mutual funds, wealth management products and These announcements confirmed that non- other schemes made available to citizens now Chinese firms could own 100% of a Mainland exceeds approximately USD20 trillion. Chinese fund management company, allowing unrestricted access to offer investment services There’s a fantastic success story to be told. Yet and products to the retail market. for the most part, many of the top prizes to date have been reserved for domestic businesses in During the last three years, Chinese regulators China. Foreign firms, i.e. -

What Happens to Microfinance Clients Who Default?

What Happens to Microfinance Clients who Default? An Exploratory Study of Microfinance Practices January 2015 LEAD AUTHOR Jami Solli Keeping clients first in microfinance CONTRIBUTORS Laura Galindo, Alex Rizzi, Elisabeth Rhyne, and Nadia van de Walle Preface 4 Introduction 6 What are the responsibilities of providers? 6 1. Research Methods 8 2. Questions Examined and Structure of Country Case Studies 10 Country Selection and Comparisons 11 Peru 12 India 18 Uganda 25 3. Cross-Country Findings & Recommendations 31 The Influence of Market Infrastructure on Provider Behavior 31 Findings: Issues for Discussion 32 Problems with Loan Contracts 32 Flexibility towards Distressed Clients 32 Inappropriate Seizure of Collateral 33 Use of Third Parties in Collections 34 Lack of Rehabilitation 35 4. Recommendations for Collective Action 36 ANNEX 1. Summary of Responses from Online Survey on Default Management 38 ANNEX 2. Questions Used in Interviews with MFIs 39 ANNEX 3. Default Mediation Examples to Draw From 42 2 THE SMART CAMPAIGN Acknowledgments Acronyms We sincerely thank the 44 microfinance institutions across Peru, AMFIU Association of Microfinance India, and Uganda that spoke with us but which we cannot name Institutions of Uganda specifically. Below are the non-MFIs who participated in the study ASPEC Asociacion Peruana de as well as those country experts who shared their knowledge Consumidores y Usuarios and expertise in the review of early drafts of the paper. BOU Bank of Uganda Accion India Team High Mark India MFIN Microfinance Institutions -

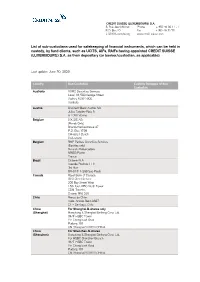

List of Sub-Custodians Used for Safekeeping of Financial Instruments

CREDIT SUISSE (LUXEMBOURG) S.A. 5, Rue Jean Monnet Phone + 352 46 00 11 - 1 P.O. Box 40 Fax + 352 46 32 70 L-2010 Luxembourg www.credit-suisse.com List of sub-custodians used for safekeeping of financial instruments, which can be held in custody, by fund clients, such as UCITS, AIFs, RAIFs having appointed CREDIT SUISSE (LUXEMBOURG) S.A. as their depositary (or banker/custodian, as applicable) Last update: June 30, 2020 Country Sub-Custodian Custody Delegate of Sub- Custodian Australia HSBC Securities Services Level 13, 580 George Street Sydney NSW 2000 Australia Austria UniCredit Bank Austria AG Julius Tandler-Platz 3 A-1090 Vienna Belgium SIX SIS AG (Bonds Only) Brandschenkestrasse 47 P.O. Box 1758 CH-8021 Zurich Switzerland Belgium BNP Paribas Securities Services (Equities only) 9 rue du Débarcadère 93500 Pantin France Brazil Citibank N.A. Avenida Paulista 1111 3rd floor BR-01311-290 Sao Paulo Canada Royal Bank of Canada GSS Client Service 200 Bay Street West 15th floor, RBC North Tower CDN-Toronto, Ontario M5J 2J5 Chile Banco de Chile Avda. Andrés Bello 2687 CL – Santiago, Chile China For Shanghai-B-shares only (Shanghai) Hongkong & Shanghai Banking Corp. Ltd. 34/F HSBC Tower Yin Cheng East Road Pudong 101 CN-Shanghai 200120 CHINA China For Shenzhen-B-shares (Shenzhen) Hongkong & Shanghai Banking Corp. Ltd. For HSBC Shenzhen Branch 34/F HSBC Tower Yin Cheng East Road Pudong 101 CN-Shanghai 200120 CHINA Colombia Cititrust Colombia S.A. Sociedad Fiduciaria Carrera 9A No. 99-02 First Floor Santa Fé de Bogotá D.C. -

Higher Education Reform: Getting the Incentives Right

Higher Education Reform: Getting the Incentives Right CPB Netherlands Bureau for Economic Policy Analysis CHEPS Van Stolkweg 14 University of Twente P.O. Box 80510 P.O. Box 217 2508 GM The Hague, The Netherlands 7500 AE Enschede, the Netherlands ISBN 90 5833 065 6 2 Contents Contents Preface 9 Introduction 11 1 The Dutch higher education system 15 1.1 Binary system 15 1.2 Formal tasks 16 1.3Types of institutions 16 1.4 Funding structure 17 1.5 Public expenditures on higher education 19 1.6 Tuition fee policies 21 1.7 Student support system 23 1.8 Admission policies 24 1.9 Quality control 25 1.10 Enrollment 26 Annex:Public funding of higher education in the Netherlands, performance-based models 29 2 Economics of higher education 35 2.1 Why do people attend higher education? 35 2.1.1 The human capital approach 35 2.1.2 The signalling approach 36 2.1.3How high are the financial and non-financial returns to higher education? 36 2.2 Why public support of higher education? 38 2.2.1 Human capital spillovers 38 2.2.2 Capital market constraints 39 2.2.3Risk 40 2.2.4 Imperfect information and transparency 41 2.2.5 Income redistribution 42 2.2.6 Tax distortions 42 2.3How to fund higher education? 42 2.3.1 Student support 43 2.3.2 Funding of higher education institutions 43 2.4 Public versus private provision of higher education 44 2.5 Should the higher education sector be deregulated? 45 2.6 Why combine education and research in universities? 46 5 Higher Education Reform: Getting the Incentives Right 2.7 Why and when should research be publicly funded? -

Banking Type Feature Summary

Banking Type Feature Summary Citi Plus Citibanking Citi Priority Citigold Citigold Private Client Local Clients Relationship Balance No minimum balance No minimum balance To maintain the “Average Daily To maintain the “Average Daily To maintain the “Average Daily Requirement requirements. requirements. Combined Balance”1 of Combined Balance”1 of Combined Balance”1 of HK$500,000 or above. HK$1,500,000 or above. HK$8,000,000 or above. Monthly Service Fee No monthly service fee. No monthly service fee. No monthly service fee. HK$300 applied if the “Average HK$300 applied if the “Average Daily Combined Balance” falls Daily Combined Balance” falls below HK$1,500,000 for 3 below HK$1,500,000 for 3 consecutive months2. consecutive months2. International Personal Banking Clients3 Relationship Balance Not applicable to this banking Not applicable to this banking Not applicable to this banking To maintain the “Average Daily To maintain the “Average Daily Requirement type. type. type. Combined Balance”1 of Combined Balance”1 of HK$1,500,000 or above. HK$8,000,000 or above. Monthly Service Fee Not applicable to this banking HK$400 applied to all clients, HK$400 applied to all clients, HK$500 applied if the “Average HK$500 applied if the “Average type. irrespective of the clients' irrespective of the clients' Daily Combined Balance” falls Daily Combined Balance” falls “Average Daily Combined “Average Daily Combined below HK$1,500,000 for 3 below HK$1,500,000 for 3 Balance”4. Balance”4. consecutive months2. consecutive months2. All Clients Account Features - Enjoy Citi Interest Booster5 - Integrated banking services - Integrated banking services - Integrated banking services - Integrated banking services (an interest-bearing checking include saving and checking include saving and checking include saving and checking include saving and checking account) that you can boost the services. -

Citibank Europe Plc Customer Information for the Purpose of Providing the Investment Services

CITIBANK EUROPE PLC CUSTOMER INFORMATION FOR THE PURPOSE OF PROVIDING THE INVESTMENT SERVICES Valid and effective from 1 April 2021 Citibank Europe plc, organizační složka Prague Czech Republic Citibank Europe plc, a company established and existing under the laws of Ireland, with its registered office at North Wall Quay 1, Dublin, Ireland, registered in the Company Register in the Irish Republic under No. 132781, conducting business in the Czech Republic through Citibank Europe plc, organizační složka, with its registered office at Bucharova 2641/14, Prague 5, Stodůlky, postal code 158 02, ID No. 28198131, incorporated in the Commercial Register administered by the Municipal Court in Prague, File Number A 59288. Member of Citigroup. The supervisory authority of Citibank Europe plc is the Central Bank of Ireland and to limited extent European Central Bank and Czech National Bank. Citibank Europe plc, a company established and existing under the laws of Ireland, with its registered office at North Wall Quay 1, Dublin, Ireland, registered in the Commercial Register in the Irish Republic under No. 132781, conducting its business in the Czech Republic through Citibank Europe plc, organizační složka, with its registered office at Praha 5, Stodůlky, Bucharova 2641/14, postal code: 158 02, Company ID No. 28198131, incorporated in the Commercial Register administered by the Municipal Court in Prague, File A 59288 (hereinafter “the Bank”). hereby announces to its customers, to whom it provides the investment services pursuant to the applicable legal regulations governing the capital market business, in particular Act No. 256/2004 Coll., on Undertaking on the Capital Market, as amended and Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 (hereinafter the "Legal Regulations"), certain information that the Bank is obliged to communicate to its customers under the aforementioned Legal Regulations. -

Final-Actis Inreview Lores Single.Pdf

Actis in review 2013 The positive power of capital Contents 03 Where we are now 08 Portfolio at work Banque Commerciale du Rwanda 10 Portfolio at work Garden City 13 Actis at a glance 14 Portfolio at work Bellagio 17 Portfolio at work Globeleq Mesoamerica Energy 20 Portfolio at work Asiri Group 23 Portfolio at work AGS 26 Regions and sectors 28 Investments 29 Investors 30 Portfolio companies 34 The team São Paulo, Brazil Welcome This report summarises the events and achievements of Actis in the last twelve months. Whether we are sharing the story of the Rwandan bank in which we invested nearly a decade ago, or the ATM chain rolling out across India, the tale we tell is of strong businesses, in attractive sectors, in some of the most populous and dynamic parts of the world. Our goal is to give you a sense of the breadth of our work, and the depth of our expertise. Providing insight into the energy and promise of those high growth markets which have already begun to define this century. I hope you enjoy reading this year’s annual review. Paul Fletcher Senior Partner Accra, Ghana Where we are now If the financial meltdown corporate governance, health and safety, labour law, and environmental and social practices. of August 2008 taught They must also be highly profitable. us anything it is that Our investment professionals have this in mind everything connects. The from the first dollar and day of the investment. Everything they do is focused on creating value. fortunes of a Manhattan Their work is supplemented by a dedicated team of in-house consultants who do nothing but headquartered bank, a implement best practices, and share what they know works from their past experiences in the string of late night phone same sectors. -

Currency Codes COP Colombian Peso KWD Kuwaiti Dinar RON Romanian Leu

Global Wire is an available payment method for the currencies listed below. This list is subject to change at any time. Currency Codes COP Colombian Peso KWD Kuwaiti Dinar RON Romanian Leu ALL Albanian Lek KMF Comoros Franc KGS Kyrgyzstan Som RUB Russian Ruble DZD Algerian Dinar CDF Congolese Franc LAK Laos Kip RWF Rwandan Franc AMD Armenian Dram CRC Costa Rican Colon LSL Lesotho Malati WST Samoan Tala AOA Angola Kwanza HRK Croatian Kuna LBP Lebanese Pound STD Sao Tomean Dobra AUD Australian Dollar CZK Czech Koruna LT L Lithuanian Litas SAR Saudi Riyal AWG Arubian Florin DKK Danish Krone MKD Macedonia Denar RSD Serbian Dinar AZN Azerbaijan Manat DJF Djibouti Franc MOP Macau Pataca SCR Seychelles Rupee BSD Bahamian Dollar DOP Dominican Peso MGA Madagascar Ariary SLL Sierra Leonean Leone BHD Bahraini Dinar XCD Eastern Caribbean Dollar MWK Malawi Kwacha SGD Singapore Dollar BDT Bangladesh Taka EGP Egyptian Pound MVR Maldives Rufi yaa SBD Solomon Islands Dollar BBD Barbados Dollar EUR EMU Euro MRO Mauritanian Olguiya ZAR South African Rand BYR Belarus Ruble ERN Eritrea Nakfa MUR Mauritius Rupee SRD Suriname Dollar BZD Belize Dollar ETB Ethiopia Birr MXN Mexican Peso SEK Swedish Krona BMD Bermudian Dollar FJD Fiji Dollar MDL Maldavian Lieu SZL Swaziland Lilangeni BTN Bhutan Ngultram GMD Gambian Dalasi MNT Mongolian Tugrik CHF Swiss Franc BOB Bolivian Boliviano GEL Georgian Lari MAD Moroccan Dirham LKR Sri Lankan Rupee BAM Bosnia & Herzagovina GHS Ghanian Cedi MZN Mozambique Metical TWD Taiwan New Dollar BWP Botswana Pula GTQ Guatemalan Quetzal -

Africa Digest Vol. 2019-04

Vol. 2019 – 04 Contents 1. Trends on China in Africa ................................................................................ 2 2. Financial Services in Africa ............................................................................. 6 3. Western Companies in Africa .......................................................................... 9 4. Fintech and Mobile Money ............................................................................ 12 5. Linking Africa to the World ............................................................................. 16 1 Vol. 2019 – 04 1. Trends on China in Africa INTRODUCTION China’s presence in Africa is the topic of many papers, articles and arguments. Over the past few years, the Chinese government and its private sector became major players on the continent in trade, investments, and support for African governments. AFRICA China has diversified its sources of energy to meet growing domestic demand. Three of its national oil companies (NOCs) increased their investment in Africa to secure oil supplies, which accounts for almost 30% of their combined international upstream capital spending (capex). Within the next five years, these NOCs are projected to become the fourth highest source of capex in Africa’s upstream sector, after global counterparts BP, Shell and Eni SpA. They will invest US$15 billion in Africa, with two-thirds of their investment going to Nigeria, Angola, Uganda and Mozambique.1 The opportunity for exports from Africa to China presents an interesting counterpoint to China’s investments in Africa. Some commentators suggest that China can narrow its trade surplus with African countries and help them develop more economic growth by importing more value-added products from Africa. China’s consumer market is the world’s largest, and is growing at 16% compared to a US consumer market that is growing at only 2%. Unsurprisingly, private sector companies from Africa are increasingly interested in entering the Chinese market. -

Personal Banking

2019 ANNUAL REPORT & ACCOUNTS ACCESS BANK PLC 1 access more 2019 ANNUAL REPORT & ACCOUNTS 2 ACCESS BANK PLC MERGING CAPABILITIES FOR SUSTAINABLE GROWTH 2019 ANNUAL REPORT & ACCOUNTS ACCESS BANK PLC 3 1 OVERVIEWS .............08 10 • Business and Financial Highlights 12 • Locations and Offices 14 • Chairman’s Statement CONTENTS// 18 • Chief Executive Officer's Review 2 BUSINESS REVIEW.............22 24 • Corporate Philosophy 25 • Reports of the External Consultant 26 • Commercial Banking 30 • Business Banking 34 • Personal Banking 40 • Corporate and Investment Banking 44 • Transaction Services, Settlement Banking and IT 46 • Digital Banking 50 • Our People, Culture and Diversity 54 • Sustainability Report 74 • Risk Management Report 3 GOVERNANCE .............92 94 • The Board 106 • Directors, Officers & Professional Advisors 107 • Management Team 108 • Directors’ Report 116 • Corporate Governance Report 136 • Statement of Directors’ Responsibilities 138 • Report of the Statutory Audit Committee 140 • Customers’ Complaints & Feedback 144 • Whistleblowing Report 4 FINANCIAL STATEMENTS ............148 150 • Independent Auditor’s Report 156 • Consolidated Statement of Comprehensive Income 157 • Consolidated Statement of Financial Position 158 • Consolidated Statement of Changes in Equity 162 • Consolidated Statement of Cash Flows 164 • Notes to the Consolidated Financial Statements 203 • Other National Disclosures SHAREHOLDER 5 INFORMATION ............404 406 • Shareholder Engagement 408 • Notice of Annual General Meeting 412 • Explanatory