Sales Volume up 4.1% in a Declining Market Net Profit

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019 Equiduct Universe Change Please see today's changes below effective 18 November 2019: Trading Reporting MIC Settlement Trading Settlement Tick Size Change/ Security Name ISIN Home Market Symbol Country Currency Currency table Action ABB LTD ABBNz CH0012221716 XSWX EQTB CH CHF CHF ESMA_E Deletion ABB ABBs CH0012221716 XSTO EQTB SE SEK SEK ESMA_E Deletion ADECCO SA ADENz CH0012138605 XSWX EQTC CH CHF CHF ESMA_E Deletion AMS AG AMSz AT0000A18XM4 XSWX EQTC CH CHF CHF ESMA_E Deletion ARYZTA AG ARYNz CH0043238366 XSWX EQTB CH CHF CHF ESMA_E Deletion JULIUS BAER GRUPPE AG BAERz CH0102484968 XSWX EQTC CH CHF CHF ESMA_E Deletion BALOISE-HLDGS BALNz CH0012410517 XSWX EQTC CH CHF CHF ESMA_D Deletion BARRY CALLEBAUT AG BARNz CH0009002962 XSWX EQTC CH CHF CHF ESMA_D Deletion BB BIOTECH BBZAd CH0038389992 XETR EQTB DE EUR EUR ESMA_D Deletion BB BIOTECH BIONz CH0038389992 XSWX EQTB CH CHF CHF ESMA_D Deletion BASILEA PHARMACEUTICA AG BSLNz CH0011432447 XSWX EQTC CH CHF CHF ESMA_D Deletion BUCHER INDUSTRIES BUCNz CH0002432174 XSWX EQTC CH CHF CHF ESMA_D Deletion COMPAGNIE FINANCIERE RICHEMONT CFRz CH0210483332 XSWX EQTC CH CHF CHF ESMA_E Deletion CLARIANT CLNz CH0012142631 XSWX EQTC CH CHF CHF ESMA_E Deletion CEMBRA MONEY BANK AG CMBNz CH0225173167 XSWX EQTC CH CHF CHF ESMA_D Deletion CREDIT SUISSE GROUP AG CSGNz CH0012138530 XSWX EQTC CH CHF CHF ESMA_E Deletion DKSH HOLDING DKSHz CH0126673539 XSWX EQTC CH CHF CHF ESMA_D Deletion DORMA+KABA HOLDING AG DOKAz CH0011795959 XSWX EQTC CH CHF -

Barry Callebaut “Cost Plus” Model Has Proven to Be Robust

Barry Callebaut 9-month key sales figures 2010/11 July 2011 Agenda Company and Industry Overview First 9 months highlights Outlook July 2011 Barry Callebaut 9 months key sales figures 2 Barry Callebaut is present in all of the stages of the chocolate industry value chain Cocoa Cocoa beans Plantations 80% Cocoa liquor ~54% ~46% Cocoa powder Cocoa butter BC core activity + Sugar, Milk, others + Sugar, Milk, + Sugar, Milk, fats, others others Powder mixes Compound/Fillings Chocolate couverture Customers: Food Manufactures Chocolatiers, Bakeries, Vending Dist. Etc July 2011 Barry Callebaut 9 months key sales figures 3 Barry Callebaut at a glance FY-2010 Sales Volume by Region FY-2010 Sales Volume by Product Group Food Service Global Sourcing & / Retail Cocoa Customers 16% 27% Consumer Products 10% Asia Europe Gourmet 4% 58% & Specialties 10% Food Cocoa Manufacturers 16% 64% Americas 22% Industrial Customers 73% FY-2010 Sales Volume: 1,3 mn tonnes FY-2010 Sales: CHF 5,213mn FY-2010 EBIT: CHF 370.4 mn FY-2010 Net Profit: CHF 251.7 mn July 2011 Barry Callebaut 9 months key sales figures 4 Barry Callebaut is the market leader in the open market Global Industrial Chocolate market in 2009 = 5,400,000 tonnes* (Long-term average annual market growth of approx 2-3%) Open market Integrated market Competitors Big 4 chocolate Others players 40% 49% 51% 80% Outsourced (long-term volumes) *BC estimates July 2011 Barry Callebaut 9 months key sales figures 5 Global leader in chocolate manufacturing Barry Callebaut is one of the of the top three cocoa grinders and the largest manufacturer of industrial chocolate, with estimated market share of 40% of sales volumes in the open market for industrial chocolate Cocoa Grinders Open Market for Chocolate ADM Barry Callebaut Kraft/ Cadbury Barry Callebaut Mars Cargill Nestlé Petra Foods Hershey Blommer Cargill Kraft/Cadbury Blommer ADM Nestlé Lindt Cémoi Ferrero Ferrero Other players 0 100 200 300 400 500 600 700 -100 100 300 500 700 900 1100 Volume ('000 MT) Sales Volume ('000 MT) Source: Barry Callebaut 2009/10 estimates (both charts). -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

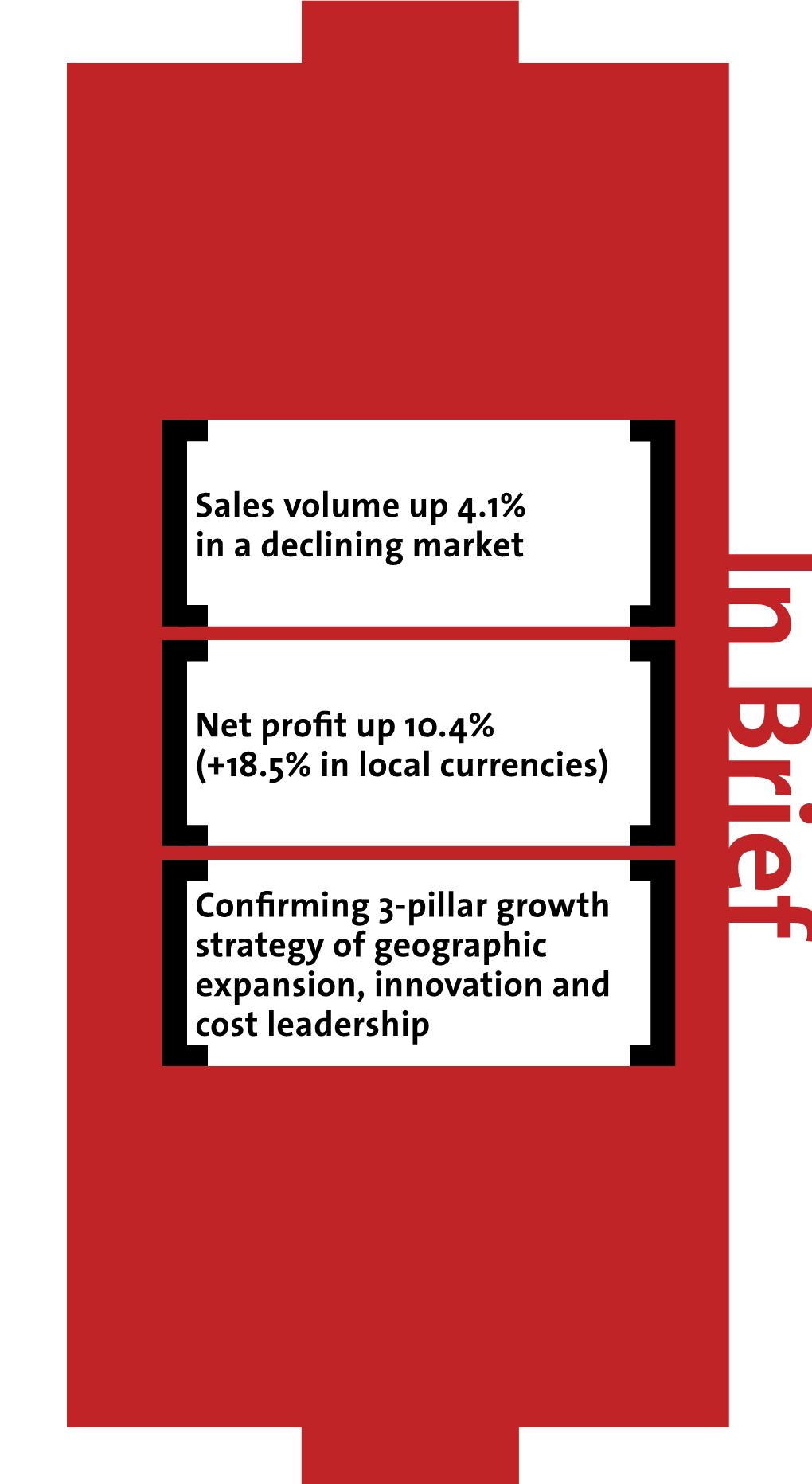

Annual Report Eport

2007/08 Annual Report 2007/08 Annual Report 2007/08 “We are always ready to create added value for our customers” Annual Report Imprint Concept/Design: Gottschalk+Ash Int’l Photos: Jonas Kuhn, KuhnDerron, Zurich; Marcel Giger, Davos Prepress/Press: Linkgroup, Zurich Strengthened global leadership and proven In Brief I business model n Brief North America, Eastern Europe and Asia on a fast growth path Sales volume up 10.1% to 1,166,007 tonnes 2 Barry Callebaut at a glance Barry Callebaut is the world’s leading manufacturer of high-quality cocoa and chocolate products and the preferred solutions provider for the food industry. Our customers include: – Multinational and national branded consumer goods manufacturers who incorporate our ingredients in their products and who increasingly also entrust us with the molding and packaging of their finished products – Artisanal and professional users of chocolate, including chocolatiers, pastry chefs, bakeries, restaurants, hotels and caterers – Food retailers for whom we make customer label as well as branded products We also provide a comprehensive range of services in product development, process- ing, training and marketing. Barry Callebaut is present in 26 countries, operates around 40 production facilities, employs more than 7,000 people and generated sales of more than chf 4.8 billion in fiscal year 2007/08. 3 Key figures Barry Callebaut Group for the fiscal year ended August 31, Change (%) 2007/08 2006/07 Income statement Sales volumes Tonnes 10.1% 1,166,007 1,059,200 Sales revenue CHF m 17.3% 4,815.4 4,106.8 EBITDA1 CHF m 3.9% 443.7 427.1 Operating profit (EBIT) CHF m 5.3% 341.1 324.0 Net profit from continuing operations2 CHF m 1.0% 209.1 207.0 Net profit for the year CHF m 65.6% 205.5 124.1 Cash flow3 CHF m 6.8% 434.3 406.8 EBIT per tonne CHF (4.4%) 292.5 305.9 as of August 31, 2008 2007 Balance sheet Total assets CHF m 17.0% 3,729.5 3 , 1 8 6 . -

GRI Report 2019 / 20

Barry Callebaut GRI Report 2019/20 GRI Report 2019 / 20 MATERIAL ISSUES – GRI STANDARDS MAPPING Barry Callebaut AG’s 2019/2020 GRI Index is based on the For further information please contact: Global Reporting Initiative (GRI) Standards. GRI is the world’s leading standard for corporate sustainability report- Taryn Ridley ing (www.globalreporting.org). Through this GRI Index, External Affairs Manager together with the Forever Chocolate Progress Report and Barry Callebaut AG the Annual Report 2019/2020, Barry Callebaut reports in Pfingstweidstrasse 60 accordance with the Core option of the GRI Standards. CH-8005 Zurich Phone: +41 43 204 03 76 All material standards and indicators discussed are report- Email: [email protected] ed as fully as the available data allow. Relevant GRI Standard(s) CHILD LABOR 408: Child Labor 412: Human Rights Assessment 414: Supplier Social Assessment FORCED LABOR 409: Forced Labor 412: Human Rights Assessment POVERTY 203: Indirect Economic Impact 413: Local Communities FARMER INCOME 203: Indirect Economic Impact 413: Local Communities LOW YIELDS 203: Indirect Economic Impact FUTURE COCOA SUPPLY 201: Economic Performance 203: Indirect Economic Impact 304: Biodiversity TRACEABILITY 308: Supplier Environmental Assessment 414: Supplier Social Assessment HEALTH & SAFETY 403: Occupational Health and Safety 414: Supplier Social Assessment TALENT 404: Training and Education 405: Diversity and Equal Opportunity EMPLOYEE ENGAGEMENT 401: Employment CLIMATE CHANGE 302: Energy 305: Emissions DEFORESTATION -

EG SWISS EQUITIES FUND (Fund Under Swiss Law for Qualified Investors) Monthly Report - August 2019

EG SWISS EQUITIES FUND (Fund under Swiss Law for Qualified Investors) Monthly Report - August 2019 Fund Facts Track Record Launch Date 1st January 2009 Portfolio Manager Peter Handschin, since May 2016 250 EG Swiss Fund Size CHF 31.5 Mio. 200 Benchmark Currency CHF Fund Domicile Switzerland 150 Fund Legal Structure Q.I. Fund NAV CHF 54.80 100 ISIN CH 0047783029 Management Company Gutzwiller Fonds Management AG 50 1 Benchmark SLI Perform TR Index 0 Reinvestment fund Accumulating Liquidity Daily if requested TER 1.77% Calendar Return (%) 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 YTD EG Swiss Equities 17.5 -3.3 -33.7 21.3 -0.6 -9.2 16.9 21.0 11.0 -0.7 -2.5 20.8 -12.1 14.6 SLI Perform TR¹ 15.8 -3.4 -34.8 18.3 -1.7 -7.8 14.9 20.2 9.5 -1.8 -3.5 20.7 -11.9 19.5 ¹ On May 1, 2016 Strategy and Benchmark have changed. Benchmark performance prior to May 1, 2016 is that of the SMI. Portfolio Character Performance EG Swiss EG Swiss SLI Perform TR Index 1 Number of Positions 29 MTD -0.5% -1.2% Volatility 3 Years annulized 10.3% YTD 14.6% 19.5% Tracking Error 1 Year 5.6% Beta 0.81 1 Year 4.8% 4.3% 3 Years p.a. 5.3% 9.1% 5 Years p.a. 3.5% 4.1% 10 Years p.a. 5.5% 5.5% Holdings Weighting (top 15) Manager Report Givaudan SA 7.2% EG Swiss Equities Fund was down 0.5% in August, with SLI TR down 1.2%. -

Chocolate Scorecard for Canada Chocolate Scorecard for Canada

CHOCOLATE SCORECARD FOR CANADA CHOCOLATE SCORECARD FOR CANADA To assist you in making purchases, we asked 10 Canadian chocolate manufacturing companies six (6) questions to learn more about what they are doing to address child labour in cocoa harvesting. Read each chart to learn what their responses were. To ask Canadian companies to source ethical cocoa and for ideas on where you can purchase ethical cocoa products, visit our Good Chocolate Guide. THESE ARE THE 6 QUESTIONS WE WILL BE ASKING: 1 Is your company aware of the use of child labour in the cocoa industry? 2 Are you taking steps to understand the problem of child labour in the cocoa industry? 3 Do any of your products sold in Canada use ethically sourced cocoa (including free from child labour)? 4 Do you commit to source only ethical cocoa by 2020 for all of your products? 5 Will the cocoa be certified ethical by a third party or independent organization? 6 Do you or your cocoa supplier support and invest in local farmers and their communities? CHOCOLATE COMPANIES’ RESPONSES BLOMMER CHOCOLATE COMPANY Page 3 BROCKMANN’S CHOCOLATE INC. Page 4 DANIEL LE CHOCOLAT BELGE CHOCOLATES Page 5 GANONG BROS COMPANY Page 7 LINDT Page 8 PURDY’S CHOCOLATES Page 10 NUTRIART (LAURA SECORD) Page 11 ROCKY MOUNTAIN CHOCOLATE FACTORY CANADA Page 12 ROGERS CHOCOLATES Page 13 WORLD’S FINEST CHOCOLATES (SCHOOL FUNDRAISING CHOCOLATES) Page 14 No Child for Sale: Chocolate ScoreCard For Canada | 2 CHOCOLATE SCORECARD FOR CANADA Questions Explanations Yes No Is your company aware of Yes. the use of child labour in the cocoa industry? Are you taking steps to Blommer Chocolate has always been committed to conducting our understand the problem of business in a fair and ethical manner child labour in the cocoa industry? http://www.blommer.com/csr_CA_transparency.html Do any of your products Blommer is a leader in cocoa products that are certified by the sold in Canada use ethically Rainforest Alliance. -

Equiduct Market Notice

Equiduct Market Notice Date: 28/06/2019 Market Notice Number: 061/2019 Suspension of Swiss instruments On Thursday 27th June 2019 the Swiss Federal Department of Finance (FDF) announced that they will be activating protective measures prohibiting trading venues in the EU from trading Swiss registered shares from 1st July 2019. On Tuesday 25th June 2019, Market Notice 058/2019 announced that Equiduct would suspend trading in all Swiss equities if the Swiss Federal Department of Finance implemented its protective measures. As such, Equiduct will suspend all Swiss instruments from the start of trading on 1st July 2019. The full list of affected instruments are listed below. Please contact the Equiduct Market Operations Team ([email protected]) if you have any questions. Full list of affected instruments ISIN Instrument ID Instrument Name Currency Trading Market CH0012221716 ABBNz ABB LTD CHF XSWX CH0012221716 ABBs ABB SEK XSTO CH0012138605 ADENz ADECCO SA CHF XSWX CH0043238366 ARYNz ARYZTA AG CHF XSWX CH0102484968 BAERz JULIUS BAER GRUPPE AG CHF XSWX CH0012410517 BALNz BALOISE-HLDGS CHF XSWX CH0009002962 BARNz BARRY CALLEBAUT AG CHF XSWX CH0038389992 BBZAd BB BIOTECH EUR XETR CH0038389992 BIONz BB BIOTECH CHF XSWX CH0011432447 BSLNz BASILEA PHARMACEUTICA AG CHF XSWX CH0002432174 BUCNz BUCHER INDUSTRIES CHF XSWX CH0210483332 CFRz COMPAGNIE FINANCIERE RICHEMONT CHF XSWX CH0012142631 CLNz CLARIANT CHF XSWX CH0225173167 CMBNz CEMBRA MONEY BANK AG CHF XSWX CH0012138530 CSGNz CREDIT SUISSE GROUP AG CHF XSWX CH0126673539 DKSHz DKSH HOLDING CHF XSWX Equiduct is the electronic trading segment of the Regulated Market Börse Berlin. Equiduct Systems provides Market Notices covering operational information including data, functional and procedural changes to the trading system. -

Annual Report 2017/18 2

Annual Report 2017/18 “We are the heart and engine of the chocolate and cocoa industry” Key figures 2017/18 Sales Volume EBIT Net Profit Free cash flow Proposed dividend +6.3% +21.2% in local currencies +31.0% in local currencies Payout ratio 37% 2 million 554.0 357.4 311.9 24.00 tonnes CHF million CHF million CHF million CHF per share Sales Volume Sales Revenue In tonnes In CHF million 2'400'000 7,500 2'000'000 6,000 1'600'000 4,500 1'200'000 3,000 800'000 400'000 1,500 0 0 2013/14 2014/15 2015/16 2016/17 2017/18 2013/14 2014/15 2015/16 2016/17 2017/18 EBIT Net profit for the year In CHF million In CHF million 600 360 500 300 400 240 300 180 120 200 60 100 0 0 2013/14 2014/15 2015/16 2016/17* 2017/18 2013/14 2014/15 2015/16 2016/17* 2017/18 * See page 48, Summary of Accounting Policies – Restatement and reclassification of prior year comparatives. Sales Volume by Region Sales Volume by Product Group In tonnes In tonnes 12% EMEA 925,144 22% Food Manufacturers 1,338,311 22% Americas 549,287 Products Asia Pacific 105,777 46% Cocoa Products 455,649 Global Cocoa 455,649 Gourmet & Specialties 241,897 5% Products 66% 27% Barry Callebaut | Annual Report 2017/18 2 Fiscal year 2017/18 in brief • Sales volume up +6.3%, well above the market growth1, first time over 2 million tonnes • Operating profit (EBIT, recurring) up +21.2% in local currencies (+25.3% in CHF) to CHF 554.0 million • Net profit (recurring) up +31.0% in local currencies (+35.9% in CHF) to CHF 357.4 million • Free cash flow of CHF 311.9 million • On track to deliver on mid-term guidance2 • Board member James (Jim) Donald will not stand for reelection. -

Roadshow Presentation

Roadshow presentation Full-Year Results 2018/19 November 2019 AGENDA BC at a glance Highlights Full-Year 2018/19 Strategy & Outlook Appendix BC AT A GLANCE 3 FY 2018/19 Roadshow presentation BC at a glance - Who are we? Strong values & strong team A merger between Cacao Barry, the very first French chocolate connaisseur since 1842 and Callebaut a Belgian chocolate couverture manufacturer expert since 1911 Listed on the SIX Swiss Exchange since 1998 Jacobs Holding long-term anchor shareholder with 50.1% of the outstanding shares Strong and diverse management team with 120 years of chocolate experience Barry Callebaut is in every 4th of all consumer product containing cocoa or chocolate 4 FY 2018/19 Roadshow presentation BC at a glance – This is Barry Callebaut ‘Shaping the world of chocolate and cocoa’ Full-Year 2018/19 5 FY 2018/19 Roadshow presentation BC at a glance - What do we do? We are present in the key parts of the cocoa and chocolate value chain From the cocoa bean to the chocolate and cocoa products 6 FY 2018/19 Roadshow presentation BC at a glance – Market Leadership A strong global market leader Cocoa grinding capacity (kMT) Industrial Chocolate (open market – kMT) Market impact BC BC Cargill Cargill Olam Fuji Oil ECOM Puratos Fuji Oil Cémoi Guan Chong Clasen Mondelez Schokinag Nestlé Irca Ferrero Kerry Group BT Cocoa Guittard Others Others Note: Olam incl. ADM, Cargill incl. ADM chocolate business and SMET, Fuji oil incl. Harald and Bloomer, Irca incl. Doblar Source: BC proprietary estimates 7 FY 2018/19 Roadshow presentation -

FTSE Publications

2 FTSE Russell Publications FTSE Developed Europe ex UK ex 19 August 2021 Controversies ex CW Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.02 GERMANY BMW 0.41 GERMANY Engie 0.27 FRANCE A P Moller - Maersk A 0.14 DENMARK BMW AG Pref 0.06 GERMANY Eni 0.37 ITALY A P Moller - Maersk B 0.2 DENMARK BNP Paribas 0.81 FRANCE Epiroc A 0.17 SWEDEN A2A 0.04 ITALY Boliden 0.13 SWEDEN Epiroc B 0.09 SWEDEN Aalberts NV 0.06 NETHERLANDS Bollore 0.06 FRANCE EQT Partners AB 0.1 SWEDEN ABB 0.69 SWITZERLAND Bouygues 0.09 FRANCE Equinor ASA 0.24 NORWAY ABN AMRO Bank NV 0.06 NETHERLANDS Brenntag AG 0.17 GERMANY Ericsson A 0.01 SWEDEN Acciona S.A. 0.04 SPAIN Bureau Veritas S.A. 0.11 FRANCE Ericsson B 0.45 SWEDEN Accor 0.08 FRANCE Buzzi Unicem 0.03 ITALY Erste Group Bank 0.12 AUSTRIA Ackermans & Van Haaren 0.04 BELGIUM CaixaBank 0.16 SPAIN EssilorLuxottica 0.65 FRANCE ACS Actividades Cons y Serv 0.08 SPAIN Campari 0.08 ITALY Essity Aktiebolag B 0.24 SWEDEN Adecco Group AG 0.12 SWITZERLAND Capgemini SE 0.36 FRANCE Eurazeo 0.05 FRANCE Adevinta 0.05 NORWAY Carl Zeiss Meditec 0.08 GERMANY Eurofins Scienti 0.17 FRANCE Adidas 0.85 GERMANY Carlsberg (B) 0.22 DENMARK Euronext 0.11 FRANCE Adyen 0.84 NETHERLANDS Carrefour 0.14 FRANCE Evolution AB 0.3 SWEDEN Aegon NV 0.09 NETHERLANDS Casino Guichard Perrachon 0.02 FRANCE Evonik Industries AG 0.08 GERMANY Aena SME SA 0.14 SPAIN Castellum 0.08 SWEDEN Evotec 0.08 GERMANY Aeroports de Paris 0.04 FRANCE CD Projekt SA 0.04 POLAND Exor NV 0.1 ITALY Ageas 0.12 BELGIUM Cellnex Telecom SAU 0.46 SPAIN Fastighets AB Balder B 0.08 SWEDEN Ahold Delhaize 0.35 NETHERLANDS Chr. -

Roadshow Presentation - Q1 2010/11

Barry Callebaut Roadshow presentation - Q1 2010/11 January 2011 Agenda X BC at a glance X Q1 Key Sales Figures X Strategy & Outlook X Q & A January 2011 Barry Callebaut Q1 2010/11 Roadshow presentation 2 Barry Callebaut as the heart and engine of the chocolate industry Cocoa CocoaCocoa beans beans Plantations 80% CocoaCocoa liquor liquor ~54% ~46% CocoaCocoa powder powder CocoaCocoa butter butter BC core + Sugar, Milk, + Sugar, Milk, + Sugar, Milk, activity others fats, others others PowderPowder mixes mixes Compound/FillingsCompound/Fillings ChocolateChocolate couverturecouverture Customers: Food Manufactures Chocolatiers, Bakeries, Vending Dist. Etc January 2011 Barry Callebaut Q1 2010/11 Roadshow presentation 3 Barry Callebaut at a glance FY 2009/10 Sales volume =1,305,280 tonnes X World leader in high-quality cocoa and chocolate products and outsourcing partner of choice, with over 40% share in the open industrial chocolate market X World’s largest supplier of Gourmet & Gourmet Specialties chocolate for artisanal customers 11 10% 23 % Consumer X Early mover in emerging markets Food Manufacturers% 10% X Global service and production network, Cocoa Products employing about more than 7,500 people 64% worldwide, over 40 production factories 16% 52 X Fully integrated with a strong position in the % countries of origin X Close to 1,700 recipes to cater for a large variety of individual customer needs Sales revenue = CHF 5,213.8 m X Low cost production with large number of focused chocolate & cocoa factories EBIT = CHF 370.4 m X Achieved