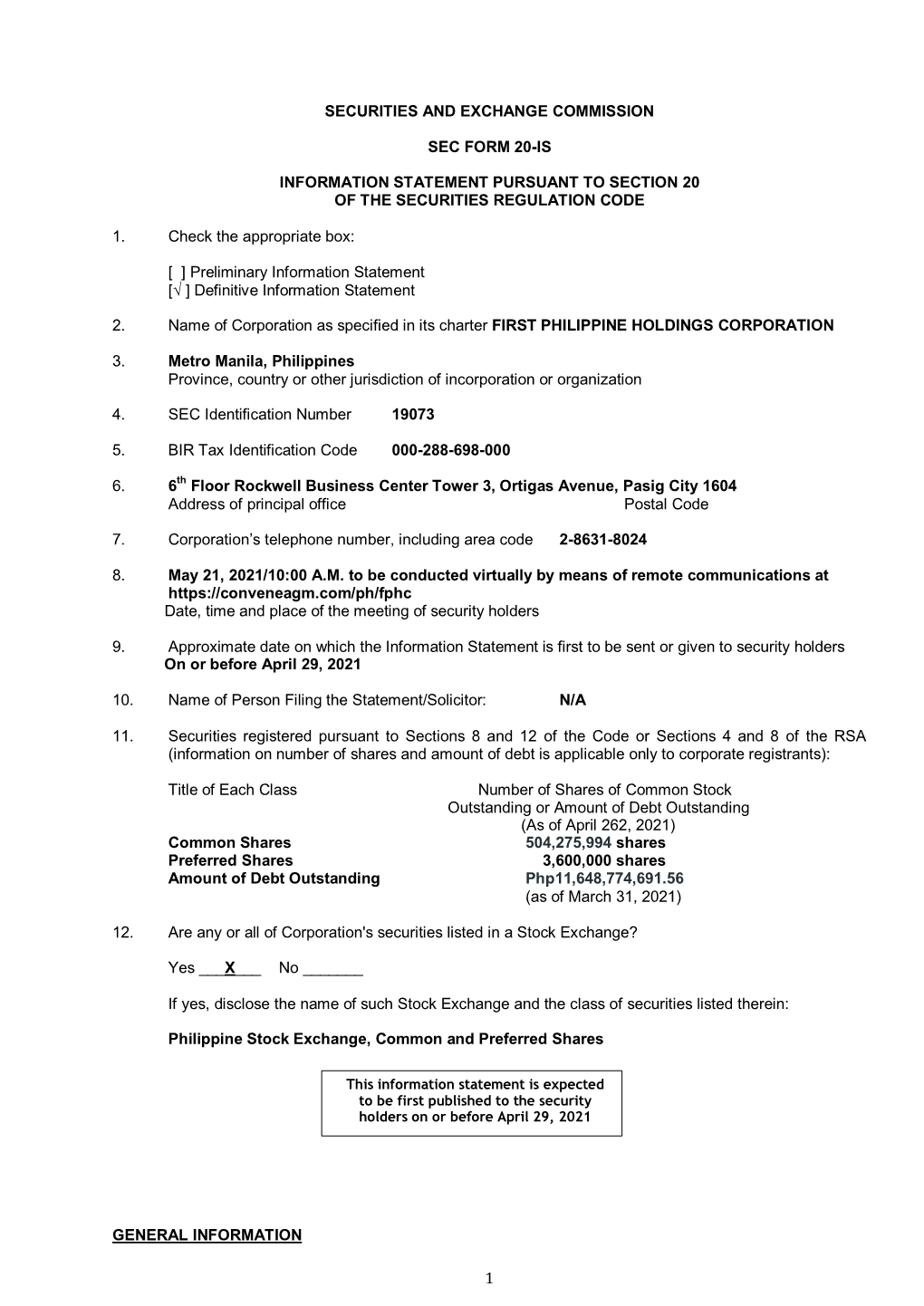

1 Securities and Exchange Commission Sec Form 20-Is

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

KTX: a Success Story Amidst Lockdown, Shutdown Story on Page 4

MARCH 2021 A monthly publication of the Lopez group of companies www.lopezlink.ph http://www.facebook.com/lopezlinkonline www.twitter.com/lopezlinkph Economic impact assessment KTX: A success story amidst lockdown, shutdown Story on page 4 Golden Arrows for The Grove LPZ, ABS-CBN opens up & First Gen …page 3 …page 7 ‘Justice’ is served …page 8 2 Lopezlink March 2021 BIZ NEWS BIZ NEWS Lopezlink March 2021 3 ‘Full steam ahead’ SKY Fiber offers leveled up speeds Exec Movements Three Lopez companies bag Golden Arrow awards EDC launches Green Bond at the same affordable rates FPH greenlights Framework on its 45th anniversary NEW and existing SKY Fiber By Dolly Pasia-Ramos By Frances Ariola subscribers can quickly enhance their productivity and lifestyle appointment Bond Shelf Registration of up and evaluation of the projects, when they maximize SKY Fi- to P15 billion, and the offer and the management of the pro- ber’s leveled up fiber-fast home issuance of an initial tranche of ceeds of the Green Bonds, and internet subscription plans that of Mayol as VP up to P3 billion with an over- subsequent reporting. are even more affordably priced LPZ VP-legal and compliance officer Atty. Maria Amina Amado and risk subscription option of up to P2 Sustainalytics has reviewed than before. THE board of directors management head Carla Paras-Sison billion fixed rate bonds, subject to and issued a Second-Party A P999 monthly fee can now of First Philippine Hold- the approval of the Securities and Opinion on EDC’s Green Bond get subscribers up to 20 Mbps, ings Corporation (FPH) on Exchange Commission (SEC), to Framework. -

Energy Development Corporation

APRIL 2012 www.lopezlink.ph Happy birthday, OML! Chairman emeritus launches new contest. See story on page 2. http://www.facebook.com/lopezlinkonline www.twitter.com/lopezlinkph EDC: King of the hill WHERE in the world is Energy Development Corporation (EDC)? EDC, one of the world’s largest producers of geothermal energy, is exporting its expertise in Chile after bagging its first international concession areas in the South American EDC: King country early this year. Turn to page 6 of the hill Nomination for ABS-CBN drive Summer essentials inspires kids to from Power Plant LAA begins …page 5 ‘bida’ best!…page 4 Mall…page 12 Lopezlink April 2012 NEWS BIZ NEWS Lopezlink April 2012 Birthday thoughts EL3: ABS-CBN finds Meralco shareholders to receive Rockwell Land shares FILIPINO stockholders of The electric utility’s board curities and Exchange Com- preferred shares with a par Meralco, meanwhile, is seek- Meralco shareholders within fulfillment in inspiring Pinoys Meralco as of March 23 will of directors in February 2012 mission (SEC) and the Phil- value of P0.01 each. ing SEC approval to distrib- five trading days after securing ippine Stock Exchange by “We look forward to the ute the property dividends to The following is an excerpt from inspire the Filipino through receive 2.818 shares of Rock- declared its 51% equity in all approvals from the SEC and OML on Wellness well Land Corporation for ev- Rockwell Land as property way of introduction. Rockwell listing of Rockwell Land. We Meralco shareholders. It plans the PSE. Target listing date is the welcome address by ABS-CBN shows that reflect their values, Land proposed to list all its have built one of the strongest to distribute 3.18 billion com- president Eugenio Lopez III dur- that affirm their self-worth ery Meralco share held. -

First Philippine Holdings Corporation

A lopez Group Company April 4, 2013 SECURITIES AND EXCHANGE COMMISSION SEC Building, EDSA Greenhills Mandaluyong City, Metro Manila The management of First Philippine Holdings Corporation (the Company) is responsible for the preparation and fair presentation of the consolidated financial statements as of December 31, 2012 and 2011, and for each of the three years in the period ended December 31, 2012, in accordance with the Philippine Financial Reporting Standards, including the additional components attached therein. This responsibility includes designing and implementing internal controls relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error, selecting and applying appropriate accounting policies, and making accounting estimates that are reasonable in the circumstances. The Board of Directors reviews and approves the consolidated financial statements and submits the same to the stockholders of the Company. SyCip Gorres Velayo & Co., the independent auditors, appointed by the stockholders, has examined the consolidated financial statements of the Company in accordance with Philippine Standards on Auditing, and in its report to the stockholders, has expressed its opinion on the fairness of presentation upon completion of such examination. Signed under oath by the following: ~~n ~ ~J FEDERICO R. LOPEZ / ELPIDIO L. m~~ FRANCIS GILES B. PUNO Chairman of the Board President & -rw Executive Vice President, Treasurer & Chief Executive Officer Chief Operating Officer & Chief Finance Officer l\PR ':G,~~ SUBSCRlBED AND SWORN to before me this,lth ayof Ap~il, 2013, affiants exhibited to me their Competent Evidence of Identity (CEI) and Community Tax Certificate (CTC) Nos. as follows: Name Details of CEI/CTC Issued On/Issued At Federico R. -

ABS-CBN Corporation Sgt

ABS-CBN Corporation Sgt. Esguerra Avenue, Quezon City, Philippines 12 May 2011 Philippine Stock Exchange, Inc. Attn: Ms. Janet A. Encarnacion Head, Disclosure Department 3rd Floor, Philippine Stock Exchange Plaza Ayala Triangle, Ayala Avenue, Makati City Subject: Amendment to “ABS-CBN Completes Sky Cable PDR Sale to STT Communications” Gentlemen / Ladies: We are providing you the amended press statement on the above stated subject, correcting some typographical errors and including a statement on ING Bank NV’s role in the transaction. Thank you. Very truly yours, Paul Michael V. Villanueva, Jr. Compliance Officer for Corporate Governance PRESS RELEASE Release Date : FOR IMMEDIATE RELEASE Reference : Paul Michael Villanueva, Jr. - Head, Treasury and Compliance Officer Tel : 415.2272 local 4322 Email : [email protected] ABS-CBN and Lopez Holdings Complete PDR Sale to STT Communications ABS-CBN Corporation and Lopez Holdings Corporation have completed the sale of PHP2.162 bn Philippine Depositary Receipts (PDRs) over shares in Sky Cable Corporation (SKYCABLE) to a subsidiary of STT Communications Ltd. (STTC), Sampaquita Communications Pte Ltd (Sampaquita). Simultaneously with these transactions, Sampaquita completed its investment in new PDRs covering PHP1.45 billion worth of SKYCABLE PDRs and its subscription to a PHP250 million convertible note issued by SKYCABLE. The investment, which amounts to about P3.862 billion in the aggregate, will give Sampaquita approximately 40% of the economic rights in the cable company. Despite the investment, Lopez Group maintains almost all voting control and an aggregate economic interest of almost 60% in SKY CABLE. The PDRs are issued by Sky Vision Corporation, the holding company of SKYCABLE and a member of the Lopez group of companies. -

Philippines in View Philippines Tv Industry-In-View

PHILIPPINES IN VIEW PHILIPPINES TV INDUSTRY-IN-VIEW Table of Contents PREFACE ................................................................................................................................................................ 5 1. EXECUTIVE SUMMARY ................................................................................................................................... 6 1.1. MARKET OVERVIEW .......................................................................................................................................... 6 1.2. PAY-TV MARKET ESTIMATES ............................................................................................................................... 6 1.3. PAY-TV OPERATORS .......................................................................................................................................... 6 1.4. PAY-TV AVERAGE REVENUE PER USER (ARPU) ...................................................................................................... 7 1.5. PAY-TV CONTENT AND PROGRAMMING ................................................................................................................ 7 1.6. ADOPTION OF DTT, OTT AND VIDEO-ON-DEMAND PLATFORMS ............................................................................... 7 1.7. PIRACY AND UNAUTHORIZED DISTRIBUTION ........................................................................................................... 8 1.8. REGULATORY ENVIRONMENT .............................................................................................................................. -

First-Gen-2016-Annual-Report.Pdf

THE LOPEZ CREDO AND VALUES We, as employees of the Lopez Group In our service to the Filipino people, we of Companies, believe that our primary will be guided by the following distinct reason for being is to serve God and the Lopez Values: Filipino people. Thus, we shall always conduct ourselves in a manner that is • A Pioneering Entrepreneurial Spirit mindful of the long-term mutual benefit • Business Excellence of the Lopez Group, and the various • Unity publics we serve. • Nationalism • Social Justice We will be responsible stewards of all our • Integrity resources, and conscious of our obligation • Concern for Employee Welfare and to present and future generations. Wellness Since 1928, and in the years and We know from generations of experience generations to follow, our commitment that it is by living according to these to the distinctive Lopez Values will not values that a company can be built to last. change as we remain committed to serve our stakeholders. 01 Vision/Mission TABLE OF 02 Why First Gen? 04 Portfolio of Assets 05 Corporate Structure CONTENTS 06 About Our Cover 08 Chairman’s Message 12 President’s Report 18 Natural Gas 26 Geothermal 34 Hydro 40 Wind & Solar 46 Corporate Social Responsibility 58 Board of Directors 62 Senior Management 66 Corporate Governance 69 Financial Report 238 Corporate Directory IBC Shareholder Information and Credits OUR VISION First Gen desires to enhance its position as the leading world-class Filipino energy company. First Gen aims to deliver cost-effective and reliable energy services to customers. First Gen will rise to the challenges of world-class competition. -

Ericsson Provides Bayantel with Ethernet DSL Access for Faster Broadband Services

2005-03-15 11:22 CET Ericsson provides BayanTel with Ethernet DSL Access for faster broadband services Bayan Telecommunications, Inc. (BayanTel), a leading provider of data and communications services in the Philippines, has boosted its wireline business with the deployment of Ericsson's Ethernet DSL Access solution to Metro Manila and major provincial cities. The deployment allows BayanTel to offer high-speed connections to its customers in these areas and offer an enhanced platform of broadband services to a wider market. "The unique scalability of Ericsson's Ethernet DSL Access solution enables us to offer superior performance and high capacities to our customers in a cost efficient way, while investing in an infrastructure that is prepared for the needs of tomorrow," said David M. Rogers, BayanTel senior consultant for network operations. "At the same time, the roll-out of the Ethernet DSL Access solutions expands our reach and extends our capability to deliver high bandwidth, high speed Internet access to key commercial and business centers in Makati and Ortigas," adds Rogers. Currently the most scalable DSLAM on the market, the innovative design of the Ethernet DSL Access secures the possibility to offer triple play services - data, video and voice - to home and office environments in a cost-efficient and future-proof way. "We are pleased that our EDA solution has enabled BayanTel to upgrade their services and to offer advanced services to its customers" said Stefano O. Celsini, President & Country Manager of Ericsson Philippines. "As a long-term partner, we are fully committed to supporting BayanTel as they expand their services further to meet growing customer demand." Ericsson is shaping the future of Mobile and Broadband Internet communications through its continuous technology leadership. -

New Beginnings

NEW BEGInnINGS ANNUAL REPORT 2009 The Lopez Credo We, the Lopez Group of Companies, believe that our primary reason for being is to serve the Filipino people. Thus we shall do business and in all ways act in a manner that will result in the long-term mutual benefit of the Lopez Group and the various publics and communities that we serve. We will be responsible stewards of all our resources, ever mindful of our obligation to present and future generations of Filipinos. In our service to the Filipino people, we will be guided by the following distinct Lopez Values—a pioneering entrepreneurial spirit, business excellence, nationalism, team work, strong work ethic, integrity, social justice, and concern for employee welfare and wellness. We know from generations of experience that it is by living according to these values that a company can be built to last. Since 1928, and in the years and generations to follow, our commitment to the Lopez way of service and the distinctive Lopez values will not change. We will remain committed to serve the Filipino. ABOUT OUR COVER First Holdings experienced ‘New Beginnings’ in 2009 primary of which was the decision to reduce exposure in power distribution, NEW BEGINNINGS and substantially support power generation. Today, First Holdings is taking off from a higher plane—financially stable, organizationally strong, and strategically positioned to benefit from a world of opportunities The Group continues its advocacy for green energy and is making significant investments in clean and renewable energy initiatives, including solar power systems manufacturing. As global competition intensifies, the summit of success is ever rising; but First Holdings has kept pace and responded with even greater vigor to the ANNUAL REPORT 2009 challenges of the moment, embracing the sun and sky daily and determined to see ‘New Beginnings’ to their intended ends. -

Knowledge Channel Powers Through Challenging Times Story on Page 4

NOVEMBER 2020 A monthly publication of the Lopez group of companies www.lopezlink.ph http://www.facebook.com/lopezlinkonline www.twitter.com/lopezlinkph Knowledge Channel powers through challenging times Story on page 4 Economic impact assessment Rockwell Kapamilya ‘TVP’ partners with Christmas streams on TGN Realty presents YouTube …page 2 …page 7 …page 8 2 Lopezlink November 2020 BIZ NEWS BIZ NEWS Lopezlink November 2020 3 Virtual corporate governance training First Gen gets DOE award to Rockwell enters partnership By Carla Paras-Sison FGEN LNG preferred tenderers THE annual corporate gover- develop pump storage project with TGN Realty to develop nance training of directors and By Joel Gaborni for binding invitation to officers of publicly listed com- panies (PLCs) associated with FIRST Gen Corporation has always available when it’s security and stability. the Lopez Group went virtual been awarded a hydro service needed,” said Ricky Carandang, The hydro service contract mixed-use community on Oct. 23 as conducted by the contract by the Department of First Gen vice president. “But gives First Gen, through First tender for charter of FSRU Institute of Corporate Direc- Energy to develop a 120-mega- with a pump storage facility Gen Hydro, five years to con- venture with the family be- one bedroom to three bedrooms tors (ICD). watt (MW) pumped-storage like the one we want to build in duct predevelopment stage FGEN LNG Corporation has Ltd. and Höegh LNG Asia construction, ownership and hind the successful Nepo Cen- sized 44 sq. m. to 142 sq. m. The The continuing education hydroelectric facility in Aya, Pantabangan, we will be able to activities—from a preliminary expanded the list of preferred Pte. -

FOR INAEC... “Whether Local Products Could in 1993, INAEC Took to Regulatory Requirements

MARCH 2012 www.lopezlink.ph Read Story on page 10. http://www.facebook.com/lopezlinkonline www.twitter.com/lopezlinkph to benefit CDO and Iligan scholars. For INAEC, the sky’s the limit “LOOK, up in the sky! It’s a bird…It’s a plane…It’s INAEC!” That doesn’t quite have the ring of the original line from the“Superman” TV series, but gives you an idea what INAEC is. If you’ve ever watched an ABS-CBN newscast, you’ve probably seen INAEC. If you’ve come across stunning photos of a volcano’s crater, that’s INAEC. Read about someone in critical condition who was airlifted to a hospital in x minutes flat? That was also likely thanks to INAEC. Turn to page 6 El Gamma The Grove by Mall Rockwell tops off chooses wonders two towers …page 3 Philippines …page 12 …page 4 Lopezlink March 2012 FEATURES BIZ NEWS Lopezlink March 2012 My sister, my boss Show on PH arts and First Balfour By Angela Lopez Guingona culture airs on KCh IT was at the dinner table one hits 5M safe “ART Republik,” a 30-minute awareness on Philippine art to night when my dad [Lopez program on Philippine arts a wider public by presenting Group Foundation Inc. chair- and culture, made its debut on its creators, the Filipino artists, man Oscar M. Lopez] asked, Knowledge Channel on Febru- whose work reflect our culture,” man-hours “How would you like Cedie ary 28, 2012. Betty Uy-Regala, producer of FIRST Balfour reached 5 mil- Accordingly, best safety prac- to head LGFI?” I thought “We created the show to “Art Republik,” said. -

Final Project Report English Pdf 39.67 KB

CEPF FINAL PROJECT COMPLETION REPORT I. BASIC DATA Organization Legal Name: First Philippine Conservation, Inc. Project Title (as stated in the grant agreement): Strengthening Corporate and Philanthropic Support for Biodiversity Conservation in the Philippines Implementation Partners for this Project: First Philippine Holdings Corporation Project Dates (as stated in the grant agreement): July 1, 2003 – September 30, 2005 Date of Report (month/year): November 2005 II. OPENING REMARKS Provide any opening remarks that may assist in the review of this report. FPCI sees its role as bringing together private corporations, other funding sources, CEPF grantees, and other players. As an intermediary, FPCI would bring the scale, expertise, independence, transparency, and accountability to investments in biodiversity conservation. To be an effective intermediary, FPCI will provide a full range of services required to mobilize funding; to initiate and develop strategies, implementation of management services and delivery of infrastructures, community organizing and enterprise ventures, applied research on habitats and species protection, the use of various instruments such as grants, equity, debt, or endowments. In developing the above role, FPCI sought the CEPF’ s intervention through the “Strengthening Corporate and Philanthropic Support for Biodiversity Conservation in the Philippines Project”. FPCI is supported by the First Philippine Holdings Corporation (FPHC) as part of its corporate social responsibility (CSR). Both are members of the Lopez Group Foundation Inc. which is the hub for the CSR programs of the Lopez Group of companies, a major business conglomerate in the Philippines. III. ACHIEVEMENT OF PROJECT PURPOSE Project Purpose: Philippine business corporations, particularly those coming from the Lopez Group of Companies, are engaged as active allies in and philanthropic supporters of the biodiversity conservation outlined in CEPF's Ecosystem Profiles. -

ABS-CBN News and Current Affairs

MARCH 2011 www.lopezlink.ph Happening on March 13! Story on page 10. www.facebook.com/pages/lopezlink www.twitter.com/lopezlinkph ABS-CBN News and Current Affairs: New challenges PHOTO BY RYAN RAMOS REGINA “Ging” Reyes, formerly the ABS-CBN’s way the company delivered news and issues relevant to North America. Under her leadership, the news bureau North America Bureau chief, returned home to take the the Filipino community abroad. grew in scope, coverage and reputation. reins as senior vice president for News and Current Af- Voted one of the 100 Most Influential Filipino Women After her eight-year stint in North America, Reyes is fairs. As news bureau chief, Reyes initiated change and in the US, Reyes also covered breaking news, US politics, expected to ensure that all ABS-CBN News productions pioneered programs in the US, which have changed the and economic, immigration and veterans’ issues while in live up to world-class standards. Turn to page 6 The Grove ‘Dahil May Isang A Mt. Pico de Loro targets new market Ikaw’ nominated in adventure… page 10 segment…page 2 NYF Awards…page 4 Lopezlink March 2011 BIZ NEWS NEWS Lopezlink March 2011 The Grove to form a Lopez Holdings shareholders ABS-CBN to comm students: Lopez-backed AIM new skyline in Pasig Listen to your audience approve ESOP, ESPP ABS-CBN executives led by by media. renovation completed chairman and CEO Eugenio With the theme “Engaging SHAREHOLDERS of Lo- Lopez Holdings chairman knowledge can be built using synergies with affiliate SKY- “Gabby” Lopez III (EL3) re- People and Media Participation THE remod- pez Holdings Corporation in and chief executive Manuel such long-term incentive plans Cable Corporation and sister minded over 700 communi- for Change,” there were also eled Asian a special meeting approved M.