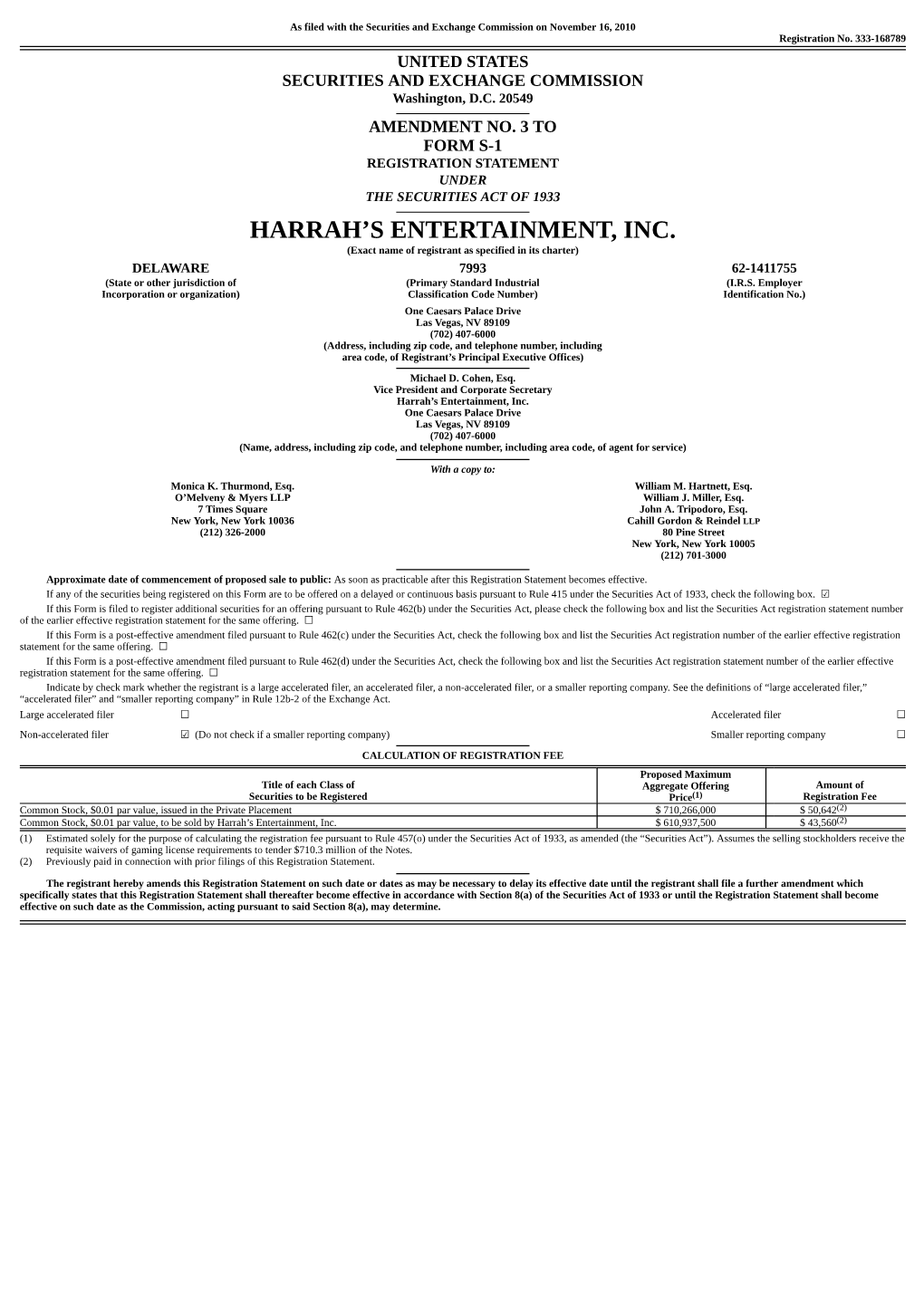

Harrah's Entertainment, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In the Blink of an Eye

FALL & WINTER 2018/19 SPOTLIGHTING EXCEPTIONAL PEOPLE AND PROGRAMS AT BOSTON MEDICAL CENTER In the Blink of an Eye he Gavaghan family knew very little information as they waited anxiously for their son and brother, Brendan, to come out of emergency neurosurgery at Boston Medical Center. All they knew for certain was his cell phone was in his T hand as he fell backwards down the stairs, as indicated by a long mark along the wall. Everything else was unknown, including an answer to the most important question of all: was he going to make it? It all started after the New England Patriots won the Super Bowl in 2017. Like any avid Patriots fan, Brendan joined thousands of others at the celebratory parade in Boston. After the fun ended, he headed home, entering his house through a back entrance like always. BMC President and CEO Kate Walsh, Chair Within seconds, an everyday routine altered Brendan’s life. As he walked up the stairs, of BMC’s Philanthropic Trust and BMC Trustee Randi Cutler, First Lady of Massachusetts Brendan tripped on the carpeting, causing him to fall backwards and land on a tile floor. Lauren Baker, Mistress of Ceremonies Heather The back of his head bore the brunt of the fall. Unruh and Director of BMC’s Grow Clinic Deborah Frank, M.D. Running to see what caused such a loud noise, Brendan’s father found his son unconscious and bleeding severely. He immediately called 911, and within moments first responders Food for Thought were rushing Brendan to BMC. Doctors assessed his condition and discovered his pupils Every November on the Monday were fixed and dilated—a sign of poor prognosis and that the team needed to act fast. -

94-732 — Managing Disruption in Media and Entertainment

Managing Disruption in Media and Entertainment: Syllabus Page 1 of 23 94-732 — Managing Disruption in Media and Entertainment Carnegie Mellon University Heinz College Spring 2021, Mini 4 Instructor: Michael D. Smith [email protected] Office Hours: I’ll make time to help you in any way I can. Feel free to email me ([email protected]) or my assistant Kristen Yeager ([email protected]) to setup a time to meet. Faculty Assistant: Kristen Yeager [email protected] Teaching Assistants: Section A: Shuxuan “Helen” Zeng ([email protected]), Hamburg Hall 3008 Section B: Yangfan Liang ([email protected]), Hamburg Hall 3002 Course Information: Section A Section B Guest Lectures TuTh 8:30-9:50 TuTh 10:10-11:30 TuTh 11:50-1:10 Zoom Link: https://cmu.zoom.us/j/99737299189?pwd=Yi8zZ1ROYWRMY002NE1tWjlTcUpaZz09 Meeting ID: 997 3729 9189 Passcode: 214151 Version: 3/21/21 Managing Disruption in Media and Entertainment: Syllabus Page 2 of 23 Zoom Policies and Expectations:1 As this class will be taught via Zoom, not in-person, I would like us to follow the following Zoom policies for the class: • Please have your video ‘on’ during the class. I have found that having the video on (allowing all of us to see each other) helps everyone feel more ‘connected’ to the other students and to the professor. If having your video on is a problem due to internet bandwidth constraints or due to some other technical issue, please notify me by e-mail or text before the class begins. • Please set your Zoom name to be your first name (or the name you would like to be referred to during the course) and your last name. -

Names, Addresses and Experience of Directors and Officers

Page | 1 Names, Addresses and Experience of Directors and Officers Woodbury Casino, LLC is wholly owned by Caesars Growth Partners. Caesars Acquisition Company is the managing member of Caesars Growth Partners. Woodbury Casino, LLC has three officers. The name, address, and title of each officer & director of Caesars Acquisition Company is included below: Mitch Garber, CEO and President, Caesars Acquisition Company o Address: 1411 Peel Street, Montreal, Quebec, CA REDACTED Craig Abrahams, Senior Vice President and Chief Financial Officer, Caesars Acquisition Company o Address: One Caesars Palace Drive, Las Vegas, NV 89109 REDACTED Michael Cohen, Senior Vice President, Corporate Development, General Counsel and Corporate Secretary, Caesars Acquisition Company o Address: One Caesars Palace Drive, Las Vegas, NV 89109 REDACTED Applicant Information VI.G. Page | 2 Caesars Entertainment Operating Company is the sole member of Woodbury Manager, LLC. Woodbury Manager, LLC has no officers or directors. The name, address, and title of each known individual that will provide executive management duties are included below: Gary Loveman, Chairman, President and CEO, Caesars Entertainment o Address: One Caesars Palace Drive, Las Vegas, NV 89109 REDACTED Greg Miller, Executive Vice President of Development, Caesars Entertainment o Address: One Caesars Palace Drive, Las Vegas, NV 89109 REDACTED Eric Hession, Senior Vice President of Finance & Treasurer, Caesars Entertainment o Address: One Caesars Palace Drive, Las Vegas, NV 89109 REDACTED Resumes of the respective individuals are included on the following pages. Applicant Information VI.G. Page | 3 Mitch Garber CEO and President, Caesars Acquisition Company Mitch Garber joined Caesars Entertainment in late 2008 and with Caesars Entertainment, started Caesars Interactive Entertainment in 2009 as CEO. -

Investigative Report for the Massachusetts Gaming Commission

INVESTIGATIVE REPORT FOR THE MASSACHUSETTS GAMING COMMISSION APPLICANT: Sterling Suffolk Racecourse, LLC PRINCIPALS: Joseph O’Donnell Richard Fields October 18, 2013 Category 1 Gaming License Entity Gaming-License Investigation: Sterling Suffolk Racecourse LLC 1 Executive Summary On January 15, 2013, Sterling Suffolk Racecourse, LLC (“Applicant” or “SSR”) filed an application for a Category 1 gaming license with the Massachusetts Gaming Commission (“Commission”). The proposed casino would be at the site of the Suffolk Downs racetrack in East Boston. SSR and its affiliated entities submitted the requisite entity disclosure forms. A table of organization for the Applicant and its various affiliates relating to the casino project is attached as an exhibit to this report (Exhibit 1). In addition, numerous individuals submitted Personal History Disclosure Forms as qualifiers of the Applicant and were subject to a thorough background investigation. The reports on their individual qualifications are included herein. The principal entity members of SSR include the Coastal Development Ownership Group ( ) and the O’Donnell Group of Ownership Companies ( ). Caesars Entertainment Corporation (“Caesars” or “Company”) holds a minority interest in the Applicant through a subsidiary company, Caesars Massachusetts Investment Company LLC ( ), and is engaged as the prospective manager and operator of the proposed casino project through another subsidiary, Caesars Massachusetts Management Company LLC. Vornado Suffolk LLC, a subsidiary of Vornado Realty Trust (“Vornado”), holds a membership interest in the Applicant, but following its decision not to submit to regulatory filing requirements, Vornado was required by the Commission’s Investigations and Enforcement Bureau (“IEB”) to place its entire interest in the Applicant into a divestiture trust. -

The Suburbanization of the Strip (1941 – 1963)

UC Berkeley UC Berkeley Electronic Theses and Dissertations Title The Strip: Las Vegas and the Symbolic Destruction of Spectacle Permalink https://escholarship.org/uc/item/3jm6702w Author Al, Stefan Johannes Publication Date 2010 Peer reviewed|Thesis/dissertation eScholarship.org Powered by the California Digital Library University of California The Strip: Las Vegas and the Symbolic Destruction of Spectacle By Stefan Johannes Al A dissertation submitted in the partial satisfaction of the Requirements for the degree of Doctor of Philosophy in City and Regional Planning in the Graduate Division of the University of California, Berkeley Committee in charge: Professor Nezar AlSayyad, Chair Professor Greig Crysler Professor Ananya Roy Professor Michael Southworth Fall 2010 The Strip: Las Vegas and the Symbolic Destruction of Spectacle © 2010 by Stefan Johannes Al Abstract The Strip: Las Vegas and the Symbolic Destruction of Spectacle by Stefan Johannes Al Doctor of Philosophy in City and Regional Planning University of California, Berkeley Professor Nezar AlSayyad, Chair Over the past 70 years, various actors have dramatically reconfigured the Las Vegas Strip in many forms. I claim that behind the Strip’s “reinventions” lies a process of symbolic destruction. Since resorts distinguish themselves symbolically, each new round of capital accumulation relies on the destruction of symbolic capital of existing resorts. A new resort either ups the language within a paradigm, or causes a paradigm shift, which devalues the previous resorts even further. This is why, in the context of the Strip, buildings have such a short lifespan. This dissertation is chronologically structured around the four building booms of new resort construction that occurred on the Strip. -

A Symposium Sponsored by the Federal Reserve Bank of Kansas City

A Symposium Sponsored By The Federal Reserve Bank of Kansas City POLICIES FOR LONG-RUN ECONOMIC GROWTH A Symposium Sponsored By The Federal Reserve Bank of Kansas City Jackson Hole, Wyoming August 27-29, 1992 Contents Foreword vii The Contributors ix Symposium Summary xvii OPENING REMARKS 1 ALAN GREENSPAN, Chairman, Board of Governors of the Federal Reserve System Causes of Declining Growth MICHAEL R. DARBY, Professor, University of California at Los Angeles Causes of Declining Growth in Industrialized Countries 15 KUMIHARU SHIGEHARA, Head of the Department of Economics and Statistics, OECD Why Has Potential Growth Declined? The Case of Germany 41 HORST SIEBERT, President, Kiel Institute of World Economics THE SEARCH FOR GROWTH CHARLES I. PLOSSER, Professor, University of Rochester Commentary: N. GREGORY MANKIW, Professor, Harvard University MACROECONOMIC POLICY AND LONG-RUN GROWTH 93 J. BRADFORD DE LONG, Professor, Harvard University LAWRENCE H. SUMMERS, Vice President and Chief Economist, The World Bank Commentary: C. FRED BERGSTEN, Director, Institute for International Economics Commentary: LAWRENCE A. KUDLOW, Chief Economist and Senior Managing Director, Bear Stearns & Co., Inc. Commentary: ALLAN H. MELTZER, Professor, 141 Carnegie-Mellon University ECONOMIC REORGANIZATION AS A PREREQUISITE TO GROWTH 149 DOMING0 F. CAVALLO, Minister of Economy and Public Works and Services, Republic of Argentina INVESTMENT POLICIES TO PROMOTE GROWTH 157 ALAN J. AUERBACH,Deputy Chief of Stafi Joint Committee on Taxation Commentary: MARTIN FELDSTEIN, President, 185 National Bureau of Economic Research Commentary: NORBERT H. WALTER, Chief Economist, 193 Deutsche Bank HUMAN CAPITAL AND ECONOMIC GROWTH 199 ROBERT J. BARRO, Professor, Harvard University Commentary: LAWRENCE F. KATZ, Professor, 217 Harvard University Commentary: JAMES C. -

Harrah's Entertainment and the Gaming Industry

Scale and Differentiation in Services: Using Information Technologies to Manage Customer Experiences at Harrah’s Entertainment and Other Companies by Vikram Mansharamani Submitted to the Alfred P. Sloan School of Management on January 11, 2007 in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy. ABSTRACT This dissertation is focused on the topic of service innovation and explores economies of scale and strategic differentiation in services via an inductive field-based case study of the world’s largest casino gaming company, Harrah’s Entertainment. It includes comparisons to services firms in other industries such as distribution/logistics (UPS) and for-profit/online education (Apollo Group/University of Phoenix). The findings suggest that scale and differentiation (considered by many to be mutually exclusive in services) can be combined through the strategic use of information technology in a manner that increases customer switching costs, resulting in improved profitability and returns. The limitations of standardization-only scale-oriented strategies are discussed, and the dissertation concludes with a description of the three key components needed by any firm seeking to employ a strategy of scalable service differentiation: (1) a loyalty program, or other means of linking specific transaction data with specific customers, (2) an analytic engine that determines the ranking/prioritization of customers and the criteria upon which to differentiate services, and (3) a set of information technology tools that automate consistent differentiated service delivery across a company’s touch-points with its customers. Thesis Supervisor: Michael A. Cusumano Title: Sloan Management Review Distinguished Professor of Management Mansharamani Page 2 ACKNOWLEDGMENTS This dissertation would not have been possible without the love, support, and encouragement of my wife, Kristen Hanisch Mansharamani, and the not-so-subtle vocal encouragement (at all hours of the day and night) from my newborn daughter Victoria (“Tori”). -

The Strip: Las Vegas and the Symbolic Destruction of Spectacle

The Strip: Las Vegas and the Symbolic Destruction of Spectacle By Stefan Johannes Al A dissertation submitted in the partial satisfaction of the Requirements for the degree of Doctor of Philosophy in City and Regional Planning in the Graduate Division of the University of California, Berkeley Committee in charge: Professor Nezar AlSayyad, Chair Professor Greig Crysler Professor Ananya Roy Professor Michael Southworth Fall 2010 The Strip: Las Vegas and the Symbolic Destruction of Spectacle © 2010 by Stefan Johannes Al Abstract The Strip: Las Vegas and the Symbolic Destruction of Spectacle by Stefan Johannes Al Doctor of Philosophy in City and Regional Planning University of California, Berkeley Professor Nezar AlSayyad, Chair Over the past 70 years, various actors have dramatically reconfigured the Las Vegas Strip in many forms. I claim that behind the Strip’s “reinventions” lies a process of symbolic destruction. Since resorts distinguish themselves symbolically, each new round of capital accumulation relies on the destruction of symbolic capital of existing resorts. A new resort either ups the language within a paradigm, or causes a paradigm shift, which devalues the previous resorts even further. This is why, in the context of the Strip, buildings have such a short lifespan. This dissertation is chronologically structured around the four building booms of new resort construction that occurred on the Strip. Historically, there are periodic waves of new casino resort constructions with continuous upgrades and renovation projects in between. They have been successively theorized as suburbanization, corporatization, Disneyfication, and global branding. Each building boom either conforms to a single paradigm or witnesses a paradigm shift halfway: these paradigms have been theorized as Wild West, Los Angeles Cool, Pop City, Corporate Modern, Disneyland, Sim City, and Starchitecture. -

GAMBLING IMPACT STUDY: Part 1, Section A: Assessment of the Florida Gaming Industry and Its Economic Effects

GAMBLING IMPACT STUDY: Part 1, Section A: Assessment of the Florida Gaming Industry and its Economic Effects Prepared for the State of Florida Legislature July 1, 2013 i Contents EXECUTIVE SUMMARY ..................................................................................................................... IX INTRODUCTION ........................................................................................................................................... IX KEY GAMBLING SECTOR FINDINGS .................................................................................................................. X FISCAL IMPACTS ........................................................................................................................................ XIII I. INTRODUCTION .........................................................................................................................1 METHODOLOGY .......................................................................................................................................... 2 II. GENERAL ASSESSMENT OF GAMBLING .......................................................................................5 A. GROWTH AND EVOLUTION OF GAMBLING IN UNITED STATES ..................................................................... 5 1. How Governments Respond to Gambling Expansion ............................................ 8 a. States Endeavor to Realize Value from Gaming via License Fees ....................... 13 2. Racetrack Casinos Evolve, Table Games Arrive.................................................. -

THE MARKETING MOMENT: Sports, Wagering, and Advertising in the United States

THE MARKETING MOMENT: Sports, Wagering, and Advertising in the United States April 15, 2021 University of Nevada, Las Vegas International Gaming Institute Jennifer Shatley, MS Kasra Ghaharian, MS Bo Bernhard, Ph.D. Alan Feldman Becky Harris, LL.M 1 Executive Summary Advertising is ubiquitous, coming at us through our phones, our screens, and even, seemingly, the ether itself, via the always-on ears and voice of Alexa or Siri. Meanwhile, social media has efficiently transformed users into data, and data into highly targeted ads. The experience of being targeted via advertising has become so omnipresent that we can easily forget where boundaries might lie, nor do many of us stop to consider the experience’s very ubiquity. This report aims to help inform a critical conversation on advertising as it plays out in sports wagering settings – a particularly contentious area that the US is only beginning to engage. We draw on evidence and insights from other jurisdictions, as the International Gaming Institute has long recommended, and we bring together experts from the fields of law, operations, regulation, problem gambling, responsible gaming, and sociology to do so. The report itself takes a “yesterdays, todays, and tomorrows” approach, by examining history first, then summarizing a number of current debates, and then providing recommendations for the future. Specifically, after reviewing the historical evidence, relevant (but relatively scant) research literature, and current debates, we recommend the following for the future – to help avoid the kinds of pitfalls that other jurisdictions have experienced: 1) Especially during this “new” period of sports wagering legalization and implementation, sports gambling operators must ensure that advertising does not target vulnerable populations, particularly youth.