The Economics of Click Fraud By

Total Page:16

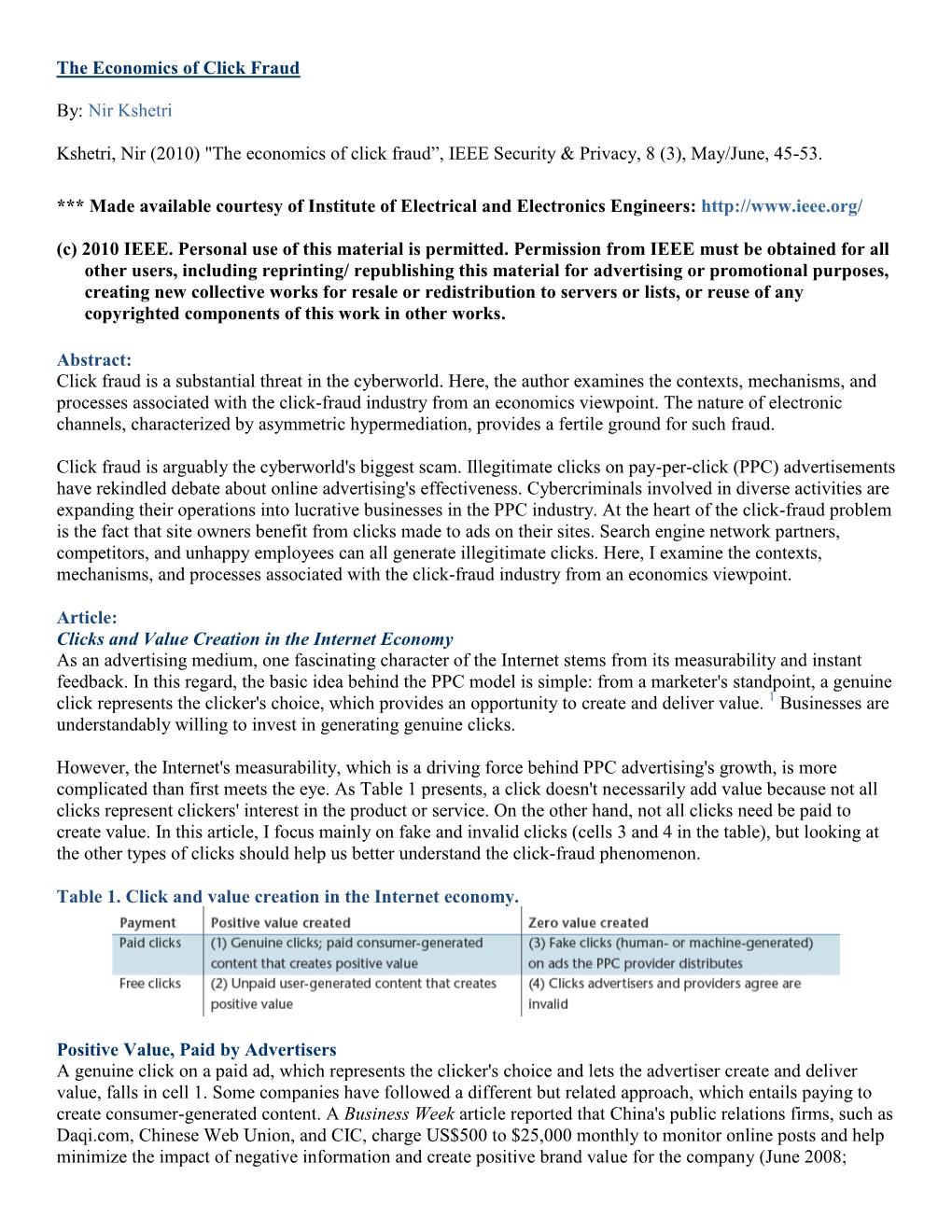

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IYIR for HTML

INFOSEC UPDATE 2006 Student Workbook Norwich University June 19-20, 2006 M. E. Kabay, PhD, CISSP-ISSMP Assoc. Prof. Information Assurance Program Director, MSIA BSIA Division of Business Management Norwich University [email protected] Copyright © 2006 M. E. Kabay. All rights reserved. Page 1 INFOSEC UPDATE 2006 -- June 19-20, 2006 01 Introduction Category 01 Introduction 2006-06-12 Introduction M. E. Kabay, PhD, CISSP WELCOME Welcome to the 2005 edition of the Information Security Year in Review (IYIR) project. In 1993 and 1994, I was an adjunct professor in the Institute for Government Informatics Professionals in Ottawa, Canada under the aegis of the University of Ottawa. I taught a one-semester course introducting information security to government personnel and enjoyed the experience immensely. Many of the chapters of my 1996 textbook, _The NCSA Guide to Enterprise Security_ published by McGraw-Hill were field-tested by my students. In 1995, I was asked if I could run a seminar for graduates of my courses to bring them up to date on developments across the entire field of information security. Our course had twenty students and I so enjoyed it that I continued to develop the material and teach the course with the NCSA (National Computer Security Association; later called ICSA and then eventually renamed TruSecure Corporation and finally CyberTrust, its current name) all over the United States, Canada, Europe, Asia and the Caribbean. After a few years of working on this project, it became obvious that saving abstracts in a WordPerfect file was not going to cut it as an orderly method for organizing the increasing mass of information that I was encountering in my research. -

Click Fraud,' Personal, Non-Commercial Use Only

April 6, 2005 PAGE ONE Traffic Jam DOW JONES REPRINTS This copy is for your In 'Click Fraud,' personal, non-commercial use only. To order presentation-ready copies Web Outfits Have for distribution to your colleagues, clients or customers, use the Order A Costly Problem Reprints tool at the bottom of any article or visit: www.djreprints.com. Marketers Worry About Bills Inflated by People Gaming • See a sample reprint in PDF format . The Search-Ad System • Order a reprint of this article now. Mr. McKelvey Turns Detective RELATED ARTICLE By KEVIN J. DELANEY • Internet Firms Face Legal Test on Staff Reporter of THE WALL STREET JOURNAL Advertising Fees3 April 6, 2005; Page A1 Nathan McKelvey began to worry about foul play when Yahoo Inc. refunded him $69.28 early last year. He grew more suspicious when a $16.91 refund arrived from Google Inc. The refunds were for "unusual clicks" and "invalid click activity" and they suggested someone was sabotaging Mr. McKelvey's advertising strategy. He pitches his charter-jet brokerage the way companies increasingly do: contracting with Yahoo and Google to serve up small text ads to anyone searching the Web using certain words, such as "private jet" or "air charter." He pays the search companies a fee every time someone clicks on his ads. But Yahoo and Google determined someone was clicking on CharterAuction.com Inc.'s ads with no intention of doing business, thus unfairly driving up the company's advertising costs. Mr. McKelvey, turning detective, combed through lists of "IP" addresses, the identifying codes supplied by computers when they access Web sites. -

Clickjacking: Attacks and Defenses

Clickjacking: Attacks and Defenses Lin-Shung Huang Alex Moshchuk Helen J. Wang Carnegie Mellon University Microsoft Research Microsoft Research [email protected] [email protected] [email protected] Stuart Schechter Collin Jackson Microsoft Research Carnegie Mellon University [email protected] [email protected] Abstract such as a “claim your free iPad” button. Hence, when Clickjacking attacks are an emerging threat on the web. the user “claims” a free iPad, a story appears in the user’s In this paper, we design new clickjacking attack variants Facebook friends’ news feed stating that she “likes” the using existing techniques and demonstrate that existing attacker web site. For ease of exposition, our description clickjacking defenses are insufficient. Our attacks show will be in the context of web browsers. Nevertheless, the that clickjacking can cause severe damages, including concepts and techniques described are generally applica- compromising a user’s private webcam, email or other ble to all client operating systems where display is shared private data, and web surfing anonymity. by mutually distrusting principals. We observe the root cause of clickjacking is that an Several clickjacking defenses have been proposed and attacker application presents a sensitive UI element of a deployed for web browsers, but all have shortcomings. target application out of context to a user (such as hiding Today’s most widely deployed defenses rely on frame- the sensitive UI by making it transparent), and hence the busting [21, 37], which disallows a sensitive page from user is tricked to act out of context. To address this root being framed (i.e., embedded within another web page). -

Online Advertising Security: Issues, Taxonomy, and Future Directions

IEEE COMMUNICATIONS SURVEYS & TUTORIALS, VOL. XX, NO. NN, XX 2021 1 Online Advertising Security: Issues, Taxonomy, and Future Directions Zahra Pooranian, Senior Member, IEEE, Mauro Conti, Senior Member, IEEE, Hamed Haddadi, Member, IEEE and Rahim Tafazolli, Senior Member, IEEE Abstract—Online advertising has become the backbone of over time. Also, mobile advertising has become one of the the Internet economy by revolutionizing business marketing. It fastest-growing industries with the advent of smartphones [6]. provides a simple and efficient way for advertisers to display Millions of mobile applications are registered in various ap- their advertisements to specific individual users, and over the last couple of years has contributed to an explosion in the plication platforms such as Google Play Store, Apps Store, income stream for several web-based businesses. For example, etc., which contain at least one advertising library that allows Google’s income from advertising grew 51.6% between 2016 and mobile advertising [7]. According to [8], in 2019, total mobile 2018, to $136.8 billion. This exponential growth in advertising advertising spending worldwide has reached $189 billion and revenue has motivated fraudsters to exploit the weaknesses of will surpass $240 billion by 2022. the online advertising model to make money, and researchers to discover new security vulnerabilities in the model, to propose Online advertising uses the same mechanisms that are countermeasures and to forecast future trends in research. applied to manage other “traditional” advertising channels, Motivated by these considerations, this paper presents a such as newspapers, radio or TV, but is much more creative in comprehensive review of the security threats to online advertising providing targeted and personalized advertisements [9], [10]. -

UI Redressing and Clickjacking: About Click Fraud and Data Theft

Introduction Attack vectors Counteractive measures Conclusion and outlook UI Redressing and Clickjacking: About click fraud and data theft Marcus Niemietz [email protected] Ruhr-University Bochum Chair for Network and Data Security 25th of November 2011 Marcus Niemietz, RUB @Zeronights UI Redressing and Clickjacking Introduction Attack vectors Counteractive measures Conclusion and outlook Short and crisp details about me Studying \IT-Security/Information Technology", RUB \Computer Science", Distance University Hagen B.Sc. in \IT-Security/Information Technology" Books Authentication Web Pages with Selenium ≥Feb. 2012: Clickjacking und UI-Redressing International speaker Work: RUB, Pixelboxx, ISP and IT-Security, Freelancer (trainings, penetration tests) Twitter: @mniemietz Marcus Niemietz, RUB @Zeronights UI Redressing and Clickjacking Introduction Attack vectors Counteractive measures Conclusion and outlook Contents 1 Introduction UI redressing Clickjacking 2 Attack vectors UI redressing Round up Clickjacking Tool 3 Counteractive measures Frame busting Busting frame busting Clickjacking statistics 4 Conclusion and outlook Marcus Niemietz, RUB @Zeronights UI Redressing and Clickjacking Introduction Attack vectors UI redressing Counteractive measures Clickjacking Conclusion and outlook Introduction Google Inc. can generate a profit of over $8.5 billion in 2010 Interesting for commercial companies to offer web applications shopping banking share status messages New attacks available that can bypass existing protection mechanisms CSRF -

Click Fraud: Interest in Using the Internet As a Marketing Tool Continues to Grow

Click fraud: Interest in using the Internet as a marketing tool continues to grow. Paid search engine, or pay-per-click advertising (when companies pay for keyword ads listed on a search engine), has what does it become the fastest-growing segment of online advertising.1 By 2010, U.S. advertisers will 2 mean for spend an estimated $7.5 billion on paid search ads compared to $3 billion in 2004. Not only has interest in pay-per-click advertising grown, but so too has click fraud. Click fraud occurs marketers? when a person or software program creates or misrepresents actual clicks. These fraudulent or inaccurate clicks result in additional charges to the advertiser. Industry consultants estimate as many as 20% of clicks on paid search engine ads are fraudulent, costing advertisers more than $1 billion annually—larger than the total magnitude of credit card fraud in the U.S.3 A study of click fraud: a growing, costly issue for advertisers About the study4 from 5MetaCom Legitimate Alleged In a 2006 study, an online clicks fraudulent clicks market research firm evalu- 29.5% (10,268 clicks) ated three paid search engine ad campaigns 9.8% (Google AdWordsீ). The (1,257 clicks) companies advertising paid a fee for each user who clicked on their ad. 8.3% The advertiser with the (349 highest cost per click ($1- clicks) 2) suffered the highest number of alleged fraudu- lent clicks (29.5%), result- 34,763 total clicks ing in bogus charges of 12,790 total clicks $15,395. The other cam- paigns had significantly 4,184 total clicks lower cost per click rates and encountered lower rates of click fraud. -

In Re Nuvelo, Inc. Securities Litigation 07-CV-04056-Declaration of Mark

BERGER & MONTAGUE, P.C. Sherrie R. Savett Carole A. Broderick Phyllis M. Parker 1622 Locust Street Philadelphia, PA 19103 Tel: (215) 875-3000 Fax: (215) 875-4604 Email: [email protected] cbroderick@bm ,net [email protected] IZARD NOBEL LLP ROBBINS GELLER RUDMAN Jeffrey S. Nobel & DOWD LLP Mark P. Kindall, Bar No 138703 Darren J. Robbins Nancy A. Kulesa Dennis J. Herman 29 South Main Street Eli R. Greenstein Suite 215 S. Ashar Ahmed West Hartford, Ct 06107 Post-Montgomery Center Tel: (860) 493-6292 One Montgomery Street, Suite 1800 Fax: (860) 493-6290 San Francisco, CA 94104 Email: [email protected] Tel: (415) 288-4545 [email protected] Fax: (415) 288-4534 [email protected] Email: [email protected] dennisb@rgrdlaw,corn [email protected] aahmed@rgrdlaw com Co-Lead Counsel for Plaintiffs Liaison Counsel UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF CALIFORNIA SAN FRANCISCO DIVISION In re NUVELO, INC. SECURITIES Master File No 07-CV-04056-VRW LITIGATION CLASS ACTION DECLARATION OF MARK P. KINDALL IN SUPPORT OF PLAINTIFFS' MOTION FOR CLASS CERTIFICATION DATE: March .3, 2011 I TIME: 10:00 a.rn. I COURTROOM: 6 DECLARATION OF MARK P KINDALL IN SUPPORT OF PLArNTIFFS' MOTION FOR CLASS CERTIFICATION - 07-CV-04056-VRW DECLARATION OF MARK P. KINDALL IN SUPPORT OF PLAINTIFFS' MOTION FOR CLASS CERTIFICATION 2 3 I, Mark P. Kindall, hereby declare as follows: 4 1. I am a partner at the law firm of Izard Nobel LLP, which was appointed Co-Lead 5 Counsel for Plaintiffs in this litigation on September 19, 2007. I have personal knowledge of the 6 facts set forth herein. -

Real-Time Ad Click Fraud Detection

San Jose State University SJSU ScholarWorks Master's Projects Master's Theses and Graduate Research Spring 5-18-2020 REAL-TIME AD CLICK FRAUD DETECTION Apoorva Srivastava San Jose State University Follow this and additional works at: https://scholarworks.sjsu.edu/etd_projects Part of the Artificial Intelligence and Robotics Commons, and the Information Security Commons Recommended Citation Srivastava, Apoorva, "REAL-TIME AD CLICK FRAUD DETECTION" (2020). Master's Projects. 916. DOI: https://doi.org/10.31979/etd.gthc-k85g https://scholarworks.sjsu.edu/etd_projects/916 This Master's Project is brought to you for free and open access by the Master's Theses and Graduate Research at SJSU ScholarWorks. It has been accepted for inclusion in Master's Projects by an authorized administrator of SJSU ScholarWorks. For more information, please contact [email protected]. REAL-TIME AD CLICK FRAUD DETECTION A Thesis Presented to The Faculty of the Department of Computer Science San Jose´ State University In Partial Fulfillment of the Requirements for the Degree Master of Science by Apoorva Srivastava May 2020 © 2020 Apoorva Srivastava ALL RIGHTS RESERVED The Designated Thesis Committee Approves the Thesis Titled REAL-TIME AD CLICK FRAUD DETECTION by Apoorva Srivastava APPROVED FOR THE DEPARTMENT OF COMPUTER SCIENCE SAN JOSE´ STATE UNIVERSITY May 2020 Dr. Robert Chun, Ph.D. Department of Computer Science Dr. Thomas Austin, Ph.D. Department of Computer Science Shobhit Saxena Google LLC ABSTRACT REAL-TIME AD CLICK FRAUD DETECTION by Apoorva Srivastava With the increase in Internet usage, it is now considered a very important platform for advertising and marketing. Digital marketing has become very important to the economy: some of the major Internet services available publicly to users are free, thanks to digital advertising. -

How Fictitious Clicks Occur in Third-Party Click Fraud Audit Reports

How Fictitious Clicks Occur in Third-Party Click Fraud Audit Reports Click Quality Team Google, Inc. August 8, 2006 Summary Google has detected pervasive reproducible problems in the way third-party click fraud auditing firms gather and report their data. These problems cause their reports to contain fictitious clicks – clicks which were never made on Google AdWords ads. Because of these fictitious clicks, third-party click fraud auditing firms significantly overestimate the number of clicks occurring on an advertiser’s account – and even more significantly overestimate the amount of “click fraud” detected. This report presents: • Background on third-party click fraud estimates and methodology problems • Findings from an internal Google review of third-party click fraud auditing reports • Recommendations for addressing this issue • Demonstrations of how fictitious clicks occur in third-party systems • Detailed case studies for three major third-party auditing services Background We have seen numerous reports of click fraud estimates which we believe significantly overestimate the impact on advertisers. We examined and addressed the methodology of one of the widely quoted reports a few months ago here: http://adwords.blogspot.com/2006/03/about-invalid-clicks.html. We have continued to see third-party click fraud auditing firms stating that their measurements show much higher levels of click fraud than we believe could possibly be realistic (e.g. 14%), which is troubling. These estimates have also had a high variance, ranging up to 35%. Although only a very small number of AdWords advertisers use third-party click fraud auditing firms, the click fraud estimates produced by these firms have been highly publicized and caused concern for many advertisers. -

A Solution for the Automated Detection of Clickjacking Attacks

A Solution for the Automated Detection of Clickjacking Attacks Marco Balduzzi Manuel Egele Institute Eurecom Technical University Vienna Sophia-Antipolis [email protected] [email protected] Engin Kirda Davide Balzarotti Christopher Kruegel Institute Eurecom Institute Eurecom University of California Sophia-Antipolis Sophia-Antipolis Santa Barbara [email protected] [email protected] [email protected] ABSTRACT 1. INTRODUCTION Clickjacking is a web-based attack that has recently received Web applications have evolved from simple collections of a wide media coverage. In a clickjacking attack, a malicious static HTML documents to complex, full-fledged applica- page is constructed such that it tricks victims into clicking tions containing hundreds of dynamically generated pages. on an element of a different page that is only barely (or not The combined use of client and server-side scripting allows at all) visible. By stealing the victim’s clicks, an attacker developers to provide highly sophisticated user interfaces could force the user to perform an unintended action that is with the look-and-feel and functionalities that were previ- advantageous for the attacker (e.g., initiate an online money ously only reserved to traditional desktop applications. At transaction). Although clickjacking has been the subject the same time, many web applications have evolved into of many discussions and alarming reports, it is currently mesh-ups and aggregation sites that are dynamically con- unclear to what extent clickjacking is being used by attackers structed by combining together content and functionalities in the wild, and how significant the attack is for the security provided by different sources. -

Using Web-Scale Graph Analytics to Counter Technical Support Scams

Using Web-Scale Graph Analytics to Counter Technical Support Scams Jonathan Larson Bryan Tower Duane Hadfield Darren Edge Christopher White Microsoft AI & Research Microsoft AI & Research Digital Crimes Unit Microsoft AI & Research Microsoft AI & Research Microsoft Microsoft Microsoft Microsoft Microsoft Silverdale, WA, USA Silverdale, WA, USA Redmond, WA, USA Cambridge, UK Redmond, WA, USA [email protected] [email protected] [email protected] [email protected] [email protected] Abstract—Technical Support Scams delivered through Support Scams. While the design of the tool was based on the malicious webpages and linked advertisements are an endemic investigative tradecraft that contributed to 16 major enforcement problem on the web. To avoid detection, scammers systematically actions taken by the FTC against scam organizations and their vary the URLs, web page designs, and phone numbers of scam owners in 2016 [7], its subsequent deployment from 2016-2018 delivery. We describe a web-scale pipeline powered by Cloud AI has led to further actions by Indian law enforcement on Delhi- services that continuously detects and links evidence of such based call centers and helped to drive a global 5-percent decline scams. By integrating this evidence in a graph structure and in consumer exposure to ad-based Technical Support Scams [2]. exposing it for forensic analysis in a user interface, we enable investigators and law enforcement partners to track the evolving scope and sophistication of scam operations. This approach automates and scales investigative tradecraft that contributed to major enforcement actions by the FTC in 2016. From 2016-2018, it helped reduce consumer exposure to such scams by 5 percent. -

Characterizing Large-Scale Click Fraud in Zeroaccess

Characterizing Large-Scale Click Fraud in ZeroAccess † ✸ ✷ † ✸ § ¶ Paul Pearce Vacha Dave Chris Grier Kirill Levchenko Saikat Guha ‡ † ✸ § § Damon McCoy Vern Paxson Stefan Savage Geoffrey M. Voelker † ✸ University of California, Berkeley International Computer Science Institute ✷ § Microsoft University of California, San Diego ¶ ‡ Microsoft Research India George Mason University ABSTRACT more lucrative niches to maximize their returns (e.g., counterfeit Click fraud is a scam that hits a criminal sweet spot by both tap- goods, fake anti-virus, ransomware, credit card theft, cryptocur- ping into the vast wealth of online advertising and exploiting that rency mining, etc.). Monetization, however, also presents some ecosystem’s complex structure to obfuscate the flow of money to its of the greatest risks, since it represents both a single point of vul- perpetrators. In this work, we illuminate the intricate nature of this nerability in the business model and a potential means of forensic activity through the lens of ZeroAccess—one of the largest click attribution [18, 24, 27]. Thus, the ideal monetization strategy for an fraud botnets in operation. Using a broad range of data sources, in- Internet scammer would not only tap into great wealth, but would cluding peer-to-peer measurements, command-and-control teleme- also effectively launder the money trail as well. As we will describe try, and contemporaneous click data from one of the top ad net- in this paper, the modern advertising ecosystem is remarkably well- works, we construct a view into the scale and complexity of modern suited to this need, and modern click fraud provides perhaps the non click fraud operations.