2009 Annual Report Julius Baer Group Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019 Equiduct Universe Change Please see today's changes below effective 18 November 2019: Trading Reporting MIC Settlement Trading Settlement Tick Size Change/ Security Name ISIN Home Market Symbol Country Currency Currency table Action ABB LTD ABBNz CH0012221716 XSWX EQTB CH CHF CHF ESMA_E Deletion ABB ABBs CH0012221716 XSTO EQTB SE SEK SEK ESMA_E Deletion ADECCO SA ADENz CH0012138605 XSWX EQTC CH CHF CHF ESMA_E Deletion AMS AG AMSz AT0000A18XM4 XSWX EQTC CH CHF CHF ESMA_E Deletion ARYZTA AG ARYNz CH0043238366 XSWX EQTB CH CHF CHF ESMA_E Deletion JULIUS BAER GRUPPE AG BAERz CH0102484968 XSWX EQTC CH CHF CHF ESMA_E Deletion BALOISE-HLDGS BALNz CH0012410517 XSWX EQTC CH CHF CHF ESMA_D Deletion BARRY CALLEBAUT AG BARNz CH0009002962 XSWX EQTC CH CHF CHF ESMA_D Deletion BB BIOTECH BBZAd CH0038389992 XETR EQTB DE EUR EUR ESMA_D Deletion BB BIOTECH BIONz CH0038389992 XSWX EQTB CH CHF CHF ESMA_D Deletion BASILEA PHARMACEUTICA AG BSLNz CH0011432447 XSWX EQTC CH CHF CHF ESMA_D Deletion BUCHER INDUSTRIES BUCNz CH0002432174 XSWX EQTC CH CHF CHF ESMA_D Deletion COMPAGNIE FINANCIERE RICHEMONT CFRz CH0210483332 XSWX EQTC CH CHF CHF ESMA_E Deletion CLARIANT CLNz CH0012142631 XSWX EQTC CH CHF CHF ESMA_E Deletion CEMBRA MONEY BANK AG CMBNz CH0225173167 XSWX EQTC CH CHF CHF ESMA_D Deletion CREDIT SUISSE GROUP AG CSGNz CH0012138530 XSWX EQTC CH CHF CHF ESMA_E Deletion DKSH HOLDING DKSHz CH0126673539 XSWX EQTC CH CHF CHF ESMA_D Deletion DORMA+KABA HOLDING AG DOKAz CH0011795959 XSWX EQTC CH CHF -

Julius Baer Multicooperation Annual Report 2005 As at June 30, 2005 (Audited)

Julius Baer Multicooperation Annual Report 2005 as at June 30, 2005 (audited) Subscriptions are only valid if made on the basis of the current Prospectus, the latest Annual Report and the latest Semi-Annual Report if published thereafter. The Articles of Association, the valid Prospectus and the Annual and Semi-Annual Reports may be obtained free of charge at the representative in Switzerland and the respective paying agent. Only the German version of the present Annual Report has been reviewed by the independent auditor. Consequently, the independent auditor's report only refers to the German version of the Report; other versions result from a conscientious translation made under the responsibility of the Board. In case of differences between the German version and the translation, the German version shall be the authentic text. AN INVESTMENT FUND DOMICILED IN LUXEMBOURG Representative in Switzerland: Julius Baer Investment Funds Services Ltd., Zurich Paying agent in Switzerland: Bank Julius Bär & Co. AG, Bahnhofstrasse 36, Postfach, CH - 8010 Zurich Paying agent in Germany: Bank Julius Bär (Deutschland) AG, Messe Turm, Friedrich-Ebert-Anlage 49, Postfach 15 01 52, D - 60061 Frankfurt on the Main Paying agent in Austria: Erste Bank der oesterreichischen Sparkassen AG, Graben 21, A - 1010 Vienna Contents Page Organisation and Management 4 Independent Auditor's Report 5 Notes to the Financial Statements 6 Julius Baer Multicooperation (Umbrella Fund) MCOO Julius Baer Multicooperation - Emerging Markets Value Stock Fund HESF Julius Baer Multicooperation -

Julius Baer Multistock Société D'investissement À Capital Variable

Julius Baer Multistock Société d'Investissement à Capital Variable Annual Report as at 30 June 2011 (audited) Subscriptions are carried out solely on the basis of the current prospectus or the simplified prospectus, or the “key investor information”, as soon as it is available, in conjunction with the latest annual report and the latest semi-annual report if published thereafter. The articles of association, the valid prospectus and the simplified prospectus, the annual and semi-annual reports (or the “key investor information”, as soon as it is available), as well as the information based on the SFA guidelines on transparency with regard to management fees, may be obtained free of charge from the representative in Switzerland and/or from the respective paying agent. In case of differences between the German version and the translation, the German version shall be the authentic text. AN INVESTMENT FUND DOMICILED IN LUXEMBOURG Representative in Switzerland: Swiss & Global Asset Management AG, Hardstraße 201, CH - 8005 Zurich (new address from 19 September 2011) Paying agent in Switzerland: Bank Julius Bär & Co. AG, Bahnhofstraße 36, Postfach, CH - 8010 Zurich Paying and information agent in Germany (until 31 December 2010): Bank Julius Bär Europe AG, An der Welle 1, Postfach 15 02 52, D - 60062 Frankfurt am Main Paying agent in Germany (since 1 January 2011): Deka Bank Deutsche Girozentrale, Hahnstraße 55, D - 60528 Frankfurt am Main Information agent in Germany (since 1 January 2011): Swiss & Global Asset Management Kapital AG, Taunusanlage 15, D - 60325 Frankfurt am Main Paying agent in Austria: Erste Bank der oesterreichischen Sparkassen AG, Graben 21, A - 1010 Vienna Representative and paying agent in Liechtenstein: LGT Bank in Liechtenstein AG, Herrengasse 12, FL - 9490 Vaduz Trade and Companies Register number: R.C.S. -

Barry Callebaut “Cost Plus” Model Has Proven to Be Robust

Barry Callebaut 9-month key sales figures 2010/11 July 2011 Agenda Company and Industry Overview First 9 months highlights Outlook July 2011 Barry Callebaut 9 months key sales figures 2 Barry Callebaut is present in all of the stages of the chocolate industry value chain Cocoa Cocoa beans Plantations 80% Cocoa liquor ~54% ~46% Cocoa powder Cocoa butter BC core activity + Sugar, Milk, others + Sugar, Milk, + Sugar, Milk, fats, others others Powder mixes Compound/Fillings Chocolate couverture Customers: Food Manufactures Chocolatiers, Bakeries, Vending Dist. Etc July 2011 Barry Callebaut 9 months key sales figures 3 Barry Callebaut at a glance FY-2010 Sales Volume by Region FY-2010 Sales Volume by Product Group Food Service Global Sourcing & / Retail Cocoa Customers 16% 27% Consumer Products 10% Asia Europe Gourmet 4% 58% & Specialties 10% Food Cocoa Manufacturers 16% 64% Americas 22% Industrial Customers 73% FY-2010 Sales Volume: 1,3 mn tonnes FY-2010 Sales: CHF 5,213mn FY-2010 EBIT: CHF 370.4 mn FY-2010 Net Profit: CHF 251.7 mn July 2011 Barry Callebaut 9 months key sales figures 4 Barry Callebaut is the market leader in the open market Global Industrial Chocolate market in 2009 = 5,400,000 tonnes* (Long-term average annual market growth of approx 2-3%) Open market Integrated market Competitors Big 4 chocolate Others players 40% 49% 51% 80% Outsourced (long-term volumes) *BC estimates July 2011 Barry Callebaut 9 months key sales figures 5 Global leader in chocolate manufacturing Barry Callebaut is one of the of the top three cocoa grinders and the largest manufacturer of industrial chocolate, with estimated market share of 40% of sales volumes in the open market for industrial chocolate Cocoa Grinders Open Market for Chocolate ADM Barry Callebaut Kraft/ Cadbury Barry Callebaut Mars Cargill Nestlé Petra Foods Hershey Blommer Cargill Kraft/Cadbury Blommer ADM Nestlé Lindt Cémoi Ferrero Ferrero Other players 0 100 200 300 400 500 600 700 -100 100 300 500 700 900 1100 Volume ('000 MT) Sales Volume ('000 MT) Source: Barry Callebaut 2009/10 estimates (both charts). -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

Julius Baer Group Business Model Simplicity in Turbulent Times

310-247-1 JULIUS BAER GROUP BUSINESS MODEL SIMPLICITY IN TURBULENT TIMES Case Study Authors M.Sc. Lyndon J. Oh Institute of Management University of St. Gallen & Prof. Dr. Christoph Lechner Institute of Management University of St. Gallen © 2010 by Lyndon J. Oh & Christoph Lechner, University of St.Gallen. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means – electronic, mechanical, photocopying, recording, or otherwise – without the permission of the copyright owner. Distributed by ecch, UK and USA North America Rest of the world www.ecch.com t +1 781 239 5884 t +44 (0)1234 750903 ecch the case for learning All rights reserved f +1 781 239 5885 f +44 (0)1234 751125 Printed in UK and USA e [email protected] e [email protected] 310-247-1 INTRODUCTION "the world as we know it was on the brink of collapse” -Raymond Baer, Chairman and President Raymond Baer, Chairman and President of Julius Baer, described the atmosphere of the financial crisis and assault on Swiss banking secrecy as one similar to that of “times of war.” An atmosphere of pure fear prevailed among investors. It was a time when many Swiss bank account- holders took their money out of accounts at UBS and brought it over in plastic bags to Julius Baer to open new accounts. As a consequence, many private and cantonal banks had profited. Julius Baer’s executive meetings at the time dealt primarily with evaluating the counterparty risk, reflecting on "which bank could go under and which country was in trouble, and just guessing who the next victim would be while trying to avoid being the next." Adding fuel to the fire, Julius Baer, the third largest private bank in Switzerland with over 3000 employees and CHF 153 billion assets under management (AuM), joined the ranks of other Swiss banks as the entire industry faced criticism over the question of banking secrecy’s role in tax evasion. -

Equities Switzerland Small & Mid Caps

31 August 2021 Swiss Life Investment Foundation Equities Switzerland Small & Mid Caps Net Asset Value (NAV) in CHF (m): 65.73 Net asset value per entitlement in CHF: 142.34 Investment Strategy Performance Investment in equity securities from companies that are tracked by the Swiss Performance Index Extra. Active sector and securities selection. Company limitation: 5% (exception: if represented in the benchmark, max. 5% points above the benchmark weighting). Implementation via investment in Swiss Life iFunds (CH) Equity Switzerland Small & Mid Cap (CHF); investment funds under Swiss law in the category "Other funds for traditional investments". Evolution in reference currency (base value 100) Product information Swiss security number: 39561890 ISIN: CH0395618900 LEI: 254900QGENUS1GIJ4549 Bloomberg Code: SWLASMC SW Benchmark: SPI Extra TR Index (CHF) Currency: CHF Domicile: Switzerland Launch Date: 01/02/2018 Initial subscription price: 100.00 End of financial year: 30.09 Past performance is no indication of current or future performance. Issuing/Redemption: daily Deadline: 14.30 Issuing/redemption commission: none Performance in reference currency Distribution policy: Profit retention CUMULATIVE PERFORMANCE ANNUALISED PERFORMANCE Asset Manager according to Swiss Life Best Select Invest Plus®: YTD 1 MONTH 1 YEAR 3 YEARS 5 YEARS 10 YEARS INCEP. Privatbank Von Graffenried AG INVESTMENT GROUP 23.55% 2.43% 34.56% 11.31% - - 10.36% External consultation: PPCmetrics provide the following services: BENCHMARK 23.70% 2.49% 34.90% 11.60% - - 10.11% Advisory services relating to suitable mandate structure Support with selection of suitable asset managers and support with Statistical information ongoing monitoring of asset managers and 1 YEAR 3 YEARS 5 YEARS 10 YEARS INCEP. -

Annual Report Eport

2007/08 Annual Report 2007/08 Annual Report 2007/08 “We are always ready to create added value for our customers” Annual Report Imprint Concept/Design: Gottschalk+Ash Int’l Photos: Jonas Kuhn, KuhnDerron, Zurich; Marcel Giger, Davos Prepress/Press: Linkgroup, Zurich Strengthened global leadership and proven In Brief I business model n Brief North America, Eastern Europe and Asia on a fast growth path Sales volume up 10.1% to 1,166,007 tonnes 2 Barry Callebaut at a glance Barry Callebaut is the world’s leading manufacturer of high-quality cocoa and chocolate products and the preferred solutions provider for the food industry. Our customers include: – Multinational and national branded consumer goods manufacturers who incorporate our ingredients in their products and who increasingly also entrust us with the molding and packaging of their finished products – Artisanal and professional users of chocolate, including chocolatiers, pastry chefs, bakeries, restaurants, hotels and caterers – Food retailers for whom we make customer label as well as branded products We also provide a comprehensive range of services in product development, process- ing, training and marketing. Barry Callebaut is present in 26 countries, operates around 40 production facilities, employs more than 7,000 people and generated sales of more than chf 4.8 billion in fiscal year 2007/08. 3 Key figures Barry Callebaut Group for the fiscal year ended August 31, Change (%) 2007/08 2006/07 Income statement Sales volumes Tonnes 10.1% 1,166,007 1,059,200 Sales revenue CHF m 17.3% 4,815.4 4,106.8 EBITDA1 CHF m 3.9% 443.7 427.1 Operating profit (EBIT) CHF m 5.3% 341.1 324.0 Net profit from continuing operations2 CHF m 1.0% 209.1 207.0 Net profit for the year CHF m 65.6% 205.5 124.1 Cash flow3 CHF m 6.8% 434.3 406.8 EBIT per tonne CHF (4.4%) 292.5 305.9 as of August 31, 2008 2007 Balance sheet Total assets CHF m 17.0% 3,729.5 3 , 1 8 6 . -

GRI Report 2019 / 20

Barry Callebaut GRI Report 2019/20 GRI Report 2019 / 20 MATERIAL ISSUES – GRI STANDARDS MAPPING Barry Callebaut AG’s 2019/2020 GRI Index is based on the For further information please contact: Global Reporting Initiative (GRI) Standards. GRI is the world’s leading standard for corporate sustainability report- Taryn Ridley ing (www.globalreporting.org). Through this GRI Index, External Affairs Manager together with the Forever Chocolate Progress Report and Barry Callebaut AG the Annual Report 2019/2020, Barry Callebaut reports in Pfingstweidstrasse 60 accordance with the Core option of the GRI Standards. CH-8005 Zurich Phone: +41 43 204 03 76 All material standards and indicators discussed are report- Email: [email protected] ed as fully as the available data allow. Relevant GRI Standard(s) CHILD LABOR 408: Child Labor 412: Human Rights Assessment 414: Supplier Social Assessment FORCED LABOR 409: Forced Labor 412: Human Rights Assessment POVERTY 203: Indirect Economic Impact 413: Local Communities FARMER INCOME 203: Indirect Economic Impact 413: Local Communities LOW YIELDS 203: Indirect Economic Impact FUTURE COCOA SUPPLY 201: Economic Performance 203: Indirect Economic Impact 304: Biodiversity TRACEABILITY 308: Supplier Environmental Assessment 414: Supplier Social Assessment HEALTH & SAFETY 403: Occupational Health and Safety 414: Supplier Social Assessment TALENT 404: Training and Education 405: Diversity and Equal Opportunity EMPLOYEE ENGAGEMENT 401: Employment CLIMATE CHANGE 302: Energy 305: Emissions DEFORESTATION -

Julius Baer Multistock Société D'investissement À Capital Variable

Julius Baer Multistock Société d'Investissement à Capital Variable Annual Report as at 30 June 2015 (audited) Subscriptions are carried out solely on the basis of the current prospectus or the key investor information, in conjunction with the latest annual report and the latest semi- annual report if published thereafter. The articles of association, the valid prospectus and the key investor information, the annual and semi-annual reports, as well as the information based on the SFAMA guidelines on transparency with regard to management fees, may be obtained free of charge from the representative in Switzerland and/or from the respective paying agent. In case of differences between the German version and the translation, the German version shall be the authentic text. AN INVESTMENT FUND DOMICILED IN LUXEMBOURG Representative in Switzerland: GAM Investment Management (Switzerland) AG, Hardstraße 201, P.O. Box, CH - 8037 Zurich Paying agent in Switzerland: Bank Julius Bär & Co. AG, Bahnhofstraße 36, P.O. Box, CH - 8010 Zurich Paying agent in Germany: DekaBank Deutsche Girozentrale, Hahnstraße 55, D - 60528 Frankfurt / Main Information agent in Germany: GAM (Deutschland) AG, Taunusanlage 15, D - 60325 Frankfurt am Main Paying agent in Austria: Erste Bank der oesterreichischen Sparkassen AG, Graben 21, A - 1010 Vienna Trade and Companies Register number: R.C.S. Luxembourg B-32188 Contents Page Organisation and Management 4 Information on risk management (unaudited) 6 Audit Report 7 Report of the Board of Directors 9 Notes to the Annual Report -

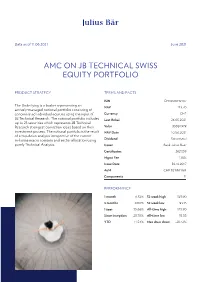

Amc on Jb Technical Swiss Equity Portfolio

Data as of 11.06.2021 June 2021 AMC ON JB TECHNICAL SWISS EQUITY PORTFOLIO PRODUCT STRATEGY TERMS AND FACTS ISIN CH0350849797 The Underlying is a basket representing an NAV 123.70 actively-managed notional portfolio consisting of concentrated individual equities using the input of Currency CHF JB Technical Research. The notional portfolio includes Last Rebal. 26.05.2021 up to 25 securities which represents JB Technical Research strongest conviction ideas based on their Valor 35084979 investment process. The notional portfolio is the result NAV Date 10.06.2021 of a top-down analysis irrespective of the current in-house macro scenario and sector allocation using Dividend Reinvested purely Technical Analysis. Issuer Bank Julius Baer Certificates 262’559 Mgmt Fee 1.10% Issue Date 30.10.2017 AuM CHF 32’636’084 Components 21 PERFORMANCE 1 month 8.32% 52 week high 123.90 3 months 8.80% 52 week low 93.15 1 year 33.66% All-time high 123.90 Since inception 23.70% All-time low 78.55 YTD 11.54% Max draw down -29.42% Data as of 11.06.2021 June 2021 PRICE CHART (06.11.2017 - 10.06.2021) MONTHLY RETURNS 120 2015 2016 110 1.60 0.89 2017 100 2.44 -2.48 -4.00 1.53 1.80 1.48 1.55 0.76 -1.23 -8.35 -3.25 -6.39 2018 90 4.91 3.69 1.01 6.58 -5.48 3.50 1.51 -3.18 2.26 2.31 4.02 0.57 2019 80 -0.56 -8.11 -10.88 2.30 5.91 2.18 4.47 3.29 2.31 -4.43 8.28 1.00 2020 -1.35 1.01 4.25 0.52 4.84 1.89 2021 70 Nov '17 Jul '18 Apr '19 Jan '20 Sep '20 Jun '21 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec PERFORMANCE ANNUAL PRODUCT COMPOSITION BY ASSET CLASS 20% 10% 2017 2.50 -

EG SWISS EQUITIES FUND (Fund Under Swiss Law for Qualified Investors) Monthly Report - August 2019

EG SWISS EQUITIES FUND (Fund under Swiss Law for Qualified Investors) Monthly Report - August 2019 Fund Facts Track Record Launch Date 1st January 2009 Portfolio Manager Peter Handschin, since May 2016 250 EG Swiss Fund Size CHF 31.5 Mio. 200 Benchmark Currency CHF Fund Domicile Switzerland 150 Fund Legal Structure Q.I. Fund NAV CHF 54.80 100 ISIN CH 0047783029 Management Company Gutzwiller Fonds Management AG 50 1 Benchmark SLI Perform TR Index 0 Reinvestment fund Accumulating Liquidity Daily if requested TER 1.77% Calendar Return (%) 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 YTD EG Swiss Equities 17.5 -3.3 -33.7 21.3 -0.6 -9.2 16.9 21.0 11.0 -0.7 -2.5 20.8 -12.1 14.6 SLI Perform TR¹ 15.8 -3.4 -34.8 18.3 -1.7 -7.8 14.9 20.2 9.5 -1.8 -3.5 20.7 -11.9 19.5 ¹ On May 1, 2016 Strategy and Benchmark have changed. Benchmark performance prior to May 1, 2016 is that of the SMI. Portfolio Character Performance EG Swiss EG Swiss SLI Perform TR Index 1 Number of Positions 29 MTD -0.5% -1.2% Volatility 3 Years annulized 10.3% YTD 14.6% 19.5% Tracking Error 1 Year 5.6% Beta 0.81 1 Year 4.8% 4.3% 3 Years p.a. 5.3% 9.1% 5 Years p.a. 3.5% 4.1% 10 Years p.a. 5.5% 5.5% Holdings Weighting (top 15) Manager Report Givaudan SA 7.2% EG Swiss Equities Fund was down 0.5% in August, with SLI TR down 1.2%.