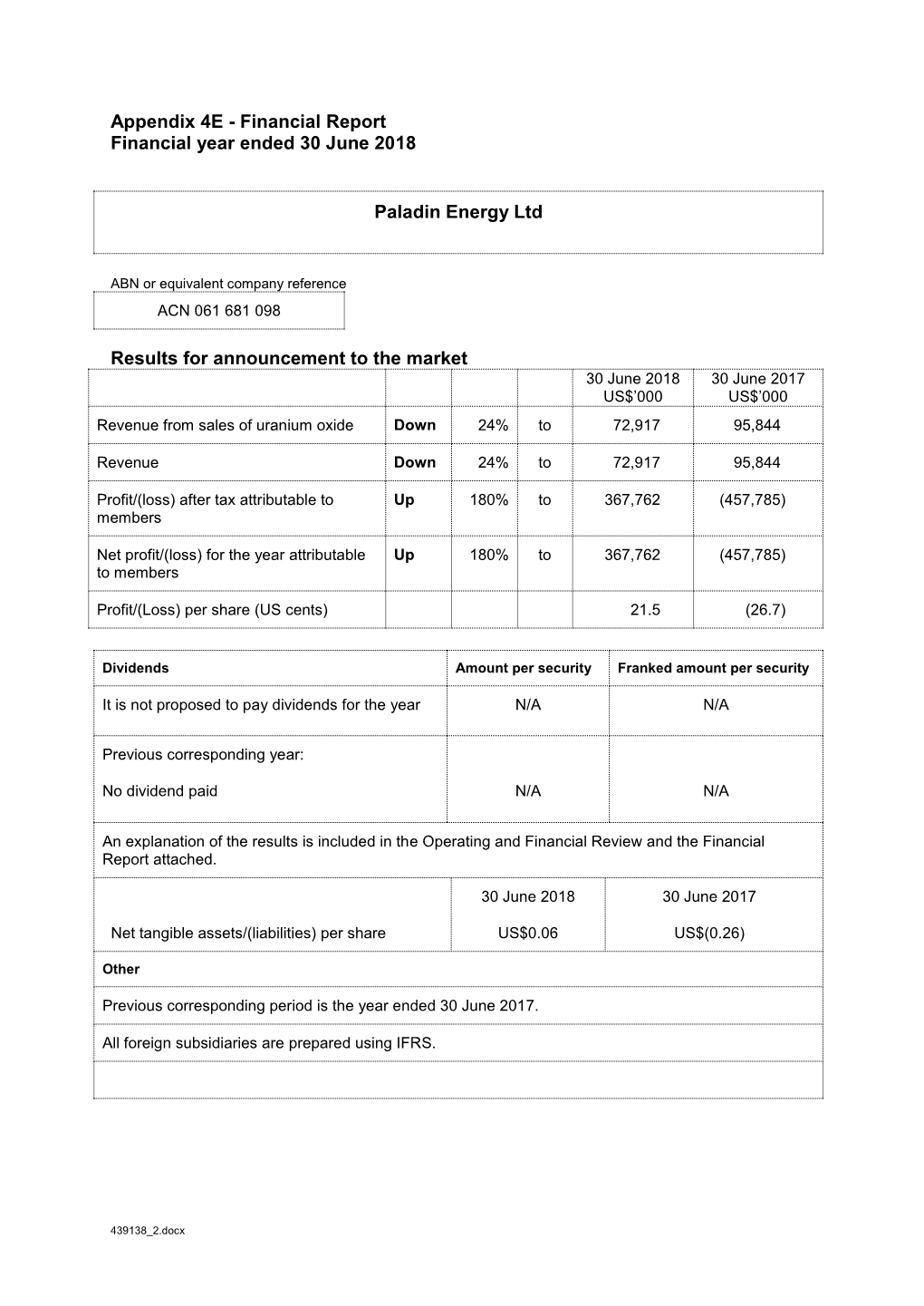

Paladin Energy Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Toro Energy Limited (TOE) Initiating Coverage

Toro Energy Limited (TOE) Initiating coverage November 2012 WHO IS IIR? Independent Investment Research Pty Ltd, “IIR” is an independent investment research house in Australia. IIR specialises in the analysis of industry trends, and high quality commissioned research. IIR was established in 2004 under Aegis Equities Holdings to provide investment research to a select group of customers. Since March 2010, IIR has operated independently from Aegis by former Aegis staff to provide customers and subscribers unparalleled research website, that covers listed and unlisted managed investments, resource companies, ETFs, property, structured products, and IPO’s. DISCLAIMER This publication has been prepared by Independent Investment Research Holdings Pty Limited trading as Independent Investment Research (“IIR”) (ACN 155 226 074), an Australian Financial Services Licensee (AFSL no. 420170). IIR has been commissioned to prepare this independent research report (the “Report”) and will receive fees for its preparation. Each company specified in the Report (the “Participants”) has provided IIR with information about its current activities. While the information contained in this publication has been prepared with all reasonable care from sources that IIR believes are reliable, no responsibility or liability is accepted by IIR for any errors, omissions or misstatements however caused. In the event that updated or additional information is issued by the “Participants”, subsequent to this publication, IIR is under no obligation to provide further research unless commissioned to do so. Any opinions, forecasts or recommendations reflects the judgment and assumptions of IIR as at the date of publication and may change without notice. IIR and each Participant in the Report, their officers, agents and employees exclude all liability whatsoever, in negligence or otherwise, for any loss or damage relating to this document to the full extent permitted by law. -

A Natural Hub for Resource Capital

Sector Profile /Resources A natural hub for resource capital Access capital with confidence, via ASX ASX is a world leader in resource capital raising, with over 145 years’ experience of funding the industry. Today, it provides access to a sophisticated network of investors, analysts and advisers, and an unrivalled depth of knowledge. Listing with ASX allows you to join a powerful peer group, including several of the world’s largest diversified and specialised resource companies such as Rio Tinto, Fortescue Metals Group, BHP and Woodside Petroleum, as well as many successful mid-tier producers and junior miners. Developing exploration projects requires the capital equity markets can provide, and ASX investors have supported over 350 resource listings since 2009. Resource and energy companies typically choose to list From junior explorers to world leaders with ASX because it offers: With over 900 resource companies involved in mineral exploration, x The opportunity to be part of a world-class peer group, alongside development and production in over 80 countries, this is ASX’s largest some of the world’s leading resource companies and a strong group industry sector by number of companies. of junior explorers. Listings from abroad are also popular options. MMG Ltd, a Hong Kong x Access to one of the world’s largest pools of investable funds – based diversified metals and mining company, chose to list on ASX and the largest in Asia – including retail and institutional investors. in 2015 after initially listing on the Hong Kong Stock Exchange (HKEX). x A main board listing, broadening investor reach and credibility. -

ETO Listing Dates As at 11 March 2009

LISTING DATES OF CLASSES 03 February 1976 BHP Limited (Calls only) CSR Limited (Calls only) Western Mining Corporation (Calls only) 16 February 1976 Woodside Petroleum Limited (Delisted 29/5/85) (Calls only) 22 November 1976 Bougainville Copper Limited (Delisted 30/8/90) (Calls only) 23 January 1978 Bank N.S.W. (Westpac Banking Corp) (Calls only) Woolworths Limited (Delisted 23/03/79) (Calls only) 21 December 1978 C.R.A. Limited (Calls only) 26 September 1980 MIM Holdings Limited (Calls only) (Terminated on 24/06/03) 24 April 1981 Energy Resources of Aust Ltd (Delisted 27/11/86) (Calls only) 26 June 1981 Santos Limited (Calls only) 29 January 1982 Australia and New Zealand Banking Group Limited (Calls only) 09 September 1982 BHP Limited (Puts only) 20 September 1982 Woodside Petroleum Limited (Delisted 29/5/85) (Puts only) 13 October 1982 Bougainville Copper Limited (Delisted 30/8/90) (Puts only) 22 October 1982 C.S.R. Limited (Puts only) 29 October 1982 MIM Holdings Limited (Puts only) Australia & New Zealand Banking Group Limited (Puts only) 05 November 1982 C.R.A. Limited (Puts only) 12 November 1982 Western Mining Corporation (Puts only) T:\REPORTSL\ETOLISTINGDATES Page 1. Westpac Banking Corporation (Puts only) 26 November 1982 Santos Limited (Puts only) Energy Resources of Aust Limited (Delisted 27/11/86) (Puts only) 17 December 1984 Elders IXL Limited (Changed name - Foster's Brewing Group Limited 6/12/90) 27 September 1985 Queensland Coal Trust (Changed name to QCT Resources Limited 21/6/89) 01 November 1985 National Australia -

QLD Resources Sector Outlook

Sustainable Technologies in the Mining Sector Brisbane 15 September 2014 QLD Resources sector outlook David Rynne Director Economic and Infrastructure Policy Presentation outline > Overview of the QRC > Tough market conditions and industry’s positioning > Long term demand fundamentals for resources > State and Federal Government policy reform agenda Who is the Queensland Resources Council? > The Queensland Resources Council (QRC) is a not-for-profit peak industry association representing the commercial developers of Queensland’s minerals and energy resources > 79 full members – explorers, miners, mineral processors, site contractors, oil and gas producers, electricity generators > 161 service members - providers of goods or services to the sector > State-based multi-commodity advocacy group formed in 2003 as successor to the Queensland Mining Council Aberdare Collieries Civil Mining and Construction Kalimati Coal Company Rockland Resources Adani Mining Coalbank Linc Energy Santos/TOGA 79 Allegiance Coal Cockatoo Coal Lucas Group Senex Energy full Altona Mining ConocoPhillips Australia Macmahon Holdings Shell Development (Australia) members Anglo American Downer EDI Mining Mastermyne Sibelco Australia Anglo American Exploration Eagle Downs Coal Mgt Metallica Minerals Sojitz Coal Mining Aquila Resources Ensham Resources MetroCoal Stanmore Coal Areva Resources Australia ERM Power Millmerran Power Mgt Summit Resources 161 Arrow Energy Evolution Mining Minerals and Metals Group Thiess service Bandanna Energy Exco Resources Mitsubishi Development -

Queensland's Energetic Future – at Risk from the Activists

QUPEX Lunch meeting 8 July 2014 Queensland’s energetic future – at risk from the activists Michael Roche Chief Executive About the Queensland Resources Council > The Queensland Resources Council (QRC) is a not-for-profit peak industry association representing the commercial developers of Queensland’s minerals and energy resources > 82 full members – explorers, miners, mineral processors, site contractors, oil and gas producers, electricity generators > 169 service members - providers of goods or services to the sector > Multi-commodity, state-based advocacy body formed in 2003 as successor to the Queensland Mining Council > Four CSG majors on QRC board. Paul Zealand (Origin) a QRC VP. Aberdare Collieries Civil Mining and Construction Kalimati Coal Company Rockland Resources Adani Mining Coalbank Leighton Contractors Santos/TOGA 82 Allegiance Coal Cockatoo Coal Linc Energy Senex Energy full Altona Mining ConocoPhillips Australia Lucas Group Shell Development (Australia) Anglo American Downer EDI Mining Macmahon Holdings Sibelco Australia members Anglo American Exploration Eagle Downs Coal Mgt Mastermyne Sojitz Coal Mining Aquila Resources Ensham Resources Metallica Minerals Stanmore Coal Areva Resources Australia ERM Power MetroCoal Summit Resources Arrow Energy Evolution Mining Millmerran Power Management Thiess 169 Bandanna Energy Exco Resources Minerals and Metals Group U & D Mining Industry service (Australia) Beach Energy Glencore Coal Mitsubishi Development Vale members Bengal Coal Glencore Copper New Hope Group Valiant Resources -

~IVIEI::.. 3Rd March 2012

~IVIEI::.. 3rd March 2012 Tim Bryant Secretariat Senate Economics Legislation Committee Parliament House CANBERRA ACT 2600 Dear Tim Senate Economics Committee Inquiry into the Minerals Resource Rent Tax - Questions on Notice Thank you for the opportunity of providing separate responses to various Questions on Notice asked at the Senate Economics Committee hearing held on 21 February 2012. AMEC would also like to provide some additional and relevant comments concerning the MRRT for the consideration of the Committee. Q from the Chair, page 56- How many small miners are currently making an annual profit of more than $75 million a year? Response In respect of the MRRT legislation, AMEC considers that a small miner should be defined as a miner producing less than ten million tons of iron ore or coal per annum. 1 2 According to Intierra , in the calendar year 2010 there were six iron ore producers and ten coal producers in production in this category. Examining the most recent annual reports of the iron ore3 producer's shows three of the six iron ore producers made a "company profit" in excess of $75 million. Four of these companies are single commodity producers (iron ore) while the other two produce other commodities. AMEC is unable to separate any iron ore profit from the balance of the company profits in the later two cases. Of the two iron ore companies mentioned by me in the hearing on 21 February, BC Iron only entered production in the first half of the 2011/12 financial year and therefore full annual financial data is unavailable. -

Deloitte WA Index 2021 Diggers & Dealers Special Edition

Deloitte WA Index 2021 Diggers & Dealers Special Edition A review of Western Australian companies listed on the Australian Securities Exchange 1 Deloitte WA Index 2021 | Diggers & Dealers Special Edition 2 Deloitte WA Index 2021 | Diggers & Dealers Special Edition Contents Executive summary 4 Deloitte WA Index Top Movers 2021 6 Commodity review 13 Celebrating 30 years – Congratulations to Diggers & Dealers 21 Lithium and the shift to renewables and electric vehicles 23 WA Index Q&A with Peter Bradford, Managing Director and CEO, IGO 26 Does it pay to play it clean? 28 WA’s top 100 listed companies 31 Contact us 34 3 Deloitte WA Index 2021 | Diggers & Dealers Special Edition Executive summary Welcome to the 2021 Diggers & Dealers edition of the Deloitte WA Index. This year the market capitalisation of Western Australian listed entities closed at AU$293.9 billion, increasing a staggering 46% from 12-months prior. This year’s WA Index performance has iron ore, as well as battery-associated markets achieved growth this year, again been a standout on so many fronts. The metals with more environmentally the WA Index outperformed the broader market capitalisation growth highlights conscious applications. ASX All Ordinaries, US S&P 500, FTSE 100 a buoyant economic recovery from the and the Nikkei 225 through the year to 30 initial shocks of the COVID-19 pandemic, Our weighting to the commodity price June 2021. with the comeback clearly aided by the upswing has seen Western Australian strength of commodity prices, particularly companies fair well, -

Copyrighted Material

Index AMP Capital Investors, ASX Trade, 20, 35–37, A 11, 48, 60–61, 69, 74, 164, 175 A2 Milk Company, 117, 218, 220, 222 Atlas Arteria, 230 131, 231 Amplia Therapeutics, 98 Atlas Iron, 94 Abacus Property, 91 Ampol, 235–236, 267 Atlas Trend, 157–158 ABC Learning Centres, Anaconda Nickel, 100–101 90, 295 at-market orders, 170 analysis, 198–205, 213–214 absolute-return equity- Atomo Diagnostics, 188 based funds, 159 Anchorage Capital, 94–95 Auckland International Aconex, 120 Andex Charts, 12, 48–49, Airport, 230, 264 58–59, 60, 83 Actinogen Medical, 72 AusNet Services, 238 Anglo American, 100–101 active exchange-traded Austal, 230 funds (ETFs), announcements, share Australand, 91 prices and, 72–73 256–257 Australia, investing active investing, passive annualised monthly outside, 152–158 investing vs., 148–151 recurring revenue (AMRR), 134 Australian Accounting Adelaide Brighton, 267 Standards Board Ansell, 224, 264 adjust phase, 175 (AASB), 114 Antipodes Global Fund, Australian Agricultural Afterpay, 62, 131, 144, 147 237, 264 Company, 231 ANZ Banking Group, 62, agency risk, 112–113 Australian Competition 74, 112, 218–219, and Consumer AGL Energy, 238, 266 220, 221, 264 Commission (ACCC), agribusiness, 159 AP Eagers, 268 37, 79, 265 Air New Zealand, 230 APA Group, 266 Australian Foundation Allan Gray, 84 Appen, 131, 144, 237, 264 Investment Company (AFIC), 245, 248 Allco Finance Group, ARB, 268 89, 90 Australian Investor Study, Argo Investments, 9–10, 125 Allegra Orthopaedics, 228 245, 247 Australian National allocations, 185–187 Aristocrat -

New Era, New Opportunities for Coal (But You’Re Gonna Have to Fight for Them!)

Central Highlands Development Corporation Turning the corner in coal Emerald, 25 July 2014 New era, new opportunities for coal (but you’re gonna have to fight for them!) Michael Roche Chief Executive Who is the Queensland Resources Council? > The Queensland Resources Council (QRC) is a not-for-profit peak industry association representing the commercial developers of Queensland’s minerals and energy resources > 81 full members – explorers, miners, mineral processors, site contractors, oil and gas producers, electricity generators > 169 service members - providers of goods or services to the sector > Building a network of regional partners around the state, including CHDC Aberdare Collieries Civil Mining and Construction Kalimati Coal Company Rockland Resources Adani Mining Coalbank Leighton Contractors Santos/TOGA 81 Allegiance Coal Cockatoo Coal Linc Energy Senex Energy full Altona Mining ConocoPhillips Australia Lucas Group Shell Development (Australia) Anglo American Downer EDI Mining Macmahon Holdings Sibelco Australia members Anglo American Exploration Eagle Downs Coal Management Mastermyne Sojitz Coal Mining Aquila Resources Ensham Resources Metallica Minerals Stanmore Coal Areva Resources Australia ERM Power MetroCoal Summit Resources Arrow Energy Evolution Mining Millmerran Power Management Thiess 169 Bandanna Energy Exco Resources Minerals and Metals Group U & D Mining Industry service (Australia) Beach Energy Glencore Coal Mitsubishi Development Vale members Bengal Coal Glencore Copper New Hope Group Valiant Resources BHP Billiton -

Issue 149 Western Australian Index a Review of Western Australian Listed Companies on the Australian Securities Exchange

Issue 149 Western Australian Index A review of Western Australian listed companies on the Australian Securities Exchange October 2015 WA’s top 100 listed companies as at 30 September 2015 Last High Low This Last Mkt Cap Mkt Cap Price Price Price EPS Month Month ASX Company Name 30 Sept 15 31 Aug 15 (mth) (yr) (yr) (PoAb) 1 1 WES Wesfarmers Limited 44,074 45,692 39.22 46.95 38.06 2.16 2 2 WPL Woodside Petroleum Ltd. 23,836 26,579 28.93 41.10 27.43 2.43 3 3 S32 South32 Limited 7,267 8,092 1.37 2.45 1.33 -0.27 4 4 FMG Fortescue Metals Group Limited 5,667 5,947 1.82 3.86 1.58 0.10 5 5 ILU Iluka Resources Ltd. 2,593 3,102 6.21 9.18 5.57 -0.13 6 6 BWP BWP Trust 1,985 2,030 3.09 3.44 2.31 0.33 7 12 NST Northern Star Resources Limited 1,602 1,212 2.67 2.72 0.92 0.16 8 8 NVT Navitas Limited 1,496 1,498 3.97 5.61 3.78 0.19 9 16 IGO Independence Group NL 1,294 780 2.53 6.21 2.49 0.33 10 10 AHG Automotive Holdings Groups Limited 1,211 1,257 3.95 4.68 3.45 0.29 11 11 SWM Seven West Media Limited 1,119 1,256 0.74 1.83 0.67 -1.81 12 18 RRL Regis Resources Limited 892 727 1.79 2.20 1.07 0.17 13 14 SFR Sandfire Resources NL 845 951 5.39 6.80 3.74 0.44 14 17 ASB Austal Ltd. -

A Natural Hub for Resource Capital

Sector Profile /Resources A natural hub for resource capital Access capital with confidence, via ASX ASX is a world leader in resource capital raising, with nearly 150 years experience of funding the industry. Today, it provides access to a sophisticated network of investors, analysts and advisers, and an unrivalled depth of knowledge. Listing with ASX allows you to join a powerful peer group, including several of the world’s largest diversified and specialised resource companies such as BHP, RIO, Woodside Petroleum and Fortescue Metals Group, as well as many successful mid-tier producers and junior miners. Developing exploration projects requires the capital equity markets can provide, and ASX investors have supported over 350 resource IPOs in the past 10 years. Resource and energy companies typically choose to list From junior explorers to world leaders with ASX because it offers: With approximately 800 resource companies involved in mineral x The opportunity to be part of a world-class peer group, alongside exploration, development and production in over 80 countries, this some of the world’s leading resource companies and a strong group is ASX’s largest industry sector by number of companies and total of junior explorers. market capitalisation. x Access the one of the largest and fastest growing pension pools Listings from abroad are also popular options. Recent listings include globally, with strong retail and institutional presence. the Canadian miner Kirkland Lake Gold that listed on ASX in 2017 x A main board listing, broadening investor reach and credibility. on the back of its growing presence in Australia. This followed on from listings on both the Toronto Stock Exchange (TSX) and New York Stock x Opportunity to be part of specific gold and resources indices, Exchange (NYSE). -

Australian Investment Into Africa a Change in Direction

Australian investment into Africa A change in direction Deloitte Western Australian Stock Exchange Index - African Mining Indaba Special Edition February 2015 AFRICAN MINING INDABA 2015 2 Western Australia Stock Exchange Index - February 2015 AFRICAN MINING INDABA 2015 Table of contents This publication contains general information only, and none of Executive summary ....................................................................................................................4 Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the ‘Deloitte Network’) is, by means of this publication, rendering professional advice or services. Changing Australian investment into Africa - the CEO perspective .............................................6 Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte movers and shakers ....................................................................................................12 Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this publication. Commodity and precious metal prices .....................................................................................22 About Deloitte Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private Performance of global financial markets ..................................................................................24 company