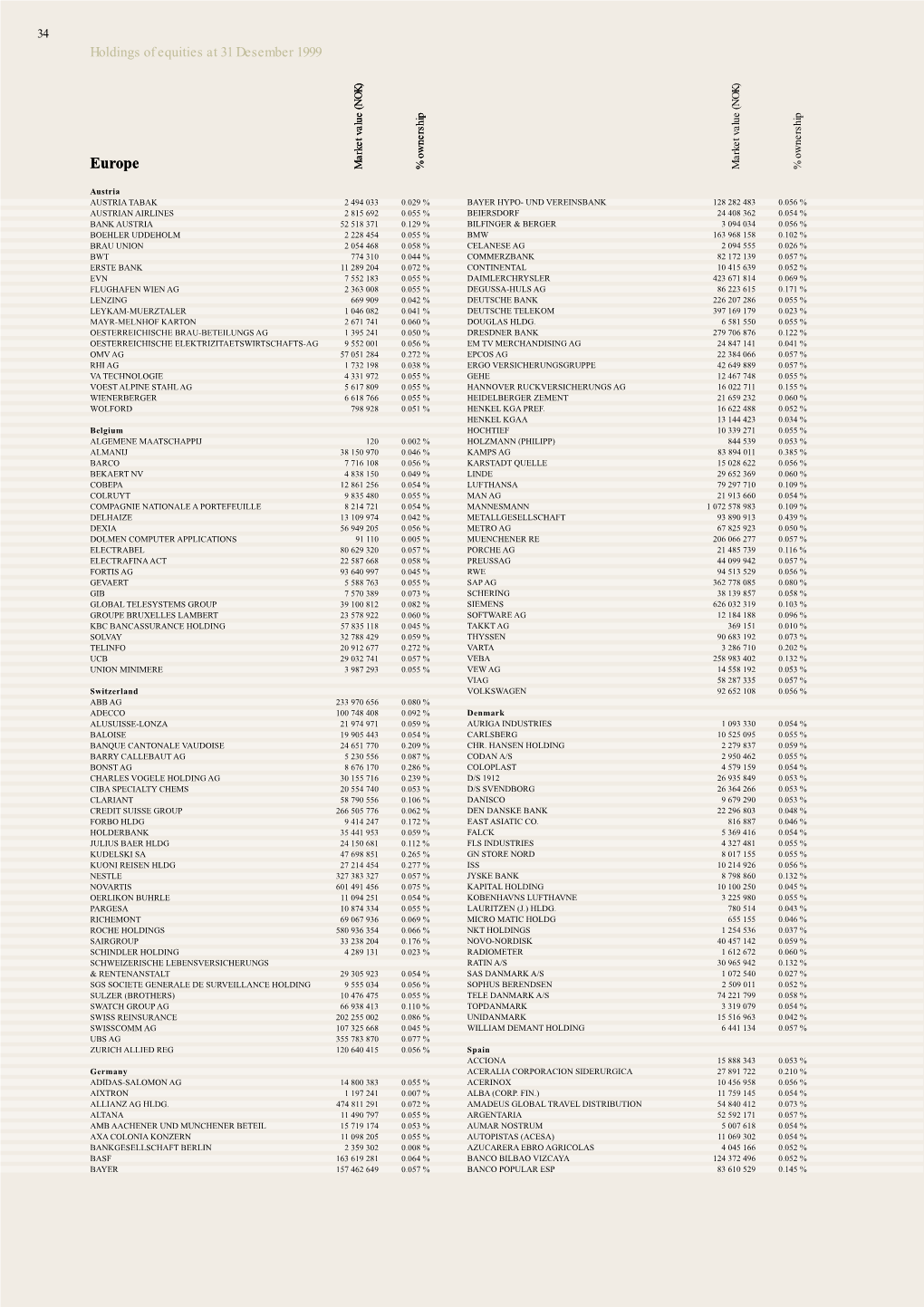

Petroleum Fund Annual Report 1999

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Negativliste. Fossil Energi

Bilag 6. Negativliste. Fossil energi Maj 2017 Læsevejledning til negativlisten: Moderselskab / øverste ejer vises med fed skrift til venstre. Med almindelig tekst, indrykket, er de underliggende selskaber, der udsteder aktier og erhvervsobligationer. Det er de underliggende, udstedende selskaber, der er omfattet af negativlisten. Rækkeetiketter Acergy SA SUBSEA 7 Inc Subsea 7 SA Adani Enterprises Ltd Adani Enterprises Ltd Adani Power Ltd Adani Power Ltd Adaro Energy Tbk PT Adaro Energy Tbk PT Adaro Indonesia PT Alam Tri Abadi PT Advantage Oil & Gas Ltd Advantage Oil & Gas Ltd Africa Oil Corp Africa Oil Corp Alpha Natural Resources Inc Alex Energy Inc Alliance Coal Corp Alpha Appalachia Holdings Inc Alpha Appalachia Services Inc Alpha Natural Resource Inc/Old Alpha Natural Resources Inc Alpha Natural Resources LLC Alpha Natural Resources LLC / Alpha Natural Resources Capital Corp Alpha NR Holding Inc Aracoma Coal Co Inc AT Massey Coal Co Inc Bandmill Coal Corp Bandytown Coal Co Belfry Coal Corp Belle Coal Co Inc Ben Creek Coal Co Big Bear Mining Co Big Laurel Mining Corp Black King Mine Development Co Black Mountain Resources LLC Bluff Spur Coal Corp Boone Energy Co Bull Mountain Mining Corp Central Penn Energy Co Inc Central West Virginia Energy Co Clear Fork Coal Co CoalSolv LLC Cobra Natural Resources LLC Crystal Fuels Co Cumberland Resources Corp Dehue Coal Co Delbarton Mining Co Douglas Pocahontas Coal Corp Duchess Coal Co Duncan Fork Coal Co Eagle Energy Inc/US Elk Run Coal Co Inc Exeter Coal Corp Foglesong Energy Co Foundation Coal -

WELLS FARGO MASTER TRUST Form N-Q Filed 2013-01-29

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2013-01-29 | Period of Report: 2012-11-30 SEC Accession No. 0001193125-13-027642 (HTML Version on secdatabase.com) FILER WELLS FARGO MASTER TRUST Mailing Address Business Address 525 MARKET STREET 525 MARKET STREET CIK:1087961| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1231 12TH FLOOR 12TH FLOOR Type: N-Q | Act: 40 | File No.: 811-09689 | Film No.: 13554496 SAN FRANCISCO CA 94105 SAN FRANCISCO CA 94105 800-222-8222 Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number: 811-09689 Wells Fargo Master Trust (Exact name of registrant as specified in charter) 525 Market Street, 12th Floor, San Francisco, CA 94105 (Address of principal executive offices) (Zip code) C. David Messman Wells Fargo Funds Management, LLC 525 Market Street, 12th Floor, San Francisco, CA 94105 (Name and address of agent for service) Registrants telephone number, including area code: 800-222-8222 Date of fiscal year end: February 29, 2012 Date of reporting period: November 30, 2012 Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document ITEM 1. PORTFOLIO OF INVESTMENTS -

Code Issue Size 1 1301 KYOKUYO CO.,LTD. Topixsmall TOPIX1000

TOPIX New Index Series (As end of October , 2012) (sort by Local Code) As of October 5, 2012 Code Issue TOPIX New Index Series Size 1 1301 KYOKUYO CO.,LTD. TOPIXSmall TOPIX1000 小型 2 1332 Nippon Suisan Kaisha,Ltd. TOPIX Mid400 TOPIX 500 TOPIX1000 中型 3 1334 Maruha Nichiro Holdings,Inc. TOPIX Mid400 TOPIX 500 TOPIX1000 中型 4 1352 HOHSUI CORPORATION TOPIXSmall 小型 5 1377 SAKATA SEED CORPORATION TOPIXSmall TOPIX1000 小型 6 1379 HOKUTO CORPORATION TOPIXSmall TOPIX1000 小型 7 1414 SHO-BOND Holdings Co.,Ltd. TOPIXSmall TOPIX1000 小型 8 1417 MIRAIT Holdings Corporation TOPIXSmall TOPIX1000 小型 9 1514 Sumiseki Holdings,Inc. TOPIXSmall 小型 10 1515 Nittetsu Mining Co.,Ltd. TOPIXSmall TOPIX1000 小型 11 1518 MITSUI MATSUSHIMA CO.,LTD. TOPIXSmall TOPIX1000 小型 12 1605 INPEX CORPORATION TOPIX Large70 TOPIX 100 TOPIX 500 TOPIX1000 大型 13 1606 Japan Drilling Co.,Ltd. TOPIXSmall 小型 14 1661 Kanto Natural Gas Development Co.,Ltd. TOPIXSmall TOPIX1000 小型 15 1662 Japan Petroleum Exploration Co.,Ltd. TOPIX Mid400 TOPIX 500 TOPIX1000 中型 16 1712 Daiseki Eco.Solution Co.,Ltd. TOPIXSmall 小型 17 1719 HAZAMA CORPORATION TOPIXSmall TOPIX1000 小型 18 1720 TOKYU CONSTRUCTION CO., LTD. TOPIXSmall 小型 19 1721 COMSYS Holdings Corporation TOPIX Mid400 TOPIX 500 TOPIX1000 中型 20 1722 MISAWA HOMES CO.,LTD. TOPIXSmall TOPIX1000 小型 21 1762 TAKAMATSU CONSTRUCTION GROUP CO.,LTD. TOPIXSmall 小型 22 1766 TOKEN CORPORATION TOPIXSmall TOPIX1000 小型 23 1780 YAMAURA CORPORATION TOPIXSmall 小型 24 1801 TAISEI CORPORATION TOPIX Mid400 TOPIX 500 TOPIX1000 中型 25 1802 OBAYASHI CORPORATION TOPIX Mid400 TOPIX 500 TOPIX1000 中型 26 1803 SHIMIZU CORPORATION TOPIX Mid400 TOPIX 500 TOPIX1000 中型 27 1805 TOBISHIMA CORPORATION TOPIXSmall TOPIX1000 小型 28 1808 HASEKO Corporation TOPIX Mid400 TOPIX 500 TOPIX1000 中型 29 1810 MATSUI CONSTRUCTION CO.,LTD. -

2005 Annual Report on Form 20-F

United States Securities and Exchange Commission Washington, D.C. 20549 FORM 20-F Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2005 Commission file number 1-32575 Royal Dutch Shell plc (Exact name of registrant as specified in its charter) England and Wales (Jurisdiction of incorporation or organisation) Carel van Bylandtlaan 30, 2596 HR, The Hague, The Netherlands tel. no: (011 31 70) 377 9111 (Address of principal executive offices) Securities Registered Pursuant to Section 12(b) of the Act Title of Each Class Name of Each Exchange on Which Registered American Depositary Receipts representing Class A ordinary shares of the New York Stock Exchange issuer of an aggregate nominal value €0.07 each American Depositary Receipts representing Class B ordinary shares of the New York Stock Exchange issuer of an aggregate nominal value of €0.07 each Securities Registered Pursuant to Section 12(g) of the Act None Securities For Which There is a Reporting Obligation Pursuant to Section 15(d) of the Act None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. Outstanding as of December 31, 2005: 3,817,240,213 Class A ordinary shares of the nominal value of €0.07 each. 2,707,858,347 Class B ordinary shares of the nominal value of €0.07 each. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Board of Investments F/C Report

Legislative Audit Division State of Montana Report to the Legislature December 2004 Financial-Compliance Audit For the Two Fiscal Years Ended June 30, 2004 Board of Investments Department of Commerce We performed a financial-compliance audit of the Board of Investments for the two fiscal years ended June 30, 2004. This report contains the audited financial statements and accompanying notes for the two fiscal years 2003-04 and 2002-03. We issued unqualified opinions on the financial statements of the Board of Investments’ Retirement Funds Bond Pool, Trust Funds Bond Pool, Short Term Investment Pool, Montana Domestic Equity Pool, Montana International Equity Pool, Montana Private Equity Pool, All Other Funds, and Enterprise Fund. This report contains two recommendations relating to: Timely Financial Reporting Required Rural and Special Improvement District Bond Report This report also contains a disclosure issue discussing concerns that certain recent INTERCAP loans to state agencies may constitute state debt. Direct comments/inquiries to: Legislative Audit Division Room 160, State Capitol PO Box 201705 04-03 Helena MT 59620-1705 Help eliminate fraud, waste, and abuse in state government. Call the Fraud Hotline at 1-800-222-4446 statewide or 444-4446 in Helena. FINANCIAL-COMPLIANCE AUDITS Financial-compliance audits are conducted by the Legislative Audit Division to determine if an agency’s financial operations are properly conducted, the financial reports are presented fairly, and the agency has complied with applicable laws and regulations. In performing the audit work, the audit staff uses standards set forth by the American Institute of Certified Public Accountants and the United States Government Accountability Office. -

(12) United States Patent (10) Patent No.: US 8,728,976 B2 Morishima (45) Date of Patent: May 20, 2014

USOO8728976B2 (12) United States Patent (10) Patent No.: US 8,728,976 B2 Morishima (45) Date of Patent: May 20, 2014 (54) PRINTING PAPER FOR PRINTING (52) U.S. Cl. STEREOSCOPIC IMAGE, STEREOSCOPIC USPC ........ 503/227; 428/1.31; 428/32.11: 430/200 IMAGE PRINTED MATTER, AND METHOD (58) Field of Classification Search FOR PROVIDING STEREOSCOPIC MAGE USPC ................ 428/1.31, 32.11: 430/200: 503/227 See application file for complete search history. (75) Inventor: Shinichi Morishima, Kanagawa (JP) (56) References Cited (73) Assignee: Fujifilm Corporation, Tokyo (JP) FOREIGN PATENT DOCUMENTS (*) Notice: Subject to any disclaimer, the term of this patent is extended or adjusted under 35 JP 5-210182 8, 1993 U.S.C. 154(b) by 217 days. JP 7-261024 10, 1995 JP HO8-0951.76 A 4f1996 (21) Appl. No.: 13/317,642 JP 2010-152351 A T 2010 Primary Examiner — Bruce H Hess (22) Filed: Oct. 25, 2011 (74) Attorney, Agent, or Firm — Jean C. Edwards; Edwards Neils PLLC (65) Prior Publication Data US 2012/O1 O7530 A1 May 3, 2012 (57) ABSTRACT Provided is printing paper for printing a stereoscopic image, (30) Foreign Application Priority Data including a light-transmitting image-receiving layer (12) and a linear polarizing layer (14), wherein a linear polarizing Oct. 28, 2010 (JP) ................................. 2010-242854 layer is patterned in a first domain and a second domain whose directions of polarizing axes are at an angle of 90° with (51) Int. Cl. respect to each other. B4LM 5/50 (2006.01) GO3CS/02 (2006.01) 10 Claims, 5 Drawing Sheets 10A 12 14 U.S. -

Petroleum Fund Annual Report 2001

36 Holdings of equities at 31 December 2001 Europe Market value (NOK) Percentage ownership Market value (NOK) Percentage ownership Austria KONE CORPORATION 9 942 555 0.090 AUSTRIAN AIRLINES 827 968 0.039 KONECRANES INTERNATIONAL CORP(KCI) 34 582 555 1.013 BOEHLER UDDEHOLM 5 143 884 0.130 LASSILA & TIKANOJA PLC 2 177 779 0.096 BRAU UNION GOSS REININGHAUS OSTERRE AUSH100 2 214 435 0.070 METSO OYJ 94 676 622 0.737 BWT AG (BENCKISER W) 2 085 701 0.060 NOKIA OYJ 3 260 784 502 0.298 ERSTE BANK DER OSTERREICHISCHEN SPARKASSEN AG 9 995 347 0.042 ORION-YHTYMA OY 2 407 775 0.044 EVN AG 7 089 600 0.053 OUTOKUMPU OY 30 282 867 0.257 FLUGHAFEN WIEN AG 2 334 943 0.052 OYJ HARTWALLABP 9 143 957 0.085 IMMOFINANZ IMMOBILIEN ANLAGEN AG 5 808 725 0.108 PERLOS OYJ 7 442 941 0.152 LENZING AG 1 354 256 0.063 POHJOLA GROUP INSURANCE 2 377 828 0.036 MAYR-MELNHOF KARTON AG 3 923 978 0.081 SAMPO 47 222 426 0.121 OESTERREICHISCHE BRAU-AG 1 766 501 0.064 SATAMA INTERACTIVE 1 134 010 0.537 OESTERREICHISCHE EL WIRTSCH 12 934 138 0.128 SONERA CORPORATION OYJ 71 107 059 0.142 OMV AG 158 013 774 0.779 STORA ENSO OYJ 111 934 733 0.108 PALFINGER AG 503 329 0.029 TECHNOMEN HOLDINGS OYJ 1 519 214 0.186 RHI AG 1 865 702 0.162 TELESTE CORP 3 989 800 0.238 TELEKOM AUSTRIA AG 15 183 591 0.117 TIETO CORPORATION 58 675 911 0.296 VA TECHNOLOGIE A 3 475 981 0.118 TIETO-X OYJ 2 247 257 0.918 VOEST-ALPINE AG 7 512 087 0.093 UPM-KYMMENE OY 190 626 917 0.247 WIENERBERGER AG 7 422 615 0.086 VACON OYJ 7 016 489 0.630 YIT-YHTYMA OY 6 468 650 0.204 Belgium/Luxembourg ACKERMANS 9 898 156 -

ANNUAL REPORT 2016 Year Ended March 31, 2016 Topics in Fiscal Year 2015

IDEMITSU KOSAN CO.,LTD. ANNUAL REPORT 2016 Year Ended March 31, 2016 Topics in Fiscal Year 2015 2015 Jun. • Successful appraisal well in the Norwegian Barents Sea Aug. • Completion of Boggabri Coal Mine Expansion Project Oct. • Short-term flow test of exploratory wells for geothermal energy development in Amemasudake area, Hokkaido, Japan • Production capacity increase at the lubricants plant in China Nov. • Idemitsu and Doosan agree to form cooperative partnership in OLED material business • Entered into Memorandum of Understanding with Showa Shell Sekiyu K.K. for the Business Integration 2016 Jan. • Increasing the production capacity for SPS resin XAREC® Feb. • Establishment of Himeji Natural Gas Power Generation Co., Ltd. with Osaka Gas., Ltd. • Opening of first commercial hydrogen station Mar. • Construction begins on one of Japan’s largest geothermal binary power plants • Reached an agreement on financing by subordinated loans Contents 02 Financial Highlights 23 Material Agreements, etc. 04 To Our Stakeholders 24 Corporate Governance 17 Management Philosophy 34 Directors, Audit & Supervisory Board Members and Executive Officers 18 At a Glance 35 Financial Section 20 Research & Development 92 Investor Information Contribute to society with harmony between the economy and the environment by effectively securing and using energy and by developing functional materials. Idemitsu Kosan Co.,Ltd. was founded in Moji, Kita-Kyushu in 1911 under the name Idemitsu Shokai to engage in oil distribution. Since its foundation, Idemitsu has worked hard under the fundamental principle of social contribution through business, always maintaining respect for human beings in carrying out business operations. During its 105-year history, the Company has utilized its expertise globally in a wide range of strategic businesses, such as petroleum products, petrochemical products, oil exploration and production, coal, and other businesses. -

Notice of Resolutions (AGM June 2003)

The Bank of Tokyo-Mitsubishi, Ltd. Global Securities Services Division Notice of Resolutions Below is the outcome of the votes taken in the AGMs held in June 2003. Y: Approved N: Rejected Agenda Item No. QUICK ISIN Description Remarks 123456789101112131415 1301 JP3257200000 KYOKUYO CO., LTD. YYYYYY 1331 JP3666000009 NICHIRO CORPORATION --CHGED FROM NICHIRO GYOGYO KAISHA YYYYYYY 1332 JP3718800000 NIPPON SUISAN KAISHA, LTD. YYYYY 1333 JP3876600002 MARUHA CORP. (FM TAIYO FISHERY) YYYYYY 1379 JP3843250006 HOKUTO YYYYYY 1491 JP3519000008 CHUGAI MINING YYYYY 1501 JP3889600007 MITSUI MINING YYYY 1503 JP3406200000 SUMITOMO COAL MINING YYY 1515 JP3680800004 NITTETSU MINING YYYYY 1518 JP3894000003 MITSUI-MATSUSHIMA (EX-MATSUSHIMA KOSAN) YYY 1725 JP3816710002 FUJITA CORPORATION (NEW) YYYY 1736 JP3172410007 OTEC CORPORATION YYYYYY 1742 JP3421900006 SECOM TECHNO SERVICE CO.,LTD. YYYYY 1757 JP3236100008 KIING HOME YYYYY 1777 JP3224800007 KAWASAKI SETSUBI KOGYO YYYYYY 1793 JP3190500003 OHMOTO GUMI YYYYYY 1800 JP3629600002 TONE GEO TECH YYYYY 1801 JP3443600006 TAISEI CORP. YYYYYY 1802 JP3190000004 OBAYASHI CORPORATION YYYYYY 1803 JP3358800005 SHIMIZU CORP. YYYYY 1805 JP3629800008 TOBISHIMA CORP. YYYYYYY 1808 JP3768600003 HASEKO CORP. ( CHGD FM HASEGAWA KOUMUTEN ) YYYY 1810 JP3863600007 MATSUI CONSTRUCTION YYY Y 1811 JP3427800002 ZENITAKA CORP. YYY YYYY 1812 JP3210200006 KAJIMA CORP. YYY YYY 1813 JP3825600004 FUDO CONSTRUCTION CO., LTD. YYY YY 1815 JP3545600003 TEKKEN CORP. (FM TEKKEN CONSTRUCTION CO., LTD.) YYY Y 1816 JP3128000001 ANDO CORP. YYY YYYY 1820 JP3659200004 NISHIMATSU CONSTRUCTION YYY YY 1821 JP3889200006 SUMITOMO MITSUI CONSTRUCTION CO., LTD. (FM. MITSUI COST. CO YY 1822 JP3498600000 DAIHO CONSTRUCTION YYY YYY 1824 JP3861200008 MAEDA CORP. YYY YY 1825 JP3227350000 ECO-TECH CONSTRUCTION CO.,LTD.(FM ISHIHARA CONSTRUCTION) Y Y YY Agenda 2 : Short of quorum 1827 JP3643600004 NAKANO CORP. -

Energy to the World: the Story of Saudi Aramco Volume 2

ENERGY TO THE WORLD: TO ENERGY ENERGY TO THE WORLD: THE STORY OF SAUDI ARAMCO OF SAUDI THE STORY THE STORY OF SAUDI ARAMCO VOLUME 2 VOLUME 2 VOLUME www.saudiaramco.com J ENERGY TO THE WORLD : VOLUME ONE TITLE K VOLUME TWO Energy to the World The Story of Saudi Aramco II ENERGY TO THE WORLD : VOLUME ONE VOLUME TWO Energy to the World The Story of Saudi Aramco Supertankers load crude oil at Ras Tanura Sea Island Terminal in 2003. Contents Copyright First Edition Volume One Volume Two © 2011 by Aramco Services Company Printed in 2011 Preface xi Illustration: Saudi Arabia viii ISBN All rights reserved. No part of this book Illustration: Saudi Arabia xiv 1 National Resources 1 978-1-882771-23-0 may be reproduced, stored in a retrieval system or transmitted in any form or 1 Prospects 1 2 Boom Time 27 Library of Congress by any means, electronic, mechanical, 2 Negotiations 33 3 Transformation 67 Control Number photocopying, recording or otherwise, 200922694 without the written permission of 3 Reading the Rocks 59 4 Rising to the Challenge 99 Aramco Services Company, except by 4 The War Years 93 5 Achieving the Vision 131 Written by a reviewer, who may quote a brief Scott McMurray passage for review. 5 Expansion 123 Appendix 168 6 Growing Pains 153 A. Upstream 170 Produced by The History Factory 7 Balancing Act 189 B. Downstream 184 Chantilly, Virginia, USA List of Abbreviations 215 C. Operations Data 194 Project Coordinators Notes on Sources 216 Company Leadership 204 Theodore J. Brockish, Kyle L. -

Royal Dutch Shell Plc (Exact Name of Registrant As Specified in Its Charter)

United States Securities and Exchange Commission Washington, D.C. 20549 FORM 20-F Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2005 Commission file number 1-32575 Royal Dutch Shell plc (Exact name of registrant as specified in its charter) England and Wales (Jurisdiction of incorporation or organisation) Carel van Bylandtlaan 30, 2596 HR, The Hague, The Netherlands tel. no: (011 31 70) 377 9111 (Address of principal executive offices) Securities Registered Pursuant to Section 12(b) of the Act Title of Each Class Name of Each Exchange on Which Registered American Depositary Receipts representing Class A ordinary shares of the New York Stock Exchange issuer of an aggregate nominal value €0.07 each American Depositary Receipts representing Class B ordinary shares of the New York Stock Exchange issuer of an aggregate nominal value of €0.07 each Securities Registered Pursuant to Section 12(g) of the Act None Securities For Which There is a Reporting Obligation Pursuant to Section 15(d) of the Act None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. Outstanding as of December 31, 2005: 3,817,240,213 Class A ordinary shares of the nominal value of €0.07 each. 2,707,858,347 Class B ordinary shares of the nominal value of €0.07 each. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

The Shell Report 2004 Meeting the Energy Challenge – Our Progress in Contributing to Sustainable Development Guide to Contents

The Shell Report 2004 Meeting the energy challenge – our progress in contributing to sustainable development Guide to contents 1 Message from the Group Chief Executive Finding your way around Jeroen van der Veer on our efforts to improve performance Don’t just take our word for it and rebuild trust after a difficult year for Shell. KPMG Accountants N.V. and PricewaterhouseCoopers 2 The year at a glance LLP have carried out assurance work on selected financial, safety and environmental data marked The main events for Shell in 2004. with , and the extraction of selected data from 4 About Shell the audited financial statements. They also reviewed What we do. How we are governed. Sustainable the other information included in this report (see development and our business strategy. pages 30 and 31 for more). Members of the communities affected by our 8 Issues operations and external experts have assessed Our response to the environmental and social issues our performance at key locations (page 30). that most affect our business. These assessments, and other uncensored views, 12 Energy security including a sample of the e-mails sent to ‘Tell Shell’, The energy security aspect of the global energy can be found in the ’What others say’ boxes. challenge and what we are doing to help. What others say 16 Location reports Our efforts to address environmental and social concerns at key locations in Nigeria, the Philippines, Tell us what you think Russia, South Africa and the USA. Share your views at [email protected], write to us (addresses on back cover) or join our forum 24 Performance data discussions at www.shell.com/tellshell.