Fiscal Year 2009

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

General License No. 8A

DEPARTMENT OF THE TREASURY WASHINGTON, D.C. 20220 Office of Foreign Assets Control Libyan Sanctions Regulations 31 C.F.R. Part 570 Executive Order 13566 of February 25, 2011 Blocking Property and Prohibiting Certain Transactions Related to Libya GENERAL LICENSE NO. SA General License with Respect to the Government of Libya, its Agencies, Instrumentalities, and Controlled Entities, and the Central Bank of Libya (a) General License No.8, dated Septernber 19,2011, is replaced and superseded in its entirety by this General License No. 8A. (b) Effective September 19,2011, all transactions involving the Government ofLibya, its agencies, instrumentalities, and controlled entities, and the Central Bank of Libya are authorized, subject to the following limitations: (1) All funds, including cash, securities, bank accounts, and investment accounts, and precious metals blocked pursuant to Executive Order 13566 of February 25, 2011, or the Libyan Sanctions Regulations, 31 C.F .R. part 570, as of September 19, 2011, remain blocked, except as provided in General License No.7A; and (2) The transactions do not involve any persons listed on the Annex to this general license. (c) Effective September 19,2011, the authorization in paragraph (b) ofthis general license supersedes General License No. 1B. Note to General License No. SA: Subject to the limitations set forth in subparagraphs (1) and (2), paragraph (b) ofthis general license authorizes any transaction involving contracts that have been blocked pursuant to Executive Order 13566 because ofan interest by the Government of Libya. Director Office of Foreign Assets Control Annex to General License No. 8A 1. AL BAGHDADI, Ali AI-Mahmoudi (a.k.a. -

Economic Dimensions of the Conflict in Yemen: Final Report

Co-funded by the European Union Economic Dimensions of the Conflict in Yemen: Final Report Achim Wennmann and Fiona Davies 19 October 2020 DISCLAIMER This report was produced with the financial and technical support of the European Union, UNDP and OCHA. Its contents are the sole responsibility of the authors and do not necessarily reflect the views of the European Union, OCHA and the UNDP. 2 Table of Contents About this report ................................................................................................................ 4 1. Economic dimensions of the crisis ............................................................................. 5 2. Humanitarian dimensions ............................................................................................. 6 3. Economic interests of key constituencies.................................................................. 7 4. Economic issues in the peace process ...................................................................... 9 5. Central banking ............................................................................................................ 10 6. Operational considerations ........................................................................................ 11 Concluding reflections ..................................................................................................... 12 3 About this report This report is co-authored by Achim Wennmann and Fiona Davies1. It synthesises responses from 20 interviews with interlocutors representing different -

07319-9781452746784.Pdf

© 2007 International Monetary Fund May 2007 IMF Country Report No. 07/148 The Socialist People's Libyan Arab Jamahiriya: Statistical Appendix This Statistical Appendix for the The Socialist People’s Libyan Arab Jamahiriya was prepared by a staff team of the International Monetary Fund as background documentation for the periodic consultation with the member country. It is based on the information available at the time it was completed on April 5, 2007. The views expressed in this document are those of the staff team and do not necessarily reflect the views of the government of The Socialist People’s Libyan Arab Jamahiriya or the Executive Board of the IMF. The policy of publication of staff reports and other documents by the IMF allows for the deletion of market-sensitive information. To assist the IMF in evaluating the publication policy, reader comments are invited and may be sent by e-mail to [email protected]. Copies of this report are available to the public from International Monetary Fund ● Publication Services 700 19th Street, N.W. ● Washington, D.C. 20431 Telephone: (202) 623 7430 ● Telefax: (202) 623 7201 E-mail: [email protected] ● Internet: http://www.imf.org Price: $18.00 a copy International Monetary Fund Washington, D.C. ©International Monetary Fund. Not for Redistribution This page intentionally left blank ©International Monetary Fund. Not for Redistribution INTERNATIONAL MONETARY FUND THE SOCIALIST PEOPLE’S LIBYAN ARAB JAMAHIRIYA Statistical Appendix Prepared by a staff team comprising M. Elhage (head), R. Abdoun, I. Al-Ghelaiqah, and S. Hussein (all MCD) Approved by the Middle East and Central Asia Department April 5, 2007 Contents Page 1. -

International Directory of Deposit Insurers

Federal Deposit Insurance Corporation International Directory of Deposit Insurers September 2015 A listing of addresses of deposit insurers, central banks and other entities involved in deposit insurance functions. Division of Insurance and Research Federal Deposit Insurance Corporation Washington, DC 20429 The FDIC wants to acknowledge the cooperation of all the countries listed, without which the directory’s compilation would not have been possible. Please direct any comments or corrections to: Donna Vogel Division of Insurance and Research, FDIC by phone +1 703 254 0937 or by e-mail [email protected] FDIC INTERNATIONAL DIRECTORY OF DEPOSIT INSURERS ■ SEPTEMBER 2015 2 Table of Contents AFGHANISTAN ......................................................................................................................................6 ALBANIA ...............................................................................................................................................6 ALGERIA ................................................................................................................................................6 ARGENTINA ..........................................................................................................................................6 ARMENIA ..............................................................................................................................................7 AUSTRALIA ............................................................................................................................................7 -

List of Certain Foreign Institutions Classified As Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms

NOT FOR PUBLICATION DEPARTMENT OF THE TREASURY JANUARY 2001 Revised Aug. 2002, May 2004, May 2005, May/July 2006, June 2007 List of Certain Foreign Institutions classified as Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms The attached list of foreign institutions, which conform to the definition of foreign official institutions on the Treasury International Capital (TIC) Forms, supersedes all previous lists. The definition of foreign official institutions is: "FOREIGN OFFICIAL INSTITUTIONS (FOI) include the following: 1. Treasuries, including ministries of finance, or corresponding departments of national governments; central banks, including all departments thereof; stabilization funds, including official exchange control offices or other government exchange authorities; and diplomatic and consular establishments and other departments and agencies of national governments. 2. International and regional organizations. 3. Banks, corporations, or other agencies (including development banks and other institutions that are majority-owned by central governments) that are fiscal agents of national governments and perform activities similar to those of a treasury, central bank, stabilization fund, or exchange control authority." Although the attached list includes the major foreign official institutions which have come to the attention of the Federal Reserve Banks and the Department of the Treasury, it does not purport to be exhaustive. Whenever a question arises whether or not an institution should, in accordance with the instructions on the TIC forms, be classified as official, the Federal Reserve Bank with which you file reports should be consulted. It should be noted that the list does not in every case include all alternative names applying to the same institution. -

Tax Relief Country: Italy Security: Intesa Sanpaolo S.P.A

Important Notice The Depository Trust Company B #: 15497-21 Date: August 24, 2021 To: All Participants Category: Tax Relief, Distributions From: International Services Attention: Operations, Reorg & Dividend Managers, Partners & Cashiers Tax Relief Country: Italy Security: Intesa Sanpaolo S.p.A. CUSIPs: 46115HAU1 Subject: Record Date: 9/2/2021 Payable Date: 9/17/2021 CA Web Instruction Deadline: 9/16/2021 8:00 PM (E.T.) Participants can use DTC’s Corporate Actions Web (CA Web) service to certify all or a portion of their position entitled to the applicable withholding tax rate. Participants are urged to consult TaxInfo before certifying their instructions over CA Web. Important: Prior to certifying tax withholding instructions, participants are urged to read, understand and comply with the information in the Legal Conditions category found on TaxInfo over the CA Web. ***Please read this Important Notice fully to ensure that the self-certification document is sent to the agent by the indicated deadline*** Questions regarding this Important Notice may be directed to Acupay at +1 212-422-1222. Important Legal Information: The Depository Trust Company (“DTC”) does not represent or warrant the accuracy, adequacy, timeliness, completeness or fitness for any particular purpose of the information contained in this communication, which is based in part on information obtained from third parties and not independently verified by DTC and which is provided as is. The information contained in this communication is not intended to be a substitute for obtaining tax advice from an appropriate professional advisor. In providing this communication, DTC shall not be liable for (1) any loss resulting directly or indirectly from mistakes, errors, omissions, interruptions, delays or defects in such communication, unless caused directly by gross negligence or willful misconduct on the part of DTC, and (2) any special, consequential, exemplary, incidental or punitive damages. -

METAC Monthly Newsletter Issue No

METAC Monthly Newsletter Issue No. 103 – September 2018 DEVELOPMENT PARTNERS: European Union | France | Germany | Switzerland | The Netherlands MEMBERS - CONTRIBUTORS: Algeria | Egypt | Iraq | Lebanon | Morocco | Sudan MEMBERS: Afghanistan | Djibouti | Jordan | Libya | Syria | Tunisia | West Bank & Gaza | Yemen Technical Assistance (TA) and Training Missions Banking Supervision covered micro stress-testing and solutions to issues the CBJ staff are facing with respect to their use of the Next Afghanistan Generation solvency and liquidity models, as well as the correlations between risks and their impacts on stress- METAC trained a team of Da-Afghanistan Bank (DAB) test outcomes. on corporate governance issues. The training covered international bank corporate governance topics, such Sudan as the corporate governance principles, internal control and internal audit functions’ frameworks issued by A work-from home mission aimed at further assisting the Basel Committee on Banking Supervision, as well as Central Bank of Sudan in upgrading the current the guidance on strengthening governance framework inspection manual and aligning it to a risk-based issued by the Financial Stability Board and included approach, including by developing a set of examination walk-throughs of related key policy guidance, reports, procedures on Credit Risk Management, Liquidity Risk and assessment tools. The training was an opportunity Management, Market Risk Management, Operational to discuss with the DAB team the difficulties that DAB Risk Management, and Capital -

2014 Vol. 5, No. 1

PRISM VOL. 5, NO. 1 2014 A JOURNAL OF THE CENTER FOR COMPLEX OPERATIONS PRISM About VOL. 5, NO. 1 2014 PRISM is published by the Center for Complex Operations. PRISM is a security studies journal chartered to inform members of U.S. Federal agencies, allies, and other partners on complex EDITOR and integrated national security operations; reconstruction and state-building; relevant policy Michael Miklaucic and strategy; lessons learned; and developments in training and education to transform America’s security and development EDITORIAL ASSISTANTS Ross Clark Ben Graves Caliegh Hernandez Communications Daniel Moore Constructive comments and contributions are important to us. Direct communications to: COPY EDITORS Dale Erickson Editor, PRISM Rebecca Harper 260 Fifth Avenue (Building 64, Room 3605) Christoff Luehrs Fort Lesley J. McNair Sara Thannhauser Washington, DC 20319 Nathan White Telephone: (202) 685-3442 DESIGN DIRecTOR FAX: Carib Mendez (202) 685-3581 Email: [email protected] ADVISORY BOARD Dr. Gordon Adams Dr. Pauline H. Baker Ambassador Rick Barton Contributions Professor Alain Bauer PRISM welcomes submission of scholarly, independent research from security policymakers Dr. Joseph J. Collins (ex officio) and shapers, security analysts, academic specialists, and civilians from the United States and Ambassador James F. Dobbins abroad. Submit articles for consideration to the address above or by email to [email protected] Ambassador John E. Herbst (ex officio) with “Attention Submissions Editor” in the subject line. Dr. David Kilcullen Ambassador Jacques Paul Klein Dr. Roger B. Myerson This is the authoritative, official U.S. Department of Defense edition of PRISM. Dr. Moisés Naím Any copyrighted portions of this journal may not be reproduced or extracted MG William L. -

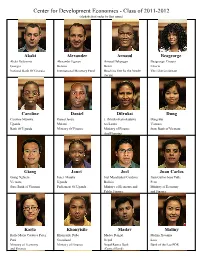

Center for Development Economics - Class of 2011-2012 (Alphabetical Order by First Name)

Center for Development Economics - Class of 2011-2012 (alphabetical order by first name) Akaki Alexander Arnaud Beageorge Akaki Gelazonia Alexander Egorov Arnaud Dakpogan Beageorge Cooper Georgia Belarus Benin Liberia National Bank Of Georgia International Monetary Fund Reaching Out for the Needy The Liberian Senate (NGO) Caroline Daniel Dilruksi Dung Caroline Ntumwa Daniel Jenya J. Dilruksi Kotinkaduwa Dung Bui Uganda Malawi Sri Lanka Vietnam Bank Of Uganda Ministry Of Finance Ministry of Finance State Bank of Vietnam And Planning Giang Janet Joel Juan Carlos Giang Nghiem Janet Mataka Joel Mendizabal Cordova Juan Carlos Sosa Valle Vietnam Uganda Bolivia Peru State Bank of Vietnam Parliament Of Uganda Ministry of Economy and Ministry of Economy Public Finance and Finance Karla Khanyisile Madav Maliny Karla Maria Cordova Perez Khanyisile Dube Madav Dangal Maliny Xavanna Perú Swaziland Nepal Laos Ministry of Economy Ministry of Finance Nepal Rastra Bank Bank of the Lao PDR and Finance (Central Bank) Center for Development Economics - Class of 2011-2012 (alphabetical order by first name) Mamisoa Mansour Mola Momed Lalaniaina Razakamanantsoa Mansour Rageh Mola Tin Momed Jamu Madagascar Yemen Cambodia Mozambique Central Bank Of Madagascar Central Bank Of Yemen Cambodia Agriculture Value KPMG Chain Program (CAVAC) Muzaffar Nakhonsy Naveed Nihal Muzaffar Tilavov Nakhonsy Manodham Naveed Bakhshi Nihal Dabure Liyanage Uzbekistan Laos Afghanistan Sri Lanka Ministry of Trade Bank of the Lao PDR Ministry Of Finance Central Bank of Sri Lanka Nino Olta Pablo Romel Nino Javakhadze Olta Manjani Pablo Evia Salas Romel Troissou Georgia Albania Bolivia Haiti Government Chancellery Bank of Albania Bureau of Economic and Social Ministry of Economy and of Georgia Policy Analysis Finance Ulvi Yeva Ulvi Yusifov Yeva Aleksanyan Azerbaijan Armenia Central Bank of Azerbaijan Ministry of Economy. -

Libya Joint Market Monitoring Initiative (JMMI) Libya Cash Working Group 2 - 10 April 2020

Libya Joint Market Monitoring Initiative (JMMI) Libya Cash Working Group 2 - 10 April 2020 INTRODUCTION METHODOLOGY KEY FINDINGS JMMI KEY FIGURES In an effort to inform cash-based interventions and better • Field staff familiar with the local market conditions • The most notable increases in the cost of the MEB Data collection from 2 - 10 April 2020 understand market dynamics in Libya, the Joint Market identified shops representative of the general were; Nalut (+50.4%), Ashshgega (+50%), Sabratha 3 participating agencies Monitoring Initiative (JMMI) was created by the Libya Cash price level in their respective locations. (+49.1%), Ghadamis (48.7%) and Algatroun (+44.5%). (DRC, REACH, WFP) Working Group (CWG) in June 2017. The initiative is guided • At least three prices per assessed item were The following factors are likely to have contributed to 34 assessed cities by the CWG Markets Taskforce, led by REACH and supported collected within each location. In line with the the increase in the cost of living in the last month: 1. 31 assessed items by the CWG members. It is funded by Office for Foreign purpose of the JMMI, only the price of the Stockpiling of essential goods due COVID-19, 2. 26% 417 assessed shops Disaster Assistance (OFDA) and the United Nations High cheapest available brand was recorded for each increase in the parallel market USD/LYD exchange Commissioner for Refugees (UNHCR). item. rate from December 2019 - April 2020, 3. the Central Bank of Libya halted foreign currency transactions EXCHANGE RATES6 April JMMI price data largely confirms preliminary price • Enumerators were trained on methodology and during the month of March, stemming the flow of goods changes outlined by key informants in the Rapid Market tools by REACH. -

OECD International Network on Financial Education

OECD International Network on Financial Education Membership lists as at May 2020 Full members ........................................................................................................................ 1 Regular members ................................................................................................................. 3 Associate (full) member ....................................................................................................... 6 Associate (regular) members ............................................................................................... 6 Affiliate members ................................................................................................................. 6 More information about the OECD/INFE is available online at: www.oecd.org/finance/financial-education.htm │ 1 Full members Angola Capital Market Commission Armenia Office of the Financial System Mediator Central Bank Australia Australian Securities and Investments Commission Austria Central Bank of Austria (OeNB) Bangladesh Microcredit Regulatory Authority, Ministry of Finance Belgium Financial Services and Markets Authority Brazil Central Bank of Brazil Securities and Exchange Commission (CVM) Brunei Darussalam Autoriti Monetari Brunei Darussalam Bulgaria Ministry of Finance Canada Financial Consumer Agency of Canada Chile Comisión para el Mercado Financiero China (People’s Republic of) China Banking and Insurance Regulatory Commission Czech Republic Ministry of Finance Estonia Ministry of Finance Finland Bank -

14879-21Tax Relief

Important Notice The Depository Trust Company B #: 14879‐21 Date: May 19, 2021 To: All Participants Category: Tax Relief, Distributions From: International Services Attention: Operations, Reorg & Dividend Managers, Partners & Cashiers Tax Relief – Country: Italy UniCredit S.p.A. CUSIP(s): 904678AG4 Subject: Record Date: 05/28/2021 Payable Date: 06/04/2021 CA Web Instruction Deadline: 06/03/2021 8:00 PM ET Participants can use DTC’s Corporate Actions Web (CA Web) service to certify all or a portion of their position entitled to the applicable withholding tax rate. Participants are urged to consult TaxInfo before certifying their instructions over CA Web. Important: Prior to certifying tax withholding instructions, participants are urged to read, understand and comply with the information in the Legal Conditions category found on TaxInfo over the CA Web. ***Please read this Important Notice fully to ensure that the self‐certification document is sent to the agent by the indicated deadline*** Questions regarding this Important Notice may be directed to Acupay at +1 212‐422‐1222. Important Legal Information: The Depository Trust Company (“DTC”) does not represent or warrant the accuracy, adequacy, timeliness, completeness or fitness for any particular purpose of the information contained in this communication, which is based in part on information obtained from third parties and not independently verified by DTC and which is provided as is. The information contained in this communication is not intended to be a substitute for obtaining tax advice from an appropriate professional advisor. In providing this communication, DTC shall not be liable for (1) any loss resulting directly or indirectly from mistakes, errors, omissions, interruptions, delays or defects in such communication, unless caused directly by gross negligence or willful misconduct on the part of DTC, and (2) any special, consequential, exemplary, incidental or punitive damages.