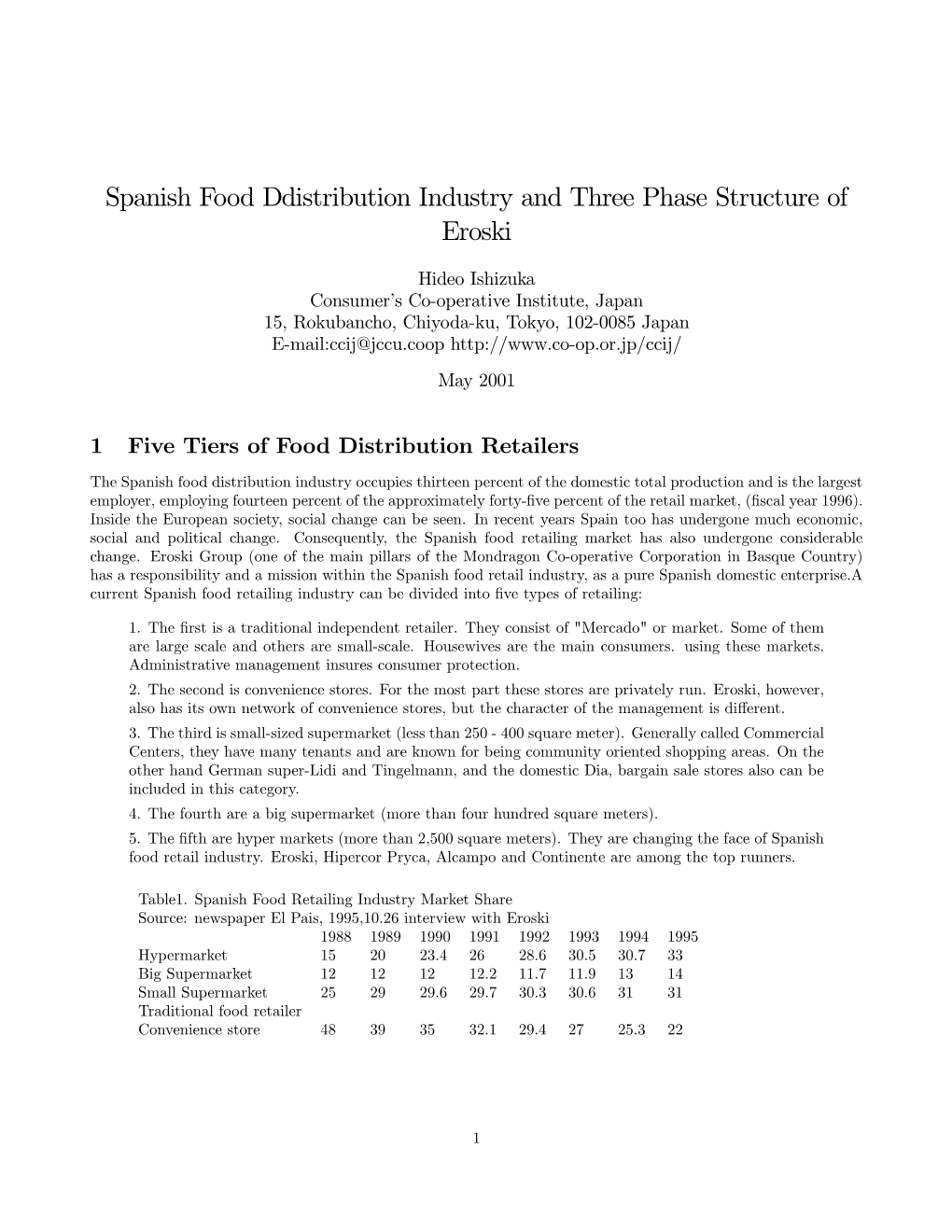

Spanish Food Distribution Industry and Eroski

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 Report Executive Summary Letter from the Chairman

2020 Report Executive summary Letter from the Chairman I would like to begin this message by thanking all the people who make EROSKI possible. People who, individually and collectively, have lived up to the demands of society, and who have done so with determination and efficiency, always giving their best for the benefit of the community. The quality of this response did not come as a surprise to any of us. But it must nevertheless be recognised, especially when it reaches this level of commitment. Our main priority is to guarantee the safety of both our employees and customers. It was complicated at the beginning, but we ended up certifying our establishments with the Bureau Veritas Safer Shopping seal. In the meantime, we had to ensure that our stores were well stocked every day. The entire value chain performed exceptionally well and we were able to provide an optimal response to an accumulated demand that increased significantly at the onset of the crisis. The pandemic adversely affected different groups and, fortunately, we were able to meet the pressing needs of many of them. Thus, we donated one million face masks to municipal councils and social organisations and the equivalent of more than 6.5 million meals to Food Banks, amongst other actions. The most complicated year had to be the most supportive year. Consumers changed their shopping habits and we wanted to accompany them in that change. The much talked-about innovation and digital transformation in business is about making life easier for customers, allowing them to find different, innovative products and providing them with a more satisfactory, agile and efficient shopping experience. -

50Th Anniversary

50th Anniversary 2005 Annual Report 2 Contents 2005 ANNUAL REPORT Highlights 05 Message from the Chairman 06 Financial Group 09 Caja Laboral 12 Lagun-Aro 14 Seguros Lagun-Aro 15 Industrial Group 17 Automotive 21 Components 22 Construction 23 Industrial Equipment 24 Household Goods 25 Engineering and Capital Goods 26 Machine Tools 27 Industrial Systems 28 MCC Worldwide 29 Distribution Group 31 Distribution 32 Research, Training and Education 37 Research Centres 38 Training and Education Centres 41 Financial Statement and Trading Account 43 Sustainability Overview 49 Governance Structure 61 Corporate and Management Bodies 62 Companies Affiliated to MCC 65 33 Certificates and Awards 2005 ANNUAL REPORT As in previous years, several MCC businesses received out- 1 Finalist for the EFQM European Award obtained side endorsement in 2005 within the sphere of excellence by Fagor Cocción in business management: Ahizke-CIM (Language Centre, 1 European Environmental Award, won by Orkli Mondragón) and Politeknika Ikastegia Txorierri received the 6 Gold Q: Caja Laboral, CIM, Copreci, Gold Q from Euskalit, whereas Fagor Electrodomésticos Fagor Minidomésticos, Fagor Industrial and Politeknika Confort was awarded the Silver Q. Txorierri Ikastegia. 13 Silver Q: Eroski PGM, Fresh Produce Platform of the In addition, 4 Cooperatives were certified to the ISO Eroski Group, Fagor Electrodomésticos Confort, 14000 Environmental Standard, which means that MCC Fagor Electrodomésticos Lavado, Fagor Mueble, now has 42 certificates in this field. Likewise, 5 certificates Fagor Electrónica, Geyser Gastech, Lea Artibai were awarded for Systems for the Prevention of Industrial Ikastetxea, Mondragon Goi Eskola Politeknikoa, Orkli, Hazards, OHSAS, adding to the 3 obtained in 2004, the year in which this certification was first introduced. -

Assessing Mondragon: Stability & Managed Change in the Face Of

THE WILLIAM DAVIDSON INSTITUTE AT THE UNIVERSITY OF MICHIGAN Assessing Mondragon: Stability & Managed Change in the Face of Globalization By: Saioa Arando, Fred Freundlich, Monica Gago, Derek C. Jones and Takao Kato William Davidson Institute Working Paper Number 100 3 November 2010 Assessing Mondragon: Stability and Managed Change in the Face of Globalization Saioa Arando, Fred Freundlich, Monica Gago, Derek C. Jones and Takao Kato November, 2010 Abstract By drawing on new interview evidence gathered during several field trips and new financial and economic data from both external and internal sources, we document and assess the changing economic importance and performance of the Mondragon group of cooperatives as well as the two largest sectors within the group. Compared to conventional firms in the Basque Country and Spain, and producer co-ops (PCs) and employee owned firms elsewhere, in general we find evidence of growing group importance and strong performance and a similarly strong record for the industrial and retail divisions. These stylized facts do not support hypotheses concerning PCs such as predictions that PCs will restrict employment and become progressively comparatively undercapitalized. In accounting for this record, we highlight key and, at times, not uncontroversial institutional developments in the group during the last 20 years or so that indicate the existence of a continuing capacity for institutional adaptation in Mondragon-- an ongoing ability to innovate and make institutional adjustments to deal with emerging challenges. In addition, we provide more detailed information than before on some key distinguishing institutional mechanisms of the Mondragon group, including the extent of worker-member transfers during economic crises, the patterns of profit pooling and the type and volume of training. -

INFORME ANUAL 2014 Annual Report 2014

1 INFORME ANUALANNUA L 2014REPORT 2014 01 Basic figures p.04 02 Message from the Chair 03 p.08 Finance p.10 3 04 Industry p.16 06 Knowledge p.32 05 Distribution p.28 125 8 1 13 13 103 PRODUCTION FOUNDATIONS MUTUAL COVERAGE INTERNATIONAL COOPERATIVES SUBSIDIARIES ASSISTANCE ORGANISATIONS DEPARTMENTS ORGANISATION 01 Basic figures In millions of euros BUSINESS 5 DEVELOPMENT 2013* 2014 Varia- tion % Total income 12,108 11,875 -1.9 Total sales (Industry and Distribution) 11,138 10,985 -1.4 Net investments 392 345 -11.9 EBITDA 1,220 1,168 -4.3 Intermediated Funds LABORAL Kutxa 1,160 18,063 5.3 LagunAro equity fund 5,205 5,566 6.9 EMPLOYMENT 2013* 2014 Varia- tion % Average jobs 74,060 74,117 0.1 % of shareholders in Industrial Area 84 83 -1.2 cooperative workforce % of female shareholders in cooperative 43.1 43 -0.2 workforce Rate of Industrial Area incidents or 31.0 29.3 -5.5 accidents SHAREHOLDING 2013* 2014 Varia- tion % 1,711 1,688 -1.3 Working shareholders capital stock Number of workers in governing bodies 812 810 -0.2 SolidaritY 2013* 2014 Varia- tion % Funds for activities with a SOCIAL 13.5 14.7 8.9 CONTENT No. of students IN educational centres 11,404 11,439 0.3 Environmental 2013* 2014 Varia- management tion % 56 69 23.2 No. of ISO 14000 certifications in force Number of eco-design certifications 4 4 0.0 INVESTMENT IN THE 2013* 2014 Varia- FUTURE tion % % funds allocated to R&D of Industrial 8.5 8.9 4.7 Area value added No. -

Country Retail Scene Report

SPAIN COUNTRY RETAIL SCENE REPORT December 2012 KANTAR RETAIL 24 – 28 Bloomsbury Way, London WC1A 2PX, UK / Tel. +44 (0)207 031 0272 / www.KantarRetail.com INFORMATION / INSIGHT / STRATEGY / EXECUTION © Kantar Retail 2012 245 First Street 24 – 28 Bloomsbury Way T +44 (0) 207 0310272 Suite 1000 London, WC1A 2PX F +44 (0) 207 0310270 Cambridge, MA 02142 UK [email protected] USA www.kantarretail.com Index I. Key Themes .......................................................................................................... 2 II. Socio – Economic Background .............................................................................. 3 III. Key Players in the Grocery Retail Sector ............................................................ 11 IV. Grocery Retail Channels ..................................................................................... 19 V. Conclusion ........................................................................................................... 24 © 2012 KANTAR RETAIL | 2012 Spain Retail Scene | www.kantarretail.com 1 245 First Street 24 – 28 Bloomsbury Way T +44 (0) 207 0310272 Suite 1000 London, WC1A 2PX F +44 (0) 207 0310270 Cambridge, MA 02142 UK [email protected] USA www.kantarretail.com I. Key Themes National players are capturing growth and increasing concentration in Spain Despite the economic turmoil in Spain, leading Spanish grocery retailers are expected to see their growth accelerate in the coming years, led by retailers such as Mercadona and Dia, both growing at over 5% per year. Mercadona is by far the largest Spanish grocery retailer in terms of sales and has successfully adapted its strategy to the economic crisis that Spain is facing. Its impressive business model has enabled it to retain shopper loyalty and support robust physical expansion and the retailer is looking to further strengthen its domination of the supermarket channel and the grocery market overall. Due to the strong growth of two of the top five grocery retailers in Spain the dominance of a few major players will increase. -

Eroski Reinforces Its Business in Catalonia and the Balearic Islands with the Entry of the Ep Corporate Group Into a 50/50 Partnership

Press Release Strengthening the financial structure of the group EROSKI REINFORCES ITS BUSINESS IN CATALONIA AND THE BALEARIC ISLANDS WITH THE ENTRY OF THE EP CORPORATE GROUP INTO A 50/50 PARTNERSHIP EP Corporate Group (Czech Republic) becomes EROSKI’s new financial partner This agreement will make it possible to relaunch investments and activity under the CAPRABO trademark in Catalonia and under the EROSKI trademark in the Balearic Islands With this agreement EROSKI takes the final step aimed at debt normalization Elorrio, 29 March 2021.- EROSKI has entered into an agreement with the investment holding company EP Corporate Group for them to become equal partners in the company SUPRATUC 2020, which comprises the businesses in Catalonia and the Balearic Islands. This way, EROSKI has completed the process to find a financial partner that started at the end of 2019 in order to strengthen the financial structure of the group and their positioning in both regions. The operation will enable EROSKI to improve their financial position and fulfil the debt repayment commitment made by the end of this year, at a higher amount than that committed with financial institutions, and will give a boost to the relaunch of investments and activity in Catalonia under the CAPRABO trademark and in the Balearic Islands under the EROSKI trademark. The full effect of the operation is subject to some conditions precedent, such as certain regulatory and contractual authorizations. EROSKI’s Chairman, Agustín Markaide, has a very positive view of the operation, as it places EROSKI where they planned it to be. “There is no doubt that, with the agreement concluded today, we are completing this process with higher capacities. -

Eroski Closed 2019 with an Operating Result of €193.8 M

Press Release Profit exceeds €45 M EROSKI CLOSED 2019 WITH AN OPERATING RESULT OF €193.8 M ● The operating profit of the group grew by over 18% as compared to 2018, improving for the ninth consecutive year ● The ebitda exceeded €260 M, a figure which had not been reached since 2012, with an almost €13 M increase ● The parent cooperative, EROSKI S.Coop., increased sales by 1.8% and reached a profit of €72.3 M ● They added 74 new stores and consolidated the transformation to the “with you” commercial model with over 845 new-generation establishments ● EROSKI is the second food distributor in the north of Spain, with a share over 13% Elorrio, 16 June 2020.- The EROSKI group has closed their accounts for the year 2019, as of 31 January 2020, with a very positive result. Their year-end profit reached 45.2 million Euros, increasing by 43.6 millions the figure of the year 2018, affected by the valuation of the terms acquired in the refinancing and the asset valuation adjustment. In the same positive line, the operating profit continued improving in 2019, for the ninth consecutive year, up to 193.8 million Euros, the best operating result in the history of the EROSKI group in relation to sales. Their ebitda also improved and grew by 12.9 million Euros up to 263.6 million Euros. This positive evolution was mainly due to their achievements in various projects aimed at improving efficiency and productivity and to the transformation and renewal of the commercial network. Openings and transformations During 2019 the EROSKI Group continued with the plan to transform the commercial network to the “with you” model which characterizes their new- generation stores. -

Eroski Retakes the Investment in Own Stores with the Opening of A

Nota de prensa It consolidates its leadership in the northern area of the peninsula, where it has a market share of around 18% EROSKI RETAKES THE INVESTMENT IN OWN STORES WITH THE OPENING OF A SUPERMARKET IN SAN SEBASTIAN It intends to make an annual investment of around 100 million Euros in the next few years The opening tomorrow, Thursday, of this new EROSKI supermarket in San Sebastian has involved the creation of 43 jobs and an investment of 1.7 million In recent years it has promoted the opening of franchises and its investment has focused on the transformation of its retail network to the “with you” model, with over 500 new generation stores Donostia-San Sebastian, 17 May 2017.- EROSKI will open this evening a supermarket at number 2 of Plaza Arroka in San Sebastian. After having promoted the development of franchises in recent years, the cooperative is now retaking the opening of own stores. Over the last few years its investment has mainly focused on remodelling its stores to the new “with you” retail model, with over 500 new generation supermarkets and hypermarkets already. This opening marks the beginning of a new own store opening cycle for which, together with the plan to transform existing stores to the “with you” model, EROSKI intends to make an annual investment of around 100 million Euros. This opening of own stores will mainly take place in the northern and eastern regions of the peninsula, from Galicia to Cataluña and the Balearic Islands, where EROSKI is well- established among consumers and represents around 18% of the market share. -

Efficiency in Employee-Owned Enterprises: an Econometric Case Study of Mondragon

IZA DP No. 5711 Effi ciency in Employee-Owned Enterprises: An Econometric Case Study of Mondragon Saioa Arando Monica Gago Derek C. Jones Takao Kato May 2011 DISCUSSION PAPER SERIES Forschungsinstitut zur Zukunft der Arbeit Institute for the Study of Labor Efficiency in Employee-Owned Enterprises: An Econometric Case Study of Mondragon Saioa Arando Mondragon University Monica Gago Mondragon University Derek C. Jones Hamilton College, WDI (Michigan), MCAC (Mondragon) and SKOPE (Oxford) Takao Kato Colgate University, CJEB (Columbia), TCER (Tokyo), CCP (Aarhus) and IZA Discussion Paper No. 5711 May 2011 IZA P.O. Box 7240 53072 Bonn Germany Phone: +49-228-3894-0 Fax: +49-228-3894-180 E-mail: [email protected] Any opinions expressed here are those of the author(s) and not those of IZA. Research published in this series may include views on policy, but the institute itself takes no institutional policy positions. The Institute for the Study of Labor (IZA) in Bonn is a local and virtual international research center and a place of communication between science, politics and business. IZA is an independent nonprofit organization supported by Deutsche Post Foundation. The center is associated with the University of Bonn and offers a stimulating research environment through its international network, workshops and conferences, data service, project support, research visits and doctoral program. IZA engages in (i) original and internationally competitive research in all fields of labor economics, (ii) development of policy concepts, and (iii) dissemination of research results and concepts to the interested public. IZA Discussion Papers often represent preliminary work and are circulated to encourage discussion. -

Annual Report 2019 Non-Financial Information Statement Annual Non-Financial Report Information Statement 2019 Letter from the Chairman Page 4

Annual Report 2019 Non-financial information statement Annual Non-financial Report information statement 2019 Letter from the Chairman page 4 Letter from the Governing Council page 6 EROSKI, 50 years with you page 8 Key data 2019 page 10 1 2 3 4 5 6 7 8 EROSKI “With you” Healthy eating Employees Value chain Environment Social action Transparency business model and network page 12 page 32 page 42 page 54 page 80 page 92 page 116 page 126 Annex page 164 Independent verification reports page 184 Letter from the Chairman 102-14 everal reasons make 2019 a landmark year for EROSKI. shopping, and the growth of the "green" and "local" mar- erate our efforts in this direction, driven by the collective One of them is undoubtedly the celebration of kets. This hyper-communicated society demands rapid internal strength that has enabled us to get this far and S our 50th anniversary. In addition, we have closed changes (at a rate never seen before) from companies which will surely enable us to earn our place in the future a good refinancing agreement and renovated a high in all kinds of sectors, from institutions..., from everyone. by responding to all that society expects and deserves percentage of our network of stores to the "with you" Food does not escape this trend: we associate it with all from EROSKI. model. It has also been a year of notable progress in the good and all the evil that happens to us: health, dis- projects related to health and sustainability, such as ease, pollution (plastics in the seas, palm oil, deforesta- I encourage you to read this annual report to learn more the increasing implementation of Nutri-Score advanced tion, the end of resources...). -

Annual Report 2018

ANNUAL REPORT 1 2018 CONTENTS WE ARE MONDRAGON INTRODUCTION 2 COOPERATION AND SHARED PROGRESS The focus on people is one of the values of MONDRAGON, BASIC FIGURES people who come together to achieve extraordinary feats 4 and grow together. MESSAGE FROM THE CHAIR WE ARE COMMITTED TO SUSTAINABLE DEVELOPMENT 6 Of our businesses, our society and our planet. FINANCE WE HAVE OUR OWN MODEL 2 9 3 Different, inclusive, responsible, fair and solidary: COOPERATIVE. INDUSTRY 15 AND WE LOOK TOWARDS THE FUTURE Proactively, exploring new opportunities that take our experience to the next level. RETAIL 19 HUMANITY AT WORK KNOWLEDGE 25 CERTIFICATIONS 42 PARTICIPATION 2017 2018 Variation (%) BASIC Working shareholders, share capital 1,733 1.795 3,6 FIGURES Number of workers in governing bodies 825 835 1,0 In € million BUSINESS DEVELOPMENT SOLIDARITY 2017 2018 Variation (%) 2017 2018 Variation (%) Total Income 11,936 12.215 2,3 Funds for activities with a social content 25.1 28,0 11,6 Total sales (Industry & Retail) 11,280 11.581 2,7 No. of students in educational centres 11,010 11.248 2,2 Net investments 451 420 -6,9 EBITDA 1,021 1.037 1,6 ENVIRONMENTAL MANAGEMENT 4 5 LABORAL Kutxa Intermediate Resources 21,014 21.841 3,9 2017 2018 Variation (%) No. of ISO 14000 certifications in force 73 75 2,7 LagunAro Equity Fund 6,477 6.169 -4,8 Number of eco-design certifications 4 4 0,0 EMPLOYMENT INVESTMENT IN THE FUTURE 2017 2018 Variation (%) 2017 2018 Variation (%) Average No. of jobs 80,818 81.837 1,3 % funds allocated to R&D from the added value of the Industrial Area 8.6 8,9 3,5 % of shareholders in Industrial Area cooperative workforce 73.8 73,6 -0,4 No. -

Degree in Gastronomy and Culinary Arts

DEGREE IN GASTRONOMY AND CULINARY ARTS 1 BASQUE CULINARY CENTER PIONEERING FACULTY TRAINING We are presenting a training, research futureand innovation project aimed at develo- leaders ping the gastronomy, catering and food sector, clearly focussed on internatio- nal targets. The Basque Culinary Center is the first project in Spain that brings professio- nal gastronomy, cooking and catering activities into university classrooms. First official This relies on the leadership of a gene- ration of chefs at the forefront of world cuisine. university degree in The project comprises a Faculty of Gas- tronomic Sciences, part of Mondragon Unibertsitatea, providing highly qua- gastronomy lified training and a Food and Gastro- nomy Research and Innovation Centre. Students from 18 Feeding different knowledge countries generation 2 A “living” faculty, a unique CAMPUS BCC: experience is waiting for you INNOVATION AND UNIQUENESS The building covers 15,000 square metres # A photo production and video post over five floors in the Miramón Technology production workshop. Park in San Sebastian, harmonising # Work and study areas. perfectly with its natural environment whilst projecting an innovating, eye-catching and # Library. daring image. # Auditorium. A functional building, equipped with the best # Some other formative workshops available equipment for streamlined and practical to the students. studies. From the perspective of sustainability, it incorporates active and passive measures to # Practical cookery room. save energy such as using Renewable Energies.