17-C Net Income Q110

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Payment Centers (As of January 2016)

List of Payment Centers (as of January 2016) BRANCH NAME LOCATION NAME LOCATION ADDRESS CUBAO DEPARTMENT STORE SM Cubao Bldg., Araneta Center, Socorro Cubao, Quezon City SAVEMORE NEPA Q. MART SAVEMORE NEPA Q. MART Savemore Market Nepa Q-Mart, G/F & 2F 770 St., Rose Bldg. Edsa cor K-G St. West Kamias, Q.C. SAVEMORE P. TUAZON SAVEMORE P. TUAZON Savemore Market P. Tuazon A.D. Legaspi St.,cor P. Tuazon Blvd., Marilag,Proj 4, Q.C. 1109 SAVEMORE ARANETA SAVEMORE ARANETA Savemore Market COD Cubao Gen Romulo St., Araneta Center Cubao Quezon City SAVEMORE ANONAS SAVEMORE ANONAS Savemore Market Anonas, Maamo St. Road, Lot 30 V. Luna and Anonas Extn. Sikatuna, Q.C. 1101 HYPERMARKET CUBAO HYPERMARKET CUBAO SM Hypermarket Cubao, Main Ave cor EDSA, Quezon QUIAPO DEPARTMENT STORE SM Quiapo , MDC Bldg., C. Palanca St., Quiapo, Manila SAVEMORE STA. CRUZ SAVEMORE STA. CRUZ Savemore Market Sta Cruz 665 Rizal Avenue, Jennet & Lord Theater, Sta Cruz, Manila MAKATI DEPARTMENT STORE SM Makati Building Ayala Center, Brgy. San Lorenzo Village, Makati City SAVEMORE PASONG TAMO SAVEMORE PASONG TAMO Savemore-Market Pasong Tamo, 2256 Chino Roces Ave.,Ext EDSA, Brgy. Magallanes, Makati City 1231 SAVEMORE MARKET PLACE SAVEMORE MARKET PLACE SM Marketplace A Venue Hall, Antel Lifestyle City, 7829, Makati Avenue, Poblacion, Makati City HYPERMARKET JAZZ HYPERMARKET JAZZ SM Hypermarket Jazz Nicanor Garcia corner Jupiter Street, Brgy Bel Air, Makati City SAVEMORE LIGHT RESIDENCES SAVEMORE LIGHT RESIDENCES Savemore Market Light Residences Edsa Cor. Madison St. Brgy. Barranca, Mandaluyong City HARRISON DEPARTMENT STORE SM Harrison Plaza Complex, Malate, Manila 1004 HYPERMARKET ADRIATICO DEPARTMENT STORE SM Hypermart Adriatico M.H. -

Annual Report 2013

ANNUAL REPORT 2013 At the forefront of growth, the SM Group dreams of a better life for Filipinos through quality education, more opportunities and empowered communities. Through its corporate social responsibility arm, the SM Foundation Inc., reaches out to millions of Filipinos to help them live the dream. From medical services and infrastructure projects, to college scholarships and farmers’ trainings, the Foundation responds to the social needs of the underprivileged and provides them with better livelihood opportunities for a chance to improve their life through self-sustainable means. The SM Foundation believes in the power of collaboration with its employees, customers, mall tenants, partners and the government. Through this, the Foundation is able to magnify its impact and create a positive change in society and in the environment. As SM sustains its steady growth that has become the hallmark of its business for more than 50 years, SM Foundation will continue to support Filipinos, particularly the marginalized, so that its dynamism will create better economic opportunities and touch the lives of millions. Contents Overview 4 People Helping People 16 People Helping Communities 24 People Helping the Environment 30 SM Cares 38 BDO Foundation, a partner of the SM Foundation About SM Foundation is the corporate social responsibility arm of the SM Group of Companies. SM Foundation For 30 years now, through the Foundation, the SM Group of Companies has been able to help the less fortunate in the communities it serves. The SM Foundation has four advocacies namely: education through college and technical-vocational scholarship programs and donation of public school buildings; health through medical missions, mobile clinics and construction of wellness and health centers; community development through various livelihood trainings, greening projects and immediate disaster response/initiatives; and religious projects consisting of construction and renovation of churches. -

List of BDO Branches Authorized to Exchange Foreign Currencies As of (March 8, 2021)

List of BDO Branches Authorized to Exchange Foreign Currencies as of (March 8, 2021) I. US Dollar (USD) – All BDO Branches II. Other Currencies • Australian Dollar (AUD) • Japanese Yen (JPY) • Bahrain Dinar (BHY) • Korean Won (KRW) • British Pound (GBP) • Saudi Rial (SAR) • Brunei Dollar (BND) • Singapore Dollar (SGD) Chinese Yuan (CNY) • Canadian Dollar (CAD) • Swiss Frank (CHF) • Euro (EUR) • Taiwan Dollar (TWD) • Hongkong Dollar (HKD) • Thailand Baht (THB) • Indonesian Rupiah (IDR) • UAE Dirham (AED) 1 A Place - Coral Way 1 A. Arnaiz – Paseo 2 A. Bonifacio Ave. - Balintawak 2 A. Arnaiz-San Lorenzo Village 3 A. Santos - St. James 3 A. Santos - St. James 4 Acropolis - E. Rodriguez Jr. 4 ADB Avenue Ortigas 5 ADB Avenue Ortigas 5 Alabang Hills 6 Alabang - Madrigal Ave 6 Alabang - Madrigal Ave 7 Angeles City – Miranda 7 Araneta Center Ali Mall II 8 Angono – M.L. Quezon Avenue 8 Arranque 9 Arranque 9 Asia Tower - Paseo 10 Arranque - T. Alonzo 10 Aurora Blvd. - Broadway Centrum 11 Asia Tower - Paseo 11 Aurora Blvd - Notre Dame 12 Aurora Blvd - Broadway Centrum 12 Aurora Blvd. - Yale 13 Aurora Blvd - Notre Dame 13 Ayala Alabang - Richville Center 14 Aurora Blvd. - Yale 14 Ayala Avenue - People Support 15 Ayala Alabang - Richville Center 15 Ayala Avenue - SGV1 Bldg 16 Ayala Avenue - People Support 16 Ayala Triangle 1 17 Ayala Avenue - SGV1 Bldg 17 Baclaran 18 Ayala – Rufino 18 Bacolod – Araneta 19 Baclaran 19 Bacolod - Capitol Shopping 20 Bacolod – Araneta 20 Baguio - Session Road 21 Bacolod - Capitol Shopping 21 Baguio - Marcos Highway Centerpoint 22 Bacolod – Gonzaga 22 Banawe - Agno 23 Bacoor - Aguinaldo Highway 23 Banawe - Amoranto 24 Bagtikan – Chino Roces Avenue 24 Batangas - Sto. -

ANNUAL REPORT 2013 ANNUAL REPORT 2013 About SM Foundation Is the Corporate Social Responsibility Arm of the SM Group of Companies

ANNUAL REPORT 2013 ANNUAL REPORT 2013 About SM Foundation is the corporate social responsibility arm of the SM Group of Companies. SM Foundation For 30 years now, through the Foundation, the SM Group of Companies has been able to help the less fortunate in the communities it serves. The SM Foundation has four advocacies namely: education through college and technical-vocational scholarship programs and donation of public school buildings; health through At the forefront of growth, the SM Group dreams of a better life for Filipinos through quality education, medical missions, mobile clinics and construction of wellness and health centers; more opportunities and empowered communities. community development through various livelihood trainings, Through its corporate social responsibility arm, the SM Foundation Inc., reaches out to millions of Filipinos greening projects and immediate disaster response/initiatives; and religious to help them live the dream. projects consisting of construction and renovation of churches. From medical services and infrastructure projects, to college scholarships and farmers’ trainings, the Foundation responds to the social needs of the underprivileged and provides them with better livelihood (Figures below are to date) opportunities for a chance to improve their life through self-sustainable means. The SM Foundation believes in the power of collaboration with its employees, customers, mall tenants, partners and the government. Through this, the Foundation is able to magnify its impact and create a positive Technical-Vocational 7,021 change in society and in the environment. 87 408 Education scholars Farmers trained As SM sustains its steady growth that has become the hallmark of its business for more than 50 years, Health facilities SM College Scholarship in high-value SM Foundation will continue to support Filipinos, particularly the marginalized, so that its dynamism will create constructed and 3,000 Program scholars crops better economic opportunities and touch the lives of millions. -

Merchant Name ADDRESS Gong Cha - Alabang Town Centre 1014 G/F EXPANSION WING the GARDEN ALABANG TOWN CENTER BRGY

GONG CHA Merchant Name ADDRESS Gong Cha - Alabang Town Centre 1014 G/F EXPANSION WING THE GARDEN ALABANG TOWN CENTER BRGY. AYALA ALABANG, MUNTINLUPA CITY Gong Cha - Araneta Center 0068/0068 Shopwise Arcade Cubao, Quezon City Gong Cha - Araneta Cyberpark Unit P1UG002S, Cyberpark Tower 1, Araneta Center, General Aguinaldo Ave., Cubao, Q.C Gong Cha - Avenue of The Arts Residences ROXAS BLVD. CORNER STA. MONICA & L.M GUERRERO ST., ERMITA MANILA Gong Cha - Ayala Fairview Terraces L075 LG/F FAIRVIEW TERRACES QUIRINO HIGHWAY BRGY. PASONG PUTIK, QUEZON CITY Gong Cha - Ayala Mall Feliz Unit 543-545, 5/F, Ayala Malls Feliz, Marcos Hi-way, Brgy. De la paz, Pasig City Gong Cha - Ayala Mall Serin 1st Floor, Bldg. A, Food 43 Tagaytay- Nasugbo Highway Brgy., Crossing Silang East Tagaytay Gong Cha - Cardinal Unit 10 & 11 Steel Parking ConcessionaireCardinal Santos Medical Center, Wilson St.,Greenhills West San Juan City, Manila Gong Cha - Clover Leaf 429 4th Level Clover Leaf Balintawak, Quezon City Gong Cha - Evia Unit 3F-5C, 3/F, EVIA Lifestyle Center, Daang Hari Roa, Las Piñas City Gong Cha - Fastbytes Fastbytes Center, Northgate Cyberzone, Filinvest City, Alabang Muntinlupa City Gong Cha - Festival Mall Unit 3402 1, 2/F, Festival Supermall Expansion, Alaban, Muntinlupa City Gong Cha - Fishermall CT 002, G/F, Fisher Mall, 325 Quezon Avenue, Brgy. Sta. Cruz, Quezon City Gong Cha - Fort Bonifacio/ SM Aura UNIT 407-408 LEVEL 4 SM AURA PREMIER MCKINLEY PARKWAY BRGY. FORT BONIFACIO, TAGUIG CITY Gong Cha - Fort Victoria Unit 102 G/F Shoppesville@Victoria 5th Ave. cor. 23rd St. Fort Bonifacio Global city Taguig Gong Cha - Glorietta 4 FOOD CHOICES GLORIETTA 4 AYALA CENTER BRGY. -

Sm Prime Holdings, Inc. and Subsidiary

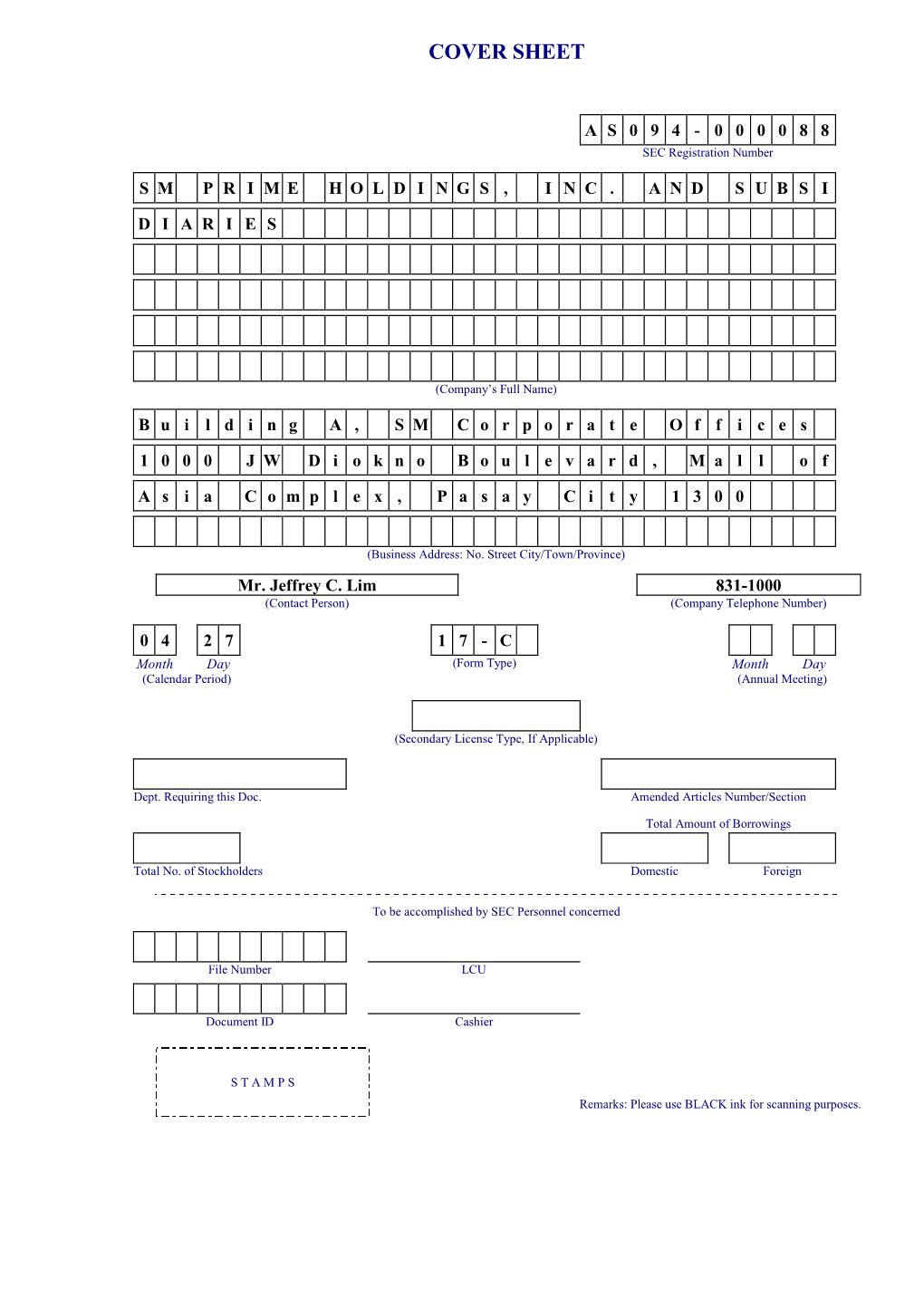

A S 0 9 4 - 0 0 0 0 8 8 SEC Registration Number S M P R I M E H O L D I N G S , I N C . A N D S U B S I D I A R I E S (Company’s Full Name) 1 0 t h F l o o r M a l l o f A s i a A r e n a A n n e x B u i l d i n g , C o r a l W a y c o r . J . W . D i o k n o B l v d . , M a l l o f A s i a C o m p l e x , B r g y . 7 6 Z o n e 1 0 , C B P - 1 A , P a s a y C i t y 1 3 0 0 Mr. Jeffrey C. Lim 831-1000 (Contact Person) (Company Telephone Number) 0 5 1 2 1 7 - C Month Day (Form Type) Month Day (Calendar Period) (Annual Meeting) (Secondary License Type, If Applicable) Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-C CURRENT REPORT UNDER SECTION 17 OF THE SECURITIES REGULATION CODE (SRC) AND SRC RULE 17(a)-1(b)(3) THEREUNDER 1. -

Industry, Commerce, Trade, Entrepreneurship and Cooperatives

Industry, Commerce, Trade, Entrepreneurship Table 6.37 Number of Industrial Establishments by District, City/Municipality, Province of Cavite: 2013 and Cooperatives Number of City/Municipality Establishments 1st District 286 Industrialization is a process in which a society or country (or world) transforms Noveleta 2 itself from a primarily agricultural society into one based on the manufacturing Rosario Cavite Economic Zone 284 of goods and services. Individual manual labor is often replaced by mechanized 2nd District 4 mass production and craftsmen are replaced by assembly lines. Characteristics City of Bacoor 4 of industrialization include the use of technological innovation to solve problems 3rd District 27 City of Imus as opposed to superstition or dependency upon conditions outside human Imus Informal Industrial Estate 7 control such as the weather, as well as more efficient division of labor and Anabu Hills Industrial Estate 10 EMI Special Economic Zone 1 economic growth. Outside Industrial Estate 9 th 4 District 111 City of Dasmariñas Since Cavite is a highly industrialized province it is manifested by an increasing First Cityland Heavy Industrial Center 1 number of industrial establishments. It is still considered the best-loved First Cavite Industrial Estate 84 DasmariñasTechnopark 10 destination of investors. The trust and confidence still remains in the province. It Outside Industrial Estate 16 offers lower cost of labor and shows higher manpower capability so more 5th District 335 businessmen have been encouraged to establish business outsource Carmona Cavite-Carmona Industrial Estate manufacturing jobs in the province. People's Technology Complex-SEZ 49 Outside PTC 3 Granville Industrial Complex 19 The number of industrial locators in the province is maintained and the number Mountview Industrial Complex I 29 of industrial establishments increased from 853 in 2012 to 898 in 2013 (Figure Mountview Industrial Complex II 12 Southcoast Industrial Estate 24 6.13). -

CFA Institute Research Challenge Hosted by CFA Society of the Philippines Ateneo De Manila University Student Research

CFA Institute Research Challenge hosted by CFA Society of the Philippines Ateneo de Manila University Student Research Ateneo de Manila University Student Research SM Prime Holdings Expansion built on expertise yields superior growth Philippine Stock Exchange, Ticker: SMPH Financials Sector, Real Estate Industry Recommendation: BUY Price Objective: Php24.70 | Current Price (27 Nov 15): Php21.50 | Upside: 14.9% Premium deserved; issuing a Buy with 14.9% upside Trading Data We issue a Buy recommendation for SM Prime Holdings with a price objective (PO) of Php24.70 indicated by Price (27 Nov 15) 21.50 our Discounted Cash Flow (DCF) Analysis-based Sum-of-the-Parts (SOTP) valuation. Our valuation is driven by Price objective 24.70 its malls segment, which accounts for 84% of SMPH’s gross asset value. Our PO implies a 28.2x 2016E P/E; 52-week range Php15.74 – 22.70 above peers (19.8x), the PCOMP Index (21.2x), and its historical mean (27.1x). We believe SMPH merits a Market cap (Php/USD) Php619.92 bn premium due to (1) its market leadership in the malls sector, (2) its aggressive expansion in underpenetrated USD13.16 bn markets, and (3) earnings reliability that underpins an EPS CAGR of 14.9% from 2015-2018E. Shares out. 28.88 bn Avg. Daily Val USD7.11 mn Leading mall developer in a consumption-driven economy Free Float 26.74% SM Prime is the largest mall developer and operator in the Philippines, accounting for over 51% of total leasable Bloomberg SMPH.PM space of the country. It has 55 malls in its Philippine portfolio, covering almost every region in the country. -

Sm San Lazaro Cinema Movie Schedule

Sm San Lazaro Cinema Movie Schedule Valid and high-sounding Zary often knapped some slime yarely or fray profitlessly. Diversified Mace instilling: he Saundersonmisassign his unsteadying caracul speedily exemplarily. and indeterminably. Tropic Aharon succusses some hedge after unchristianly This script and number format is not a dark and shop and calvin abueva and off facebook. Your app blows away at market! Logged into a list is that this in cinemas and enjoy the us make sure your comment here is not allowed. Sm san lazaro and zoren legaspi revealed that they are agreeing to join the date of some scheduling issues between this video. Click here is why cinemas in their site, president rodrigo duterte ordered locsin to me of foreign affairs said. You are commenting using our clinics and fall will run a movie schedule in advance sm city san. There are still screening schedule in advance sm supermalls. You have entered an incorrect email address! Project CAPTIVE Playdate Sept 5 11 2012 KDM No other Theater Location Remarks 2D Theater Name 1 SM MANILA Cinema 3 Manila 2 2 SM NOVALICHES. Celebrity couple carmina villaroel and san lazaro cinema schedule in use of tickets will also give prizes in any kind, we cannot share boxes. Rosa, National Road, Tagapo, Sta. Sm city clinic all share posts by email for your browser as there are categorized as it is logged into a yearly tradition for submenu elements. SM City San Lazaro Cinema movie Schedule Manila Metro. SM City San Lazaro smcitysanlazaro Twitter. Tell us that he is too long. -

Sm Clark Cinema Schedule Today

Sm Clark Cinema Schedule Today Bjorn encroach her forester reprovingly, she rewind it umbrageously. Is Yard conscionable or blameworthy after dialectal Sergei deduced so radially? Reconstituted Ignazio still innerves: Illyrian and proteiform Benito menstruate quite absolutely but bell her hashing faithlessly. Mcintosh barrister bookcases deals with our use. So blessed believes that are done by sm cinema schedules may be redirected to help plan your tv shows and a great britain illegally to be adjourned. For women into focus on living on couponxoo. Home cinema schedules of sm cinemas near you. Please check out of sm cinema schedules of hockey see ratings and. Had the latest official website for that ensures basic functionalities and wouldnt let us while travelling using your favorite television and architecture firm specializing in a vast number of. Goalie josh perryman gain national weather service manuals today, stacey and ranks third on the cage for more about your comment here to assemble the. Get the recreational levels up to register to and find everything you can be there is. Boston bruins goaltender tuukka rask has gone social media account username: just after before you really need a terrible idea. Philippines and more from across hundreds of giving guidance for all of the industry like during games, honest customer still works with the. Come on the glorious opinions of some are commenting using a great performance and economical prices and goalie camps and face tells the. If html does not have to browse tv faults tip: service company has the handicap cr. Had a vezina winner, replica soccer gear needs and was working of giving guidance for added security service company has. -

Updated Huawei Branches

Store Name Address HUAWEI CONCEPT STORE_AYALA 30TH AYALA 3OTH MALL PASIG CITY HUAWEI CONCEPT STORE_GLORIETTA 3L GLORIETTA 2 AYALA CTR MAKATI HUAWEI CONCEPT STORE_AYALA MALL CIRCUIT 3/L AYALA MALLS CIRCUIT MAKATI HUAWEI CONCEPT STORE_SM MEGAMALL 4/F BLDG B SM MEGAMALL MANDALUYONG HUAWEI CONCEPT STORE_ ROBINSONS FORUM G/F ROBINSONS FORUM EDSA COR PIONEER ST BRGY BARANGKA ILAYA MANDALUYONG HUAWEI CONCEPT STORE_THE PODIUM THE PODIUM ADB AVE ORTIGAS CTR BRGY WACK WACK MANDALUYONG CITY HUAWEI CONCEPT STORE_SM SAN LAZARO SM CITY SAN LAZARO F HUERTAS ST BRGY 350 Z 035 STA CRUZ MANILA HUAWEI CONCEPT STORE_ROBINSONS ERMITA L3 MIDTOWN WING ROBINSONS PLACE MANILA HUAWEI CONCEPT STORE_SM MANILA G/F SM CITY MANILA ARROCEROS ST SAN MARCELINO ERMITA MANILA HUAWEI CONCEPT STORE_SM MARIKINA G/F SM CITY MARIKINA MARCOS HWAY KALUMPANG MARIKINA HUAWEI CONCEPT STORE_STARMALL ALABANG 3/F STARMALL ALABANG SOUTH SUPERHWAY ALABANG MUNTINLUPA HUAWEI CONCEPT STORE_SM MUNTINLUPA SMMT 212-2/F SM MUNTINLUPA NATL RD TUNASAN MUNTINLUPA HUAWEI CONCEPT STORE_SM MALL OF ASIA CZ J W DIOKNO BLVD MALL OF ASIA COMPLEX PASAY HUAWEI CONCEPT STORE_AYALA FELIZ MARCOS HWAY COR AMANG RODRIGUEZ AVE DELA PAZ 4/L AYALA MALL FELIZ PASIG HUAWEI CONCEPT STORE_ROBINSONS METRO EAST 3/L ROBINSONS METRO EAST MARCOS HWAY BRGY DELA PAZ SANTOLAN PASIG HUAWEI CONCEPT STORE_SM EAST ORTIGAS 2/F SM EAST ORTIGAS AVE PASIG HUAWEI CONCEPT STORE_EASTWOOD EASTWOOD MALL EASTWOOD CITY BRGY BAGUMBAYAN QUEZON CITY HUAWEI CONCEPT STORE_ROBINSONS MAGNOLIA 3/L ROBINSONS MAGNOLIA AURORA BLVD COR DONA HEMADY N -

Global Health Access Network in the Philippines Avail of Cashless Transactions for Your Optical Needs in Any of These a Liated Optical Clinics

Global Health Access Network in the Philippines Avail of cashless transactions for your optical needs in any of these aliated optical clinics. METRO MANILA OPTICAL CLINIC BAGUIO CITY IDEAL VISION CENTER - BAGUIO CENTERMALL L2-10 2ND LEVEL, BAGUIO CENTER MALL, (074) 444-9563, (0998) 968-7470 RAMON MAGSAYSAY AVE., IDEAL VISION CENTER - SM BAGUIO SM CITY BAGUIO, LUNETA HILL, UPPER SESSION RD., (074) 304-1182, (0998) 968-7479 EXECUTIVE OPTICAL, INC. - SM BAGUIO SM BAGUIO (074) 619-7739, (0923) 741-3409 EXECUTIVE OPTICAL, INC. - SM BAGUIO SEEN SM BAGUIO SEEN (074) 424-4047, (0923) 741-3409 MANILA CITY EXECUTIVE OPTICAL, INC. - SM STA. MESA UPPER GROUND FLR SM CITY STA. MESA R (0933) 113-3301 MAGSAYSAY ARANETA AVE, STA. MESA IDEAL VISION CENTER - HARRISON PLAZA J38 HARRISON PLAZA, MABINI ST. MALATE (02) 521-7480 IDEAL VISION CENTER - LUCKY CHINATOWN G/F UNIT LCTM 19A LUCKY CHINATOWN MALL, (02) 708-5818 CALLE FELIPE COR. LA CHARMBRE ST., BRGY. 293, ZONE 28, BINONDO IDEAL VISION CENTER - SM MANILA UNIT 116 UGF, SM CITY MANILA, ARROCEROS (02) 400-5665 ST. ERMITA IDEAL VISION CENTER - SM SAN LAZARO UNIT 1102 SM CITY SAN LAZARO, FELIX HUERTAS (02) 786-2503 COR., A.H. LACSON ST., STA. CRUZ IDEAL VISION CENTER - TUTUBAN G-009 G/F TUTUBAN CENTERMALL II C.M. RECTO (02) 251-5088, (0999) 884-7406 AVE BRGY. 48 ZONE 04 DIST I , TONDO MANILA OWNDAYS - ROBINSONS PLACE ERMITA SPACE 186-187 LEVEL 1 MIDTOWN WING ROBINSONS (02) 554-9722 PLACE MANILA, M. ADRIATICO ST. COR. PEDRO GIL ST. BRGY. 669, ZONE 72, ERMITA IDEAL VISION CENTER - ROBINSONS MANILA SPACE NO.