Libya Economic Monitor

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

General License No. 8A

DEPARTMENT OF THE TREASURY WASHINGTON, D.C. 20220 Office of Foreign Assets Control Libyan Sanctions Regulations 31 C.F.R. Part 570 Executive Order 13566 of February 25, 2011 Blocking Property and Prohibiting Certain Transactions Related to Libya GENERAL LICENSE NO. SA General License with Respect to the Government of Libya, its Agencies, Instrumentalities, and Controlled Entities, and the Central Bank of Libya (a) General License No.8, dated Septernber 19,2011, is replaced and superseded in its entirety by this General License No. 8A. (b) Effective September 19,2011, all transactions involving the Government ofLibya, its agencies, instrumentalities, and controlled entities, and the Central Bank of Libya are authorized, subject to the following limitations: (1) All funds, including cash, securities, bank accounts, and investment accounts, and precious metals blocked pursuant to Executive Order 13566 of February 25, 2011, or the Libyan Sanctions Regulations, 31 C.F .R. part 570, as of September 19, 2011, remain blocked, except as provided in General License No.7A; and (2) The transactions do not involve any persons listed on the Annex to this general license. (c) Effective September 19,2011, the authorization in paragraph (b) ofthis general license supersedes General License No. 1B. Note to General License No. SA: Subject to the limitations set forth in subparagraphs (1) and (2), paragraph (b) ofthis general license authorizes any transaction involving contracts that have been blocked pursuant to Executive Order 13566 because ofan interest by the Government of Libya. Director Office of Foreign Assets Control Annex to General License No. 8A 1. AL BAGHDADI, Ali AI-Mahmoudi (a.k.a. -

07319-9781452746784.Pdf

© 2007 International Monetary Fund May 2007 IMF Country Report No. 07/148 The Socialist People's Libyan Arab Jamahiriya: Statistical Appendix This Statistical Appendix for the The Socialist People’s Libyan Arab Jamahiriya was prepared by a staff team of the International Monetary Fund as background documentation for the periodic consultation with the member country. It is based on the information available at the time it was completed on April 5, 2007. The views expressed in this document are those of the staff team and do not necessarily reflect the views of the government of The Socialist People’s Libyan Arab Jamahiriya or the Executive Board of the IMF. The policy of publication of staff reports and other documents by the IMF allows for the deletion of market-sensitive information. To assist the IMF in evaluating the publication policy, reader comments are invited and may be sent by e-mail to [email protected]. Copies of this report are available to the public from International Monetary Fund ● Publication Services 700 19th Street, N.W. ● Washington, D.C. 20431 Telephone: (202) 623 7430 ● Telefax: (202) 623 7201 E-mail: [email protected] ● Internet: http://www.imf.org Price: $18.00 a copy International Monetary Fund Washington, D.C. ©International Monetary Fund. Not for Redistribution This page intentionally left blank ©International Monetary Fund. Not for Redistribution INTERNATIONAL MONETARY FUND THE SOCIALIST PEOPLE’S LIBYAN ARAB JAMAHIRIYA Statistical Appendix Prepared by a staff team comprising M. Elhage (head), R. Abdoun, I. Al-Ghelaiqah, and S. Hussein (all MCD) Approved by the Middle East and Central Asia Department April 5, 2007 Contents Page 1. -

List of Certain Foreign Institutions Classified As Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms

NOT FOR PUBLICATION DEPARTMENT OF THE TREASURY JANUARY 2001 Revised Aug. 2002, May 2004, May 2005, May/July 2006, June 2007 List of Certain Foreign Institutions classified as Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms The attached list of foreign institutions, which conform to the definition of foreign official institutions on the Treasury International Capital (TIC) Forms, supersedes all previous lists. The definition of foreign official institutions is: "FOREIGN OFFICIAL INSTITUTIONS (FOI) include the following: 1. Treasuries, including ministries of finance, or corresponding departments of national governments; central banks, including all departments thereof; stabilization funds, including official exchange control offices or other government exchange authorities; and diplomatic and consular establishments and other departments and agencies of national governments. 2. International and regional organizations. 3. Banks, corporations, or other agencies (including development banks and other institutions that are majority-owned by central governments) that are fiscal agents of national governments and perform activities similar to those of a treasury, central bank, stabilization fund, or exchange control authority." Although the attached list includes the major foreign official institutions which have come to the attention of the Federal Reserve Banks and the Department of the Treasury, it does not purport to be exhaustive. Whenever a question arises whether or not an institution should, in accordance with the instructions on the TIC forms, be classified as official, the Federal Reserve Bank with which you file reports should be consulted. It should be noted that the list does not in every case include all alternative names applying to the same institution. -

Tax Relief Country: Italy Security: Intesa Sanpaolo S.P.A

Important Notice The Depository Trust Company B #: 15497-21 Date: August 24, 2021 To: All Participants Category: Tax Relief, Distributions From: International Services Attention: Operations, Reorg & Dividend Managers, Partners & Cashiers Tax Relief Country: Italy Security: Intesa Sanpaolo S.p.A. CUSIPs: 46115HAU1 Subject: Record Date: 9/2/2021 Payable Date: 9/17/2021 CA Web Instruction Deadline: 9/16/2021 8:00 PM (E.T.) Participants can use DTC’s Corporate Actions Web (CA Web) service to certify all or a portion of their position entitled to the applicable withholding tax rate. Participants are urged to consult TaxInfo before certifying their instructions over CA Web. Important: Prior to certifying tax withholding instructions, participants are urged to read, understand and comply with the information in the Legal Conditions category found on TaxInfo over the CA Web. ***Please read this Important Notice fully to ensure that the self-certification document is sent to the agent by the indicated deadline*** Questions regarding this Important Notice may be directed to Acupay at +1 212-422-1222. Important Legal Information: The Depository Trust Company (“DTC”) does not represent or warrant the accuracy, adequacy, timeliness, completeness or fitness for any particular purpose of the information contained in this communication, which is based in part on information obtained from third parties and not independently verified by DTC and which is provided as is. The information contained in this communication is not intended to be a substitute for obtaining tax advice from an appropriate professional advisor. In providing this communication, DTC shall not be liable for (1) any loss resulting directly or indirectly from mistakes, errors, omissions, interruptions, delays or defects in such communication, unless caused directly by gross negligence or willful misconduct on the part of DTC, and (2) any special, consequential, exemplary, incidental or punitive damages. -

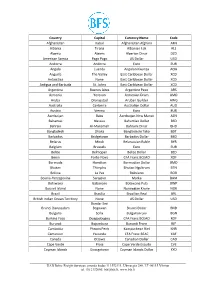

Countries Codes and Currencies 2020.Xlsx

World Bank Country Code Country Name WHO Region Currency Name Currency Code Income Group (2018) AFG Afghanistan EMR Low Afghanistan Afghani AFN ALB Albania EUR Upper‐middle Albanian Lek ALL DZA Algeria AFR Upper‐middle Algerian Dinar DZD AND Andorra EUR High Euro EUR AGO Angola AFR Lower‐middle Angolan Kwanza AON ATG Antigua and Barbuda AMR High Eastern Caribbean Dollar XCD ARG Argentina AMR Upper‐middle Argentine Peso ARS ARM Armenia EUR Upper‐middle Dram AMD AUS Australia WPR High Australian Dollar AUD AUT Austria EUR High Euro EUR AZE Azerbaijan EUR Upper‐middle Manat AZN BHS Bahamas AMR High Bahamian Dollar BSD BHR Bahrain EMR High Baharaini Dinar BHD BGD Bangladesh SEAR Lower‐middle Taka BDT BRB Barbados AMR High Barbados Dollar BBD BLR Belarus EUR Upper‐middle Belarusian Ruble BYN BEL Belgium EUR High Euro EUR BLZ Belize AMR Upper‐middle Belize Dollar BZD BEN Benin AFR Low CFA Franc XOF BTN Bhutan SEAR Lower‐middle Ngultrum BTN BOL Bolivia Plurinational States of AMR Lower‐middle Boliviano BOB BIH Bosnia and Herzegovina EUR Upper‐middle Convertible Mark BAM BWA Botswana AFR Upper‐middle Botswana Pula BWP BRA Brazil AMR Upper‐middle Brazilian Real BRL BRN Brunei Darussalam WPR High Brunei Dollar BND BGR Bulgaria EUR Upper‐middle Bulgarian Lev BGL BFA Burkina Faso AFR Low CFA Franc XOF BDI Burundi AFR Low Burundi Franc BIF CPV Cabo Verde Republic of AFR Lower‐middle Cape Verde Escudo CVE KHM Cambodia WPR Lower‐middle Riel KHR CMR Cameroon AFR Lower‐middle CFA Franc XAF CAN Canada AMR High Canadian Dollar CAD CAF Central African Republic -

Libya Joint Market Monitoring Initiative (JMMI) Libya Cash Working Group 2 - 10 April 2020

Libya Joint Market Monitoring Initiative (JMMI) Libya Cash Working Group 2 - 10 April 2020 INTRODUCTION METHODOLOGY KEY FINDINGS JMMI KEY FIGURES In an effort to inform cash-based interventions and better • Field staff familiar with the local market conditions • The most notable increases in the cost of the MEB Data collection from 2 - 10 April 2020 understand market dynamics in Libya, the Joint Market identified shops representative of the general were; Nalut (+50.4%), Ashshgega (+50%), Sabratha 3 participating agencies Monitoring Initiative (JMMI) was created by the Libya Cash price level in their respective locations. (+49.1%), Ghadamis (48.7%) and Algatroun (+44.5%). (DRC, REACH, WFP) Working Group (CWG) in June 2017. The initiative is guided • At least three prices per assessed item were The following factors are likely to have contributed to 34 assessed cities by the CWG Markets Taskforce, led by REACH and supported collected within each location. In line with the the increase in the cost of living in the last month: 1. 31 assessed items by the CWG members. It is funded by Office for Foreign purpose of the JMMI, only the price of the Stockpiling of essential goods due COVID-19, 2. 26% 417 assessed shops Disaster Assistance (OFDA) and the United Nations High cheapest available brand was recorded for each increase in the parallel market USD/LYD exchange Commissioner for Refugees (UNHCR). item. rate from December 2019 - April 2020, 3. the Central Bank of Libya halted foreign currency transactions EXCHANGE RATES6 April JMMI price data largely confirms preliminary price • Enumerators were trained on methodology and during the month of March, stemming the flow of goods changes outlined by key informants in the Rapid Market tools by REACH. -

OECD International Network on Financial Education

OECD International Network on Financial Education Membership lists as at May 2020 Full members ........................................................................................................................ 1 Regular members ................................................................................................................. 3 Associate (full) member ....................................................................................................... 6 Associate (regular) members ............................................................................................... 6 Affiliate members ................................................................................................................. 6 More information about the OECD/INFE is available online at: www.oecd.org/finance/financial-education.htm │ 1 Full members Angola Capital Market Commission Armenia Office of the Financial System Mediator Central Bank Australia Australian Securities and Investments Commission Austria Central Bank of Austria (OeNB) Bangladesh Microcredit Regulatory Authority, Ministry of Finance Belgium Financial Services and Markets Authority Brazil Central Bank of Brazil Securities and Exchange Commission (CVM) Brunei Darussalam Autoriti Monetari Brunei Darussalam Bulgaria Ministry of Finance Canada Financial Consumer Agency of Canada Chile Comisión para el Mercado Financiero China (People’s Republic of) China Banking and Insurance Regulatory Commission Czech Republic Ministry of Finance Estonia Ministry of Finance Finland Bank -

Fiscal Year 2009

Statement by the Chairperson of the METAC Steering Committee t was a pleasure for me to chair the Steering Committee of the IMF Middle East Regional Technical Assistance Center (METAC) for the first time this year. The meeting, which was held in Beirut on May 6, I 2009, provided a good opportunity for member countries and donors to gauge the important results and progress achieved in Fiscal Year (FY) 2009, widely recognized by beneficiary member governments, to review the priorities and work plan for FY 2010, and to look forward to the next medium-term phase. The present Annual Report for FY 2009 reviews and addresses these subjects in some detail. As Chairperson, I seized the opportunity to highlight the important role of the Steering Committee in promoting and guiding the work of METAC, and to review ways and means to enhance the role of the Committee with a view to make it more dynamic and effective, including through increased networking and monitoring. I emphasized the important role of METAC in the cross-border fertilization of knowledge and stressed the need for increasing knowledge-sharing and learning as an integral part of METAC’s work. Being located in Beirut, close to the countries it serves, METAC provides several important benefits, including decentralized delivery of technical assistance, which allows for greater flexibility in responding to changing or emerging needs, close coordination with regional technical assistance providers, enhanced country ownership and accountability, and more focused and subject-specific training for local officials. The location of this important center reaffirms the traditional role of Beirut as a regional center of excellence and reflects recognition of Lebanon’s wealth in qualified human resources. -

Origins of the Libyan Conflict and Options for Its Resolution

ORIGINS OF THE LIBYAN CONFLICT AND OPTIONS FOR ITS RESOLUTION JONATHAN M. WINER MAY 2019 POLICY PAPER 2019-12 CONTENTS * 1 INTRODUCTION * 4 HISTORICAL FACTORS * 7 PRIMARY DOMESTIC ACTORS * 10 PRIMARY FOREIGN ACTORS * 11 UNDERLYING CONDITIONS FUELING CONFLICT * 12 PRECIPITATING EVENTS LEADING TO OPEN CONFLICT * 12 MITIGATING FACTORS * 14 THE SKHIRAT PROCESS LEADING TO THE LPA * 15 POST-SKHIRAT BALANCE OF POWER * 18 MOVING BEYOND SKHIRAT: POLITICAL AGREEMENT OR STALLING FOR TIME? * 20 THE CURRENT CONFLICT * 22 PATHWAYS TO END CONFLICT SUMMARY After 42 years during which Muammar Gaddafi controlled all power in Libya, since the 2011 uprising, Libyans, fragmented by geography, tribe, ideology, and history, have resisted having anyone, foreigner or Libyan, telling them what to do. In the process, they have frustrated the efforts of outsiders to help them rebuild institutions at the national level, preferring instead to maintain control locally when they have it, often supported by foreign backers. Despite General Khalifa Hifter’s ongoing attempt in 2019 to conquer Tripoli by military force, Libya’s best chance for progress remains a unified international approach built on near complete alignment among international actors, supporting Libyans convening as a whole to address political, security, and economic issues at the same time. While the tracks can be separate, progress is required on all three for any of them to work in the long run. But first the country will need to find a way to pull back from the confrontation created by General Hifter. © The Middle East Institute The Middle East Institute 1319 18th Street NW Washington, D.C. -

International Currency Codes

Country Capital Currency Name Code Afghanistan Kabul Afghanistan Afghani AFN Albania Tirana Albanian Lek ALL Algeria Algiers Algerian Dinar DZD American Samoa Pago Pago US Dollar USD Andorra Andorra Euro EUR Angola Luanda Angolan Kwanza AOA Anguilla The Valley East Caribbean Dollar XCD Antarctica None East Caribbean Dollar XCD Antigua and Barbuda St. Johns East Caribbean Dollar XCD Argentina Buenos Aires Argentine Peso ARS Armenia Yerevan Armenian Dram AMD Aruba Oranjestad Aruban Guilder AWG Australia Canberra Australian Dollar AUD Austria Vienna Euro EUR Azerbaijan Baku Azerbaijan New Manat AZN Bahamas Nassau Bahamian Dollar BSD Bahrain Al-Manamah Bahraini Dinar BHD Bangladesh Dhaka Bangladeshi Taka BDT Barbados Bridgetown Barbados Dollar BBD Belarus Minsk Belarussian Ruble BYR Belgium Brussels Euro EUR Belize Belmopan Belize Dollar BZD Benin Porto-Novo CFA Franc BCEAO XOF Bermuda Hamilton Bermudian Dollar BMD Bhutan Thimphu Bhutan Ngultrum BTN Bolivia La Paz Boliviano BOB Bosnia-Herzegovina Sarajevo Marka BAM Botswana Gaborone Botswana Pula BWP Bouvet Island None Norwegian Krone NOK Brazil Brasilia Brazilian Real BRL British Indian Ocean Territory None US Dollar USD Bandar Seri Brunei Darussalam Begawan Brunei Dollar BND Bulgaria Sofia Bulgarian Lev BGN Burkina Faso Ouagadougou CFA Franc BCEAO XOF Burundi Bujumbura Burundi Franc BIF Cambodia Phnom Penh Kampuchean Riel KHR Cameroon Yaounde CFA Franc BEAC XAF Canada Ottawa Canadian Dollar CAD Cape Verde Praia Cape Verde Escudo CVE Cayman Islands Georgetown Cayman Islands Dollar KYD _____________________________________________________________________________________________ -

06307-9781451883558.Pdf

© 2005 International Monetary Fund March 2005 IMF Country Report No. 05/78 Socialist People’s Libyan Arab Jamahiriya: Statistical Appendix This Statistical Appendix paper for the Socialist People’s Libyan Arab Jamahiriya was prepared by a staff team of the International Monetary Fund as background documentation for the periodic consultation with the member country. It is based on the information available at the time it was completed on January 4, 2005. The views expressed in this document are those of the staff team and do not necessarily reflect the views of the government of the Socialist People’s Libyan Arab Jamahiriya or the Executive Board of the IMF. The policy of publication of staff reports and other documents by the IMF allows for the deletion of market-sensitive information. To assist the IMF in evaluating the publication policy, reader comments are invited and may be sent by e-mail to [email protected]. Copies of this report are available to the public from International Monetary Fund ● Publication Services 700 19th Street, N.W. ● Washington, D.C. 20431 Telephone: (202) 623 7430 ● Telefax: (202) 623 7201 E-mail: [email protected] ● Internet: http://www.imf.org Price: $15.00 a copy International Monetary Fund Washington, D.C. ©International Monetary Fund. Not for Redistribution This page intentionally left blank ©International Monetary Fund. Not for Redistribution INTERNATIONAL MONETARY FUND SOCIALIST PEOPLE’S LIBYAN ARAB JAMAHIRIYA Statistical Appendix Prepared by a staff team consisting of M. Elhage (head), R. Abdoun, J. Bailen, and N. Farhan (all MCD) Approved by Middle East and Central Asia Department January 4, 2005 Contents Page Tables 1. -

Classification of Accounts Guide Last Updated – January 2018

Classification of Accounts Guide Last updated – January 2018 Contents Part I: General introduction Part II: Residence Part III: Sector categories Part IV.1 – IV.2: Industrial classification Part IV.3: Relationship between sector and industrial classifications Part V.1: Sector components (ESA 10) and sub components Part V.2: List of countries 1 Part I Classification of Accounts Guide – General Introduction I.1 Foreword This guide is intended for all institutions completing a range of Bank of England statistical returns. It describes the two most important systems of classification used in compiling economic and financial statistics in the United Kingdom – the economic sector classification, and the industrial classification. This guide is intended to serve both as an introduction for newcomers and as a source of reference. The nomenclature in the sector classification is in line with international standards – in particular, the European System of National and Regional Accounts (abbreviated to ‘ESA10’). In addition, the analysis of industrial activity is in line with the 2007 standard industrial classification of economic activities (SIC) introduced by the Office for National Statistics. Those without knowledge of accounts classification are recommended to refer to the ‘Guide to Classification’ (Part I Section 3) which takes the reader through the main questions to be answered to help classify accounts correctly. The system of classification used in this guide is solely for statistical purposes. Parts II to IV of the guide describe the main aspects of the classification system in more detail, including lists of examples of institutions, or a web link reference, for many categories. I.2 An introduction to the classification of accounts Sector and industrial classification To understand the underlying behaviour which is reflected in movements in economic and financial statistics, it is necessary to group those entities engaged in financial transactions into broad sectors with similar characteristics.