JKX Oil & Gas Plc Annual Report 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Financing Options in the Oil and Gas Industry, Practical Law UK Practice Note

Financing options in the oil and gas industry, Practical Law UK Practice Note... Financing options in the oil and gas industry by Suzanne Szczetnikowicz and John Dewar, Milbank, Tweed, Hadley & McCloy LLP and Practical Law Finance. Practice notes | Maintained | United Kingdom Scope of this note Industry overview Upstream What is an upstream oil and gas project? Typical equity structure Relationship with the state Key commercial contracts in an upstream project Specific risks in financing an upstream project Sources of financing in the upstream sector Midstream, downstream and integrated projects Typical equity structures What is a midstream oil and gas project? Specific risks in financing a midstream project What is a downstream oil and gas project? Specific risks in financing a downstream project Integrated projects Sources of financing in midstream, downstream and integrated projects Multi-sourced project finance Shareholder funding Equity bridge financing Additional sources of financing Other financing considerations for the oil and gas sectors Expansion financings Hedging Refinancing Current market trends A note on the structures and financing options and risks typically associated with the oil and gas industry. © 2018 Thomson Reuters. All rights reserved. 1 Financing options in the oil and gas industry, Practical Law UK Practice Note... Scope of this note This note considers the structures, financing options and risks typically associated with the oil and gas industry. It is written from the perspective of a lawyer seeking to structure a project that is capable of being financed and also addresses the aspects of funding various components of the industry from exploration and extraction to refining, processing, storage and transportation. -

Seismic Reflections | 5 August 2011

1 | Edison Investment Research | Seismic reflections | 5 August 2011 Seismic reflections Confidence in Kurdistan grows Iraq, including the autonomous Kurdistan region, probably has the world’s largest concentration of untapped, easily recoverable oil reserves. Pioneering moves were made into Kurdistan in the 2000s by the likes of Gulf Keystone and Hunt Oil, with considerable drill-bit success. In late July, two important Kurdistan exploration and development deals were announced. These involve Afren acquiring interests in two PSCs with sizeable contingent reserves and a Hess-Petroceltic partnership signing two PSCs for exploration purposes. With increasing production and Analysts improving relations between the regional and Iraqi federal governments, Ian McLelland +44 (0)20 3077 5756 these deals reflect growing confidence in Kurdistan’s potential as a major Peter J Dupont +44 (0)20 3077 5741 new petroleum province. Elaine Reynolds +44 (0)20 3077 5700 Krisztina Kovacs +44 (0)20 3077 5700 Anatomy of the Kurdistan oil province [email protected] 6,000 Kurdistan is located in the North Arabian basin and is on same fairway as the 5,500 prolific oilfields of Saudi Arabia’s Eastern Province, Kuwait, southern Iraq and Syria. 5,000 4,500 The geological backdrop to Kurdistan tends to be simple and is characterised by 4,000 3,500 large anticlinal structures, deep organic-rich sediments and carbonate reservoirs 3,000 mainly of Jurassic to Cretaceous age. Drilling commenced in the region in 2006. So far, 28 wells have been drilled, of which 20 have been discoveries, resulting in A pr/11 Oct/10 Jun/11 Fe b/11 Aug/10 Dec/10 Aug/11 estimated reserves of over 5.8bn boe. -

Description Holding Book Cost Market Price Market Value £000'S £000'S

DORSET COUNTY PENSION FUND VALUATION OF PORTFOLIO AT CLOSE OF BUSINESS 31 March 2017 Book Market Description Holding Market Value Cost Price £000's £000's UK EQUITIES MINING ACACIA MINING 33,000 147.93 4.502 148.57 ANGLO AMERICAN ORD USD0.54 270,390 2,804.18 12.27 3,317.69 ANTOFAGASTA ORD GBP0.05 74,500 151.50 8.355 622.45 BHP BILLITON ORD USD0.50 436,926 2,401.54 12.395 5,415.70 CENTAMIN EGYPT LTD 226,000 349.07 1.732 391.43 FRESNILLO 35,500 88.20 15.52 550.96 GLENCORE XSTRATA 2,412,543 5,662.91 3.141 7,577.80 HOCHSCHILD MINING ORD GBP0.25 49,000 108.90 2.765 135.49 KAZ MINERALS 53,600 89.80 4.551 243.93 PETRA DIAMONDS 106,900 169.67 1.329 142.07 POLYMETAL INT'L 53,800 514.30 9.945 535.04 RANDGOLD RESOURCES ORD USD0.05 19,250 485.32 69.7 1,341.73 RIO TINTO ORD GBP0.10 (REG) 250,150 2,876.49 32.185 8,051.08 VEDANTA RESOURCES ORD USD0.10 18,500 75.07 8.11 150.04 Total MINING 15,924.89 28,524.69 OIL & GAS PRODUCERS AFREN PLC 218,000 215.93 0 0.00 BP ORD USD0.25 3,948,100 13,177.95 4.5885 18,115.86 CAIRN ENERGY ORD GBP0.06153846153 119,207 236.32 2.048 244.14 NOSTRUM OIL & GAS 17,700 84.36 4.796 84.89 ROYAL DUTCH 'B' ORD EUR0.07 1,642,961 20,190.09 21.945 36,054.78 TULLOW OIL ORD GBP 0.10 188,500 789.92 1.99026 375.16 Total OIL & GAS PRODUCERS 34,694.58 54,658.45 CHEMICALS CRODA INTL ORD GBP0.10 26,995 211.15 35.77 965.61 ELEMENTIS 99,000 130.23 2.899 287.00 JOHNSON MATTHEY ORD GBP1.00 40,357 446.31 30.82 1,243.80 SYNTHOMER 57,665 118.87 4.751 273.97 VICTREX ORD GBP0.01 17,000 111.61 19.02 323.34 Total CHEMICALS 1,018.16 3,087.91 CONSTRUCTION -

UK Bribery Digest

UK Bribery Digest Edition 14 September 2020 UK BRIBERY DIGEST | EDITION 14 CONTENTS WELCOME Click to continue 1 | UK Bribery Digest Edition 14 | September 2020 Regulatory and enforcement landscape: Guidance released for an effective compliance programme Over the last 18 months we have seen a significant encourage more effective collaboration between key volume of updated compliance guidance being issued players within an organisation. by regulators and enforcement agencies. Whilst these releases are from regulators and As part of their Operational Handbook, the Serious enforcement agencies in different jurisdictions, Fraud Office (SFO) released the ‘Corporate Co- due to the increasingly global reach of white-collar operation Guidance’ in August 2019, and in crime legislation and the increased cross border January 2020, released an updated chapter on the cooperation between enforcement agencies, ‘Evaluating a Compliance Programme’. a multinational corporation would be naïve to focus on a single framework. Instead, most global With little to no warning, in June 2020 the United businesses set a standard which at least meets States Department of Justice (DoJ) also released • Transparency International — Business principles the requirements of all the leading legislation and updated guidance on the ‘Evaluation of Corporate for countering bribery guidance. By way of example of the increasingly Compliance Programs’. This was followed with an global nature of guidance, the latest FCPA Resource • United Nations Global Compact — The ten updated -

Vanguard Total World Stock Index Fund Annual Report October 31, 2020

Annual Report | October 31, 2020 Vanguard Total World Stock Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard. -

Significant Energy Assets on the Market (SEAM) Database on IHS

Significant Energy Assets on the Market (SEAM) Database on IHS Connect IHS Energy has launched a new database tool that actively tracks all known energy assets on the market and independently values them in a transparent manner utilizing more than 40,000 comparable transactions from IHS’s M&A database dating back to 1988. Assets on the Market database features include: • Searchable and exportable database covering all global and regional • Source documents including offering memos, prospectuses, and locations and all resource segments, detailing valuations and full press releases. operational data including reserves, production and acreage. • Full opportunity set currently totals approximately $250 billion • Contact information for sellers and advisors. Canada $25 B+ Europe $30 B+ Sellers Key Assets for Sale (or JV) Sellers Key Assets for Sale (or JV) Apache Corp. 1 million acres in Provost region of east-central Alberta Antrim Energy Skellig Block in Porcupine Basin Athabasca Oil Corp. 350,000 net prospective acres in Duvernay BNK Petroleum Joint venture partner sought for Polish shale gas play Canadian Oil Sands Rejects Suncor offer; reviewing strategic alternatives BP 16% stake in Culzean gas field in UK North Sea Centrica plc Offering 6,346 boe/d (86% gas) ConocoPhillips 24% stake in UK’s Clair oil field. Considering sale of Norwegian Cequence Energy Montney-focused E&P undergoing strategic review North Sea fields ConocoPhillips Western Canada gas properties Endeavour Int’l. Bankrupt; to sell Alba and Rochelle fields in the UK North -

Energy & Utilities Sector

ENERGY & UTILITIES SECTOR Global experience With a team of ‘unmatched experts’ that consistently performs at the best possible level £275m INCLUDING A BIT ABOUT US TURNOVER 252 PARTNERS PRINCIPAL 12 200+ #1 ADVISORS TO JURISDICTIONS MOST INNOVATIVE and an international “best friend” firm LAW FIRM 20 OFFICES network 2018 FT Innovative Lawyer Awards FTSE 100 companies 6 UK London, Leeds, Manchester, Edinburgh, COVERAGE IN Glasgow and Aberdeen 21 40+ NORTHERN IRELAND & NATIONALITIES FTSE 100 CLIENTS REPUBLIC OF IRELAND Including BP, National Grid, SSE, with capabilities to speak over 36 THROUGH BEST FRIEND FIRM Diageo, DfT, Sainsbury’s, Barclays & 6 OVERSEAS languages NETWORK. Doha, Hamburg, Muscat, Dubai, GSK Singapore, Hong Kong and a strategic alliance with Hashidate in Tokyo 1020 OUR CORE LAWYERS specialists in 8 different sectors Energy & Transport SECTORS Utilities Financial Health Services Retail & Real Consumer Estate A TRACK RECORD OF FIRSTS IN ENERGY • The largest smart metering deal in Europe • The two largest solar and wind developments in England • The first bio-methane project and the first bio-mass project in the UK • An oil & gas giant’s first global entry back into the renewables market • The only UK government-mandated fund investing in electric vehicles • One of only 2 at-scale carbon capture projects in the UK • Advised the Energy regulator Ofgem, in its policy for the UK’s first offshore transmission rounds Working from 12 offices around the world, we’ve acted in 94 countries for our clients in the last three years. You can rely on us wherever you need an imaginative legal solution to a pivotal business problem. -

Adherence to the Frcs Stewardship Code

Investment Management Association Adherence to the FRC’s Stewardship Code At 30 September 2013 May 2014 Investment Management Association 65 Kingsway London WC2B 6TD United Kingdom Tel: +44 (0)20 7831 0898 Fax: +44 (0)20 7831 9975 www.investmentuk.org May 2014 © Investment Management Association (2014). All rights reserved. No reproduction without permission of the IMA. Adherence to the FRC’s Stewardship Code – 2013 Contents Key findings 3 1. Introduction 7 2. Profile of respondents 8 3. Policies 11 4. Structure and resources 15 5. Monitoring and engagement, together with practical examples 22 6. Voting 34 7. Reporting 38 Appendices 1. Steering Group members 41 2. Respondents to the questionnaire 42 3. Markets and proportion of shares voted 44 1 Investment Management Association 2 Adherence to the FRC’s Stewardship Code – 2013 Key findings This fourth report on the adherence to the Financial Encouragingly, the proportion of Asset Managers where Reporting Council’s (FRC) Stewardship Code looks at “all” or “some” mandates refer to stewardship increased the activities that support institutional investors’ to 83 per cent from 71 per cent in 2012 and 65 per cent commitment in practice. It summarises the responses to in 2011. In particular, for 44 per cent of Asset Managers a questionnaire sent to 274 signatories as at 30 stewardship is referred to in the mandates of all their September 2013, an increase from 241 as at 30 clients – as compared to 30 per cent in 2012 and 29 per September 2012 and from 172 as at 30 September cent in 2011. 2011. The FRC encourages signatories to review their Code The total number of respondents was 114 in 2013 up statements annually. -

Investor Presentation

Investor Presentation 12 January 2015 Disclaimer This presentation does not constitute an offer to buy or sell shares or other financial instruments of Panoro Energy ASA (“Company”). This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements”, which include all statements other than statements of historical fact. Forward-looking statements involve making certain assumptions based on the Company’s experience and perception of historical trends, current conditions, expected future developments and other factors that we believe are appropriate under the circumstances. Although we believe that the expectations reflected in these forward-looking statements are reasonable, actual events or results may differ materially from those projected or implied in such forward-looking statements due to known or unknown risks, uncertainties and other factors. These risks and uncertainties include, among others, uncertainties in the exploration for and development and production of oil and gas, uncertainties inherent in estimating oil and gas reserves and projecting future rates of production, uncertainties as to the amount and timing of future capital expenditures, unpredictable changes in general economic conditions, volatility of oil and gas prices, competitive risks, regulatory changes and other risks and uncertainties discussed in the Company’s periodic reports. Forward-looking statements are often identified by the words “believe”, “budget”, “potential”, “expect”, “anticipate”, “intend”, “plan” and other similar terms and phrases. We caution you not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation, and we undertake no obligation to update or revise any of this information 2 Panoro Energy ASA – Company snapshot . -

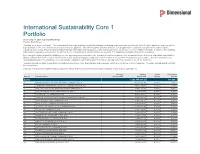

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

International Sustainability Core 1 Portfolio As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions -

1 Modelling Oil and Gas Stock Returns Using Multi Factor Asset Pricing

Modelling oil and gas stock returns using multi factor asset pricing model including oil price exposure Abstract Oil and gas is one of the most important sectors in every economy and the valuation of oil and gas companies becomes quite challenging due to the volatility of crude oil price. The paper investigates the determinants of the UK oil and gas stock returns using multi factor asset pricing model and the existence of asymmetric effects in the Brent crude oil price. Our results show that market risk, oil price risk, size and book-to-market related factors are all relevant in the determination of asset returns of the oil and gas companies quoted on the London stock exchange. Oil price increases and decreases decomposed separately have more effect on the oil companies’ stock returns than the normal log changes of the price which shows the presence of asymmetric effect. However, the oil price shocks in general do not seem to strongly affect stock returns in oil and gas sector possibly due to horizontal and vertical integration of bigger companies in the sector. Keywords: asset pricing models, Brent crude oil, asymmetry in oil price, size effect, book to market ratio, oil and gas sector, oil price exposure, structural breaks. JEL Classification Codes: G12 1 1. Introduction One of the biggest challenges in the field of finance is how to effectively model the risk and return of financial securities. Researchers have formulated various asset pricing models that tend to explain the determinants of asset returns. Markowitz’s (1952) mean-variance analysis provides the foundations of portfolio optimisation. -

Annual Report 2015

BUILDING ON SUCCESS CAIRN ENERGY PLC Annual Report and Accounts 2015 CAIRN ENERGY PLC Annual Report and Accounts 2015 DELIVERING VALUE FROM DISCOVERY AND DEVELOPMENT About Cairn Energy PLC Cairn Energy PLC is an independent oil and gas exploration and development company listed on the London Stock Exchange. Cairn has its headquarters in Edinburgh, Scotland, with additional offices in London, Norway and Senegal. Cairn has discovered oil and gas in a variety of locations throughout the world. Today the business holds a balanced portfolio of exploration, appraisal and development assets and is organised in three core groups: Senegal, UK and Norway and International. STRATEGIC REPORT 01 LEADERSHIP AND GOVERNANCE 62 Overview of 2015 02 Board of Directors 62 Company Balance Sheet 147 Chairman’s statement 04 Directors’ report 64 Company Statement of Cash Flows 148 Highlights 05 Corporate Governance statement 67 Company Statement of Changes in Equity 149 Industry overview 06 Audit Committee report 76 Section 7 – Notes to the Company Financial Statements 150 CEO’s review 08 Directors’ Remuneration report 81 Strategy and business model 10 ADDITIONAL INFORMATION 155 Senegal – Building on success 12 F INANCIAL statements 105 Group booked reserves and resources 155 Focus on North Sea 18 Independent Auditors’ Report 105 Licence list 156 2015 Key Performance Indicators (KPIs) 20 Group Income Statement 112 Glossary 158 2016 Key Performance Indicators 24 Group Statement of Comprehensive Income 112 Company information Inside back cover Operational review