Support to Export Promotion and Investment Attraction in the Republic of Moldova

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Product Recalls the Sgs Publication Gathering Consumer Product Recalls in the Eu, in the Usa and in Australia

PRODUCT RECALLS THE SGS PUBLICATION GATHERING CONSUMER PRODUCT RECALLS IN THE EU, IN THE USA AND IN AUSTRALIA CONSUMER TESTING SERVICES (CTS) 01– 15 JULY 2011 CONTENTS ELECTRICAL & ELECTRONICS Pages 2 to 13 Electrical Appliances (15) Lighting Equipments (4) Cord Sets, Plugs & Sockets (2) HARDLINES Pages 14 to 43 Toys (17) Juvenile Items (2) Children articles (2) - See ‘Personal & Home Care Items’ Children articles (1) - See ‘Sports & Leisure Goods’ Children articles (5) - See ‘SOFTLINES’ Home Furnishing & Houseware (13) Home Improvement & DIY (5) Personal & Home Care Items (14) Sport & Leisure Goods (5) PPE (2) SOFTLINES Pages 44 to 50 Wearing Apparels (9) Home Textiles (0) Footwear, Bags and Accessories (4) E&E: ELECTRICAL APPLIANCES NOTIFYING PRODUCT DANGER MEASURES COUNTRY ADOPTED EU/MALTA CATEGORY: Electrical appliances FIRE Voluntary recall PRODUCT The product poses a risk of fire from consumers. Hairdryer "Salon Essential Hairdryer" and "Salon Dry because in rare cases it can Travel Hairdryer" overheat when left plugged into the mains electrical supply, BRAND: Philips even when the appliance is TYPE/NUMBER OF MODEL switched off and not in use. models HP4931 & HP4940. Produced between June The product does not comply 2006 and April 2011. with the Low Voltage Directive DESCRIPTION: Foldable hairdryer. (LVD). COUNTRY OF ORIGIN: China EU/SPAIN CATEGORY: Electrical appliances FIRE Voluntary recall PRODUCT The product poses a risk of fire from consumers. Power Inverter "Soladin 600, Soladin Wind 500 and as a component in the inverter Windmaster 500" may fail. BRAND: Mastervolt The product does not comply with the Low Voltage Directive TYPE/NUMBER OF MODEL (LVD). Models: Soladin 600, Soladin Wind 500 and Windmaster 500, manufactured between May 2006 and September 2008. -

Šablona Pro Skripta

MASARYKOVA UNIVERZITA EKONOMICKO-SPRÁVNÍ FAKULTA Business Management in the Czech Republic Petr Suchánek, Radoslav Škapa a kol. Brno 2008 Autorský kolektiv: Doc. Ing. Petr Suchánek, Ph.D. (kap. 1) Ing. Radoslav Škapa, Ph.D. (kap. 4, 5) vedoucí autorského kolektivu Ing. Ondřej Částek (kap. 6) Ing. Michael Doleţal (kap. 12) Ing. Lenka Jaterková (kap. 11) Ing. Eva Karpissová (kap. 7) Ing. Eva Kubátová (kap. 9, 10) Ing. Alena Klapalová, Ph.D. (kap. 2, 3) Ing. Petr Valouch (kap. 8) Recenzoval: Doc. Ing. Martin Svoboda, Ph.D. © Petr Suchánek, Radoslav Škapa a kol., 2006, 2008 ISBN 978-80-210-4662-7 CONTENT INTRODUCTION ..................................................................................... 6 1 ECONOMIC TRANSITION OF CORPORATE SECTOR: FROM CENTRAL PLANNED TO MARKET ECONOMY..................................... 7 1.1 The Methods of privatisation .................................................................... 7 1.1.1 Theoretical elements of privatisation ........................................................... 7 1.1.2 Speed of privatisation and restructuring ...................................................... 8 1.1.3 Ownership change and restructuring progress ............................................ 8 1.1.4 Restructuring and the role of the state ........................................................ 9 1.2 Transformation in the Czech Republic ................................................... 10 1.3 Appendix 1 - Situation in the Industry of the Czech Republic after 1997 ..................................................................................................................... -

SERBIAN REAL ESTATE MARKET OVERVIEW H2 2013 Macroeconomic Indicators

SERBIAN REAL ESTATE MARKET OVERVIEW H2 2013 Macroeconomic indicators Economy key facts Macroeconomic Indicators 2008 2009 2010 2011 2012 2013 GDP (EUR bn) 33.2 31.5 33.0 31.1 28.7 31.6 The most significant news for 2013 is that the GDP growth (y-o-y %) 3.8 -3.5 1 1.6 -1.5 2.6 European Union plans to start negotiations with CPI (y-o-y %) 8.6 6.6 10.3 7.0 12.2 2.2 Serbia. Serbian EU accession talks are expected to be Central Bank reference rate 17.8 17.0 8 11.42 9.5 9.5 launched in January 2014. This step will represent a Exports of goods (in mil. EUR) 10,157 8,478 10,070 11,472 11,913 14,375 strong positive signal for all foreign investors to Imports of goods (in mil. EUR) -18,843 -13,404 -14,643 -16,627 -17,211 -18,024 come and invest in Serbia. Public debt (ext.+int. in % of GDP) 29.2 34.7 44.5 48.2 60.0 64.4 External debt to GDP (in %) 64.6 77.7 85.0 76.7 86.9 81.7 Serbia has been able to sustain its economic progress Current account (as % of GDP) -21.6 -6.6 -6.7 -9.1 -10.5 -6.3 as a result of its macroeconomic stability fueled by Population (in mil) 7.5 7.3 7.3 7.1 7.4 7.2 the Serbian government. Increasing private sector Unemployment rate (%) 13.3 16.1 20 23.7 26.5 24.4 participation in Serbia economic structure is another Exchange rate to EUR 89.8 94.2 103.5 102.0 115.0 113,09 key factor that helped the nation to sustain an rising Inflation rate (%) 10.6 9.0 7.2 7 12 4 Average net salary (in EUR) 369.6 330.9 324 363 364 383 real GDP growth. -

AUPO Geographica 41

Acta Universitatis Palackianae Olomucensis – Geographica, Vol. 41, No. 2, 2010, pp. 5-20 5 DEVELOPMENT OF RETAIL GEOGRAPHICAL STRUCTURE IN THE CZECH REPUBLIC: A CONTRIBUTION TO THE STUDY OF URBAN ENVIRONMENT CHANGES 1 Zdeněk Szczyrba 1 Department of Geography, Faculty of Science, Palacký University Olomouc, 17. listopadu 12, 771 46 Olomouc, [email protected] Abstract In the last 20 years of transformation, the Czech retail business underwent fundamental changes in its ter- ritorial and organisational structure and in numerous cases refl ects the model of retail trade transformation within the Central European region. After a long period of time of the development of the so-called socialist trading, the countries in the region were affected, with unprecedented intensity, by new, hitherto unknown forms of retailing within the expansion of foreign retail chains to their markets. Such changes took very marked effect in the urban structure of the landscape in these countries, for example in the Czech Republic. The following paper captures the basic extent of transformation of the Czech retail business and its refl ection in the urban environment. Key words: Czech Republic, internationalisation of retail, urban environment INTRODUCTION joint-ventures and strategic alliances. As a matter of course, they establish their own logistic and distri- Retail trade belongs to the sectors of economy bution centres for supplying the network of their characterised by heavy internationalisation trad- stores. This alone is an interesting geographical ing activities. The essential feature of the current problem allowing the monitoring of complicated retail trade is constant penetration of multina- and ever-changing relations between the manufac- tional retail chains to foreign markets and related turers and the vendors (Birkin et al. -

2006 Annual Report Document De Référence

2006 Annual Report Document de Référence Nagoya TABLE OF CONTENTS COMPANY OVERVIEW 3 Financial highlights 4 The year 2006 6 The outdoor advertising industry 8 One business, three segments 16 Our advertisers 31 Sustainable developement 34 Research and development 43 FINANCIAL STATEMENTS 45 Management discussion and analysis of group consolidated financial statements 46 Consolidated financial statements and notes 56 Management discussion and analysis of corporate financial statements 114 Corporate financial statements and notes 116 LEGAL INFORMATION 139 Corporate governance and internal control 140 Shareholders and trading information 164 Share capital 169 Other legal information 178 COMBINED ANNUAL MEETING OF SHAREHOLDERS, 10 MAY 2007 188 Agenda 189 Summary of proposed resolutions 190 Proposed resolutions 192 OTHER INFORMATION 206 Statutory auditors’ reports 207 Person responsible for the Annual Report and persons responsible for the audit of the financial statements 211 Incorporation by reference In accordance with Article 28 of EU Regulation n°809/2004 dated 29 April 2004, the reader is referred to previous “Documents de référence” containing certain information: 1. Relating to fiscal year 2005: - The Management Discussion and Analysis and consolidated financial statements, including the statutory auditors’ report, set forth in the “Document de référence” filed on 7 April 2006 under number D.06-218 (pages 42 to 113 and 191, respectively). - The corporate financial statements of JCDecaux SA, their analysis, including the statutory auditors’ report, set forth in the “Document de référence” filed on 7 April 2006 under number D.06-218 (pages 114 to 134 and 192, respectively). - The statutory auditors’ special report on regulated agreements with certain related parties, set forth in the “Document de référence” filed on 7 April 2006 under number D.06-218 (pages 193 and 194). -

Business Management in the Czech Republic Ing.�Petr�Suchánek,�Ph.D.,�Ing.�Radoslav�Škapa,�Ph.D.,�A�Kolektiv

MASARYKOVA UNIVERZITA EKONOMICKO-SPRÁVNÍ FAKULTA Business Management in the CzechRepublic Petr Suchánek, Radoslav Škapa a kol. Brno 2006 Autorský kolektiv: Ing. Petr Suchánek, Ph.D. (kap. 1) Ing. Radoslav Škapa, Ph.D. (kap. 8, 9, 10) vedoucí autorského kolektivu Ing. Ondřej Částek (kap. 8, 9, 10) Ing. Michael Doležal (kap. 2) Ing. Eva Kubátová (kap. 5) Ing. Alena Klapalová (kap. 6, 7) Ing. Martin Krištof (kap. 3) Ing. Petr Valouch (kap. 4) Recenzoval: Doc. Ing. Martin Svoboda, Ph.D. © Petr Suchánek, Radoslav Škapa a kol., 2006 ISBN 80-210-4147-1 CONTENT INTRODUCTION ..................................................................................... 6 1 ECONOMIC TRANSITION OF CORPORATE SECTOR: FROM CENTRAL PLANNED TO MARKET ECONOMY ..................................... 7 1.1 The Methods of privatisation ....................................................................7 1.1.1 Theoretical elements of privatisation ............................................................7 1.1.2 Speed of privatisation and restructuring .......................................................8 1.1.3 Ownership change and restructuring progress .............................................8 1.1.4 Restructuring and the role of the state ..........................................................9 1.2 Transformation in the Czech Republic ...................................................10 1.3 Appendix 1 - Situation in the Industry of the Czech Republic after 1997 ......................................................................................................................13 -

Accessguide Template Document

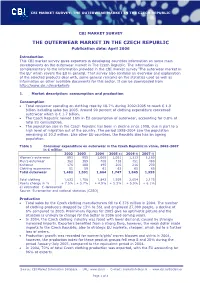

CBI MARKET SURVEY: THE OUTERWEAR MARKET IN THE CZECH REPUBLIC CBI MARKET SURVEY THE OUTERWEAR MARKET IN THE CZECH REPUBLIC Publication date: April 2006 Introduction This CBI market survey gives exporters in developing countries information on some main developments on the outerwear market in The Czech Republic. The information is complementary to the information provided in the CBI market survey ‘The outerwear market in the EU’ which covers the EU in general. That survey also contains an overview and explanation of the selected products deal with, some general remarks on the statistics used as well as information on other available documents for this sector. It can be downloaded from http://www.cbi.nl/marketinfo 1. Market description: consumption and production Consumption • Total consumer spending on clothing rose by 18.7% during 2002-2005 to reach € 1.9 billion including sales tax 2005. Around 90 percent of clothing expenditure concerned outerwear which is € 1.7 billion. • The Czech Republic ranked 16th in EU consumption of outerwear, accounting for 0.8% of total EU consumption. • The population size in the Czech Republic has been in decline since 1998, due in part to a high level of migration out of the country. The period 1998-2004 saw the population remaining at 10.2 million. Like other EU countries, the Republic also has an ageing population. Table 1 Consumer expenditure on outerwear in the Czech Republic in value, 2002-2007 in € million 2002 2003 2004 2005 e) 2006 f) 2007 f) Women’s outerwear 893 955 1,000 1,051 1,113 1,180 Men’s outerwear 362 389 408 428 451 480 Knitwear 176 188 195 206 216 230 Clothing accessories 51 59 61 62 65 65 Total outerwear 1,482 1,591 1,664 1,747 1,845 1,955 Total clothing 1,633 1,756 1,842 1,939 2,054 2,175 Yearly change in % + 7.5% + 5.7% + 4.9% + 5.3% + 5.9% + 6.1% e) estimated f) forecasted Source: Euromonitor and national statistics (CZSO) Production • Total sales by the Czech clothing manufacturers fell to € 376 million in 2004. -

Company Profile 30 June 2019 Company Profile

MAS REAL ESTATE INC. COMPANY PROFILE 30 JUNE 2019 COMPANY PROFILE PROPERTY INVESTOR, DEVELOPER AND OPERATOR 40 SHARE PRICE (ZAR) MAS Real Estate Inc (“MAS”) is a commercial property investor, DIVIDEND REINVESTED developer and operator listed on the main board of the Johannesburg 30 Stock Exchange (“JSE”) and is listed and admitted to trading on the EX-DIVIDEND Euro-MTF market of the Luxembourg Stock Exchange (“LuxSE”). BUSINESS STRATEGY 20 MAS’ strategy is to focus exclusively on real estate investment, predominantly in retail and residential, in the Central and Eastern 10 European (CEE) market, and have a substantial development pipeline in that market through our partners. To this end the group will redeploy capital invested in Western Europe to the CEE in a focused 0 and disciplined manner; and strengthen and integrate end to end 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 institutional capability to manage and grow the CEE investments with the focus on income growth. INVESTMENT PROPERTY PASSING RENT¹ PASSING RENT¹ MANAGEMENT BY SEGMENT BY SECTOR BY LOCATION MAS is internally managed, combining investment, development and asset management skills. Developments are undertaken both directly and by teaming up with strong developers that have intimate knowledge of the local markets and by agreeing terms that lead to a strong alignment of interests. €964.67 €58.79 €58.79 FUNDING MILLION MILLION MILLION MAS is targeting a long-term aggregate portfolio LTV of 40%. This may fluctuate up to a maximum of 50% on a temporary basis as the portfolio grows. Long-term debt funding is preferred and interest rates are managed through the group’s hedging strategy. -

Accessguide Template Document

CBI MARKET SURVEY: THE OUTERWEAR MARKET IN SLOVAKIA CBI MARKET SURVEY THE OUTERWEAR MARKET IN SLOVAKIA Publication date: April 2006 Introduction This CBI market survey gives exporters in developing countries information on some main developments on the outerwear market in Slovakia. The information is complementary to the information provided in the CBI market survey ‘The outerwear market in the EU’ which covers the EU in general. That survey also contains an overview and explanation of the selected products dealt with, some general remarks on the statistics used as well as information on other available documents for this sector. It can be downloaded from http://www.cbi.nl/marketinfo. 1. Market description: consumption and production Consumption • Consumer spending on clothing in Slovakia amounted to € 703 million in 2005, an increase of 17.5% during the period 2002-2005. 88% of spending on clothing concerned outerwear. Slovakia ranked 19th in EU outerwear consumption and accounted for 0.3% of total EU consumption. • The growth of the economy is supported by stabilisation of real wages growth and thus household consumption as well. A further growth on clothing expenditure of about 6.5% is expected for the coming years. • The population size in the Slovak Republic grew from 5,379 thousand in 2000 to 5,385 thousand in 2005. Much of the minimal growth stems from immigration rather than natural increase. Like other EU countries the Slovak Republic also has an ageing population. The younger age group is in decline: 19.8% of the population was younger than 15 years in 2000 against 17.6% in 2005. -

Montecristo-Company Profile V2.Indd

FASHION & BEAUTY RETAIL PARTNER ON MARKETS OF EX YUGOSLAVIA COMPANY PROFILE INTRODUCTION MONTECRISTO SL is a modern, brand new fashion and beauty retailing company, but with long tradition. Located in Slovenia, we are supporting and developing brands accross 4 countries of former Yugoslavia. In fact, through the acqusition of Modiana, former greater consumer awareness and equity. textile and beauty division of Mercator group, our start dates back to 1964. Today, our network Montecristo Group is currently covering the consists of more than 100 stores, about 700 following territories: Romania, Czech Republic, employees and 48.000 m2 of retail sales area Bolgaria and Slovakia through the HQ offices throughout the territory of Slovenia, Croatia, based in Romania; and Slovenia, Croatia, Serbia Serbia and Bosnia & Hercegovina. and Bosnia & Hercegovina through offices based in Slovenia. Combined, Montecristo Group currently 30% of the company is owned by the manages more than 200 stores throughout these management, which makes us highly motivated. territories. The remaining 70% was invested by Montecristo Group, who owns and develops a portfolio of But there is still plenty of room to grow. Maintaining GORAN KRISTAN important consumer brands as Kenvelo, Lee a long term relationships with our customers President of the Board, CEO Cooper, and Timeout. Through its in-house brand - fashion conscious individuals, offering them and business development, merchandising, contemporary style in best value for money, our advertising and public relations department, vision is to became the biggest beauty & fashion Montecristo Group manages its brands to drive retailer in the region. OUR TIMELINE Fashion Group with 40 years of tradition and ambitious plans. -

European Retail Guide Shopping Centres November 2014 2 | European Retail Guide – Shopping Centres // Introduction

European Retail Guide Shopping Centres November 2014 2 | European Retail Guide – Shopping Centres // Introduction Welcome to our third edition of ‘European Retail Guide - In this context, pipeline of shopping centres is expected to The European Shopping Centre investment Shopping Centres’. This guide provides high-level data on rebound in the short term, with 9 million of sq m to be delivered market has changed considerably in the last year. the European shopping centre industry. It is designed as a in 2015 and 2016. In this new guide we assess socio-economic Investment market conditions in several countries reference document for comparing shopping centre provision trends, as well as trends in the retail market in order to provide have improved significantly. The boom in Shopping across major cities and identifying hotspots for future areas of our view on the adequacy of current levels of shopping centre Centre investment, representing 47% of all retail development. The information provided is similar for all cities in provision and identify main hotspots for future opportunities. investment so far this year, is significantly higher order to facilitate comparison. than in 2013. We hope you enjoy this publication! The guide includes: Trading in many European countries remains tough » statistics on the major cities and their respective national for retailers but South European countries such economies, including GDP growth, earnings and retail sales as Spain and Italy have seen retail investment figures volumes increase by 15 and 315% respectively. Shopping Centre investment volume in Southern » information on shopping centre provision, including number Europe is currently higher than Germany or France. -

Survey-2-Public-Bids-And-Squeezeouts-In-Germany.Pdf

II II Exemptions from Mandatory Bids 2002 – 2016 Survey II: Exemptions from Mandatory Bids No. Applicant(s) Target Date of BaFin Exemption Basic Facts and Reasons for the Exemption/Comments Decision Granted / Denied 1 BNP Paribas S.A., Paris, France Berliner Effektengesellschaft AG, Berlin 3/5/2002 granted The applicant acquired a 53% stake in Berliner Effektengesellschaft AG, a stock broker at the Berlin stock exchange, mediated through Consors Discount Broker AG. The reasons for the exemption were not published. 2 Kraftwerk Laufenburg AG, Laufenburg, Kraftübertragungswerke Rheinfelden AG, 5/16/2002 granted The exemption was granted based on Section 36 no. 3 of the Takteover Act. Switzerland Rheinfelden The applicant acquired 69% of the shares in the target in the course of a reorganization within a group of companies. Despite being granted an exemption, the applicant launched a tender offer for the remaining shares in the target (see no. 18 in Survey I: Public Bids). 3 Marbert AG (subsequently Marbert Holding Jean Pascale AG, Norderstedt 8/15/2002 application The applicant acquired a 88.6% stake in the target, mediated through Wiland S.A., Luxembourg, and its subsidiary. AG), Dusseldorf (date of publication withdrawn Following the acquisition of an indirect shareholding in the target, the applicant initially reserved the right to apply for an exemption. Subsequently, by the applicant) the applicant made a mandatory bid, abandoning the earlier reservation (see no. 31 in Survey I: Public Bids). 4 Thiel Logistik AG, Grevenmacher, Microlog Logistics AG, Frankfurt am Main 10/17/2002 granted The exemption was granted based on Section 36 no.