AIA Group (1299 HK)

Total Page:16

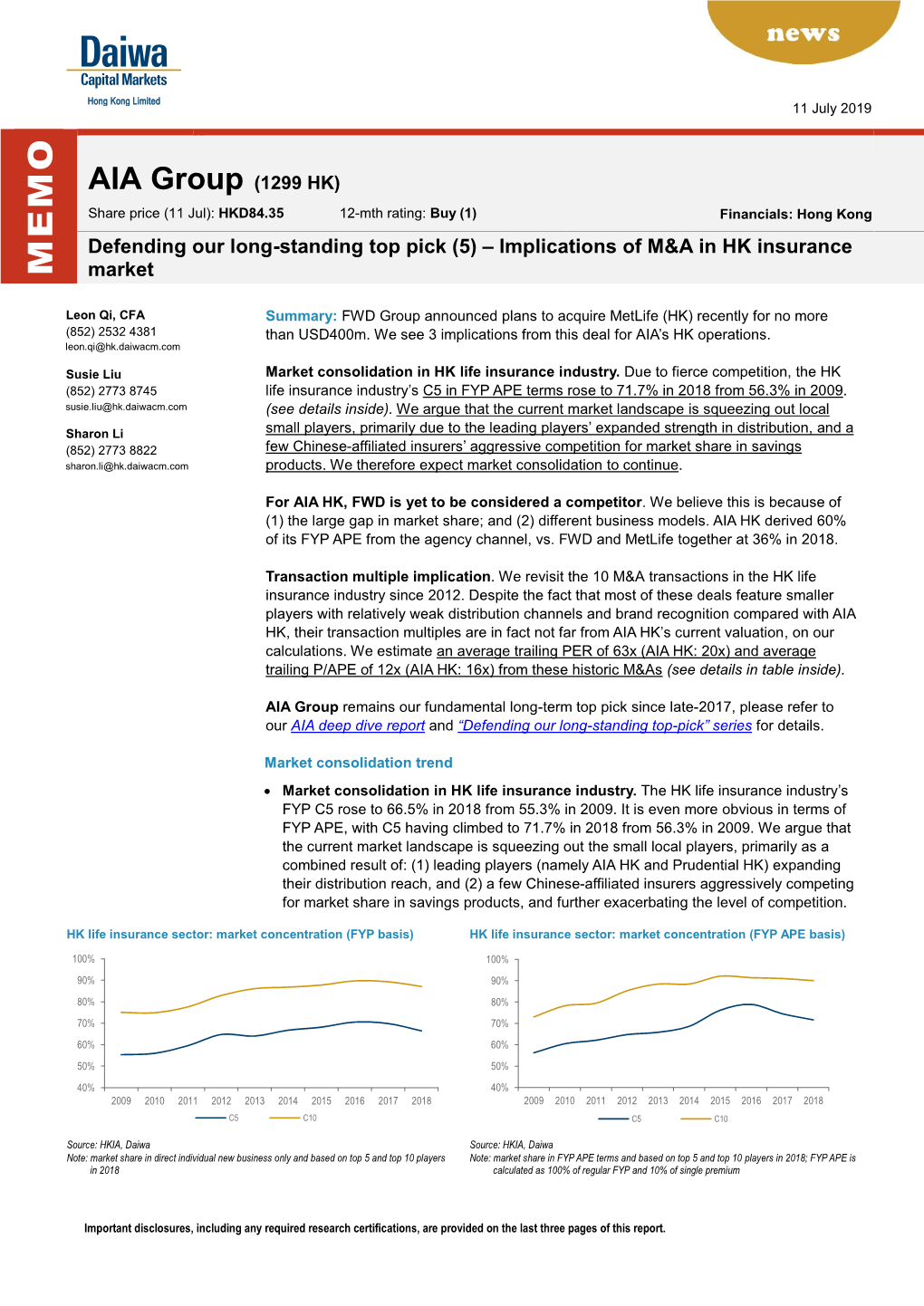

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Post Event Report

presents 9th Asian Investment Summit Building better portfolios 21-22 May 2014, Ritz-Carlton, Hong Kong Post Event Report 310 delegates representing 190 companies across 18 countries www.AsianInvestmentSummit.com Thank You to our sponsors & partners AIWEEK Marquee Sponsors Co-Sponsors Associate Sponsors Workshop Sponsor Supporting Organisations alternative assets. intelligent data. Tech Handset Provider Education Partner Analytics Partner ® Media Partners Offical Broadcast Partner 1 www.AsianInvestmentSummit.com Delegate Breakdown 310 delegates representing 190 companies across 18 countries Breakdown by Organisation Institutional Investors 46% Haymarket Financial Media delegate attendee data is Asset Managemer 19% independently verified by the BPA Consultant 8% Fund Distributor / Private Wealth Management 5% Media & Publishing 4% Commercial Bank 4% Index / Trading Platform Provider 3% Association 2% Other 9% Breakdown of Institutional Investors Insurance 31% Endowment / Foundation 27% Corporation 13% Pension Fund 13% Family Office 8% Breakdown by Country Sovereign Wealth Fund 6% PE Funds of Funds 1% Mulitlateral Finance Hong Kong 82% Institution 1% ASEAN 10% North Asia 5% Australia 1% Europe 1% North America 1% Breakdown by Job Function Investment 34% Finance / Treasury 20% Marketing and Investor Relations 19% Other 11% CEO / Managing Director 7% Fund Selection / Distribution 7% Strategist / Economist 2% 2 www.AsianInvestmentSummit.com Participating Companies Haymarket Financial Media delegate attendee data is independently verified by the BPA 310 institutonal investors, asset managers, corporates, bankers and advisors attended the Forum. Attending companies included: ACE Life Insurance CFA Institute Board of Governors ACMI China Automation Group Limited Ageas China BOCOM Insurance Co., Ltd. Ageas Hong Kong China Construction Bank Head Office Ageas Insurance Company (Asia) Limited China Life Insurance AIA Chinese YMCA of Hong Kong AIA Group CIC AIA International Limited CIC International (HK) AIA Pension and Trustee Co. -

China Insurance Sector

China / Hong Kong Industry Focus China Insurance Sector Refer to important disclosures at the end of this report DBS Group Research . Equity 1 Nov 2017 Multi-year value growth ahead HSI: 28,336 • Strong growth potential back by C-ROSS, favourable policy direction, and structural drivers ANALYST • Favourable asset/liability mismatch position Ken SHIH +852 2820 4920 [email protected] bodes well under a rising rate environment; China lifers’ book value is set to rise Keith TSANG CFA, +852 2971 1935 nd [email protected] • Impact from 2 phase of auto insurance pricing reform expected to be more severe; online insurers considered to be a disruptive force Recommendation & valuation • Initiating coverage on China Insurance sector. Top picks: China Taiping (966 HK), CPIC (2601 HK), and C losing Targe t FY17F Ping An (2318 HK). Top SELLs: PICC P&C (2328 HK), Stock Ticker Rating Price Price PB Yield ROE and China Re (1508 HK) (HKD) (HK D) (X) (%) (% ) Spotlight on value enhancement: We believe China’s low Ping A n - H 2318 H K BUY 68. 1 86. 0 2.4 1.5 17.8 insurance coverage, launch of China Risk-Oriented Solvency C hina Life - H 2628 H K BUY 25. 8 32. 0 1.9 1.8 9.6 System (C-ROSS), and policy guidance will continue to direct China Taiping 966 HK BUY 25.1 38.0 1.4 1.1 8.9 China life insurers to refocus on traditional life products and C hina Pacific - H 2601 HK BUY 37. 7 54. 0 2.0 2.8 11.1 value enhancement. -

Asian Insurance Industry 2019 Gearing up for Regulatory Complexities

Asian Insurance Industry 2019 Gearing Up for Regulatory Complexities OVERVIEW & METHODOLOGY This report, in its sixth iteration, analyzes Asia’s life insurance industry through the PRODUCT DETAILS asset management lens. It provides both qualitative and quantitative information, including life insurance assets and premiums, asset allocations, investment practices, Included with Purchase and outsourcing to affiliated and third-party asset managers. The report discusses y Digital copy and hardcopy in color both institutional (general account) and retail (separate account or investment-linked y Online access to five related reports product) segments, and covers China, Taiwan, Hong Kong, Korea, Singapore, Thailand, y Unlimited online firm-wide access Indonesia, and Malaysia. y Exhibits in Excel The report also details key factors that influence insurers’ investments, such as y Key findings regulations, asset-liability management, products, distribution landscapes, and other y Analyst support key developments. Besides covering three region-wide themes—retirement products, y Interactive Report Dashboards insurers’ alternative investments, and outsourcing—the report provides in-depth analysis of Asia ex-Japan’s insurance markets, capturing trends in both chart and Interactive Report Dashboards text forms. Experience Cerulli’s digital analytics platform and explore interactive data from this report USE THIS REPORT TO 1. Asian Insurance Investment Landscape: Analyze five years of historical data that y Review the opportunities for asset managers -

2017 Life Insurance Conference of China Thank You to Our Sponsors

2 2017 Life Insurance Conference of China Thank You to Our Sponsors Elite Sponsors Sponsors Media Sponsors ORGANIZING COMMITTEE CHAIRMAN IAN J. WATTS, LIMRA/LOMA MEMBERS NING SHOUBO, Sunshine Life Insurance Co., Ltd. ZHANG KE, Taiping Life Insurance Co., Ltd. HU GUOPING, Pearl River Life Insurance Co., Ltd. HUANG MIN, Minsheng Life Insurance Co., Ltd. YU NING, Aviva Cofco Life Insurance Co., Ltd. SUN XIAOHONG, Aeon Life Insurance Co., Ltd. 2017 Life Insurance Conference of China 3 2017 Antitrust Policy and Caution Each person attending this function must be mindful of the constraints imposed by applicable antitrust laws. Some personnel here today represent companies that are in direct business competition with one another. This meeting’s purpose is to provide a forum for the free exchange of ideas on the designated topics. It is not the purpose of this meeting to reach any agreement that could have anticompetitive effects. You can avoid antitrust compliance problems by following simple guidelines: • Stick to the published agenda. • Pricing, premiums, and benefits to be offered or terminated are competitively sensitive information which competitors should not exchange or discuss with each other. Never take a poll of views or make a collective agreement on these issues. • Always retain your right to make an independent judgment on behalf of your company. LIMRA and LOMA are dedicated to the purpose of assisting all of their members to achieve their competitive potential. 4 2017 Life Insurance Conference of China 2017 Life Insurance Conference of China t TUESDAY, OCTOBER 31 u 11:00 a.m. – 12:30 p.m. -

New Group Capital Rule to Boost Hong Kong Insurance Market

Hong Kong Insurance BEST’S COMMENTARYOur Insight, Your Advantage. September 3, 2020 New Group Capital Rule to Boost Hong Kong Insurance Market Hong Kong’s Insurance Authority (IA) launched an industry-wide consultation on a proposed New proposed Group Capital Rule (GCR) on 19 August 2020. This proposed regulation, which will enhance the IA’s supervision of insurance holding companies, is expected to be credit positive for insurance rule to groups in the Hong Kong insurance industry. AM Best considers the introduction of the GCR – which will augment the current regulatory framework to allow the IA to monitor multinational empower insurance groups on a group basis – to be beneficial to the group-wide risk and capital the regulator management culture of insurance entities. The closer collaboration between the regulators across jurisdictions will also help to reduce compliance costs for the industry. with greater supervisory The IA acts as the group supervisor to several multinational insurance organisations, including AIA Group Limited (AIA), Prudential plc (Prudential), and FWD Group. Among authority over these, AIA and Prudential have been identified as internationally active insurance groups insurance according to Common Framework for the Supervision of Internationally Active Insurance Groups (ComFrame) criteria set out by the International Association of Insurance Supervisors holding (IAIS). As the regulator of a group’s main insurance operations domiciled in Hong Kong, companies the IA currently takes an indirect approach that mainly involves the continual fit and proper assessments of the insurance holding companies’ ability to manage their subsidiaries, as well as liaison and cooperation with other regulators of a group’s member operations. -

CORPORATE / ASSOCIATE MEMBERS LIST AUSTRALIA Tal

CORPORATE / ASSOCIATE MEMBERS LIST AUSTRALIA Marco Antonio Rossi Prime Islami Life Insurance Tal Life Limited President Ltd. Brett Clark Kazi Mohammad Mortuza Ali Group Chief Executive Officer CANADA Chief Consultant to the Board Reinsurance Group of BAHRAIN America, Incorporated The General Insurance Paul Nitsou Arab Insurance Group - Corporation of India (GIC Executive Vice President ARIG Global Accounts Re) Yassir Albaharna Alice Geevarghese Vaidyan Chief Executive Officer GERMANY Chairman-cum-General SAP Manager Trust Holdings Robert Cummings Ghazi Kamel Abu Nahl Global Head of Insurance IRAN Group Chairman Amin Reinsurance Company HONG KONG S. Mostafa Kiaie BANGLADESH AIA Group, Ltd. Managing Director & Board Green Delta Insurance Mark E. Tucker Member Company, Ltd. Group Executive Chairman Forhad Abbas Hussain and Chief Executive Officer JAMACIA Senior Executive Director, ICWI Group, Ltd. Reinsurance and Specialized FWD Group Management Dennis H. Lalor Underwriting Division Holdings Limited Chairman Julian Lipman BERMUDA Group Chief Operating Officer JAPAN Arch Capital Group, Ltd. Equinix Constantine "Dinos" Iordanou INDIA David Wilkinson Chairman, President and Chief ICICI Lombard General Senior Director, Asia Pacific Executive Officer Insurance Company, Ltd. Lead, Vertical Marketing Bhargav Dasgupta Assured Guaranty Ltd. Managing Director and Chief Mitsui Sumitomo Insurance James M. Michener Executive Officer Company, Ltd. General Counsel Takeo Inokuchi IndiaFirst Life Insurance Senior Advisor BHUTAN Company Ltd Royal Insurance R. M. Vishakha Sompo Japan Nipponkoa Managing Director and Chief Corporation of Bhutan Ltd. Insurance Inc. Executive Officer Namgyal Lhendup Keiji Nishizawa Chief Executive Officer President and Chief Executive Life Insurance Corporation Officer BRAZIL of India Brazilian Insurance V.K. Sharman Confederation (CNseg) Chairman Sumitomo Life Insurance NETHERLANDS Company Achmea SPAIN Masahiro Hashimoto Robert Otto MAPFRE S.A. -

2020 Global Benefits Financing Matrix and Poolable Coverages

2020 Global benefits financing matrix and poolable coverages Complete listing of the nine global benefits networks and their affiliated insurers across 212 countries and territories 2020 Global benefits financing matrix and poolable coverages Zurich Global AIG Global Allianz Global Swiss Life Country AIA Generali GEB IGP Insurope Maxis GBN Employee Benefits Network Benefits Global Solutions Solutions Number of countries and territory 19 120 86 125 68 105 116 77 135 members Afghanistan None None None None None None None None None SIGAL Life UNIQA Partner not Albania None None None None None Group Austria Life, None None disclosed Albania (L,A,D) AXA Assurances Salama, Globus Algeria None None None Macir Vie (L,A,D) None None Algérie Vie SPA None Networks (L,A,M) (L,A,D,M) Andorra None None None None None None None None Zurich Spain Sanlam Pan-Africa, Saham Angola Saham Angola Fidelidades, Globus Angola None Saham Angola None None None None Seguros (L,A,D) Seguros Network (L,A,D,M) Seguros (L,A,D,M) Pan-American Life Pan American Life Pan American Life Antigua and Sagicor Life Insurance Company None Insurance Group None None None None Insurance Group Barbuda (L,A,D,M) of the Eastern (L,A,D,M) (L,A,D,M) Caribbean (L,A,D,M) HSBC Seguros Allianz Argentina Galicia Vida Prudential Seguros La Caja De Seguros de Vida Argentina Argentina None Compañía de SMG LIFE (L,A,D) MetLife Argentina Compañía de Zurich (L,A,D) S.A. (L,A,D) (L,A,D) (L,A,D)/Prudential Seguros S.A. -

Fwd Insurance Targets Philippines Top 5

FWD INSURANCE TARGETS PHILIPPINES TOP 5 PROJECT SPONSOR GOING FORWARD WITH FWD Written by: Fran Roberts Produced by: Kiron Chavda Written by: Fran Roberts Produced by: Kiron Chavda 3 he Philippine life insurance industry is T poised to post one of the fastest growth rates in the next nine years among emerging markets, and is expected to register a compound annual growth rate (CAGR) of 9.1% from 2017 to 2025. FWD Life Insurance is certainly looking to leverage on this predicted growth, as Rogelio ‘Nooky’ Umali, CTO, explains: “There’s a distrust of insurance companies – only about 3% of Philippines have life insurance. This is a market prime for FWD because we are Market newcomer changing that perception.” FWD Insurance has Indeed, a 97% market penetration opportunity is one that will appeal already disrupted to any company. FWD Insurance’s the Philippine advantage is how it utilises disruptive insurance sector IT to offer unique products to its with its innovative clients, as well as offering them first-class customer service. IT developments as the company CREATING RIPPLES looks to change the Headquartered in Hong Kong and with a pan-Asian presence, FWD industry’s image Insurance is a comparatively new player in the Philippines, having 4 commenced operations there in others are now asking, ‘How is 2014. Despite this working for FWD?’ It’s eating this, the company is already having a up their share,” Umali continues. dramatic impact. “In the Philippines, “Three years ago, we were nobody; there are a lot of terror activities and last year we were already number insurance companies were not 12 in the Philippines. -

News Release

News release a Swiss Re to invest up to USD 425 million in FWD Group Contact: Zurich, 16 October 2013 — Swiss Re announces that it has entered into an agreement with Pacific Century Group to invest Media Relations, Zurich Telephone +41 43 285 7171 up to USD 425 million in FWD Group, confirming Swiss Re's commitment to the High Growth Markets. Corporate Communications, Hong Kong Telephone +852 2582 3912 Swiss Re's investment in FWD Group (FWD) consists of an initial Corporate Communications, New York investment for a 12.3% stake in FWD and a commitment for additional Telephone +1 914 828 6511 investments to fund FWD's planned expansion across Asia. Investor Relations, Zurich Telephone +41 43 285 4444 The total transaction size, including committed capital, is USD 425 million. Swiss Re's ultimate ownership stake in FWD will be determined based on the amount of committed capital eventually Swiss Re Ltd Mythenquai 50/60 deployed. P.O. Box CH-8022 Zurich In February 2013, Asia-based private investment group Pacific Century Group completed the acquisition of ING's life insurance Telephone +41 43 285 2121 operations in Hong Kong, Macau, and Thailand, and the general Fax +41 43 285 2999 www.swissre.com insurance and pensions operations in Hong Kong. The operations were renamed "FWD" in August 2013. Swiss Re's Group CEO Michel M. Liès says: "FWD is an exciting new regional player which will bring attractive insurance products to help address the rapidly growing needs of consumers and significant protection gaps across Asia." Swiss Re's Group Strategy Officer John R. -

Evaluatie Uitsluitingenbeleid

Memo Onderwerp Evaluatie Uitsluitingenbeleid Datum 17 januari 2019 Pagina 1 van 5 1 Inleiding Beide fondsen hebben in 2017 een uitsluitingenbeleid vastgesteld. De fondsen sluiten investeringen in bedrijven uit die in hun bedrijfsvoering of producten en diensten niet aan de minimale eisen voor een duurzaam beleid voldoen. In het Beleid Duurzaam Beleggen zijn hier zes criteria voor gedefinieerd. Niet naleven van de UN Global Compact richtlijnen. Betrokken bij de productie van controversiële wapens. De fondsen sluiten – conform het wettelijk verbod - bedrijven uit die betrokken zijn bij de productie van clustermunitie. Daarnaast hanteren de fondsen een uitsluitingsbeleid op overige controversiële wapens die niet onder de wetgeving vallen (zoals biologische / chemische wapens, witte fosfor, verarmd uranium en kernwapens). Bedrijven die meer dan 5% van hun omzet uit de productie van deze wapens halen worden door de fondsen uitgesloten. Betrokkenheid bij kinderarbeid . De fondsen sluiten bedrijven uit die direct betrokken zijn bij kinderarbeid, en in de productieketen een verhoogd risico hebben op incidenten gerelateerd aan kinderarbeid. Kinderarbeid is ook al één van de uitsluitingsgronden van UN Global Compact, maar met deze additionele controles worden meer bedrijven uitgesloten. Betrokkenheid bij genetisch gemodificeerde planten en zaden. Een hoge score op ESG-controversies. De 10% slechtst scorende ondernemingen per sector, per regio. De fondsen streven er naar om het duurzaamheidsprofiel van de portefeuille te verbeteren. Om dit te realiseren worden ondernemingen beoordeeld op hun duurzaamheidskarakteristieken. De 10% laagst scorende ondernemingen per sector, per regio worden uitgesloten. Voor bovenstaande selectiecriteria wordt de screening van het universum uitgevoerd door Sustainalytics, die per onderneming aangeeft of deze wel of niet moet worden uitgesloten. -

BBA in Insurance, Financial and Actuarial Analysis YOUR DEVELOPMENT

2020 -2021 BBA in Insurance, Financial and Actuarial Analysis YOUR DEVELOPMENT By the time you complete the IFAA Programme, you should be familiar with the purpose, design and application of insurance products, finance and investment tools, as well as accounting, economics, marketing and management, mathematics, statistics and actuarial science. You can also expect to possess the following: • Solid business communication skills; • Effective analytical and problem-solving insight; • Ability to apply learned business knowledge in a corporate environment; • Confidence to propose innovative strategies in a global context; • Awareness of current ethical issues in today’s business world; and • Specific knowledge of actuarial science and insurance, including life and non-life insurance product design, pricing, and risk management. INSURANCE, FINANCIAL AND ACTUARIAL ANALYSIS IFAA Novel investment and insurance products make stability new ways, effectively managing the risk of products related vital in the modern financial security system. The ever - to mortality, morbidity, casualty, pensions and investments. progressing field of actuarial science is a major contributor The IFAA Programme at CUHK has a stellar record of preparing to this stability. Insurance experts today are skilled students for bright careers as actuaries, financial analysts, mathematicians who apply their knowledge to business in risk managers and insurance professionals. OVERVIEW Offered by the Department of Finance and unique in level of recognition offered to universities. Hong Kong, the progressive BBA Programme in Insurance, While rooted in Hong Kong’s institutional environment, Financial and Actuarial Analysis provides comprehensive the programme will give you frequent exposure to broader training in all aspects of actuarial science and insurance international issues and practices. -

Global Insurance Industry Year in Review 2019

GLOBAL INSURANCE INDUSTRY YEAR IN REVIEW 2019 FEBRUARY 2020 Table of Contents Mergers & Acquisitions LIFE SECTOR . 1 North America and Bermuda . 1 UK and Europe . 3 Asia . 4 PROPERTY-CASUALTY SECTOR . 8 North America and Bermuda . 8 UK and Europe . 11 Asia . 14 TRANSACTIONAL LIABILITY INSURANCE . 18. United States . 18 UK and Europe . 20 Insurance Corporate Finance EQUITY CAPITAL MARKETS . 27 DEBT CAPITAL MARKETS . 30 ILS and Convergence Markets PROPERTY-CASUALTY . 35 LIFE AND ANNUITY . 39 United Kingdom . 39 United States . 42 Insurance Regulatory US/NAIC . 47 Impetus from Insurtech May Lead to Changes in Anti-Rebating Law . 47 NAIC Investment-Related Initiatives . 51 Major New Developments Related to Credit for Reinsurance . 56 Update on US Insurance Business Transfer and Division Legislation . 59 New York DFS “Best Interest” Standard for All Life Insurance Products Goes Into Effect While the SEC and NAIC Adopt Rules Addressing Specific Segments of the Market . 64 SECURE Act Signed Into Law . 67 Finding Common Ground – Recent Developments in International Group Supervision . 69 NAIC Begins to Address Cannabis . 72 NAIC Pet Insurance White Paper Released and Pet Insurance Model Act Under Development . 74 Breaking Down Blockchain Implications of Blockchain Technology for the Insurance Industry . 77 UK/BREXIT . 82 ASIA . 85 Technology Insurtech . 93 Cybersecurity . 97 European Case Law Developments UK and Europe . 103 MERGERS & GLOBAL INSURANCE INDUSTRY ACQUISITIONS YEAR IN REVIEW 2019 Mergers and Acquisitions | Property-Casualty Sector | North America and Bermuda LIFE SECTOR North America and Bermuda UK and Europe Asia PROPERTY-CASUALTY SECTOR North America and Bermuda UK and Europe Asia Bancassurance TRANSACTIONAL LIABILITY INSURANCE United States UK and Europe MERGERS & ACQUISITIONS LIFE SECTOR LIFE SECTOR North America and Bermuda Overview Insurance M&A activity in the life and annuity sector remained strong in 2019 .