Chapter Iii Wine Industry in Nashik District

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

With Wines for Reasonsthat Go

Kavita Devi Faiella H o t Food L ı st July-August Sula’s Dindori Reserve Shiraz Harper’s Bazaar picks four wines from Sula Vineyards’s bouquet that women are sure to love While Chhavi may not be a yardstick, she is definitely an • Sula Vineyards Blush Zinfandel indicator of the growing 2008: A rosé with the sweet aromas oenophilia, the love of wine, of watermelon, grapefruit and amongst women. As more honeysuckle, it has an off-dry palate and more indigenous and and flavours of candied fruit. Served international wines make chilled, it’s great for picnics and hot their presence felt, Ameeta Sharma summer days. Rs 400 onwards. exclusive wine clubs multiply and it becomes occasion, to just wanting to understand The all-welcoming approach has other • Sula Vineyards Dindori Reserve difficult to get tables at wines better.” The group consisted of benefits as well. “you can’t ignore the fact Shiraz 2007: This is a dark purple haute wine bars, women homemakers and corporate executives, that holding a wine glass is a fashion wine with intense aromas of pepper, are finding themselves aged 27 to 45, some of who knew a lot statement, not to forget its much- Alexandra Marnier-Lapostolle Karishma Grover dark fruits and spicy oak. Its perfect wanting to turn about wines, some who had absolutely no publicised health aspects,” says Sanjay accompaniments are grilled meats connoisseur. And it’s not knowledge. “I think this itself is an indicator Menon, oenophile and managing director and seafood, and spicy Mexican just about the taste. -

Celebrating the Emergence of Indian Wines the Wine Lounge at The

the wine lounge at The Malabar House celebrating the emergence of Indian wines 2014 / 15 we serve wine by the glass ! Sparkling Sula Brut, méthode Champegnoise Rosé Sula vineyards Nashik Valley, Maharashtra 3500. Zinfandel Rosa Rosé Zampa Soirée brut rosé, méthode Champegnoise Light bodied with the right acidity & a bouquet of berries & cherry Grover vineyards Nandi Hills, Karnataka 3500. Chateaux de Banyan Nashik Valley 1800. l 150 ml. glass 380. Sula Blush Zinfandel White a versatile & fruity rosé for hot summer days, Viognier Art Collection abounding with aromas of honeysuckle & fresh strawberries intense aromas of peach, apricot and tropical fruits Sula vineyards Nashik Valley, Maharashtra 1800. Grover vineyards Nandi Hills, Karnataka 1800. l 150 ml. glass 380. Red Chenin Blanc delicate, lightly aromatic with hint of apple, lemon & peach Cabernet Sauvignon Big Banyan Grover vineyards Nandi Hills, Karnataka 1800. l 150 ml. glass 380. deep red ruby, intense spicy notes of eucalyptus & sweet fruit Chateaux de Banyan Nashik Valley 2100. l 150 ml. glass 430. Sula Riesling fruity & aromatic with hints of green apples, grape fruit, La Reserve, Cabernet Sauvignon & Shiraz, deep ruby red wine peach & honey, best enjoyed well chilled with a bouquet of ripe fruits & a hint of spices, aged in French oak Sula vineyards Nashik Valley, Maharashtra 3300. Grover vineyards Nandi Hills, Karnataka 3200. Grover Sauvignon Blanc Art Collection Reserva Shiraz Dindori, grown at the hills of Dindori estate & well structured and with crisp acidity, best with seafood aged for one year in new oak, this Reserva is fragrant & smooth, Grover vineyards Nandi Hills, Karnataka 1900. l 150 ml. -

Hallgarten Druitt

Sula Vineyards, Maharashtra, Zinfandel 2020 Appealing notes of smoky cooked plums with spice and pepper through to a supple and lingering finish. Producer Note Situated in Nashik, India's largest grape-growing region, Sula Vineyards was set up in 1997 by Rajeev Samant & Kerry Damsky. They pioneered the growing of the French grape varieties Sauvignon Blanc and Chenin Blanc, which were first released in 2000 to wide acclaim as India's best white wines. Sula now cultivates Shiraz and Zinfandel amongst other international varieties and is broadly recognised as India's premium wine producer. At Sula, they believe in being a steward of the land and follow sustainable practices. As an eco-friendly company, a significant amount of resources is committed to sustainable winemaking practices and ensuring fair livelihoods for Sula's community of farmers across Maharashtra and Karnataka. A large number of Sula's workers come from disadvantaged communities and have seen a significant change in their standard of living through their employment with the company; this has been nothing short of a revolution in the surrounding villages. Vineyard Since its inception Sula has been working to integrate a wide array of measures at its 97 hectare estate vineyard and within its winery to minimise the environmental impact of not only its farming, but also its processing and distribution practices. In the vineyard the vines are trained on a high trellising system, which maximises airflow. The red soil is composed of clay and gravel, which has a high iron content and offers the vine good drainage. Winemaking The grapes were fermented with selected yeasts in temperature controlled stainless steel tanks in order to preserve the varietal characteristics of Zinfandel. -

La Dolce Vita at Fratelli Fresh Fratelli Fresh Is the Premium Italian Restaurant, Serving Italian Cuisine with a Contemporary Twist

La Dolce Vita at Fratelli Fresh Fratelli Fresh is the premium Italian restaurant, serving Italian cuisine with a contemporary twist. Located within the environs of Fratelli Fresh is the Wine Bar. Around 2500 bottles with 127 Labels fill up the walls on either side of entrance. 43 listed labels are from Italy. It is one of the only restaurants in the city to offer different vintages of Italian wines that are very highly rated such as: Bertani Amarone Della Valpolicella Classico DOCG,1977/1983/1990/2000, Veneto, Italy. Fattoria Le Pupille Elisabetta Geppetti ‘Saffredi’ Maremma, 2003, Tuscany, Italy. Ornellaia Bolgheri Superiore Rosso, 2000/2004/2005, Tuscany, Italy. Although having an interesting local story about a wine selection is desired, it cannot take precedence over quality. At Renaissance we are encouraged to work with local wine suppliers, to seek out the hidden gems of wine in the community, and share those finds with the guests. This is what makes Fratelli Fresh Wine Bar & Restaurant, the perfect venue for locals to Greet, Meet & Eat. WINE LIST A GLASS OF BUBBLES 150 ML G.H MUMM, CORDON ROUGE, REIMS 2500 (Pinot Noir, Pinot Meunier, Chardonnay) TIAMO PROSECCO, VENETO, ITALY 975 750 FRATELLI NOI, FRATELLI VINEYARDS, 750 MAHARASHTRA, INDIA SULA BRUT ROSE, SULA VINEYARDS, 750 MAHARASHTRA, INDIA (Chardonnay, Pinot Noir) A GLASS OF WHITE 150 ML CHATEAU LOS BOLDOS TRADITION, 1250 CHARDONNAY, CACHAPOAL VALLEY, CHILE SANTA CRISTINA, PINOT GRIGIO DELLE 1250 VENEZIE IGT, SICILY, ITALY CAPE ELEPHANT, CHENIN BLANC, LUTZVILLE 1000 VALLEY, SOUTH AFRICA SULA RIESLING, SULA VINEYARDS, INDIA 700 GROVER CHENIN BLANC, GROVER 700 VINEYARDS, KARNATAKA, INDIA All prices are exclusive of taxes at the time of printing. -

“ Indian Grape Varieties” Introduction

“ INDIAN GRAPE VARIETIES” INTRODUCTION Cultivated grapes are believed to have been introduced into the north of India by the Persian invaders in 1300 AD, from where they were introduced into the south. Famous Indian medicine scholars, Sasruta and Charaka in their medical treatises entitled ‘Sasruta Samhita’ and ‘Charaka Samhita’, respectively, written during 1356-1220 BC, mentioned the medicinal properties of grapes. Kautilya in his ‘Arthashastra’ written in the fourth century BC mentioned the type of land suitable for grape cultivation. “CLIMATE AND GRAPE GROWING REGIONS” The Western Ghats have laterite soils which are rich in iron with good drainage. They vary from sandy clay loam and red laterite, basalt rock to murrum soils, all well suited for wine grape cultivation. The summer growing season in India tends to be very hot and prone to monsoons. Many of India's wine regions also fall within the tropical climate band. Summertime temperature can get as hot as 113 °F (45 °C) and wintertime lows can fall to 46°F (8°C). During the peak growing season between June and August, rainfall averages 25–60 inches (625-1,500 mm). Grapes are usually harvested at the end of winter (January–March), which helps to expose the crop to warm days and cool nights. This exposure aids in the slow maturation of the grapes, enhancing their quality. “CLIMATE AND GRAPE GROWING REGIONS” Vineyards are then planted at higher altitudes along slopes and hillsides to benefit from cooler air and some protection from wind. The altitude of India's vineyards typically range from around 660 ft (200 m) in Karnataka, 984 ft (300 m) in Maharashtra, 2,600 ft (800 m) along the slopes of the Sahyadri to 3,300 ft (1000 m) in Kashmir. -

Table of Contents

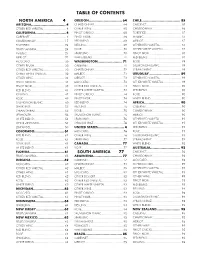

TABLE OF CONTENTS NORTH AMERICA 4 OREGON..........................................................................................64 CHILE..........................................................................................85 ARIZONA..........................................................................................4 CHARDONNAY..........................................................................................64 CABERNET..........................................................................................85 OTHER RED VARIETAL..........................................................................................4 OTHER WINE..........................................................................................65 CHARDONNAY..........................................................................................86 CALIFORNIA..........................................................................................4 PINOT GRIGIO..........................................................................................65 FORTIFIED..........................................................................................87 CABERNET..........................................................................................4 PINOT NOIR..........................................................................................66 MALBEC..........................................................................................87 CHARDONNAY..........................................................................................17 -

A Study on Marketing Analysis and Strategic Distribution of Wines

EXECUTIVE SUMMARY Project title: - A study on marketing analysis and strategic distribution of wines. Objectives of the project:- Following are the objectives, To determine the size of wine market. To identify the market share of the other brands of wines available in the market. To identify the effectiveness of advertising and sales promotion schemes of the company. To identify the pricing aspects of the product. To identify the market potential with reference to the various marketing strategies of the company. Research methodology:- In research methodology we have used the following methods to collect the information. 1. Primary data: - It is collected with the help of structured questionnaire. 2. Secondary data: - It is collected with the help of Company manuals and records Websites on the internet 3. Research instrument: - Questionnaire 1 4. Sampling plan:- Universe: - All wine shop owners, distributors and wholesalers. Frame: - All the individuals between the ages of 20 to 65 years. Sample size: - The project maintained a sample size of 25. 5. Contact method: - The method of personal interview was conducted to gather information in detail. Findings:- Analysis and interpretation of information collected Analysis of advertising information Analysis of sales promotion activities Analysis of the channel of distribution Analysis of the prices Analysis of impact of the advertisement Recommendations:- Price sensitivity Promotional schemes N.D Shoppe Availability of the product Database and information Bottling and labeling 2 INTRODUCTION TO PROJECT WINE¶S &VINERYARADS IN NASIK WINE PRODUCTION IN INDIA India has about 1, 23,000 acres of vineyards, but only seven percent of these acres are used for wines. -

The Fort Beverage List

THETHE FORTFORT BEVERAGEBEVERAGE LISTLIST APERITIF CAMPARI 400 MARTINI ROSSO, BIANCO OR EXTRA DRY 250 RUM MALIBU 300 BACARDI CARTA BLANCA 250 CAPTAIN MORGAN SPICED GOLD 250 BACARDI RESERVA 250 OLD MONK 200 TEQUILA CORRALEGO REPOSADO 600 CAMINO GOLD 400 CAMINO SILVER 300 GIN TANQUERAY NO. TEN 500 BOMBAY SAPPHIRE 350 BEEFEATER 300 TANQUERAY 300 GORDON’S 300 BLUE RIBAND 250 VODKA BELVEDERE 500 ABSOLUT ELYX 450 CRYSTAL HEAD 450 CIROC 450 CIROC RED BERRY 450 GREY GOOSE 450 PINKY 400 ABSOLUT 300 SMIRNOFF ORANGE TWIST 275 SMIRNOFF ESPRESSO 275 SMIRNOFF GREEN APPLE 275 SMIRNOFF REGULAR 275 Our Standard Measure is 30 ml. Kindly inform our associates if you are allergic to any of the ingredients. All prices are in Indian rupees and subject to applicable government taxes. We levy no service charge BEER HOEGAARDEN 450 CORONA 350 HEINEKEN 300 BIRA WHITE 250 KINGFISHER ULTRA 225 BUDWEISER 225 CARLSBERG 200 BIRA BLONDE 200 KINGFISHER 150 ALCOPOPS BACARDI BREEZER 225 Orange, Jamaican Passion, Cranberry SPARKLING COCKTAILS RAVI’S SPARKAHLUA 650 SPARKLING COCKTAILS Sula Brut Tropical And Kahlua CLASSIC SPARKLER 650 Janus, Angostura Bitters, Sugar Cube And Sula Brut Tropical BELLINI 650 Peach Schnapps, Sula Brut Tropical ULTRA MARINE 650 Blue Curacao And Sula Brut Tropical ALL TIME THE MARTINI 550 CLASSICS Classic, Extra Dry, Perfect BLOODY MARY 550 Absolut, Tomato Juice, Worcestershire & Tabasco LONG GOAN ICED TEA 550 Cashew Feni, Absolut, Beefeater, Triple Sec & Seven Up LONG ISLAND ICED TEA 550 Absolut, Beefeater, Camino Silver, Bacardi Carta Blanca, -

Everyday Club June 2021

Everyday Club June 2021 2019 Vina Robles Vigonier- Paso Robles, Central Coast, California Growers and makers of expressive, approachable estate wines from Paso Robles, California, Vina Robles owns and farms six estate SIP® Certified Sustainable vineyards in five sub- districts in the region. The Vina Robles lineup includes small lots of a wide range of varieties and creative blends. While adhering to traditional winemaking methods, veteran winemaker Kevin Willenborg implements modern technologies to make his estate wines with minimal intervention. Full-figured and charmingly floral, Viognier is one of the most important white grapes of the northern Rhône where it is used both to produce single varietal wines and as an important blending grape. Great New World examples can be found in California, and this Paso Robles wine is a rich vibrant example of the Rhône varietal. Viognier is planted at the highest point in the estate and benefits from the cooling Pacific breezes that blow through the Templeton Gap in the afternoon. Aromas of peach and mandarin orange zest with hints of honeysuckle and ginger fill the nose. It is medium-bodied with lively peach and citrus flavors leading to a quenching finish. WE 89 PTS, V 89 PTS Pairings: Viognier is a food friendly wine that pairs well with spicy Asian food, a wide variety of seafood and shellfish, roasted or grilled chicken, veal, pork, spicy flavors and Asian cuisine. It pairs well with select vegetable and salad courses and hard or soft cheese. 2019 Sula Chenin Blanc- Maharashtra, India Sula Vineyards has quickly gained a reputation as India’s #1 premium wine company since the launch of the company’s first wines in 2000. -

Our Wine Philosophy in Terms of Style and Structure Is Simple, Wines That Are True to Their Nature and That Complement Our Style of Food

WINES Our wine philosophy in terms of style and structure is simple, wines that are true to their nature and that complement our style of food. Executive Chef Surender Mohan and Head Sommelier Robert Tőzsér have developed a small, yet strong portfolio of wines which will enhance & enrich the flavours of our cuisine. We have taken pleasure in studying the balance on spices, flavours & aromas to perfectly pair with 260 wines from the menu. Wines By The Glass Champagne 125ml Bottle NV Laurent-Perrier ‘La Cuvée’ 16 95 Tours-Sur-Marne NV Laurent-Perrier ‘Cuvée Rosé’ 21 125 Tours-Sur-Marne White Wines 125ml 500ml Bottle 2017 Pouilly-Fuissé ‘Clos Reissier’ 13 43 64 Domaine Perraton Frères Burgundy, France 2018 Gewurztraminer 10.5 36 54 Dopff au Moulin, Alsace, France 2017 Riesling ‘Kremser Weinberge’ 11.5 39 58 Weingut Türk, Kremstal, Austria 2019 Chenin Blanc, Cannonberg 7.5 24 36 Western Cape, South Africa 2018 Albariño ‘Sobre Lías’, Caeiro 10 32.5 49 Rías Baixas, Spain 2019 Sauvignon Blanc, Auntsfield 10 32.5 49 Marlborough, New Zealand Rosé Wine 125ml 500ml Bottle 2019 Rosé ‘Prestige’ 12 42 62 Château Minuty Côtes de Provence, France Red Wines 125ml 500ml Bottle 2018 Bourgogne Pinot Noir 12 42 62 Bernard Moreau, Burgundy, France 2015 Château Boutisse 15 58 85 Grand Cru, Saint-Emilion, France 2016 Tempranillo, Finca Antigua 7.5 24 36 La Mancha, Spain 2014 Touriga Nacional 10.5 36 54 Churchill Estate, Douro, Portugal 2019 Malbec ‘Hunuc’, D. Bousquet 10 33 50 Tupungato, Mendoza 2019 Nero d’Avola ‘Il Passo Verde’ 9.5 30 45 Vigneti Zabù, Sicilia, Italy Prices include VAT. -

Sula Vineyards: India’S Case for Wine

Sula Vineyards: India’s case for wine When foreign sommeliers come to India, they come with very low expectations. After all, India is better known for its cotton industry than wine production. However that is now changing. In 1993, Stanford-trained engineer Rajeev Samant gives it the cool climate and protection from the left his job at Oracle in Silicon Valley to follow his monsoons - ideal conditions for growing wine entrepreneurial spirit “to do something on my own.” grapes,” Samant told INSEAD Knowledge. He wasn’t quite sure what he’d be doing when he came home to India. “That seemed like a great opportunity for wine production. Moreover with the way things were One day his father showed him their 30-acre family looking in India economically, there is bound to be a farm in the hill station of Nashik, 180 kilometres from demand for wine.” Mumbai which he had wanted to sell. Samant started growing mangoes on the site but soon realised that In 1996 and 1997, with the help of Californian traditional agriculture in the region was not winemaker Kerry Damskey, Samant grew five acres profitable. He noticed that a lot of table grapes were of grape varieties never planted in India before: being grown in the area but no one was making Sauvignon Blanc and Chenin Blanc, under the brand wine. ‘Sula Vineyards.’ They used New World techniques because India didn’t have a tradition of wine- making. In 1998, money was raised to build the winery. Pioneering work In 1999, the modest Sula Vineyards with its iconic sunburst had its first crush, and in “Nashik was 600 metres 2000, sold its first bottle of wine. -

Sula Vineyards Milestones

Sula Vineyards is India’s leading wine company and is Sula Vineyards leading the charge of Indian wine across the wine world. Milestones... Sula Vineyards is a winery and vineyard located in the Nashik region of western India, A History of Firsts 180 km northeast of Mumbai. After the launch of its first wines in 2000, Sula expanded from • India’s Largest Winery its original 30 acre family estate in Nashik to approximately 1800 acres across Nashik and • Established in 1996 the state of Maharashtra. • First Harvest in 1999 The name “Sula” came from Rajeev’s mother’s name - “Sulabha” - and symbolized the rich, Indian heritage of his wines. This was a wine that took pride in being Indian, being the first • 2005 - Opened India’s first company in the country to use an Indian logo. Tasting Room. • 2008 - 1st edition of #SulaFest, Rajeev Samant India’s premier gourmet music Deeply influenced by his travels and his festival in a vineyard. It is now personal values, Rajeev Samant firmly a HUGE annual event. believes in being a steward of the land and • 2010 - Launched Beyond, in sustainable business practices. India’s first Vineyard Resort. • Created India’s first ever Under his guidance, Sula is one of the Chenin Blanc. most eco-friendly companies in India, • Created India’s first ever with a significant amount of its resources Sauvignon Blanc. committed to sustainable winemaking • Created India’s first ever practices and ensuring fair livelihoods for Zinfandel. Sula’s community of farmers across • Created India’s first ever Maharashtra and Karnataka. Riesling.