Partnering an Energised India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Jharkhand Report No 4 of 2016 Revenue Sector

Report of the Comptroller and Auditor General of India on Revenue Sector for the year ended 31 March 2016 Government of Jharkhand Report No. 4 of the year 2016 TABLE OF CONTENTS Paragraph Page Preface v Overview vii CHAPTER – I: GENERAL Trend of receipts 1.1 1 Analysis of arrears of revenue 1.2 5 Arrears in assessments 1.3 6 Evasion of tax detected by the Department 1.4 7 Pendency of Refund Cases 1.5 7 Response of the Departments/Government towards Audit 1.6 8 Analysis of mechanism for dealing with issues raised by 1.7 11 Audit Audit execution for the financial year 2015-16 1.8 12 Results of audit 1.9 13 Coverage of this Report 1.10 13 CHAPTER – II: TAXES ON SALES, TRADE ETC. Tax administration 2.1 15 Results of Audit 2.2 15 Implementation of mechanism of cross-verification of VAT/CST transactions in Commercial Taxes 2.3 17 Department System of collection of arrears of revenue in 2.4 28 Commercial Taxes Department in Jharkhand Irregularities in determination of actual turnover 2.5 46 Interest not levied 2.6 48 Irregularities in compliance to the Central Sales Tax Act 2.7 51 Application of incorrect rate of tax under JVAT Act 2.8 53 Incorrect exemptions 2.9 54 Irregularities in grant of Input Tax Credit (ITC) 2.10 55 Purchase tax was not levied 2.11 56 Penalty not imposed 2.12 57 CHAPTER – III: STATE EXCISE Tax administration 3.1 59 Results of Audit 3.2 60 Provision of Acts/Rules not complied with 3.3 61 Retail liquor shops not settled 3.4 61 Short lifting of liquor by retail vendors 3.5 62 i Audit Report for the year ended 31 March 2015 -

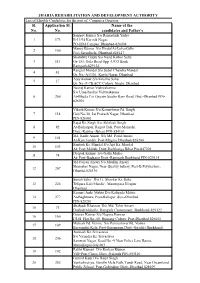

Sl. No. Application Sl. No. Name of the Candidates and Father's JHARIA

JHARIA REHABILITATION AND DEVELOPMENT AUTHORITY List of Eligible Candidates for the post of Computer Operator Sl. Application Sl. Name of the No. No. candidates and Father's Sanjeev Kumar S/o Ramashish Yadav 1 173 B-11/94 Karmik Nagar, PO-ISM Campus, Dhanbad-826004 Manoj Kumar S/o HiralalAt-Loharkulhi 2 100 Post-Saraidhela, Dhanbad-828127 Shambhu Gupta S/o Nand Kishor Sahu 3 113 Gr-153, Gola Road Opp.-UCO Bank Ramgarh-829122 Ranglal Mandal S/o Subal Chandra Mandal 4 41 Qr. No.-A1/301, Koyla Nagar, Dhanbad Ajay Kumar S/o Krishna Sahu 5 17 Qr. No.-F-7B ACC Colony, Sindri, Dhanbad Neeraj Kumar Vishwakarma S/o Umashankar Vishwakarma 6 260 At-Bhuda C/o Gayatri Studio Rani Road, Dist.-Dhanbad PIN- 826001 Vikash Kumar S/o Kameshwar Pd. Singh 7 114 Gali No-10, Jai Prakash Nagar, Dhanbad PIN-826001 Rajat Kr. Singh S/o Akhilesh Singh 8 92 At-Bishanpur, Rajput Tola, Post-Mansahi, Distt.-Katihar (Bihar) PIN-854103 Md. Kadir Ansari S/o Md. Farid Ansari 9 101 At-Kanchandih, Post-Mugma Dhanbad-828204 Santosh Kr. Mandal S/o Ajit Kr. Mandal 10 103 At+Post-Mahuli, Distt-Darbhanga Bihar Pin-847201 Deepak Kumar S/o Gallu Mahto 11 74 At+Post-Badgaon Distt.-Ramgarh Jharkhand PIN-829134 Md Faiyaz Ansari S/o Muslim Ansari Shamsher Nagar, Near Quality bakery, Post-B.Polytechnic, 12 267 Dhanbd-828130 Sonali Saha D/o Lt. Shankar Kr. Saha 13 224 Telipara Kali Mandir , Masterpara Hirapur Dhanbad Kumari Janki Mahto D/o Kalipada Mahto 14 277 At-Baghmara, Post-Baliapur, dist.-Dhanbad PIN-828201 Shahjadi Khatoon D/o Md. -

An Empirical Study on Tourists Interest Towards Archaeological Heritage Sites in West Bengal

International Journal of Research ISSN NO:2236-6124 An Empirical Study on Tourists interest towards Archaeological Heritage Sites in West Bengal Dr. Santinath Sarkar Assistant Professor, Dept. Of Education, University of Kalyani, Nadia, West Bengal. Pincode: 741235 ABSTRACT: Tourism as a modern term is applicable to both international and domestic tourists. Tourism aims to recognize importance of it in generating local employment both directly in the tourism sector and in various support and resource management sectors. West Bengal has improved its share in international tourism receipts during the course of past decade i.e. from about 3.36% in 2005 to about 5.88% in 2016 of foreign tourists visiting India. Archaeological heritage is a vital part of the tourism product and is one of the energetic factors that can develop the competitiveness of a tourism destination. Archaeological heritage tourism is one of the largest and fastest growing global tourism markets and it covers all aspects of travel that provide an opportunity for visitors to learn about other areas’ history, culture and life style. The present investigated the relationship between tourists’ satisfaction and the attributes of archaeological heritage destinations in West Bengal (WB). The area of the study at selected archaeological heritage destinations of West Bengal, which is located in eastern India and the data of this study have been collected from the on-site survey method at Victoria Memorial Hall, Belur Math, Chandannagar, Hazarduari, Shantiniketan, Bishnupur. These destinations are highly of the rich archaeological heritage of the State of West Bengal. The sample population for this study was composed of tourists who visited in these places in between December 2016 to January 2017. -

Master Plan for Dealing with Fire, Subsidence and Rehabilitation in the Leasehold of Bccl

STRICTLY RESTRICTED FOR COMPANY USE ONLY RESTRICTED The Information given in this report is not to be communicated either directly or indirectly to the press or to any person not holding an official position in the CIL/Government BHARAT COKING COAL LIMITED MASTER PLAN FOR DEALING WITH FIRE, SUBSIDENCE AND REHABILITATION IN THE LEASEHOLD OF BCCL UPDATED MARCH’ 2008. CENTRAL MINE PLANNING & DESIGN INSTITUTE LTD REGIONAL INSTITUTE – 2 DHANBAD - 1 - C O N T E N T SL PARTICULARS PAGE NO. NO. SUMMARISED DATA 4 1 INTRODUCTION 11 2 BRIEF OF MASTER PLAN ‘1999 16 3 BRIEF OF MASTER PLAN ‘2004 16 CHRONOLOGICAL EVENTS AND NECESSITY OF 4 17 REVISION OF MASTER PLAN 5 SCOPE OF WORK OF MASTER PLAN 2006 19 MASTER PLAN FOR DEALING WITH FIRE 6 21 MASTER PLAN FOR REHABILITATION OF 7 UNCONTROLLABLE SUBSIDENCE PRONE 49 INHABITATED AREAS 8 DIVERSION OF RAILS & ROADS 77 9 TOTAL INDICATIVE FUND REQUIREMENT 81 10 SOURCE OF FUNDING 82 ` - 2 - LIST OF PLATES SL. PLATE PARTICULARS NO. NO. 1 LOCATION OF JHARIA COALFIELD 1 2 COLLIERY WISE TENTATIVE LOCATIONS OF FIRE AREAS 2 3 PLAN SHOWING UNSTABLE UNCONTROLLABLE SITES 3 4 LOCATION OF PROPOSED RESETTLEMENT SITES 4 5 PROPOSED DIVERSION OF RAIL AND ROADS 5 - 3 - SUMMARISED DATA - 4 - SUMMARISED DATA SL PARTICULARS MASTER PLAN’04 MASTER PLAN’06 MASTER PLAN’08 NO A Dealing with fire 1 Total nos. of fires 70 70 70 identified at the time of nationalisation 2 Additional fires identified 6 7 7 after nationalisation 3 No. of fires extinguished 10 10 10 till date 4 Total no. -

Echoing Tagore's Love for the Monsoons

ECHOING TAGORE’S LOVE FOR THE MONSOONS Sukanya Guha Alumni of Banaras Hindu University, India Contact: [email protected] Abstract In India, Bengal’s most celebrated literary figure, Rabindranath Tagore, was specifically sensitive regarding the various seasons occurring in India. The monsoon and its relation with Tagore’s songs is the main focus of this paper. The monsoon, when Mother Nature spreads her beauty by unravelling her bounty treasures, is richly expressed by Tagore. In the composition for the khanika (poem) ‘Asho nai tumi phalgune’ [you did not come in the spring season] Tagore says: “when I awaited eagerly for your visit in the spring, you didn’t come. Please, don’t make me wait any longer and do come during the full monsoon”. In another of his songs he visualises on a cloudy sunless day, a person’s longing to share his or her deepest treasure of feeling for that particular important person ‘Emon ghonoghor boroshaye’ [in this heavy downpour] (Tagore 2002: 333, song 248). Through these poetic compositions and many more, one may understand the depth in Tagore’s understanding of the human’s emotional details regarding this specific season. The monsoon may also be disastrous. According to Tagore’s a composition ‘Bame rakho bhoyonkori’ [keep aside the destructions] (Tagore 2002: 394, song 58) he describes as well as wishes that the monsoon keeps away the damage or distress from people’s lives. His tunes blend with his words and emotions, not to mention the ragas that are believed to be related with rain that is popular to the Indian subcontinent such as Rag Megh or Rag Mian ki Malhar. -

Bharat Coking Coal Limited Koyla Bhawan, Dhanbad

BHARAT COKING COAL LIMITED (A Subsidiary of Coal India Limited ) KOYLA BHAWAN, DHANBAD TENDER DOCUMENT PART – I TENDER NOTICE NO- 61 NAME & PLACE OF WORK :- Hiring of HEMM for removal and transportation of OB, extraction and transportation of coal with fire fighting from X seam (IX/X)& 4 feet seam (XA)at Kujama ‘X’ seam patch of Bastacola Area . (R EF NO- BCCL/ GM (CMC)/ F- HEMM– OS/ 2009/200 DT 07.02.2009 Estimated Cost : Rs. 1424057020/- BHARAT COKING COAL LIMITED (A Subsidiary of Coal India Limited ) KOYLA BHAWAN, DHANBAD Part - I :: Contains 55(Fifty five) marked pages . Tender Notice No. : 61 Name & place of Work : - Hiring of HEMM for removal & transportation of OB, extraction and transportation of coal with fire fighting from X seam (IX/X)& 4 feet seam (XA)at Kujama ‘X’ seam patch of Bastacola Area . Date & time of submission of Tenders . : on 12.03.09 upto 3.30 PM Date & Time opening Of tender (Part-I ) : on 13.03.2009 at 4.00 PM Name & address of the Tenderer to whom issued. ______________________________________________ Date of issue: ______________________________________________ Cost of Tender document : Rs.5000 /- ( non-refundable ) Cash Receipt No. & Date _____________________________________________ Signature of the Officer Issuing Tender document. Part - I Document Name of Work:- - Hiring of HEMM for removal & transportation of OB, extraction and transportation of coal with fire fighting from X seam (IX/X)& 4 feet seam (XA)at Kujama ‘X’ seam patch of Bastacola Area . Tender Notice Number ---61 Ref. No- BCCL/GM(CMC) / F-HEMM-OS / 2009/200 dt.07.02.2009. I N D E X Contents Page No . -

For the Year Ended 31 March 2014

Report of the Comptroller and Auditor General of India on General, Social and Economic (Non-PSUs) Sectors for the year ended 31 March 2014 Government of Jharkhand Report No. 2 of the year 2015 TABLE OF CONTENTS Reference to Paragraph Page Preface v Overview vii CHAPTER – 1 INTRODUCTION Budget profile 1.1.1 1 Application of resources of the State Government 1.1.2 1 Persistent savings 1.1.3 2 Funds transferred directly to the State implementing agencies 1.1.4 2 Grants-in-aid from Government of India 1.1.5 3 Planning and conduct of audit 1.1.6 3 Lack of responsiveness of Government to Inspection Reports 1.1.7 3 Follow-up on Audit Reports 1.1.8 4 Government response to significant audit observations (draft 1.1.9 5 paragraphs/reviews) Status of placement of Separate Audit Reports of Autonomous Bodies 1.1.10 6 in the State Assembly CHAPTER – 2 PERFORMANCE AUDIT DRINKING WATER & SANITATION DEPARTMENT Total Sanitation Campaign/Nirmal Bharat Abhiyan 2.1 7 LABOUR, EMPLOYMENT & TRAINING DEPARTMENT AND SCIENCE AND TECHNOLOGY DEPARTMENT Establishment and Upgradation of Government Women ITIs and 2.2 25 Government Women Polytechnics in Jharkhand HUMAN RESOURCES DEPARTMENT (HIGHER EUUCATION) Functioning of State Universities in Jharkhand 2.3 38 FOREST AND ENVIRONMENT DEPARTMENT Compliance with Environmental Laws in Dhanbad district including 2.4 66 Dhanbad Agglomeration SOCIAL WELFARE, WOMEN & CHILD DEVELOPMENT DEPARTMENT AND PLANNING & DEVELOPMENT DEPARTMENT Implementation of Schemes for Welfare and Protection of Girls in 2.5 77 Jharkhand HOME DEPARTMENT Information Technology Audit on preparedness of Crime and 2.6 94 Criminal Tracking Network System HUMAN RESOURCE DEVELOPMENT DEPARTMENT AND HEALTH, MEDICAL EDUCATION & FAMILY WELFARE DEPARTMENT Tribal Sub Plan (Education and Health Sectors) 2.7 105 ENERGY DEPARTMENT Implementation of Solar Energy programmes in Jharkhand 2.8 116 Audit Report on General, Social and Economic (Non-PSUs) Sectors for the year ended 31 March 2014 CHAPTER – 3 COMPLIANCE AUDIT Non-Compliance with the Rules, Orders, etc. -

Celebrates Rabindranath Tagore in Song Music & Dance

International Centre Goa and Information and Resource Center, Singapore Celebrates Rabindranath Tagore in Song Music & Dance Building a Better Asia In honour of the Visiting Delegates from various Asian countries 7.15 pm AT THE INTERNATIONAL CENTER GOA Dona Paula The Nippon Group of Foundations PROGRAMME 7:15 pm Inauguration of the Musical Evening with felicitation of artists at the hands of Smt. Vijayadevi Rane , Chairperson, Bal Bhavan 7:25 pm Welcome song by young artists from Goa 7: 30 pm Tagore songs by Smt. Swastika Mukhopadhyay Sangeet Bhavan, Viswa Bharati Univeristy, Shantiniketan 8:00 pm Recitation of Tagore’s Poem in English 8:05 pm Theme Dance – Ritu Ranga by Shri. Arup Mitra, Smt. Sujata Mitra, Smt. Anusuya Das & Shri. Saikat Mukherjee Viswa Bharati Univeristy, Shantiniketan Music Director: Swastika Mukhopadhyay Choreographer: Arup Mitra 8:50 pm Recitation of Tagore’s Poem in English 9:00 pm Sitar Recital & Fusion Music by Shri Manab Das , Goa College of Music, Goa Accompanied by Shri Vishu Shirodkar, Shri Mayuresh Vast, Shri Prakash Amonkar & Shri Prakash Khutwalkar 9:30 pm End of the programme The programme is presented by the Information & Resource Center and the International Centre Goa with the cooperation of PRATIDHWANI – A Bengali cultural group of artists from Bengal and Goa. BABA 2008 Goa “BUILDING A BETTER ASIA: FUTURE LEADERS’ DIALOGUE” 2007-08 Theme “BUILDING THE COMMON GOOD IN ASIA” 16-24 February, 2008 (Goa, India) www.buildingabetterasia.com The ultimate objective of the Building a Better Asia: Future Leaders’ Dialogue is to nurture future leaders for Asia so that they can contribute to the building of a better Asia in the future. -

MUSIC Hindustani

The Maharaja Sayajirao University of Baroda, Vadodara Ph. D Entrance Tet (PET) SYLLABUS Subject: MUSIC PET ExamCode : 21 Hindustani (Vocal, Instrumental & Musicology), Karnataka, Percussion and Rabindra Sangeet Note:- Unit-I, II, III & IV are common to all in music Unit-V to X are subject specific in music -1- Unit-I Technical Terms: Sangeet, Nada: ahata & anahata , Shruti & its five jaties, Seven Vedic Swaras, Seven Swaras used in Gandharva, Suddha & Vikrit Swara, Vadi- Samvadi, Anuvadi-Vivadi, Saptak, Aroha, Avaroha, Pakad / vishesa sanchara, Purvanga, Uttaranga, Audava, Shadava, Sampoorna, Varna, Alankara, Alapa, Tana, Gamaka, Alpatva-Bahutva, Graha, Ansha, Nyasa, Apanyas, Avirbhav,Tirobhava, Geeta; Gandharva, Gana, Marga Sangeeta, Deshi Sangeeta, Kutapa, Vrinda, Vaggeyakara Mela, Thata, Raga, Upanga ,Bhashanga ,Meend, Khatka, Murki, Soot, Gat, Jod, Jhala, Ghaseet, Baj, Harmony and Melody, Tala, laya and different layakari, common talas in Hindustani music, Sapta Talas and 35 Talas, Taladasa pranas, Yati, Theka, Matra, Vibhag, Tali, Khali, Quida, Peshkar, Uthaan, Gat, Paran, Rela, Tihai, Chakradar, Laggi, Ladi, Marga-Deshi Tala, Avartana, Sama, Vishama, Atita, Anagata, Dasvidha Gamakas, Panchdasa Gamakas ,Katapayadi scheme, Names of 12 Chakras, Twelve Swarasthanas, Niraval, Sangati, Mudra, Shadangas , Alapana, Tanam, Kaku, Akarmatrik notations. Unit-II Folk Music Origin, evolution and classification of Indian folk song / music. Characteristics of folk music. Detailed study of folk music, folk instruments and performers of various regions in India. Ragas and Talas used in folk music Folk fairs & festivals in India. -2- Unit-III Rasa and Aesthetics: Rasa, Principles of Rasa according to Bharata and others. Rasa nishpatti and its application to Indian Classical Music. Bhava and Rasa Rasa in relation to swara, laya, tala, chhanda and lyrics. -

'Aradhona' a University of Visual & Performing Arts By

‘ARADHONA’ A UNIVERSITY OF VISUAL & PERFORMING ARTS BY IFREET RAHIMA 09108004 SEMINAR II Submitted in partial fulfillment of the requirements for the degree of Bachelors of Architecture Department of Architecture BRAC University SUMMER 2013 DISSERTATION THE DESIGN OF ‘ARADHONA’ A UNIVERSITY OF VISUAL & PERFORMING ARTS This dissertation is submitted to the Department of Architecture in partial gratification of the exigency for the degree of Bachelor of Architecture (B.Arch.) at BRAC University, Dhaka, Bangladesh IFREET RAHIMA 09108004 5TH YEAR, DEPARTMENT OF ARCHITECTURE BRAC UNIVERSITY, DHAKA FALL 2013 DECLARATION The work contained in this study has not been submitted elsewhere for any other degree or qualification and unless otherwise referenced it is the author’s own work. STATEMENT OF COPYRIGHT The copyright of this dissertation rests with the Architecture Discipline. No quotation from it should be published without their consent. RAHIMA | i ‘ARADHONA’ A UNIVERSITY OF VISUAL & PERFORMING ARTS A Design Dissertation submitted to the Department of Architecture in partial fulfillment of the requirement for the Degree of Bachelor of Architecture (B.Arch) under the Faculty of BRAC University, Dhaka. The textual and visual contents of the Design Dissertation are the intellectual output of the student mentioned below unless otherwise mentioned. Information given within this Design Dissertation is true to the best knowledge of the student mentioned below. All possible efforts have been made by the author to acknowledge the secondary sources information. Right to further modification and /or publication of this Design Dissertation in any form belongs to its author. Contents within this Design Dissertation can be reproduced with due acknowledgement for academic purposes only without written consent from the author. -

PFR JRP Bricks Kusumdaha Alias Bagula

BRICK CLAY MINE PROJECT IN VILLAGE KUSUMDAHA ALIAS BAGULA OVER AN AREAAREA---- 2.282.282.28 AAACRESACRES OR 0.92 HA IN, P.SP.SP.S-P.S --- SARAIDHELA, DISTRICT ––– DHANBADDHANBAD,, JHARKHAND. APPLICANT: M/s J. R. P. BRICKS PRE FEASIBILITY REPORT PRE- FEASIBILITY REPORT 0 BRICK CLAY MINE PROJECT IN VILLAGE KUSUMDAHA ALIAS BAGULA OVER AN AREAAREA---- 2.282.282.28 AAACRESACRES OR 0.92 HA IN, P.SP.SP.S-P.S --- SARAIDHELA, DISTRICT ––– DHANBADDHANBAD,, JHARKHAND. APPLICANT: M/s J. R. P. BRICKS PRE FEASIBILITY REPORT CONTENTS EXECUTIVE SUMMARY .......................................................................................................................................... 3 1.0 INTRODUCTION ........................................................................................................................................ 3 1.1 SALIENT FEATURES OF THE PROJECT ........................................................................................................................... 4 1.2 PRESENT LAND USE PLAN ........................................................................................................................................ 5 1.3 PROPOSED PLANNING ............................................................................................................................................. 5 1.4 UTILIZATION ......................................................................................................................................................... 5 2. INTRODUCTION OF THE PROJECT/ BACKGROUND INFORMATION .................................................................. -

Town Survey Report, Dhanbad, Part XB, Series-4, Bihar

CENSUS OF INDIA 1981 PARTXB SERIES 4 BIHAR TOWN SURVEY REPORT DHANBAD Drafted by Rajendra Prasad Asstt. Director Edited by S.C. Saxena Deputy Director Supervised by V.K. Bhargava Deputy Director Directorate of Census Operations BIHAR FOREWORD Apart from the decennial enumeration of population, the Indian Census is ~teeped in the tradition of undertaking a variety of studies of topical interest. In fact, the publications brought out in connection with the earlier censuses contained veritable mines of informatfon!On racial, cultural, linguistic and a number of other aspects of life of the people of this country. With the advent of freedom, however, the scope and dimension of these special studies had to be re structured in a manner that would provide the basic feedbacks on the processes of development taking place in different spheres of life of the people especially under planned development. Thus, in connection with the 1961, Census, a massive programme wa~s launched inter-alia to conduct socio-economic survey of about 500 villages selected from different parts of the country. The main objective of this study was to know the way of life of the people living in Indian villages which accounted for 82 per cent of the total population as per the 1961 Census. There was, however, an imperative need to extand the area of the study to urban centres as well, to -provide a complete coverage of the people living in diverse sodo economic conditions. It was with this objective in view ancillary studies on towns were launched as part of the social studies programme in connection with the 1971 Census.