Capital Impact Investment Notes

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Capital Impact Partners and Subsidiaries

Capital Impact Partners and Subsidiaries Consolidated Financial Report December 31, 2018 Contents Independent auditor’s report 1-2 Financial statements Consolidated statements of financial position 3 Consolidated statements of activities 4 Consolidated statements of functional expenses 5 Consolidated statements of cash flows 6-7 Notes to consolidated financial statements 8-48 Supplementary information: Consolidating statement of financial position 49 Consolidating statement of activities 50 Independent Auditor's Report To the Board of Directors Capital Impact Partners and Subsidiaries Report on the Financial Statements We have audited the accompanying consolidated financial statements of Capital Impact Partners and Subsidiaries (the Organization), which comprise the consolidated statements of financial position as of December 31, 2018 and 2017, the related consolidated statements of activities, functional expenses and cash flows for the years then ended, and the related notes to the consolidated financial statements (collectively, the financial statements). Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these financial statements based on our audits. We did not audit the 2017 financial statements of Impact V CDE 7, LLC, a consolidated affiliate, which statements reflect total assets and revenue constituting 4.7% and 4.4%, respectively in 2017, of the related consolidated totals. -

Capital Impact Partners and Subsidiaries

Capital Impact Partners and Subsidiaries Consolidated Financial Report December 31, 2017 Contents Independent auditor’s report 1-2 Financial statements Consolidated statements of financial position 3 Consolidated statements of activities 4 Consolidated statements of cash flows 5-6 Notes to consolidated financial statements 7-42 Independent Auditor’s Report To the Board of Directors Capital Impact Partners and Subsidiaries Report on the Financial Statements We have audited the accompanying consolidated financial statements of Capital Impact Partners and Subsidiaries, which comprise the consolidated statements of financial position as of December 31, 2017 and 2016, the related consolidated statements of activities and cash flows for the years then ended, and the related notes to the consolidated financial statements (collectively, the financial statements). Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these financial statements based on our audits. We did not audit the 2017 and 2016 financial statements of Impact V CDE 7, LLC, a consolidated affiliate, which statements reflect total assets and revenue constituting 4.7 percent and 4.4 percent, respectively in 2017, and 9.7 percent and 4.7 percent, respectively in 2016, of the related consolidated totals. Those statements were audited by other auditors whose reports have been furnished to us, and our opinion, insofar as it relates to the amounts included for Impact V CDE 7, LLC, is based solely on the reports of the other auditors. -

$2 BILLION in IMPACT …And Counting

$2 BILLION IN IMPACT …and counting 2014 IMPACT REPORT At Capital Impact Partners, we work with communities to create a strong fabric of high-quality services that foster good health, job creation, economic growth, and interconnectedness—empowering individuals to improve their lives and livelihoods. + 30 = $2 YEARS BILLION A mission-driven experience working invested in Community Development in underserved projects that deliver Financial Institution communities social impact HEALTHY FOOD DIGNIFIED AGING Why we do it: $132 MILLION + $18 MILLION + Why we do it: Kids in Invested in over Invested in over Green House communities elders maintain with safe places 79 stores & 166 Green House homes + self-care abilities to play and 1 MILLION customers 143 village communities longer, with fewer access to & over 14 THOUSAND elders experiencing healthy foods decline in late-loss are 56% less activities of daily likely to be living. obese. HEALTHY FOODS AFFORDABLE HOUSING HEALTHCARE Why we do it: $207 MILLION + $752 MILLION + Why we do it: Extremely Invested in over Invested in over Improved low-income asthma control households are 229 communities & 506 clinics & for low-income more likely to 35 THOUSAND units 2 MILLION patients and minority be located in children equals high-crime healthier lives neighborhoods and fewer and structurally PHARMACY missed days of inadequate school. units. COMMUNITY HEALTH CENTER FOR SALE DENTAL EDUCATION COOPERATIVES Why we do it: $664 MILLION + $278 MILLION + Why we do it: Median weekly Invested in over Invested in over The average earnings of food cooperative full-time 219 schools & 208 Cooperatives stimulates the workers with a 228 THOUSAND & 863 THOUSAND economy by high school students customers purchasing diploma are nearly 20% of its $180 higher products from than those local sources. -

Our 2020 Vision for Communities 2015 Impact Highlights

Our 2020 Vision for Communities 2015 Impact Highlights: $131 MILLION 154,000 1,050 EDUCATION: HEALTH CARE: HEALTHY FOOD: CLOSED PEOPLE JOBS 4,500 87,000 61,000 LOANS SERVED CREATED STUDENTS PATIENTS CUSTOMERS Through our efforts, we will work to address systemic poverty, build equitable opportunities, create healthy communities and ensure inclusive growth. Building a Foundation of Equity, Opportunity and Inclusiveness strong financial position, scale the Green House and learn how Michele nation of communities report will provide you deep partnerships and model for dignified Reynolds, who, along built on a foundation with our initial roadmap. innovative product long-term care and the with her neighbors in of equity, opportunity development. We Cornerstone Partnership Washington D.C.’s Ward and inclusiveness. It is an I look forward to provided ongoing to expand affordable 5, now has access to appropriate North Star continuing Terry leadership in the health housing, we saw those quality care. You will for our ambitious agenda. Simonette’s legacy and care space, helped initiatives become self- also experience the am excited to join my a number of charter sufficient, independent kindness of Meals on Through our efforts, colleagues in taking the schools expand their organizations. Wheels volunteers we will work to address bold steps necessary educational offerings in Texas who bring systemic poverty, build to find new ways to and saw several of our In the accompanying hot meals to Kajl, an equitable opportunities, address the social and Ellis Carr projects come online pages, you’ll see the accomplished chef no create healthy economic justice issues President and CEO across Detroit. -

The Healthy Food Financing Initiative (HFFI)

The Healthy Food Financing Initatve (HFFI) An Innovatve Public-Private Partnership Sparking Economic Development and Improving Health According to a USDA 2012 study, more than 29 million Americans in low-income communites and communites of color lack access to healthy food. In urban communites, residents walk out their front doors and see nothing but fast-food and convenience stores selling high-fat, high-sugar processed foods. Rural residents face long drives to purchase healthy food. These same communites are ofen faced with struggling local economies and diet related diseases. Fortunately, the federal government’s cornerstone efort to address this issue, the Healthy Food Financing Initatve (HFFI) is a viable, efectve and economically sustainable soluton to the lack of fresh food access in underserved communites. HFFI programs provide one-tme grants and loans to projects seeking to improve access to healthy foods by fnancing grocery stores, farmers’ markets, food hubs, co-ops and other food access businesses in urban or rural areas of need. HFFI Program Summary HFFI HIGHLIGHTS SINCE 2011 Since 2011, over $169 million has been awarded through the federal HFFI, bringing jobs, economic • >$1 billion development, and improving access to healthy food for leveraged through public-private low-income communities across the country. HFFI’s partnerships public-private partnership model has leveraged over $1 billion in grants, loans, federal tax incentives, and • >3,000 jobs investments from financial, health care, and created or retained through HFFI projects philanthropic institutions, enabling HFFI to finance over 200 successful projects. One-time grants and • >$169 million loans targeting both urban and rural communities have in federal grants distributed been distributed in more than 30 diferent states and are being used to create jobs, revitalize communities, • >200 projects and improve access to healthy food. -

Healthy Communities

EXPERTS IN HEALTHY COMMUNITIES Social Building Environment; Access to Access to Air, Soil and Financial Built Early Childhood Personal/Public Public Community Healthy Food Medical Care Aesthetics Water Quality Capacity Environment Development Education Employment Entrepreneurship Safety Physical Activity Transportation Senior Needs Engagement Social Services ACCION Texas ✔ ✔ Active Living Research ✔ ✔ ✔ ✔ ✔ ✔ American Institute of Architects ✔ ✔ ✔ ✔ ✔ Annie E. Casey Foundation ✔ ✔ ✔ ✔ ✔ ✔ ✔ Atlanta BeltLine ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ The Boston Foundation ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ Boulder, CO ✔ ✔ ✔ ✔ The California Endowment ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ Capital Impact Partners (formerly NCB Capital Impact) ✔ ✔ ✔ ✔ ✔ ✔ Capital Link ✔ Center for Financial Services Innovation ✔ Centers for Disease Control and Prevention's Healthy Community ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ Design Initiative ChangeLab Solutions ✔ ✔ ✔ ✔ ✔ ✔ Charleston, SC ✔ ✔ ✔ ✔ ✔ ✔ ✔ The Cleveland Foundation ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ Consumer Credit Counseling Service (CCCS) of Greater ✔ Dallas Corporation for Enterprise Development (CFED) ✔ ✔ ✔ Dallas Women's Foundation ✔ ✔ ✔ ✔ ✔ ✔ Detroit, MI ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ Elgin, IL ✔ ✔ ✔ ✔ Enterprise Community Partners ✔ ✔ ✔ ✔ Evergreen Cooperative Corp. ✔ ✔ ✔ ✔ F.B. Heron Foundation ✔ ✔ The Food Trust ✔ Ford Foundation ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ Growing Power ✔ ✔ ✔ ✔ ✔ ✔ Habitat for Humanity International ✔ HEALTHY COMMUNITIES I FEDERAL RESERVE BANK OF DALLAS EXPERTS IN HEALTHY COMMUNITIES (CONTINUED) Social Building Environment; Access to Access to Air, Soil and Financial Built Early -

Michigan Good Food Fund Is a New Public- Payments: Payments Vary Based on Loan Type

Innovative Financing For Michigan’s Healthy Food Projects Michigan Good Sample Terms Loan Amount: $250,000 to $6,000,000+ Food Fund Term: Up to 10 years The Michigan Good Food Fund is a new public- Payments: Payments vary based on loan type. Your loan officer can provide final details private partnership loan fund that provides financing based on individual circumstances. to food enterprises increasing access to healthy Examples include: food, spark economic development, and create jobs. Leverage loans: Interest only Facility/mini-perm: P&I (15-20 year amortization) Through this unique program, Capital Impact Partners Equipment loans: 7-year fully amortizing offersdirect financing to food enterprises that grow, process, distribute, and sell healthy food that Interest Rate: Rate fixed at closing, indexed to reaching low-income populations across Michigan. benchmark. Rate resets may apply. Fees: Origination fee of 1.25% Key Features: Purpose: Financing of community or economic Mission-driven lending initiative designed to development projects that increase finance projects that increase access to healthy access to healthy foods and jobs for food for Michigan’s children and families low-income populations. Real estate acquisition Financing solutions tailored to Construction and property improvement meet individual project needs Equipment purchase Expertise working with both single-site Collateral: Up to 90% LTV on real estate, operators and large multi-site organizations business assets considered Low transaction costs Corporate -

$150 83 VING 1 MILLION+ SER MILLION+ FINANCING Retailers Customers

Creating Impact Through Financing Healthy Food Enterprises More than 20 million Americans live in areas without supermarkets or other means to access fresh, nutritious foods. We have the opportunity to address this major public health challenge that overwhelmingly impacts underserved communities. Where many lenders may only see risks and collateral, it is our mission to help you build and expand facilities that increase access to fresh and healthy foods in places where it does not exist. Capital Impact is a leading nonprofit lender to food projects across the country. Our $150 million in financing has led to the development of new stores, expansion of existing stores, and innovations such as mobile markets and food hubs that scale distribution efforts. This effort creates healthier communities while spurring economic growth and job creation. Your Lender and Partner Acquisition, construction, equipment purchasing, and working capital loans from as low as $500,000 to more than $5 million. Expertise working with retail operators, kitchen incubators, co-ops, and innovative food distribution models. Encourage industry growth through policy engagement and capacity building measures. DELIVERING HEALTHY FOOD IMPACT TO UNDERSERVED COMMUNITIES NATIONWIDE $150 83 VING 1 MILLION+ SER MILLION+ FINANCING Retailers Customers To learn more about how we can help you, contact Ian Wiesner at 313.230.1116 or [email protected] Whatever your financing need CAPITAL IMPACT HAS DONE IT Supporting healthy food access is part of Capital Impact’s larger mission to INNOVATIVE FINANCING use capital and commitment that helps Healthy Food Deals Loan Amount Impact people and communities break the Imperial $6 Million Serving 75,000 residents barriers to success. -

Home Care Cooperatives Revenue Growth and Diversification

Home Care Cooperatives Revenue Growth And Diversification A guide to help home care cooperatives better understand and assess revenue growth to support long term sustainability. This guide provides a discussion and review of four promising revenue diversification opportunities home care cooperatives could pursue to support long term growth. About The Organizations Through capital and commitment, Capital Impact Partners helps people build communities of opportunity that break barriers to success. We deliver strategic financing, incubate new social programs, and provide capacity building to help ensure that low-to-moderate- income individuals have access to quality health care and education, healthy foods, affordable housing, and the ability to age with dignity. A nonprofit Community Development Financial Institution, Capital Impact Partners has disbursed more than $2.7 billion to revitalize communities over the past 35 years. Our leadership in delivering financial and social impact has resulted in Capital Impact earning an “A+” rating from S&P Global and being recognized by Aeris since 2005 for our performance. Headquartered in Arlington, VA, Capital Impact Partners operates nationally, with local offices in Detroit, MI, New York, NY, and Oakland, CA. Learn more at: www.capitalimpact.org ICA seeks to create, promote, and support jobs, while collaborating with workers to define a truly entrepreneurial, democratic, and community- minded economy. Our approach interrupts economic destabilization of individuals and communities, transforming jobs into meaningful, ICA GROUP dignified drivers of a robust economy. ICA envisions a future where workers lead and own democratic workplaces and shape political and economic systems. This new economy will support racial and gender equity, foster respect and inclusion, and create real opportunities for workers to cultivate wealth and autonomy. -

The New Markets Tax Credit Program

$ The New Markets Tax Credit Program Capital Impact Partners Policy Brief The New Markets Tax Credit Program is a proven tool for helping community development organizations such as Capital Impact Partners attract private sector capital to communities where new investment is needed most. The New Markets Tax Credit Program: Bringing high-impact investment to low-income communities One of the persistent economic challenges our nation’s low-income communities face is the lack of access to private investment capital for local businesses and real estate projects. This lack of capital means that there is a lack of opportunity in these communities. It means that there are fewer local businesses and local jobs. It means that household incomes are lower and unemployment and poverty rates are higher. It means that the roots of economic hardship remain tenacious and deep. The New Markets Tax Credit Program (NMTC Program) was established to generate The purpose new investment—and new opportunity—in low- of the NMTC income communities. Over the past decade Program is to and a half, the program attract private has had a tremendous impact, developing critical investment into real estate projects and community facilities, low-income creating new businesses and jobs, reviving local communities. economies, and expanding the tax base of local governments. Designed to attract new capital The NMTC Program was enacted in 2000 as part of the bipartisan Community Renewal Tax Relief Act. The program is administered by the Community Development Financial Institutions Fund (CDFI Fund), an agency within the U.S. Department of the Treasury that is dedicated to increasing economic opportunity in distressed communities throughout the United States. -

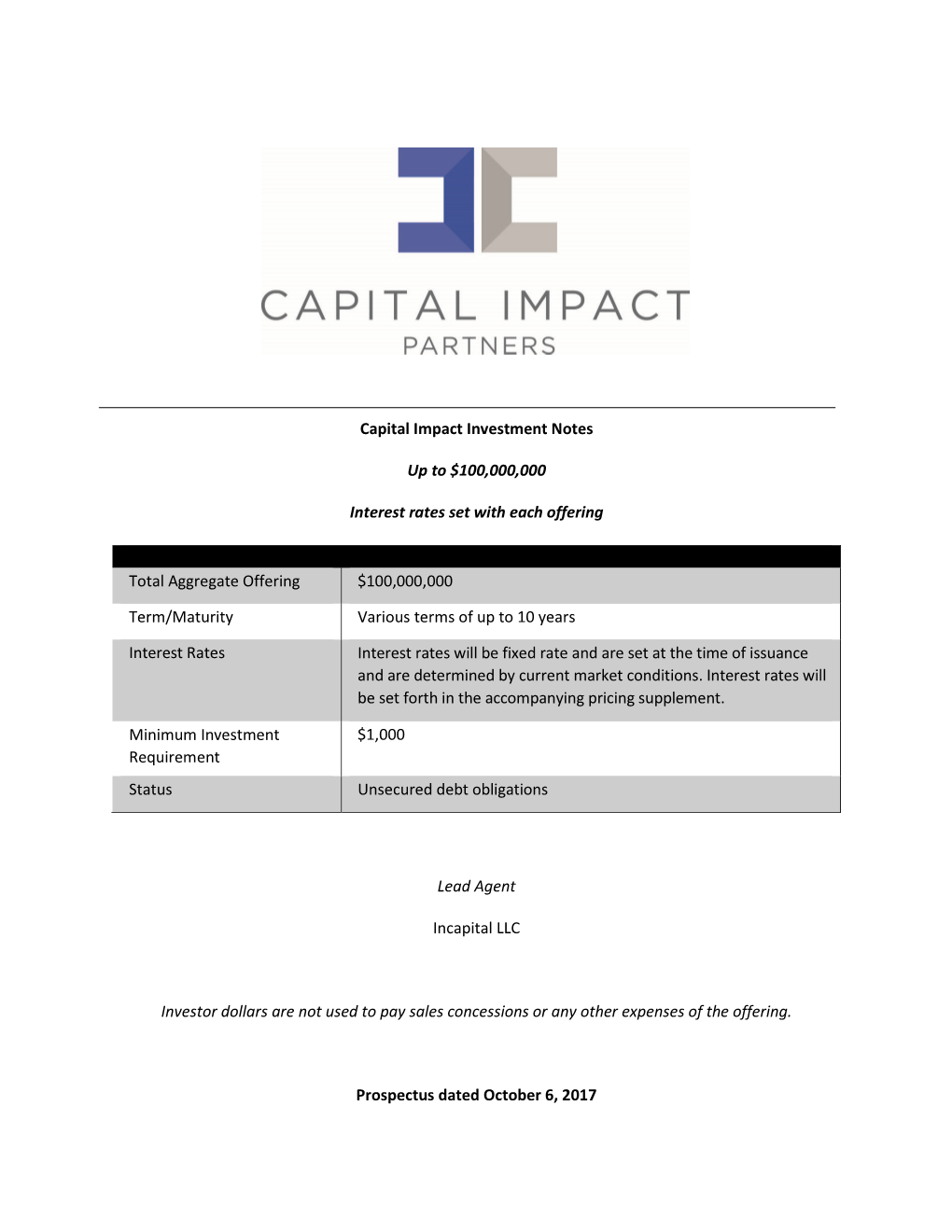

Capital Impact Investment Notes up To

Capital Impact Investment Notes Up to $150,000,000 Interest rates set with each offering Total Aggregate Offering $150,000,000 Term/Maturity Various terms of up to 15 years Interest Rates Interest rates will be fixed rate and are set at the time of issuance and are determined by current market conditions. Interest rates will be set forth in the accompanying pricing supplement. Minimum Investment $1,000 Requirement Status Unsecured debt obligations Lead Agent Incapital Investor dollars are not used to pay sales concessions or any other expenses of the offering. Prospectus dated August 6, 2020 Included in this Prospectus is the essential information related to the Capital Impact Investment Notes (the “Notes”), fixed income securities that raise capital to financially support impact investments targeted towards underserved communities across the United States. Prospective investors are advised to read this Prospectus carefully prior to making any decisions to invest in the Notes. The Notes are issued by Capital Impact Partners (“Capital Impact”), a District of Columbia nonprofit corporation organized at the direction of the United States Congress that is a tax‐exempt Internal Revenue Code 501(c)(3) public charity and is a Community Development Financial Institution (“CDFI”) certified by the U.S. Department of the Treasury Community Development Financial Institutions Fund (the “CDFI Fund”). Capital Impact’s national headquarters are located at 1400 Crystal Drive, Suite 500, Arlington, Virginia 22202. Capital Impact’s telephone number is (703) 647‐2300. Specific terms of the Notes will be described in a separate pricing supplement. The Notes will be global book‐entry Notes, which means that they may be purchased electronically through a prospective investor’s brokerage account and settled through the Depository Trust Company (“DTC”). -

Welcome and Opening Remarks Federal Resources for Cdfis & Tax

Welcome and Opening Remarks Dominik Mjartan Optus Bank Dominik Mjartan serves as President and CEO of Optus Bank, a U.S. Treasury certified CDFI and an MDI (FDIC designated Minority Depository Institution). He spent more than a decade as a senior executive officer at a community development bank, Southern Bancorp, most recently as the Executive Vice President of Southern Bancorp, Inc. (SBI), a holding company for Southern Bancorp Bank and CEO of an affiliated lending company Southern Bancorp Community Partners (SBCP). He currently serves as Chair of the CDFI Coalition and a director of the Community Development Bankers Association, D.C. based advocacy organizations. He is also finance chair of Midlands Arts Conservatory and serves on the finance committee of Women’s Rights & Empowerment Network. He earned an MBA at the University of Ulster in United Kingdom, graduating with distinction. He graduated Summa Cum Laude and as a Donaghey Scholar with a B.S. in management from University of Arkansas Little Rock. Federal Resources for CDFIs & Tax Reform Panel Teresa Montoya Bio GECU Moderator Teresa Montoya serves as Senior Vice President and Chief Marketing Officer for GECU, a state-chartered credit union located in El Paso, Texas with over 400,000 members. She has 19 years’ experience in the credit union movement. Teresa serves on the Senior Leadership Team and has direct responsibility for Community Development, Communication, Deposits, Investment and Trusts and the GECU Foundation. GECU has certifications as a CDFI, low-income designation and Juntos Avanzamos (Together We Advance). Montoya has a BBA from the University of Texas at El Paso (UTEP).