YCTD 2020Nov Minutes

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Woodland Transit Study

Woodland Transit Study Prepared for the Yolo County Transportation District Prepared by LSC Transportation Consultants, Inc. Woodland Transit Study Prepared for the Yolo County Transportation District 350 Industrial Way Woodland, CA 95776 530 402-2819 Prepared by LSC Transportation Consultants, Inc. P.O. Box 5875 2690 Lake Forest Road, Suite C Tahoe City, California 96145 530 583-4053 April 27, 2016 LSC #157020 TABLE OF CONTENTS Chapter Page 1 Introduction and Key Study Issues ............................................................................... 1 Introduction .................................................................................................................. 1 Study Issues ................................................................................................................ 1 2 Existing Community Conditions .................................................................................... 3 Geography of Yolo County .......................................................................................... 3 Demographics ............................................................................................................. 3 Economy ................................................................................................................... 13 3 Review of Existing Transit Services ............................................................................ 19 Yolo County Transportation District ........................................................................... 19 Existing Woodland -

Yolo County Transportation District 350 Industrial Way

Yolo County Transportation District 350 Industrial Way Woodland, CA 95776 City of Davis – City of West Sacramento – City of Winters 530.661.0816 FAX: 530.661.1732 City of Woodland – County of Yolo EX Officio – Caltrans District 3 – University of California, Davis www.yolobus.com Paid Internship Position Title: Transportation Planning Internship Background: The Yolo County Transportation District (YCTD) operates both local and intercity transit service (YOLOBUS) in the cities and communities of Davis, West Sacramento, Winters, Woodland, and to unincorporated communities of Yolo County. Additionally, YCTD is also the Congestion Management Agency for Yolo County, and serves as the interim administrator of the Yolo Transportation Management Association (TMA) Yolo Commute. YCTD staff is currently comprised of eleven full time employees, in addition to approximately 100 contract employees. YCTD has been awarded grant funding to continue its internship program through Fiscal Year 2018/19. Past internship participants have successfully leveraged their experiences with YCTD into full-time positions with public agencies including the District itself, Caltrans, Sacramento Regional Transit, AC Transit, and more. Description: YCTD seeks to hire up to six (6) interns in Fiscal Year 2018/19 to assist in transportation planning, marketing, communications, public relations, and operations related tasks and assignments: Activities will include but not be limited to: o Inventorying and assessing condition of Yolobus stops throughout the service area; o -

Solanoexpress Bus Routes Transit Information Fairfield Transportation Center Fairfield

Regional Transit Map Transit REGIONAL TRANSIT DIAGRAM To To Eureka Clearlake Information Mendocino Transit DOWNTOWN AREA TRANSIT CONNECTIONS Authority To Ukiah Lake Oakland Mendocino Transit 12th Street Oakland City Center BART: Greyhound BART, AC Transit FA FA 19th Street Oakland BART: FA BART, AC Transit Cloverdale San Francisco Yolobus To Davis Civic Center/UN Plaza BART: Winters Fairfi eld and Suisun Transit SolanoExpress is Solano SolanoExpress is Solano BART, Muni, Golden Gate Transit, SamTrans Fairfield 101 Embarcadero BART & Ferry Terminal: County’s intercity transit connection. County’s intercity transit connection. BART, Golden Gate Transit, Muni, SamTrans, (FAST) is the local transit system Baylink, Alameda/Oakland Ferry, Alameda Harbor Faireld and Healdsburg Bay Ferry, Blue & Gold Fleet, Amtrak CA Thruway Suisun Transit SolanoExpress routes connect cities SolanoExpress routes connect cities Transit To Sacramento for Fairfi eld and Suisun City and also Mongomery Street BART: Healdsburg BART, Muni, Golden Gate Transit, SamTrans Dixon within the county and provide service within the county and provide service Calistoga Readi- operates many of the SolanoExpress (Operated by FAST) (Operated by SolTrans) Handi Powell Street BART: Transportation Ride Van Calistoga BART, Muni, Golden Gate Transit, SamTrans regional routes. Please visit www.fasttransit. to neighboring counties, BART, and the ferry. to neighboring counties, BART, and the ferry. San Francisco Caltrain at 4th & King: Dixon Windsor Deer Caltrain, Muni, Amtrak CA Thruway org or call 707-422-BUSS (707-422-2877) for For more information, call (800) 535-6883 or For more information, call (800) 535-6883 or Park Transbay Temporary Terminal: Guerneville AC Transit, Muni, Golden Gate Transit, SamTrans, 80 visit www.solanoexpress.com. -

Solano Express Bus Routes Transit Information Pleasant Hill Station Area Contra Costa Centre

Fare Information effective January 1, 2016 Senior3 Adult/ (65+) Youth2 County Connection & (6-64) For more detailed information about BART Disabled service, please see the BART Schedule, BART 1 Transit CASH FARES (exact change only) Regional Transit Map System Map, and other BART information REGIONAL TRANSIT DIAGRAM displays in this station. Regular Ride $2.00 $1.00 To To Express Ride (900 series route numbers) $2.25 $1.00 Eureka Clearlake Information Mendocino Transit DOWNTOWN AREA TRANSIT CONNECTIONS PREPAID FARES Authority To Ukiah Lake Oakland ® 4 $2.00 $1.00 Mendocino Transit 12th Street Oakland City Center BART: Clipper Cash Value Greyhound BART, AC Transit 19th Street Oakland BART: 5 $3.75 $1.75 BART, AC Transit Day Pass Cloverdale San Francisco Yolobus To Davis Discount Regular/Express 20-Ride Pass N/A $15.00 Civic Center/UN Plaza BART: Winters BART, Muni, Golden Gate Transit, SamTrans Commuter Card (20 Regular+BART Transfer-Rides) $40.00 N/A Pleasant Hill 101 Embarcadero BART & Ferry Terminal: BART, Golden Gate Transit, Muni, SamTrans, Baylink, Alameda/Oakland Ferry, Alameda Harbor Faireld and 6 $60.00 N/A Healdsburg Bay Ferry, Blue & Gold Fleet, Amtrak CA Thruway Suisun Transit East Bay Regional Local 31-Day Transit To Sacramento Mongomery Street BART: Healdsburg BART, Muni, Golden Gate Transit, SamTrans Dixon 6 $70.00 N/A Calistoga Readi- County Connection (CCCTA) effective January 1, 2016 East Bay Regional Express 31-Day Handi Powell Street BART: San Francisco Bay Area Rapid Fare Information Station Area Ride BART Red* Ticket -

Paid Internship Position Title: Transportation Planning Internship

Yolo County Transportation District 350 Industrial Way, Woodland, CA 95776 (530) 661-0816 - (530) 661-1732 fax www.yolobus.com City of Davis - City of West Sacramento - City of Winters City of Woodland - County of Yolo Ex Officio: CalTrans District 3 - University of California, Davis Paid Internship Position Title: Transportation Planning Internship The Yolo County Transportation District (YCTD), its office is located in Woodland California, operates both local and intercity transit service in the cities of Davis, West Sacramento, Winters, and Woodland and provides service to unincorporated areas of Yolo County. Additionally, YCTD is also the Congestion Management Agency for Yolo County. There are twelve (12) in-house full time employees, in addition to 100 contract employees. Description: Assist in transportation planning, marketing, and operations. These activities will include: performing route and schedule planning; designing, implementing, tabulating and analyzing surveys; maintaining transit facilities and bus operations databases; performing reviews of routes and transit facilities for appearance, safety, and access; responding to passenger comments; riding buses and providing written observations; providing staff assistance in the preparation of agendas and staff reports for meetings; taking detailed notes/minutes at meetings; taking photo IDs and answering phones; performing other transportation planning, marketing, and operations projects; assisting in the implementation of YCTD’s automatic vehicle location system; utilizing YCTD’s sign-making equipment, making and installing route and schedule information on bus stop signs; assisting in the design, maintenance, and updates of YCTD’s web site; delivering and picking up meeting packets, schedules, and other items on behalf of YCTD; assisting in development reviews; assisting in the development of bus routes and schedules; assisting in the design of various marketing materials; and performing other related tasks assigned by Executive Director or designee. -

Vacaville Transit Service Evaluation Study Final Report

Vacaville Transit Service Evaluation Study Final Report Prepared for the City of Vacaville Administrative Services Department Prepared by LSC Transportation Consultants, Inc. This page left intentionally blank. Vacaville Transit Service Evaluation Study Final Report _________________________ Prepared for the City of Vacaville Administrative Services Department 650 Merchant Street Vacaville, CA 95688 Prepared by LSC Transportation Consultants, Inc. 2690 Lake Forest Road, Suite C P. O. Box 5875 Tahoe City, California 96145 April 20, 2018 This page left intentionally blank. TABLE OF CONTENTS Chapter 1: Introduction ................................................................................................................................ 1 Chapter 2: Market Analysis ........................................................................................................................... 3 Chapter 3: Review of Existing Service ......................................................................................................... 33 Chapter 4: City Coach Passenger Boarding/Alighting Data ........................................................................ 61 Chapter 5: City Coach On-Time Performance ............................................................................................. 75 Chapter 6: City Coach Route Segment Analysis .......................................................................................... 85 Chapter 7: City Coach Passenger Onboard Survey .................................................................................... -

California Transportation Needs Assessment: the Transportation Barriers and Needs of Welfare Recipients and Low-Wage Workers

UCLA Community Service Projects/Papers Title California Transportation Needs Assessment: The Transportation Barriers and Needs of Welfare Recipients and Low-Wage Workers Permalink https://escholarship.org/uc/item/0g04h3rt Authors Blumenberg, Evelyn Miller, Douglas Schweitzer, Lisa et al. Publication Date 2003-05-01 eScholarship.org Powered by the California Digital Library University of California CALIFORNIA TRANSPORTATION NEEDS ASSESSMENT: The Transportation Barriers and Needs of Welfare Recipients and Low-Wage Workers May 30, 2003 Prepared by: Evelyn Blumenberg, Doug Miller, Mark Garrett, Lisa Schweitzer Karen Kitsis, Michael Manville, and Bravishwar Mallavarapu The Ralph & Goldy Lewis Center for Regional Policy Studies UCLA School of Public Policy and Social Research Prepared for the California Department of Transportation California Transportation Needs Assessment: The Transportation Barriers and Needs of Welfare Recipients and Low-Wage Workers Final Draft Prepared by: Evelyn Blumenberg, Douglas Miller, Mark Garrett, Lisa Schweitzer Karen Kitsis, Michael Manville, and Bravishwar Mallavarapu The Ralph & Goldy Lewis Center for Regional Policy Studies UCLA School of Public Policy and Social Research Prepared for the California Department of Transportation May 30, 2003 Funding for this study was provided by the California Department of Transportation, State Planning and Research Program (80% Federal Highway Administration and 20% State transportation funds). Disclaimer The statements and conclusions in this report are those of the authors and not necessarily those of the California Department of Transportation. Copyright Information The text of this document and any images (e.g. photos, graphics, figures, and tables) that are specifically attributed (in full or in coordination with another group) to the California Department of Transportation may be freely distributed or copied, so long as full credit is provided. -

Fairfield and Suisun Transit (FAST) Short Range Transit Plan FY 2021 – FY 2030

Fairfield and Suisun Transit (FAST) Short Range Transit Plan FY 2021 – FY 2030 To be approved by the Fairfield City Council on November 17, 2020 Prepared for & Reviewed/Edited by Fairfield and Suisun Transit 2000 Cadenasso Drive Fairfield, CA 94533 On behalf of Solano Transportation Authority One Harbor Center, Suite 130 Suisun City, CA 94585 Prepared by Moore & Associates, Inc. 25115 Avenue Stanford, Suite 215 Valencia, CA 91355 Federal transportation statutes require that the Metropolitan Transportation Commission (MTC), in partnership with state and local agencies, develop and periodically update a long-range Regional Transportation Plan (RTP), and a Transportation Improvement Plan (TIP) which implements the RTP by programming federal funds to transportation projects contained in the RTP. In order to effectively execute these planning and programming responsibilities, MTC requires that each transit operator in its region which receives federal funding through the TIP, prepare, adopt, and submit to MTC a Short Range Transit Plan (SRTP). FAST Short Range Transit Plan FY 2021-2030 Solano Transportation Authority Draft Final Report This page intentionally blank. ii Moore & Associates, Inc. | June 2020 FAST Short Range Transit Plan FY 2021-2030 Solano Transportation Authority Draft Final Report Table of Contents Chapter 1: Overview of Transit System ........................................ 01 Chapter 2: Goals, Objectives, Measures, and Standards ............... 17 Chapter 3: System and Service Performance Evaluation ............... 23 Chapter 4: Operations Plan ......................................................... 41 Chapter 5: Capital Improvement Program ................................... 49 Chapter 6: Other MTC Requirements ........................................... 57 Appendix A: FAST Title VI Plan..................................................... 59 iii Moore & Associates, Inc. | June 2020 FAST Short Range Transit Plan FY 2021-2030 Solano Transportation Authority Draft Final Report This page intentionally blank. -

Regional Transit Diagram for Real-Time Departure Information, Check Nearby Displays

Regional Transit Diagram For Real-Time Departure Information, check nearby displays. Or, you can call Transit Regional Transit Map 511 and say “Departure Times.” For Free Transit Information Free Transit Information more details, look for the 511 Real-Time Call 511 or Visit 511.org REGIONAL TRANSIT DIAGRAM Call 511 or Visit 511.org To To Departure Times description in the “Transit Eureka Clearlake Information” column on the right. Information Mendocino Transit DOWNTOWN AREA TRANSIT CONNECTIONS Authority To Ukiah Lake Oakland Mendocino Transit 12th Street Oakland City Center BART: Greyhound BART, AC Transit 19th Street Oakland BART: BART, AC Transit Cloverdale San Francisco Yolobus To Davis Civic Center/UN Plaza BART: Winters BART, Muni, Golden Gate Transit, SamTrans Embarcadero 101 Embarcadero BART & Ferry Terminal: BART, Golden Gate Transit, Muni, SamTrans, Baylink, Alameda/Oakland Ferry, Alameda Harbor Faireld and Healdsburg Bay Ferry, Blue & Gold Fleet, Amtrak CA Thruway Suisun Transit BART Red* Ticket Transit To Sacramento San Francisco Bay Area Rapid Harbor Bay/San Francisco Route Vallejo/San Francisco Ferry and Blue & Gold Fleet operates Mongomery Street BART: Schedule Information Healdsburg BART, Muni, Golden Gate Transit, SamTrans Dixon 62.5% discount for persons with Calistoga Readi- Transit (BART) rail service connects operates weekdays only between Bus Routes operate weekdays, weekday ferry service from the Handi Powell Street BART: effective September 10, 2012 Station Ride disabilities, Medicare cardholders Van Calistoga BART, Muni, Golden Gate Transit, SamTrans the San Francisco Peninsula with Alameda’s Harbor Bay Isle and the weekends, and some holidays San Francisco Ferry Terminal to San Francisco Caltrain at 4th & King: Dixon and children 5 to 12 years: $24 Windsor Deer Caltrain, Muni, Amtrak CA Thruway Oakland, Berkeley, Fremont, See schedules posted throughout this station, San Francisco Ferry Building. -

Yolo County Transportation District to Encourage Participation in the Meetings of the Board of Directors

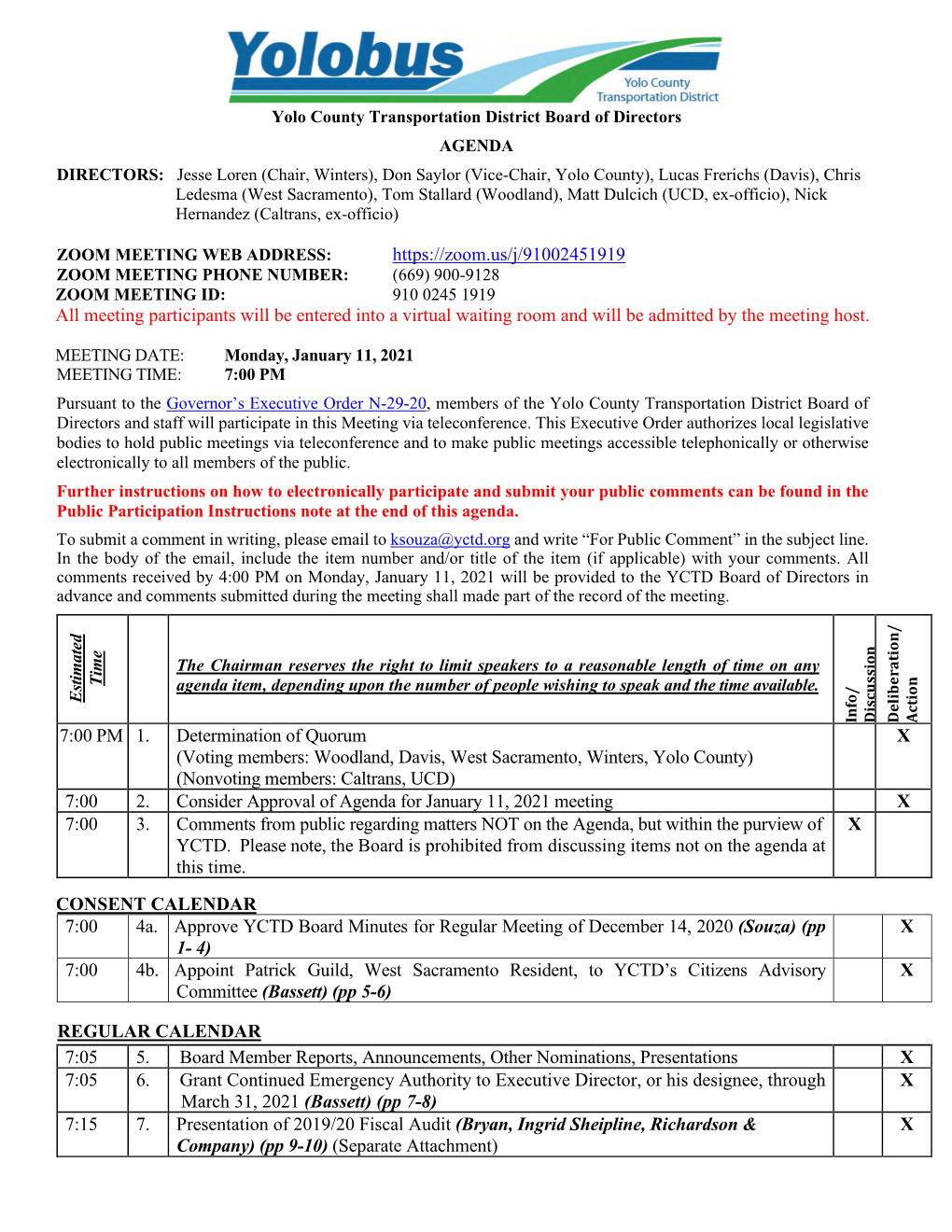

AGENDA (530) 661-0816 NOTICE If requested, this agenda can be made available in appropriate alternative formats to persons with a disability, as required by Section 202 of the Americans with Disabilities Act of 1990 and the Federal Rules and Regulations adopted in implementation thereof. Persons seeking an alternative format should contact Kathy Souza, Administrative Assistant, for further information. In addition, a person with a disability who requires a modification or accommodation, including auxiliary aids or services, in order to participate in a public meeting should telephone or otherwise contact Kathy Souza as soon as possible and preferably at least 24 hours prior to the meeting. Kathy Souza may be reached at telephone number (530) 661-0816 or at the following address: 350 Industrial Way, Woodland, CA 95776. It is the policy of the Board of Directors of the Yolo County Transportation District to encourage participation in the meetings of the Board of Directors. At each open meeting, members of the public shall be provided with an opportunity to directly address the Board on items of interest to the public that are within the subject matter jurisdiction of the Board of Directors. Please fill out a speaker card and give it to the Board Clerk if you wish to address the Board. Speaker cards are provided on a table by the entrance to the meeting room. MEETING DATE: Monday, May 14, 2012 MEETING TIME: 7:00 P.M. MEETING PLACE: Woodland City Hall, Council Chambers 300 First Street Woodland, CA 95695 The Chairman reserves the right to limit speakers to a reasonable length of time on any agenda item, depending upon the number of people wishing to speak and the time available. -

Solano County Mobility Guide

OUTSIDE Call Center Transportation Transportation Seniors & People 800-535-6883 Providers Providers with Disabilities The Solano Mobility Call Center NON-PROFIT PROVIDERS INTER-COUNTY TRANSPORTATION offers free live personalized assistance The Adult Recreation Center (ARC) Services connect Solano with Contra Solano County for traveling around Solano, Napa and Taxi Scrip Program provides taxi Costa, Napa, Yolo, Sacramento, and neighboring counties. The Call Center trips from Fairfield/Suisun City to the San Francisco counties. Mobility Guide provides a family of transportation ARC. Participants must be 60+, be options such as bus, rail, ferry, shared approved for the local Reduced Fare SolanoExpress services the cities of ride, airporters, taxis, paratransit, Taxi Program or DART Paratransit. Benicia, Dixon, Fairfield, Suisun City, (800) 535-6883 private and non-profit transportation, Application and Scrip are available at Vacaville and Vallejo and provides www.solanomobility.org and bike information. ARC. Cost is $1.75 one way. Please service to Davis, Sacramento, Suisun call 434-3800 for more information. City AMTRAK, San Francisco Bay Ferry TRAVEL TRAINING Faith in Action/Ride With Pride & BART (El Cerrito del Norte, Pleasant The Travel Training Program is provides free door-to-door rides for Hill, Walnut Creek).........(800) 535-6883 available to ALL Solano County seniors (60+) throughout Solano VINE connects Vallejo and Fairfield to the residents. Contact the Solano Mobility County. Advance reservation is Napa Valley.....................(800) 696-6443 Call Center for more information and required at 469-6675. Donations are YoloBus connects Vacaville to Winters to schedule a training session in your accepted. and Davis....................(530) 666-2877 area. -

California, United States of America Destination Guide

California, United States of America Destination Guide Overview of California Key Facts Language: English is the most common language spoken but Spanish is often heard in the south-western states. Passport/Visa: Currency: Electricity: Electrical current is 120 volts, 60Hz. Plugs are mainly the type with two flat pins, though three-pin plugs (two flat parallel pins and a rounded pin) are also widely used. European appliances without dual-voltage capabilities will require an adapter. Travel guide by wordtravels.com © Globe Media Ltd. By its very nature much of the information in this travel guide is subject to change at short notice and travellers are urged to verify information on which they're relying with the relevant authorities. Travmarket cannot accept any responsibility for any loss or inconvenience to any person as a result of information contained above. Event details can change. Please check with the organizers that an event is happening before making travel arrangements. We cannot accept any responsibility for any loss or inconvenience to any person as a result of information contained above. Page 1/47 California, United States of America Destination Guide Travel to California Climate for California Health Notes when travelling to United States of America Safety Notes when travelling to United States of America Customs in United States of America Duty Free in United States of America Doing Business in United States of America Communication in United States of America Tipping in United States of America Passport/Visa Note Page 2/47 California, United States of America Destination Guide Airports in California Los Angeles International (LAX) Los Angeles International Airport www.flylax.com/ Location: Los Angeles The airport is situated 18 miles (29km) southwest of Los Angeles.