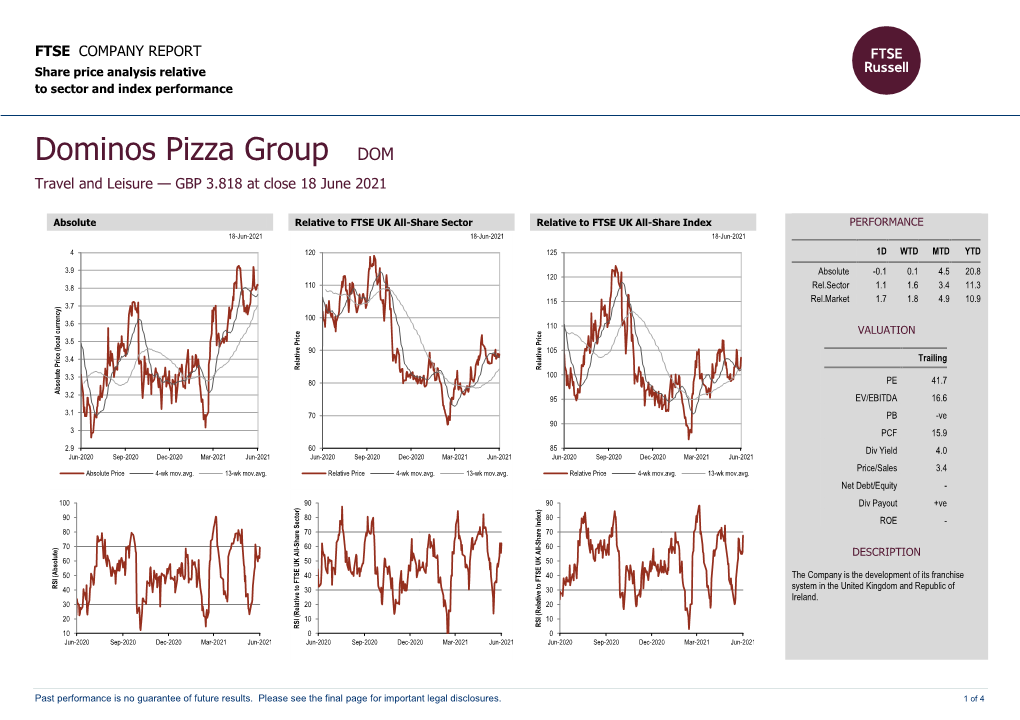

FTSE Factsheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020-Annual-Report-Web-Edition.Pdf

Domino’s Pizza Group plc Annual Report & Accounts 2020 Accounts & Report Pizza plc Annual Group Domino’s WE GOT THIS Annual Report & Accounts 2020 DOMINO’S PIZZA GROUP PLC 1 Thornbury, West Ashland, Milton Keynes MK6 4BB https://corporate.dominos.co.uk Domino’s Pizza Group plc Domino’s Pizza is the UK’s leading pizza brand and a major player in the Republic of Ireland We are incredibly proud that the business traded throughout the year and grateful to all our team members” OVERVIEW STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS 01 Highlights 12 Q&A with Chief Executive Officer 70 Board of Directors 134 Independent Auditor’s report and Chief Financial Officer 02 At a glance 74 Chair’s introduction to 144 Group income statement 14 Chief Executive Officer’s review Corporate Governance 03 Purpose, vision and values 145 Group statement of 24 Strategic priorities 76 Corporate Governance comprehensive income 04 Investment case 26 Market context 88 Nomination Committee report 146 Group balance sheet 06 Chair’s statement 28 Key performance indicators 90 Audit Committee report 148 Group statement of changes 08 Covid-19 in equity 30 Business model 100 Directors’ remuneration report 149 Group cash flow statement 32 Sustainability 127 Directors’ report 151 Notes to the Group financial 45 Section 172 of the Companies Act 131 Statement of Directors’ statements responsibilities 46 Engaging with our stakeholders 217 Company balance sheet and workforce 218 Company statement of changes 48 Chief Financial Officer’s review in equity 56 Risk management 219 -

Stelios Targets Easyjet's Finance Chief in Dispute

Source: Daily Mail {Main} Edition: Country: UK Date: Tuesday 7, April 2020 Page: 72 Area: 311 sq. cm Circulation: ABC 1134184 Daily Ad data: page rate £32,508.00, scc rate £129.00 Phone: 020 7938 6000 Keyword: Stelios Haji-ioannou Stelios targets Easyjet’s finance chief in dispute tbt jt’ id it ld t k hit i Chi THE spat between Easyjet’s board and its colourful founder MARKET REPORT intensified as he lined up the air- line’s finance boss as his next tar- get in an attack on management. by Sir Stelios Haji-Ioannou wants Easyjet to cancel a £4.5bn order to Francesca buy 107 planes from Airbus as the firm struggles to stay afloat dur- Washtell ing the coronavirus pandemic. He claims Easyjet will run out of money by around August other- about its rapid expansion plans. wise, and has vowed not to put He has derided the planes on any more cash into the business order as ‘useless’ after Covid-19 unless it agrees to this demand. brought air travel to a virtual This has weight, considering he standstill, with Easyjet’s 344- and his family own more than a strong fleet already grounded. third of Easyjet’s shares. Easyjet insists one-off meetings Stelios heaped more pressure on to vote on directors would be ‘an management by calling on the unhelpful distraction’. company to remove finance chief Yesterday it said it has become Andrew Findlay, saying it would the first airline to secure a corona- be ‘the best way to stop him writ- virus loan from the Treasury and ing billion-pound cheques plus to Bank of England’s emergency Airbus every year’. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

2013 Agms: Key Trends and Issues from a Review of 215 FTSE 350 Companies June 2013

2013 AGMs: Key trends and issues from a review of 215 FTSE 350 companies June 2013 Statistics Commentary RESOLUTIONS Annual re-election of all directors 99% (213 companies) proposed annual re- 3% (7 companies) amended their articles to election of all directors reflect annual re-election Authority to allot shares: extra one 67% (144 companies) proposed a resolution This is similar to the results for 2012 third authority for the extra one third authority; 27% (57 companies) included a statement that where Under the UK Corporate Governance Code this extra one-third authority was used, the (Code) FTSE 350 directors should be subject directors would stand for re-election to annual election, so no longer necessary Any resolution to convene general 84% (181 companies) passed a resolution to NAPF recommends that companies should only meeting on 14 days’ notice convene a general meeting on 14 clear days’ call a general meeting on 14 clear days’ notice notice; 73% (158 companies) stated the in limited circumstances and these should be circumstances where meetings will be held on explained when tabling the resolution 14 clear days’ notice Details of any unusual resolution Resolutions proposed to approve an increase A few companies have increased this to in maximum aggregate fees payable to around £700,000 to allow them to appoint directors non-executive directors to the board Details of substantial vote (10-49%) 15% (33 companies) detailed substantial votes So far this year no FTSE 350 company has had against the directors’ remuneration against -

Non-Executive Chairman Appointment

Non-Executive Chairman Appointment Released : 03/03/2021 07:00 RNS Number : 9313Q Playtech PLC 03 March 2021 Playtech plc ('Playtech' or the 'Company') Non-Executive Chairman Appointment Playtech is delighted to announce that Brian Mattingley has been selected as Non-Executive Chairman. Brian will succeed Claire Milne, who has served as Interim Chairman since May 2020. Brian will be stepping down as Chairman of 888 Holdings Plc and his appointment as Chairman of Playtech, and to the Board, will take effect on 1 June 2021. Brian brings considerable PLC Board experience to the role, as well as his extensive experience in the gambling and leisure industries. Brian first joined 888 Holdings in 2005 as a Non-Executive Director, before being appointed CEO in March 2012, and has been Non-Executive Chairman since March 2016. Prior to 888, Brian was CEO of Gala Regional Developments, and held senior roles with Gala Group, Ritz Bingo, Kingfisher Plc and Dee Corporation Plc. Claire Milne, Interim Chairman, commented: "In selecting the new Chair, we wanted to appoint an individual with significant online gambling experience and a track record of delivering high levels of corporate governance and stakeholder engagement in a highly regulated and fast- growing industry. Over the course of the last 30 years Brian has delivered strongly in these areas and has been at the forefront of the development of our industry. We are delighted that someone of Brian's calibre is joining the Board and look forward to benefitting from his experience to support our continued progress and growth." Brian Mattingley, Chairman Designate, commented: "I'm very pleased to be joining Playtech, at such an exciting time in the Company's development. -

June 2018 Share Price: £2.19 Net Asset Value: £2.16 Premium: 1.4% Market Cap: £106M Data As at 30 June 2018

Aurora Investment Trust – June 2018 Share Price: £2.19 Net Asset Value: £2.16 Premium: 1.4% Market Cap: £106m Data as at 30 June 2018 Equities >3% at 30 June 2018 Tesco Lloyds Banking Group GlaxoSmithKline Sports Direct Randall & Quilter Vesuvius Hornby Bellway Morrisons easyJet Redrow Dignity JD Wetherspoon Others <3% (2) Phoenix SG Limited Cash Position demographic trends. However, to achieve their potential and attract and delight new customers it is essential to modernise and make the most of new technologies and insights. The internet, rather than hurting a business-like Stanley Gibbons, in fact does the opposite. It allows a unique single iconic location in London to reach a worldwide audience inexpensively, and for a business so rich in intellectual property and knowledge, to offer an engaging and immersive experience tailored to the interest of the customer. The building blocks for a great business are there in terms of the brand, heritage, reputation and capability. We look forward to updating you in the coming years on their progress. The following is taken from Gary Channon's latest 02 report to investors in the Phoenix UK Fund: We invest by making business and stock specific decisions, one by one, whilst paying attention to the overall risk profile of the portfolio. Some think this means that our decisions therefore contain no macro-economic element, however this is not possible. All our businesses operate within the overall economy The expected future cashflows of a business will exist in a macro-economic context and we recognise that when we build models and derive valuations. -

Annual Report and Accounts 2010 Annual Report and Accounts 2010 Accounts and Report Annual Annual Report and Accounts 2010 Welcome Aboard!

Annual report and accounts 2010 Annual report and accounts 2010 Annual report and accounts 2010 Welcome aboard! Navigating your way around this report... 01 Overview 54 Accounts 2010 Business highlights 01 Independent auditors’ report to the members easyJet at a glance 02 of easyJet plc 54 15 years of continued success 04 Consolidated income statement 55 Chairman’s statement 06 Consolidated statement of comprehensive income 56 Consolidated statement of financial position 57 Consolidated statement of changes in equity 58 Consolidated statement of cash flows 59 Notes to the accounts 60 Company statement of financial position 90 Company statement of changes in equity 91 Company statement of cash flows 92 Notes to the Company accounts 93 08 Business review 95 Other information Chief Executive’s statement 08 Five year summary 95 Strategy and KPIs 14 Glossary 96 Financial review 16 Corporate responsibility 28 34 Governance Directors’ report easyJet plc is incorporated as a public limited company and is registered in Directors’ profiles 34 England with the registered number 3959649. easyJet plc’s registered office Corporate governance 36 is Hangar 89, London Luton Airport, Bedfordshire LU2 9PF. The Directors Shareholder information 40 present the Annual report and accounts for the year ended 30 September Report on Directors’ remuneration 41 2010. References to ‘easyJet’, the ‘Group’, the ‘Company’, ‘we’, or ‘our’ are to Statement of Directors’ responsibilities 53 easyJet plc or to easyJet plc and its subsidiary companies where appropriate. Pages 01 to 53, inclusive, of this Annual report comprise the Directors’ report that has been drawn up and presented in accordance with English company law and the liabilities of the Directors in connection with that report shall be subject to the limitations and restrictions provided by such law. -

EDF Position Paper on Air Passengers' Rights for Persons With

EDF Position Paper on Air Passengers’ Rights for Persons with Disabilities European Disability Forum [email protected] | +32 2 329 00 59 Mundo Madou, Avenue des Arts 7-8, 1210 Brussels, Belgium June 2020 This publication has received financial support from the European Union. The information contained in this publication does not necessarily reflect the official position of the European Commission. EDF position on Regulation 1107/2006 concerning the rights of persons with disabilities when travelling by air Contents About the European Disability Forum (EDF) ............................................................... 1 Executive summary ..................................................................................................... 2 Introduction ................................................................................................................. 2 Issues to be tackled .................................................................................................... 3 Discrimination against persons with disabilities and “Denied boarding” .................. 3 Full compensation for damaged, lost, or destroyed mobility equipment, and injured assistance animal ..................................................................................................................... 6 Transparent and simplified booking of assistance .................................................. 8 Better communication between airlines, airports, and booking agents ................... 9 Choice of seating and other operational procedures -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

JANUARY 2021 ES River and Mercantile UK DYNAMIC EQUITY FUND CLASS B GBP (Accumulation)

31 JANUARY 2021 ES River and Mercantile UK DYNAMIC EQUITY FUND CLASS B GBP (Accumulation) PAST PERFORMANCE INVESTMENT OBJECTIVE The chart and tables below show the performance of the fund’s GBP B (Acc) share class To grow the value of your investment since the launch of the share class on 21 November 2012. (known as "capital growth") in excess of the Source: River and Mercantile Asset Management LLP. Fund performance is calculated using midday published MSCI United Kingdom Investable Market prices. Benchmark performance is calculated using close of business mid-market prices. Index (IMI) net total return (the Past performance is not a reliable guide to future results. "Benchmark") over a rolling 5-year period, after the deduction of all fees. PERFORMANCE SINCE INCEPTION PORTFOLIO MANAGER 140% William Lough 120% PORTFOLIO & RISK 100% CHARACTERISTICS 80% 60% Number of Holdings 54 Fund Volatility 14.8% 40% Benchmark Volatility 13.9% 20% Beta 1.00 0% Active Money 77.6% Nov 2012 Nov 2013 Nov 2014 Nov 2015 Nov 2016 Nov 2017 Nov 2018 Nov 2019 Nov 2020 ES R&M UK Dynamic Equity Fund B share class MSCI UK IM Index KEY FACTS Fund launch date 22/03/2007 CUMULATIVE PERFORMANCE Share class launch date 21/11/2012 Benchmark MSCI UK Investable Since inception Markets Index 1 Month % 3 Months % 1 Year % 3 Years % 5 Years % % IA sector UK All Companies B share class (Acc) -2.3 15.7 -4.3 -3.9 38.1 97.8 Total fund size £75.3m MSCI UK IM Index -0.8 16.4 -9.5 -4.7 27.8 55.0 Domicile UK Fund type UCITS DISCRETE 12 MONTH PERFORMANCE SEDOL B7H1R58 12 months to -

Some Perspectives on Fatigue Risk Management Systems

Some Perspectives on Fatigue Risk Management Systems EUROCONTROL Table of contents 1. Introduction 5 2. Fatigue Risk Management Systems (FRMS) 6 What they are 6 An FRMS Model 7 Advantages for stakeholders 9 Some Myths 10 3. History of FRMS 11 4. The FRMS Forum 12 5. Status of FRMS in Aviation 13 Status in Regulators 13 Status of FRMS in the Airline Industry 14 Studies in the aviation domain 16 UK Rail Industry 17 6. Modelling 19 On choosing a model 21 7. Suggested initial steps when starting to explore FRMS 22 8. Summary 23 3 1. Introduction Shift workers who work at night, late evenings or early mornings will experience some degree of sleep deprivation leading to a fall in alertness during the duty period. For night workers, this is exacerbated by naturally falling performance that is driven by the circadian rhythm. With the exception of night workers on oil rigs, there is unlikely to be any improvement due to adaptation. The degree of sleep deprivation varies with the individual and becomes more pronounced with aging. Although counter measures such as napping before and during duty can help, it is likely that some adverse effects will persist. The consequence of a fall in alertness leads to slowed reaction times and reduced vigilance, poor decision making and lack of communication. In extreme cases this may contribute to incidents and accidents as evidenced by Exxon Valdiz and the Challenger space mission disaster. Unless individuals actually fall asleep, the incident or accident is normally a combination of faulty decision making within a critical situation. -

Morningstar® Developed Markets Ex-North America Target Momentum Indexsm 18 June 2021

Morningstar Indexes | Reconstitution Report Page 1 of 8 Morningstar® Developed Markets ex-North America Target Momentum IndexSM 18 June 2021 The index consists of liquid equities that display above-average return on equity. The indexes also emphasize stocks with increasing fiscal For More Information: earnings estimates and technical price momentum indicators. http://indexes.morningstar.com US: +1 312 384-3735 Europe: +44 20 3194 1082 Reconstituted Holdings Name Ticker Country Sector Rank (WAFFR) Weight (%) KUEHNE & NAGEL INTL AG-REG KNIN Switzerland Industrials 1 0.50 PostNL NV PNL Netherlands Industrials 2 0.50 Uponor Corporation UPONOR Finland Industrials 3 0.51 Smart Metering Systems PLC SMS United Kingdom Industrials 4 0.50 QT GROUP OYJ QTCOM Finland Technology 5 0.50 ASML Holding NV ASML Netherlands Technology 6 0.51 Vectura Group PLC VEC United Kingdom Healthcare 7 0.50 Lasertec Corp 6920 Japan Technology 8 0.52 Troax Group AB Class A TROAX Sweden Industrials 9 0.48 BayCurrent Consulting Inc 6532 Japan Technology 10 0.50 Sagax AB B Shares SAGA B Sweden Real Estate 11 0.50 Bilia AB A BILIa Sweden Consumer Cyclical 12 0.51 Mycronic AB MYCR Sweden Technology 13 0.49 Protector Forsikring ASA PROTCT Norway Financial Services 14 0.49 AP Moller - Maersk AS B MAERSK B Denmark Industrials 15 0.50 Polar Capital Holdings PLC POLR United Kingdom Financial Services 16 0.51 Secunet Security Networks AG YSN Germany Technology 17 0.50 Hermes Intl RMS France Consumer Cyclical 18 0.50 Kety KTY Poland Basic Materials 19 0.51 ASM Intl ASMI Netherlands Technology 20 0.51 Nippon Yusen KK 9101 Japan Industrials 21 0.54 Dexerials Corp.